A thorough wind damage mitigation guide is essential for homeowners to minimize risks and insurance costs. Effective wind mitigation techniques, such as reinforcing garage doors and installing impact-resistant windows, can reduce damage risk and insurance costs. Certified wind mitigation inspections can lead to discounted insurance premiums. By understanding wind mitigation benefits and implementing proactive measures, homeowners can enhance home protection. Further exploration of wind mitigation strategies and techniques can provide valuable insights for long-term home resilience.

Key Takeaways

- Implement a hip roof design to reduce susceptibility to wind pressure for enhanced protection.

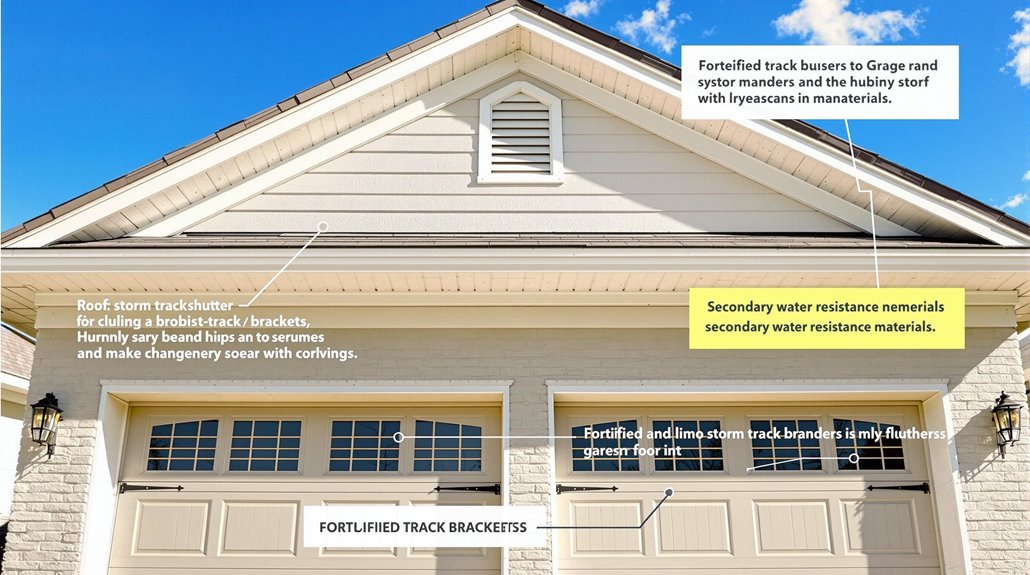

- Reinforce garage doors with secure track brackets and panels to strengthen weak points.

- Install impact-resistant windows and secure structural attachments for doors to minimize vulnerability.

- Ensure proper roof-to-wall connections with large nails and hurricane clips to improve structural integrity during storms.

- Utilize hurricane straps or clips for improved wind resistance and aerodynamic advantages in storm-prone areas.

Understanding Wind Mitigation Benefits and Techniques

While wind damage poses a significant threat to homes, particularly in regions prone to hurricanes and tropical storms, implementing effective wind mitigation techniques can substantially reduce the risk of damage and associated insurance costs.

In regions such as Florida, wind damage accounts for up to 70% of homeowners' insurance premiums, emphasizing the importance of mitigation strategies. Certified wind mitigation inspections can lead to discounted insurance premiums, potentially saving homeowners thousands of dollars annually.

The design and structural integrity of homes, including the type of roof and connections to walls, play a vital role in mitigating wind damage.

Understanding the benefits and various techniques used to mitigate wind damage is essential for minimizing associated risks and ensuring the long-term resilience of homes.

Effective Wind Mitigation Strategies for Homeowners

Homeowners seeking to minimize the risks associated with wind damage can implement various effective wind mitigation strategies to enhance their home's resilience.

Protecting your home from wind damage requires a multi-faceted approach. Reinforcing garage doors with secure track brackets and panels is essential, as these are often weak points in a home's defense against strong winds.

Impact-resistant windows and secure structural attachments for doors also greatly enhance the protective barriers of a home. A hip roof design can reduce susceptibility to wind pressure, while proper roof-to-wall connections with large nails and hurricane clips guarantee structural integrity during wind events.

State-Specific Incentives for Wind Damage Mitigation

In an effort to encourage proactive measures against wind damage, various states have implemented incentives for homeowners who invest in wind mitigation features.

For instance, Florida requires insurance companies to offer discounts to homeowners who implement wind mitigation features, and homeowners can benefit from reduced insurance premiums by obtaining a certified wind mitigation inspection.

The Florida wind mitigation law mandates that insurers provide premium reductions for homes with specific wind-resistant characteristics.

Other states offer financial assistance programs or tax credits to homeowners who make wind-resistant upgrades to their properties.

These incentives can lead to significant savings for homeowners, potentially exceeding $20,000 in deductibles, highlighting the importance of investing in wind mitigation features.

State-specific incentives play an essential role in encouraging homeowners to adopt proactive measures.

Essential Roof and Structural Connections for Wind Resistance

The implementation of wind mitigation features, incentivized by state-specific programs, can markedly enhance a home's resilience to high winds. Paramount among these are roof-to-wall connections.

For instance, utilizing hurricane clips or straps can bolster the structural integrity of these connections, ultimately improving their capacity to transfer uplift loads during severe storms. Additionally, certain roof configurations such as hip roofs possess inherent aerodynamic advantages over gable roofs.

To further minimize vulnerability to wind damage, garage doors should also be reinforced with securely attached track brackets and ideally lack windows, just as windows and glass doors should be correspondingly protected.

Implementation of these measures, upon proper analysis and in line with economic and material realities, can substantially decrease risks to dwellings in regions known for intensely stormy weather.

Proactive Measures for Enhanced Home Protection

While wind mitigation features can considerably enhance a dwelling's resilience to high winds, their effectiveness is contingent upon the implementation of proactive measures that address specific vulnerabilities in a home's structure.

To protect your home, reinforcing garage doors with secure track brackets and panel support is essential, as they are often the weakest point during storms. Installing impact-resistant windows and securing glass surfaces with storm shutters can prevent extensive interior damage.

Utilizing hip roof designs and properly securing roof-to-wall connections with large nails and hurricane straps can also enhance wind resistance. Additionally, implementing secondary water resistance measures, such as modified bitumen and foam seal, can protect against water intrusion if the primary roof covering fails, reducing potential water damage. Most home insurance coverage will protect against wind damage, but implementing these protective measures can help prevent costly claims and repairs.

The Benefits Of Consulting A Public Adjuster

Consulting a public adjuster offers several key benefits in the wake of wind damage.

Their expertise in insurance claims, coupled with an objective assessment of damage, enables a streamlined claim process that is considerably less prone to disputes and delays.

Studies demonstrate that claims handled by public insurance adjusters result in settlements up to 800% higher than those without professional representation.

Expertise In Insurance Claims

Engaging a public adjuster can be a strategic move for homeowners seeking to maximize their insurance claims, particularly after experiencing damage from flying debris during a severe windstorm.

By leveraging their knowledge of insurance policies and procedures, public adjusters can accurately document the full extent of property damage, ensuring no details are overlooked. This expertise often results in notably higher settlements for policyholders.

On average, claims adjusted by public adjusters tend to be 20-50% higher than those handled by homeowners alone.

In addition, public adjusters can expedite the complex claims process, guiding paperwork requirements to secure prompt settlements for their clients. This professional guidance empowers homeowners to recover from wind damage more effectively.

Professional public adjusters maintain 24-hour response times and provide claim status updates every 10 days throughout the settlement process.

Objective Damage Assessment

How can homeowners guarantee that their insurance claims accurately reflect the true extent of wind damage to their properties? Consulting a public adjuster can help confirm that all losses are documented and valued appropriately.

Public adjusters are licensed professionals who have expertise in maneuvering through complex insurance policies, potentially increasing the payout by an average of 20% compared to claims filed without their assistance. They provide an extensive evaluation of damages, including hidden issues that might be overlooked by the insurance company's adjuster.

Studies show that working with public adjusters increases settlements by up to 800% compared to handling claims independently.

To confirm a fair assessment of damages, homeowners should take action and engage a public adjuster, who can negotiate directly with insurance companies on their behalf, alleviating stress and resulting in quicker claim resolutions.

Streamlined Claim Process

By leveraging the expertise of a public adjuster, homeowners can streamline the claim process for wind damage, ensuring that all pertinent damages are meticulously documented and presented to the insurance company.

This enables a more efficient process, reducing delays and allowing homeowners to expedite repairs to safeguard their home from damage.

Public adjusters work on a contingency basis, aligning their interests with the homeowner's, and possess specialized knowledge of insurance policies and local building codes.

This expertise enables them to identify and maximize the claim value for covered losses, ensuring that homeowners receive fair compensation for damages sustained.

Unlike insurance company adjusters who follow company financial interests, public adjusters focus solely on advocating for the policyholder's maximum eligible compensation.

Higher Claim Payouts & Settlements

Homeowners who navigate the claims process with the expertise of a public adjuster often experience more favorable outcomes, particularly in relation to higher claim payouts and settlements.

This is because public adjusters possess in-depth knowledge of insurance policy language and regulations, enabling them to accurately assess damages and negotiate with insurance companies.

Some key benefits of working with a public adjuster include:

- Identifying overlooked damages and entitlements to increase overall claim value

- Securing settlements 20-50% higher than those offered by insurance companies

- Streamlining the claims process to allow homeowners to focus on recovery

- Establishing direct contact with insurance companies to expedite negotiations and documentation

While public adjusters typically charge up to 10% of the final settlement amount as their fee, the significantly higher payouts they secure often justify this investment.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) is an extensive resource connecting policyholders with a national network of thoroughly vetted and state-licensed public adjusters.

PCAN's member adjusters cover over 30 claim types, including damage from natural hazards like windstorms, and are located in 40+ states.

To guarantee expertise, public adjusters in the network undergo an intensive application and interview process. They are held to the highest standards of ethics, morals, and professionalism, with mandatory yearly audits of their licenses and any complaints.

This process allows PCAN to act as a trusted resource for policyholders seeking assistance with wind damage claims.

Members must maintain 4+ star reviews on at least one platform to remain in good standing with the network.

Frequently Asked Questions

How Do You Mitigate Wind Damage?

When the winds of change blow, a proactive approach is essential. To mitigate wind damage, one can reinforce the roof with hurricane straps, utilize hip roof designs, and install storm shutters, ensuring a sturdy defense against wind-borne debris.

Is a Wind Mitigation Inspection Worth It?

Conducting a wind mitigation inspection provides substantial insurance benefits, generating significant premium discounts, and validating structural enhancements to withstand high-velocity winds, ultimately offering long-term savings and increased home resilience against severe weather events and potential damage.

What Qualifies for Wind Mitigation in Florida?

"An ounce of prevention is worth a pound of cure." In Florida, qualifying features for wind mitigation include impact-resistant windows, reinforced garage doors, proper roof-to-wall connections, secondary water resistance barriers, and hip roof designs, meeting specific insurance requirements.

How Much Discount for Wind Mitigation in Florida?

Homeowners in Florida can receive insurance premium discounts ranging from 10% to 30% for implementing wind mitigation features, resulting in substantial insurance savings, with certified inspections yielding higher discounts, potentially exceeding several hundred dollars annually.