Wondering when to bring a public adjuster on board? Let’s dive into this crucial timing question that could make or break your insurance claim.

Think of public adjusters as property damage detectives – they’re most effective when they can investigate the scene while the evidence is still fresh. The golden window? Right after disaster strikes and before you file that insurance claim. Just like solving a puzzle, having all the pieces from the start makes the whole process smoother. A thorough assessment conducted during this crucial time can help in accurately documenting the damage and preventing potential issues down the line. However, there are common pitfalls for public adjusters that can hinder their effectiveness, such as rushing to file claims without gathering sufficient evidence or miscommunicating with the insurance company. By avoiding these traps and meticulously gathering information, public adjusters can ensure a more favorable outcome for their clients.

But don’t panic if you’ve already started your claim! While it’s never technically “too late” to hire a public adjuster, their impact may decrease as time marches on. It’s similar to calling a coach mid-game – they can still help turn things around, but they might have missed some key plays early on.

Several factors can complicate late-stage involvement:

- Repairs already in progress

- Missing or incomplete documentation

- Initial settlement offers accepted

- Evidence of damage altered or gone

You might be thinking, “My insurance company made an offer – is it worth getting a public adjuster now?” The answer is yes, but act quickly. These professionals can still negotiate on your behalf and potentially uncover overlooked damages, even if you’re mid-claim.

The bottom line? The sooner you partner with a public adjuster, the better positioned you’ll be to maximize your settlement. Don’t wait until you’re deep in the claims maze to seek expert guidance – early intervention is your best bet for optimal results.

Key Takeaways

Timing Is Everything: Your Guide to Hiring a Public Adjuster

Think of a public adjuster as your property damage superhero – but even superheroes need to arrive at the right moment! The golden window? Right after disaster strikes your property. Just like you wouldn’t wait days to treat a broken arm, don’t delay getting professional help for your insurance claim.

Want the best possible outcome? Bring in a public adjuster before you file your claim or while you’re still in those early dance steps with your insurance company. They’ll know exactly which moves to make!

Already received an offer from your insurer? Don’t worry – you haven’t missed the boat completely. A skilled public adjuster can still review your case and potentially negotiate a better settlement. They might spot valuable details you didn’t even know to look for!

Watch out for these red flags that might make it too late:

- Claim deadlines have zoomed past

- You’ve already completed repairs without proper documentation

- You’ve signed off on a final settlement

Quick tip: If you’ve started repairs or accepted partial payments, don’t panic! Just document everything thoroughly with photos and receipts – your public adjuster might still be able to help.

Remember: Insurance claims are like chess games – the earlier you bring in your expert player, the better your chances of winning!

Understanding the Critical Time Frames for Hiring a Public Adjuster

While hiring a public adjuster is possible at nearly any stage of an insurance claim, understanding the ideal timing can measurably impact the outcome of the settlement. The most advantageous timing windows occur immediately after property damage, ensuring thorough documentation and favorable claim processing from the start.

Critical filing periods exist within the claims process that policyholders should consider. Though it’s never technically too late to hire a public adjuster while a claim remains open, certain circumstances may limit their effectiveness. License requirements must be verified when selecting an adjuster to ensure compliance with state regulations.

These include cases where final settlements have been accepted, filing deadlines have expired, or claims stem from damages that occurred years prior without proper notification. Additionally, insufficient documentation of damages can substantially hamper a public adjuster’s ability to negotiate effectively.

For maximum benefit, engagement should occur before claim submission or during initial negotiations, though adjusters can still provide value even after receiving an initial offer from the insurance company. Studies show that claims handled by public insurance adjusters result in settlements up to 800% higher compared to independently managed claims.

Key Factors That Impact Public Adjuster Involvement Deadlines

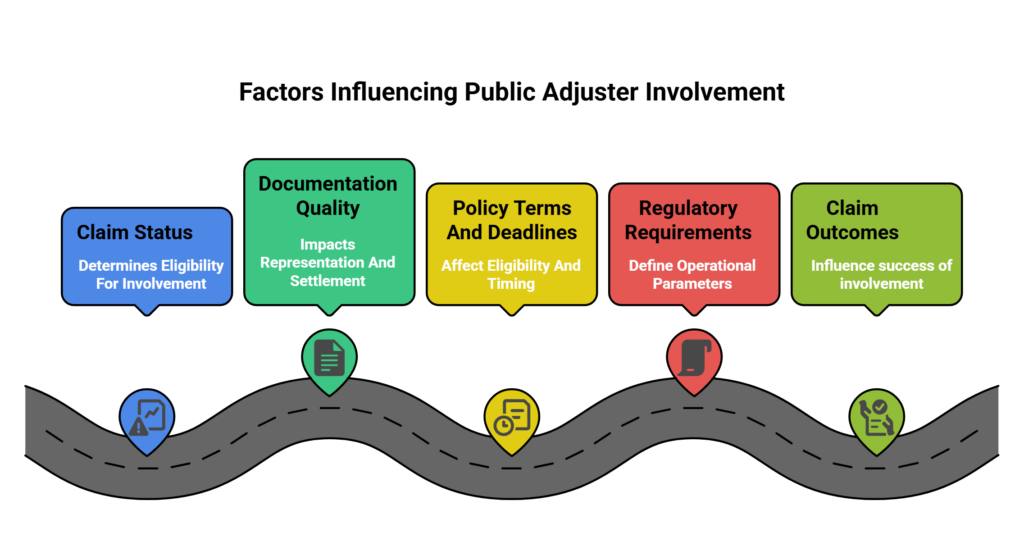

Several critical factors determine the timing and effectiveness of public adjuster involvement in insurance claims.

The status of a claim substantially influences eligibility for public adjuster services, with timing limitations playing a vital role in the process. Complex commercial claims often require both public adjuster and attorney involvement for optimal outcomes.

- Claim Status: Open or unresolved claims typically allow for public adjuster involvement, while fully settled claims with signed releases generally preclude further negotiation unless fraud or significant errors are discovered.

- Documentation Quality: The completeness and accuracy of claim documentation directly impact a public adjuster’s ability to effectively represent the policyholder’s interests and maximize potential settlements.

- Policy Terms and Deadlines: Understanding policy-specific time frames, reporting requirements, and contractual obligations is essential, as these factors can affect claim eligibility and the window of opportunity for public adjuster involvement.

Regulatory requirements and state-specific laws further define the parameters within which public adjusters can operate, making timing considerations particularly important for successful claim outcomes.

While independent adjusters earn approximately $300 per day working for insurance companies, public adjusters typically charge a percentage of the final settlement amount.

Warning Signs You’re Running Out of Time

Recognizing warning signs of limited time in an insurance claim process can help policyholders make informed decisions about hiring a public adjuster. Insurance delays often manifest through stalled claims processing, minimal communication from insurers, and mounting challenges in evidence collection.

Several indicators suggest diminishing options for policyholders. These include passed claim filing deadlines, incomplete documentation of damages, and prolonged periods without insurer updates. Public adjuster settlements**** increase claim payouts by 30-50% on average.

Missed deadlines, gaps in damage records, and extended silence from insurance companies signal shrinking opportunities for successful claims.

When policyholders struggle to gather adequate evidence, such as photographs, damage reports, or witness statements, their position weakens substantially. Additionally, pressure to accept rushed settlements or sign release forms without proper review signals a critical juncture in the claims process.

Other warning signs include increasing claim complexity, difficulties understanding policy terms, and persistent payment processing delays. Policyholders experiencing multiple warning signs should promptly consider professional assistance to protect their interests before further complications arise.

Understanding that claim determination timelines typically range from 30-60 days makes it crucial for policyholders to act swiftly when issues arise.

Common Mistakes That Can Limit Your Options

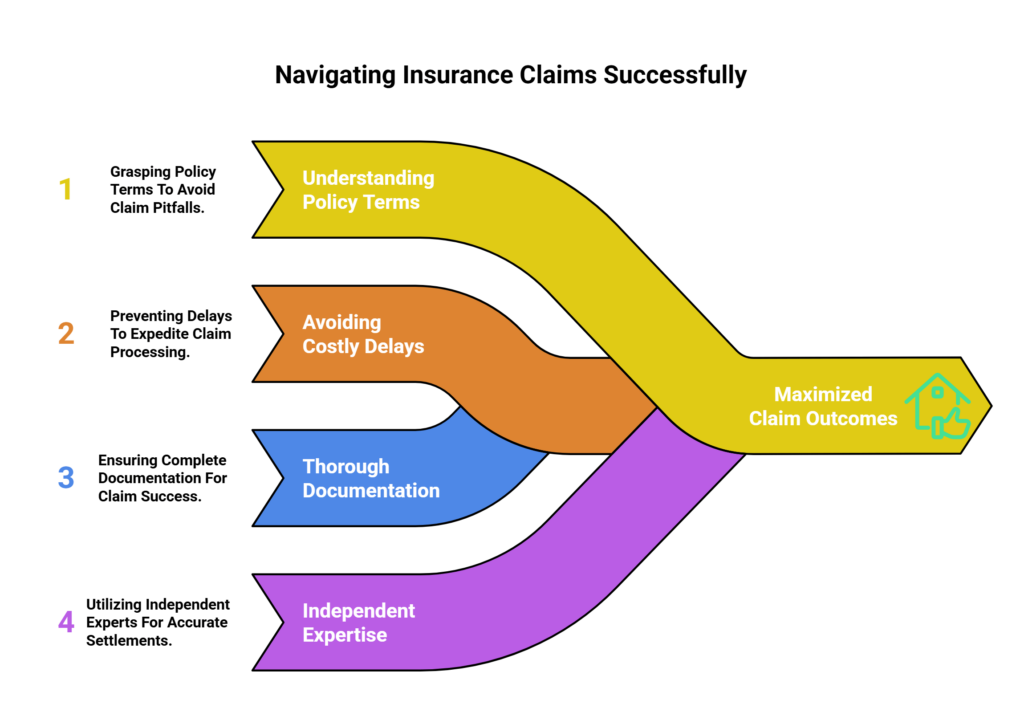

Insurance claims can become greatly compromised when policyholders make common yet avoidable mistakes during the claims process.

Mishandled paperwork and costly delays often stem from insufficient understanding of policy terms and deadlines, leading to reduced settlements or claim denials. Professional guidance early in the process is vital for avoiding these pitfalls and maximizing claim outcomes. Initial claims can take 10-30 days for acknowledgment and processing before reaching settlement stages.

- Filing claims without thoroughly reviewing policy coverage and exclusions results in misaligned expectations and potential settlement issues

- Starting repairs or signing agreements prematurely without proper documentation and assessment can severely limit future claim options

- Relying solely on insurance company adjusters while neglecting to secure independent expertise may lead to undervalued settlements

Understanding these critical mistakes helps policyholders recognize when professional assistance from a public adjuster is necessary. Their expertise can help navigate complex claim requirements, guarantee proper documentation, and negotiate more favorable settlements.

Studies show that engaging a public adjuster can result in 20-50% higher settlements when compared to claims handled without professional representation.

Making the Most of Available Time With a Public Adjuster

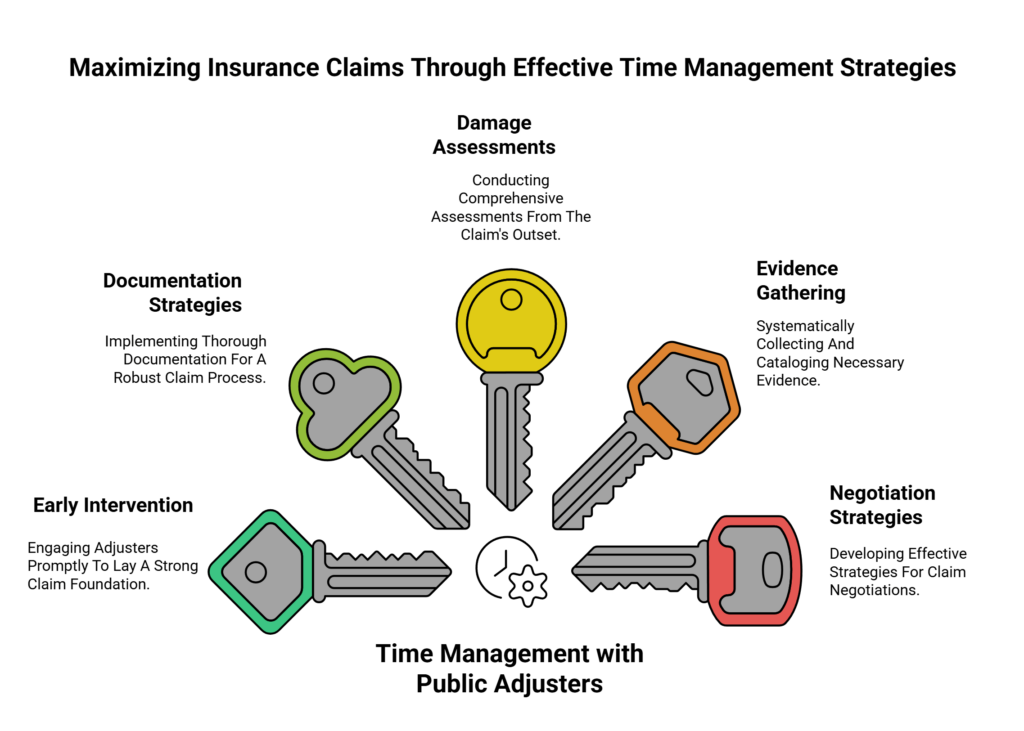

Time management expertise plays an essential role when working with a public adjuster to maximize insurance claim outcomes. Early intervention allows these professionals to implement thorough documentation strategies and establish a strong foundation for the claim process.

By engaging their services promptly, policyholders benefit from thorough damage assessments and expert policy review from the outset. Professional standards require adjusters to maintain fairness to clients, insurers, and the public throughout the process.

Timely documentation becomes particularly vital when dealing with complex claims that require detailed evidence gathering. Public adjusters can systematically catalog damages, compile necessary paperwork, and develop effective negotiation strategies when given adequate time to work.

They can also address potential issues before they escalate, preventing delays that might compromise the claim’s success. While these professionals can still assist later in the process, their ability to secure ideal outcomes increases substantially when they have sufficient time to analyze, document, and negotiate the claim effectively.

Public Claims Adjusters Network members must provide claim status updates every 10 days to keep policyholders informed throughout the process.

The Benefits Of Consulting A Public Adjuster

Consulting a public adjuster provides access to professional expertise in handling complex insurance claims and procedures.

These specialists offer objective property damage assessments while streamlining the entire claims process through efficient documentation and skilled negotiations.

Their involvement often results in higher claim settlements, as they leverage their knowledge of policy terms and industry practices to secure maximum compensation for policyholders.

Expertise In Insurance Claims

When policyholders face complex insurance claims, a public adjuster‘s expertise can prove invaluable in securing fair settlements.

Their claim expertise encompasses extensive knowledge of policy interpretation, negotiation strategies, and industry practices that typical policyholders may not possess.

- Public adjusters leverage their adjuster competency to identify overlooked damages and potential coverage areas that insurance companies might not readily acknowledge

- They navigate complex policy language and legal terminology to guarantee claimants understand their rights and entitlements

- Their professional experience enables them to manage administrative processes efficiently while advocating for maximum compensation

This specialized knowledge allows public adjusters to challenge low settlement offers and expedite claim resolutions, particularly in cases involving significant property damage or disputed claims where technical expertise is critical for success.

Objective Damage Assessment

Through an objective damage assessment, public adjusters provide property owners with thorough evaluations that establish accurate claims valuations. Their independent analysis guarantees complete documentation of all damages, including those not immediately visible, while creating a detailed damage scope that strengthens the claim’s position during negotiations with insurance companies.

Public adjusters conduct precise evaluations through multi-faceted analysis, combining on-site inspections with extensive data collection. This systematic approach covers structural, non-structural, and personal property damages, supported by incident reports, photographs, and cost estimations.

Their expert knowledge enables them to identify necessary resources for recovery and prevent potential disputes. By maintaining clear communication with insurers and leveraging evidence-based documentation, public adjusters help property owners secure fair settlements while avoiding procedural delays and missed opportunities.

Streamlined Claim Process

A streamlined insurance claim process represents one of the most significant advantages of hiring a public adjuster.

Through effective process optimization and workflow management, public adjusters transform complex claims into manageable procedures, allowing policyholders to focus on recovery rather than administrative tasks.

- Public adjusters handle all communications with insurance companies, manage critical deadlines, and organize documentation, creating a more efficient claims experience.

- Their professional expertise reduces stress by managing intricate paperwork and negotiating with insurers on behalf of policyholders.

- The streamlined approach includes thorough policy interpretation, skilled negotiation, and continuous monitoring of claim progress, ensuring that policyholders receive maximum entitled benefits while minimizing delays and potential disputes.

Higher Claim Payouts & Settlements

Public adjusters consistently demonstrate their value through their ability to secure higher claim payouts and more favorable settlements for policyholders. Their expertise in policy interpretation, extensive damage assessment, and skilled negotiation enables maximum recovery on insurance claims.

Through detailed documentation and objective representation, public adjusters identify hidden damages that policyholders might overlook, ensuring all losses are properly accounted for. By meticulously analyzing the claims process, they also help mitigate common pitfalls for public adjusters, such as inadequate communication with insurers and failure to gather sufficient evidence. This proactive approach not only protects the interests of policyholders but also enhances the credibility of the claims being submitted. Ultimately, their expertise leads to more accurate settlements, allowing clients to recover effectively from their losses.

Their professional advocacy leads to enhanced settlements, often substantially higher than what policyholders might achieve on their own. While public adjusters typically charge a percentage-based fee of up to 10% of the settlement, their involvement frequently results in payouts that more than offset their costs. Their ability to navigate complex policy terms and negotiate effectively with insurance companies proves invaluable in maximizing claim settlements.

About The Public Claims Adjusters Network (PCAN)

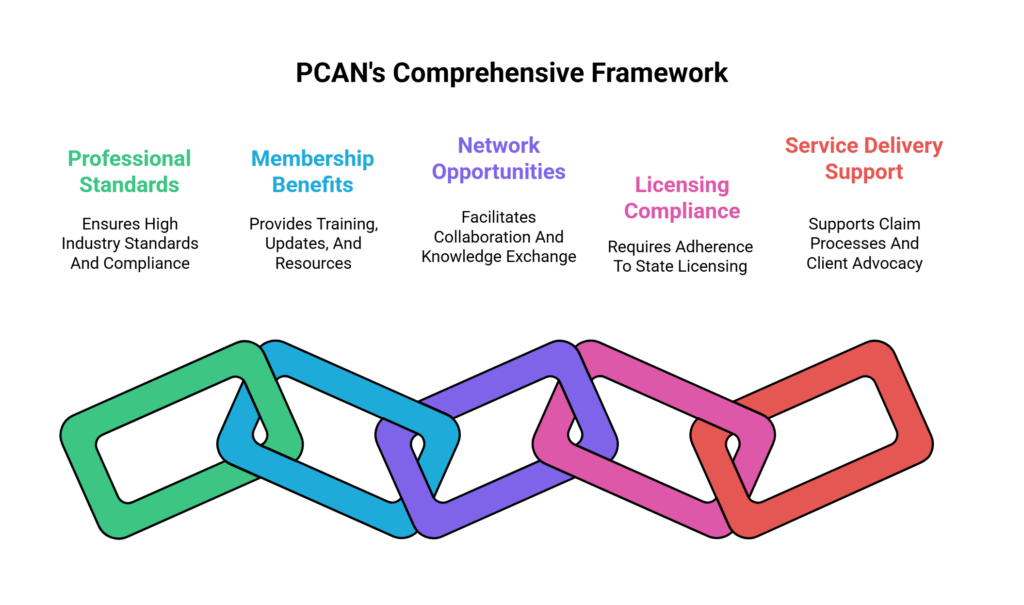

The Public Claims Adjusters Network (PCAN) stands as a professional organization dedicated to maintaining high standards within the public adjusting industry.

Through its thorough network of licensed professionals, PCAN guarantees that policyholders receive expert representation during the claims process while adhering to state regulations and ethical guidelines.

- Membership Benefits include access to specialized training, regulatory updates, and shared resources that enhance adjusters’ ability to maximize claim settlements for their clients

- Network Opportunities facilitate collaboration among licensed professionals, enabling knowledge exchange and improved service delivery across different jurisdictions

- PCAN members must maintain proper licensing through the California Department of Insurance and other state authorities, demonstrating commitment to professional standards

The organization supports public adjusters in delivering essential services, from initial damage assessment to final settlement negotiation, while guaranteeing compliance with legal requirements and fee structures that protect policyholder interests. Additionally, the organization provides comprehensive training and resources to enhance the expertise of public adjusters in navigating complex insurance claims. Through workshops and seminars, public adjusters explained in detail the intricacies of policy coverage and claims processes, ensuring that they are well-equipped to advocate for their clients effectively. This commitment to professional development ultimately strengthens the trust between public adjusters and policyholders, fostering an environment where clients feel supported and informed throughout their claims journey.