Is your membrane roof giving you the silent treatment after a windstorm? Let's talk about what's really going on up there!

Wind damage on membrane roofs isn't just about a few wrinkles – think of it as your roof's cry for help through tell-tale signs: flapping or torn materials (like a loose sail in the wind), curling edges that wave goodbye to protection, and those dreaded water spots on your ceiling that look like unwanted abstract art.

Getting your roof back in fighting shape? You're looking at $6.50-$9.50 per square foot for materials, while skilled roofers charge $45-$75 hourly. But here's the silver lining – your homeowners insurance might be your financial superhero in this story.

Want to maximize your insurance claim? Consider bringing in a public insurance adjuster. These pros are like roof damage detectives who can boost your settlement by 20-50% through their expert sleuthing and negotiation skills. They know exactly where to look and what documentation will make your case bulletproof.

Remember, treating wind damage is like treating a wound – the sooner you spot it and take action, the better your chances of a full recovery. A thorough damage assessment isn't just paperwork; it's your roadmap to proper repairs and fair compensation. Don't let a damaged membrane roof rain on your parade!

Key Takeaways

Is your roof throwing a tantrum after that wild windstorm? Let's break down what you need to know about wind-damaged membrane roofs!

Think of your roof membrane like a protective blanket – when wind gets underneath, it can lift, tear, and expose what's beneath. You'll spot telltale signs: peeling corners, ripped surfaces (like a bandage pulled too quickly), and flashing that's playing hide-and-seek around the edges.

Got your wallet ready? Fixing these aerial battles isn't cheap. You're looking at $6.50-$9.50 per square foot for materials, while skilled roofers charge $45-75 hourly. But here's the silver lining – your homeowners insurance likely has your back!

Speaking of insurance, imagine public adjusters as your claim's personal trainers. They flex their expertise to pump up settlements by 20-50%, making sure you're not left high and dry. Your policy's deductible typically runs 1-5% of your home's value – worth every penny when Mother Nature throws a fit.

When should you wave goodbye to repairs and hello to replacement? Here's your rule of thumb: if repairs would cost more than 30% of a new roof, or if your roof looks like Swiss cheese with multiple punctures, it's time for a fresh start. Remember, a stitch in time saves nine – but sometimes you need a whole new sweater!

Common Types Of Wind Damage To Membrane Roofing

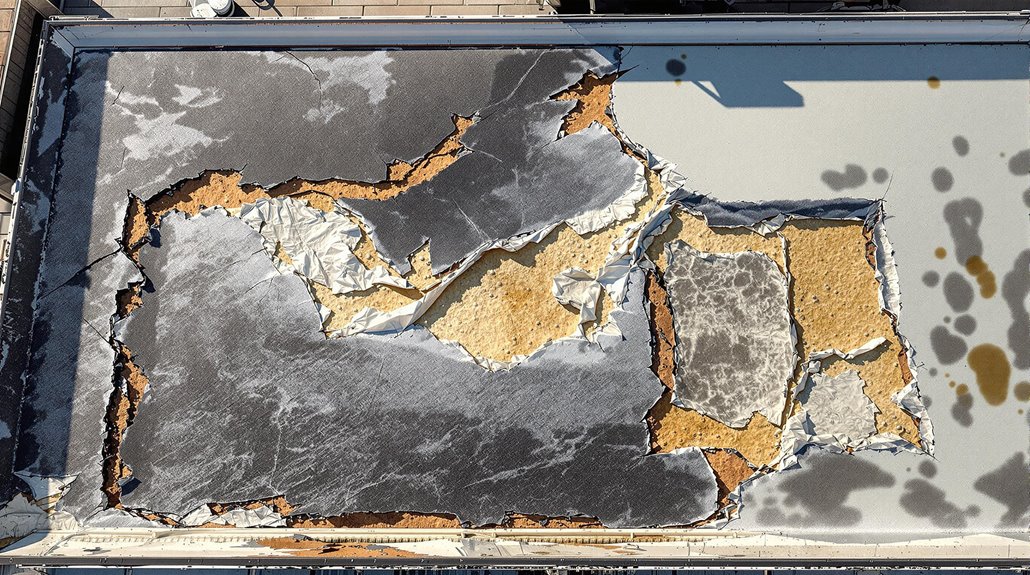

The primary forms of wind damage to membrane roofing systems manifest through several distinct mechanisms. Wind uplift forces can compromise membrane integrity through lifting, tearing, and displacement of materials. These membrane vulnerability factors often result in exposure of underlying insulation and create entry points for moisture infiltration.

| Damage Type | Impact |

|---|---|

| Surface Tears | Compromises waterproof barrier |

| Fastener Failure | Reduces structural stability |

| Debris Impact | Creates punctures and abrasions |

Wind damage prevention requires understanding how these mechanisms affect roofing systems. High winds can cause membrane blistering, detachment of flashing components, and systematic failure of adhesive bonds. The large surface area of flat membrane roofs makes them particularly susceptible to wind-related stresses, especially when installation or maintenance protocols have been inadequately followed. Documenting wind damage within 24 hours of damage is critical for successful insurance claims processing.

Warning Signs Your Membrane Roof Needs Repairs From Wind Damage

When membrane roofs sustain wind damage, several distinct warning signs emerge that property owners and facility managers must recognize for timely intervention. A thorough roof inspection and damage assessment can reveal both exterior and interior indicators requiring immediate attention.

| Warning Location | Primary Signs | Secondary Signs |

|---|---|---|

| Exterior Surface | Torn/lifted membrane, exposed insulation | Bubbles, loose adhesion |

| Roof Perimeter | Edge damage, cracked sealants | Curling membrane |

| Building Interior | Water stains, dampness | Ceiling cracks, paint damage |

Visual identification of these warning signs enables property managers to address issues before they escalate into major structural problems. Professional assessment should follow initial detection, particularly when multiple indicators are present, as this often signals systematic wind damage requiring expert repair intervention. Using thermal imaging cameras during inspections can help detect hidden moisture damage that may not be visible to the naked eye.

Does Homeowners Insurance Cover Wind Damaged Membrane Roof Claims?

Most homeowners insurance policies cover wind damage to membrane roofs, though coverage specifics depend on policy type, deductibles, and exclusions. Insurance providers typically offer either Actual Cash Value (ACV) policies, which factor in depreciation, or Replacement Cost Value (RCV) policies that cover full replacement costs. Understanding named perils versus hidden perils in policy language is essential, as wind damage coverage may vary based on specific policy provisions and regional requirements. Working with public insurance adjusters can increase claim settlements by 20-50% compared to filing independently.

| Coverage Factor | Impact on Claims |

|---|---|

| Deductibles | Affects out-of-pocket expenses before coverage applies |

| Policy Limits | Determines maximum payout for membrane roof repairs |

| Named Perils | Explicitly listed events covered by the policy |

| Hidden Perils | Damages not specifically excluded from coverage |

Insurance Deductibles, Coverage Limits, & Exclusions For Membrane Roof Wind Damage Claims

Maneuvering insurance coverage for membrane roof wind damage requires understanding three critical components: deductibles, coverage limits, and policy exclusions.

| Insurance Component | Key Considerations | Impact on Claims |

|---|---|---|

| Deductibles | 1-5% of home value | Higher deductibles reduce premiums |

| Coverage Limits | Based on dwelling coverage | Affects maximum claim payout |

| Policy Exclusions | Varies by location/insurer | Determines claim eligibility |

A thorough deductible comparison reveals that costs can vary greatly based on geographic location and risk factors. Coverage evaluation should focus on matching limits to current property values while accounting for local building codes. Standard policies typically exclude flood damage, gradual deterioration, and poor installation. High-risk areas may require supplemental windstorm coverage, particularly for named storms, which often carry separate deductibles and restrictions. Working with public adjusters can increase settlement amounts by 20-50% compared to handling claims independently.

Actual Cash Value Vs. Replacement Cost In Relation To Membrane Roof Wind Damage

Insurance policies for membrane roof wind damage typically offer two primary valuation methods: Actual Cash Value (ACV) and Replacement Cost Value (RCV). Understanding the differences between these options is essential for property owners when selecting coverage.

| Feature | ACV | RCV |

|---|---|---|

| Depreciation | Deducted | Not deducted |

| Payout Amount | Partial value | Full replacement |

| Premium Cost | Lower | Higher |

| Out-of-pocket | Higher | Lower |

| Requirements | Basic maintenance | Regular inspections |

ACV policies consider depreciation based on the roof's age and condition, resulting in lower payouts but more affordable premiums. RCV coverage provides full replacement costs without depreciation deductions, ensuring sufficient funds to restore the roof to its original condition. While RCV premiums are higher, they typically result in reduced out-of-pocket expenses when filing wind damage claims. Working with a public adjuster can help secure payouts up to 574% higher compared to self-filing claims.

Named Vs. Hidden Perils

Understanding whether homeowners insurance covers wind-damaged membrane roofs requires careful examination of named and hidden perils within policy documents. While most policies include wind damage as a named peril, hidden exclusions can limit coverage based on specific circumstances.

| Coverage Aspect | Named Perils | Hidden Exclusions |

|---|---|---|

| Cause of Damage | Direct wind impact | Gradual deterioration |

| Documentation | Photos, reports | Maintenance records |

| Time Frame | Immediate damage | Long-term issues |

| Assessment | Adjuster inspection | Pre-existing conditions |

| Claims Process | Straightforward | Complex verification |

Insurance typically covers sudden, wind-related membrane roof damage when properly documented and reported promptly. However, claims may be denied if damage stems from improper installation, lack of maintenance, or gradual wear. Understanding these distinctions helps property owners maintain appropriate coverage and successfully navigate the claims process. Working with public adjusters can increase insurance claim settlements by 20-800% through professional expertise and strategic negotiation.

Repair Vs. Replacement For Membrane Roof Wind Damage

The decision between repairing or replacing a wind-damaged membrane roof requires careful evaluation of multiple factors to guarantee the most cost-effective and durable solution.

Professional contractors must assess the extent of damage, age of the existing roof, and potential long-term implications before recommending the appropriate course of action.

Critical factors that influence this decision include:

- Scale of damage – isolated tears versus widespread membrane separation

- Remaining service life of the existing roof system

- Building code requirements and insurance policy stipulations

- Cost comparison between repair investment and full replacement value

Working with public insurance adjusters can lead to settlements up to 747% higher compared to filing claims independently.

When To Choose Roof Repair For A Wind Damaged Membrane Roof

Making an informed decision between repair and replacement for a wind-damaged membrane roof depends on several vital factors that professionals must evaluate. The repair timeline and contractor selection play essential roles in ensuring successful outcomes for wind-damaged membrane roofs.

| Assessment Criteria | Repair Suitable | Replacement Needed |

|---|---|---|

| Damage Extent | Localized tears | Widespread damage |

| Roof Age | Under 10 years | Over 15 years |

| Material Condition | Minor wear | Notable deterioration |

| Cost Analysis | Under 30% replacement cost | Over 30% replacement cost |

| Insurance Coverage | Covered repairs | Full replacement coverage |

Repair is typically recommended when damage is localized, the roof is relatively new, and the membrane material maintains its structural integrity. Additionally, when repair costs remain considerably lower than replacement and insurance coverage supports repairs, maintaining the existing roof through professional restoration becomes the ideal choice. Working with a public adjuster service can increase settlement amounts by 20-50% when filing insurance claims for wind damage repairs.

When To Choose Roof Replacement For A Wind Damaged Membrane Roof

Professionals must evaluate several essential factors when determining if a wind-damaged membrane roof requires full replacement rather than repairs. Membrane roofing considerations include structural integrity, damage extent, and long-term economic viability.

| Assessment Criteria | Replacement Indicators |

|---|---|

| Physical Damage | Large tears, multiple punctures, widespread failure |

| Structural Issues | Compromised attachments, repeated stress damage |

| Economic Factors | Replacement cost analysis vs. repair expenses |

| System Performance | Age of roof, energy efficiency potential |

When conducting a replacement cost analysis, factors such as insurance coverage, future maintenance savings, and property value enhancement must be weighed. Additionally, building code compliance, frequent storm exposure, and the integrity of adjacent roofing systems play essential roles in the decision-making process. Systemic failures or multiple previous repairs often indicate replacement as the most cost-effective solution. Working with public insurance adjusters can increase claim settlements by up to 747% compared to unrepresented claims.

Repair Cost Breakdown For Membrane Roof Wind Damage

Several key factors contribute to the cost breakdown of membrane roof wind damage repairs, including material selection, labor requirements, and the extent of damage sustained. Cost analysis reveals that material expenses range from $6.50 to $9.50 per square foot, while labor rates typically fall between $45 and $75 per hour. Repair techniques and costs vary based on damage severity and local market conditions.

| Cost Component | Price Range |

|---|---|

| Membrane Materials | $6.50-$9.50/sq ft |

| Labor Rates | $45-$75/hour |

| Disposal Fees | $2-$4/sq ft |

| Site Cleanup | $1-$2/sq ft |

| Additional Repairs | $3-$7/sq ft |

Total project expenses encompass not only direct repair costs but also removal of damaged materials, disposal fees, and necessary structural modifications. Market conditions and contractor availability in specific regions can greatly influence final costs. Working with public adjusters on insurance claims can increase settlement amounts by up to 574% compared to self-filed claims.

Insurance Company Adjusters: They Work For The Insurance Company's Benefit … NOT YOURS

Insurance company adjusters operate with a primary obligation to protect their employer's financial interests, which often conflicts with the policyholder's need for fair compensation.

Understanding adjuster motives is vital when filing a wind damage claim for membrane roofs, as their assessment directly impacts settlement outcomes.

Key aspects of adjuster responsibilities that affect policyholder rights:

- Thorough investigation focused on finding exclusions or limitations in coverage

- Documentation review aimed at minimizing company liability

- Damage assessment methods that may undervalue repair costs

- Settlement strategies designed to reduce payout amounts

To protect their interests, property owners should consider hiring public adjusters who exclusively represent policyholder interests.

These professionals can provide accurate damage documentation, navigate complex policy language, and guarantee fair compensation through balanced negotiations.

Getting Help From A Public Adjuster: Your Advocate & Ally

Public adjusters serve as essential advocates for property owners facing membrane roof wind damage, offering specialized expertise in damage assessment, policy interpretation, and claim negotiation.

These licensed professionals work exclusively for the policyholder's benefit, typically charging a percentage of the final settlement rather than requiring upfront fees.

Their thorough understanding of wind damage patterns, roofing systems, and insurance protocols often results in higher settlement amounts and more efficient claims processing compared to self-managed claims.

The Role Of Public Adjusters In Wind Damaged Membrane Roof Claims

When complex wind damage claims threaten to overwhelm property owners, professional public adjusters serve as essential advocates throughout the insurance settlement process. Their expertise helps navigate intricate policy terms and documentation requirements while ensuring fair compensation for membrane roof damage.

Public adjuster expertise encompasses detailed damage assessments, evidence collection, and strategic negotiations with insurance carriers. They conduct thorough inspections, document wind-related deterioration, and prepare extensive reports that substantiate claims.

Through their claim process insights, they help address common denial reasons, such as disputes over age-related wear versus storm damage.

These specialists also provide valuable guidance on preventive measures and risk management strategies, helping property owners protect their investments while maximizing the likelihood of successful future claims.

Benefits Of Using A Public Claims Adjuster For Wind Damaged Membrane Roof Repair Or Replacement Claims

Professional claim adjusters deliver substantial value to property owners facing wind-damaged membrane roof issues by providing extensive expertise across multiple critical areas. Their specialized knowledge enhances claim outcomes through detailed damage assessments, expert documentation, and strategic negotiations with insurance companies. Public adjuster benefits include increased claim acceptance rates and prevention of underpayment through detailed evidence gathering and policy review.

| Benefit Category | Claims Process Advantages | Impact on Outcomes |

|---|---|---|

| Investigation | Detailed damage assessment | Accurate claim valuation |

| Documentation | Professional evidence gathering | Enhanced claim validity |

| Expertise | Specialized knowledge application | Improved settlement rates |

| Advocacy | Insurance company negotiation | Maximum claim recovery |

How Are Public Insurance Adjusters Paid & What Are Their Fees?

Understanding the fee structure and payment arrangements for public insurance adjusters is essential for property owners considering professional claim assistance with wind-damaged membrane roofs. Public adjuster compensation typically follows regulated models, with most states requiring transparent documentation of all fees and services.

| Payment Method | Fee Range | Payment Timing | Key Considerations |

|---|---|---|---|

| Contingency Fee | 5-15% | After Settlement | Most Common Method |

| Flat Rate | Fixed Amount | Pre-Agreed Terms | Simple Claims Only |

| Hourly Rate | Varies | As Billed | Less Common Option |

| Mixed Structure | Variable | Case Dependent | Complex Claims |

Fee transparency is mandated by state regulations, requiring written agreements that outline all costs and services. Most public adjusters operate on contingency fees, receiving payment only after successful claim settlement, ensuring alignment with the property owner's interests.

Public Adjusters Vs. The Insurance Company Adjuster

Property owners facing wind-damaged membrane roof claims must navigate the distinct differences between public adjusters and insurance company adjusters to maximize their settlement potential. While insurance company adjusters operate with inherent limitations focused on minimizing payouts, public adjusters serve as dedicated advocates for policyholders.

| Aspect | Public Adjuster Benefits | Insurance Adjuster Limitations |

|---|---|---|

| Loyalty | Represents policyholder exclusively | Serves insurance company interests |

| Expertise | Extensive policy knowledge | Limited to company-specific training |

| Outcome | Maximizes claim settlements | Focuses on cost containment |

Understanding these fundamental differences becomes essential when dealing with complex membrane roof damage claims, where proper documentation and valuation greatly impact settlement outcomes. Public adjusters' specialized knowledge and policyholder advocacy often result in more thorough assessments and higher compensation amounts compared to settling directly with insurance company adjusters.

When To Contact A Public Adjuster For Membrane Roof Wind Damage

Building on the distinct roles of adjusters, timing becomes a key factor in maximizing insurance settlements for wind-damaged membrane roofs. Public adjuster roles extend beyond basic claim filing, offering expertise in complex damage assessment and claim negotiation strategies. Property owners should contact these professionals immediately after discovering wind damage to guarantee proper documentation and valuation.

| Timing Factor | Impact | Action Required |

|---|---|---|

| Initial Damage | Critical Documentation | Immediate Assessment |

| Complex Issues | Policy Analysis | Technical Evaluation |

| Settlement Phase | Negotiation Support | Strategic Planning |

Early involvement of public adjusters proves particularly valuable when dealing with extensive membrane roof damage, disputed claims, or when initial insurance company offers appear inadequate. Their expertise in policy interpretation and damage documentation strengthens the policyholder's position throughout the claims process, often resulting in more thorough settlements.

When to Contact Your Insurance Provider For Membrane Roof Wind Damage

Contacting an insurance provider for membrane roof wind damage requires careful consideration of whether to proceed independently or with a public adjuster's assistance.

Property owners filing claims independently should notify their insurance company immediately after discovering damage, documenting all visible issues with photos and detailed notes before an adjuster arrives.

Those opting to work with a public adjuster should secure their services before initiating contact with the insurance company, as these professionals can guide the initial claim filing process and guarantee proper documentation from the start.

If Using A Public Adjuster

When facing wind damage to a membrane roof, engaging a public adjuster before contacting the insurance provider can greatly improve claim outcomes.

Public adjuster advantages include specialized expertise in identifying both obvious and concealed damage, along with thorough understanding of complex insurance policies. These professionals work on a contingency basis, eliminating upfront costs while maximizing settlement potential.

Effective claim negotiation strategies begin with thorough documentation and inspection of all wind-related damage. Public adjusters coordinate with licensed contractors, prepare detailed damage reports, and handle all communication with insurance companies.

They guarantee proper assessment of structural issues, facilitate accurate damage valuations, and advocate for fair settlements. This systematic approach helps property owners navigate the claims process while maintaining focus on proper roof restoration.

If Filing On Your Own

Property owners who choose to handle wind damage claims independently must take immediate action following a storm event.

Insurance claim strategies begin with thorough documentation of the storm date and visible damage signs, including photos and videos of affected membrane sections, missing materials, and any contributing debris.

When traversing claims process requirements, property owners should review their policy details to understand coverage specifics, deductibles, and filing deadlines.

Initial contact with the insurance provider should include a detailed damage report, accompanied by professional assessments if necessary.

Property owners must prepare for adjuster inspections by organizing all documentation, including evidence of water intrusion linked to wind damage.

Following insurance company guidelines precisely helps guarantee smooth claim processing and appropriate settlement amounts.

Filing Process For Wind Damaged Membrane Roof Claims Using A Public Adjuster

Filing a membrane roof wind damage claim through a public adjuster streamlines the complex insurance process while maximizing policy benefits.

Professional adjusters conduct thorough damage assessments, handle communications with insurers, and coordinate with qualified contractors to document the full scope of repairs needed.

The systematic approach includes:

- Exhaustive site inspection and detailed documentation of all wind-related membrane damage

- Analysis of policy coverage terms to identify applicable benefits and endorsements

- Direct negotiation with insurance company adjusters using supporting evidence and expert assessments

- Coordination of contractor estimates and professional evaluations to validate claim amounts

Public Adjuster Thoroughly Inspects & Documents Wind Damage To Your Membrane Roof

After sustaining wind damage to a membrane roof, engaging a public adjuster can greatly streamline the insurance claims process and maximize potential compensation. The adjuster conducts exhaustive inspections focusing on key damage indicators while documenting findings to support claim strategies and address cost implications.

| Inspection Area | Documentation Method | Purpose |

|---|---|---|

| Surface Damage | Photos & Measurements | Evidence of tears, cracks, punctures |

| Edge Conditions | Video Documentation | Record frayed edges, lifting |

| Interior Effects | Moisture Readings | Verify water infiltration |

| Structural Impact | Technical Assessment | Evaluate system integrity |

The public adjuster meticulously reviews policy terms while gathering photographic evidence, preparing detailed damage reports, and developing documentation that substantiates the full extent of wind-related damage. This systematic approach guarantees thorough claim preparation and supports negotiations with insurance carriers.

Public Adjuster Reviews Policy For Hidden Roofing Coverage & Helps Maximize Policy Benefits

When homeowners face membrane roof wind damage, a public adjuster's expertise in policy analysis becomes invaluable for uncovering hidden coverage options and maximizing insurance benefits. Through thorough insurance policy review and coverage identification, adjusters analyze policy details, endorsements, and exclusions to guarantee all applicable benefits are claimed.

| Insurance Policy Review Steps | Coverage Identification | Benefit Maximization |

|---|---|---|

| Analyze Policy Language | Identify Endorsements | Calculate Full Value |

| Review Coverage Limits | Locate Hidden Benefits | Document All Damages |

| Examine Exclusions | Verify Wind Coverage | Negotiate Terms |

| Check Endorsements | Assess Repair Options | Challenge Denials |

| Evaluate Deductibles | Review Replacement Cost | Secure Fair Settlement |

Public adjusters leverage their industry knowledge to interpret complex policy terminology and advocate for the policyholder's interests, often securing more extensive repair solutions rather than temporary fixes.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Professional public adjusters streamline the insurance claim filing process by initiating direct communication with insurance carriers and managing interactions with company adjusters on behalf of policyholders with wind-damaged membrane roofs. Their expertise in public adjuster roles and insurance negotiation strategies guarantees ideal claim outcomes through:

- Documentation gathering and damage verification through detailed photos, notes, and professional assessments.

- Technical advocacy during damage disputes, facilitating second opinions when necessary.

- Strategic negotiations with insurance company adjusters to achieve fair damage assessments.

- Continuous claim monitoring and follow-up to address issues promptly.

Public adjusters handle all aspects of the claim, from initial notification through final settlement, providing technical expertise to justify damage extent and enhance policy benefits while managing contractor selection and supplemental claims when needed.

Public Adjuster Gets Professional Assessments

Thorough professional assessments form the cornerstone of successful wind-damaged membrane roof claims, with public adjusters orchestrating extensive evaluations through multiple inspection methods and expert consultations.

Adjuster expertise guides the deployment of assessment techniques ranging from wind uplift tests to advanced moisture surveys, ensuring complete documentation of both visible and concealed damage.

- Thermal imaging and drone technology provide detailed aerial mapping of membrane separation

- Structural engineers evaluate substrate integrity and potential internal damage

- Moisture detection equipment identifies water infiltration patterns beneath the membrane

- Wind uplift testing determines the extent of adhesion compromise

Public adjusters coordinate these specialized inspections while maintaining detailed documentation, including photographic evidence and technical reports, to substantiate insurance claims and facilitate accurate damage assessment for proper compensation.

Public Adjuster Gathers Supporting Evidence

Building upon extensive evaluations, public adjusters undertake systematic evidence gathering to fortify wind-damaged membrane roof claims. When documenting evidence, adjusters compile thorough photographic records, witness statements, and maintenance histories while evaluating damage patterns across the roof system.

| Evidence Type | Purpose | Documentation Method |

|---|---|---|

| Visual Documentation | Damage Verification | Photos/Videos with Timestamps |

| Weather Data | Event Validation | Historical Records/Reports |

| Maintenance Records | Condition Evaluation | Service Logs/Receipts |

| Expert Reports | Technical Validation | Inspection Forms/Analyses |

Their methodical approach includes collecting date-stamped imagery, organizing detailed damage inventories, and securing weather data that validates wind event severity. This documentation creates a robust foundation for insurance claims, establishing clear connections between weather events and observed membrane roof damage while meeting carrier requirements for claim processing.

Public Adjuster Submits Complete Claims Package

After completing thorough damage assessments and evidence collection, public adjusters compile and submit detailed claims packages to insurance carriers for wind-damaged membrane roofs. The claims package submission process requires meticulous documentation accuracy and adherence to specific filing protocols.

| Documentation Component | Purpose | Required Elements |

|---|---|---|

| Policy Information | Verification | Policy number, coverage details |

| Damage Assessment | Scope Definition | Inspection reports, measurements |

| Visual Evidence | Damage Proof | Photos, videos, diagrams |

| Cost Analysis | Value Determination | Repair estimates, quotes |

| Supporting Documents | Claim Validation | Weather reports, maintenance records |

The complete package typically includes professional inspection reports, photographic evidence, weather data, repair estimates, and relevant maintenance records. This extensive documentation helps facilitate prompt claim processing and increases the likelihood of fair settlement approval.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Professional public adjusters manage the extensive follow-up communications and time-sensitive requirements throughout the wind damage claims process. Their expertise in claims communication strategies guarantees efficient handling of documentation, deadlines, and insurance company interactions.

Public adjuster responsibilities include maintaining detailed records of all correspondence while advocating for fair settlements.

Key aspects of their follow-up management include:

- Tracking and responding to all insurance company requests within required timeframes

- Submitting supplemental documentation, including contractor estimates and expert reports

- Coordinating inspections between insurance adjusters and roofing professionals

- Monitoring claim status and addressing potential delays or concerns proactively

This systematic approach helps navigate complex claim requirements while guaranteeing compliance with policy terms and maintaining proper documentation throughout the process.

Public Adjuster Enforces Policyholder's Rights, & Negotiates Higher & More Fair Settlement

Public adjusters vigorously advocate for policyholder rights while strategically negotiating higher settlements in wind-damaged membrane roof claims. Their expertise in Fair Settlement Negotiation guarantees extensive damage assessment, thorough documentation, and maximum claim value.

Public Adjuster Responsibilities encompass critical actions to protect policyholder interests:

- Conducting detailed roof inspections to identify primary and secondary wind damage.

- Documenting all damages with photographic evidence and professional reports.

- Challenging improper claim denials through evidence-based presentations.

- Leveraging policy terms to negotiate ideal settlement amounts.

These professionals navigate complex insurance processes, identify hidden damages, and provide accurate repair cost estimates.

Their involvement often results in considerably higher settlements compared to policyholder-handled claims, particularly when addressing complex membrane roof damage scenarios.

Public Adjuster Speeds Up Claim Settlement Time

Partnering with a public adjuster dramatically accelerates the settlement timeline for wind-damaged membrane roof claims. Their expertise streamlines the claim process while ensuring policy benefits are fully utilized.

Public adjusters manage all aspects of documentation, communication, and negotiation with insurance carriers.

Key efficiency improvements include:

- Immediate professional inspection and extensive damage documentation

- Direct coordination with contractors and insurance company adjusters

- Expedited claim filing with detailed repair estimates and supporting evidence

- Proactive claim monitoring to prevent processing delays

Public adjusters eliminate common roadblocks by leveraging industry knowledge and established protocols.

Their systematic approach includes thorough damage assessment, proper documentation submission, and strategic negotiations, resulting in faster claim resolutions and more efficient restoration of damaged membrane roofs.

Choosing & Working With Trusted Membrane Roof Contractors

Working with a public adjuster provides access to an established network of qualified membrane roofing contractors who can deliver accurate repair or replacement estimates. Professional contractors within the adjuster's network maintain proper licensing, insurance coverage, and proven track records of quality workmanship. Public adjusters review contractor estimates to verify fair pricing, thorough scope of work, and adherence to industry standards before proceeding with repairs.

| Contractor Verification | Public Adjuster Benefits |

|---|---|

| License & Insurance Status | Access to Vetted Network |

| Industry Certifications | Estimate Review & Validation |

| Project Portfolio | Fair Pricing Verification |

| Reference Checks | Scope of Work Analysis |

| Quality Control Standards | Claims Documentation Support |

Utilize Your Public Adjusters Extensive Professional Network

Three critical advantages emerge when leveraging a public adjuster's professional network for membrane roof repairs.

First, access to pre-vetted, qualified contractors eliminates the uncertainty in contractor selection, ensuring licensed professionals with proven membrane roofing expertise.

Second, public adjusters facilitate seamless communication between contractors and insurance companies, maximizing claim outcomes through professional documentation and negotiation support.

Third, their network typically includes contractors familiar with local building codes and climate conditions. These established relationships streamline the repair process while ensuring compliance with insurance policy requirements.

Public adjusters' networks often include contractors who provide extensive warranties, use quality materials, and maintain high workmanship standards. This integrated approach combines technical expertise with insurance claim optimization, resulting in more efficient project execution and favorable settlement outcomes.

Getting Professional Membrane Roofing Repair Or Replacement Estimates

Building upon established professional networks, obtaining accurate estimates for membrane roofing repairs or replacements requires systematic evaluation of qualified contractors. Contractor qualifications should be thoroughly vetted through detailed documentation review, reference checks, and verification of proper licensing and insurance coverage.

| Estimate Component | Required Details | Impact on Accuracy |

|---|---|---|

| Material Costs | Type, quantity, brand | 30-40% of total |

| Labor Requirements | Crew size, timeframe | 40-50% of total |

| Equipment Needs | Rental duration, type | 10-20% of total |

To guarantee estimate accuracy, contractors should provide itemized breakdowns including disposal costs, permits, and warranty terms. Professional estimates typically range from $6.50 to $9.80 per square foot, varying based on installation method and material selection. Regular quality control measures during estimation help prevent overlooked costs and guarantee project success.

Let Your Public Adjuster Review Estimates To Ensure Contractor Honesty

To guarantee accuracy and fairness in roofing repair estimates, property owners should engage public adjusters who can thoroughly evaluate contractor proposals and identify potential discrepancies.

These professionals possess essential public adjuster qualifications, including expertise in Xactimate software and extensive understanding of insurance claim processes.

Public adjusters serve as impartial intermediaries, ensuring contractor transparency through detailed review of material specifications, labor costs, and scope of work.

They verify that estimates align with industry standards and insurance company requirements while confirming compliance with local building codes.

By leveraging their experience in claims negotiation, public adjusters can identify inconsistencies in contractor proposals and protect property owners from potential overcharging or incomplete repairs.

This oversight helps maintain high standards in membrane roofing repairs while facilitating smooth insurance claim settlements.

Preventing Future Membrane Roof Damage From Wind

Protecting membrane roofs from wind damage requires a comprehensive approach that combines proper installation, regular maintenance, and strategic upgrades. Preventive maintenance strategies include regular inspections to identify vulnerabilities and implementing wind resistant materials designed for high-performance applications.

| Prevention Aspect | Action Required | Expected Outcome |

|---|---|---|

| Installation | Secure fastening systems | Enhanced wind uplift resistance |

| Materials | High-wind rated products | Improved durability |

| Maintenance | Regular inspections | Early problem detection |

| Upgrades | SPF roofing application | Superior adhesion strength |

Industry professionals recommend utilizing advanced fastening techniques, particularly in vulnerable areas like corners and edges. Additionally, incorporating continuous cleated systems and top-tier cover boards greatly enhances wind resistance. For maximum protection, building owners should guarantee compliance with relevant building codes and maintain adequate insurance coverage.

About The Public Claims Adjusters Network (PCAN)

When damage occurs to membrane roofs, property owners often seek professional guidance for maneuvering complex insurance claims.

The Public Claims Adjusters Network (PCAN) consists of licensed professionals who specialize in representing policyholder interests throughout the claims process.

PCAN members deliver essential Public Adjuster Benefits, including thorough damage assessments, detailed documentation, and skilled negotiations with insurance providers.

During the Public Claims Process, these adjusters conduct extensive inspections of wind-damaged membrane roofs, develop accurate repair estimates, and work to secure fair settlements.

Operating on a contingency basis, PCAN adjusters typically charge a percentage of the final settlement, eliminating upfront costs for property owners.

Their expertise helps maximize claim values while ensuring compliance with insurance requirements and state regulations.

References

- https://www.cmsroofing.com/minimizing-the-risk-of-wind-damage-to-flat-membrane-and-asphalt-shingle-roofing-systems

- https://bmroofing.com/wind-damage-to-roof/

- https://vtroofing.com/tips/roof-wind-damage-comprehensive-guide/

- http://smrhomepros.com/wind-damage-to-roof/

- https://litespeedconstruction.com/what-causes-damage-to-a-commercial-roof-membrane/

- https://northfaceconstruction.com/blog/wind-damage-to-roof/

- https://www.roperroofingandsolar.com/roof-wind-damage/wind-damage-signs/

- https://www.kirberg.com/flat-roof-wind-damage/

- https://www.superstormrestoration.com/blog/how-to-tell-if-high-winds-damaged-your-roof/

- https://www.billraganroofing.com/blog/insurance-cover-roof-damage-wind