Water damage claims should be filed when sudden, accidental events cause significant structural damage exceeding the policy deductible. Key indicators include visible deterioration, persistent musty odors, and unexplained increases in water bills. Documentation requires timestamped photos and detailed records of damage location, cause, and discovery date. Professional assessment may be necessary for complex claims, as insurance adjusters evaluate coverage based on policy terms and maintenance history. Understanding the full scope of coverage options enables ideal claim outcomes. Additionally, it’s crucial to promptly file a claim for water damage to ensure timely processing and minimize further losses. Homeowners should contact their insurance provider immediately upon discovering damage to initiate the claims process and receive guidance on the next steps. Being proactive in addressing the issue not only aids in recovery efforts but also reinforces the validity of the claim, as insurers appreciate prompt reporting and thorough documentation.

Key Takeaways

- File when visible structural damage occurs, such as warped floors, cracked walls, or water stains indicating significant water intrusion.

- Submit a claim when repair costs substantially exceed your insurance deductible to make filing financially worthwhile.

- Report damage immediately after sudden events like burst pipes or major plumbing failures that cause unexpected water damage.

- Document water damage when professional assessment confirms hidden moisture issues causing mold growth or structural deterioration.

- File when clear evidence shows damage resulted from covered perils rather than maintenance neglect or gradual deterioration.

Understanding Types of Water Damage Coverage

Water damage coverage in homeowners insurance policies encompasses specific categories of incidents and excludes others based on cause and circumstance. Standard policies typically cover sudden and accidental events, including burst pipes, unforeseen plumbing failures, and damage from heavy rain through compromised roof structures. Coverage also extends to ice dam-related structural issues and water damage resulting from vandalism.

Understanding water damage types and coverage exclusions is essential for proper claim management. Insurance policies generally do not cover damage stemming from negligence or inadequate maintenance, such as long-term leaks or visible mold growth left unaddressed.

External flooding from natural sources requires separate flood insurance coverage, while water or sewer backup protection necessitates additional endorsements. Homeowners should note that gradual deterioration from water-related issues falls outside standard coverage parameters.

To guarantee thorough protection, policyholders must evaluate their specific risks and consider supplementary coverage options for excluded water damage types.

Signs You Should File a Water Damage Claim

Water damage requiring an insurance claim often manifests through visible structural deterioration, including warped floors, cracked walls, or compromised ceilings.

Professional assessment becomes necessary when persistent musty odors indicate potential hidden moisture issues, particularly in enclosed spaces or crawl areas.

Hidden pipe bursts, often detected through unexplained increases in water bills or the sound of running water when fixtures are not in use, necessitate immediate claim filing to prevent extensive property damage.

Visible Structural Water Damage

Recognizing visible structural water damage presents critical indicators that signal the necessity of filing an insurance claim. Homeowners should monitor for visible cracks in walls and ceilings, which indicate water seepage and potential progressive deterioration.

Sagging floors constitute a severe structural concern, potentially compromising the building's stability and requiring immediate professional intervention.

Additional structural indicators include foundation shifting due to water-saturated soil, which manifests as leaning or uneven walls. The integrity of building materials often demonstrates observable changes, such as warped surfaces or soft, spongy textures in walls and ceilings.

When water accumulation becomes severe, ceilings may develop water bubbles or begin leaking, necessitating urgent attention. These conditions warrant thorough documentation and prompt insurance claim submission to prevent further structural compromise.

Persistent Musty Odors

The presence of persistent musty odors within a property serves as a critical indicator warranting consideration for filing a water damage insurance claim.

These characteristic odors typically signify underlying moisture accumulation and potential mold proliferation, particularly in susceptible areas such as basements and bathrooms.

Insurance carriers recognize musty odors as potential evidence of concealed water damage, which may stem from various sources including compromised plumbing, malfunctioning appliances, or water infiltration behind walls.

When documenting such claims, property owners must demonstrate the connection between musty odors and verifiable water damage.

Prompt reporting is essential, as delayed action may result in claim denial due to gradual deterioration clauses.

Professional assessment and remediation services should be engaged to identify the source, document findings, and implement necessary repairs before conditions deteriorate further.

Hidden Pipe Bursts Detected

Hidden pipe bursts present numerous telltale indicators that signal homeowners to initiate insurance claims for water damage.

Hidden leaks manifest through visible signs including warping walls, ceiling discoloration, and peeling wallpaper. Pipe detection becomes evident through abnormal water usage patterns, particularly when water meters show continuous flow despite closed faucets.

Physical indicators encompass brown stains, water rings, and unexplained mold growth on non-shower walls. Auditory cues such as trickling, gurgling, or hissing sounds behind walls further confirm potential leaks.

Considerably elevated water bills and reduced water pressure provide additional verification of concealed pipe damage.

When these signs emerge, homeowners should document all evidence thoroughly, including photographs and professional assessments, to support their insurance claims while maintaining detailed records of associated expenses.

Calculating the Cost-Benefit of Filing a Claim

When evaluating whether to file an insurance claim, policyholders must first compare their deductible against the estimated repair costs to determine if filing exceeds the out-of-pocket threshold.

The potential for premium increases following a claim submission requires careful analysis, as insurance carriers may adjust rates based on claim frequency and severity.

Historical claims data indicates that multiple claims within a three to five-year period can notably impact future insurability and premium costs, making it essential to reserve claims for substantial damages.

Deductible Vs Repair Costs

Determining whether to file an insurance claim requires careful analysis of the relationship between repair costs and deductible amounts. A thorough deductible analysis and repair cost estimation helps property owners make informed decisions about filing claims.

| Cost Scenario | Recommended Action |

|---|---|

| Repairs < Deductible | Self-pay repairs |

| Repairs = Deductible | Consider self-pay |

| Repairs > Deductible | File claim |

When repair costs fall below the deductible threshold, filing a claim becomes financially counterproductive, as the insurance provider will not contribute to the expenses. Conversely, when repair costs greatly exceed the deductible, filing a claim becomes advantageous. Property owners must evaluate the long-term implications, considering that claims history can affect future premium rates. This assessment should account for both immediate out-of-pocket expenses and potential premium increases.

Rate Increase Risk Analysis

The accurate calculation of potential rate increases forms a critical component in the decision to file an insurance claim. Insurance providers conduct thorough risk assessments following claims, potentially resulting in premium increases ranging from 20% to 40% for periods of two to five years.

Claim frequency and severity greatly influence these determinations, with multiple claims potentially leading to non-renewal and placement in high-risk insurance categories.

- Liability claims typically generate more substantial rate increases due to their associated risk factors.

- Extensive claims may have minimal impact on premiums depending on the insurer's policies.

- Claim cost thresholds vary by provider and must be evaluated against long-term premium implications.

- Multiple claims within a short period greatly elevate the risk of policy non-renewal.

Claims History Impact

Strategic evaluation of claims history requires an extensive cost-benefit analysis to determine the financial implications of filing an insurance claim. Insurance carriers assess claims frequency as a key indicator of risk, potentially leading to increased premiums or policy cancellation. This risk assessment process considers the severity, type, and timing of previous claims.

Before filing a water damage claim, policyholders must weigh immediate repair costs against long-term insurance implications. Minor incidents may not warrant claims if repair costs barely exceed the deductible.

Documentation of damage, understanding policy limits, and consultation with insurance professionals enable informed decision-making. Thorough evaluation should consider both the urgency of repairs and potential premium increases, ensuring the claim provides substantial financial benefit beyond immediate restoration needs.

Essential Steps Before Filing Your Claim

Successful insurance claims require methodical preparation and proper documentation before initiating the formal filing process. Homeowners must implement effective leak detection methods and water damage prevention strategies immediately upon discovering the issue. The primary focus should be on mitigating further damage while preserving evidence for the claims process.

Essential preparatory measures include:

- Identifying and shutting off the water source while documenting the exact location and nature of the damage

- Reviewing policy coverage terms and limitations to understand the scope of potential compensation

- Collecting thorough photographic evidence and maintaining detailed records of all damaged items

- Securing professional assessments from licensed contractors while avoiding permanent repairs

Before submitting a claim, property owners should thoroughly review their policy requirements and gather all necessary documentation. This preparation guarantees compliance with reporting deadlines and establishes a strong foundation for the claims process.

Understanding coverage limitations and exclusions helps determine whether filing a claim is financially advantageous.

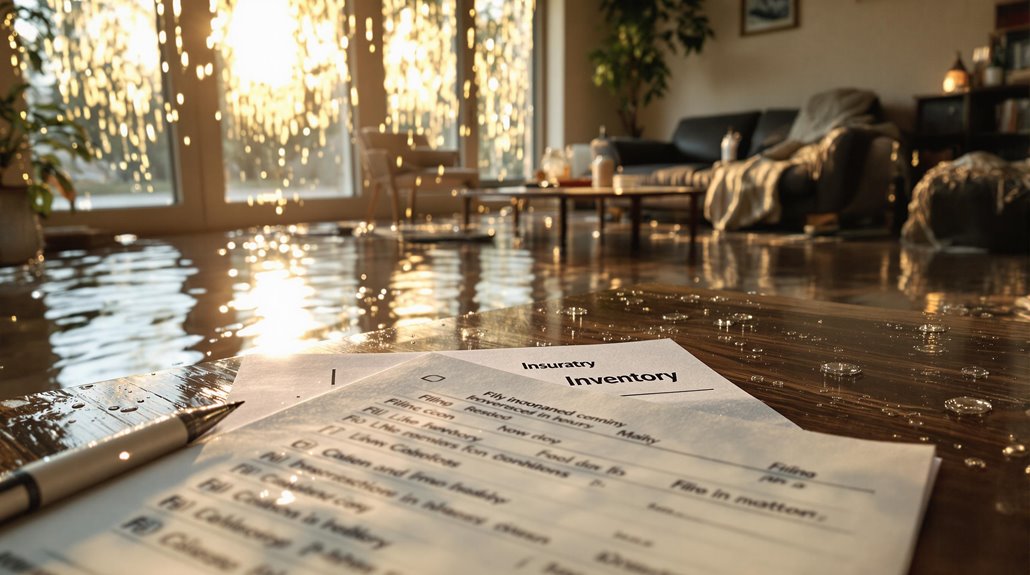

Documenting Water Damage Effectively

Proper documentation serves as the cornerstone of water damage insurance claims, requiring meticulous attention to detail and systematic recording procedures. The process encompasses extensive photographic evidence, detailed inventories, and chronological logging of all damage-related events.

| Documentation Element | Required Components |

|---|---|

| Visual Evidence | Timestamped photos, video walkthroughs |

| Source Documentation | Location, cause, date of discovery |

| Damage Assessment | Affected areas, severity levels |

| Claims Records | Communications, professional reports |

Water damage documentation must include clear, well-lit photographs capturing both overview shots and specific damage details. An effective inventory should catalog all affected items with their purchase dates, costs, and current condition. Insurance adjusters rely on this systematic documentation to evaluate claims accurately. Maintaining organized digital backups of all documentation safeguards critical evidence throughout the claims process. Professional restoration work should be logged with corresponding invoices and completion reports, establishing a complete record for claim processing.

Working With Insurance Adjusters

Collaborating effectively with insurance adjusters requires policyholders to maintain detailed documentation, establish clear communication channels, and understand their policy coverage parameters.

During adjuster communication, policyholders should present organized documentation, including damage assessments, repair estimates, and expense records. Professional claim negotiation involves remaining factual, avoiding speculation, and responding promptly to information requests.

- Document all interactions meticulously, including adjuster names, conversation details, and agreed-upon actions

- Present extensive evidence of water damage, emphasizing extent and impact through professional assessments

- Maintain professional assertiveness while avoiding admission of fault or unnecessary information disclosure

- Consider engaging a public adjuster for complex claims requiring specialized expertise and negotiation skills

For ideal outcomes, policyholders must balance cooperative engagement with strategic communication.

Insurance adjusters evaluate claims based on documented evidence and policy terms, making detailed preparation and professional interaction essential elements of successful claim resolution.

Common Reasons for Claim Denials

Insurance claim denials often stem from specific circumstances that policyholders can anticipate and prevent through proper preparation and compliance.

Primary factors leading to denials include late filing outside established claim timelines, insufficient documentation requirements, and non-payment of premiums. Insurance providers frequently reject claims due to exclusion clauses or pre-existing damage conditions specified in the policy terms.

Gradual damage and maintenance-related issues present particular challenges, as standard policies typically exclude damage occurring over time. Policyholders must demonstrate they have taken reasonable steps to mitigate further damage after the initial incident.

Claims may also face rejection due to negligence or failure to maintain the property adequately. Statistical data indicates that water damage claims average $13,954 in payouts, making proper claim submission critical.

Understanding policy terms, maintaining accurate records, and adhering to documentation requirements greatly improve the likelihood of claim approval.

Preventing Future Water Damage Claims

Implementing thorough water damage prevention measures can greatly reduce the likelihood of filing insurance claims while protecting property values and structural integrity. A detailed maintenance checklist should incorporate both regular inspections and automated protection systems to mitigate potential water-related risks.

Essential preventive measures include:

- Installing water flow sensors and automatic shut-off valves for early leak detection

- Maintaining proper humidity levels through dehumidifiers and ventilation systems

- Conducting regular plumbing inspections and replacing aging pipes

- Implementing extensive drainage solutions including sump pumps and French drains

Property owners should focus on both interior and exterior protection strategies. This includes maintaining appropriate indoor humidity levels between 30-50%, waterproofing basements, and ensuring proper drainage systems.

Regular inspections of plumbing fixtures, water heaters, and appliances, combined with the installation of protective devices, create a robust defense against water damage and subsequent insurance claims.

Tips for Successful Claims Processing

After establishing preventive measures, the successful processing of insurance claims requires meticulous attention to documentation and procedural compliance.

Policyholders must capture thorough photographic evidence of water damage, including detailed close-ups and panoramic views, while maintaining an itemized inventory of affected possessions with their corresponding values.

Timely claim filing is essential, as insurance policies often specify strict deadlines for submission. Immediate notification to the insurance provider, coupled with systematic documentation of all communications, strengthens the claim's validity.

Maintaining organized records of expenses, repairs, and professional services guarantees a complete claim submission.

For complex claims, securing professional assistance from claims adjusters can optimize settlement outcomes.

Policyholders should thoroughly review their insurance policy terms, understanding coverage limits and exclusions before proceeding.

This knowledge, combined with accurate information provision and proper documentation management, greatly enhances the likelihood of successful claim resolution.

The Benefits Of Consulting A Public Adjuster

Public adjusters provide professional expertise in steering through complex insurance claims through objective damage assessments and thorough documentation processes.

Their specialized knowledge of insurance policies and procedures enables a more streamlined and efficient claims resolution process for policyholders.

Statistical evidence indicates that claims handled by public adjusters typically result in notably higher settlements compared to those processed without professional representation.

Expertise In Insurance Claims

Licensed insurance claims specialists known as public adjusters offer policyholders significant advantages when maneuvering complex insurance claims processes.

Their public adjuster roles encompass detailed damage assessments, thorough documentation, and strategic claim negotiation strategies to secure ideal settlements. Studies demonstrate their effectiveness, with claims handled by public adjusters averaging $22,266 compared to $18,659 without their assistance.

- Extensive expertise in identifying overlooked damages and ensuring meticulous claim documentation

- Professional knowledge of insurance policies, regulations, and industry standards

- Strategic negotiation capabilities focused on maximizing claim settlements

- Objective, unbiased approach that eliminates emotional factors from the claims process

These specialists operate under strict licensure requirements and typically work on contingency, aligning their interests with achieving the best possible outcome for policyholders while maintaining regulatory compliance throughout the claims process.

Objective Damage Assessment

Thorough damage assessment serves as a critical foundation for successful insurance claims processing, requiring meticulous evaluation of both apparent and latent property damages. Public adjusters employ advanced assessment techniques, including thermal imaging and moisture meters, to guarantee extensive damage evaluation. Their expertise enables accurate identification of structural issues, water intrusion patterns, and potential secondary damages that might otherwise go unnoticed.

| Assessment Component | Impact | Benefits |

|---|---|---|

| Thermal Imaging | Detects hidden moisture | Prevents mold growth |

| Moisture Meters | Measures water content | Validates damage extent |

| Visual Documentation | Creates evidence record | Strengthens claims |

| Expert Consultation | Provides professional insight | Guarantees accuracy |

| Extensive Reports | Details all findings | Maximizes settlement |

Independent assessments conducted by public adjusters facilitate objective documentation, strengthening the policyholder's position during claims negotiations and guaranteeing fair compensation for all documented damages.

Streamlined Claim Process

Building upon thorough damage assessments, engaging a public adjuster introduces notable procedural advantages throughout the claims process. Their expertise streamlines communication channels and expedites resolution through professional claims documentation and systematic management of administrative tasks.

Public adjusters leverage their extensive understanding of insurance policies to navigate complex claim procedures efficiently.

- Advanced tools and methodologies for accurate damage verification and valuation

- Professional claim negotiation strategies to secure appropriate settlements

- Systematic documentation and submission of all required evidence and paperwork

- Real-time progress tracking and regular policyholder updates

The involvement of public adjusters transforms a potentially overwhelming process into a structured, professionally managed procedure.

Their systematic approach guarantees thorough documentation while maintaining compliance with policy requirements and regulatory standards. This professional oversight considerably reduces administrative burden while maximizing the likelihood of a fair settlement.

Higher Claim Payouts & Settlements

Professional engagement of a public adjuster greatly enhances the likelihood of securing higher insurance claim settlements through methodical damage assessment and strategic negotiation procedures.

Their thorough evaluation methodology identifies concealed damages, including moisture infiltration and secondary effects like mold growth, which considerably impacts settlement values.

Public adjusters leverage their expertise in policy interpretation and claims procedures to maximize higher claim payouts through documented evidence and strategic advocacy.

Operating on a contingency basis, they meticulously navigate insurance company tactics while maintaining regulatory compliance.

Their settlement negotiation approach combines technical knowledge with objective analysis, resulting in demonstrably increased compensation for policyholders.

This systematic process eliminates emotional decision-making and guarantees all legitimate damages are properly valued and included in the final settlement determination.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) operates as a consortium of licensed insurance professionals who specialize in policyholder advocacy and claims management. This network leverages extensive experience in claims adjustment, offering thorough support through their team of daily and catastrophe adjusters.

Public Adjuster Benefits include expert policy analysis, thorough damage assessment, and sophisticated claim negotiation strategies.

The network provides essential services through a structured framework that includes:

- Professional evaluation of coverage parameters and policy limitations

- Documentation and validation of damages using industry-standard protocols

- Implementation of strategic claim presentation methodologies

- Coordination with contractors, witnesses, and insurance representatives

PCAN maintains dedicated call center support for immediate assistance and claim status updates, ensuring continuous communication throughout the adjustment process.

Their systematic approach encompasses all aspects of claims management, from initial loss notification through final settlement negotiation, maximizing potential compensation for policyholders while adhering to regulatory requirements.

Frequently Asked Questions

How Long Does a Water Damage Insurance Claim Typically Take to Process?

Like clockwork from ancient times, water damage insurance claim timelines typically span 30-60 days, with processing factors including damage complexity, documentation requirements, and adjuster workload affecting resolution periods.

Will My Insurance Cover Hotel Stays During Water Damage Repairs?

Insurance policies typically provide hotel coverage and temporary housing costs under Loss of Use provisions when water damage renders a property uninhabitable, subject to policy terms and documented necessity for relocation.

Can I Choose My Own Contractor for Water Damage Repairs?

Despite insurers' wishful thinking, policyholders maintain full contractor selection rights. Standard procedures require obtaining multiple repair estimates, though using insurance-recommended contractors may expedite claim processing and settlement terms.

Does Filing Multiple Water Damage Claims Affect My Ability to Switch Insurers?

Multiple water damage claims considerably impact insurance claim history, often resulting in higher premium rates and reduced acceptance rates when seeking coverage from new insurance carriers.

Are Water Damage Claims From Neighbor's Property Covered Under My Policy?

Standard homeowners policies typically cover water damage from neighboring properties, subject to policy exclusions. Coverage determination involves assessment of neighbor liability and specific policy terms regarding external water sources.