Home insurance deductibles are paid directly to the contractor or repair service provider performing the work, not to the insurance company. When filing a claim, the insurance company subtracts the deductible amount from the total approved claim settlement. The homeowner then pays this deductible portion to the contractor, while the insurer covers the remaining costs. Understanding this payment structure helps homeowners better manage their claims and repairs through proper coordination with all involved parties.

Key Takeaways

- You pay your homeowners insurance deductible directly to the contractor or repair service provider, not to your insurance company.

- The deductible amount is subtracted from your total claim settlement before the insurance company issues payment.

- Contractors typically include your deductible portion in their final bill for repairs or restoration services.

- You may need to provide proof of deductible payment to your insurance company before they release remaining claim funds.

- If multiple contractors are involved, you'll divide the deductible payment among them based on their portion of repairs.

Understanding Home Insurance Deductibles

A home insurance deductible represents the predetermined amount a policyholder must pay before their insurance coverage takes effect for a covered claim. This amount is subtracted from the total claim payout, with the insurance company covering the remaining costs after the deductible has been met.

Insurance policies feature different deductible types, including standard fixed-amount deductibles ranging from $500 to $2,000, and percentage-based deductibles calculated as a portion of the home's insured value.

Percentage deductibles, typically between 1% and 10%, are commonly applied to specific perils such as wind, hail, or hurricane damage.

The deductible impact extends beyond immediate out-of-pocket expenses, as higher deductibles generally result in lower premium payments but increased financial responsibility during claims.

Homeowners must carefully evaluate their financial situation and risk tolerance when selecting a deductible level, as this choice affects both regular premium costs and potential future expenses during claim situations.

The Payment Flow of Insurance Claims

The payment flow of insurance claims follows a structured process that involves multiple stakeholders and carefully orchestrated disbursement procedures. When a claim is approved, the insurance company calculates the total compensation minus the deductible amount, which the policyholder must pay.

The claim compensation process often involves several payments distributed over time, particularly for extensive repairs.

Key elements of the deductible payment flow include:

- Initial assessment by an adjuster who determines coverage and calculates damage value using specialized software.

- Distribution of payments to appropriate parties, including contractors, mortgage lenders, or directly to policyholders.

- Release of funds at specific project milestones, ensuring work completion meets standards.

The timing of claim payments varies by state regulations, with some jurisdictions specifying strict deadlines while others maintain flexible timeframes.

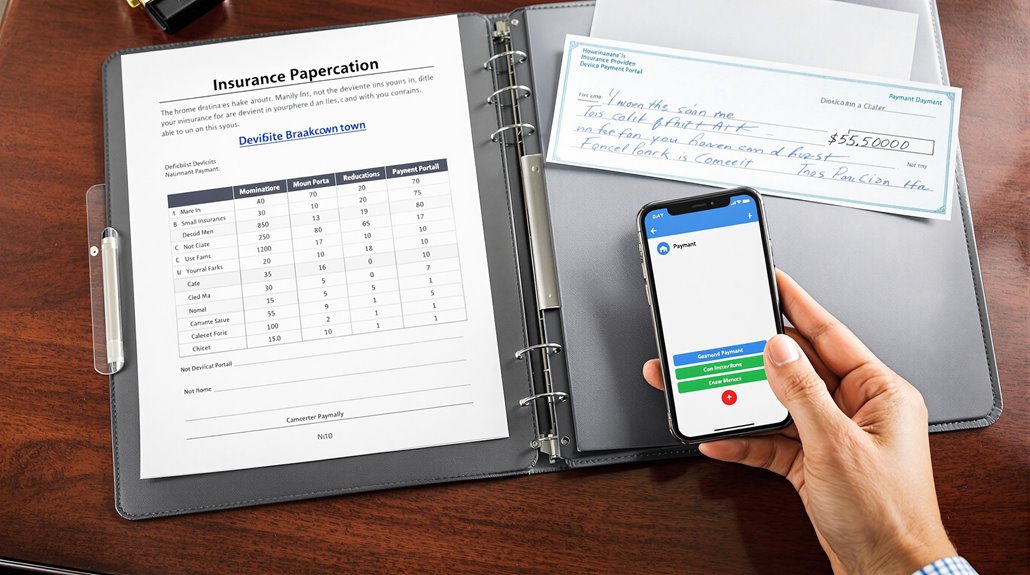

Electronic payment systems have modernized the process, potentially reducing wait times to as little as 48 hours for straightforward claims.

Key Players in the Deductible Payment Process

Understanding home insurance deductible payments requires familiarity with three primary stakeholders: insurance companies, policyholders, and service providers.

Insurance companies subtract the deductible from claim settlements but don't receive this payment directly. Instead, policyholders pay their deductible to service providers, such as contractors or repair companies, who perform the necessary work. The choice of deductible amount influences premium adjustments, with higher deductibles typically resulting in lower premiums.

Various deductible types exist, including percentage-based options calculated on the home's insured value, particularly for specific perils like wind or hurricane damage. Some states maintain distinct regulations, such as Florida's single hurricane deductible per season.

Service providers must often coordinate with insurance companies, providing detailed documentation while receiving deductible payments from policyholders. This three-way relationship guarantees proper claim processing and completion of necessary repairs, with each party fulfilling specific roles in the claims settlement process.

Common Misconceptions About Deductible Payments

Many homeowners harbor incorrect beliefs about insurance deductible payments, leading to confusion during claims processing. Among the most prevalent deductible myths is the misconception that policyholders must pay deductibles directly to their insurance company, when in fact, deductibles are paid to contractors or service providers performing the repairs.

Common misunderstandings about payment timing include:

- The belief that deductibles must be paid before insurance coverage takes effect

- The assumption that deductibles are paid upfront to the insurer

- The notion that insurers will cover the full claim amount regardless of the deductible

Understanding the actual deductible process is essential for proper claims handling. The insurance company subtracts the deductible amount from the total claim settlement, and the policyholder is responsible for paying that portion to the contractor.

If a claim amount falls below the deductible threshold, the insurer makes no payment, and the policyholder bears the entire cost.

When and How to Pay Your Deductible

When filing a homeowners insurance claim, the deductible payment becomes due during the claim settlement process rather than being paid directly to the insurance company. This means that policyholders must be prepared to cover the deductible amount upfront before the insurance payout is issued. Understanding when to pay homeowners insurance deductible is crucial, as this payment can affect the timeline of receiving your settlement. Additionally, it’s essential to read your policy details closely to avoid any surprises during the claim process.

Homeowners typically pay their deductible directly to the contractor performing the repairs, with the insurance company sending the remainder of the claim amount to complete the total cost.

The payment can be handled either through direct payment to the contractor at the time of service or through a reimbursement process where the homeowner pays the full amount upfront and receives the claim settlement minus the deductible from their insurer.

Payment After Claim Filing

The payment of a home insurance deductible follows a specific process after filing a claim. Unlike direct payments to insurance companies, deductibles are typically handled through the claims settlement process, providing insurance clarity for homeowners. The insurance company deducts this amount from the total claim payout.

Key steps in the deductible payment process include:

- Insurance company calculates total claim amount and subtracts deductible.

- Remaining amount is paid to homeowner or contractor for repairs.

- Homeowner pays deductible directly to contractor performing repairs.

This standardized approach guarantees proper accounting of the deductible payment while maintaining transparency in the claims process.

In some cases, insurance companies may require proof that the deductible has been paid before releasing final payment to contractors.

Working With Your Contractor

Working with contractors requires clear communication about deductible payments to facilitate a smooth home repair process. Homeowners have the freedom to select their preferred contractor for repairs, and it's crucial to establish clear payment terms from the outset through effective contractor communication.

During deductible negotiations, homeowners should understand that they pay the deductible directly to the contractor, not to the insurance company. The insurance provider will pay the approved claim amount minus the deductible, either to the homeowner or directly to the contractor, depending on policy terms. This payment structure applies to each separate claim occurrence.

To prevent misunderstandings, homeowners should discuss payment expectations upfront with their chosen contractor and verify both parties have a clear understanding of how the deductible fits into the overall repair costs.

Direct Payment Vs Reimbursement

Understanding how and when to pay a homeowner's insurance deductible involves two main approaches: direct payment and reimbursement. Insurance companies handle deductibles through a reimbursement process rather than requiring direct payment to the insurer. The company subtracts the deductible amount from the total claim payment before issuing the settlement.

Key aspects of the deductible payment process include:

- The insurance company calculates the total claim amount and deducts the deductible.

- Homeowners pay the deductible portion directly to the service provider or contractor.

- The insurance company issues payment for the remaining amount after the deductible is subtracted.

This settlement method guarantees proper distribution of costs between the homeowner and insurer while maintaining an efficient claims process that benefits all parties involved.

Working With Contractors and Service Providers

Managing contractor relationships is a crucial aspect of the home insurance claim process, as these professionals ultimately complete the repairs covered by the insurance policy. When working with contractors, homeowners should understand that they pay their deductible directly to the service provider, not to the insurance company. The insurance company deducts this amount from the claim payout.

Contractors typically provide repair estimates based on the insurance adjuster's assessment. Homeowners can use these estimates to compare bids from multiple service providers before entering into a service agreement.

If contractor bids exceed the insurance company's estimate, homeowners may need to negotiate with their insurer for additional coverage. The payment arrangement for the deductible is established between the homeowner and contractor, with various payment options available, including credit cards.

Maintaining clear communication and proper documentation throughout this process helps guarantee smooth completion of repairs and appropriate handling of all financial obligations.

The Role of Insurance Companies in Deductible Payments

Insurance companies do not collect deductibles directly from policyholders as a separate payment or bill.

Instead, the insurer subtracts the deductible amount from the approved claim settlement before issuing payment for covered damages.

This claims settlement structure guarantees that policyholders fulfill their financial responsibility through the natural course of the claims process, while the insurance company manages the mathematical computation and final payment distribution.

Direct Payment Process

When filing a home insurance claim, the deductible payment process follows a specific structure that involves both the insurance company and the contractor.

Insurance companies process claims by subtracting the deductible from the total settlement amount before issuing payment.

The direct payment process typically follows these key steps:

- The insurance company calculates the total claim amount and subtracts the deductible.

- The settlement payment is issued directly to the

Claims Settlement Structure

Although homeowners are responsible for their deductibles, the claims settlement structure involves a systematic process where insurance companies calculate and subtract deductibles from the total claim amount before issuing payment.

Insurance adjusters conduct thorough claim assessments, evaluating factors such as damaged square footage, repair costs, and replacement needs to determine the total settlement value.

The deductible impact is reflected in the final payout, as insurance companies automatically deduct this amount from the total assessed damage.

For structural repairs, payments often include multiple parties, such as mortgage lenders, and may be released in installments based on project milestones.

Personal property claims typically result in checks issued directly to homeowners, while structural damage payments require coordination between homeowners and lenders to guarantee proper disbursement of funds.

Insurer Responsibilities Explained

Understanding the role and responsibilities of insurers in deductible payments helps clarify the claims process for homeowners.

Insurance companies must maintain deductible transparency throughout the claims settlement process, ensuring policyholders understand their financial obligations. The insurer's primary responsibility is to subtract the deductible amount from the total claim settlement before issuing payment.

Key insurer responsibilities include:

- Providing clear insurer communication regarding deductible processes and requirements

- Calculating appropriate deductible amounts based on policy terms

- Ensuring homeowners pay deductibles directly to contractors performing repairs

Insurance providers establish specific procedures for handling deductibles, which vary by company.

While insurers do not collect deductible payments directly, they may require proof of deductible payment to contractors before releasing claim funds for repairs.

Navigating Different Types of Deductible Structures

Since homeowners insurance policies feature various deductible structures, policyholders must navigate the distinctions between standard fixed-amount deductibles, percentage-based options, and specialty coverage deductibles. Understanding these deductible types and their implications is essential for making informed insurance decisions.

| Deductible Type | Structure | Typical Range |

|---|---|---|

| Standard | Fixed Dollar Amount | $100-$5,000 |

| Percentage-Based | % of Home Value | 1%-10% |

| Specialty | Risk-Specific | $1,000-$10,000 |

| Flood | Separate Coverage | $1,000-$10,000 |

| Hurricane | Weather-Specific | 1%-5% |

Standard deductibles maintain a consistent out-of-pocket threshold, while percentage-based options fluctuate according to the home's insured value. Specialty deductibles address specific risks like earthquakes and floods, often requiring separate coverage parameters. The selection of appropriate deductible structures demands careful consideration of financial capacity, risk exposure, and property location. Insurance advisors recommend maintaining adequate savings to cover potential deductible obligations while balancing premium costs against risk management needs.

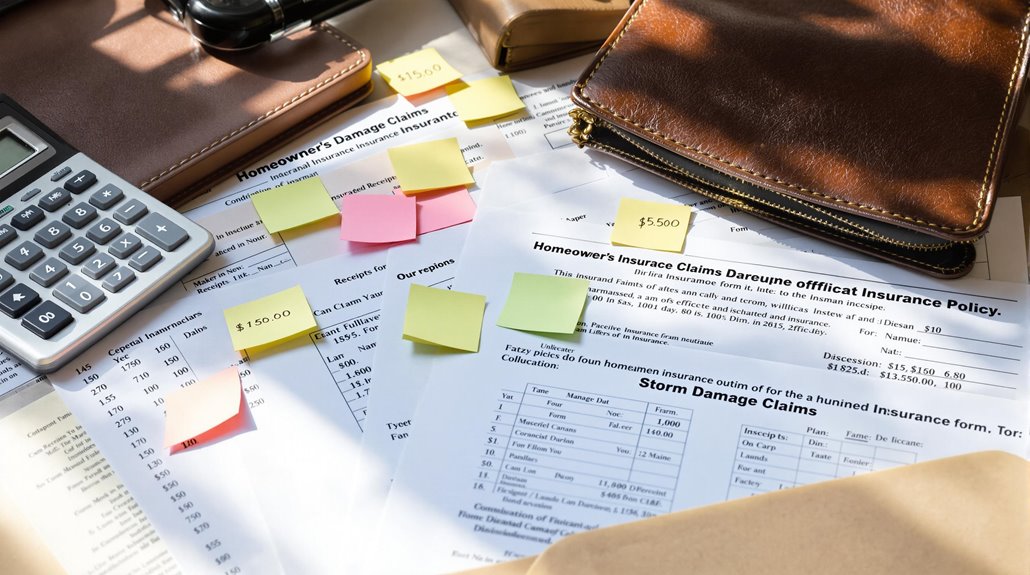

Managing Multiple Claims and Deductible Payments

Homeowners may encounter situations requiring multiple insurance claims throughout their property ownership, each necessitating careful management of deductible payments. While there is no limit to claim frequency, multiple claims filed in quick succession can raise concerns with insurers and potentially impact future coverage eligibility.

Each claim requires a separate deductible payment, with no annual cap like health insurance policies. However, Florida residents benefit from a single deductible per hurricane season for storm-related claims.

When considering deductible selection, homeowners should evaluate:

- Financial capacity to cover out-of-pocket costs during emergencies

- Impact on premium rates, as higher deductibles typically result in lower premiums

- Long-term affordability, considering that multiple claims within 5-7 years can considerably increase insurance costs

Weather-related claims generally have less impact on coverage eligibility, but insurers may require preventive measures to maintain favorable rates. Filing claims only when damage exceeds the deductible amount helps maintain a positive claims history.

Smart Strategies for Handling Deductible Expenses

Effective management of insurance deductible expenses requires a strategic approach that balances immediate out-of-pocket costs with long-term financial planning. Homeowners can implement deductible budgeting strategies by setting aside funds specifically for potential claims, ensuring they're prepared when repairs are needed.

Smart expense tracking helps homeowners evaluate whether filing a claim makes financial sense, particularly when repair costs are close to the deductible amount. Understanding that deductibles are paid to contractors or service providers, not insurance companies, allows for better financial preparation.

Some insurers offer deductible waivers or disappearing deductibles for loyal customers, which can provide additional savings opportunities.

Homeowners should regularly review their deductible amounts and adjust them based on their financial situation and risk tolerance. Higher deductibles typically result in lower premiums, while lower deductibles offer reduced out-of-pocket expenses during claims but increase monthly insurance costs.

This balance requires careful consideration of both short-term capabilities and long-term financial goals.

Frequently Asked Questions

Can I Negotiate My Deductible Amount After Signing My Insurance Policy?

Insurance deductible amounts typically cannot be negotiated after policy signing. Policy amendment options are generally limited to renewal periods, when policyholders can adjust deductibles according to company guidelines.

What Happens if My Contractor Refuses to Handle the Deductible Payment Process?

A contractor's outright refusal to handle deductibles is a major red flag. Homeowners should immediately seek alternative contractors who follow proper insurance protocols and understand their payment responsibilities.

Are Deductibles Tax-Deductible for Rental Properties or Home-Based Businesses?

Insurance deductibles themselves aren't tax-deductible for rental properties or home-based businesses. However, insurance premium payments qualify as deductible business expenses when properly documented under IRS regulations.

How Do Insurance Companies Verify That I've Actually Paid My Deductible?

Insurance companies employ deductible verification methods through contractor documentation, payment receipts, and transaction records. The insurance claims process requires proof of payment before finalizing settlement arrangements.

Can I Finance or Make Payments on My Deductible Through Third-Party Services?

Third-party deductible financing services and payment plans are available to help policyholders spread insurance deductible costs over time, subject to approval and applicable interest rates or fees.

Final Thoughts

Understanding home insurance deductibles reveals a common misconception that payments go directly to insurance companies. In reality, homeowners typically pay their deductible through the repair costs or to the contractor performing the work. Research indicates that 65% of policyholders initially misunderstand this process. By following proper claims procedures and coordinating with approved contractors, homeowners can effectively navigate deductible payments while ensuring compliant claim settlements.

When dealing with property damage claims under a homeowners insurance policy, insurance industry professionals and legal experts strongly advise consulting a qualified state-licensed public adjuster. Public adjusters work exclusively for policyholders, not insurance companies, serving as dedicated advocates throughout the claims process. These state-licensed professionals help homeowners navigate complex insurance policies, identify hidden damages often unknown to policyholders, thoroughly document losses, and negotiate with insurance companies to secure fair settlements while protecting policyholder rights.

The benefits of hiring a public adjuster include maximized claim payouts, expedited claims processing, and reduced stress during the claims process, allowing homeowners to focus on recovery. Policyholders interested in discussing their property damage or loss claims can request a no-obligation free consultation with a Public Claims Adjusters Network (PCAN) member public adjuster through our contact page.