The Fireline Wildfire Risk Score is an analytical tool used to evaluate wildfire hazards for properties. It assigns scores from 0 to 30, with higher numbers indicating greater risk. The score considers factors such as vegetation type, terrain slope, and access routes. Properties with low scores benefit from potential insurance savings, while high scores may lead to coverage challenges. Understanding this risk score is essential for homeowners and insurers in making informed decisions and could uncover transformative insights.

Key Takeaways

- The Fireline Wildfire Risk Score quantifies wildfire hazards on a scale from 0 to 30.

- Scores above 2 can lead to insurance denial or increased premiums.

- Vegetation type, terrain slope, and access routes are key factors influencing the score.

- Awareness of scores aids in emergency preparedness and influences property insurance decisions.

- Advancements in technology are enhancing the accuracy of wildfire risk assessments.

Understanding The Basics Of Fireline Wildfire Risk Scores

The Fireline Wildfire Risk Score serves as a quantifiable metric vital for evaluating wildfire hazards in specific locations, offering a systematic approach to understanding potential risks. This score, ranging from 0 to 30, identifies data trends that reveal a wide variation in risk levels across properties.

Approximately 73% of properties secure scores of 0 or 1, indicating low risk, while 15% register between 4 and 30, signifying elevated risk.

Homeowner awareness of their Fireline scores is important for effective emergency preparedness. This awareness facilitates informed decisions regarding property protection and insurance eligibility.

Risk communication is mandated by the California Insurance Commissioner, requiring insurers to disclose these scores to policyholders. Such transparency highlights the role of Fireline scores in shaping insurance underwriting decisions and costs.

Consequently, understanding score variations enables homeowners to better assess their wildfire exposure and take proactive measures to mitigate potential hazards.

Properties in high-risk regions often require state-backed FAIR plans when traditional insurance coverage becomes unavailable or too costly.

Key Factors Influencing Wildfire Risk Scores

Several pivotal factors intricately shape the Fireline Wildfire Risk Score, each playing an essential role in determining the potential threat level associated with a property.

Vegetation management is critical; dense vegetation heightens risk, necessitating strategic fire resistant landscaping to reduce susceptibility.

Slope mitigation is another key factor, as properties on steeper terrains face elevated risk due to accelerated fire spread. Effective slope mitigation can lower risk scores by enhancing fire control efforts.

Emergency access further influences the score, with properties on dead-end roads or with restricted access facing higher risk due to impaired firefighting capability. Ensuring clear, unobstructed routes for emergency vehicles can greatly improve the score.

Utilizing risk assessment tools, such as historical fire data analysis, provides an extensive evaluation within a quarter-mile radius, integrating land characteristics to refine accuracy.

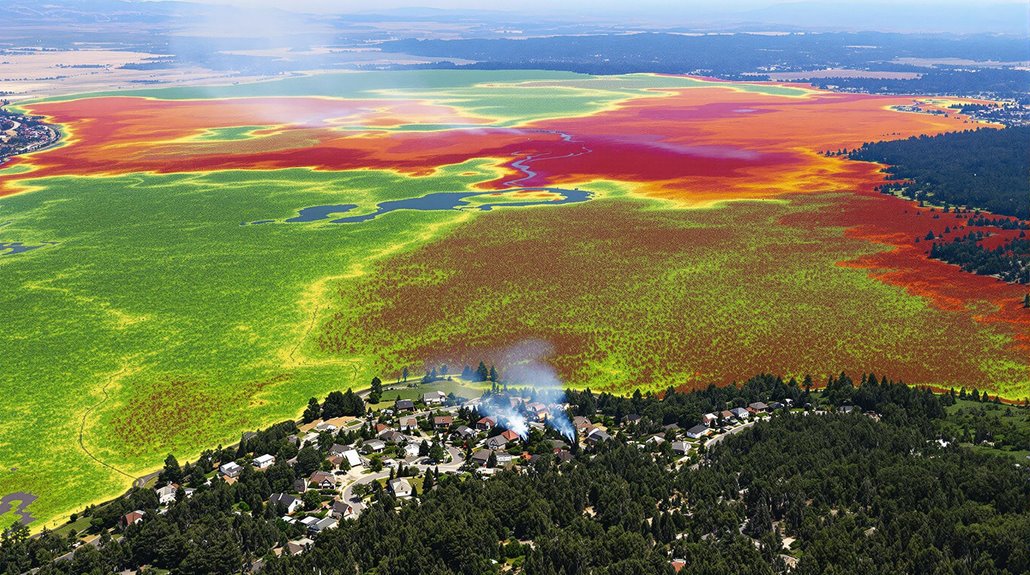

Advanced GIS technology enables standardized assessments that consider vegetation, topography, and climate factors for comprehensive risk evaluations.

These methodical considerations collectively inform the Fireline Wildfire Risk Score, aiding informed decision-making in wildfire preparedness.

Importance Of Vegetation Type In Risk Assessment

Understanding the various factors influencing wildfire risk, vegetation type emerges as a crucial component in risk assessment. Different vegetation types, characterized by their fuel moisture and growth patterns, play a vital role in determining fire behavior.

Dense forests and dry grasslands, for instance, offer ample fuel, facilitating rapid fire spread and increasing intensity, consequently resulting in higher Fireline scores. Conversely, areas incorporating non-flammable vegetation, such as xeriscaping or low moisture plants, contribute to lowering wildfire risk through effective risk mitigation strategies.

Land management practices focused on reducing flammable vegetation can considerably influence the wildfire risk profile of a property. By carefully selecting and managing vegetation types, landowners and policymakers can effectively control fuel availability, thereby modulating potential fire behavior.

Understanding these dynamics is essential for strategic planning and implementing effective risk mitigation measures. Taking vegetation type into account provides a methodical approach to crafting exhaustive wildfire risk assessments. Creating defensible space zones around properties by strategically clearing vegetation has become a fundamental practice in modern wildfire prevention strategies.

How Terrain Slope Affects Fireline Scores

When evaluating the impact of terrain slope on Fireline Wildfire Risk Scores, it becomes evident that steeper inclines considerably accelerate wildfire spread. The slope impact is a significant factor in risk calculations, as it dictates the intensity and behavior of fires.

Areas with significant elevation changes are assigned higher scores due to the increased speed at which fires can travel uphill, presenting formidable terrain challenges. This elevation influence not only exacerbates fire growth but also complicates firefighting access, as steep slopes hinder the movement of emergency services.

Moreover, terrain can alter airflow patterns and affect moisture retention, both of which are essential in determining fire potential. Properties situated on sloped land consequently face elevated risks, compounded by vegetation fuel sources and limited accessibility.

Hence, understanding the slope impact in Fireline assessments is essential for accurate risk elevation and effective wildfire management, underscoring the need for meticulous terrain analysis.

Analyzing Access Routes & Their Impact On Risk

While evaluating Fireline Wildfire Risk Scores, the appraisal of access routes emerges as a vital component in determining wildfire risk levels. Effective access route evaluation considers factors such as road size, type, and proximity to main roads, influencing emergency service accessibility and firefighting infrastructure efficiency. Poor access, like narrow or dead-end roads, complicates emergency vehicle entry, elevating the risk score and affecting insurance eligibility. The maintenance of roads is essential for ensuring swift response times, underscoring road maintenance importance in risk mitigation strategies. Additionally, properties distant from fire departments or lacking water sources, like hydrants, may experience heightened risk levels. The Fire Suppression Rating Schedule directly influences insurance premiums through systematic evaluation of local firefighting capabilities and infrastructure.

| Factor | Impact on Risk | Risk Mitigation Strategies |

|---|---|---|

| Road Type | Affects accessibility | Improve road conditions |

| Proximity to Main Roads | Influences score | Enhance connectivity |

| Distance from Fire Services | Increases risk | Establish nearby firefighting infrastructure |

Comprehensive access route evaluations contribute to a nuanced understanding of wildfire risk, aiding stakeholders in managing vulnerabilities effectively.

Utilizing The Iso Fireringtm Model For Assessment

Employing the ISO FireRingTM model for evaluating wildfire risk allows for an extensive and detailed evaluation of potential hazards at specific locations. This methodology calculates a Wildfire Hazard Score by conducting a thorough Risk Assessment, factoring in elements such as fuel types, slope, and property access.

Integral to Hazard Mitigation, this model leverages Environmental Analysis, utilizing satellite imagery and Geographic Information Systems (GIS) technology to interpret data specific to each property. The assessment also evaluates the Special Hazard Interface Area (SHIA), which identifies risks from adjacent high-fuel zones, particularly in densely vegetated regions. The system aligns with wildfire monitoring services that have completed over 30,000 property assessments since 2013.

Benefits Of Knowing Your Fireline Wildfire Risk Score

Understanding the methodology behind the ISO FireRingTM model highlights the practical advantages of knowing one's FireLine Wildfire Risk Score. This score serves as a pivotal tool for homeowners aiming to enhance risk mitigation strategies and wildfire preparedness.

Knowledge of a low FireLine score, such as 0 or 1, can provide significant insurance savings due to decreased perceived risk. Conversely, a higher score prompts proactive measures, potentially elevating property value through targeted risk reduction efforts, like vegetation management.

Moreover, the FireLine score fosters community awareness, encouraging collective actions to safeguard neighborhoods. Recognizing these implications can lead to more informed decisions regarding insurance coverage, ultimately mitigating financial burdens from potential wildfire damage.

Annual premiums can be reduced by thousands of dollars when homeowners understand and optimize their FireLine scores.

- Insurance savings through lower premiums for low-risk properties.

- Enhanced property value by implementing risk mitigation strategies.

- Informed risk mitigation actions to prevent wildfire damage.

- Community awareness initiatives for collective safety efforts.

- Improved wildfire preparedness through understanding and action.

Implications For Property Owners & Insurance Providers

Steering through the implications of the FireLine Wildfire Risk Score presents significant challenges and considerations for property owners and insurance providers alike. This score plays a pivotal role in risk assessment, influencing wildfire insurance availability and property value.

With a range from 0 to 30, scores above 2 can lead to coverage refusals, particularly from insurers like Bamboo Insurance. Approximately 73% of properties receive a score of 0 or 1, benefiting from favorable coverage options.

However, high-risk scores (13-30) often lead to insurance denials and force homeowners into plans like the California Fair Plan, which carries higher premiums. This financial impact is substantial, affecting not only insurance costs but also marketability in real estate transactions.

Properties with elevated scores experience decreased property value, as potential buyers are wary of the increased risk and associated financial burdens. This underscores the critical nature of understanding and managing wildfire risk assessments. Working with public insurance adjusters can help property owners maximize their settlement amounts and ensure fair compensation when filing fire-related claims.

Strategies For Reducing Your Wildfire Risk Score

Minimizing wildfire risk scores requires a methodical approach that incorporates multiple strategies to effectively mitigate potential hazards. A key strategy involves fire safe landscaping, which emphasizes the removal of flammable vegetation and the implementation of defensible space around properties.

Regular vegetation clearing techniques are essential, focusing on the maintenance of dead vegetation, leaves, and debris to reduce fire spread likelihood. Community engagement initiatives play an important role, where collective efforts like controlled burns and vegetation management enhance neighborhood safety and improve FireLine scores.

Emergency preparedness plans should be developed, integrating access routes for emergency vehicles and guaranteeing quick response capabilities. Finally, insurance policy adjustments may be necessary, reflecting the reduced risk and potentially lowering premiums due to these mitigation efforts.

Maintaining a well-irrigated landscape with non-flammable materials like gravel and concrete can significantly slow the spread of flames during a wildfire.

- Fire safe landscaping: Create defensible space around properties.

- Vegetation clearing techniques: Remove flammable materials regularly.

- Community engagement initiatives: Participate in neighborhood safety efforts.

- Emergency preparedness plans: Ensure efficient emergency response.

- Insurance policy adjustments: Reflect risk reductions in coverage.

Future Developments In Wildfire Risk Assessment Technology

In the rapidly evolving field of wildfire risk assessment, technological advancements are poised to greatly enhance the precision and reliability of risk evaluations. Emerging technologies, such as advanced data analytics and predictive modeling, are being integrated into new risk assessment tools.

For instance, RMS's forthcoming wildfire risk score will consider factors like home construction and defensible space, refining risk management strategies. The First Street Foundation employs satellite imagery and weather data, projecting risks over a 30-year horizon, enhancing climate adaptation efforts.

Future developments in technology aim to deliver granular insights into property-specific risks, potentially influencing insurance underwriting and pricing. The integration of AI-generated simulations with climate projections is expected to deepen understanding of shifting fire risks.

These advancements suggest a paradigm shift where precise, data-driven assessments will guide more effective mitigation measures and policy decisions, aligning with the broader objectives of climate adaptation and sustainable risk management. Working with public insurance adjusters can help homeowners maximize their settlement amounts while navigating these evolving risk assessment technologies.

Frequently Asked Questions

What Is a Good Fireline Score?

A good FireLine score, ranging from 0 to 1, represents low wildfire risk. Key indicators include minimal vegetation and accessible terrain. Understanding FireLine score interpretation and improving ratings enhances community awareness and aids thorough fireline risk assessment. Additionally, communities can take proactive measures to mitigate wildfire risks by actively managing vegetation and modifying landscape features. By educating residents about the fireline definition and explanation, individuals can make informed decisions regarding property maintenance and emergency preparedness. This knowledge empowers communities to collaborate on fire prevention strategies, ultimately leading to safer environments during peak wildfire seasons.

How Do I Find Out My Fireline Score?

The fireline score calculation, a beacon of safety amid wildfire threats, involves understanding wildfire assessments. Factors influencing fireline scores include vegetation and terrain. Comparing fireline scores through insurers or vendors reveals the importance of wildfire preparedness and risk understanding.

What Is a Wildfire Risk Score?

A wildfire risk score evaluates potential fire hazards using risk assessment tools, environmental impact factors, and scoring systems explained to guide wildfire prevention strategies. It aids in community preparedness plans by analyzing vegetation, slope, and other fire-spreading elements.

What Is a Fireline Score of 6?

A Fireline score of 6 signifies high wildfire risk, influenced by score impact factors like vegetation and terrain. Score interpretation methods compare this to lower scores, suggesting challenges in insurance and necessitating score improvement strategies, such as mitigation measures.

Final Thoughts

To sum up, the Fireline Wildfire Risk Score functions like a vigilant sentinel, constantly evaluating the dynamic interplay of vegetation, terrain, and access routes to gauge wildfire threats. This analytical tool is indispensable for property owners and insurance providers, guiding them in implementing strategic, data-driven wildfire preparedness and mitigation plans. As technology advances, the precision of risk evaluations will improve, further safeguarding communities from the escalating menace of wildfires by facilitating informed, proactive decision-making.

For homeowners dealing with wildfire-related property damage covered by their homeowners insurance policy, insurance industry professionals and legal experts strongly advise consulting a qualified state-licensed public adjuster. These professionals work exclusively for policyholders, not insurance companies, serving as dedicated advocates throughout the claims process. Public adjusters are state-licensed experts who help navigate complex insurance policies, identify hidden damages often unknown to policyholders, meticulously document losses, and negotiate with insurance companies to ensure fair settlements while protecting policyholder rights.

Engaging a public adjuster can substantially benefit homeowners by maximizing claim settlements, expediting the claims process, and reducing the stress of dealing with insurance companies, allowing policyholders to focus on recovery. For those seeking expert guidance on property damage or loss claims, a no-obligation free consultation is available with a Public Claims Adjusters Network (PCAN) member public adjuster through our contact page.