Work With Trusted & Experienced

Public Adjusters In Midlothian, Virginia That Work For YOU!

100% Contingency Based. We Don't Get Paid Unless YOU Get Paid!

*Not All Services Available In All Areas.

Don't Settle For Less!

Get The HIGHEST & Most FAIR Settlement Amount, That You Are Legally Entitled To, From Your Insurance Claim!

Get a free on-site inspection & insurance policy evaluation from one of our expert public claims adjusters!

Work with highly trained & verified Midlothian public adjusters who are state-licensed, bonded, and trained to handle all residential or commercial insurance claims, big or small!

Public Claims Adjusters Network (PCAN) member public claims adjusters in Midlothian, Virginia offer technical and detailed expertise that has satisfied countless homeowners, business owners, condominium associations, property management companies, and HOAs.

Our network members have years of experience dealing with insurance companies. Many of our network’s public adjusters also have previous backgrounds in construction and/or insurance, giving them a significant advantage in quickly securing the highest claim settlement compensation for their clients.

They know what to look for, what repairs actually cost, and what the insurance company’s adjusters tend to ignore (and hope you don’t know about!).

Consultations are always:

- Friendly

- Free

- No-Obligation

- 100% contingency-based In Nearly Every State

… meaning your public adjuster doesn’t get paid, unless you get paid!*

PCAN public adjusters take pride in providing superior customer service, and clear & friendly communication. Please fill out our contact form to schedule a no-obligation consultation with one of our network’s licensed & verified Virginia public adjusters today!

*Some Services Not Available In All Areas. Contingency Fee Not Permitted By Law In Lousianna. By law, services in Kansas are only available for commercial claims.

Request Your No-Obligation Consultation With a PCAN-Verified Member Public Adjuster Today!

- Required Fields

*Some Services May Not Be Available In All Areas. Public Claims Adjusters Network (PCAN) is not a Public Adjusting Agency. PCAN is a private network of stringently vetted, state-licensed, bonded, and PCAN Verified Public Adjusters with members Nationwide. Your contact request will be matched to one of our verified member public adjusters serving the Midlothian community, to ensure the highest quality of service & care.

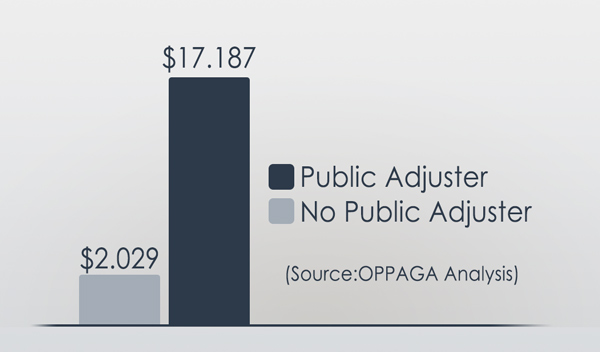

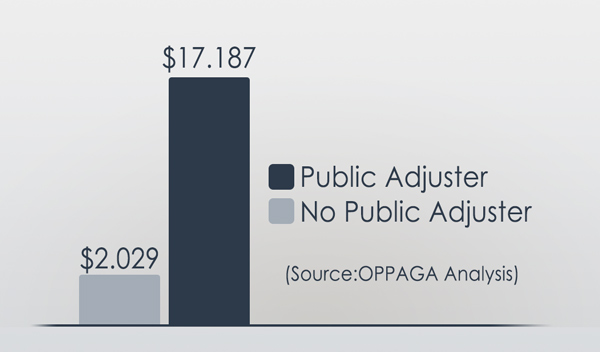

Higher Claim Payouts When Using A Public Adjuster According To Landmark OPPAGA Study!

Contingency Based. We don’t get paid, unless you get paid!

*Contingency fees not permitted by law in Louisiana.

Why Hire A Public Claims Adjuster In Midlothian Virginia?

Midlothian Public Adjusters Help Get You The HIGHEST & Most Fair Settlement Amount (That You Are Legally Entitled To) From Your Homeowners, Roofing, Condo & HOA, & Business Insurance Claims!

Get a Free On-Site Inspection & Insurance Policy Evaluation From One Of Our Expert public insurance adjusters Members Today!

- Save You Time & Help Speed Up The Claim Process

- Help Alleviate Stress & Walk You Through The Whole Process

- Negotiate With The Insurance Company & Make Sure You Get The Highest Settlement Possible*

- Prepare & File All The Necessary Documents, And Handle All The Necessary Follow-up's

*Some Services Not Available In All Areas.

What Our Network Of Licensed Midlothian Public Insurance Adjusters Bring To The Table

Insurance Policy & Claims Specialists For Midlothian Residents

PCAN member public adjusters have years of experience in claims & reviewing coverages. As such, they understand the numerous types of policies and endorsements you may experience when dealing with your claim in Midlothian, Virginia. Their expertise allows them to find & utalize the various coverages your policy may have, and in many cases, inform you of coverage & clauses you may not even know about.

Advocates For Homeowners, Businesses, & HOA's In Midlothian, Virginia

PCAN member public insurance adjusters advocate for your rights as the policy holder. They ensure that the clients’ rights are being protected throughout the claims process, and make sure you get all the benefits you are entitled to based on your policy. Public adjusters are there with you every step of the way!

Experts In Seen & Unseen Damages For Midlothian Homeowners Insurance Claims

PCAN member public insurance claims adjusters in Midlothian, Virginia have years of experience identifying damage, and in most cases, come from professional construction, roofing, and insurance backgrounds. As such, they are able to find & isolate damages that you may not even know to look for, or know would/should be covered by your policy! They also incorporate the latest assessment techniques & technology when conducting their property inspections.

Expert Midlothian Damage Claim Negotiators

Settlement negotiation is critically important when it comes to the claims process. Public adjusters in Midlothian, Virginia know how the insurance companies think, and come to the negotiation table fully prepared to defend & enforce your rights. PCAN member public adjusters have the expertise and experience in claims negotiations to ensure that you get what you are actually entitled to under your policy ... not what the insurance company tells you that you are, based on their own interests. When the insurance company plays hardball or puts up a fight, your public adjuster won't be afraid to get in that ring and fight them for what's rightfully yours!

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Frequently Asked Questions (FAQ) About Midlothian Virginia Public Adjusting

What Is A Public Claims Adjuster In Midlothian & What Do They Do?

Midlothian Public adjusters are licensed insurance professionals who independently represent policyholders in the insurance claims process. According to the National Association of Public Insurance Adjusters (NAPIA) they are professionals act as advocates for property owners to ensure that their interests are protected in dealing with insurance companies..

The role of public adjusters has become increasingly important in recent years, especially because insurance claims are becoming more complicated. A landmark study by the Office of Program Policy Analysis and Government Accountability (OPPAGA) revealed that policyholders who utilized public adjusters received settlements that were up to 800% more than those who handled claims themselves.

Public adjusters provide comprehensive services throughout the claim process. They conduct thorough assessments of the damages, and prepare and file all necessary documentation, and manage all communication with insurance companies. This professional support significantly reduces the time and stress associated with filing claims and allows policyholders owners to focus on recovery.

Operating primarily on a basis of contingency fees which typically range from 10% to 20% of the final settlement, public adjusters are incentivized to secure the most compensation for their clients. The fee structure is according to the complexity of the claim, state regulations, and the resources required.

These professionals have extensive understanding of insurance policies, and building codes, and construction costs. They leverage this expertise to:

- Accelerate the claims process

- Document and evaluate the damages thoroughly

- Navigate complex policies

- Negotiate directly with insurance carriers

- Ensure compliance with deadlines for filing and other policy requirements

Research has clearly shown that professional representation during the claim process typically results in more comprehensive settlements and quicker claim resolution times. Public adjusters’ understanding of insurance regulations and industry practices helps prevent common pitfalls that could otherwise hinder or delay settlements.

Related Story: Are Public Adjusters Worth It?

Disclaimer: *Some Services Not Available In All Areas. Contingency fees not allowed in Louisiana.

Will My Settlement Be Larger If I Hire A Midlothian Public Adjusting Company?

Industry research and industry analysis show the hiring of a public insurance adjuster can substantially increase policyholder settlements for claims. According to groundbreaking study by the Office of Program Policy Analysis and Government Accountability (OPPAGA), policyholders who utilized public adjusters received settlements up to 800% more that those who managed claims independently.

Public adjusters in Midlothian, Virginia serve as licensed professionals who exclusively represent policyholders throughout the claim process. The National Association of Public Insurance Adjusters (NAPIA) states that these state-licensed professionals provide detailed claims management services, which include detailed documents for property damage as well as policy interpretation as well as settlement negotiations with insurance companies.

The importance of a professional representation becomes particularly evident in the final settlement figures, as professionally managed claims generally result in more thorough damage assessments and more accurate estimates of losses.

Public adjusters streamline the claims process by:

- Handling all correspondence and documentation with insurance companies

- Conducting thorough assessments of property damage

- Preparing comprehensive claim submissions

- Negotiating directly with insurance carriers

- Speeding up the settlement timeline

- Ensures compliance with policy requirements and deadlines

The majority of public adjusters operate on a basis of contingency fees, that typically range from 10% to 20% of the final settlement amount. This fee structure aligns the adjuster’s interests with those of the policyholder, as their compensation is contingent upon securing a favorable settlement.

A Public adjuster’s expertise often proves valuable in difficult claims scenarios, where technical knowledge of building codes, construction costs, & insurance policy provisions can have a significant impact on settlement outcomes.

Their expert oversight ensure that no damaged claims are missed and claims are appropriately valued in accordance with current market conditions.

Related Story: When Should I Consult With A Public Adjuster?

Disclaimer: *Some Services Not Available In All Areas. Contingency fees are not accepted in Louisiana.

How Much Do Midlothian Public Adjusters Near Me Charge?

Public adjusters typically operate on a contingency fee basis, charging between 10% to 20% of the final insurance claim settlement. According to the National Association of Public Insurance Adjusters (NAPIA), these fees vary based on claim complexity, state regulations, and required resources. The contingency fee structure ensures that public adjusters’ interests align directly with those of their clients, as their compensation depends on securing favorable settlements.

Before engagement, policyholders should carefully review fee arrangements and contract terms, ensuring clear understanding of the service agreement. According to the Insurance Information Institute (III), public adjusters must maintain state licenses and adhere to strict professional standards, providing an additional layer of consumer protection. Their role becomes particularly valuable in complex claims where specialized knowledge can significantly impact settlement outcomes.

A landmark study by the Office of Program Policy Analysis and Government Accountability (OPPAGA) demonstrated that policyholders who engaged public adjusters received settlements up to 800% higher than those who handled claims independently. This significant difference underscores the value these professionals bring to the claims process.

Related Story:How Does A Public Claims Adjuster Work?

Disclaimer: *Some Services Not Available In All Areas. Contingency fees not allowed in Louisiana.

When Should You Hire A Public Claims Adjuster In Midlothian, Virginia?

Complex insurance claims often require expert knowledge to navigate effectively. Public insurance adjusters, state-licensed professionals who work exclusively on behalf of policyholders, can have a significant impact on the outcome of claims and settlement outcomes.

A variety of scenarios could require the use of a public adjuster:

- Property damage that is extensive

- Claims that involve multiple coverage types

- Disputed claims or partial claim denials

- Complex documentation requirements

- Situations that are time-sensitive which require immediate attention

Public adjusters streamline the claims process by:

- Conducting extensive damage assessments

- The preparation and filing of required documentation

- Managing communication with insurance companies

- Settlement negotiations on behalf of the policyholders

- Ensuring compliance with policy terms and deadlines

Public adjusters particularly benefit policyholders through:

- Stress reduction through professional claim management

- Speeding up the settlement process

- Providing objective damage assessments

- Ensuring comprehensive documentation

- Utilizing industry-specific expertise to ensure fair settlements

Related Story:Are Public Insurance Adjusters Legitimate?

Disclaimer: *Some Services Not Available In All Areas. Contingency fees are not accepted in Louisiana.

When Is It Too Late To Hire A Public Adjuster Near Me In Midlothian?

Navigating the insurance claims process requires careful timing and professional expertise. Understanding when to engage a Virginia public adjuster can significantly impact claim outcomes and settlement amounts. According to the National Association of Public Insurance Adjusters (NAPIA), policyholders can benefit from hiring a public adjuster at any point during an active claim, though earlier engagement typically yields better results.

Key timing considerations include:

Statute of Limitations:

- Each state maintains different deadlines for filing insurance claims

- Claims must be initiated within these legal timeframes

- Public adjusters can assist with existing claims, even if initially filed independently

Documentation Requirements:

- Public adjusters help organize and prepare comprehensive claim documentation

- They can recover or reconstruct missing documentation

- Professional documentation improves claim validity and settlement potential

Claim Status:

- Active claims benefit from professional representation

- Denied claims may be reopened with proper documentation

- Disputed settlements can be renegotiated

Public adjusters provide valuable services throughout the claims process Including:

- Expedited claim processing through professional management

- Expert negotiation with insurance carriers

- Complete documentation preparation and submission

- Regular communication with insurance companies

- Stress reduction through professional claim handling

- Maximum settlement potential through experienced representation

Related Story:Common Public Adjuster Pitfalls & How To Avoid Them

Disclaimer: *Some Services Not Available In All Areas. Contingency fees are not permitted in Louisiana.

Why hire a Public Adjuster In Midlothian if your insurance company already sent an adjuster?

The choice to engage a state-licensed public adjuster, even if an insurance company has assigned its own adjuster dramatically affect the outcome of an insurance claim.

While the insurance company adjusters work for the insurance company’s interests … public claims adjusters In Midlothian, Virginia serve as dedicated advocates for policyholders. The National Association of Public Insurance Adjusters (NAPIA) highlights that these state-licensed & regulated adjusters operate independently, ensuring fair settlement of claims and a thorough policies are interpreted.

Public adjusters streamline the claims process by managing the documentation, performing thorough damage assessments, and handling all communication with insurance companies. This professional intervention typically speeds up claim resolution and reduces homeowners administrative burdens.

The importance of public adjusters also extends beyond monetary benefits. They provide expert advice during the claim process, guiding clients through the complexities of policy and ensuring that all damage is properly documented and assessed.

They prepare specific damage estimates, gather necessary evidence, and deal directly with insurance carriers to maximize settlement outcomes.

Insurance claims are complicated and time-consuming, making professional representation crucial during large loss events. Public adjusters’ expertise in policy interpretation and negotiation often results in more comprehensive settlements that cover evident and hidden losses.

Disclaimer: *Some Services Not Available In All Areas. Contingency fees not allowed in Louisiana.

Related Story:How Do Public Adjusters Get Paid & Who Pays Them?

Disclaimer: *Some Services Not Available In All Areas. Contingency fees are not accepted in Louisiana.

Can I File My Insurance Claim Myself In Midlothian, Virginia?

Although policyholders have the right to make insurance claims on their own, research from experts in the industry suggest this method may not produce ideal results.

The main challenges with self-filing include:

- Complex documentation requirements and policy interpretation

- Time-intensive communication with insurance representatives

- Risk of overlooking covered damages or benefits

- Potential undervaluation of claims by insurance companies

- Limited-to-zero negotiation experience with insurers

Licensed public adjusters have important advantages to the process of settling claims:

-

- Professional Documentation and Assessment – Public adjusters thoroughly document damages, and create comprehensive claims files, and manage all necessary paperwork, making sure that nothing is missed.

- Time and Stress Management – These professionals handle all communications with insurance companies so that homeowners can focus on recovery while expediting the process of filing claims.

- Expert Negotiation – With extensive knowledge of the insurance policies and rules, public adjusters deal directly with insurance companies in order to secure fair settlements.

- Cost-Effective Service – Public adjusters typically work on a contingency fee basis, typically ranging between 10-20% of the settlement amount, which ensures alignment with the policyholder’s interests.

The National Association of State Insurance Commissioners (NAIC) recognizes public adjusters as licensed professionals who represent the interests of policyholders throughout the process of settling claims. Their expertise can be particularly beneficial in complex claims or when significant damages are involved.

Statistics from the industry demonstrate that expert representation by state-licensed public insurance claims adjusters leads to better outcomes for policy holders, with faster processing time, and more comprehensive settlement packages.

Related Story:How Much Do Public Claims Adjusters Cost

Disclaimer: *Some Services Not Available In All Areas. Contingency fees are not permitted in Louisiana.

In Midlothian, Can My Contractor Represent Me Against My Insurance Company?

Although contractors frequently offer the opportunity to negotiate with insurers, this approach can present significant limitations and potential risks. According to the National Association of Insurance Commissioners (NAIC), contractors do not have the legal authority and expertise to serve as representative for insurers in claims negotiations.

This limitation could greatly affect the outcomes of a case and may limit the rights of the policyholder.

The state insurance departments oversee licensed public adjusters, who receive extremely specialized training, must pass Federal background checks, and require specialized licensing by the state to operate. They also are legally authorized to act on behalf of the policyholder to safeguard and protect their right … legal authority that contractors do not have … thus they are the legal alternative to the representation of contractors.

Public Adjusters are experts in the interpretation of insurance policies, assessing damages, and negotiating with insurance companies to guarantee fair and equitable claim compensation.

Public adjusters provide several distinct advantages, such as:

- Specialist claim documents and filing

- Professional negotiation with insurance carriers

- Comprehensive damage assessment

- Expedited claim processing

- Reduce stress through total claim management

The National Association of Public Insurance Adjusters (NAPIA) insists on the fact that public insurance claims adjusters need to maintain professional licenses and follow strict ethical standards. This provides another layer of consumer protection not available with contractor representation.

For complex claims for more complex claims, public adjusters have a wealth of knowledge in interpreting policies, document requirements, and negotiation strategies often proves invaluable, potentially preventing costly errors and denials of claims that might occur with negotiation led by contractors.

Related Story:When Is It Too Late To Hire A Public Insurance Claims Adjuster?

Disclaimer: *Some Services Not Available In All Areas. Contingency fees are not permitted in Louisiana.

I Already Settled My Claim, But It Wasn’t Enough Money To Cover The Damages. Is It Too Late To Try To Get More Money?

When insurance settlements fail to cover property damages, the policyholder has a variety of legal options to seek additional compensation, even following the initial claim settlement.

As per the National Association of Insurance Commissioners (NAIC), policyholders should carefully evaluate their settlement terms and related documentation before accepting the final settlement payment.

The timing and circumstances for pursuing additional compensation are critical factors, as most insurance policies contain specific timeframes for claim disputes as well as appeals, typically between one and two years after the settlement date.

Licensed public insurance adjusters are vital in re-assessing settled claims and identifying previously unnoticed damages. Public adjusters perform thorough assessments of property damages, as well as document any additional damage, and deal with insurance companies for policyholders.

The most important steps to pursue additional compensation include:

- Document newly discovered damages

- Review the policy terms and settlement agreements

- Gather supporting evidence and estimates

- Think about professional representation from a state-licensed public insurance adjusters

The National Association of Public Insurance Adjusters (NAPIA) stresses that public adjusters are often able to identify missed damages and policy provisions that allow for the need for additional compensation. Their knowledge of policy interpretation and the valuation of claims is particularly useful when challenging settled claims.

Insurance policyholders must act promptly upon discovering insufficient settlement amounts, as delay can compromise their ability to obtain additional compensation. When utilizing a PCAN member Public Insurance Adjuster, the claim review and negotiation process typically progresses more efficiently than policyholder-directed efforts.

Disclaimer: *Some Services Not Available In All Areas. The use of contingency fees is not permitted in Louisiana.

Can My Insurance Company Cancel My Contract If I Use a Public Adjuster In Midlothian, Virginia?

No. Insurance companies cannot legally cancel policies solely because policyholders hire public adjusters to represent their interests during the claims process, according to the National Association of Insurance Commissioners (NAIC). Policy cancellations are strictly governed by contractual terms and state regulations, typically limited to specific circumstances such as non-payment of premiums or material misrepresentation.

The National Association of Public Insurance Adjusters (NAPIA) emphasizes that hiring a licensed public claims adjusters is a protected right of policyholders. These professionals serve as advocates during insurance claims, handling documentation, negotiations, and communications with insurance carriers to expedite settlements.

The Insurance Information Institute (III) confirms that policyholders maintain the right to professional representation during claims processes, and insurers must honor this right while adhering to fair claims handling practices.

Related:Public Insurance Claim Adjusting Guides

Disclaimer: *Some Services Not Available In All Areas. Contingency fees are not permitted in Louisiana.

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

The Homeowners Insurance Claims Recovery Process In Midlothian, Virginia

Virginia state-licensed public insurance claims adjusters are fluent in “Insurance Policy Jargon”, and will guide you through the entire property insurance claims process, while they fight to make sure you get the highest & most fair compensation possible for your claim!

View 7-Step Claims Recovery Process Map

Step #1

Make Sure Your Family Is Safe

When disaster strikes, the priority is to make sure your family is safe. Always have an emergency bag!

Step #2

Contact A PCAN Public Adjuster In Midlothian, Virginia

Contact one of the PCAN verified and state-licensed public insurance claims adjusters to schedule an appointment for them to come out & meet with you to inspect the damage.

Step #3

Thorough Review Of Your Policy

Your public insurance claims adjuster will conduct a comprehensive review of your policy, note any coverage restrictions, coinsurance requirements, limitations, and review additional options that may be available to you.

Step #4

Create A Claims Strategy That Works For Your Specific Goals & Needs

Your public insurance adjuster will discuss what is most important to you when it comes to your claim, then create & tailor the right claims strategy to take care of your family.

Step #5

Public Adjuster Takes Care Of All Insurance Related Paperwork, Negotiations, & Follow Up.

Once you have agreed on a strategy, your public insurance adjuster will:

- Meet with insurance company adjusters & personnel at the loss/damage location.

- Agree to the scope of damages & make sure that they are including all the damages in the scope, as well as clearly deciding on what should be repaired vs. replaced.

- Prepare a detailed reconstruction estimate.

- Prepare a detailed inventory of personal property.

Step #6

Negotiations & Final Settlement

Your public adjuster will work to make sure you receive the highest settlement possible under your specific insurance policy.

Step #7

Restoration | Reconstruction | Relocation

Your public adjuster will negotiate with the insurance company to ensure that you can achieve your specific goals. Whether that’s full or partial restoration, rebuilding your property, or a full-relocation.

(Click To Expand Infographic)

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Explore How Midlothian Public Claims Adjusters Can Help You Maximize Settlements From These Types Of Homeowners Insurance Damage Claims

- Water Property Damage Insurance Claims Public Adjusters

- Hurricane Claims Adjusters

- Flood Property Damage Claims Public Adjusters

- Hail Property Damage Claims

- Sewer Line Claims Adjusters

- Flooded Basement Property Damage Insurance Claims Public Adjusters

- Sinkhole Damage Claims Public Adjusters

- Slab Leak Damage Claims Adjusters

- Foundation Property Damage Insurance Claims

- Water Line & Pipe Damage Insurance Claims Public Adjusters

- Fire Claims

- Wildfire Property Damage Insurance Claims Adjusters

- Denied Homeowners Property Damage Insurance Claims Public Adjusters

- Underpaid Homeowners Property Damage Insurance Claims Adjusters

- New Property Damage Claims

- Commercial Damage Insurance Claims Public Adjusters

- Homeowners Association (HOA) Damage Claims

- Condo Association Property Damage Insurance Claims

- Theft Claims Adjusters

- Vandalism Property Damage Claims

- Roofing Damage Claims Adjusters

- Storm & Wind Damage Insurance Claims Adjusters

- Tornado Property Damage Claims

- Property Claims Public Adjusters

- Personal Property Claims Adjusters

- Earthquake Damage Claims Adjusters

- Structural Property Damage Claims

- Lightning Damage Claims Public Adjusters

- Mold Damage Claims

- Business Interruption Property Damage Claims Adjusters

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Read The Latest Articles Related To Your Specific Claim

- Featured

- Adjusting

- Basement

- Black Mold

- Business Interruption

- CA

- Ceiling Damage

- Commercial Property Damage

- Condo Association

- Contractors

- Denied Insurance Claims

- Earthquake Damage

- Fire Damage

- Flood Damage

- Foundation Damage

- Hail

- Hail Damage

- Homeowners Association

- Homeowners Insurance

- Hurricane

- Hurricane Damage

- Inspections

- Installation

- Insurance

- Insurance FAQ

- Lightning

- Mitigation

- Mold Damage

- New Claims

- Personal Property Damage

- Property Damage

- Public Adjusting Guides

- Remediation

- Repairs

- Replacement

- Roof Damage

- Roof Leaks

- Sewer Lines

- Sinkhole Damage

- Slab Leak

- Solar Panels

- Storm Damage

- Storms

- Structural Damage

- terms

- Theft

- Tornado

- Tornado Damage

- TX

- Underpaid Insurance Claims

- Vandalism

- Water Damage

- Water Lines And Pipes

- Wildfire Damage

- Wind

- Wind

- Featured

- Adjusting

- Basement

- Black Mold

- Business Interruption

- CA

- Ceiling Damage

- Commercial Property Damage

- Condo Association

- Contractors

- Denied Insurance Claims

- Earthquake Damage

- Fire Damage

- Flood Damage

- Foundation Damage

- Hail

- Hail Damage

- Homeowners Association

- Homeowners Insurance

- Hurricane

- Hurricane Damage

- Inspections

- Installation

- Insurance

- Insurance FAQ

- Lightning

- Mitigation

- Mold Damage

- New Claims

- Personal Property Damage

- Property Damage

- Public Adjusting Guides

- Remediation

- Repairs

- Replacement

- Roof Damage

- Roof Leaks

- Sewer Lines

- Sinkhole Damage

- Slab Leak

- Solar Panels

- Storm Damage

- Storms

- Structural Damage

- terms

- Theft

- Tornado

- Tornado Damage

- TX

- Underpaid Insurance Claims

- Vandalism

- Water Damage

- Water Lines And Pipes

- Wildfire Damage

- Wind

- Wind

A homeowners insurance terms glossary provides insight to policyholders of critical terms and definitions commonly used to clarify various aspects of coverage and claims.

Key concepts include such terms as Actual Cash Value, a method for determining compensation based on replacement costs minus recoverable depreciation, and ALE, which cover necessary living costs when a home is uninhabitable.

For example, understanding your homeowners insurance declaration page, common home insurance claim deductibles for various kinds of home & property damage, the general policy exclusions standard in many home insurance policies, can bring much-needed awareness & clarity to policyholders of potential insurance policy lingo that may affect their claim outcomes. For example, knowing which key documents (such as photographs and receipts) are essential for substantiating claims.

Related Articles:

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Find PCAN Public Adjusters In These Surrounding Cities:

View Additional Cities Around Midlothian That We Serve

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

More About Midlothian, Virginia

Midlothian | |

|---|---|

Ruins of the Grove Shaft air-pumping station, now part of the Mid-Lothian Mines Park. | |

| Coordinates: 37°31′17.4″N 77°39′53.2″W / 37.521500°N 77.664778°W / 37.521500; -77.664778 | |

| Country | |

| State | |

| County | Chesterfield |

| Settled | c.1700 (1700) |

| Founded | c.1730 (1730) |

| Founded by | Wooldridge brothers |

| Named for | Mid-Lothian Mining and Manufacturing Company |

| Government | |

| • District supervisor | Mark S. Miller, Ph.D. |

| Area | |

• Total | 8.64 sq mi (22.4 km) |

| • Land | 8.568 sq mi (22.19 km) |

| • Water | 0.072 sq mi (0.19 km) |

| Elevation | 367 ft (112 m) |

| Population (2020) | |

• Total | 18,320 |

| • Density | 2,120.4/sq mi (818.7/km) |

| Time zone | UTC-5:00 (EST) |

| • Summer (DST) | UTC-4:00 (EDT) |

| ZIP code | 23112, 23113, 23114 |

| Area code | 804 |

| Website | www |

Midlothian ( mid-LOH-thee-ən) is an unincorporated area and census-designated place in Chesterfield County, Virginia, U.S. Settled as a coal town, Midlothian village experienced suburbanization effects and is now part of the western suburbs of Richmond, Virginia south of the James River in the Greater Richmond Region. Because of its unincorporated status, Midlothian has no formal government, and the name is used to represent the original small Village of Midlothian and a vast expanse of Chesterfield County in the northwest portion of Southside Richmond served by the Midlothian post office.

The Village of Midlothian was named for the early 18th-century coal mining enterprises of the Wooldridge family. Incorporated in 1836, their Mid-Lothian Mining and Manufacturing Company employed free and enslaved people to do the deadly work of digging underground. Midlothian is the site of the first commercially-mined coal in the Colony of Virginia and North America.

By the early 18th century, several mines were being developed in Chesterfield County by French Huguenots and others. The mine owners began to export the commodity from the region in the 1730s. Midlothian-area coal from Harry Heth‘s Black Heath mines heated the U.S. White House for President Thomas Jefferson. The transportation needs of coal shipping stimulated construction of a paved toll road (Virginia’s first), the Manchester Turnpike in 1807; and the Chesterfield Railroad, Virginia’s first, in 1831; each traveled the 13 miles (21 km) from the mining community to the port of Manchester, just below the Fall Line of the James River. In 1850, the Richmond and Danville Railroad built Coalfield Station, a freight and later passenger depot, near the mines.

SourceOur Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.