Is your roof throwing a tantrum after that windstorm? Let’s talk about why those shingles might be dancing where they shouldn’t be!

When Mother Nature gets rowdy, your roof often takes the biggest hit. Think of shingles as your home’s protective armor – when wind crashes the party, it can leave your defense system compromised. You’ll spot the telltale signs: shingles doing the diagonal wave, edges curling up like old photographs, and tiny granules collecting in your gutters like breadcrumbs.

Don’t let a damaged roof rain on your parade (literally!). Getting professional help isn’t just smart – it’s essential. Today’s repair costs typically run between $5-30 per square foot, with skilled labor taking up about two-thirds of your bill. Think of it as investing in your home’s hat – it needs to fit just right!

Here’s the silver lining: your homeowner’s insurance likely has your back. But timing is everything – you’ll want to file that claim faster than you can say “missing shingle” (ideally within 72 hours). Pro tip: partnering with a public adjuster can be your secret weapon. These roof whisperers know how to maximize your claim and speak the insurance lingo, potentially turning a modest settlement into something much more substantial.

Ready to weather-proof your investment? Don’t wait until your ceiling becomes an indoor water feature. Get those shingles checked before a small problem becomes a major headache!

Key Takeaways

Is Your Roof Throwing a Tantrum After That Wind Storm?

Let’s talk about those telltale diagonal battle scars wind leaves on your roof – like nature’s angry fingerprints. When winds hit hurricane-force levels (that’s 74+ mph), your shingles start playing a dangerous game of “catch me if you can.”

Think your wallet’s about to take a hit? You’re looking at a sliding scale of investment. Basic 3-tab shingles might be easier on your budget at $5-7 per square foot, while their sophisticated architectural cousins command $7-12. Here’s the kicker: most of that cost isn’t even for materials – it’s the skilled hands doing the work.

Got insurance? Good news! Wind damage typically falls under standard coverage. But don’t hit the snooze button – you’ve got a 72-hour window to file that claim. Think of it as a race against time, where photos and professional assessments are your winning tickets.

Here’s a pro tip that might surprise you: bringing a public adjuster to your corner can be like having an ace up your sleeve. They’re known to boost settlements dramatically, often securing payouts that tower 30-50% above DIY claims.

Want to stay ahead of the game? Be your roof’s best friend. Keep an eye out for those sneaky warning signs – those little granules collecting in your gutters are like breadcrumbs leading to potential problems. And those curling shingles at the edges? They’re practically waving red flags at you.

Remember: catching wind damage early is like treating a small cut before it needs stitches – much easier and way less expensive to handle!

Common Types Of Wind Damage To Shingle Roofing

Storm-force winds can inflict several distinct types of damage on shingle roofs, each requiring specific repair approaches. Wind patterns typically create directional damage, with uplift forces causing shingle displacement in diagonal patterns across the roof surface. Structural vulnerabilities become evident when wind speeds exceed 74 mph, leading to various forms of deterioration.

| Damage Type | Characteristics |

|---|---|

| Missing Shingles | Diagonal patterns of complete removal |

| Creased Shingles | Visible folds from partial lifting |

| Lifted Shingles | Broken sealant bonds, appears intact |

| Granule Loss | Bald spots on shingle surface |

Professional inspection often reveals hidden damage not visible from ground level, particularly in cases of compromised sealant bonds. This unseen damage can create entry points for water, potentially leading to more extensive structural issues if left unaddressed. Public adjusters increase insurance claim settlements by up to 800% compared to unassisted claims.

Warning Signs Your Shingle Roof Needs Repairs From Wind Damage

Wind-damaged shingle roofs typically exhibit several distinct warning signs that homeowners should monitor after severe weather events. Through regular Visual Inspection, property owners can identify issues before they escalate into major structural problems. An Attic Assessment often reveals the first indicators of damage, while understanding local Weather Patterns helps anticipate potential vulnerabilities.

| Location | Warning Signs | Required Action |

|---|---|---|

| Exterior | Missing/lifted shingles | Immediate repair |

| Gutters | Granule accumulation | Professional inspection |

| Interior | Dark spots/stains | Water damage assessment |

| Edges | Curled/separated materials | Seal verification |

Material Quality plays a vital role in wind resistance, while proper Ventilation Issues can impact overall roof performance. Homeowners should document all visible damage thoroughly, particularly when preparing insurance claims, focusing on areas where shingles show compromise or separation from the underlying structure. Documenting damage within the 72-hour window post-storm is crucial for maximizing insurance claim settlements.

Does Homeowners Insurance Cover Wind Damaged Shingle Roof Claims?

Most standard homeowners insurance policies cover wind damage to shingle roofs, though coverage specifics depend on policy type, deductibles, and documentation. Insurance providers typically offer either Actual Cash Value (ACV) coverage, which factors in depreciation, or Replacement Cost Value (RCV) coverage, which pays for full replacement after deductible. Understanding the distinctions between named perils and hidden damage coverage is essential for maximizing claim benefits and avoiding future premium increases. Public adjusters can help homeowners navigate complex wind damage claims and ensure fair settlement amounts.

| Coverage Factor | Impact on Wind Damage Claims |

|---|---|

| Policy Type | ACV vs RCV determines payout amount |

| Deductibles | Must be met before coverage applies |

| Documentation | Photos, inspection reports required |

| Claim History | Multiple claims may increase premiums |

| Maintenance | Regular upkeep affects coverage eligibility |

Insurance Deductibles, Coverage Limits, & Exclusions For Wind Damaged Shingle Claims

When homeowners experience wind damage to their shingle roofs, understanding insurance coverage becomes critical for managing repair costs effectively. Insurance providers typically structure coverage options around specific deductible amounts and policy limitations. Most standard policies cover wind damage, but exclusion types can substantially affect claim outcomes.

| Coverage Factor | Impact on Claims |

|---|---|

| Deductible Range | $500-$2,500 out-of-pocket |

| Payment Method | ACV vs. RCV settlement |

| Claim Timeline | 1-2 years from damage date |

| Multiple Claims | Premium increases, coverage risk |

Homeowners should carefully review their policies, noting exclusions for pre-existing damage, wear and tear, or improper installation. Multiple wind damage claims within a short period can lead to increased premiums or potential coverage limitations, making proper maintenance and documentation essential for long-term protection. Working with public adjusters can increase claim settlements by 20-30% on average through expert policy interpretation and skilled negotiation with insurance companies.

Actual Cash Value Vs. Replacement Cost In Relation To Wind Damaged Shingles

Understanding the distinction between Actual Cash Value (ACV) and Replacement Cost Value (RCV) can substantially affect the outcome of wind-damaged shingle claims. The value comparison between these settlement options reveals significant coverage differences in how insurers calculate payouts.

| Feature | ACV Coverage | RCV Coverage |

|---|---|---|

| Initial Payment | Depreciated Value Only | Depreciated Value First |

| Depreciation | Not Recoverable | Recoverable After Repairs |

| Final Settlement | Single Payment | Two-Part Payment Process |

While ACV policies provide only the depreciated value of damaged shingles, RCV coverage offers full replacement cost through a two-payment system. Payment timing varies, with RCV claims requiring completion of repairs before receiving the recoverable depreciation. Depreciation calculations consider the roof’s age, condition, and expected lifespan, making RCV policies generally more advantageous for homeowners facing wind damage repairs. Homeowners can significantly increase their claim settlements by working with public adjusters who specialize in accurately assessing property damage and negotiating with insurance companies.

Named Vs. Hidden Perils

Homeowners insurance policies approach wind damage coverage through two distinct frameworks: named perils and hidden perils coverage. The key coverage differences lie in how each policy variation handles risk assessment and claim documentation.

| Aspect | Named Perils | Hidden Perils |

|---|---|---|

| Definition | Lists specific covered events | Covers all except excluded risks |

| Burden of Proof | Homeowner must prove coverage | Insurer must prove exclusion |

| Documentation | Requires specific event proof | Less stringent proof requirements |

| Claim Process | Must match listed perils | Assumed covered unless excluded |

Understanding peril definitions becomes vital when filing wind damage claims. Named perils policies explicitly list wind damage coverage, requiring homeowners to demonstrate damage from specific weather events. In contrast, hidden perils policies place the claim burden on insurers to prove why damage isn’t covered, offering broader protection for unexpected scenarios. Working with public adjusters can increase claim payouts by 20-50% regardless of which peril coverage type applies.

Repair Cost Breakdown For Wind Damaged Shingle Roofing(By Shingle Type)

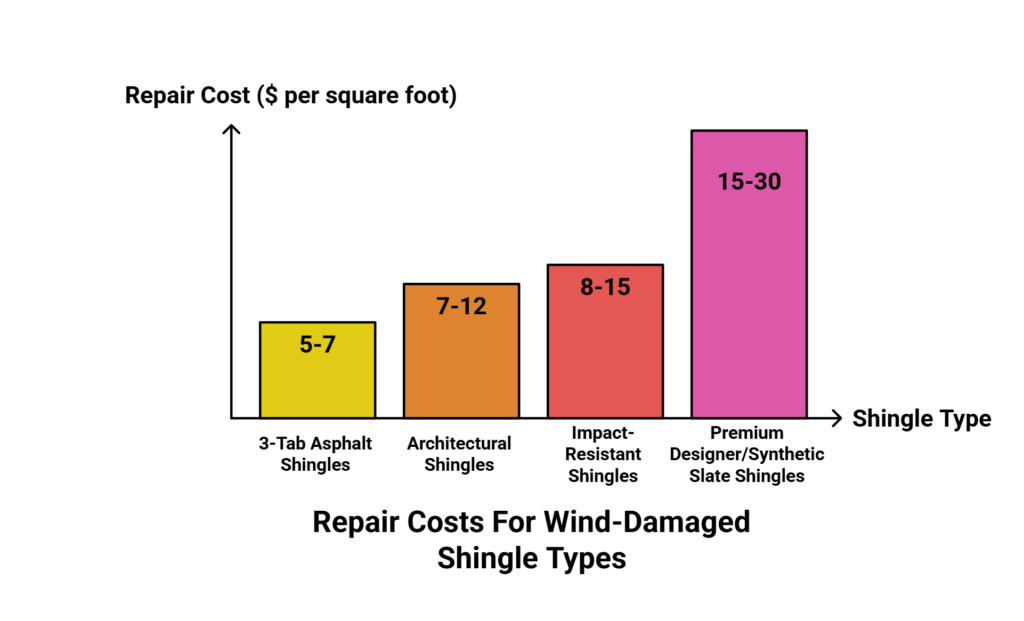

Different shingle types come with varying repair costs after wind damage, ranging from basic 3-tab options to premium designer materials.

Understanding the cost implications for each shingle variety helps homeowners make informed decisions about repairs and insurance claims.

Professional contractors typically assess wind damage repair costs based on these common shingle categories:

- 3-tab asphalt shingles: $5-7 per square foot

- Architectural shingles: $7-12 per square foot

- Impact-resistant shingles: $8-15 per square foot

- Premium designer/synthetic slate shingles: $15-30 per square foot

Early detection and repairs within 72 hour window of wind damage significantly improve insurance claim success rates.

Wind Damaged Asphalt Shingle Roof Repair Cost

When faced with wind-damaged shingles, repair costs can vary substantially based on the type of asphalt shingle installed. Repair estimates typically factor in material costs, labor charges, and weather considerations, with seasonal variations affecting final pricing. Professional contractors assess damage extent to determine appropriate repair strategies and associated costs. Public insurance adjusters can help secure up to 574% higher claim settlements for wind damage repairs.

| Shingle Type | Damage Area (per 100 sq ft) | Cost Range |

|---|---|---|

| 3-Tab Basic | Minor Repairs | $150-$400 |

| Architectural | Medium Repairs | $450-$800 |

| Premium Designer | Major Repairs | $800-$1,200 |

| Individual Shingles | Per Shingle | $30-$60 |

| Complete Section | Per Square | $700-$1,500 |

These costs reflect thorough repairs including removal of damaged materials, substrate inspection, and installation of new shingles with appropriate underlayment and flashing as needed.

Wind Damaged Architectural Shingle Roof Repair Cost

Architectural shingle repairs typically command higher costs than basic 3-tab varieties, ranging from $450 to $750 per square for moderate wind damage. Material costs increase substantially with premium wind-rated options, which can elevate repair expenses by 40-60%. Roof slope impact and accessibility challenges can further increase costs by 25-35%, particularly in areas with severe wind patterns and harsh climate factors.

| Repair Type | Cost Range |

|---|---|

| Standard Architectural | $450-750/square |

| Premium Wind-Rated | $630-1200/square |

| Steep Slope Areas | $563-1013/square |

| Spot Repairs | $150-300/bundle |

| Basic 3-Tab Compare | $360-525/square |

Spot repairs for isolated wind damage average $150-300 per bundle, covering approximately 33 square feet. Repair duration varies based on damage extent, accessibility, and weather conditions during installation. Class 4 rated shingles provide superior protection against high winds up to 130 mph, making them a preferred choice for storm-prone regions.

Wind Damaged 3-Tab Shingle Roof Repair Cost

Basic 3-tab shingles represent the most economical repair option for wind damage, with costs ranging from $150-$400 per square for standard repairs without structural complications. Professional damage assessment determines repair techniques needed, from individual shingle replacement at $30-$50 each to complete section repairs. Material costs typically comprise 30-40% of total expenses, while labor accounts for 60-70%. Seasonal factors and emergency situations can increase costs by 50-100% for immediate leak prevention. Professional claims adjusters can increase final insurance settlement amounts by 20-50% through expert negotiation and documentation.

| Repair Type | Standard Cost | Emergency Cost |

|---|---|---|

| Single Shingle | $30-$50 | $45-$75 |

| Partial Section | $150-$250 | $225-$375 |

| Full Square | $150-$400 | $225-$600 |

| Complete Roof | $350-$500/sq | $525-$750/sq |

Wind Damaged Performance Shingle Roof Repair Cost

Performance shingles command substantially higher repair costs compared to standard 3-tab varieties, with prices ranging from $8-15 per square foot for wind damage restoration. The specialized repair techniques and installation methods require skilled labor, accounting for 60-70% of total costs. Professional damage assessment is essential for maintaining warranty coverage.

| Repair Component | Standard Performance | Luxury Performance |

|---|---|---|

| Material Costs | $4-6/sq ft | $8-12/sq ft |

| Labor Rate | $5-7/sq ft | $8-10/sq ft |

| Small Area (<100 sq ft) | $600-800 total | $1,000-1,200 total |

| Impact-Resistant (Class 4) | +20-30% premium | +25-35% premium |

| Installation Time | 4-6 hours | 6-8 hours |

Class 4 impact-resistant performance shingles typically incur 20-30% higher material costs due to their premium construction, while luxury variants can exceed $20 per square foot for complete wind damage repairs.

Wind Damaged Impact Resistant Shingle Roof Repair Cost

Impact-resistant shingle roof repairs following wind damage present distinct cost considerations across different rating classes. Material costs vary dramatically based on shingle ratings, with Class 4 options commanding a 10-20% premium but offering superior wind resistance up to 130 mph. Installation methods require specialized repair techniques, increasing labor expenses to 60-70% of total costs due to strict safety requirements.

| Shingle Type | Cost per Sq Ft | Wind Rating |

|---|---|---|

| Three-Tab | $3-5 | Basic |

| Architectural | $5-7 | Enhanced |

| Impact-Resistant | $7-10 | Premium |

| Class 4 Premium | $8-12 | Superior |

Standard residential roof repairs typically range from $5,000 to $12,000, while partial repairs affecting areas under 100 square feet start at $750. These costs reflect both material quality and specialized installation requirements necessary for maintaining warranty coverage.

Wind Damaged Luxury Designer Shingle Roof Repair Cost

Luxury designer shingle repairs present substantially higher cost considerations compared to standard roofing materials, with repair expenses typically ranging from $650-1,200 per square. The increased costs stem from Premium Materials requirements and specialized Labor Expertise needed for proper Installation Complexities. Pattern Matching challenges, especially with discontinued designs, can drive Designer Costs even higher, sometimes necessitating complete section replacement.

| Cost Component | Standard Range | Premium Range |

|---|---|---|

| Materials/Bundle | $200-300 | $350-450 |

| Labor/Square | $300-400 | $400-550 |

| Pattern Match | $150-200 | $200-300 |

| Total/Square | $650-900 | $950-1,200 |

Multi-layered luxury shingles demand precise installation techniques, increasing labor costs by 25-40%. Insurance claims require detailed documentation to justify premium material costs, particularly when matching intricate patterns or replacing discontinued designs.

Wind Damaged Metal Shingles/Shakes Roof Repair Cost

Metal shingle and shake roof repairs present substantially higher cost considerations compared to traditional roofing materials, with wind damage repairs typically ranging from $15-25 per square foot. Despite superior metal durability and weather resistance, wind damage can necessitate specialized installation techniques and material grades for proper repair. Individual metal shingle replacement costs vary from $75-150, while larger section repairs can reach $3,000 per 100 square feet. Uplift prevention requires enhanced fastening systems, increasing costs by 30-50%.

| Repair Component | Cost Range |

|---|---|

| Single Shingle | $75-150 |

| Per Square Foot | $15-25 |

| 100 Sq Ft Section | $1,000-3,000 |

| Fastening System | +30-50% |

| Insurance Payout | +20-40% |

These higher costs typically result in insurance claims paying 20-40% more than standard shingle repairs, reflecting the premium materials and specialized labor required.

Wind Damaged Wood Shake Shingle Roof Repair Cost

Wood shake shingle roof repairs typically command higher costs than standard asphalt alternatives, with wind damage restoration ranging from $800-$2,000 for areas under 100 square feet. Professional wind assessment reveals individual shake repairs cost $12-$25 per shingle, while extensive damage requiring complete replacement averages $9,000-$14,000 for 1,500 square feet.

| Repair Type | Material Costs | Labor Costs |

|---|---|---|

| Emergency Repairs | $18-30/shake | 2x standard rate |

| Aged Shake Repairs | $15-25/shake | +35% premium |

| Standard Repairs | $12-20/shake | Base rate |

| Full Replacement | $6-8/sq ft | $3-4/sq ft |

Installation methods for weathered shakes require specialized repair techniques, increasing costs by 25-40%. Emergency response scenarios typically result in premium charges of 1.5-2 times standard rates due to immediate mobilization requirements.

Wind Damaged Solar Tile Shingle Roof Repair Cost

Solar tile shingle repairs present unique cost considerations when addressing wind damage, with expenses typically running 30-50% higher than conventional roofing materials. Repairs require specialized contractors with installation certification in both roofing and electrical systems. Beyond physical damage, thorough repairs often include voltage testing and inverter replacement to maintain solar efficiency.

| Repair Component | Cost Range |

|---|---|

| Single Tile Replacement | $400-900 |

| Labor (Per Hour) | $100-150 |

| Inverter Testing | $150-250 |

| Weatherproofing | $200-400 |

Insurance coverage typically requires specific policy endorsements due to the integrated technology. Weatherproofing requirements are particularly stringent for solar tiles, as water infiltration can damage both roofing and electrical components. Professional evaluation must address both structural integrity and power generation capability to guarantee complete restoration of the system.

Wind Damaged Clay & Concrete Tile Shingle Roof Repair Cost

Although clay and concrete tile roofs offer exceptional durability, wind damage repair costs for these materials range substantially from $8-20 per square foot, with high-end restorations reaching up to $40 per square foot for specialized vintage tiles. Material analysis and pattern matching are essential for maintaining aesthetic consistency during repairs. Installation expertise and fastener assessment dramatically impact repair success, adding 20-35% to base material costs compared to standard shingle work.

| Repair Component | Cost Range |

|---|---|

| Single Tile Replacement | $5-15/tile |

| Full Section (100 sq ft) | $700-1,500 |

| Structural Reinforcement | $2-5/sq ft |

| Pattern Matching | $10-15/sq ft |

| Installation Labor | 20-35% premium |

Preserving tile integrity requires specialized equipment and techniques, particularly when addressing vintage materials or complex patterns that demand precise color and texture matching.

Wind Damaged Slate & Synthetic Slate Shingle Roof Repair Cost

While clay and concrete tiles present their own repair challenges, slate roofing repairs demand even more specialized attention and higher investment. Weather impact on natural and synthetic slate creates distinct repair costs, with material comparisons showing synthetic options at roughly half the expense of natural slate. Installation challenges drive labor costs to 60-70% of total repairs due to required expertise.

| Repair Type | Natural Slate | Synthetic Slate |

|---|---|---|

| Per Square Foot | $15-30 | $8-16 |

| Single Shingle | $45-75 | $25-40 |

| Per Square (100 sq ft) | $1,500-3,000 | $800-1,600 |

Durability differences between materials affect long-term value, though both require careful handling during repairs. Costs increase 25-40% when addressing damage near roof features like chimneys and valleys, reflecting the complexity of maintaining these premium roofing systems.

Dealing With Insurance Company Adjusters: No, They Are NOT Your Friend

Many homeowners mistakenly view insurance adjusters as helpful advocates during wind damage claims, but this perspective can prove costly.

Insurance adjusters work for their employers, utilizing various tactics to minimize claim payouts.

Understanding common adjuster tricks and deceptive practices helps homeowners protect their interests during settlement negotiations.

To effectively counter insurance tactics and adjuster delays, homeowners should:

- Document all roof damage extensively with detailed photos and videos

- Obtain independent professional assessments before filing claims

- Review estimates carefully, watching for minimized damage assessments or repair-only solutions

- Exercise their right to dispute findings and demand secondary inspections

Thorough documentation and professional third-party evaluations provide vital leverage when challenging lowball estimates or claim denials.

Homeowners must remain vigilant throughout the claims process, prepared to advocate for fair compensation.

Getting Help From A Public Adjuster: Your Advocate & Ally

Public adjusters serve as independent advocates who work solely on behalf of homeowners during wind damage roof claims, often securing settlements substantially higher than those obtained without professional representation. These licensed professionals thoroughly document damage, interpret complex policy terms, and negotiate directly with insurance companies while charging a percentage-based fee only after successful settlements. Given that insurance company adjusters primarily serve their employers’ interests, hiring a qualified public adjuster can level the playing field and help guarantee fair compensation for roof repairs.

| Aspect | Insurance Company Adjuster | Public Adjuster |

|---|---|---|

| Loyalty | Insurance company | Policyholder |

| Payment | Salary from insurer | % of claim settlement |

| Objective | Minimize claim payout | Maximize claim value |

| Process | Quick assessment | Detailed documentation |

| Appeals | Rarely challenges denials | Actively appeals decisions |

The Role Of Public Adjusters In Wind Damaged Shingle Roof Claims

When homeowners face complex wind damage claims for their roofs, licensed public adjusters serve as invaluable advocates who work exclusively to maximize insurance settlements. Their adjuster experience in policy expertise and damage documentation typically results in settlements 40-750% higher than claims filed without professional representation.

These specialists charge 5-15% of the final settlement amount, bringing essential skills in policy interpretation and detailed loss assessment.

Their all-encompassing approach includes thorough damage documentation, expert settlement negotiation, and complete claim management. Public adjusters leverage their specialized knowledge to interpret complex policy language, conduct methodical inspections, and build strong cases for maximum compensation. With proper adjuster licensing and industry expertise, they navigate the intricate claims process while ensuring homeowners receive fair compensation for wind-damaged roofs.

Benefits Of Using A Public Claims Adjuster For Wind Damaged Shingle Roof Repair Claims

Handling a wind damage insurance claim for roof repairs can overwhelm even the most diligent homeowner. Leveraging a licensed public adjuster’s claim expertise provides substantial adjuster advantages, including thorough damage documentation and skilled policy interpretation. These professionals deliver measurable policyholder protection while pursuing settlement maximization.

| Adjuster Credentials | Policyholder Benefits |

|---|---|

| Fiduciary Duty | 30-50% Higher Settlements |

| Licensed Expert Status | Faster Claim Resolution |

| Policy Analysis Skills | Complete Damage Documentation |

| Negotiation Experience | Reduced Claim Denials |

Studies confirm that public adjusters considerably improve claim outcomes through their specialized knowledge of wind damage patterns and insurance procedures. Their contingency-based fee structure aligns with policyholder interests, ensuring dedicated advocacy throughout the claims process while maximizing compensation for all covered damages.

How Are Public Insurance Adjusters Paid & What Are Their Fees?

Understanding the fee structure of public insurance adjusters is essential before engaging their services for wind-damaged roof claims. Their commission rates typically range from 10% to 20% of the final settlement amount, with payment timing structured on a contingency basis – meaning they only get paid when you receive your settlement.

| Fee Structure Details | Description |

|---|---|

| Standard Commission | 10-20% of settlement |

| Payment Timing | After claim settlement |

| Service Agreement | Written contract required |

Most service agreements clearly outline fee structures and payment terms before work begins. While this may seem substantial, studies show that public adjusters often secure settlements up to 800% higher than unrepresented claims, making their services cost-effective. This success-based model aligns the adjuster’s interests with maximizing the policyholder’s settlement percentages.

Public Adjusters Vs. The Insurance Company Adjuster

The key difference between public adjusters and insurance company adjusters lies in their fundamental allegiances and objectives. Public adjusters work independently to maximize policyholder settlements, while company adjusters represent insurer interests. This expertise contrast substantially impacts claim outcomes.

| Adjuster Comparisons | Public Adjuster | Company Adjuster |

|---|---|---|

| Allegiance | Policyholder | Insurance Company |

| Cost | 5-15% of Settlement | Free |

| Evaluation Depth | Thorough | Often Limited |

| Negotiation Approach | Aggressive Advocacy | Company Guidelines |

Through detailed settlement analysis and thorough negotiation tactics, public adjusters typically identify additional covered damages that company adjusters might overlook. Their specialized expertise in policy interpretation and documentation often results in higher settlements, despite their fee structure. While company adjusters provide free services, their evaluation differences can lead to lower payouts aligned with insurer interests.

When to Contact Your Insurance Provider For Wind Damaged Shingle Roof Repairs

Whether pursuing a wind damage claim through a public adjuster or independently, homeowners must contact their insurance provider promptly after discovering shingle damage.

Public adjusters can handle all insurer communications and documentation requirements while advocating for maximum claim value, though their services typically cost 10-15% of the settlement.

Homeowners filing directly should photograph all visible damage, document the storm date and conditions, and submit their claim within their policy’s specified timeframe, typically maintaining copies of all communications with the insurance company.

If Using A Public Adjuster

Working with a public adjuster for wind-damaged roof claims can substantially increase settlement amounts and expedite the claims process. Public adjusters provide valuable financial protection by documenting damage before temporary repairs begin and typically secure payouts 2-3 times higher than unrepresented claims.

While adjusters charge 10-20% of the final settlement, their investigation strategies and settlement expertise often justify the cost. They effectively manage timelines by ensuring claims are filed within mandatory 30-60 day windows and resolve cases 30-50% faster than self-managed claims.

For denied claims, public adjusters strengthen cases through detailed documentation and professional assessments that insurance companies are more likely to accept. Understanding adjuster requirements is essential, as their professional representation can dramatically impact the success of wind damage claims.

If Filing On Your Own

Filing an insurance claim independently for wind-damaged roofs requires immediate action and meticulous documentation. Property owners should begin with thorough photo documentation of all affected areas, creating a detailed damage mapping of missing shingles and potential water infiltration points.

Successful claims depend on thorough weather tracking to establish a clear connection between storm events and roof damage. Homeowners must review their policy lookup to understand coverage terms and reporting deadlines, typically within 30-60 days of the incident.

Maintaining precise expense recording for emergency repairs is essential, as these costs may be reimbursable. All receipts, contractor estimates, and repair photos should be organized chronologically. This systematic approach to documentation strengthens the claim’s validity and increases the likelihood of appropriate compensation from the insurance provider.

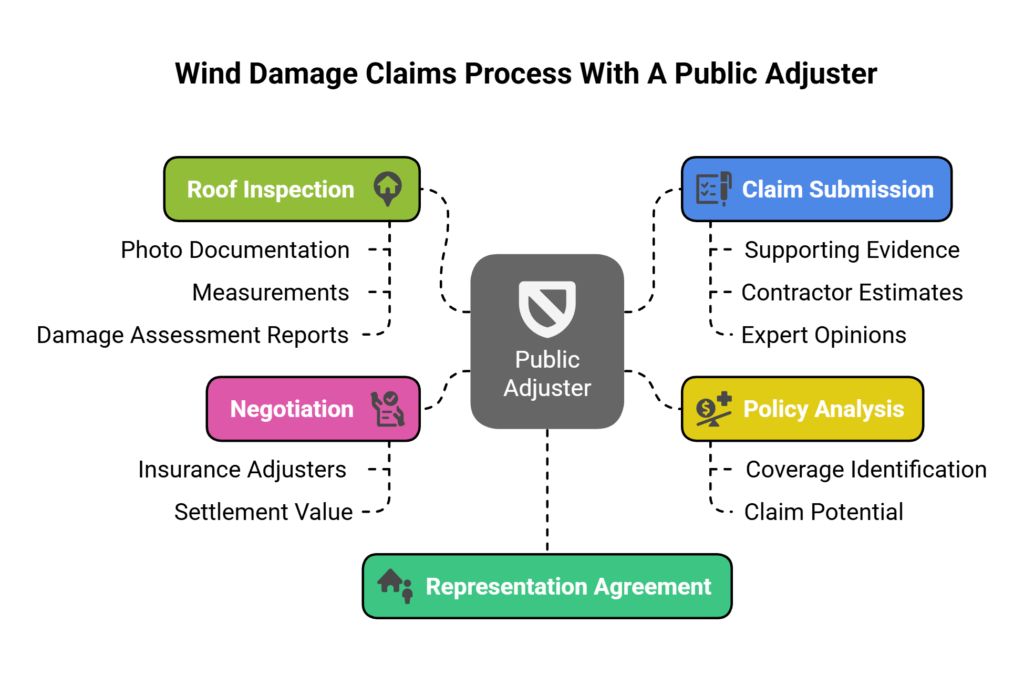

Filing Process For Wind Damaged Shingle Roof Claims (When Using A Public Adjuster)

Public adjusters streamline the wind damage claims process by conducting thorough documentation and managing all insurance company interactions on behalf of homeowners.

Upon signing a representation agreement, the adjuster examines policy coverage, performs detailed roof inspections, and builds a complete damage assessment file.

The systematic claims process typically follows these key steps:

- Initial roof inspection with photo documentation, measurements, and professional damage assessment reports

- Policy analysis to identify all applicable coverage and maximum claim potential

- Submission of detailed claim package with supporting evidence, contractor estimates, and expert opinions

- Ongoing negotiation with insurance adjusters to secure maximum settlement value

Public Adjuster Documents Wind Damage To Roof Shingles Thoroughly

When property owners face wind-damaged roofs, a licensed public adjuster conducts a methodical documentation process to support insurance claims. Through thorough damage mapping and detailed photography, adjusters record patterns of compromised shingles while conducting wind analysis using local weather data.

| Documentation Method | Purpose |

|---|---|

| Infrared Scanning | Detect hidden moisture damage |

| Sample Collection | Verify material specifications |

| Moisture Detection | Assess water infiltration levels |

The adjuster compiles multiple site visits into a chronological record, performing thorough moisture detection and infrared scanning to identify underlying issues. Their detailed reports include engineering assessments, notarized statements, and line-by-line cost estimates. This systematic approach guarantees proper documentation of all visible and concealed damage, strengthening the property owner’s position during the claims process.

Public Adjuster Reviews Policy For Hidden Roofing Coverage & Helps Maximize Policy Benefits

Throughout the insurance claims process, experienced public adjusters meticulously analyze policy documents to identify overlooked coverage provisions for wind-damaged roofs. Through extensive benefit analysis and policy optimization, adjusters uncover hidden provisions that substantially impact claim settlements.

| Policy Review Steps | Coverage Benefits | Settlement Impact |

|---|---|---|

| Document Analysis | Hidden Provisions | 40-350% Increase |

| Coverage Review | Additional Items | Maximum Value |

| Policy Language | Extended Benefits | Full Compensation |

Public adjusters leverage their expertise to conduct thorough coverage reviews, ensuring no potential benefits are missed. By negotiating directly with insurance companies and disputing inadequate estimates, they achieve settlement maximization for homeowners. This systematic approach to policy analysis helps secure proper compensation that accurately reflects the full scope of wind damage repairs.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

After engaging a public adjuster‘s services, homeowners can rely on experienced professionals to manage all aspects of their wind-damaged roof claim.

The adjuster’s thorough approach to communications and negotiations with insurance companies guarantees thorough claim handling while protecting policyholder interests.

Key steps in the public adjuster’s process include:

- Initiating formal claim notifications and providing detailed policy explanations to insurance carriers

- Submitting thorough damage documentation, including weather data, photos, and professional assessments

- Coordinating directly with insurance company adjusters for property inspections and damage verification

- Applying negotiations expertise to secure maximum settlement amounts based on policy coverage

This professional oversight typically results in higher claim settlements while relieving homeowners of complex claim management responsibilities.

Public Adjuster Gets Professional Assessments

During the claims process, public adjusters coordinate thorough professional assessments to build a strong foundation for wind damage roof claims.

They systematically gather expert validation through detailed technical analysis and engineering reports to document the full scope of damage.

Key professional opinions secured include:

- Complete roofing inspection reports with photographic evidence of visible and hidden structural damage

- Weather data analysis and wind speed documentation correlating to the time of loss

- Detailed repair estimates from qualified contractors specifying required materials and labor

- Engineering assessments evaluating structural integrity and potential long-term impacts

This thorough damage assessment approach guarantees all aspects of the wind damage are properly documented, strengthening the claim’s validity and maximizing potential settlement value under the policy terms.

Public Adjuster Gathers Supporting Evidence

Building upon professional assessments, public adjusters methodically compile exhaustive evidence portfolios to substantiate wind damage roof claims. Through systematic evidence collection, they document all damage aspects using high-resolution damage photos and detailed measurement documentation. Weather records from the date of loss establish storm severity, while witness statements provide additional context.

| Evidence Type | Purpose | Impact on Claim |

|---|---|---|

| Aerial Photos | Document widespread damage | Establishes pattern |

| Ground Photos | Detail specific damage areas | Shows precise impact |

| Weather Data | Verify storm conditions | Proves causation |

| Measurements | Record damage scope | Quantifies repairs |

This thorough documentation strengthens the claim’s validity, helping guarantee fair compensation for roof repairs. The adjuster organizes these materials into a compelling narrative that insurance carriers find difficult to dispute.

Public Adjuster Submits Complete Claims Package

When all evidence has been meticulously gathered, the public adjuster assembles and submits a detailed claims package to the insurance carrier for wind-damaged roof compensation. Through systematic claims preparation and package assembly, the adjuster guarantees all required documentation demonstrates covered storm damage within the policy period.

| Claims Package Components | Purpose |

|---|---|

| Weather Data | Verify storm occurrence |

| Damage Photos | Document specific issues |

| Inspection Reports | Detail professional assessment |

| Cost Estimates | Outline repair expenses |

| Policy Documentation | Confirm coverage terms |

The adjuster manages damage coordination and evidence organization throughout the process, maintaining clear documentation management protocols. Their expertise in assembling thorough claim submissions helps maximize coverage potential while meeting all insurer requirements for proper evaluation and processing.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

A skilled public adjuster serves as the homeowner’s dedicated liaison throughout the wind damage claim process, managing all communications and requirements with the insurance company.

Through exhaustive deadline management and documentation oversight, the adjuster guarantees all aspects of the claim are properly handled and tracked.

- Coordinates insurance coordination by reviewing policies, preparing damage assessments, and submitting required documentation within specified timelines

- Maintains thorough communication tracking of all interactions, responses, and follow-up requests from the insurance carrier

- Handles correspondence handling duties including responding to inquiries, scheduling inspections, and submitting supplemental materials

- Provides regular status updates to homeowners while managing all aspects of claim timeline adherence and documentation requirements

This professional oversight allows homeowners to focus on their daily responsibilities while guaranteeing their claim progresses efficiently toward resolution.

Public Adjuster Enforces Policyholder’s Rights, & Negotiates Higher & More Fair Settlement

The professional advocacy of a public adjuster substantially strengthens a policyholder’s position during wind damage claim negotiations.

Through proven claims expertise and exhaustive damage documentation, adjusters enforce policy rights while implementing effective negotiation strategies for settlement enhancement.

Key ways public adjusters maximize claim settlements:

- Conduct thorough property assessments with detailed photos, measurements, and professional engineering reports

- Review policy terms to identify all available coverage and guarantee proper damage categorization

- Coordinate expert documentation and contractor estimates to substantiate higher settlement values

- Apply industry knowledge and proven negotiation tactics to achieve policy maximization

Statistics show professionally managed claims typically result in settlements 40-350% higher than those handled without representation, justifying the standard 5-15% contingency fee structure.

Public Adjuster Speeds Up Claim Settlement Time

Professional representation through a public adjuster substantially accelerates wind damage roof claim settlements by streamlining documentation, communication, and negotiation processes.

Studies demonstrate that claims handled by public adjusters achieve expedited settlements 30-50% faster than those filed independently.

Public adjusters facilitate faster approvals and prompt resolutions through:

- Immediate professional documentation of wind damage using photos, videos, and detailed assessments

- Direct communication channels with insurance carriers, eliminating delays and miscommunication

- Swift processing of required paperwork and coordinated scheduling of necessary inspections

- Quicker disbursements through expert valuation of damages and efficient negotiation of settlement terms

This systematic approach guarantees thorough claim packages are properly prepared and submitted, leading to swift claim resolutions that maximize coverage under the policy terms.

Choosing & Working With Trusted Roofing Contractors

Working with a public adjuster provides access to their vetted network of licensed roofing contractors who specialize in insurance-related repairs. Professional roofers can provide detailed estimates that outline material costs, labor requirements, and manufacturer specifications needed for proper shingle installation. By having the public adjuster review contractor estimates before signing agreements, homeowners gain protection against inflated pricing and guarantee proposed work aligns with insurance coverage parameters.

| Contractor Selection Criteria | Key Considerations |

|---|---|

| Licensing & Insurance | Current state licenses, liability/workers comp coverage |

| Experience & Specialization | Years in business, expertise with insurance claims |

| References & Reviews | Past client feedback, BBB ratings, project portfolio |

| Written Documentation | Detailed estimates, warranties, material specifications |

| Payment Terms | Progress billing schedule, no upfront fees, lien waivers |

Utilize Your Public Adjusters Extensive Professional Network

Seasoned public adjusters offer invaluable access to extensive networks of trusted roofing contractors, streamlining the repair process for wind-damaged roofs. Through rigorous contractor vetting and consistent licensure verification, these networks guarantee professional standards are maintained throughout the repair process.

The network strength of public adjusters’ professional connections provides property owners with contractors who understand insurance claim requirements and documentation protocols. This expertise proves particularly valuable when coordinating complex repairs requiring multiple specialists.

Quality assurance is enhanced through standardized pricing and adherence to insurance company specifications. Contractors within these networks demonstrate proven track records handling insurance-related repairs and proficiency with industry-standard estimation software. This systematic approach helps expedite claim processing while maintaining the high level of documentation necessary for successful insurance claims.

Getting Professional Shingle Roofing Estimates

When seeking estimates for wind-damaged shingle repairs, property owners should obtain detailed written proposals from multiple licensed roofing contractors to guarantee accurate damage assessment and fair pricing. The bidding process should include thorough assessment methods, with contractors documenting damage through photos and measurements.

| Estimate Components | Required Details |

|---|---|

| Materials | Shingle type, quantities |

| Labor | Timeline planning, crew size |

| Documentation | Photos, measurements |

Professional contractors must provide roofing references, proof of insurance, and proper licensing. Material considerations should address both immediate repairs and long-term durability. Each estimate should outline specific repair methods, including any necessary deck or flashing repairs. Property owners should compare 3-5 bids to confirm consistency in damage assessment and fair market pricing while verifying contractor qualifications.

Let Your Public Adjuster Review Estimates To Ensure Contractor Honesty

To protect homeowners from potential overcharging or unnecessary repairs, having a licensed public adjuster review roofing contractor estimates serves as a critical safeguard in the wind damage repair process.

Public adjusters provide independent estimate verification by examining contractor proposals before work agreements are signed. Their expertise in construction costs and insurance claims enables thorough pricing analysis to guarantee fair market rates.

Through detailed contractor screening, they help identify potential red flags in repair recommendations and proposed markups. The adjuster’s assessment documentation creates a valuable record for insurance claims while validating the scope of necessary repairs.

Their markup evaluation specifically examines material and labor costs to prevent inflated pricing. This third-party review process helps secure appropriate claim compensation and protects homeowners’ interests throughout the contractor selection phase.

Preventing Future Roof Shingle Damage From Wind

Protecting a roof from future wind damage requires a thorough preventive maintenance strategy that combines regular inspections with strategic upgrades. Key elements include wind proofing through high-rated shingle installation, preventive inspection protocols, and structural reinforcement of vulnerable areas.

| Prevention Area | Required Action |

|---|---|

| Shingles | Install 130+ mph rated materials |

| Inspection | Schedule annual professional checks |

| Ventilation | Optimize attic airflow systems |

| Vegetation | Trim branches 10+ feet from roof |

| Drainage | Maintain clean, functional gutters |

Ventilation optimization helps preserve shingle integrity by regulating temperature and moisture levels. Regular gutter maintenance prevents water accumulation that weakens adhesion points. Professional inspections can identify potential issues before they escalate into major problems during severe weather events. This complete approach substantially reduces the risk of wind-related roof damage and extends the life expectancy of roofing materials.

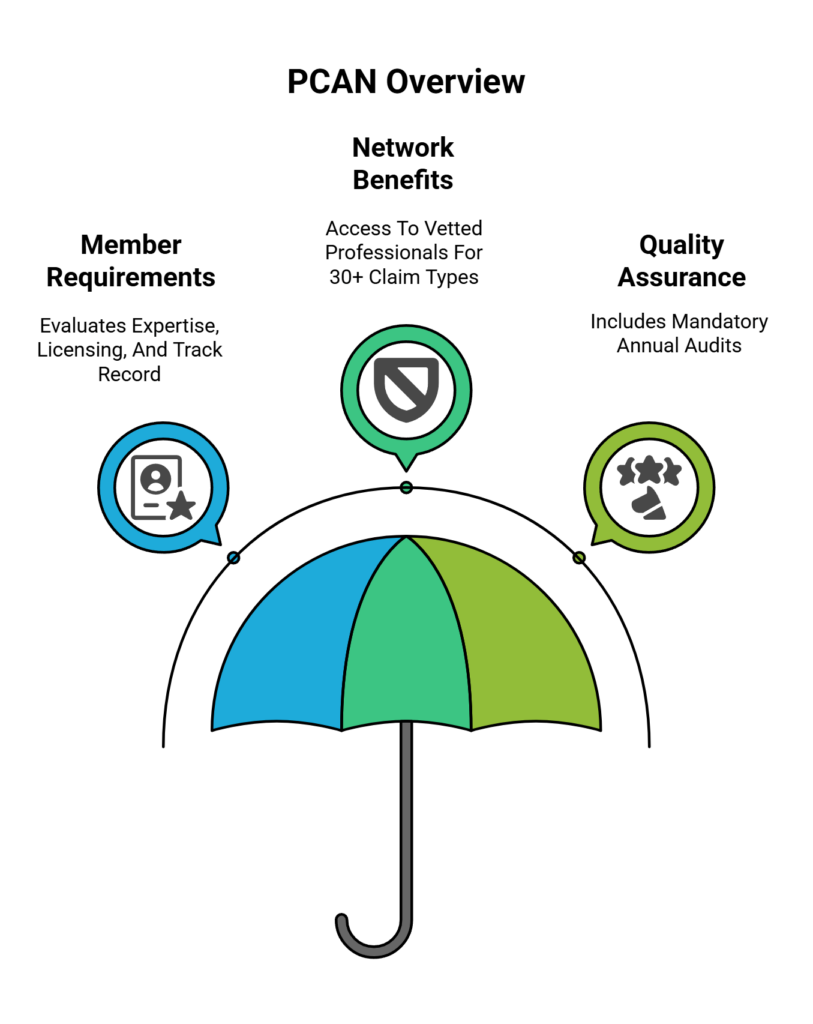

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) stands as a nationwide alliance of state-licensed public adjusters who specialize in property damage insurance claims. Operating across 40+ states, PCAN maintains strict member requirements through an intensive screening process that evaluates adjusters’ expertise, licensing, and professional track record.

Network benefits include access to thoroughly vetted professionals who handle over 30 different claim types for both residential and commercial properties.

PCAN’s quality assurance measures include mandatory annual audits of licenses and complaint records, ensuring members uphold the highest standards of ethics and professionalism. This rigorous oversight helps property owners connect with expert adjusters who have demonstrated excellence in their field, making PCAN a trusted resource for those seeking assistance with insurance claims.