Feeling overwhelmed by your insurance claim? Let’s talk about when bringing in a public adjuster might be your smartest move.

Think of a public adjuster as your personal insurance claim navigator – they’re the pros who go to bat for you when dealing with complex claims. Just like having a skilled attorney in court, these licensed experts know the ins and outs of insurance policies and can speak the language that insurance companies understand.

When should you pick up the phone and call one? If you’re facing:

- Major property damage that makes your head spin

- An insurance policy that reads like ancient Greek

- A claim that’s moving slower than molasses

- Natural disasters that have turned your world upside down

Here’s what makes public adjusters worth their weight in gold: they typically help secure settlements up to 800% higher than what you might get handling things solo. They’ll tackle everything from documenting every scratch and dent to negotiating with insurance companies who might be playing hardball. Their expertise allows them to interpret policy language and identify coverage that policyholders may overlook, ensuring a fair evaluation of damages. However, it’s important to weigh the public adjusters benefits and drawbacks, as their fees can be a percentage of the claim payout. Ultimately, the decision to hire a public adjuster can lead to significant financial gains, making it a worthy consideration for many homeowners.

The best part? While you focus on getting your life back to normal, they’re in the trenches handling the mountain of paperwork, technical jargon, and back-and-forth negotiations. Think of them as your insurance claim bodyguard, protecting your interests when you need it most.

Key Takeaways

Feeling Overwhelmed by Your Insurance Claim? Here’s When to Call a Public Adjuster

Think of a public adjuster as your personal insurance claim quarterback – they’ll navigate the complex plays while you focus on getting your life back on track. You might want to bring one onto your team when:

Your Claim Looks Like a Puzzle with Missing Pieces

You’re drowning in paperwork, juggling multiple damage types, and can’t seem to make sense of what’s covered and what’s not. A public adjuster speaks “insurance-ese” fluently and can piece everything together.

Your Insurance Company’s Playing Hard to Get

If you’re getting the runaround, vague responses, or outright claim denials without solid explanations, it’s time to level the playing field. A public adjuster knows the rules of engagement and won’t let insurers give you the cold shoulder. They can effectively advocate on your behalf, ensuring that your claim is evaluated fairly and thoroughly. Understanding when to hire a public adjuster is crucial; they can help maximize your settlement and reduce the stress of navigating complex insurance processes. With their expertise, you’ll have a better chance of receiving the compensation you deserve without unnecessary delays.

Mother Nature Threw You a Curveball

Major disasters like hurricanes can turn claim filing into a high-stakes game. With professional expertise in your corner, settlements can soar dramatically – we’re talking potential increases of up to 800% in catastrophic events.

Insurance Policies Read Like Ancient Sanskrit

When policy language has you scratching your head, a public adjuster can translate the fine print into plain English and uncover coverage options you didn’t even know existed.

The Numbers Make Sense

If your claim is substantial enough to offset the adjuster’s fee (typically 5-20% of your settlement), their expertise could be worth its weight in gold. Remember: bigger claims often justify professional help.

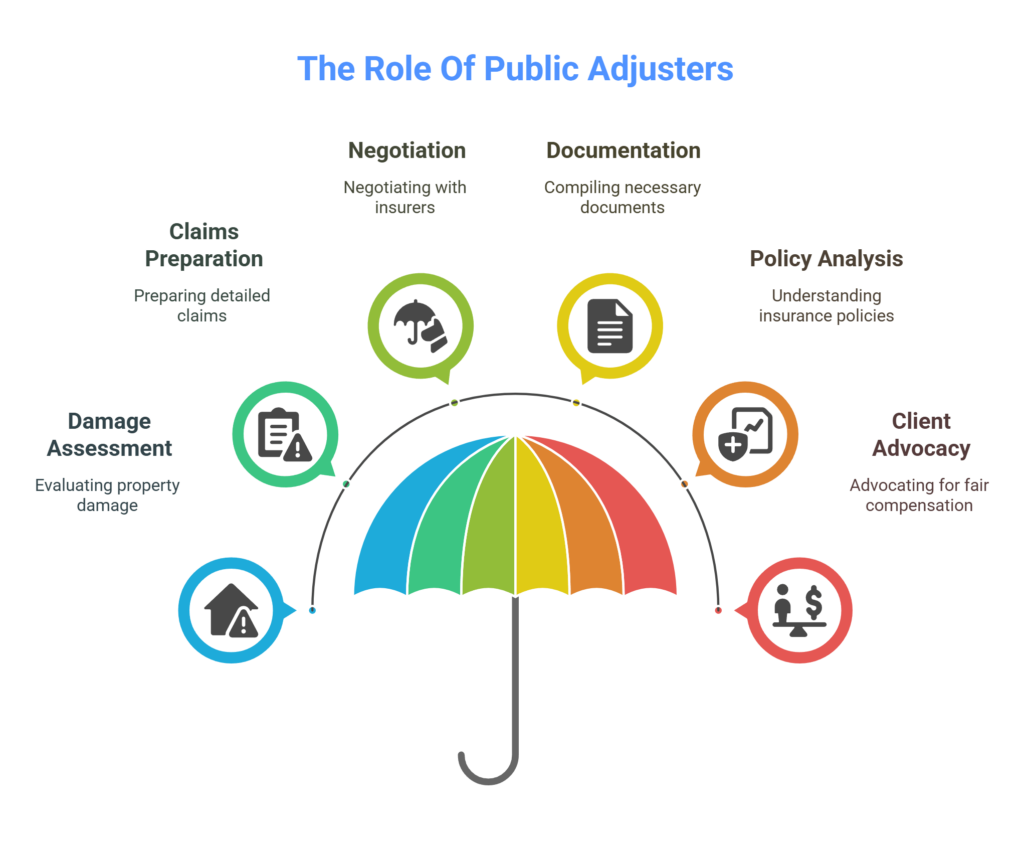

Understanding the Role of a Public Adjuster

What exactly does a public adjuster do in the complex world of insurance claims? A public adjuster serves as a licensed professional who exclusively represents policyholders in their dealings with insurance companies. Their primary role involves thorough assessment of property damage, preparation of detailed claims, and skilled negotiation with insurers. In addition to their expertise in evaluating damages, public adjusters streamline the claims process for clients, ensuring that all necessary documentation is properly compiled and submitted. They understand the intricacies of insurance policies and can effectively advocate for fair compensation on behalf of policyholders. By providing this dedicated support and representation, they demonstrate how public adjusters assist clients in navigating the often overwhelming claims process.

With extensive policy knowhow, these professionals analyze coverage terms and guarantee that policyholders receive appropriate compensation for their losses. Their claim coordination responsibilities include gathering essential documentation, capturing photographic evidence, and preparing complete reports. They maintain 24-hour response times to ensure effective communication throughout the claims process.

Unlike adjusters employed by insurance companies, public adjusters work solely for the policyholder’s interests, guaranteeing settlements adequately address their clients’ needs. They manage all aspects of the claims process while adhering to professional standards and ethical guidelines, effectively reducing the burden on policyholders during what is often a stressful and complex process. Studies have shown that policyholders who use public adjusters receive 800% higher settlements compared to those who handle claims independently.

Key Signs You Need Professional Claim Assistance

Property owners facing complex insurance claims often find themselves overwhelmed by the extensive documentation requirements and intricate negotiations involved.

The frustration of managing multiple aspects of a claim while dealing with delayed settlement offers can substantially impact daily life and financial stability.

When claims become too complex to handle alone or insurance companies appear to be stalling the settlement process, these are clear indicators that professional claim assistance may be necessary.

Studies show that engaging public adjuster services typically results in higher settlement amounts compared to initial insurance company offers.

With contingency-based fees in most states, property owners can access professional claim assistance without upfront costs.

Complex Claims Overwhelming You

When insurance claims become overwhelmingly complex, policyholders often face multiple challenges that signal the need for professional assistance.

Document overwhelm frequently occurs when trying to prove damages across multiple categories, from physical property damage to financial losses. The extensive paperwork challenges can become particularly intimidating during major disasters like floods or fires.

The complexity intensifies when insurance companies demand excessive documentation or reference multiple policy clauses to justify claim denials.

Policyholders must navigate detailed assessments, expert reports, and contractor estimates while managing their daily responsibilities. These experts typically charge 5-20% contingency fees based on the final settlement amount.

The technical nature of insurance policies, filled with complex terms and conditions, further complicates the process. These challenges, combined with time constraints and the stress of recovery, often indicate that professional support from a public adjuster is necessary.

Unlike company claims adjusters who protect insurer interests, public adjusters represent policyholders throughout the complex claims process.

Delayed Settlements Create Frustration

Insurance settlement delays can trigger a cascade of financial and emotional challenges for policyholders, often signaling the need for professional intervention. As settlement fatigue sets in, policyholders face mounting pressure from prolonged wait times, administrative complications, and communication barriers with insurers. The expertise of a licensed public adjuster can help navigate complex policy requirements while ensuring compliance with state insurance laws.

| Impact of Delays | Solutions with Public Adjuster |

|---|---|

| Financial Strain | Expert Claim Navigation |

| Stress & Anxiety | Professional Negotiation |

| Lower Settlements | Maximized Compensation |

When settlements extend beyond 30 days, policyholders often experience increased financial burdens and may feel pressured to accept unfavorable offers. Insurance carriers may employ various tactics to manage claim payouts, including intentional delays or requests for additional documentation. Public adjusters can effectively address these challenges by leveraging their expertise to expedite claims and secure fair compensation. Studies show that public adjuster involvement typically results in settlements 10-15% higher than claims filed without professional representation.

The Financial Benefits of Hiring a Public Adjuster

Studies consistently show that policyholders who hire public adjusters often receive substantially higher settlement amounts compared to those who handle claims independently.

While public adjusters typically charge a percentage fee, the increased settlement amounts frequently provide a substantial return on investment that more than justifies the cost.

Public adjusters are especially valuable for hurricane damage claims, where settlements increase by up to 800% with their assistance.

Their expertise in negotiation and thorough documentation practices generally leads to faster payment recovery, helping policyholders receive fair compensation sooner.

Public adjusters can help secure up to 50% more in claim settlements through their professional assessment and documentation handling capabilities.

Increased Settlement Amounts

The financial impact of hiring a public adjuster can dramatically outweigh their service fees, with settlements often resulting in substantially higher payouts for policyholders.

Studies by the Office of Program Policy Analysis & Government Accountability reveal settlement multipliers of up to 747% when public adjusters are involved, demonstrating their effectiveness in maximizing claim values through comparative valuations and expert negotiations.

- Professional advocacy guarantees thorough damage assessments and accurate documentation

- Expert knowledge of policy language helps identify all eligible coverage areas

- Detailed understanding of claims processes leads to more thorough settlements

- Strategic negotiation skills help counter insurance company undervaluations

These factors contribute to markedly increased settlement amounts, even after accounting for the adjuster’s contingency fee, which typically ranges from 5% to 10% of the final settlement.

Return on Investment

Investing in a public adjuster’s services often yields substantial financial returns that extend beyond the initial settlement amount. The investment optimization occurs through multiple channels, including the prevention of costly mistakes in claim filing and the elimination of expenses related to legal consultations for policy interpretation.

Public adjusters provide financial leverage by expertly maneuvering through insurance policies and identifying all available coverage options. Their professional management of the claims process prevents administrative errors that could result in claim denials or reduced settlements.

While public adjusters typically charge a percentage of the settlement, their expertise in documentation, negotiation, and policy interpretation often leads to higher payouts that offset their fees. This makes their services a cost-effective solution for policyholders seeking maximum claim value.

Fast Payment Recovery

Securing fast payment recovery through a public adjuster’s services delivers substantial financial advantages for policyholders facing property damage claims.

Public adjusters optimize the claims process by managing communications with insurers and providing thorough documentation, leading to significant payment acceleration.

Their expertise in handling complex claims procedures and negotiating with insurance companies helps expedite settlements.

- Professional documentation and evidence gathering reduces delays and prevents claim denials

- Early involvement of public adjusters streamlines the entire claims process from start to finish

- Regular communication with insurance providers maintains consistent recovery speed

- Expertise in policy interpretation and claim procedures prevents costly delays and mistakes

Their contingency-based fee structure guarantees they remain motivated to achieve swift resolutions while maximizing settlement amounts, allowing property owners to begin repairs and recovery promptly.

Navigating Complex Insurance Claims

Modern insurance claims have evolved into increasingly intricate processes that demand expertise and careful attention to detail.

The complexity stems from multiple factors, including changing workforce demographics, evolving industry expectations, and intricate policy requirements.

Claims documentation has become more sophisticated, requiring thorough understanding of coverage terms and conditions.

Public adjusters possess specialized knowledge to navigate these complexities effectively. Their expertise includes implementing strategic settlement strategies that account for hidden damages and potential claim components that insurance companies might overlook.

They understand the nuances of various insurance sectors, from property-casualty to workers’ compensation, where claims often involve multiple variables and risk factors.

This professional guidance becomes particularly valuable when dealing with extensive property damage, delayed claims, or situations where policyholders lack the time or expertise to manage the process effectively.

Their involvement helps guarantee accurate claim valuation and fair compensation through systematic documentation and skilled negotiation.

What to Expect During the Claims Process

When policyholders initiate an insurance claim, they enter a structured process that requires careful attention to documentation and deadlines.

The claims timeline typically begins with notifying the insurance company and extends through settlement negotiations.

From initial notification to final settlement talks, every insurance claim follows a defined path toward resolution.

Understanding what to expect can help policyholders navigate process challenges more effectively.

Insurance companies follow established procedures that include:

- Assignment of a claims adjuster who evaluates damages and reviews policy coverage

- Documentation requirements including proof of loss, photos, and relevant receipts

- Investigation of the claim through site inspections and expert assessments

- Settlement discussions and payment determinations based on policy terms

Throughout this process, policyholders must maintain detailed records of all communications and expenses while meeting specific deadlines.

The complexity of claims can vary substantially, potentially extending the timeline from days to months.

Understanding these steps helps policyholders prepare for potential delays and make informed decisions about seeking professional assistance.

Choosing the Right Public Adjuster for Your Case

The selection of a qualified public adjuster can substantially impact the outcome of an insurance claim. When evaluating potential adjusters, begin with a service comparison of their licensing credentials, certifications, and track record of successful settlements. Verify their licensure through state authorities and look for additional professional certifications from recognized organizations like NAPIA or NAIC.

Local experience plays an essential role in effective claims handling, as adjusters familiar with regional conditions and regulations can navigate the process more efficiently.

Consider their specialization in specific claim types, such as residential or commercial properties, and examine their communication practices and negotiation skills. Review their fee structure carefully, ensuring all terms are clearly documented in writing.

Request references and examples of previous cases similar to yours, and evaluate their responsiveness and availability during the initial consultation to gauge their commitment to client service.

Maximizing Your Insurance Settlement

Successful insurance settlements require a strategic approach combining thorough documentation, effective negotiation tactics, and professional advocacy.

Settlement strategies focus on gathering exhaustive evidence, establishing clear communication channels with adjusters, and developing strong negotiation positions.

Effective claim settlements require meticulous evidence collection, open lines of communication, and carefully crafted negotiating strategies.

When pursuing maximum compensation, policyholders must carefully consider both immediate and long-term impacts of their claims.

Key negotiation tactics include:

- Maintaining detailed records of all damages and related expenses

- Setting clear minimum acceptable settlement amounts based on documented losses

- Presenting evidence in an organized, professional manner

- Communicating respectfully while firmly advocating for fair compensation

Understanding when to leverage professional assistance can substantially impact settlement outcomes.

Public adjusters bring expertise in policy interpretation, damage assessment, and negotiation, often securing higher settlements than policyholders might achieve independently.

Their experience in managing complex claims and maneuvering insurance company procedures can prove invaluable in maximizing settlement amounts.

The Benefits Of Consulting A Public Adjuster

Public adjusters offer invaluable expertise in maneuvering complex insurance claims while providing impartial assessments of property damage.

Their professional management of the claims process helps streamline documentation, communication, and negotiation with insurance companies.

Studies have shown that claims handled by public adjusters often result in substantially higher settlements compared to those filed by policyholders alone.

Expertise In Insurance Claims

Professional expertise in insurance claims stands as a cornerstone benefit when consulting a public adjuster. These licensed professionals undergo rigorous Policy Analysis training and must meet strict Certification Standards to practice.

Their extensive understanding of insurance terminology, policy structures, and claims processes enables them to effectively navigate complex situations on behalf of policyholders.

Key areas of expertise include:

- Interpreting intricate policy language and identifying all applicable coverages

- Documenting and evaluating property damage with professional precision

- Negotiating with insurance companies using industry knowledge

- Leveraging insights from previous claims experience to maximize settlements

This specialized knowledge proves particularly valuable in complex claims situations, where understanding policy nuances and industry practices can substantially impact settlement outcomes.

Objective Damage Assessment

Building upon the solid foundation of expertise, an objective damage assessment emerges as a central advantage of engaging a public adjuster. Through thorough damage inspection, these professionals conduct rigorous evaluations that identify both visible and hidden property damages that might otherwise go unnoticed.

Public adjusters provide an accurate evaluation of losses through detailed documentation and analysis of all affected items. Their impartial approach guarantees that nothing is overlooked during the assessment process, from structural damage to personal belongings.

This methodical examination results in a complete understanding of the loss extent, supported by professional documentation. The adjuster’s objective stance proves particularly valuable when dealing with insurance companies, as their detailed reports and evidence-based assessments strengthen the policyholder’s position during settlement negotiations.

Streamlined Claim Process

When maneuvering through the complex terrain of insurance claims, a streamlined process can make the difference between a swift resolution and a prolonged struggle.

Public adjusters enhance process efficiency through systematic document management and coordinated communication channels. Their expertise facilitates a more organized approach to claims handling, resulting in faster processing and improved outcomes.

Key elements of a streamlined claims process include:

- Thorough documentation gathering and organization of damage evidence

- Strategic coordination of inspections and assessments

- Efficient handling of all insurance company communications

- Systematic tracking of claim progress and deadlines

This structured approach minimizes delays, reduces administrative burden, and guarantees all necessary documentation is properly submitted, ultimately expediting the path to settlement while maintaining claim accuracy and completeness.

Higher Claim Payouts & Settlements

One of the most compelling reasons to engage a public adjuster is the significant increase in claim payouts they typically secure for policyholders. Studies reveal consistent payout patterns showing substantially higher settlements when public adjusters are involved, with some cases reporting increases of up to 747% in hurricane-related claims.

The settlement success rate stems from public adjusters’ specialized expertise and negotiation skills. Operating on a contingency fee basis, typically capped at 10% of the settlement, these professionals are inherently motivated to maximize claim values.

Data indicates that homeowners working with public adjusters receive an average payout of $22,266, compared to $18,659 for those handling claims independently. This difference becomes even more pronounced in catastrophic events, where complex policy terms and extensive damage assessment require professional expertise.

About The Public Claims Adjusters Network (PCAN)

Although public adjusters commonly work through various professional networks and organizations, limited information is available about the specific entity known as the Public Claims Adjusters Network (PCAN).

Public adjusters typically operate through independent firms or established professional associations that provide Network Benefits and Member Resources to support their work with policyholders. These organizations often offer training programs, legal assistance, and networking opportunities, enabling public adjusters to enhance their skills and knowledge. Additionally, they may provide access to valuable industry tools and resources that help streamline the claims process. For those seeking to understand their role further, public adjusters explained in detail can shed light on how they advocate for clients and ensure fair compensation after losses.

Professional networks of public adjusters generally offer:

- Collaborative expertise for handling complex insurance claims

- Shared resources and best practices for claim documentation

- Access to specialized knowledge in various types of property damage

- Professional development and certification opportunities

These networks enable public adjusters to better serve both residential and commercial clients by maintaining high professional standards and staying current with industry practices. While specific information about PCAN is not available, public adjusters continue to work through various professional organizations to guarantee quality service delivery and maintain their state licensing requirements.