In 2025, several insurers continue to write new homeowners insurance policies in California, despite market volatility and rate increases. CSAA Insurance, Mercury Insurance, and Auto Club Enterprises are among the major providers issuing new policies, with average annual rates ranging from $1,324 to $1,388.

Meanwhile, top insurers like State Farm, Allstate, and Farmers Insurance have limited or ceased new policy issuance due to catastrophic exposure. Regulatory reforms aim to stabilize the market, and policymakers are working to balance carrier viability and consumer affordability. Further exploration of the California homeowners insurance market reveals additional options and insights.

Key Takeaways

- Major insurers writing new policies in California include CSAA Insurance, Mercury Insurance, and Auto Club Enterprises.

- USAA provides coverage for military families, and Travelers writes new policies at competitive rates.

- Chubb continues to serve affluent customers with high-value homes, despite market instability.

- The FAIR Plan provides basic coverage for high-risk properties unable to secure traditional insurance.

- Farmers Insurance is expanding operations in California, despite other major carriers pausing new policy issuance.

Major Homeowners Insurance Providers

The landscape of major homeowners insurance providers in California has undergone significant changes, with several prominent insurers limiting or ceasing to write new policies. Despite this, various insurers continue to offer new policies. Travelers offers policies with an average annual rate of $1,097, while USAA provides coverage to military members and their families at $1,305.

CSAA Insurance, Mercury Insurance, and Auto Club Enterprises also continue to write new policies, with average annual rates ranging from $1,324 to $1,388. This reduced insurer competition has impacted policy options, with State Farm, Allstate, Farmers Insurance, Nationwide, and Chubb limiting or ceasing new policy issuance.

As a result, California homeowners face fewer choices and potentially higher rates. Insurers willing to write new policies have become more competitive, but overall options remain limited. California homeowners pay an average annual premium of $1,405, with geographic location playing a significant role in determining insurance costs.

Market Concentration in California

The California homeowners insurance market is characterized by a high level of concentration, with the top five insurers, excluding the FAIR Plan, accounting for 54% of the market share in 2023 direct written premium. State Farm and Farmers Insurance dominate the market, holding 19.9% and 14.9% of the market share, respectively.

This concentration can exacerbate pressure on the supply of coverage available to consumers, particularly following significant loss events such as wildfires. California’s regulatory environment features a state guaranty fund that protects claims if an admitted insurance company becomes insolvent.

Market Share Breakdown

Five major insurers dominate California’s homeowners insurance market, accounting for 54% of the total direct written premium in 2023. State Farm holds the largest market share at 19.9%, followed by Farmers Insurance at 14.9%. CSAA Insurance Exchange, Liberty Mutual, and Mercury Insurance each have a market share of 6.5%, 6.5%, and 6.1%, respectively.

The concentration of market share among these top insurers indicates a competitive landscape with significant market trends and competition dynamics at play. The $13.2 billion California homeowners insurance market faces strain due to the concentration and exodus of carriers, ultimately affecting the supply of coverage available to consumers and making it difficult for homeowners to find affordable insurance.

This market concentration has far-reaching implications for the state’s insurance landscape. Some insurers have opted to abandon California’s market entirely due to unsustainable losses attributed to poor forest management practices.

Top Insurers’ Influence

While market share among California’s homeowners insurers has fluctuated over the years, 2023 data reveals a high concentration of market share among the top five insurers, accounting for 54% of the total direct written premium. This concentration increases strain on the supply of coverage available to consumers, particularly after large loss events like wildfires.

The top insurers, including State Farm, Farmers Insurance, and Travelers, have significant market presence, with State Farm holding the largest market share at 19.9% despite not writing new policies. Insurer strategies, such as suspending new policies or exiting the market, impact market dynamics, contributing to a “hard market” with limited consumer negotiating power.

Regulatory bodies face added challenges in balancing insurer sustainability due to increased construction costs. Regulatory bodies must balance insurer sustainability with consumer protection, overseeing market trends and ensuring fair practices.

Regulatory Environment Challenges

As California’s insurance landscape continues to evolve, key regulatory reforms aim to address the state’s complex risk environment, marked by devastating wildfires and increasing environmental threats. The implementation of rate setting reforms, allowing insurers to use complex computer models, aims to improve the accuracy of risk assessments.

Reinsurance incorporation is also now permitted, seeking to stabilize the insurance market and increase coverage options. Nonetheless, regulatory compliance challenges persist, contributing to insurance market volatility. Insurers face notable risk exposure, exacerbated by the FAIR Plan’s risk exposure rising from $153 billion in 2020 to $458 billion by September 2023. T

he bureaucratic rate approval process and escalating environmental risks further complicate the regulatory environment. The one-year moratorium established by the California Department of Insurance’s Bulletin 2025-1 has been invoked 34 times since its enactment in 2018.

Recent Trends and Changes

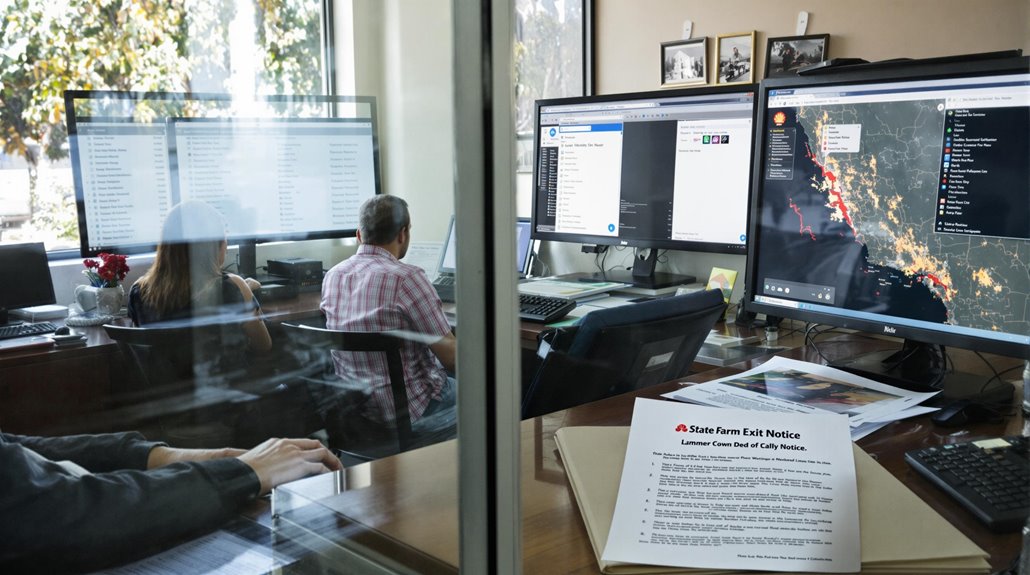

Despite efforts to stabilize California’s insurance market, recent trends indicate a shift in the availability of homeowners insurance, with major carriers adjusting their business strategies in response to escalating environmental risks and regulatory challenges. Remarkably, State Farm and Allstate have stopped or paused writing new policies, citing catastrophic exposure, reinsurance costs, and heightened wildfire risks.

Conversely, Farmers has expanded its operations in California, and the state’s insurance commissioner expects new carriers to enter the market in 2025. Climate impact has contributed to rising construction costs and catastrophe exposure, driving insurers to reassess their risk appetites. As insurers adapt to shifting insurance trends, policymakers are working to stabilize the market through new regulations, striking a balance between carrier viability and consumer affordability.

Best Homeowners Insurance Companies

The best homeowners insurance companies in California offer a balance of coverage, affordability, and customer satisfaction. Based on data, top companies include State Farm, Allstate, Travelers, and Nationwide. These companies provide a range of coverage options, including dwelling protection, personal property coverage, liability protection, and additional living expenses.

- Dwelling Protection: covers the structure of the house against fire damage, smoke damage, vandalism, and theft.

- Personal Property Coverage: protects personal belongings inside and outside the home against theft and vandalism.

- Liability Protection: defends against lawsuits if someone is injured on the property.

- Additional Living Expenses (ALE): cover increased expenses if the home becomes uninhabitable after a covered loss.

These companies also offer various discounts and features, such as bundling discounts, smart home programs, and policy customization, to help homeowners tailor their homeowners insurance policies to their specific needs.

Market Share and Exposure Rates

The California homeowners insurance market is characterized by a high concentration of market share among the top insurers, with the top five insurers accounting for 54% of the direct written premium in 2023. This concentration, combined with recent exits of carriers, has increased the strain on coverage supply, particularly in high-risk areas prone to wildfires.

As the market continues to evolve, exposure rates are also being impacted, with the CA FAIR Plan’s wildfire exposure rapidly increasing due to more frequent and destructive wildfires.

Market Share Breakdown

Five major insurance companies dominate California’s homeowners insurance market, collectively accounting for nearly 60% of the market share in 2023. Led by State Farm and Farmers Insurance, these companies possess the highest market shares. Significant factors influencing the market dynamics include market share concentration and the exodus of several leading insurers from high-risk areas.

- The Top 5 Insurers accounted for 54% of the market share in 2023 for direct written premiums, illustrating high market concentration.

- Wildfires pose significant challenges to insurance innovation, prompting some insurers to limit or cease coverage in high-risk areas.

- California’s homeowners insurance market is characterized by high regulation, with strict rate approval processes.

- The dwindling number of companies willing to write new policies has led to limited coverage options for homeowners in fire-prone areas.

Exposure Rates Analysis

While market share concentration remains a concern in California’s homeowners insurance market, analyzing exposure rates provides valuable insight into insurers’ risk management strategies, particularly in high-risk areas. The CA FAIR Plan‘s wildfire exposure has increased by 123% from 2020 to 2024, with substantial exposure in areas like Pacific Palisades.

The plan’s policy count and written premium have also surged, indicating a growing reliance on it for high-risk areas. New regulations, such as the Net Cost of Reinsurance and Ratemaking regulation, aim to guarantee insurers provide coverage to these areas while considering reinsurance costs in ratemaking.

This effort promotes wildfire preparedness and insurance affordability by encouraging insurers to write policies in high-risk areas, ultimately stabilizing the insurance market and providing residents with more options.

Non-Admitted Surplus Lines Insurers

Non-admitted surplus lines insurers play a critical role in California’s insurance market, providing coverage to homeowners when admitted carriers are unwilling or unable to do so. Governed by California Insurance Code Sections 1765.1 and 1765.2, these insurers must meet specific requirements, including capital and surplus requirements of at least $45 million.

Key aspects of non-admitted surplus lines insurers include:

- Eligibility requirements: Foreign and alien insurers meeting specific standards can be used for surplus line placements.

- LASLI listing: Insurers must be listed on the California Department of Insurance’s List of Approved Surplus Line Insurers.

- Regulatory compliance: Insurers must comply with California Insurance Code sections for eligibility and operations.

- Financial evaluation: Policyholders must evaluate the financial strength and credit rating of non-admitted insurers.

Availability of Homeowners Insurance

As the California insurance market continues to evolve, the availability of homeowners insurance has become a pressing concern for residents. Homeowner concerns regarding insurance accessibility have intensified due to reduced availability and market instability. Several large insurers have stopped accepting new policies or limited their issuance in California.

| Insurance Company | Availability Status |

|---|---|

| USAA | Limited new policies, tightened wildfire safety standards |

| Travelers | Still writing policies, offers cheapest home insurance |

| Nationwide | Still writing policies, offers low rates and extra coverages |

| Chubb | Still writing policies, serves affluent policyholders with high-value homes |

Regulatory challenges and increasing insurance rates further exacerbate the issue. The FAIR Plan, an insurance program for high-risk homes, is also under pressure. Efforts to stabilize the market and expand coverage are underway, including new regulations and initiatives to address insurance accessibility.

California Homeowners Insurance Rates

California homeowners insurance rates are influenced by a range of factors, including general inflation, reinsurance costs, wildfire risks, regulatory challenges, and market conditions. The statewide average homeowners insurance cost in California is $1,250 per year, or about $104 per month, for $300,000 in dwelling coverage, with notable regional variations.

Cities like Los Angeles and Acton exhibit higher rates, while cities like San Jose and Sunnyvale have lower rates, underscoring the importance of location in determining premium costs.

Average Premium Costs

Multiple factors are analyzed in calculating average premium costs for homeowners insurance in California, and these variables can greatly impact the quoted insurance rate. A detailed premium cost analysis reveals that insurance carriers, claims history, city, and home age are key determinants of average premium costs.

- Average premium costs by insurance carrier range from $750 (Allstate) to $1,184 (USAA)

- Claims history considerably affects premium costs, with a variation of up to 40% increase

- City-specific average premium costs range from $1,055 (San Jose) to $1,485 (Los Angeles)

- Home age also impacts premium costs, with newer homes averaging $669 and 30-year-old homes averaging $1,601

Understanding these factors is essential for a thorough premium cost analysis, as claims impact and other variables can greatly influence the quoted insurance rate.

Rate Increase Factors

Rising insurance premiums in the Golden State can be attributed to a complex array of factors. Key rate increase drivers include inflation and rising costs of construction materials and labor, increased reinsurance costs due to higher risks from natural disasters like wildfires, and regulatory restrictions such as Prop 103.

Insurance companies have responded with significant rate increases, such as Allstate’s approved 34% rate increase, and non-renewals or limited writing of new policies in high-risk areas. Market volatility factors, including catastrophe modeling and the impacts of climate change, further exacerbate premium increases. The stabilization efforts by the Insurance Commissioner aim to mitigate these effects. Understanding these rate increase factors can inform strategies to address California homeowners insurance market challenges.

Regional Rate Variations

Variations in homeowners insurance rates across different regions in California are influenced by a range of factors, resulting in significant disparities in premiums. Wildfire impact is a primary driver of rate disparities. Regional characteristics, such as wildfire risk and catastrophe modeling, contribute to rate variations.

- Wildfire Risk Areas: face higher premiums to account for increased risk.

- Insurer Pricing Strategies: incorporate catastrophe modeling to tailor rates to regional risks.

- Reinsurance Costs: are passed on to consumers, potentially leading to 40% premium increases.

- Regulatory Changes: aim to stabilize the market and expand coverage, but may lead to short-term rate increases.

Alternatives to Traditional Insurers

How can California homeowners protect their properties when traditional insurance companies are no longer a viable option? With the withdrawal of several insurance providers, alternatives have become increasingly important. Options like the California FAIR Plan, Supplemental Policies, and Peer-to-Peer Insurance have gained traction.

These alternatives address the need for extensive coverage in a changing insurance landscape, with the FAIR Plan and Supplemental Policies offering solutions for coverage gaps and Peer-to-Peer Insurance providing a collaborative approach to risk management.

| Insurance Options | Coverage | Eligibility |

|---|---|---|

| California FAIR Plan | Basic property damage, optional coverage for additional perils | All California homeowners |

| Supplemental Policies | Broader coverage, including liability and medical payments | Factors like construction type, roof age, and previous claims |

| Peer-to-Peer Insurance | Risk-sharing network for individuals with similar interests | May require additional reinsurance or tiered coverage solutions |

Final Thoughts

The future of homeowners insurance in California appears uncertain, like a house of cards teetering in the Golden State’s winds of change. By 2025, the insurance landscape may have shifted in response to regulatory pressures and market trends. Increasing competition from non-admitted surplus lines insurers and alternative risk transfer mechanisms could challenge traditional insurers’ dominance.

Despite these headwinds, established players are adapting, and innovative newcomers are entering the market, suggesting a resilient industry poised to weather the storm.