Work With Trusted & Experienced

Public Adjusters In Tacoma, Washington That Work For YOU!

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

*Not All Services Available In All Areas.

Don't Settle For Less!

Get The HIGHEST & Most FAIR Settlement Amount, That You Are Legally Entitled To, From Your Insurance Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with highly trained & verified Tacoma public adjusters who are state-licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small!

Public Claims Adjusters Network (PCAN) member public claims adjusters in Tacoma, Washington offer technical and detailed expertise that has satisfied countless homeowners, business owners, condominium associations, property management companies, and HOAs.

Our network members have years of experience dealing with insurance companies. Many of our network’s public adjusters also have previous backgrounds in construction and/or insurance, giving them a significant advantage in quickly securing the highest claim settlement compensation for their clients.

They know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Consultations are always:

- Friendly

- Free

- No-Obligation

- 100% contingency-based In Nearly Every State

… meaning your public adjuster doesn’t get paid, unless you get paid!*

PCAN public adjusters take pride in providing superior customer service, and clear & friendly communication. Please fill out our contact form to schedule a no-obligation consultation with one of our network’s licensed & verified Washington public claims adjusters today!

*Some Services Not Available In All Areas. Contingency Fee Not Permitted By Law In Lousianna. By law, services in Kansas are only available for commercial claims.

Request Your No-Obligation Consultation With a PCAN-Verified Member Public Adjuster Today!

- Required Fields

*Some Services May Not Be Available In All Areas. Public Claims Adjusters Network (PCAN) is not a Public Adjusting Agency. PCAN is a private network of stringently vetted, state-licensed, bonded, and PCAN Verified Public Adjusters with members Nationwide. Your contact request will be matched to one of our verified member public adjusters serving the Tacoma community, to ensure the highest quality of service & care.

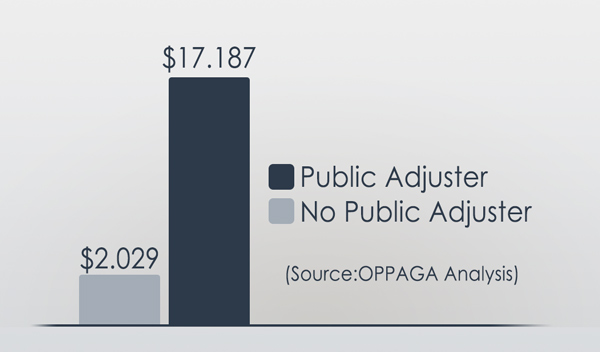

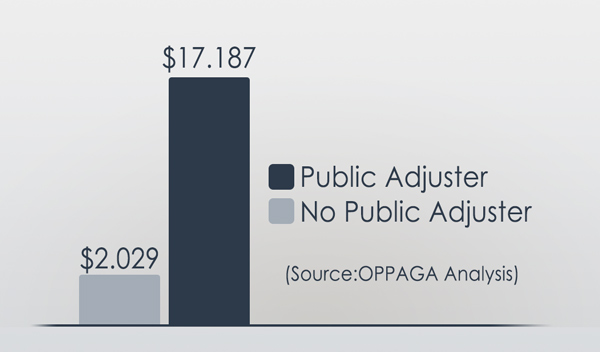

Higher Claim Payouts When Using A Public Adjuster According To Landmark OPPAGA Study!

Contingency Based. We don’t get paid, unless you get paid!

*Contingency fees not permitted by law in Louisiana.

Why Hire A Public Adjuster In Tacoma Washington?

Tacoma Public Adjusters Help Get You The HIGHEST & Most Fair Settlement Amount (That You Are Legally Entitled To) From Your Homeowners, Roofing, Condo & HOA, & Business Insurance Claims!

Get a Free On-Site Inspection & Insurance Policy Evaluation From One Of Our Expert public adjusters Members Today!

- Save You Time & Help Speed Up The Claim Process

- Help Alleviate Stress & Walk You Through The Whole Process

- Negotiate With The Insurance Company & Make Sure You Get The Highest Settlement Possible*

- Prepare & File All The Necessary Documents, And Handle All The Necessary Follow-up's

*Some Services Not Available In All Areas.

What Our Network Of Licensed Tacoma Public Insurance Adjusters Bring To The Table

Insurance Policy & Claims Specialists For Tacoma Residents

PCAN member public claims adjusters have years of experience in claims & reviewing coverages. As such, they understand the numerous types of policies and endorsements you may experience when dealing with your claim in Tacoma, Washington. Their expertise allows them to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocates For Homeowners, Businesses, & HOA's In Tacoma, Washington

PCAN member public claims adjusters advocate for your rights as the policy holder. They ensure that the clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Public adjusters are there with you every step of the way!

Experts In Seen & Unseen Damages For Tacoma Homeowners Insurance Claims

PCAN member public insurance adjusters in Tacoma, Washington have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, they are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! They also incorporate the latest assessment techniques & technology when conducting their property inspections.

Expert Tacoma Damage Claim Negotiators

Settlement negotiation is critically important when it comes to the claims process. Public adjusters in Tacoma, Washington know how the insurance companies think, and come to the negotiation table fully prepared to defend & enforce your rights. PCAN member public insurance adjusters have the expertise and experience in claims negotiations to ensure that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, your public adjuster won't be afraid to get in that ring and fight them for what's rightfully yours!

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Frequently Asked Questions (FAQ) About Tacoma Washington Public Adjusting

What Is A Public Claims Adjuster In Tacoma & What Do They Do?

Tacoma Public adjusters are licensed insurance professionals who work on their own to advocate for policy holders throughout the insurance claims process. According to the National Association of Public Insurance Adjusters (NAPIA) the experts act as advocates for homeowners and ensure their rights are secured when working with insurance companies..

The role of public adjusters has become increasingly important over the last few years, particularly because insurance claims are becoming more complex. A landmark study by the Office of Program Policy Analysis and Government Accountability (OPPAGA) found that policyholders who used public adjusters received settlements up to 800% higher than those who handled claims independently.

Public adjusters provide comprehensive services throughout the claims process. They conduct detailed damage assessments, and prepare and file necessary documentation, and manage all communication with insurance companies. This type of support from licensed professionals, significantly reduces the stress and time associated with filing claims and allows policyholders to concentrate on recovering.

Operating mostly on a basis of contingency fees that typically range from 10% to 20% of the final settlement, public adjusters are rewarded for securing the highest possible amount of settlement for their clients. The fee structure varies based on claim complexity as well as state regulations and the resources required.

They have vast expertise of insurance policies, as well as building codes, as well as construction costs. They use this knowledge to:

- Speed up the claims process

- Document and assess the extent of damages

- Navigate complex policy language

- Directly negotiate with insurance companies

- Make sure you are in compliance with filing deadlines and additional policy requirements

Research has clearly shown that professional representation during the claim process typically results in more comprehensive settlements as well as quicker resolution of claims. Public adjusters’ understanding of insurance regulations and industry practices helps prevent common mistakes that could delay or diminish claim settlements.

Related Story: Are Public Claims Adjusters Worth It?

Disclaimer: *Some Services Not Available In All Areas. Contingency fees not allowed in Louisiana.

Will My Settlement Be Larger If I Hire A Tacoma Public Adjusting Company?

Industry research and industry analysis have shown the hiring of a public insurance adjuster can significantly increase policyholder claim settlements. According to groundbreaking study by the Office of Program Policy Analysis and Government Accountability (OPPAGA), policyholders who employed public adjusters received settlements that were up to 800% more than those who handled claims independently.

Public adjusters in Tacoma, Washington serve as licensed professionals who exclusively represent policyholders throughout the claim process. The National Association of Public Insurance Adjusters (NAPIA) reports that these state-licensed professionals offer detailed claims management services, including precise documents for property damage, policy interpretation, and settlement negotiations with insurance carriers.

The value of representation by a professional is particularly evident in final settlement figures, as professionally managed claims generally produce more detailed damage estimates, and more accurate valuations of losses.

Public adjusters streamline the claims process by:

- Handling all documentation and correspondence with insurance companies

- Conducting thorough assessment of the damage to property

- Preparing comprehensive claim submissions

- Directly negotiating with insurance carriers

- Expediting the settlement timeline

- Ensures compliance with policy guidelines and deadlines

Most public adjusters operate on a contingency fee basis, typically ranging from 10% to 20% of the final settlement amount. The fee structure is aligned with the adjuster’s interests with the interests of the policyholder, since their compensation is contingent on securing a favorable settlement.

A Public adjuster’s expertise often is invaluable in complicated claims situations, where the knowledge of building codes, construction costs, and insurance policy provisions can have a major impact on settlement outcomes.

Their professional oversight helps ensure no damaged claims are missed and claims are properly assessed in accordance with current market conditions.

Related Story: When Should I Retain A Public Adjuster?

Disclaimer: *Some Services Not Available In All Areas. Contingency fees are not accepted in Louisiana.

How Much Do Tacoma Public Adjusters Near Me Charge?

Public adjusters typically operate on a contingency fee basis, charging between 10% to 20% of the final insurance claim settlement. According to the National Association of Public Insurance Adjusters (NAPIA), these fees vary based on claim complexity, state regulations, and required resources. The contingency fee structure ensures that public adjusters’ interests align directly with those of their clients, as their compensation depends on securing favorable settlements.

Before engagement, policyholders should carefully review fee arrangements and contract terms, ensuring clear understanding of the service agreement. According to the Insurance Information Institute (III), public adjusters must maintain state licenses and adhere to strict professional standards, providing an additional layer of consumer protection. Their role becomes particularly valuable in complex claims where specialized knowledge can significantly impact settlement outcomes.

A landmark study by the Office of Program Policy Analysis and Government Accountability (OPPAGA) demonstrated that policyholders who engaged public adjusters received settlements up to 800% higher than those who handled claims independently. This significant difference underscores the value these professionals bring to the claims process.

Related Story:How Does A Public Claims Adjuster Work?

Disclaimer: *Some Services Not Available In All Areas. Contingency fees are not permitted in Louisiana.

When Should You Hire A Public Claims Adjuster In Tacoma, Washington?

Complex insurance claims often require expert knowledge to effectively navigate. Public insurance adjusters, state-licensed professionals who only work for policyholders, can significantly impact the outcome of claims and settlement amount.

Several scenarios need a public adjuster:

- Extensive property damage

- Claims involving multiple types of coverage

- Disputed claims or partial claim denials

- Complex requirements for documentation

- Time-sensitive situations requiring immediate attention

Public adjusters streamline the claims process by:

- Conducting extensive damage assessments

- Preparing and filing the necessary documentation

- Managing communication with insurance companies

- Negotiating settlements on behalf of policyholders

- Ensure compliance with policy conditions and deadlines

Public adjusters particularly benefit policyholders because of:

- Stress reduction through expert claim management

- Expediting settlement processes

- Offering objective damage assessments

- Ensuring comprehensive documentation

- Leveraging industry knowledge for fair settlements

Related Story:Are Public Insurance Claims Adjusters Legit?

Disclaimer: *Some Services Not Available In All Areas. Contingency fees not allowed in Louisiana.

When Is It Too Late To Hire A Public Adjuster Near Me In Tacoma?

Navigating the insurance claims process requires careful timing and professional expertise. Understanding when to engage a Washington public adjuster can significantly impact claim outcomes and settlement amounts. According to the National Association of Public Insurance Adjusters (NAPIA), policyholders can benefit from hiring a public adjuster at any point during an active claim, though earlier engagement typically yields better results.

Key timing considerations include:

Statute of Limitations:

- Each state maintains different deadlines for filing insurance claims

- Claims must be initiated within these legal timeframes

- Public adjusters can assist with existing claims, even if initially filed independently

Documentation Requirements:

- Public adjusters help organize and prepare comprehensive claim documentation

- They can recover or reconstruct missing documentation

- Professional documentation improves claim validity and settlement potential

Claim Status:

- Active claims benefit from professional representation

- Denied claims may be reopened with proper documentation

- Disputed settlements can be renegotiated

Public adjusters provide valuable services throughout the claims process Including:

- Expedited claim processing through professional management

- Expert negotiation with insurance carriers

- Complete documentation preparation and submission

- Regular communication with insurance companies

- Stress reduction through professional claim handling

- Maximum settlement potential through experienced representation

Related Story:Common Public Adjuster Pitfalls & How To Avoid Them

Disclaimer: *Some Services Not Available In All Areas. Contingency fees not allowed in Louisiana.

Why hire a Public Adjuster In Tacoma if your insurance company already sent an adjuster?

The decision to employ a state-licensed public insurance claims adjuster, even if an insurance company has appointed its own adjuster, can dramatically affect the final outcome of an insurance claim.

Although insurance company adjusters work for the insurance company’s interests … public insurance claims adjusters In Tacoma, Washington serve as dedicated advocates for policyholders. The National Association of Public Insurance Adjusters (NAPIA) highlights that these state-licensed & regulated professionals operate independently to ensure fair settlements of claims and complete policy interpretation.

Public adjusters streamline the claims process by coordinating documentation as well as conducting thorough evaluations of damage and coordinating all communications with insurance companies. This professional intervention typically accelerates claim resolution and reduces homeowners’ administrative burdens.

The benefit of public adjusters isn’t only limited to monetary benefits. They offer expert advice throughout the claims process, explaining complicated policy terms and making sure that all damage is properly documented and assessed.

They make detailed damage estimates, gather necessary evidence, and negotiate directly with insurance carriers in order to get the best settlement results.

Insurance claims are complicated and time-consuming which makes professional representation valuable during significant loss events. Public adjusters’ expertise in negotiation and interpretation of policies often results in more extensive settlements that cover the obvious as well as concealed damages.

Disclaimer: *Some Services Not Available In All Areas. Contingency fees are not permitted in Louisiana.

Related Story:How Do Public Claims Adjusters Get Paid & Who Pays Them?

Disclaimer: *Some Services Not Available In All Areas. Contingency fees not allowed in Louisiana.

Can I File My Insurance Claim Myself In Tacoma, Washington?

While policyholders are entitled to file insurance claims independently, research from industry experts suggests this approach may not yield ideal results.

Key challenges of self-filing include:

- Complex documentation requirements and policy interpretation

- Time-intensive communication with insurance representatives

- Risk of overlooking covered damages or benefits

- Potential undervaluation of claims by insurance companies

- Limited-to-zero negotiation experience with insurers

licensed public adjusters provide significant advantages in the claims process:

-

- Professional Documentation and Assessment – Public adjusters thoroughly document damages, prepare comprehensive claims files, and manage all necessary paperwork, making sure that nothing is missed.

- Time and Stress Management – These professionals manage all communications with insurance companies so that homeowners can focus on recovering while speeding up the process of submitting claims.

- Expert Negotiation – With extensive knowledge of the insurance policies and rules, public adjusters negotiate directly with insurance companies to negotiate fair settlements.

- Cost-Effective Service – Public adjusters typically work on a contingency-fee basis, typically ranging between 10-20% of the final settlement amount, to ensure alignment with the policyholder’s interests.

The National Association of State Insurance Commissioners (NAIC) recognizes public adjusters as licensed professionals who represent the interests of policyholders throughout the process of settling claims. Their expertise can be beneficial in complicated claims or when significant damages are involved.

Industry statistics consistently show that professional expert representation by state-licensed public insurance adjusters leads to better outcomes for policy holders, with quicker processing, and more complete settlement packages.

Related Story:How Much Do Public Insurance Adjusters Cost

Disclaimer: *Some Services Not Available In All Areas. Contingency fees are not accepted in Louisiana.

In Tacoma, Can My Contractor Represent Me Against My Insurance Company?

Although contractors frequently offer negotiations with insurers this strategy can have serious risks and restrictions. According to the National Association of Insurance Commissioners (NAIC), contractors lack the legal authority and know-how to be official representatives for insurance claims negotiations.

This restriction could dramatically affect the result of a case and could compromise the rights of the insurance company.

State insurance departments oversee licensed public adjusters, who undergo highly specialized training, have to pass Federal background checks, and require specialized licenses from the state to operate. They also have the legal authority to act on behalf of the policyholder to protect & protect their right … legal authority that contractors don’t possess … thus they are the legal alternative to the representation of contractors.

Public Adjusters specialize in interpreting insurance policies, assessing and documenting damage, and negotiating with insurance companies to guarantee fair settlements.

Public adjusters provide several distinct advantages, which include:

- Expert claim documentation and filing

- Professional negotiation with insurance carriers

- Comprehensive damage assessment

- Accelerated claim processing

- Stress reduction through complete claim management

The National Association of Public Insurance Adjusters (NAPIA) insists on the fact that public adjusters must maintain professional licenses and adhere to strict ethical standards. This provides an additional layer of consumer protection that is not offered by contractor representation.

For more complex claims for complex claims, for more complex claims, public adjusters are experts in the interpretation of policies, documentation specifications and negotiation strategies frequently is invaluable, and can help avoid costly errors and denials of claims that might occur with contractor-led negotiations.

Related Story:When Is It Too Late To Retain A Public Claims Adjuster?

Disclaimer: *Some Services Not Available In All Areas. Contingency fees not allowed in Louisiana.

I Already Settled My Claim, But It Wasn’t Enough Money To Cover The Damages. Is It Too Late To Try To Get More Money?

When insurance settlements fail to cover property damages, the policyholder has a variety of legal options to seek additional compensation, even after the initial settlement of claim.

According to the National Association of Insurance Commissioners (NAIC), policyholders should be sure to carefully review their settlement terms and related documents prior to accepting the final settlement.

The timing and circumstances for the pursuit of additional compensation are important elements, as the majority of insurance policies include specific timeframes for claim disputes as well as appeals, typically ranging from one to two years after settlement date.

Licensed public insurance adjusters are essential in re-evaluating settled claims and finding overlooked damages. Public adjusters conduct thorough assessments of property damages, as well as document any additional damage, and deal with insurance companies on behalf of policyholders.

The most important steps to pursue additional compensation include:

- Document newly discovered damages

- Review the policy terms and settlement agreements

- Collect additional evidence and estimations

- Request professional representation from a state-licensed public adjusters

The National Association of Public Insurance Adjusters (NAPIA) insists that public adjusters are often able to spot overlooked damages and policy provisions that support an additional amount of compensation. Their experience in policy interpretation and the valuation of claims is especially valuable when challenging settled claims.

Insurance policyholders must act promptly when they discover insufficient settlement amounts, as delay could hinder their ability to recover additional compensation. When utilizing a PCAN member Public Insurance Adjuster, the claim review and negotiation process typically progresses more efficiently than policyholder-directed efforts.

Disclaimer: *Some Services Not Available In All Areas. The use of contingency fees is not permitted in Louisiana.

Can My Insurance Company Cancel My Contract If I Use a Public Adjuster In Tacoma, Washington?

No. Insurance companies cannot legally cancel policies solely because policyholders hire public adjusters to represent their interests during the claims process, according to the National Association of Insurance Commissioners (NAIC). Policy cancellations are strictly governed by contractual terms and state regulations, typically limited to specific circumstances such as non-payment of premiums or material misrepresentation.

The National Association of Public Insurance Adjusters (NAPIA) emphasizes that hiring a licensed public insurance claims adjusters is a protected right of policyholders. These professionals serve as advocates during insurance claims, handling documentation, negotiations, and communications with insurance carriers to expedite settlements.

The Insurance Information Institute (III) confirms that policyholders maintain the right to professional representation during claims processes, and insurers must honor this right while adhering to fair claims handling practices.

Related:Public Claims Adjusting Guides

Disclaimer: *Some Services Not Available In All Areas. Contingency fees are not accepted in Louisiana.

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

The Homeowners Insurance Claims Recovery Process In Tacoma, Washington

Washington state-licensed public insurance claims adjusters are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while they fight to make sure you get the highest & most fair compensation possible for your claim!

View 7-Step Claims Recovery Process Map

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact A PCAN Public Adjuster In Tacoma, Washington

Contact one of the PCAN verified and state-licensed public claims adjusters to schedule an appointment for them to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

Your public insurance adjuster will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

Your public adjuster will discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

Public Adjuster Takes Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once you have agreed on a strategy, your public claims adjuster will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Your public claims adjuster will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

Your public insurance claims adjuster will negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

(Click To Expand Infographic)

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Explore How Tacoma Public Claims Adjusters Can Help You Maximize Settlements From These Kinds Of Homeowners Insurance Claims

- Water Damage Claims Adjusters

- Hurricane Damage Insurance Claims

- Flood Damage Claims

- Hail Damage Insurance Claims Public Adjusters

- Sewer Line Property Damage Insurance Claims Adjusters

- Flooded Basement Damage Insurance Claims Adjusters

- Sinkhole Damage Insurance Claims

- Slab Leak Damage Claims Adjusters

- Foundation Claims Public Adjusters

- Water Line & Pipe Damage Claims Public Adjusters

- Fire Property Damage Insurance Claims Public Adjusters

- Wildfire Property Damage Insurance Claims Adjusters

- Denied Homeowners Damage Claims Adjusters

- Underpaid Homeowners Property Damage Insurance Claims

- New Claims

- Commercial Damage Insurance Claims Public Adjusters

- Homeowners Association (HOA) Property Damage Insurance Claims Adjusters

- Condo Association Property Damage Insurance Claims

- Theft Claims Public Adjusters

- Vandalism Damage Insurance Claims Adjusters

- Roofing Damage Claims Public Adjusters

- Storm & Wind Property Damage Insurance Claims Public Adjusters

- Tornado Property Damage Claims

- Property Claims Public Adjusters

- Personal Property Damage Claims Adjusters

- Earthquake Damage Insurance Claims Public Adjusters

- Structural Damage Insurance Claims Public Adjusters

- Lightning Damage Claims Adjusters

- Mold Property Damage Insurance Claims

- Business Interruption Property Damage Claims Adjusters

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Read The Latest Articles Related To Your Specific Claim

- Featured

- Adjusting

- Basement

- Black Mold

- Business Interruption

- CA

- Ceiling Damage

- Commercial Property Damage

- Condo Association

- Contractors

- Denied Insurance Claims

- Earthquake Damage

- Fire Damage

- Flood Damage

- Foundation Damage

- Hail

- Hail Damage

- Homeowners Association

- Homeowners Insurance

- Hurricane

- Hurricane Damage

- Inspections

- Installation

- Insurance

- Insurance FAQ

- Lightning

- Mitigation

- Mold Damage

- New Claims

- Personal Property Damage

- Property Damage

- Public Adjusting Guides

- Remediation

- Repairs

- Replacement

- Roof Damage

- Roof Leaks

- Sewer Lines

- Sinkhole Damage

- Slab Leak

- Solar Panels

- Storm Damage

- Storms

- Structural Damage

- terms

- Theft

- Tornado

- Tornado Damage

- TX

- Underpaid Insurance Claims

- Vandalism

- Water Damage

- Water Lines And Pipes

- Wildfire Damage

- Wind

- Wind

- Featured

- Adjusting

- Basement

- Black Mold

- Business Interruption

- CA

- Ceiling Damage

- Commercial Property Damage

- Condo Association

- Contractors

- Denied Insurance Claims

- Earthquake Damage

- Fire Damage

- Flood Damage

- Foundation Damage

- Hail

- Hail Damage

- Homeowners Association

- Homeowners Insurance

- Hurricane

- Hurricane Damage

- Inspections

- Installation

- Insurance

- Insurance FAQ

- Lightning

- Mitigation

- Mold Damage

- New Claims

- Personal Property Damage

- Property Damage

- Public Adjusting Guides

- Remediation

- Repairs

- Replacement

- Roof Damage

- Roof Leaks

- Sewer Lines

- Sinkhole Damage

- Slab Leak

- Solar Panels

- Storm Damage

- Storms

- Structural Damage

- terms

- Theft

- Tornado

- Tornado Damage

- TX

- Underpaid Insurance Claims

- Vandalism

- Water Damage

- Water Lines And Pipes

- Wildfire Damage

- Wind

- Wind

A glossary of insurance terms provides insight to policyholders of critical terms and definitions commonly used to clarify various aspects of coverage and claims.

Key concepts include such terms as Actual Cash Value (ACV), a method for determining compensation based on replacement costs minus recoverable depreciation, and ALE Coverage, which cover necessary living costs when a home is uninhabitable.

For example, understanding your homeowners insurance policy declaration page, common homeowners insurance claim deductibles for various kinds of home damage, the general policy exclusions standard in many home insurance policies, can bring much-needed awareness & clarity to policyholders of potential basic insurance terms that may affect their claim outcomes. For example, knowing which key documents (such as photographs and receipts) are essential for substantiating claims.

Related Articles:

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Find PCAN Public Adjusters In These Surrounding Cities:

View Additional Cities Around Tacoma That We Serve

- Public Claims Adjusters Federal Way, Washington

- Public Claims Adjusters Auburn, Washington

- Public Claims Adjusters South Hill, Washington

- Public Claims Adjusters Kent, Washington

- Public Claims Adjusters Burien, Washington

- Public Claims Adjusters Renton, Washington

- Public Claims Adjusters Seattle, Washington

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

More About Tacoma, Washington

Tacoma | |

|---|---|

Aerial view of Downtown Tacoma with Mount Rainier in the background | |

| Nickname(s): City of Destiny, Grit City | |

Location of Tacoma in Pierce County and Washington state | |

| Coordinates: 47°14′45″N 122°27′34″W / 47.24583°N 122.45944°W / 47.24583; -122.45944 | |

| Country | United States |

| State | Washington |

| County | Pierce |

| Adopted | 1868 |

| Founded | 1872 |

| Incorporated | November 12, 1875 |

| Named for | Tahoma |

| Government | |

| • Type | Council–manager |

| • Mayor | Victoria Woodards |

| Area | |

• City | 62.42 sq mi (161.68 km) |

| • Land | 49.71 sq mi (128.76 km) |

| • Water | 12.71 sq mi (32.92 km) |

| Elevation | 387 ft (118 m) |

| Population (2020) | |

• City | 219,346 |

• Estimate (2023) | 222,906 |

| • Rank | US: 105th WA: 3rd |

| • Density | 4,412.51/sq mi (1,703.53/km) |

| • Urban | 3,544,011 (Seattle urban area) (US: 13rd) |

| • Metro | 4,034,248 (Seattle metropolitan area) (US: 15th) |

| Demonym | Tacoman (plural: Tacomans) |

| Time zone | UTC–8 (Pacific (PST)) |

| • Summer (DST) | UTC–7 (PDT) |

| ZIP codes | Zip codes

|

| Area code | 253 |

| FIPS code | 53-70000 |

| GNIS feature ID | 2412025 |

| Website | cityoftacoma |

Tacoma ( tə-KOH-mə) is the county seat of Pierce County, Washington, United States. A port city, it is situated along Washington’s Puget Sound, 32 miles (51 km) southwest of Seattle, 36 miles (58 km) southwest of Bellevue, 31 miles (50 km) northeast of the state capital, Olympia, 58 miles (93 km) northwest of Mount Rainier National Park, and 80 miles (130 km) east of Olympic National Park. The city’s population was 219,346 at the time of the 2020 census. Tacoma is the second-largest city in the Puget Sound area and the third-most populous in the state. Tacoma also serves as the center of business activity for the South Sound region, which has a population of about 1 million.

Tacoma adopted its name after the nearby Mount Rainier, called təˡqʷuʔbəʔ in the Puget Sound Salish dialect, and “Takhoma” in an anglicized version. It is locally known as the “City of Destiny” because the area was chosen to be the western terminus of the Northern Pacific Railroad in the late 19th century. The decision of the railroad was influenced by Tacoma’s neighboring deep-water harbor, Commencement Bay. By connecting the bay with the railroad, Tacoma’s motto became “When rails meet sails”. Commencement Bay serves the Port of Tacoma, a center of international trade on the Pacific Coast and Washington’s largest port. The city gained notoriety in 1940 for the collapse of the Tacoma Narrows Bridge, which earned the nickname “Galloping Gertie” due to the vertical movement of the deck during windy conditions.

Like most industrial cities, Tacoma suffered a prolonged decline in the mid-20th century as a result of suburbanization and divestment. Since the 1990s, downtown Tacoma has experienced a period of revitalization. Developments in the downtown include the University of Washington Tacoma; the T Line (formerly Tacoma Link), the first modern electric light rail service in the state; the state’s highest density of art and history museums; and a restored urban waterfront, the Thea Foss Waterway.

SourceOur Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.