Homeowners insurance covers sagging floors only when caused by sudden, accidental events listed as covered perils in the policy. Common covered causes include fire damage, severe weather incidents, or water damage from burst pipes. Normal wear and tear, construction defects, and maintenance neglect are typically excluded from coverage. Documentation through photographs, inspection reports, and timely claim submission is essential. Understanding specific policy coverage and exclusions helps determine eligibility for compensation.

Key Takeaways

- Homeowners insurance typically covers sagging floors only when caused by sudden accidents or covered perils like fire or burst pipes.

- Normal wear and tear, foundation issues, and damage from poor maintenance are generally excluded from standard insurance coverage.

- Documentation through photographs, professional inspection reports, and timely claim submission are essential for coverage approval.

- Working with public insurance adjusters can help maximize claim outcomes and navigate coverage limitations effectively.

- Regular inspections and maintenance records are crucial for proving damage wasn't pre-existing or due to negligence.

Coverage Details for Sagging Floor Insurance Claims

When homeowners discover sagging floors in their residences, insurance coverage depends primarily on the specific cause of the structural issue. Insurance policies typically provide protection when sagging floors result from sudden accidents or covered perils, such as fire damage, severe weather events, or water damage from burst pipes.

To successfully file claims for sagging floors, homeowners must demonstrate that the damage stems from a covered incident rather than maintenance neglect or gradual deterioration. Insurance providers require thorough documentation, including photographs and professional inspection reports, to verify the cause and extent of the damage. Claims must be submitted promptly after discovering the issue to maintain eligibility for coverage.

Foundation problems leading to sagging floors may be excluded from standard homeowners insurance policies if they arise from construction defects, normal wear and tear, or inadequate maintenance.

Understanding these coverage limitations helps homeowners determine their eligibility for insurance compensation when dealing with floor structural issues.

Working with public insurance adjusters can help maximize claim settlements for covered structural damage to floors.

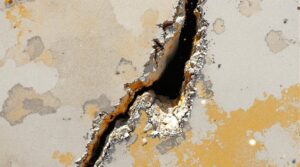

Common Causes and Warning Signs of Floor Damage

Understanding the root causes of floor damage enables homeowners to better evaluate their insurance coverage options and take preventive measures. Several common causes can contribute to structural issues in floors, requiring early intervention to prevent extensive damage.

- Water damage from persistent leaks weakens support structures and compromises floor integrity.

- Foundation movement due to soil shifts or settling creates uneven surfaces throughout the home.

- Poor construction practices, including inadequate support beams or improper installation methods.

- Pest infestations, specifically termites and carpenter ants, that deteriorate floor joists.

Regular inspections are essential for identifying warning signs before floors develop significant problems. Homeowners should watch for cracks in walls, doors that stick or don't close properly, and noticeably uneven surfaces.

These indicators often signal underlying issues that require professional assessment. Early detection through systematic monitoring allows property owners to address problems before they escalate into major structural concerns requiring costly repairs.

Consulting with insurance specialists can help determine if your dwelling coverage includes protection against structural damage to floors.

Steps to Document and Report Floor Issues

Proper documentation of floor issues plays an essential role in successfully filing insurance claims and obtaining necessary repairs. Homeowners must systematically gather evidence of sagging floors through clear photographs, detailed notes, and professional evaluations. Documentation should include maintenance records demonstrating responsible property upkeep and any foundation damage assessments. Working with public insurance adjusters can help maximize potential settlements for severe structural damage claims.

| Documentation Type | Purpose | Required Details |

|---|---|---|

| Photographs | Visual Evidence | Cracks, uneven surfaces, structural damage |

| Written Records | Timeline | First notice date, progression, related incidents |

| Maintenance Logs | Proof of Upkeep | Regular inspections, repairs, improvements |

| Professional Reports | Expert Assessment | Cause analysis, damage extent, repair recommendations |

| Insurance Forms | Claim Processing | Policy information, incident details, supporting documents |

When filing a claim, homeowners should promptly contact their insurance company, submit thorough documentation, and follow specific guidelines for claims processing. This systematic approach increases the likelihood of homeowners insurance covering sagging floor repairs and expedites the resolution process.

Preventive Measures and Regular Maintenance Guidelines

Implementing preventive measures and adhering to regular maintenance schedules can significantly reduce the risk of floor sagging and structural deterioration.

Homeowners insurance providers often require evidence of proper maintenance when evaluating claims related to structural issues, making regular inspections and upkeep essential.

- Schedule biannual inspections by a qualified structural engineer to assess floor stability and foundation integrity

- Maintain detailed documentation of all maintenance activities, repairs, and professional assessments for insurance claims

- Implement proper drainage solutions around the property's perimeter to prevent water-related foundation damage

- Conduct regular plumbing inspections to identify and address leaks before they compromise floor structure

Property owners should establish a systematic approach to maintenance, focusing on early detection of potential issues.

Regular monitoring of floor levels, foundation conditions, and moisture control systems helps prevent extensive damage and supports successful homeowners insurance claims when necessary.

Professional evaluations provide critical documentation that may prove invaluable during the claims process.

Understanding your standard policy exclusions can help determine whether additional coverage is needed for structural issues.

Frequently Asked Questions

Will Insurance Pay to Replace the Entire Floor?

Insurance coverage for complete floor replacement depends on documented sudden damage from covered perils, not wear and tear. Policy details, inspection findings, and structural damage causes determine claim approval.

What Not to Say to Home Insurance?

Homeowners should avoid admitting fault, speculating about causes, discussing maintenance history, or suggesting wear and tear during claims. Precise documentation and professional assessments strengthen cases while maintaining factual, verifiable statements.

Does Homeowners Insurance Cover Foundation Settling?

Homeowners insurance typically excludes foundation settling damage unless caused by covered perils. Proper home maintenance, regular foundation inspections, and risk assessment can help prevent claims denials and manage repair costs within coverage limits.

Does Homeowners Insurance Cover Rotted Floors?

Homeowners insurance typically excludes rotted floors, classifying them as maintenance responsibility rather than sudden damage. Coverage applies only when rot directly results from covered perils, requiring thorough damage assessment and policy verification.

Final Thoughts

Understanding homeowners insurance coverage for sagging floors depends on the cause of damage and policy specifics. While sudden, accidental events may be covered, gradual deterioration typically isn't. What could be more costly: addressing structural issues promptly or waiting until catastrophic failure occurs? Regular inspections, documentation, and immediate reporting of floor problems remain essential for both insurance claims and maintaining structural integrity. Prevention through proper maintenance proves the most reliable protection.

For homeowners facing property damage claims related to their homeowners insurance policy, including sagging floors, insurance industry professionals and legal experts strongly advise consulting a qualified state-licensed public adjuster. These professionals work exclusively for policyholders, not insurance companies, serving as dedicated advocates throughout the claims process.

Public adjusters are state-licensed professionals who help policyholders navigate complex insurance policies, identify hidden damages often unknown to homeowners, thoroughly document losses, and negotiate with insurance companies to secure fair settlements. Their expertise ensures policyholder rights are protected while maximizing claim payouts and expediting the claims process. This allows homeowners to focus on recovery while reducing the stress of dealing with insurance companies. Policyholders interested in discussing their property damage claims can request a no-obligation free consultation with a Public Claims Adjusters Network (PCAN) member public adjuster.