Homeowners insurance typically covers mold damage only when it results from a covered peril like burst pipes or appliance malfunctions. Standard HO-3 policies exclude mold unless directly caused by these sudden, accidental events. Coverage limits generally range from $1,000 to $10,000, though costs can exceed $30,000 for whole-house remediation. Long-term maintenance issues, floods, and natural wear remain excluded. Working with public adjusters can increase claim settlements by 30-700% through expert policy navigation and documentation.

Key Takeaways

- Standard homeowners insurance policies exclude mold damage unless it results from a covered peril like burst pipes or appliance malfunctions.

- Coverage limits for mold remediation typically range from $1,000 to $10,000 under standard policies.

- Additional mold coverage can be purchased through policy endorsements for broader protection against mold-related damages.

- Insurance won't cover mold from long-term maintenance issues, poor ventilation, natural wear and tear, or flooding.

- Immediate documentation and notification to insurance providers is essential when discovering mold from a covered water event.

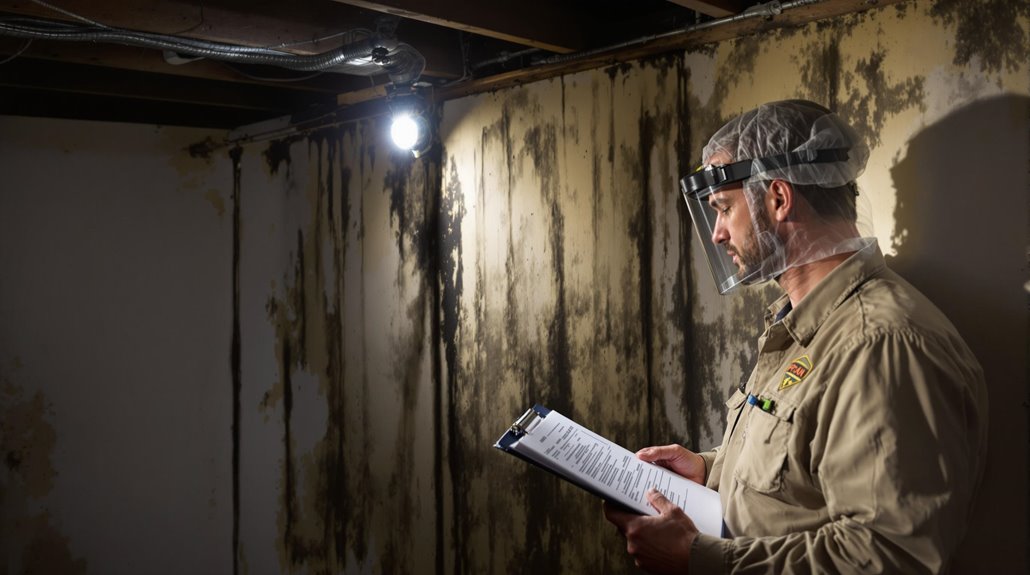

Understanding Black Mold Coverage in Standard Insurance Policies

Standard homeowners insurance policies have complex stipulations regarding black mold coverage, with most basic policies excluding mold damage unless it results directly from a covered peril. Coverage Basics typically focus on sudden and accidental water damage, such as burst pipes or storm-related incidents, while excluding damage from long-term maintenance issues or neglect.

Policy Requirements vary among insurers, with some implementing absolute mold exclusion provisions that deny coverage under any circumstances.

HO-3 policies, the most prevalent type, cover all perils except those specifically excluded, while named peril policies like HO-1 or HO-2 only protect against explicitly listed damages.

When coverage is provided, remediation limits generally range from $1,000 to $10,000, depending on the policy terms. Homeowners seeking complete protection can often secure additional mold coverage through policy endorsements or separate coverage options, though this requires careful review of policy documents and consultation with insurance agents. Construction-related moisture issues are typically excluded from standard policies, making it crucial for homeowners to address building defects promptly.

When Your Insurance Will Pay for Mold Damage

Homeowners insurance typically covers mold damage when it stems from specific covered perils outlined in the policy. For instance, if mold develops as a result of a covered peril such as a burst pipe or flooding due to a storm, the costs associated with remediation may be included in the homeowners insurance mold coverage. However, it’s important for homeowners to review their policies carefully, as some may exclude mold damage or limit coverage under certain conditions. Regular maintenance and timely repairs can also help mitigate mold risks and ensure better protection under their insurance policy.

Coverage applies when mold results from sudden and accidental events, such as burst pipes, appliance malfunctions, or water damage from firefighting efforts. A thorough Coverage Evaluation by insurance adjusters determines if the cause falls within policy parameters.

For successful claims, homeowners must demonstrate that the mold damage was unforeseen and not due to negligence or lack of maintenance. The process requires extensive documentation through photos and videos, followed by prompt notification to the insurance provider.

Proper Moisture Detection and immediate remediation efforts are vital steps to prevent further damage and strengthen the claim.

Insurance companies require professional assessment of the damage extent and implementation of appropriate remediation measures. Policyholders should maintain detailed records of all moisture control efforts, including the use of dehumidifiers and professional cleaning services, to support their claim and guarantee proper coverage.

Working with public insurance adjusters can significantly increase the chances of maximizing compensation through their expertise in identifying overlooked policy benefits.

Common Exclusions and Limitations for Mold Claims

Insurance policies contain significant restrictions and exclusions when it comes to mold-related claims, with many providers implementing strict limitations on coverage. Common coverage denials include mold damage resulting from floods, water backup issues, poor maintenance, and high humidity conditions.

Many policies incorporate hidden restrictions through absolute mold exclusions or specific sub-limits for remediation costs.

Standard homeowners insurance typically excludes mold damage stemming from long-term issues, such as neglected maintenance, natural wear and tear, or inadequate ventilation. Coverage is generally limited to sudden and accidental events, with specific monetary caps on remediation expenses.

To obtain broader protection, homeowners may need to purchase additional endorsements like water and sewage backup coverage, flood insurance, or specialized mold mitigation policies. Equipment breakdown coverage can also provide protection against mold resulting from mechanical failures, though these supplemental options often require higher premiums.

Only 27% of homeowners in designated flood zones carry flood insurance to protect against water-related damages like mold.

The Real Cost of Mold Remediation and Insurance Coverage

When confronting mold issues in residential properties, homeowners face significant financial implications, with remediation costs ranging from $1,125 to $3,439 nationally.

The specific expenses vary based on the type of mold present and its location within the structure, with black mold remediation typically commanding higher costs between $800 and $7,000.

Location-specific remediation costs fluctuate considerably, from $500 for crawl space treatment to upwards of $30,000 for whole-house interventions.

Property damage in critical areas such as HVAC systems can incur expenses between $1,500 and $10,000.

Insurance coverage for these costs depends primarily on the cause of the mold growth and policy specifications.

While sudden and accidental mold damage may qualify for coverage, most policies impose specific caps, commonly around $10,000.

Homeowners should note that damage resulting from neglect or inadequate maintenance typically falls outside insurance coverage parameters.

Professional mold testing services typically cost between $200 and $600 for initial inspections to identify the specific species present.

Essential Steps to Protect Your Home and Insurance Rights

Protection against mold damage requires a strategic approach that combines preventive measures with proper insurance documentation. Homeowners must implement regular preventive maintenance, including moisture control, installation of exhaust fans in high-humidity areas, and prompt repair of any water leaks.

Essential protective measures include directing gutters and downspouts away from the foundation and avoiding carpet installation in damp areas.

Regular home inspections can identify potential issues before they escalate into significant problems. When water damage occurs, thorough insurance documentation becomes critical, as coverage typically applies only to sudden and accidental events.

Homeowners should consider supplementing their standard policy with specialized endorsements for complete protection. These may include coverage for water backup, sump pump failure, and increased mold remediation limits.

Understanding policy exclusions, particularly those related to long-term water seepage and maintenance-related issues, helps guarantee appropriate coverage and timely response to potential claims.

Working with public adjusters can help homeowners secure settlements up to 700% higher than handling claims independently.

The Benefits Of Consulting A Public Adjuster

Consulting a public adjuster provides homeowners with expert guidance through complex mold-related insurance claims while ensuring objective damage assessments.

Public adjusters streamline the claims process by managing documentation, negotiations, and communications with insurance companies on behalf of policyholders.

Their expertise often results in higher claim settlements, as they thoroughly understand policy coverage and can identify all compensable damages that might otherwise be overlooked.

Studies show that working with qualified public adjusters can increase settlement amounts by up to 500% for non-catastrophe claims like mold damage.

Expertise In Insurance Claims

Three key advantages make public adjusters invaluable during insurance claims processes: their extensive knowledge of policy intricacies, professional expertise in documentation, and skilled negotiation capabilities.

Their claims expertise encompasses thorough understanding of insurance policies, procedures, and company tactics.

Public adjusters interpret complex policy language and identify specific nuances that impact coverage outcomes. Through professional assessment, they navigate the intricate claims process while recognizing and counteracting strategies insurance companies may use to minimize payouts.

Their proficiency extends to organizing vital documentation, including damage assessments, repair estimates, and proof of loss paperwork. This systematic approach guarantees all evidence is properly compiled and presented, maximizing the potential for fair settlements while reducing the policyholder's direct involvement in complex administrative procedures.

With thorough damage identification, public adjusters are skilled at discovering hidden losses that insurance company adjusters might overlook during their assessments.

Objective Damage Assessment

While homeowners may attempt to assess property damage independently, engaging a public adjuster provides significant advantages through professional, unbiased evaluation. Public adjusters conduct thorough structural analysis and identify complex damage patterns that property owners might overlook, maximizing potential claim settlements.

Operating on a contingency basis with fees up to 10% of the total claim amount, these licensed professionals work exclusively for policyholders, not insurance companies.

Their objective assessment helps identify all relevant damages while reducing errors and omissions in the claims process. Studies indicate that professional adjuster involvement typically results in higher claim payouts compared to self-managed claims.

Additionally, public adjusters handle negotiations with insurance companies, ensuring complete documentation of damages while adhering to strict legal and regulatory requirements regarding their services.

Members of The Public Claims Adjusters Network must maintain a perfect record with no Department of Insurance complaints for the previous 12 months.

Streamlined Claim Process

Beyond objective assessment, public adjusters streamline the often complex insurance claims process for mold damage. Their expertise in reviewing policies, understanding coverage limits, and recognizing potential underestimates guarantees process efficiency throughout the claim lifecycle.

Public adjusters facilitate seamless submission by gathering exhaustive documentation, including detailed photographs, damage assessments, and repair estimates. Their knowledge of insurance company procedures and potential loopholes positions them to secure more favorable outcomes for homeowners.

They handle all negotiations with insurers, presenting valuable evidence and arguments to support maximum payouts.

This professional intervention reduces the burden on homeowners while increasing the likelihood of fair settlements. Public adjusters' years of experience in managing mold claims helps avoid common pitfalls and expedites resolution through clear communication with insurance companies.

Working with qualified public adjusters can help increase insurance claim settlement amounts by 30-50% compared to handling the process alone.

Higher Claim Payouts & Settlements

Statistics consistently show that homeowners who engage public adjusters receive substantially higher claim settlements compared to those who handle claims independently. Public adjusters achieve this through strategic claim maximization techniques and expert settlement negotiations.

| Expertise Area | Impact on Claims | Outcome |

|---|---|---|

| Documentation | Thorough Assessment | Higher Valuation |

| Legal Knowledge | Policy Compliance | Protected Rights |

| Negotiation | Strategic Communication | Maximized Settlements |

| Technical Analysis | Professional Appraisals | Accurate Compensation |

Their expertise in policy interpretation, detailed damage documentation, and strategic communication with insurers guarantees all covered losses are properly identified and valued. Public adjusters leverage their understanding of insurance law, claim precedents, and industry practices to advocate effectively for homeowners, resulting in settlements that more accurately reflect the true extent of mold-related damages. While charging 5-20% contingency fees, public adjusters provide professional claim management without requiring upfront payments from homeowners.

About The Public Claims Adjusters Network (PCAN)

When dealing with complex insurance claims, homeowners often turn to the Public Claims Adjusters Network (PCAN), a professional organization of independent adjusters who advocate exclusively for policyholders. The network structure consists of licensed professionals who possess extensive industry experience and specialized training in claims management. Member qualifications include demonstrated expertise in policy interpretation, damage assessment, and negotiation skills.

PCAN adjusters provide complete services throughout the entire claims process, from initial documentation to final settlement. These professionals conduct detailed property assessments, interpret complex policy provisions, and handle all communications with insurance carriers.

Their expertise extends to various aspects of claims, including business interruption calculations and property devaluation analysis. By leveraging their thorough understanding of repair costs and construction practices, PCAN members work to secure maximal claim outcomes while maintaining high standards of professional service and client satisfaction.

Frequently Asked Questions

How Quickly Does Black Mold Spread After Water Damage Occurs?

Black mold can begin colonizing within 24-48 hours of water damage, with visible growth appearing in 18-21 days, depending on moisture levels, ventilation requirements, and environmental conditions.

Can I Stay in My House During Professional Mold Remediation?

Temporary relocation is recommended during professional mold remediation due to health risks from airborne spores. If staying, occupants must follow strict safety protocols and remain isolated from contaminated areas.

Will Filing a Mold Claim Increase My Insurance Premiums?

Like clockwork, filing a mold claim typically leads to premium increases. Insurance providers factor claim history into premium calculations, potentially resulting in higher rates and long-term coverage impacts.

Does Homeowners Insurance Cover Mold Testing and Inspection Costs?

Homeowners insurance covers inspection costs and testing prices when mold results from a covered peril. Coverage typically includes professional assessment services, but only if the mold stems from an insured incident.

Can I Remove Black Mold Myself to Save on Insurance Deductibles?

DIY black mold removal is strongly discouraged due to health risks and potential spore dispersal. Without proper safety equipment and protective clothing, individuals risk exposure and inadequate remediation, potentially increasing long-term costs.

References

- https://www.valuepenguin.com/does-homeowners-insurance-cover-mold

- https://www.puroclean.com/southlake-tx-puroclean-southlake/blog/mold-remediation-costs-what-to-expect/

- https://www.anidjarlevine.com/faqs/does-homeowners-insurance-cover-black-mold/

- https://www.libertymutual.com/insurance-resources/property/home-insurance-and-mold-faqs

- https://rescueclean911.com/blog/who-pays-for-mold-remediation/

- https://openly.com/the-open-door/articles/does-homeowners-insurance-cover-mold

- https://www.kin.com/blog/is-mold-covered-by-home-insurance/

- https://www.investopedia.com/does-homeowners-insurance-cover-mold-4782771

- https://www.bankrate.com/insurance/homeowners-insurance/does-homeowners-insurance-cover-mold/

- https://www.worldinsurance.com/blog/does-your-homeowners-insurance-cover-your-home-for-mold