Wildfire insurance policies provide extensive financial protection against fire-related property damage through multiple coverage components. Standard homeowners policies typically include dwelling coverage for structural repairs, personal property protection for belongings, and additional living expenses during reconstruction. Coverage limits average $78,838 per claim, with deductibles ranging from 1-5% of dwelling coverage. Enhanced protection options offer guaranteed replacement costs and broader coverage terms. Understanding policy specifics helps homeowners maximize their protective strategies against devastating wildfire losses.

Key Takeaways

- Standard homeowners insurance covers wildfire damage, including structural repairs, personal belongings, and temporary living expenses during reconstruction.

- Coverage limits should reflect current rebuilding costs, with typical fire-related claims averaging $78,838 for adequate protection.

- Regular policy reviews are essential to maintain coverage alignment with property values and evolving wildfire risks.

- Enhanced protection options offer guaranteed replacement costs and broader coverage with fewer exclusions for high-risk areas.

- Deductibles typically range from 1-5% of dwelling coverage, with potential savings through strategic coverage choices.

Does Homeowners Insurance Cover Wildfires?

When it comes to wildfire protection, standard homeowners insurance policies typically provide coverage for damage caused by wildfires, including structural damage to the home, personal property losses, and smoke-related destruction.

Insurance companies evaluate coverage based on detailed risk assessment tools and property evaluations to determine appropriate coverage levels.

- Dwelling coverage encompasses structural repairs and rebuilding costs, with extended replacement options available for high-risk areas.

- Personal property protection covers belongings damaged by fire, smoke, or ash, subject to policy limits and documentation requirements.

- Additional living expenses coverage provides temporary housing costs during home repairs or reconstruction.

- Liability coverage protects against third-party claims related to fire spread from the insured property.

Homeowners should integrate insurance policy comparisons with broader wildfire preparedness strategies, including emergency evacuation plans and fire resistant landscaping.

Regular policy reviews guarantee coverage aligns with current property values and regional wildfire risks, particularly in areas with increasing threat levels.

With average fire-related claims reaching $78,838, maintaining adequate coverage limits is essential for comprehensive property protection.

UnderstandIng Basic Wildfire Coverage Components

Wildfire coverage components form the fundamental framework of extensive insurance protection for homeowners in fire-prone regions. Understanding these coverage essentials enables property owners to conduct thorough risk assessments and navigate policy differences effectively. The core elements of wildfire insurance encompass structural protection, personal belongings coverage, and provisions for temporary displacement.

| Coverage Type | Protection Scope |

|---|---|

| Dwelling | Physical structure rebuilding costs |

| Personal Property | Belongings and valuables |

| Additional Living Expenses | Temporary housing and relocation |

| Landscaping | Outdoor elements and vegetation |

The claim process typically involves documenting damages, submitting detailed inventories, and working with adjusters to determine compensation levels. While standard policies include basic wildfire protection, coverage variations exist between insurers. Homeowners must verify specific inclusions, exclusions, and coverage limits to guarantee adequate protection against fire-related losses. Understanding these components facilitates informed decision-making when selecting or updating insurance policies.

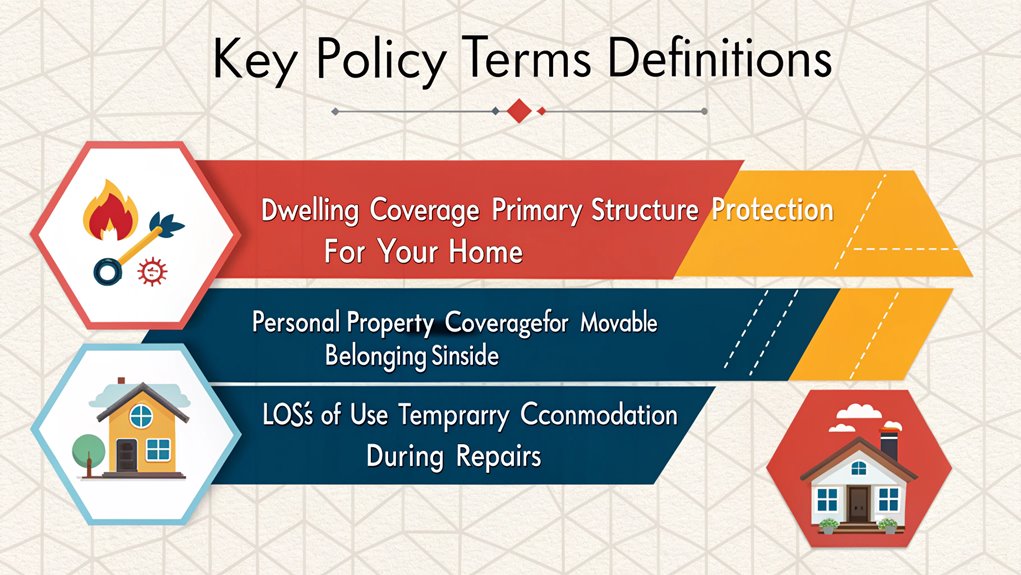

Key Policy Terms & Definitions

Understanding key wildfire insurance policy terms requires familiarity with specific coverage components and their interrelated functions. Insurance policies contain standardized terminology that defines the scope of protection for dwelling structures, personal belongings, and contingency expenses. Critical policy definitions establish the framework for coverage limits, deductible requirements, and exclusion categories that affect claim settlements. Wildfire Defense Services provide comprehensive monitoring and emergency response across 22 states to supplement standard policy protections.

| Term | Definition | Application |

|---|---|---|

| Dwelling Coverage | Primary structure protection value | Establishes rebuilding cost basis |

| Personal Property | Movable belongings coverage | Determines compensation for contents |

| Loss of Use | Temporary relocation expenses | Covers displacement costs |

Dwelling Coverage Explained

A fundamental pillar of wildfire insurance policies, dwelling coverage provides financial protection for the primary structure of a home, including its essential systems and permanent fixtures.

Coverage comparisons across different dwelling types help homeowners determine appropriate policy adjustments based on construction estimates and rebuild strategies.

- Extended replacement cost coverage offers additional funds beyond standard limits to address escalating construction costs post-disaster

- Guaranteed replacement cost guarantees complete rebuilding coverage regardless of policy limits

- Coverage extends to major home systems including heating, electrical, and plumbing components

- Policy limits should align with current construction costs, factoring in local market conditions

Understanding dwelling coverage requirements enables homeowners to secure adequate protection against wildfire damage, guaranteeing sufficient funds for reconstruction if disaster strikes.

While actual cash value policies may offer lower premiums, they provide reduced compensation due to depreciation calculations.

Personal Property Protection

When homeowners evaluate their wildfire insurance policies, the personal property protection component serves as a critical safeguard for their movable assets and belongings. Insurance providers offer two distinct coverage options: Actual Cash Value (ACV) and Replacement Cost Coverage, with the latter providing superior protection against climate impact assessments and rising replacement costs.

- Personal property upgrades and safety equipment recommendations should be documented through extensive inventory tracking methods.

- High value items require special consideration, as standard policies typically impose coverage sub-limits on jewelry, electronics, and collectibles.

- Loss of use coverage supplements personal property protection by funding temporary living arrangements.

- Maintaining detailed documentation of belongings through photographs, receipts, and digital records facilitates efficient claims processing.

Most policies provide personal property coverage that reimburses between 50% to 70% of the dwelling coverage limit.

The effectiveness of personal property coverage depends considerably on thorough documentation and regular policy reviews to verify adequate protection levels.

Additional Living Expenses (ALE)

Critical to wildfire insurance coverage, Additional Living Expenses (ALE) provisions safeguard policyholders from financial strain during periods of displacement from their homes. ALE reimbursement methods typically operate on a percentage-based system tied to dwelling coverage limits, ensuring extensive support for temporary relocation options. Documentation best practices include maintaining detailed records of hotel cost considerations, meal expense limits, and other displacement-related expenditures.

| Expense Category | Coverage Details | Documentation Required |

|---|---|---|

| Lodging | Hotel/rental costs | Receipts, agreements |

| Meals | Daily allowance | Restaurant receipts |

| Transportation | Additional mileage | Travel logs |

| Storage | Personal items | Facility contracts |

| Utilities | Temporary setup | Service statements |

The duration and monetary limits of ALE coverage vary by policy, making it essential for homeowners to understand their specific terms and maintain organized expense records for efficient claims processing. Actual cash value options significantly impact the reimbursement amounts homeowners can receive for their displacement expenses.

Coverage Limits & Deductibles

Understanding coverage limits and deductibles forms the foundation of effective wildfire insurance policies. Through detailed policy comparisons and risk assessment, homeowners must evaluate their coverage options to guarantee adequate protection.

Annual premium savings can reach thousands of dollars when implementing the right coverage strategy.

Deductible strategies often reflect geographic risk factors, with higher-risk areas typically requiring larger out-of-pocket expenses before coverage activation.

- Coverage limits should align with current rebuilding costs, including extended or guaranteed replacement cost provisions for inflation protection.

- Deductible amounts vary based on property location and risk factors, affecting premium costs and claim processes.

- Personal property coverage may include category-specific sub-limits for valuable items.

- Extended coverage options provide additional protection beyond standard dwelling limits.

These components require careful evaluation to guarantee thorough protection against wildfire-related losses while maintaining cost-effective coverage.

Policy Exclusion Categories

Wildfire insurance policies contain several distinct exclusion categories that property owners must carefully evaluate before securing coverage. A detailed policy exclusions review reveals limitations on fire retardant damage claims and restricted coverage for properties not meeting fire safety compliance standards. Insurance mitigation strategies often require separate policies for high-value personal property limits, particularly regarding jewelry and collectibles. Property owners impacted by wildfire exclusion endorsements often struggle to find alternative coverage options for protecting their investments against fire-related losses.

| Category | Common Exclusions |

|---|---|

| Property | Fire Retardant Damage, Code Violations |

| Weather | Extreme Drought Conditions, High-Risk Zones |

| Claims | Personal Property Limits, Safety Non-Compliance |

The claims process overview typically identifies restrictions based on local building codes and weather-related factors. Properties in drought-prone areas may face additional exclusions or elevated deductibles, while non-compliance with regional fire safety regulations can void coverage entirely, making thorough policy evaluation essential for adequate protection.

StandArd Coverage Vs. Enhanced Protection

An analysis of standard wildfire insurance versus enhanced protection reveals significant differences in coverage limits, deductible structures, and extensive benefits for homeowners.

Standard policies typically provide basic dwelling coverage with fixed sub-limits, while enhanced protection offers expanded benefits including guaranteed replacement costs and higher coverage limits for external structures.

The coverage gap between these options becomes evident when examining specific policy elements such as temporary housing allowances, high-value item protection, and post-disaster recovery expenses.

Basic Vs. Premium Benefits

When selecting wildfire insurance coverage, homeowners must carefully evaluate the distinct advantages between standard and enhanced protection plans. Basic coverage comparison reveals fundamental differences in policy scope and financial protection levels. Premium policy advantages offer thorough safeguards with higher limits and fewer exclusions.

| Feature | Basic Coverage | Premium Benefits |

|---|---|---|

| Structure Protection | Actual Cash Value | Guaranteed Replacement |

| Personal Property | Limited Coverage | Full Replacement Cost |

| Additional Expenses | Basic Allowance | Extended Living Costs |

| Landscaping/Structures | Minimal Coverage | Detailed Protection |

Fire damage specifics vary considerably between policy tiers, with premium options providing more extensive protection for both direct and indirect losses. Risk assessment importance increases as coverage levels expand, allowing for more precise claims process overview and tailored protection strategies aligned with property values and regional wildfire threats. With 2.6 million homes facing significant wildfire risks across western states, comprehensive coverage becomes increasingly critical for property protection.

Coverage Gap Analysis

Understanding the disparities between standard and enhanced wildfire protection requires systematic analysis of coverage components. Through coverage evaluation methods and policy comparison techniques, homeowners can identify potential vulnerabilities in their insurance coverage.

| Coverage Element | Standard Policy | Enhanced Protection |

|---|---|---|

| Dwelling Coverage | Base replacement cost | Guaranteed replacement |

| Personal Property | Limited sub-limits | Expanded coverage limits |

| Additional Structures | 10% of dwelling value | Customizable limits |

Risk mitigation strategies and insurance policy customization options enable properties to maintain thorough protection against wildfire threats. Enhanced policies typically incorporate wildfire preparedness initiatives, offering superior coverage for landscaping losses and temporary housing expenses. This systematic approach to analyzing coverage gaps helps homeowners make informed decisions about their insurance needs while ensuring adequate financial protection against wildfire-related damages. Without proper coverage analysis, financial devastation risks can significantly impact property owners who experience fire-related losses.

Deductible Comparison Options

The substantial differences between standard and enhanced wildfire insurance deductibles greatly influence a homeowner's financial exposure during catastrophic events. Coverage comparisons reveal that while standard policies typically require 1-5% deductibles of dwelling coverage, enhanced protection plans often feature lower percentages or flat-rate options, improving policy efficiency and streamlining claim processes.

| Deductible Types | Standard Coverage | Enhanced Protection |

|---|---|---|

| Percentage Range | 1-5% of dwelling | 0.5-2% of dwelling |

| Premium Impacts | Lower premiums | Higher premiums |

| Deductible Waiver | Not included | Available for specific claims |

| Coverage Limits | Basic limits | Higher protection limits |

| Claim Flexibility | Standard process | Expedited processing |

Enhanced protection plans, though carrying higher premium impacts, offer extensive benefits through reduced out-of-pocket expenses and broader coverage options during wildfire-related incidents.

Do Renters & Condo Insurance Cover Wildfires?

Regardless of whether one rents or owns a condo, wildfire protection through insurance remains a vital consideration for protecting personal property. Both renters and condo insurance policies provide coverage for belongings damaged or destroyed by wildfires, with coverage limits determined by the total value of owned items.

These policies include important provisions for temporary living expenses through loss of use coverage when properties become uninhabitable due to wildfire damage. While the building structure itself falls under the property owner's insurance responsibility, tenants and condo owners must guarantee adequate coverage for their personal possessions.

Regular assessment of coverage limits is significant, particularly for high-value items such as electronics, jewelry, and collections that may require additional protection. Understanding policy exclusions and wildfire risk factors helps policyholders maintain appropriate coverage levels.

Insurance providers typically outline specific terms regarding wildfire-related claims, making it vital to review policy details thoroughly.

With the average fire-related claim reaching $78,838 per incident, maintaining proper coverage is essential for financial security.

Assessing Your Property's Wildfire Risk Level

Property owners can utilize fire hazard mapping tools and local threat rating systems to evaluate their wildfire exposure level through geospatial analysis and historical fire data.

These assessment tools incorporate factors such as topography, vegetation density, and historical fire patterns to generate detailed risk profiles for specific locations.

The evaluation of defensive space around structures, including vegetation management zones and fire-resistant landscaping, provides critical data points for determining a property's overall wildfire vulnerability.

Engaging a public adjuster's expertise during risk assessment can help identify potential coverage gaps and ensure adequate insurance protection before disaster strikes.

Fire Hazard Mapping Tools

Modern fire hazard mapping tools provide homeowners with sophisticated methods to evaluate their property's wildfire risk level through data-driven analysis. These risk mapping technologies integrate GIS systems with historical data to deliver precise fire risk assessments, enabling informed insurance policy selection and targeted wildfire prevention strategies.

- Interactive maps allow property owners to input addresses for specific hazard classifications.

- Analysis includes vegetation management techniques through detailed plant coverage data.

- Environmental factors such as slope gradients and water proximity influence risk calculations.

- Regular updates reflect current drought conditions and recent fire incidents.

State and local agencies maintain these digital resources, making them readily accessible through fire departments and forestry websites.

This technology-driven approach helps homeowners implement appropriate mitigation measures while making well-informed decisions about their insurance coverage needs.

Understanding your property's wildfire risk can help determine if you need coverage beyond a standard named peril policy for comprehensive fire protection.

Local Threat Rating Systems

Understanding local threat rating systems enables homeowners to quantify their property's vulnerability to wildfires through standardized assessment protocols.

These extensive local risk assessment frameworks evaluate multiple factors to determine threat levels, typically categorizing risks from low to very high. Advanced GIS technology enhances the precision of these evaluations by analyzing geographical data and historical fire patterns.

- Vegetation impact analysis examines surrounding plant types and density

- Topographical features assessment identifies terrain-related risks

- Climate factors monitoring tracks weather patterns and seasonal variations

- Home preparation recommendations based on specific risk categories

Communities utilize these rating systems to inform residents about their risk levels, enabling targeted mitigation strategies.

Regular monitoring is essential as environmental conditions evolve. Fire departments and community services provide access to these assessments, helping homeowners make informed decisions about insurance coverage and property protection measures.

Maintaining detailed dwelling condition records can support future wildfire-related claims and potentially reduce insurance premiums.

Defensive Space Evaluation

Effective defensive space evaluation requires a systematic assessment of the buffer zones surrounding residential structures to determine wildfire vulnerability.

Property owners must implement defensive space strategies that encompass multiple protection layers, including fire resistant landscaping and proper vegetation management tips. The evaluation process focuses on creating and maintaining a minimum 30-foot safety perimeter.

- Strategic placement of fire-resistant plants and calculated tree spacing reduces potential fire spread.

- Slope impact assessment determines necessary adjustments to defensive space requirements based on terrain.

- Regular removal of dead vegetation and combustible materials maintains buffer zone integrity.

- Ember guard techniques, including gutter maintenance and eave protection, prevent ignition points.

These combined measures create a thorough defensive barrier that markedly enhances property protection against advancing wildfires, particularly in high-risk areas where proper implementation is essential for insurance compliance.

Essential Coverage Options For High-Risk Areas

Homeowners in wildfire-prone regions require extensive insurance coverage that addresses multiple risk factors unique to fire-related disasters. A robust policy must include adequate dwelling structure coverage that aligns with current rebuilding costs, personal property protection for belongings damaged by fire or smoke, and alternative housing reimbursement through Additional Living Expenses (ALE) coverage.

These essential components form the foundation of effective wildfire insurance protection and should be carefully evaluated based on the property's specific risk factors.

- Dwelling coverage should account for local construction costs and potential post-disaster price increases.

- Personal property coverage must extend to smoke damage and items destroyed during evacuation.

- ALE coverage should provide sufficient funds for extended temporary housing if needed.

- Policy limits should be regularly reviewed and adjusted to match current market conditions.

Working with public adjusters can significantly improve the chances of receiving fair compensation for wildfire-related claims.

Dwelling Structure Coverage

When protecting property in wildfire-prone regions, dwelling structure coverage serves as the cornerstone of thorough wildfire insurance protection. Regular dwelling inspections confirm coverage adequacy aligns with current replacement costs, while promoting wildfire resilience through structural assessments. Insurance adjustments become essential as construction expenses fluctuate, particularly in post-disaster scenarios.

| Coverage Element | Risk Factor | Required Action |

|---|---|---|

| Structure Value | Market Volatility | Annual Assessment |

| Building Codes | Regulatory Changes | Coverage Updates |

| Materials Cost | Supply Chain Impact | Limit Adjustments |

Standard policies include basic wildfire protection, but homeowners must verify specific coverage details. Extended or guaranteed replacement cost coverage provides additional financial security beyond standard limits, addressing potential gaps in primary dwelling coverage. This thorough approach confirms adequate protection against catastrophic wildfire damage. Understanding policy limitations and exclusions helps homeowners maintain appropriate coverage levels for wildfire risks.

Personal Property Protection

Personal property protection in wildfire-prone regions requires strategic coverage decisions that extend beyond standard policy limits. Insurance claim processes necessitate thorough wildfire damage documentation, making detailed personal property assessments essential before disasters occur.

| Coverage Type | Protection Level | Requirements |

|---|---|---|

| Standard Policy | Basic Protection | Item Inventory |

| Actual Cash Value | Depreciated Worth | Proof of Ownership |

| Replacement Cost | Current Market Value | Documentation |

| High-Value Items | Enhanced Coverage | Appraisals |

Renter's policy specifics include provisions for temporary relocation and personal belongings protection, while homeowners must evaluate high value item coverage needs separately. Many policies establish sub-limits for valuable collections, requiring additional riders for extensive protection. Insurers typically require systematic documentation of belongings through photographs, receipts, and professional appraisals to expedite claims following wildfire damage.

Alternative Housing Reimbursement

Living in high-risk wildfire zones requires extensive alternative housing reimbursement coverage to protect against temporary displacement costs. Insurance policies typically include loss of use provisions that facilitate temporary housing solutions during the wildfire recovery process. Financial preparedness strategies must account for reimbursement policy limits, which are calculated as a percentage of dwelling coverage.

| Coverage Component | Standard Inclusion | Typical Limitations |

|---|---|---|

| Hotel Expenses | Yes | Per-day cap |

| Meal Costs | Yes | Monthly maximum |

| Extended Stay | Variable | Time restrictions |

Insurance policy evaluations should focus on thorough displacement coverage that encompasses both immediate evacuation needs and long-term temporary housing arrangements. Homeowners must verify their policies include adequate reimbursement for essential living expenses, ensuring sustained financial support throughout the recovery period. Understanding these coverage parameters enables informed decision-making when selecting appropriate insurance protection.

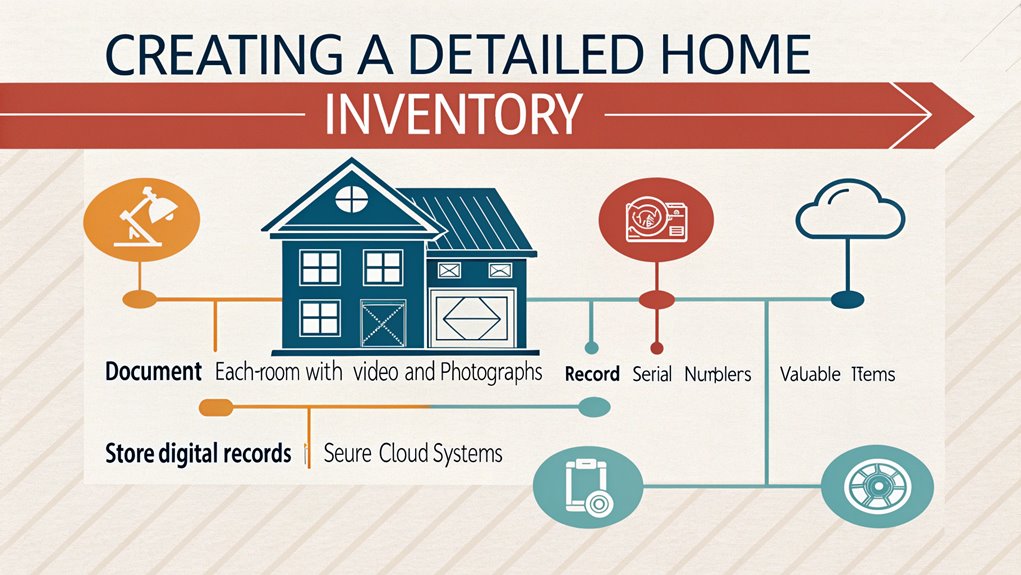

Creating A Detailed Home Inventory

A thorough home inventory constitutes a critical component of wildfire insurance documentation, requiring meticulous digital records stored in cloud-based systems for secure access. The room-by-room documentation process necessitates systematic recording of contents, including photographs, serial numbers, and estimated values of belongings. Seasonal updates to the inventory guarantee accuracy and completeness, particularly after major purchases or home improvements.

| Documentation Element | Digital Method | Key Details Required |

|---|---|---|

| Room Contents | Video Recording | Item Descriptions |

| Valuable Items | Photos | Serial Numbers |

| Purchase Records | Scanned Docs | Cost/Date Info |

| Important Papers | Cloud Storage | Policy Numbers |

| Property Changes | Updated Lists | Modification Dates |

Digital Records Are Essential

In the digital age, maintaining thorough documentation of household belongings has become a critical component of wildfire preparedness. Digital inventory benefits include expedited claims processing and extensive documentation of assets. The risks of neglect in maintaining digital records can severely impact compensation during insurance claims.

- Smartphone video recordings provide detailed visual evidence of room contents, including items stored in drawers and closets.

- Cloud storage solutions protect digital inventories from physical damage while guaranteeing accessibility.

- Regular updates reflect current valuation of belongings and recent acquisitions.

- Documentation of high-value items requires specific attention, including purchase records and professional appraisals.

Secure storage options for digital records eliminate the vulnerability of physical documentation to wildfire damage, while systematic updates guarantee accuracy in coverage requirements and potential claims.

Room-By-Room Documentation Process

Systematic documentation of household contents requires a methodical room-by-room approach to create an accurate home inventory.

Utilizing modern documentation methods, homeowners should employ video recording techniques to capture extensive views of their personal property. Room organization plays an essential role in effective inventory management, making sure no items are overlooked during the documentation process.

- Conduct detailed video walkthroughs of each room, focusing on furniture, electronics, and valuable decor items.

- Document contents of storage spaces, including closets, drawers, and cabinets, with descriptive annotations.

- Record serial numbers, purchase dates, and estimated values for high-value items.

- Create digital backups of all documentation, storing inventory records in secure, off-site locations or cloud services.

This methodical approach guarantees thorough documentation of personal property, facilitating smoother insurance claims processing in the event of wildfire damage.

Update Inventory Each Season

Regular seasonal updates to home inventories serve as a critical component of extensive wildfire preparedness. Implementing consistent inventory management practices guarantees claim accuracy and enhances financial protection in case of loss.

Digital documentation through smartphone applications and cloud storage platforms provides secure, accessible records that streamline the claims process.

- Conduct systematic reviews each season to document new acquisitions, modifications, or removed items

- Store digital photographs, receipts, and appraisals in cloud-based systems for immediate access

- Record detailed descriptions of high-value items, including brand names, model numbers, and purchase dates

- Maintain separate documentation for items requiring specific coverage limits or additional riders

This methodical approach to seasonal updates creates a thorough record that expedites claims processing and maximizes insurance recovery potential following wildfire damage.

Additional Living Expenses Coverage

Additional Living Expenses (ALE) coverage provides essential financial support when homeowners must relocate due to wildfire damage. This coverage encompasses temporary housing costs, including hotels and rental properties, as well as increased daily expenses such as restaurant meals when cooking facilities are unavailable.

Pet owners should note that boarding costs for animals may also qualify under ALE coverage when temporary housing arrangements cannot accommodate pets.

- Insurance providers typically require documentation of normal living expenses to determine eligible additional costs

- Coverage duration varies by policy but generally extends until the home becomes habitable again

- Maximum ALE limits are often calculated as a percentage of the dwelling coverage amount

- Policyholders must maintain detailed records of all displacement-related expenses for reimbursement

Temporary Housing Costs

When homeowners face displacement due to wildfire damage, temporary housing costs can present a significant financial burden during recovery. Additional Living Expenses (ALE) coverage provides essential reimbursement for these costs, requiring careful documentation and understanding of policy provisions.

| Housing Type | Typical Coverage | Documentation Required |

|---|---|---|

| Hotel/Motel | Room charges | Daily receipts |

| Rental Home | Monthly rent | Lease agreement |

| Family Stay | Fair market value | Written agreement |

| Extended Stay | Weekly rates | Payment records |

The ALE reimbursement process necessitates meticulous tracking of all expenses while managing housing alternatives. Mental health considerations often influence temporary housing options, making it vital to select accommodations that provide stability during reconstruction. Insurance providers evaluate claims based on reasonable costs within policy limits, emphasizing the importance of maintaining detailed expense documentation throughout the displacement period.

Restaurant & Meal Expenses

Displaced homeowners may seek reimbursement for restaurant and meal expenses through their ALE coverage during wildfire-related relocation periods. Meal reimbursement policies typically outline specific restaurant expense limits and travel meal allowances to guarantee reasonable compensation for temporary dining solutions.

| Expense Type | Coverage Details | Documentation Required |

|---|---|---|

| Restaurant Meals | Daily limit applies | Itemized receipts |

| Grocery Items | Based on household size | Store receipts |

| Food Delivery | Service fees included | Digital confirmations |

| Special Dietary Needs | Case-by-case review | Medical documentation |

Insurance providers establish food preparation guidelines that differentiate between necessary meal expenses and discretionary dining choices. Policyholders must maintain detailed records of all food-related expenditures, including receipts and documentation of special circumstances, to facilitate efficient claims processing and guarantee appropriate reimbursement under their coverage terms.

Pet Boarding Requirements

Pet boarding requirements under ALE coverage encompass specific provisions for animal care expenses during wildfire evacuations and displacement periods. Insurance policies typically address pet safety considerations through coverage for temporary boarding facilities when homeowners must relocate due to wildfire threats.

| Requirement | Coverage Details |

|---|---|

| Documentation | Boarding facility receipts and veterinary records |

| Time Limits | Duration of displacement or specified policy period |

| Facility Type | Licensed boarding facilities meeting local regulations |

| Coverage Scope | Basic care, feeding, and emergency protocols |

Policyholders must verify their specific insurance requirements regarding pet boarding coverage limits and approved facility types. Many policies mandate that boarding facilities meet certain safety standards and maintain proper licensing. Understanding these provisions guarantees seamless claims processing and appropriate care for pets during wildfire-related displacement.

LandScaping & Exterior Structure Protection

Homeowners insurance policies provide specific coverage allocations for landscaping elements, typically offering 5-10% of the dwelling coverage limit for vegetation replacement after wildfire damage.

Protection extends to detached structures such as sheds, fences, and pools through the "other structures coverage" provision, which generally amounts to 10% of the primary dwelling coverage.

Insurance carriers require adherence to specific pool protection guidelines, including proper maintenance of pump systems and adequate clearing of surrounding vegetation to maintain coverage eligibility.

Vegetation Replacement Coverage

When wildfires threaten residential properties, vegetation replacement coverage becomes a critical component of extensive insurance protection. Insurance policies typically allocate a percentage of the dwelling limit specifically for landscaping insurance options, ensuring homeowners can implement ecological recovery strategies post-disaster.

This coverage encompasses thorough vegetation assessment techniques to determine the extent of damage and necessary replanting best practices.

- Coverage extends to trees, shrubs, and plants damaged or destroyed during wildfire events

- Policy limits vary based on property value and selected coverage customization

- Wildfire vegetation management requirements may influence coverage terms

- Structural components like fences and outdoor features are often included

Understanding these coverage elements enables property owners to make informed decisions about their insurance needs and maintain adequate protection for their outdoor investments.

Detached Buildings Insurance

Beyond vegetation coverage, thorough wildfire protection must address detached structures on residential properties. Standard homeowners policies typically allocate 10% of the dwelling coverage limit for detached structures coverage, encompassing fences, sheds, and garages.

A detailed wildfire damage assessment should evaluate these exterior components to guarantee adequate protection.

- Renovation impact evaluation becomes vital when property improvements affect the value of detached structures, potentially requiring coverage adjustments.

- Outdoor space restoration provisions extend to landscaping elements, including trees and shrubs damaged by wildfires.

- Debris removal costs are typically included in policies, covering the cleanup of damaged structures post-wildfire.

- Regular policy reviews help identify coverage gaps, particularly when property modifications alter the value of detached structures.

Pool Protection Guidelines

A property's pool area demands strategic protection measures to minimize wildfire vulnerability and maximize its potential as a firefighting resource.

Implementing extensive pool safety measures requires careful attention to landscaping strategies and the installation of fire resistant materials around the perimeter.

- Create backyard firebreaks using gravel or rock features surrounding the pool area to prevent ember ignition.

- Establish emergency water access points around the pool for firefighting equipment and bucket-filling operations.

- Install non-flammable decking and fencing materials, such as metal or brick, to enhance the pool area's fire resilience.

- Maintain proper vegetation management within 30 feet of the pool zone, incorporating fire-resistant plants and regular trimming.

These protective measures not only safeguard the pool area but also transform it into a valuable defensive asset during wildfire events.

Policy Exclusions & Limitations

Standard wildfire insurance policies contain various exclusions and limitations that homeowners must carefully evaluate before settling on coverage.

Insurance providers

Smoke Damage Coverage Limits

Homeowners seeking wildfire insurance protection must carefully examine their policies' smoke damage coverage limits and exclusions. Understanding coverage nuances is essential, as policies vary greatly in their treatment of smoke-related claims. While standard policies typically include basic smoke damage protection, specific limitations and sub-limits may restrict claim processing capabilities.

| Coverage Component | Typical Inclusions |

|---|---|

| Dwelling Coverage | Direct structural damage, ventilation systems |

| Personal Property | Furniture, electronics, clothing |

| Preventive Measures | Air filtration, emergency cleaning |

| Policy Exclusions | Gradual damage, negligent maintenance |

Policyholders should note that smoke damage coverage may differ from standard fire damage provisions. Insurance carriers often require documentation of preventive measures taken before and during wildfire events, and failure to implement these measures could result in claim denials or reduced settlements.

LandScaping Replacement Restrictions

While wildfire insurance policies commonly include provisions for landscaping damage, significant restrictions and limitations often apply to replacement coverage. Policy amendments often cap landscape valuation at 5-10% of total dwelling coverage, requiring careful insurance appraisal to guarantee adequate protection. Plant exclusions frequently affect non-replantable vegetation and common landscaping features.

| Coverage Element | Standard Policy | Coverage Enhancement |

|---|---|---|

| Trees & Shrubs | Limited Coverage | Higher Sub-limits |

| Plant Types | Basic Species | Expanded Selection |

| Fire Retardant | Not Covered | Optional Coverage |

Policyholders must thoroughly review sub-limits and exclusions, particularly following property improvements or new plantings. Insurance providers typically restrict coverage to direct fire damage, excluding losses from firefighting chemicals. Understanding these limitations is essential for maintaining appropriate coverage levels and considering supplemental protection options when necessary.

Evacuation Cost Restrictions

Understanding evacuation cost restrictions represents a significant aspect of wildfire insurance coverage analysis. Insurance providers typically include evacuation expenses within loss of use provisions, subject to specific limitations and exclusions. A thorough policy comparison reveals varying degrees of protection, necessitating careful risk assessment by homeowners.

| Coverage Element | Standard Policy | Enhanced Policy | Premium Policy |

|---|---|---|---|

| Daily Allowance | Limited | Moderate | Extensive |

| Duration Limit | 14 days | 30 days | 60+ days |

| Total Cap | Basic | Extended | Unlimited |

Policyholders should evaluate their evacuation plan against coverage restrictions, ensuring adequate emergency funds for immediate needs. The claim process often requires documentation of mandatory evacuation orders and associated expenses, with reimbursement contingent upon policy terms. Optional endorsements may provide expanded coverage in high-risk zones, offering additional financial protection during wildfire emergencies.

Adjacent Property Damage Rules

Insurance policies governing adjacent property damage contain essential exclusions and limitations that policyholders must carefully evaluate. Coverage limitations often exclude damages to neighboring properties when fires originate outside the insured premises. Liability exclusions can leave homeowners financially exposed for fire damage affecting adjacent properties, particularly when fire retardants cause additional destruction.

| Coverage Type | Typical Limitations |

|---|---|

| Property Damage | No coverage for adjacent structures |

| Personal Property | Sub-limits for items outside premises |

| Liability Protection | Limited neighboring property coverage |

| Fire Retardant Damage | Often excluded from policy |

| Claims Processing | Separate adjacent property restrictions |

Understanding these restrictions is vital for filing successful insurance claims and maintaining adequate protection. Homeowners should review their policies' specific provisions regarding adjacent property coverage to identify potential gaps in protection and consider supplemental coverage where necessary.

Special Endorsement Requirements

Within wildfire insurance policies, special endorsements represent a specific category of coverage modifications that address distinct limitations and exclusions. Specific risk considerations necessitate additional coverage necessities through enhanced protection plans, particularly in high-risk zones where standard policies may prove insufficient. The wildfire endorsement importance becomes evident when addressing coverage gaps and sub-limits.

| Coverage Type | Special Policy Options | Protection Level |

|---|---|---|

| High-Value Items | Extended Sub-limits | All-encompassing |

| Fire Retardant | Damage Coverage | Supplemental |

| Landscaping | Recovery Protection | Enhanced |

These special endorsements often require careful evaluation to guarantee adequate protection against wildfire-related risks. Insurance providers typically offer various enhanced protection plans that can be customized based on property location, value, and specific vulnerabilities, making regular policy reviews essential for maintaining appropriate coverage levels.

Steps To File A Wildfire Damage Claim

When filing a wildfire damage claim, property owners must immediately document all damage through thorough photographs and detailed written descriptions while maintaining a meticulous record of destroyed or damaged items. Insurance providers should be contacted within 24 hours of the incident to initiate the claims process and secure approval for temporary housing arrangements if the property is uninhabitable. Successful claims require meticulous tracking of all expenses, including temporary lodging costs, emergency repairs, and replacement purchases, accompanied by relevant receipts and documentation.

| Critical Steps | Required Actions |

|---|---|

| Documentation | Photograph damage, list destroyed items, gather pre-damage images |

| Contact Insurance | Report incident, obtain claim number, review coverage details |

| Temporary Housing | Secure approved accommodations, retain all receipts |

| Expense Tracking | Record all purchases, maintain communication logs, file receipts |

Document Damage Immediately

An infographic including the written phrase "Document Damage Immediately (Steps To File A Wildfire Damage Claim)" and featuring a vibrant red-orange color scheme with flame elements, smoke patterns, and camera icons arranged in a vertical timeline format. Include warning symbols and insurance document graphics to emphasize urgency.

Write the text: "Photograph all damage extensively from multiple angles"

Write the text: "Create detailed inventory lists of damaged property"

Write the text: "Save receipts for emergency expenses and repairs"

Write the text: "Document communications with insurance adjusters and officials"

Thoroughly documenting wildfire damage serves as a critical first step in filing an effective insurance claim. During post fire cleanup and recovery strategies, proper documentation facilitates insurance negotiations and mitigates the emotional impact of loss.

Detailed documentation enhances wildfire preparedness for future claims and expedites the assessment process.

- Capture detailed photographs and videos of all exterior and interior damage, ensuring clear visibility of affected structures and personal property.

- Create a systematic inventory of damaged items, including descriptions, approximate purchase dates, and estimated values.

- Maintain organized records of temporary living expenses, including hotel stays, meals, and essential purchases.

- Preserve damaged items and debris until insurance adjusters complete their assessment, as physical evidence supports claim validation.

The thorough documentation process establishes a reliable foundation for successful claim resolution and appropriate compensation.

Contact Insurance Provider First

Initiating contact with an insurance provider represents the crucial first step in filing a wildfire damage claim. The insurance claims process begins with establishing clear client provider communication to determine specific policy requirements and coverage limitations.

Insurance representatives utilize policy assessment tools to evaluate the scope of coverage and guide claimants through necessary documentation standards.

During this initial contact, homeowners should prepare to discuss immediate expenses, temporary housing needs, and preliminary loss estimation methods. The provider will outline specific timeframes for claim submission and required evidence of damage.

Understanding these requirements guarantees compliance with policy terms and expedites claim processing. Prompt communication also enables insurers to initiate emergency assistance provisions when applicable and helps establish a documented timeline of the claim from the onset of damage.

Take Detailed Photo Evidence

Detailed photographic documentation serves as a cornerstone of successful wildfire damage claims, providing insurers with ample visual evidence of property losses. Following established photographic guidelines guarantees thorough damage assessment during the claim process.

Property owners must implement systematic photo organization methods, capturing both broad views and detailed close-ups of affected areas.

- Photograph exterior damage systematically, including all structural components and landscape features impacted by fire.

- Document interior damages room by room, focusing on smoke damage, water damage, and heat-related deterioration.

- Capture close-up images of high-value items and personal belongings, noting serial numbers when applicable.

- Record video walkthroughs of the entire property to supplement still photographs and provide context.

Store all visual evidence securely through cloud-based services, maintaining backup copies throughout the claims process for reference and verification purposes.

Secure Temporary Living Arrangements

When a wildfire forces evacuation from a damaged home, securing temporary living arrangements becomes an immediate priority through the activation of loss of use coverage.

Insurance providers offer assistance in finding temporary lodging options while processing claims for damaged properties. To facilitate the reimbursement process steps, homeowners must maintain detailed documentation and communicate regularly with their insurance representatives.

- Contact insurance agent recommendations for pre-approved temporary housing facilities and housing assistance resources

- Implement systematic living expense tracking, including accommodation costs, meals, and essential supplies

- Document all expenses with detailed receipts and maintain organized records for insurance reimbursement

- Utilize available local housing resources and emergency shelter options while permanent arrangements are secured

The shift to temporary housing requires careful coordination with insurance providers to guarantee coverage compliance and proper reimbursement for all qualifying expenses.

Track All Related Expenses

Maintaining detailed records of all wildfire-related expenses serves as a critical foundation for filing an accurate insurance claim. Effective expense tracking strategies include systematic documentation of costs through digital or physical receipts, photographs, and detailed inventories. Insurance policy comparison reveals that most carriers require extensive financial documentation practices for successful reimbursement procedures.

| Expense Category | Documentation Required |

|---|---|

| Temporary Housing | Rental agreements, hotel receipts |

| Personal Property | Inventory lists, photos of damage |

| Emergency Repairs | Contractor invoices, material costs |

| Additional Living Costs | Transportation, food receipts |

Following these claim filing tips guarantees policy holders maintain accurate records of all expenses incurred during displacement and recovery. Utilizing specialized tracking apps or spreadsheets facilitates organized documentation, streamlining the claims process and maximizing potential reimbursement from insurance providers.

Contact A Public Adjuster Immediatly

Property owners facing wildfire damage should immediately engage a public adjuster to maximize their insurance claim potential and guarantee proper documentation of losses.

The adjuster serves as an expert intermediary between the policyholder and insurance company, facilitating efficient claims processing and fair settlements.

- Submit extensive documentation including photographs, inventory lists, and prior insurance correspondence

- Review policy details with adjuster to understand coverage parameters, inclusions, and exclusions

- Maintain consistent communication throughout the claims process for timely issue resolution

- Leverage adjuster expertise during negotiations to secure appropriate compensation based on policy terms

A public adjuster's professional guidance streamlines the complex claims process while ensuring thorough assessment of wildfire-related damages and losses.

Best For: Homeowners affected by wildfire damage who want expert assistance navigating complex insurance claims and maximizing their settlement potential.

Pros:

- Professional expertise in documenting and valuing property damage accurately

- Skilled negotiation with insurance companies to secure fair compensation

- Reduces stress and time commitment for homeowners during claim process

Cons:

- Additional cost as public adjusters typically charge a percentage of the settlement

- May extend the overall timeline of the claims process

- Some insurance companies may be less cooperative when working with public adjusters

Cost Factors In Wildfire Insurance

The determination of wildfire insurance costs involves multiple variables, including location-based risk assessment ratings that evaluate geographical wildfire susceptibility and a property's specific features such as construction materials and defensible space implementations.

Coverage selections greatly impact premium calculations, with guaranteed replacement policies commanding higher rates than basic coverage options, while previous claims history affects insurers' risk evaluations.

Implementation of fire mitigation measures, such as clearing vegetation and installing fire-resistant materials, can reduce premium costs through demonstrated risk reduction and improved property resilience.

Location Risk Assessment Ratings

Insurance providers utilize thorough location risk assessment ratings to determine wildfire coverage costs for residential properties. Their location assessment methods incorporate advanced data analytics and GIS mapping strategies to evaluate factors including proximity to brushlands and historical fire patterns. Premium pricing factors are influenced by fire response capabilities of local departments and regional risk characteristics.

| Risk Factor | Assessment Criteria | Impact on Rating |

|---|---|---|

| Geographic Location | Proximity to high-risk zones | High influence |

| Historical Data | Past wildfire occurrences | Moderate influence |

| Response Resources | Local firefighting capacity | Significant impact |

Construction resiliency assessments examine building materials and defensible space requirements, which directly affect property risk ratings. Insurers regularly update these assessments to reflect evolving wildfire threats and changing environmental conditions, ensuring accurate risk quantification for coverage determination.

Coverage Level Selection Impact

Selecting appropriate coverage levels fundamentally shapes the cost structure of wildfire insurance policies, with premiums directly correlating to chosen protection limits and endorsements.

Premium variations reflect the extensive nature of coverage selections, with higher dwelling limits necessitating increased costs due to potential rebuilding costs. Insurance adjustments factor in regional risk assessments, leading to elevated rates in high-hazard zones.

- Extended replacement cost coverage triggers premium increases but provides enhanced protection beyond standard dwelling limits.

- Endorsement effects on pricing reflect additional coverage options for landscaping and ordinance compliance.

- Fire-resistant home improvements may qualify for premium reductions while maintaining adequate protection.

- Coverage levels for temporary housing and personal property protection contribute to overall policy costs.

Property Features Affect Rates

Property characteristics play a decisive role in determining wildfire insurance premiums, with structural elements and geographical positioning serving as primary rate determinants. The integration of fire resistant materials notably reduces rates, while property location impact affects risk assessment based on proximity to wildfire-prone zones. Insurance carriers evaluate defensible space benefits, offering premium reductions for maintained clearance zones around structures. Home size variations directly correlate with coverage costs due to increased replacement values.

| Factor | Rate Impact |

|---|---|

| Building Materials | Fire-resistant components lower premiums |

| Location Risk | Higher rates in wildfire-prone areas |

| Defensible Space | Maintained clearance reduces costs |

| Fire Services Proximity | Closer stations decrease premiums |

| Structure Size | Larger homes increase rates |

Proximity to fire services and hydrants further influences premium calculations, with closer emergency response resources typically resulting in more favorable rates.

Previous Claims History Influence

When evaluating wildfire insurance costs, previous claims history emerges as a critical determinant of premium rates, with insurers utilizing sophisticated algorithms to assess risk patterns and establish appropriate coverage terms.

Insurance algorithms analyze historical data to perform thorough risk assessments, leading to premium adjustments based on past incidents and property valuation metrics.

- Properties with documented wildfire claims typically face increased premium costs due to heightened risk perception

- Geographic locations with recurring wildfire incidents influence risk assessment calculations

- Single significant claims can trigger long-term premium adjustments

- Claims-free properties generally qualify for more favorable insurance rates

The claims impact on insurance premiums reflects insurers' methodical approach to risk management, where historical data directly shapes future coverage terms.

This systematic evaluation guarantees premium structures align with actual risk exposure levels, particularly in wildfire-prone regions.

Mitigation Measures Cost Benefits

Strategic implementation of wildfire mitigation measures offers substantial financial benefits through reduced insurance premiums and enhanced property protection. Homeowner responsibilities include conducting wildfire risk assessments and implementing fire resistant landscaping, which can yield insurance premium discounts up to 25%. A thorough cost benefit analysis reveals significant returns on mitigation investments.

| Mitigation Measure | Potential Premium Reduction |

|---|---|

| Sprinkler Systems | Up to 10% |

| Non-combustible Roofing | 15-20% |

| Defensible Space | 20-25% |

Properties equipped with fire-resistant features demonstrate improved insurability rates. Regular maintenance activities, including gutter clearing and tree management, contribute to favorable coverage terms. Following local fire department recommendations enhances eligibility for premium reductions while simultaneously strengthening property resilience against wildfire threats.

Finding Coverage In Denied Markets

For homeowners unable to secure traditional wildfire insurance coverage, state-sponsored Fair Plans provide essential basic fire protection as insurers of last resort.

Alternative insurance pools and specialized high-risk carriers offer supplemental coverage options through Difference in Conditions policies and expanded protection packages.

Independent brokers who specialize in denied markets can connect property owners with insurers willing to underwrite policies in high-risk wildfire zones, often providing more extensive coverage than standard Fair Plans.

Fair Plans For Homes

Many homeowners facing denials from standard insurance carriers due to elevated wildfire risks can access coverage through state-mandated FAIR Plans.

These policies provide essential protection when traditional options are unavailable, though coverage limitations and premium costs require careful consideration during risk assessment.

- FAIR Plan benefits include basic fire coverage for structures, personal belongings, and temporary living expenses.

- Coverage limitations typically necessitate supplemental policies, such as Difference in Conditions (DIC) coverage.

- Maximum coverage amounts vary based on property value and location within designated high-risk zones.

- Policy comparisons reveal FAIR Plan premiums generally exceed standard insurance rates due to increased risk exposure.

The California FAIR Plan exemplifies this insurance solution, offering vital protection while allowing homeowners to maintain coverage in wildfire-prone regions, despite its higher costs and restricted scope.

Alternative Insurance Pools

Thousands of homeowners in wildfire-prone regions have turned to alternative insurance pools as traditional carriers increasingly deny coverage in high-risk areas. These insurance pool benefits include vital property protection when market availability trends indicate a significant reduction in standard coverage options.

The California FAIR Plan exemplifies how alternative coverage options function, providing basic protection for properties that conventional insurers deem too risky.

- Insurance pools conduct systematic wildfire risk assessments to determine coverage eligibility.

- Public-private partnerships strengthen the stability of alternative insurance programs.

- Homeowner strategies often involve combining pool coverage with supplemental policies.

- State regulations support the development and maintenance of these vital markets.

Understanding coverage limitations remains important as these pools typically offer foundational protection rather than all-encompassing policies, requiring careful evaluation of individual property needs.

High-Risk Market Solutions

When traditional insurers deny coverage in wildfire-prone regions, homeowners can pursue several market-based solutions to secure essential property protection.

Insurance affordability and coverage accessibility remain critical concerns in high-risk areas, necessitating alternative approaches to obtain adequate protection.

- The California FAIR Plan serves as a last-resort option, providing basic fire insurance coverage for properties deemed too high-risk by standard insurers.

- Independent insurance brokers facilitate extensive policy comparisons across multiple carriers, expanding options beyond those offered by captive agents.

- Difference in Conditions (DIC) policies supplement standard coverage by addressing specific wildfire risk exclusions.

- The California Department of Insurance finder tool provides homeowner resources for locating available insurers in high-risk zones, streamlining the search for viable coverage options.

Prevention Measures That Lower Premiums

Homeowners can greatly reduce their wildfire insurance premiums by implementing specific prevention measures on their properties. Strategic implementation of defensible space strategies and fire resistant materials demonstrates commitment to risk mitigation, often resulting in significant premium reductions from insurers.

| Prevention Measure | Premium Impact |

|---|---|

| Defensible Space | Up to 20% reduction |

| Fire-Resistant Materials | 15-25% savings |

| Landscaping Maintenance | 5-10% discount |

| Ember-Resistant Vents | 10-15% reduction |

| Community Programs | 5-8% savings |

Regular landscaping maintenance tips include removing dead vegetation, trimming grass, and clearing debris from gutters. Installing ember-resistant vents and screens provides additional protection against flying embers during wildfires. Participation in community prevention initiatives often qualifies homeowners for premium discount eligibility, particularly when combined with other mitigation efforts. Insurance providers frequently reassess premium rates based on the thorough implementation of these preventive measures, making it financially advantageous for homeowners to invest in wildfire protection strategies.

Policy Review & Updates Schedule

Regular evaluation of wildfire insurance policies requires a structured approach to affirm ideal coverage protection. Insurance policy trends indicate that annual reviews with qualified agents are essential for maintaining adequate coverage levels and understanding current risk mitigation strategies.

Coverage adjustment importance becomes particularly evident when analyzing reconstruction costs and market value changes in wildfire-prone regions.

- Conduct thorough policy assessments to verify extended replacement cost provisions and affirm sufficient dwelling coverage

- Document personal property inventories and review sub-limits for high-value items annually

- Perform renovation impact assessments immediately following home improvements to update coverage accordingly

- Evaluate claim filing processes and policy exclusions to affirm preparedness for potential incidents

Understanding these components enables homeowners to maintain appropriate coverage levels while adapting to changing circumstances. The systematic review process helps identify coverage gaps and affirms policy updates align with current construction costs and property values, ultimately optimizing protection against wildfire-related losses.

Claims Documentation Requirements

Extensive documentation forms the cornerstone of successful wildfire insurance claims, requiring homeowners to maintain detailed photo and video evidence of their property's condition both before and after damage occurs.

A thorough property damage inventory list, supported by professional assessment reports, establishes the scope and value of losses while validating claim legitimacy.

Pre-loss documentation and organized expense receipts provide essential evidence for insurance adjusters to evaluate claims accurately and expedite the reimbursement process.

Photo & Video Evidence

Properly documenting property conditions through systematic photo and video evidence stands as a cornerstone of successful wildfire insurance claims.

Photo documentation techniques and video inventory methods create an extensive record of property assets, while digital backup solutions guarantee data preservation. Homeowners should implement thorough itemization strategies by capturing detailed images of their property's exterior, interior spaces, and valuable possessions.

- Photograph all rooms systematically, including close-ups of high-value items and serial numbers

- Record video walkthroughs of storage areas, closets, and drawers to document contents

- Create detailed inventory lists with purchase dates, values, and descriptions

- Store all documentation in cloud-based systems or off-site locations for post-wildfire evaluation

This systematic approach to documentation strengthens insurance claims by providing verifiable evidence of property condition and possession ownership prior to wildfire damage.

Property Damage Inventory Lists

An infographic including the written phrase "Property Damage Inventory Lists (Claims Documentation Requirements)" and vibrant icons representing home insurance, documentation, and safety measures. Use a modern design layout with contrasting colors of blue, orange, and white. Include visual elements like checkmarks, folders, cameras, and cloud storage symbols arranged in a flowing vertical format.

Write the text: Document valuable items with photos and detailed descriptions

Write the text: Store digital copies in secure cloud-based systems

Write the text: Create room-by-room video recordings of possessions

Write the text: Maintain receipts for high-value purchases and renovations

Building on the foundation of visual documentation, detailed property damage inventory lists serve as a fundamental component of wildfire insurance claims documentation.

Effective inventory management strategies incorporate thorough itemization of possessions, including descriptions, values, and acquisition dates. Digital backup solutions guarantee secure storage of these records, while video documentation tips emphasize the importance of room-by-room visual records for verification purposes.

- Implement high value asset categorization for jewelry, artwork, and collectibles, noting specific coverage limitations

- Store inventory documentation in cloud-based systems or secure off-site locations

- Utilize systematic video recording methods to capture detailed views of each room's contents

- Establish seasonal update reminders to maintain accurate records of new acquisitions and notable purchases

This structured approach to property documentation greatly streamlines the claims process and helps confirm appropriate compensation following wildfire damage.

Professional Assessment Reports

Professional evaluation reports form the cornerstone of successful wildfire insurance claims documentation, providing authoritative evaluations of property damage and associated costs. The professional appraisal importance cannot be overstated, as these evaluations establish credible baselines for claim settlements.

Expert damage evaluations conducted by licensed professionals adhere to evaluation report standards that insurance companies recognize and trust.

- Licensed appraisers analyze structural integrity and document visible damage patterns

- Public adjusters quantify losses and prepare detailed damage inventories

- Building specialists calculate precise estimates when evaluating rebuilding costs

- Environmental experts evaluate landscape damage and remediation requirements

Documentation best practices emphasize the need for thorough professional evaluations to substantiate claims effectively. These reports provide insurers with verified data points and expert opinions necessary for processing claims, ultimately facilitating faster and more accurate settlements for affected homeowners.

Pre-Loss Home Documentation

While professional assessment reports provide expert evaluation after a loss, thorough pre-loss documentation serves as the foundation for expedited claims processing.

Home insurance essentials encompass detailed records of property condition and contents, essential for extensive risk assessment during wildfire policy details verification.

- Create and maintain an extensive digital inventory with photographs and videos of each room, ensuring accurate documentation of belongings.

- Store purchase receipts, warranty information, and renovation records in cloud-based systems for immediate access.

- Document high-value items separately with detailed descriptions to prevent undervalued belongings during the claims submission process.

- Update records regularly to reflect new acquisitions, home improvements, and structural modifications.

This systematic approach to documentation greatly streamlines the claims process, providing insurers with verifiable evidence of property condition and value before wildfire damage occurs.

Expense Receipt Organization

Organizing expense receipts systematically after a wildfire incident constitutes a critical component of successful claims processing. Effective expense tracking methods enable homeowners to document all costs related to temporary housing, debris removal, and property restoration. Electronic receipt management systems facilitate the organization of documentation while providing secure backup storage for essential records.

- Software for expense tracking streamlines the categorization of costs, including temporary living arrangements, repairs, and replacement purchases.

- Professional organizing medical receipts related to fire-induced health issues guarantees thorough claim submission.

- Digital documentation systems protect receipts from physical damage while enabling quick retrieval during claims processing.

- Tax deduction strategies require meticulous receipt organization to maximize potential write-offs for uninsured losses.

This systematic approach to expense documentation accelerates claim processing and helps guarantee appropriate reimbursement for all eligible costs.

Tips To Protect Yourself From Wildfires

Creating defensible space around residential structures serves as a critical first-line defense against approaching wildfires by maintaining a minimum 30-foot buffer zone free of combustible materials and vegetation.

Developing and regularly updating a thorough emergency plan enables residents to respond swiftly and effectively during wildfire threats, including evacuation routes, communication protocols, and designated meeting points.

These protective measures, when combined with proper documentation of home contents and regular insurance policy reviews, form an integrated approach to wildfire preparedness and risk mitigation.

Create Defensible Space

An infographic including the written phrase "Create Defensible Space (Tips To Protect Yourself From Wildfires)" and featuring a modern, colorful layout with wildfire prevention icons, flame symbols, and house protection illustrations. Use orange, red, and earth-tone color schemes with clear visual hierarchy and attention-grabbing design elements.

Write the text: Clear debris and vegetation within 30 feet of home

Write the text: Install fire-resistant landscaping and hardscaping features

Write the text: Maintain 10-foot clearance between trees and structures

Write the text: Regular roof and gutter cleaning prevents ember ignition

To effectively safeguard properties against wildfire threats, homeowners must establish a defensible space extending at least 30 feet from their structures.

This critical wildfire prevention technique involves implementing fire resistant plants and strategic landscape maintenance tips to minimize potential fuel sources. Proper backyard fire safety measures include regular clearing of debris, dead vegetation, and pine needles from vulnerable areas.

- Create vertical and horizontal spacing between trees and bushes, maintaining a minimum 10-foot clearance from structures.

- Install hardscaping features like gravel or stone pathways to establish natural fire barriers.

- Utilize drought-resistant plants and non-flammable materials in landscaping design.

- Regularly inspect and clean roofs, gutters, and foundation areas to eliminate combustible materials.

This defensible zone not only enhances property protection but also facilitates emergency evacuation plans during wildfire events.

Have An Emergency Plan

An infographic including the written phrase "Have An Emergency Plan (Tips To Protect Yourself From Wildfires)" and featuring a bold design with orange and red flames, emergency symbols, and evacuation route illustrations. Use warning colors and emergency iconography throughout. Include a family silhouette and emergency kit graphics.

Write the text "Pack emergency supplies kit with water, food, medications"

Write the text "Create multiple evacuation routes for quick escape"

Write the text "Monitor local wildfire alerts and warning systems"

Write the text "Practice emergency drills with all family members"

Strategic emergency planning serves as an essential safeguard for property owners in wildfire-prone regions.

A thorough emergency response protocol encompasses multiple critical components to guarantee household safety during wildfire events.

- Maintain a fully-stocked emergency kit containing water, non-perishable food, medications, and crucial documents for immediate evacuation needs

- Establish multiple evacuation routes and designated meeting locations for family members, accounting for potential road closures

- Monitor local wildfire alerts and conditions through official channels and emergency notification systems

- Conduct regular household evacuation drills to confirm all family members understand and can execute the emergency response plan efficiently

These preparedness measures greatly enhance survival chances during wildfire emergencies while minimizing response time when evacuation becomes necessary.

Best For: Homeowners and families living in wildfire-prone areas who want to ensure their household's safety through comprehensive emergency preparedness planning.

Pros:

- Comprehensive approach that covers multiple aspects of emergency preparedness including supplies, evacuation routes, and communication

- Regular drills help ensure all family members understand and can execute the plan effectively

- Flexible framework allows for customization based on specific household needs and local conditions

Cons:

- Requires significant time investment to develop and maintain all components of the plan

- Multiple evacuation routes may not be available in all locations

- Emergency supplies need regular checking and rotation to maintain freshness and effectiveness

Frequently Asked Questions

What Is Covered in a Fire Insurance Policy?

Fire insurance policies cover rebuilding costs, fire damage claims, personal property losses, and additional living expenses, subject to policy limits and coverage exclusions established within individual agreements.

Is Wildfire Insurance Different Than Fire Insurance?

Wildfire insurance differs from standard fire insurance through broader coverage differences, specialized policy options, and extensive risk assessment based on environmental factors, typically featuring distinct claims processes for wildfire-specific damages.

How to Reduce Fire Insurance Cost?

Homeowners can reduce fire insurance costs through thorough risk assessment, implementing fire safety tips, maintaining proper home landscaping, comparing multiple policy options, and qualifying for insurance discounts through preventative measures.

How Much Is Wildfire Insurance in Colorado?

Colorado wildfire insurance costs range from $800-$2,000+ annually, varying by wildfire risk assessment, policy coverage limits, and premium rate factors. Mitigation measures discounts can reduce rates, while claims history affects pricing.

Final Thoughts

Like a shield against nature's fury, thorough wildfire insurance policies provide essential protection for property owners in high-risk areas. Regular policy reviews, meticulous documentation protocols, and implementation of preventive measures constitute critical components of effective coverage. Understanding the nuances between standard and enhanced protection enables informed decision-making, while maintaining updated coverage guarantees superior financial security against wildfire-related losses.