Standard homeowners insurance typically excludes sump pump failures and water damage from backups. Property owners need specialized water backup coverage, with limits ranging from $5,000 to $10,000 and annual premiums between $25 and $250. Coverage focuses on mechanical failures, electrical outages, and overflow incidents. Documentation requirements include photographs, maintenance records, and detailed damage inventories. Understanding coverage options, risk factors, and preventive maintenance strategies helps maximize protection against costly water damage incidents.

Key Takeaways

- Standard homeowners insurance excludes sump pump failures, requiring additional water backup coverage endorsements for protection against overflow damage.

- Water backup coverage typically costs $25-$250 annually and provides $5,000-$10,000 in protection for sump pump-related water damage.

- Document sump pump incidents with photos, maintenance records, and itemized damage lists to support successful insurance claims.

- Power outages, mechanical malfunctions, and severe weather are common causes of sump pump failures covered by specialized insurance.

- Evaluate property risk factors and maintain detailed sump pump maintenance records to ensure adequate coverage and smoother claims processing.

Understanding Sump Pump Insurance Coverage Basics

Standard homeowners insurance policies typically do not cover sump pump installation costs, as this falls under routine home maintenance and improvements.

Insurance companies consider sump pump installation a preventative measure rather than a response to covered damage or loss.

However, if a sump pump needs replacement due to sudden, accidental damage from a covered peril, the replacement costs may qualify for coverage under specific policy provisions.

Does Homeowners Insurance Cover Sump Pump Installation?

When homeowners consider installing a sump pump system, they should understand that standard homeowners insurance policies do not cover the initial installation costs.

Insurance providers classify sump pump installation as a preventative maintenance measure rather than a covered repair or damage incident.

Key considerations regarding sump pump installation coverage:

- Insurance policies typically exclude preventative measures, focusing instead on sudden and accidental damage

- Water backup coverage endorsements protect against sump pump failure but not installation costs

- Homeowners must independently finance the installation as part of regular home maintenance

While the installation itself isn't covered, homeowners can protect themselves against future water damage by adding specific endorsements to their policies that cover sump pump failures and water backup incidents.

Consulting with insurance agents helps clarify available coverage options and limitations.

Common Causes Of Sump Pump Failures & Overflows

When a sump pump fails, water can rapidly accumulate in basements and crawl spaces, potentially causing extensive structural damage and property loss.

The most common failure scenarios include power outages that disable electrical pumps, mechanical malfunctions of critical components like float switches, and system overload during severe weather events.

These failures often result in water backup, which can damage floors, walls, stored items, and electrical systems, particularly when backup systems are not in place.

What Happens When Sump Pump Fails?

Homeowners face significant risks when sump pumps fail to operate effectively, leading to potential basement flooding and water damage. Property damage caused by sump pump failures can be extensive, requiring immediate attention to prevent further deterioration.

Regular maintenance and backup endorsement coverage through homeowners insurance can help mitigate these risks.

Common consequences of sump pump failure include:

- Water accumulation in basements due to mechanical breakdowns or power outages, resulting in damaged belongings, structural issues, and potential mold growth.

- Discharge pipe clogs causing water backup, leading to overflow situations that may not be covered by standard insurance policies.

- System overload during heavy rainfall, particularly when backup systems aren't installed, resulting in extensive property damage that requires significant restoration efforts.

Standard Homeowners Policy vs. Specialized Sump Pump Coverage

Although standard homeowners insurance provides essential protection for various perils, it typically excludes coverage for water damage caused by sump pump failures and backups. Homeowners seeking extensive financial protection must obtain specialized sump pump coverage through a policy endorsement, which specifically addresses water backup incidents and resulting property damage.

| Feature | Standard Policy | Specialized Coverage |

|---|---|---|

| Sump Pump Failure | Not Covered | Covered |

| Water Backup | Not Covered | Covered |

| Personal Property Damage | Limited | Extensive |

| Repair Costs | Excluded | Included |

| Annual Premium | Base Rate | $25-250 Additional |

This specialized coverage fills critical gaps in standard homeowners policies, offering protection against water-related damages that could otherwise result in significant out-of-pocket expenses. The relatively modest cost of sump pump coverage, typically ranging from $25 to $250 annually, provides valuable insurance coverage against potentially costly water backup incidents and associated repairs to your property.

Essential Coverage Options For Water Backup Protection

Understanding water backup protection requires examining several key coverage options available to property owners. Homeowners insurance policies typically exclude water backup incidents, making specialized sump pump coverage essential for thorough protection. Property owners can obtain overflow coverage through endorsements that specifically address damage to your home caused by sump pump failures.

Key considerations for water backup protection include:

- Coverage limits ranging from $5,000 to $10,000 with standard $1,000 deductibles

- Annual premiums between $25 to $70 for sump pump insurance coverage

- Protection against damages from mechanical failures, electrical malfunctions, and backup incidents

This specialized coverage safeguards against financial losses resulting from water-related incidents that standard policies exclude.

When selecting appropriate coverage for damage, property owners should evaluate their basement's contents, potential risk factors, and the cost-benefit ratio of different coverage limits.

Regular maintenance of sump pump systems remains vital for minimizing the likelihood of claims and ensuring continuous protection.

Cost Factors For Sump Pump Insurance Coverage

Several key factors influence the cost of sump pump insurance coverage, with annual premiums typically ranging from $25 to $70. Insurance providers analyze property location, value, and historical water-related claims when determining rates.

Coverage limits, which can range from $5,000 to full replacement cost, greatly impact premium calculations. Adding sump pump coverage as an endorsement to existing homeowners insurance presents a cost-effective solution compared to standalone water backup policies.

Independent insurance agents can assist property owners in evaluating their specific risk factors and selecting appropriate coverage levels for overflow insurance. The cost of water backup protection varies among insurance providers, reflecting differences in coverage terms and conditions.

When considering sump pump insurance, homeowners should review their property's unique characteristics and potential vulnerabilities.

Consulting with an experienced insurance agent helps guarantee adequate protection while maintaining cost-effectiveness through properly structured coverage options.

Filing Claims For Sump Pump Related Damages

The success of a sump pump damage claim largely depends on proper documentation and timely reporting to insurance providers. When homeowners experience water backup due to sump pump failure, they must immediately document the incident with photographs and compile an extensive list of affected belongings.

Insurance adjusters require detailed information about when the failure occurred and its cause to properly evaluate claims under water backup coverage policies.

Key steps for filing successful sump pump damage claims:

- Verify that your policy includes specific water backup coverage, as standard homeowners insurance typically excludes sump pump-related incidents.

- Document all damage with photographs, detailed descriptions, and an itemized list of affected property.

- Submit maintenance records demonstrating proper upkeep of the sump pump system, which can strengthen your claim's validity.

Prompt reporting and thorough documentation greatly improve the likelihood of claim approval, enabling homeowners to receive appropriate compensation for covered damages.

Preventive Maintenance To Reduce Insurance Claims

Regular maintenance of sump pump systems plays an essential role in preventing water damage and minimizing insurance claims. Homeowners can substantially reduce the risk of failed sump incidents by implementing a thorough preventive maintenance schedule that includes annual testing and routine inspections of critical components.

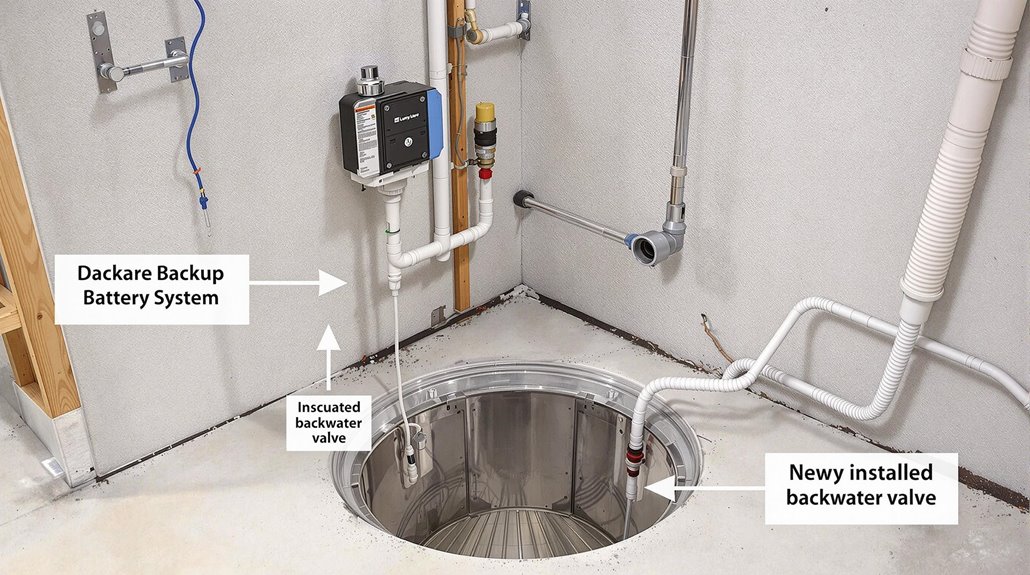

Essential maintenance tasks include cleaning the sump pit, verifying proper float switch operation, and ensuring the discharge path remains unobstructed. Installing a backwater prevention valve provides additional protection against water backup, further safeguarding against potential insurance claims. Documentation of all maintenance activities strengthens the homeowner's position when dealing with insurance carriers regarding sump pump coverage.

To maintain peak performance, homeowners should conduct quarterly inspections of their sump pump installation, checking for signs of wear or malfunction.

This proactive approach to system maintenance helps prevent catastrophic failures during heavy rainfall events and supports successful claims processing when water damage occurs despite preventive measures.

Evaluating Your Property's Sump Pump Risks

Properly evaluating sump pump risks requires homeowners to assess multiple environmental and mechanical factors that could impact their property's vulnerability to water damage. Understanding these risks helps determine appropriate sump pump coverage and overflow insurance needs.

Regular monitoring of discharge locations, equipment breakdown potential, and water backup scenarios enables homeowners to implement effective preventive measures.

- Analyze local weather patterns and historical rainfall data to anticipate potential stress on sump pump systems during peak precipitation periods.

- Evaluate surrounding vegetation and monitor tree roots that could compromise drainage systems, leading to water backup issues.

- Assess electrical reliability in the area to determine if a backup pump installation is necessary for maintaining protection during power outages.

Comprehensive risk evaluation should include documentation of existing conditions through photographs and maintenance records, which can support future homeowners insurance claims.

This systematic approach to risk assessment helps property owners make informed decisions about necessary coverage levels and preventive measures.

Documentation Requirements For Coverage Approval

Securing approval for sump pump coverage claims requires homeowners to maintain detailed documentation of water damage incidents and associated losses. When filing a claim for water backup damage, property owners must provide extensive photographic evidence depicting the extent of the destruction, accompanied by detailed written descriptions of affected areas.

Insurance companies mandate specific documentation requirements for processing sump pump coverage insurance claims. This includes a systematically compiled inventory of damaged items with their estimated replacement costs. Homeowners must retain all receipts for water damage remediation services, repairs, and replacement purchases as proof of expenses.

Additionally, a detailed written statement explaining the circumstances surrounding the sump pump failure must be submitted to the insurance company.

Prompt reporting of incidents is critical, as delays in notifying the homeowners insurance provider may jeopardize claim approval. These documentation requirements facilitate efficient processing and appropriate compensation for covered water damage events.

Selecting The Right Coverage Limits & Deductibles

Determining appropriate coverage limits and deductibles for sump pump insurance requires careful evaluation of multiple factors that affect potential water damage risks.

Coverage options typically range from $5,000 to full replacement cost, with annual premiums between $50 and $250. Most policies feature a standard $1,000 deductible for water backup incidents, which homeowners must consider when reviewing their financial preparedness for potential claims.

- Assess local climate patterns and historical water damage events to determine adequate coverage limits for your home's specific risk profile.

- Calculate potential repair costs versus premium increases when selecting different coverage tiers and deductible amounts.

- Review the age and maintenance status of your sump pump system to evaluate likelihood of failure and necessary coverage extent.

Insurance agents can provide customized guidance on ideal coverage limits and deductibles based on property characteristics, location-specific risks, and the homeowner's financial circumstances, ensuring thorough protection against sump pump-related water damage.

Frequently Asked Questions

Is Sump Pump Overflow Covered by Insurance?

Standard homeowners insurance typically excludes sump pump overflow coverage. A separate endorsement must be added to protect against water damage caused by sump pump failure or malfunction.

What Is Overflow Coverage?

Like a safety net beneath a tightrope walker, overflow coverage is an insurance endorsement that protects against water damage from backed-up drains, failed sump pumps, and sewer system malfunctions.

Is Coverage for Water Backup or Sump Pump Overflow Excluded From the Dwelling Policy However?

Standard dwelling policies exclude water backup and sump pump overflow coverage by default. These protections require separate endorsements to be added specifically to the homeowner's insurance policy for coverage.

What Happens if Sump Pump Overflows?

When a sump pump overflows, basements face immediate flooding risks, potentially causing extensive structural damage, destroying personal belongings, and creating hazardous mold conditions that require professional remediation and costly repairs.

Final Thoughts

Thorough sump pump coverage represents a prudential safeguard against unforeseen moisture-related incidents that could compromise residential structural integrity. Through methodical evaluation of coverage options, maintenance protocols, and risk assessment strategies, property owners can mitigate potential financial exposure. When combined with appropriate documentation and preventive measures, specialized sump pump insurance provisions offer a systematic approach to addressing water-related challenges while maintaining property value optimization.

For homeowners experiencing property damage related to sump pump failures or water-related incidents, insurance industry professionals and legal experts strongly advise consulting a qualified state-licensed public adjuster. These professionals work exclusively for policyholders, not insurance companies, serving as dedicated advocates throughout the claims process. Public adjusters are state-licensed experts who help navigate complex insurance policies, identify hidden damages often unknown to policyholders, thoroughly document losses, and negotiate with insurance companies to ensure fair settlements while protecting policyholder rights.

Engaging a public adjuster can lead to maximized claim payouts, expedited processing, and reduced stress during the claims process, allowing homeowners to focus on property restoration. Policyholders seeking expert guidance for their property damage claims can request a no-obligation free consultation with a Public Claims Adjusters Network (PCAN) member public adjuster through our contact page.