Has your roof taken a beating from Mother Nature? Let's talk storm damage – it's more common than you might think! Think of your roof as a protective helmet for your home, and when storms strike, they can leave quite a mark.

You'll spot the tell-tale signs: shingles playing hide-and-seek (missing ones, that is), sneaky water finding its way inside, and those pesky dimples from hail that look like a golf ball went to town on your roof. Not exactly the home improvement project you were planning, right?

When it comes to fixing the damage, your wallet might need to brace itself. A full replacement typically runs between $3,000 to $5,500, with the final tab depending on your shingle choice and how extensive the storm's "redecorating" efforts were.

Here's the silver lining: your homeowners insurance might have your back! Whether you've got an ACV policy (think depreciated value) or an RCV policy (full replacement cost), documenting everything is your golden ticket. Think of it as building a rock-solid case for your roof's defense.

Want to maximize your insurance claim? Team up with a professional roof inspector and snap photos like you're a home improvement paparazzi. Understanding your policy's fine print isn't exactly thrilling beach reading, but it's your roadmap to getting the coverage you deserve.

Key Takeaways

Is Your Roof Telling You It's Time for a Post-Storm Makeover?

Think of your roof as a protective shield that's just been through battle. Storm damage isn't always obvious, but knowing the telltale signs can save you thousands. Keep an eye out for those sneaky missing shingles playing hide-and-seek, dimpled surfaces from hail's unwelcome dance, and those mysterious water spots creeping across your ceiling.

Got storm damage? Let's talk numbers. A full roof replacement typically runs between $3,000 to $5,500 – though your final bill depends on whether you're going with basic asphalt or premium materials. It's like choosing between a reliable sedan and a luxury vehicle; both will get you there, but comfort levels vary.

Smart homeowners know documentation is their best friend. Before you ring up your insurance company, channel your inner photographer: snap detailed pictures of every dent, crack, and water stain. Think of it as building your case for the insurance jury.

Speaking of insurance, not all policies are created equal. Replacement Cost Value (RCV) is your premium package deal, covering what it actually costs to replace your roof. Actual Cash Value (ACV)? Well, that's more like getting the depreciated bargain version.

Want a pro tip? Don't settle for just one contractor's opinion. Gather at least three estimates, and consider bringing in a public adjuster – these roof claim whisperers often boost settlements by 20-50%. They're like having a skilled negotiator in your corner during a high-stakes game.

Common Types Of Storm Damage To Roofs

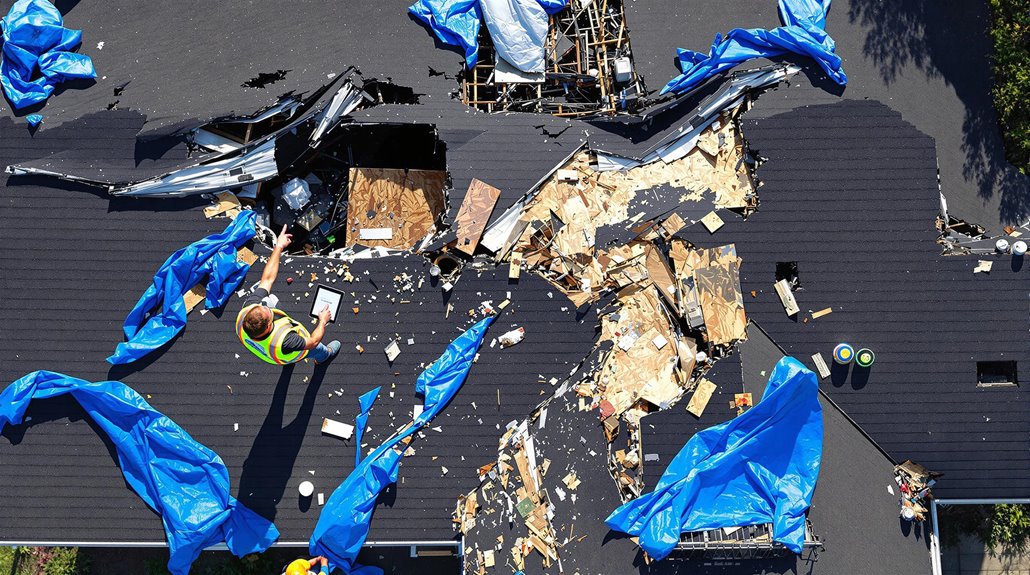

Several distinct types of storm damage can compromise a residential roof's structural integrity and protective function. High winds frequently cause missing shingles and flashing damage around chimneys and vents, while hail damage creates dents or punctures requiring immediate roof replacement. Falling debris during storms can lead to severe structural damage, necessitating thorough repairs. Professional repairs typically require 2-4 hours for completion under normal conditions.

| Damage Type | Impact |

|---|---|

| Wind Damage | Missing shingles, compromised flashing |

| Hail Impact | Surface dents, material punctures |

| Water Intrusion | Interior leaks, mold formation |

| Tree Damage | Structural compromise, immediate replacement |

Early detection and documentation of these issues are vital for successful insurance claims. Water damage from roof leaks can escalate rapidly, affecting interior spaces and requiring extensive restoration beyond the initial storm damage repair. Homeowners should know that 90% of leaks typically occur at roof valley points where sections of the roof intersect.

What Does Storm Damage Look Like On A Roof?

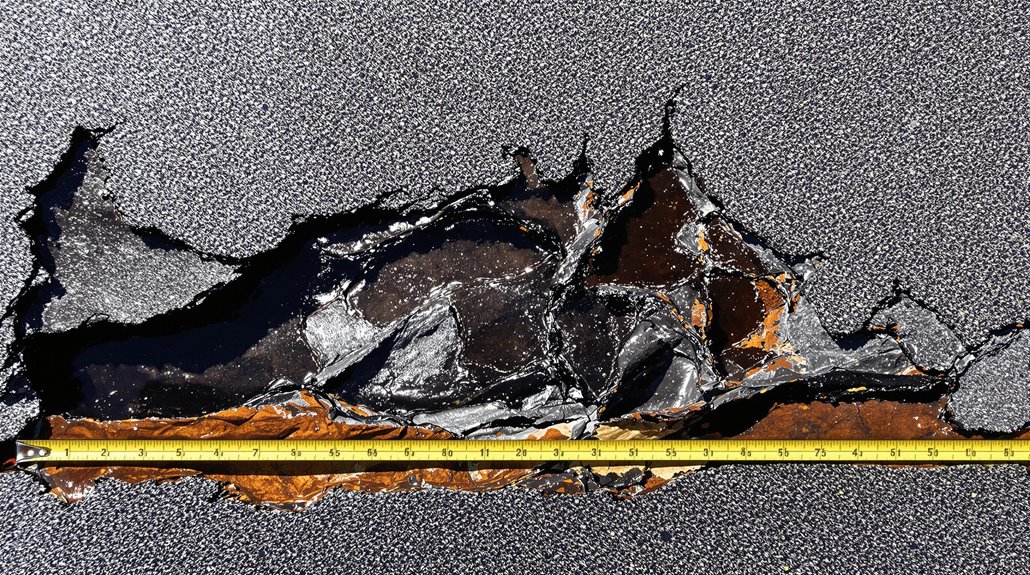

Identifying storm damage on a residential roof requires a systematic visual inspection to detect compromised areas that may threaten the structure's integrity. Common indicators include missing or torn shingles, water leaks penetrating interior spaces, and dents or punctures from hail impact. Damaged flashing around roof penetrations often signals vulnerability requiring immediate attention. Working with public insurance adjusters can increase damage claim settlements by up to 800% through professional documentation and strategic negotiation. Architectural shingles typically last between 24-30 years when properly maintained.

| Damage Type | Visual Indicators |

|---|---|

| Wind Damage | Missing or torn shingles, lifted edges |

| Hail Damage | Dents in metal surfaces, granule loss |

| Water Damage | Ceiling stains, compromised flashing |

Regular inspection of clogged gutters and downspouts helps prevent additional storm damage. Documenting these issues thoroughly supports insurance claims and facilitates roof repairs covered by homeowners insurance policies. Professional assessment guarantees accurate damage evaluation and appropriate remediation strategies.

Does Homeowners Insurance Cover Storm Damage Roof Replacement Claims?

Understanding homeowners insurance coverage for storm-damaged roofs requires careful review of policy details including deductibles, coverage limits, and named perils versus hidden perils. It is essential to identify the specific roof storm damage types and signs that may be covered under the policy, as different insurers often have varying definitions of what constitutes storm-related damage. Homeowners should also be aware that some policies might exclude certain risks, such as flooding or wind damage, which could leave them vulnerable if these events occur. Additionally, documenting any damage immediately after a storm can help expedite the claims process and ensure that any necessary repairs are made promptly. Moreover, understanding the specific hurricane roof damage types within the context of your policy can help homeowners anticipate potential challenges during the claims process. For instance, damage caused by heavy winds, rain, or flying debris may be treated differently depending on the insurer’s criteria. It is advisable for homeowners to maintain a thorough record of their property’s condition prior to a storm, as this documentation can serve as critical evidence when filing claims related to any roof damage encountered.

Coverage variations between actual cash value (ACV) and replacement cost value (RCV) can markedly impact out-of-pocket expenses for roof replacement after storm damage. Insurance providers typically evaluate factors such as the roof's age, maintenance history, and documented storm severity when processing claims. Most roofs experience 4% annual depreciation which affects coverage eligibility and payout amounts.

- Insurance deductibles must be met before coverage applies, with storm damage claims often subject to specific wind/hail deductibles.

- Actual Cash Value policies factor in depreciation, potentially leaving homeowners with substantial costs for older roofs.

- Named perils policies cover only specifically listed events, while all-risk policies provide broader storm damage protection.

- Documentation through photos, professional inspections, and maintenance records strengthens claim validity.

Working with public insurance adjusters can increase settlement amounts by 20-50% compared to filing claims independently.

Insurance Deductibles, Coverage Limits, & Exclusions For Storm Damage Roof Replacement Claims

When homeowners face storm damage to their roofs, insurance coverage typically provides financial protection, though specific terms and conditions apply. Understanding policy specifics, including insurance deductibles, coverage limits, and exclusions, is essential for managing the claims process effectively. Thermal imaging technology enables precise detection of hidden moisture damage that could affect claim outcomes. Homeowners must consider the difference between Actual Cash Value (ACV) and Replacement Cost Value (RCV) policies, as this affects reimbursement amounts for roof replacement. Working with public insurance adjusters can increase claim settlements by 30-50% through proper documentation and negotiation.

| Component | Coverage Details | Important Considerations |

|---|---|---|

| Deductibles | Out-of-pocket expense | Must be paid before coverage applies |

| Coverage Limits | Maximum payout amounts | Varies by policy terms |

| Exclusions | Specific limitations | Review policy carefully |

| Policy Type | ACV vs. RCV | Affects reimbursement value |

| Natural Disasters | Variable coverage | May require additional protection |

Actual Cash Value Vs. Replacement Cost In Relation To Storm Damaged Roofing

The distinction between Actual Cash Value (ACV) and Replacement Cost Value (RCV) coverage plays a fundamental role in determining how much homeowners can recover from insurance claims for storm-damaged roofs. Understanding your policy coverage type is essential when filing a claim for roof damage caused by storms.

| Coverage Type | Payment Method | Financial Impact |

|---|---|---|

| ACV | Depreciated Value | Higher Out-of-Pocket |

| RCV | Full Replacement | Complete Coverage |

| Claim Process | Documentation | Reimbursement |

When homeowners insurance covers storm damage, ACV policies compensate only for the depreciated value of the damaged roof, often resulting in significant out-of-pocket expenses. Conversely, RCV policies provide extensive coverage for the entire roof replacement costs, though they may require initial payment from the homeowner before reimbursement through the insurance process for roof claims. Working with public insurance adjusters can increase settlement amounts by 30-50% through expert evaluation and effective negotiation with insurance companies. Thorough damage documentation with photos and detailed receipts significantly improves the chances of claim approval.

Named Vs. Hidden Perils Related To Storm Damage Roofing Replacement Claims

Insurance coverage for storm-damaged roofs hinges on the essential distinction between named and hidden perils within homeowners' policies. Understanding this difference is vital when filing roofing replacement claims, as it directly impacts coverage approval.

| Peril Type | Coverage Status | Claim Requirements | Typical Outcome |

|---|---|---|---|

| Named | Generally Covered | Prompt Reporting | Usually Approved |

| Named | Storm Damage | Photo Documentation | Quick Processing |

| Hidden | Case-by-Case | Detailed Evidence | Possible Denial |

| Hidden | Gradual Damage | Proof of Causation | Extended Review |

Homeowners must promptly report storm damage to their insurance company and provide thorough documentation. While named perils like hurricanes and tornadoes typically receive straightforward coverage, hidden perils often require additional verification and may face more scrutiny during the claims process. Licensed public adjusters can identify hidden damage issues that homeowners might overlook during claims assessment. Successful claims depend on understanding policy terms and maintaining proper documentation. Working with public adjusters increases settlements by 30-50% compared to handling claims independently.

Solar Panel Storm Damage: Types Of Damage, Replacement Costs, & Home Insurance Coverage

Solar panels installed on roofs are susceptible to various types of storm damage, including cracked glass from hail impacts, lifted panels from high winds, and electrical system failures from water infiltration. Understanding the costs associated with solar panel replacement, which typically range from $200-$1,500 per panel, helps homeowners prepare for potential storm-related repairs. Most homeowner insurance policies cover storm damage to solar panels, but proper documentation and prompt reporting are essential for successful claims processing. Professional insurance adjusters can increase claim settlements by 20-50% through thorough documentation and systematic inspections. Dwelling coverage limits may offer extended protection of 10-50% above standard policy amounts.

| Damage Type | Common Causes | Typical Solutions |

|---|---|---|

| Physical Damage | Hail, Falling Debris | Panel Replacement |

| Wind Damage | Severe Storms, Tornados | Reinforcement/Reinstallation |

| Electrical Issues | Water Infiltration, Lightning | System Repair/Rewiring |

| Frame Damage | Strong Winds, Impact | Frame Replacement/Resealing |

Types Of Solar Panel Damages Caused By Storms

Powerful storms can inflict significant damage on residential solar panel systems through multiple mechanisms. Common types of damage include physical impacts from hail and wind-driven debris, which can crack or completely shatter panels. Water infiltration through compromised seals can cause electrical malfunctions, while strong winds may dislodge panels from their mounting systems, affecting performance and safety. Catastrophic events typically require immediate documentation to ensure proper coverage under most insurance policies.

| Damage Type | Impact |

|---|---|

| Physical Impact | Cracking, shattering of panels |

| Water Infiltration | Electrical system failure |

| Wind Force | Mount dislodgement, misalignment |

| Debris Contact | Surface scratches, frame damage |

Homeowners should document all storm damage thoroughly for insurance claims, as coverage varies by policy. Swift identification and professional assessment of damage helps expedite repair processes and prevents further complications from exposure to elements. Working with public insurance adjusters can increase storm damage claim settlements by 30-50% through their objective assessment capabilities.

How Much Does It Cost To Replacement Storm Damaged Solar Panels?

When storm damage occurs to residential solar installations, homeowners face significant financial considerations for repairs and replacements. The cost to replace storm-damaged solar panels typically ranges from $1,000 to $3,000 per panel, making thorough insurance coverage vital for protecting this investment. Regular maintenance inspections can reduce insurance premiums by 10-15% while protecting solar panel investments.

| Cost Factor | Impact on Replacement |

|---|---|

| Damage Extent | Determines repair vs. full replacement |

| Panel Type | Influences material costs |

| Installation | Labor and mounting requirements |

| Insurance Coverage | Affects out-of-pocket expenses |

Homeowners should immediately document all storm damage through detailed photos and descriptions, promptly reporting incidents to their insurance provider. Understanding policy coverage specifics is essential, as some policies may exclude or limit solar panel protection. Working with qualified contractors guarantees accurate damage assessment and proper installation while maintaining documentation for insurance claims. Hiring a public insurance adjuster can lead to settlements up to 800% higher than filing claims independently.

Does Home Insurance Cover Storm Damage Replacements To Solar Panels?

Understanding home insurance coverage for storm-damaged solar panels requires careful review of policy details and coverage terms. Most homeowners insurance policies may cover solar panel damage from storms, but coverage varies based on specific perils like hail, wind, or falling trees. Proper damage documentation and prompt notification to insurance providers are essential for successful claims processing. Working with public adjusters increases settlements by 30-50% compared to filing independently. Annual inspections prove critical for maintaining coverage eligibility and successful claims.

| Coverage Aspect | Key Considerations | Action Required |

|---|---|---|

| Policy Type | Dwelling vs Personal Property | Review Coverage |

| Damage Sources | Covered Perils | Document Evidence |

| Financial Limits | Replacement Costs | Check Deductibles |

Replacement costs can range from $1,000 to $10,000, making it vital to understand policy exclusions and coverage limits. Homeowners should verify whether their solar panels are included under dwelling coverage or classified as personal property, as this distinction affects claim outcomes and reimbursement amounts.

Can Solar Panels Withstand Storms?

Modern solar panels demonstrate remarkable resilience against severe weather conditions, with most models engineered to withstand wind speeds up to 140 mph and significant hail impact.

However, severe storm damage can still occur, requiring homeowners to understand potential risks and insurance coverage specifics.

Common types of storm damage to solar panels include:

- Cracked or shattered glass from hail impacts

- Loose electrical connections due to high winds

- Structural damage to mounting hardware

- Water infiltration causing internal component failure

When damage occurs, homeowners should document the affected areas thoroughly with photographs and promptly notify their insurance provider to initiate a claim.

Most insurance policies cover solar panel repair or replacement, though coverage varies by policy.

Professional assessment of damaged panels guarantees proper evaluation and appropriate repair solutions while maintaining warranty compliance.

Are There Storm Resistant Solar Panels?

Yes, storm-resistant solar panels exist and represent a significant advancement in renewable energy technology.

These panels meet rigorous IEC 61215 standards for durability and performance, offering enhanced protection against severe weather conditions. Regular inspections and maintenance guarantee peak storm resistance and identify potential vulnerabilities before damage occurs.

Key features of storm-resistant solar panels include:

- Reinforced mounting systems to prevent wind displacement

- Impact-resistant surfaces that withstand hail damage

- Enhanced frame construction for superior structural integrity

- Weather-sealed components to prevent water infiltration

When considering roof replacement or solar installation, understanding home insurance policies and coverage specifics is essential. Homeowners should review their policies to determine if roof damage is included and what conditions apply for replacements. Additionally, exploring damaged roof insurance options can provide peace of mind, ensuring you’re financially protected in case of unforeseen incidents during the installation process. Consulting with your insurance provider can help clarify coverage limits and any necessary assessments before making significant updates to your home.

Storm damage costs typically range from $200 to $1,000 per panel, making insurance claims documentation vital. Most policies cover solar panel storm damage, though terms vary by provider.

Replacement Vs. Replacement For Storm Damaged Roofing

Homeowners must evaluate specific criteria when determining if storm damage warrants a complete roof replacement rather than repairs.

The decision depends on factors including the age of the existing roof, extent of storm damage, and insurance coverage terms.

Professional assessment by qualified roofing contractors helps identify when replacement becomes the most practical solution for storm-damaged roofs.

- Visible structural compromise affecting more than 30% of the roof surface

- Multiple layers of damaged shingles or widespread loss of protective granules

- Water infiltration causing interior damage or compromised decking integrity

- Evidence of systemic damage that undermines the roof's ability to protect the structure

When To Choose Roof Replacement For A Storm Damaged Roof

When severe storms strike a property, determining whether to repair or replace a damaged roof requires careful evaluation of multiple factors. Professional assessment from qualified roofing contractors helps identify signs of storm damage and evaluate the roof's structural integrity. Insurance coverage and claims processing play significant roles in the decision-making process.

| Decision Factors | Replacement Indicators |

|---|---|

| Damage Extent | Multiple missing shingles, widespread leaks |

| Repair Costs | Exceeds 50% of replacement value |

| Roof Age | Near end of expected lifespan |

| Insurance Coverage | Policy covers storm damage replacement |

| Structural Issues | Compromised roof integrity |

Homeowners should document all storm damage thoroughly for insurance claims purposes and consider long-term cost implications when deciding between repair and replacement. A complete roof replacement often provides better value when significant storm damage occurs, particularly for aging roofs or those with extensive structural issues.

Storm Damaged Shingle Roof: Damage Signs & Replacement Costs

Storm damage to shingle roofs requires careful assessment to differentiate from normal wear patterns like blistering, with distinct markers including granule loss, lifting edges, and impact indentations. The replacement costs for storm-damaged shingles vary considerably by type, with architectural shingles typically commanding higher material costs than standard 3-tab varieties. Professional evaluation helps determine the full scope of storm damage while ensuring accurate cost estimates for insurance claims and repairs.

| Shingle Type | Average Cost/Sq.Ft. | Common Storm Damage Signs |

|---|---|---|

| 3-Tab | $3.50-$4.00 | Missing tabs, torn edges |

| Architectural | $4.00-$4.75 | Granule loss, crack lines |

| Performance | $4.50-$5.50 | Impact marks, delamination |

| Designer | $5.00-$6.00 | Corner lift, seal failure |

| Impact-Resistant | $5.50-$7.00 | Punctures, surface bruising |

Storm Damage VS. Shingle Blistering

Distinguishing between storm damage and shingle blistering requires careful inspection and understanding of distinct characteristics. Storm damage typically appears as localized issues with missing or torn shingles and specific impact points, while blistering manifests as raised areas across broader sections due to trapped heat and moisture.

| Characteristic | Storm Damage | Shingle Blistering |

|---|---|---|

| Appearance | Missing/torn shingles, dents | Raised bubbles on surface |

| Coverage Area | Localized damage | Widespread pattern |

| Insurance Claims | Generally covered | May not be covered |

| Repair Costs | $300-$1,500 minor repairs | Requires full replacement |

| Documentation | Immediate photos needed | Maintenance records essential |

Understanding these differences is important for homeowners insurance claims and determining appropriate repair strategies. Storm damage requires prompt documentation and immediate action, while blistering often indicates underlying ventilation issues requiring thorough roof replacement.

Costs For Storm Damaged Asphalt Shingles

Many homeowners face significant financial decisions when addressing storm-damaged asphalt shingles, with replacement costs typically ranging from $3.50 to $5.50 per square foot. Standard homes generally require between $5,000 and $10,000 for complete roof replacement, though costs vary based on damage extent and local rates.

| Cost Factor | ACV Policy | RCV Policy |

|---|---|---|

| Initial Coverage | Depreciated Value | Full Replacement |

| Deductible | Required | Required |

| Labor Costs | Partial Coverage | Full Coverage |

| Materials | Basic Rate | Current Market |

| Additional Damage | Limited | Extensive |

When filing insurance claims, homeowners should thoroughly document damage with photos and promptly contact their insurance company. Understanding policy type is essential, as Actual Cash Value covers depreciated costs while Replacement Cost Value provides full replacement coverage. Working with qualified roofing contractors guarantees proper assessment and repair implementation.

Costs For Storm Damaged Architectural Shingles

Architectural shingles damaged by storms present distinct challenges, with replacement costs typically ranging from $350 to $650 per square. Insurance claims require detailed documentation of visible damage, including missing or torn shingles, granule loss, and water leaks. Professional inspections help identify the full extent of storm damage and support claims for insurance cover roof damage.

| Damage Type | Cost Impact |

|---|---|

| Missing Shingles | High |

| Granule Loss | Moderate |

| Water Leaks | Severe |

| Hail Damage | High |

| Wind Damage | Moderate |

The costs to replace architectural shingles vary based on damage severity and local labor rates. Homeowners should immediately document visible damage through photographs and secure professional assessments to guarantee thorough insurance coverage and prevent further deterioration from unaddressed issues.

Costs For Storm Damaged 3-Tab Shingles

While architectural shingles offer premium protection, 3-tab shingles remain a common roofing material that requires specific attention after storm damage. Homeowners facing storm-damaged 3-tab shingles should understand typical costs and insurance considerations before proceeding with replacement.

| Cost Factor | Details |

|---|---|

| Average Replacement | $3,000-$5,500 |

| Insurance Coverage | Subject to policy limits |

| Documentation Needs | Photos, damage descriptions |

| Contractor Estimates | Minimum 3 recommended |

When evaluating storm-damaged 3-tab shingles, look for missing, cracked, or curled sections. Hail damage often presents as dents or bruises that can compromise roof integrity. For insurance claims, thorough documentation is essential. Multiple estimates from roofing contractors help guarantee fair pricing, while reviewing coverage limits with homeowners insurance providers clarifies financial responsibilities before beginning repairs. Additionally, it’s important to assess the overall condition of the roof, as unresolved small issues can escalate into larger problems if not addressed promptly. Once you have all necessary documentation and estimates, prioritize securing a trusted contractor who specializes in roof hail damage repairs to ensure the job is done safely and effectively. This proactive approach not only protects your investment but also enhances the longevity of your roof.

Costs For Storm Damaged Performance Shingles

Performance shingles, designed to withstand severe weather conditions, can sustain significant damage during intense storms that compromise their protective capabilities. When storm damage occurs, replacement costs typically range from $3.50 to $5.50 per square foot, with additional expenses for underlying issues like damaged decking or underlayment.

| Cost Factor | Low Range | High Range |

|---|---|---|

| Installation | $3.50/sq ft | $5.50/sq ft |

| Materials | $150/square | $250/square |

| Labor | $2.00/sq ft | $3.50/sq ft |

To manage repair costs effectively, homeowners should conduct regular inspections, document the damage thoroughly for insurance claims, and promptly report incidents to their insurance company. Performance shingle replacement requires careful assessment of both visible damage and potential structural issues to guarantee thorough restoration of the roof's integrity.

Costs For Storm Damaged Impact Resistant Shingles

Storm damage to impact-resistant shingles demands specific attention due to their specialized construction and higher material costs. The average cost to replace these shingles ranges from $3 to $5 per square foot, with total roof replacement costs typically between $8,000 and $15,000. Professional assistance is essential for identifying signs of damage, including cracks, dents, or missing sections that compromise roof integrity.

| Factor | Details | Cost Range |

|---|---|---|

| Material Cost | Impact-Resistant Shingles | $3-5/sq ft |

| Insurance Deductible | Standard Coverage | $500-2,000 |

| Full Roof Replacement | Including Labor | $8,000-15,000 |

| Coverage Type | Hail/Wind Damage | Policy Dependent |

| Installation | Professional Labor | Location Based |

When filing insurance claims, homeowners should document all roofing materials damage thoroughly and verify policy coverage for storm-related incidents.

Costs For Storm Damaged Luxury Designer Shingles

Luxury designer shingles represent a significant investment in both aesthetics and durability, making storm damage particularly costly for homeowners. When evaluating storm damage to these premium materials, costs typically range from $4 to $12 per square foot, with total roof replacement expenses varying based on damage severity and specific design choices.

| Damage Type | Cost Impact | Insurance Considerations |

|---|---|---|

| Wind Damage | $4-6/sq ft | RCV coverage applies |

| Hail Impact | $6-8/sq ft | Document all dents |

| Water Infiltration | $8-10/sq ft | Evaluate underlayment |

| Complete Failure | $10-12/sq ft | Full replacement claim |

For insurance claims, thorough documentation of visible damage is essential. Homeowners should photograph all affected areas and maintain detailed records for insurance adjusters. Policies with replacement cost value coverage typically offer extensive protection, subject to the deductible amount.

Costs For Storm Damaged Metal Shingles/Shakes

Metal roofing systems, including shingles and shakes, present unique challenges when evaluating storm-related damage and associated costs. When filing a storm damage insurance claim, homeowners should document signs of damage such as dents, missing panels, and compromised seams. Repair costs typically range from $3 to $6 per square foot, with insurance coverage often available after meeting the deductible.

| Damage Type | Assessment Method | Cost Impact |

|---|---|---|

| Panel Dents | Visual Inspection | Low-Medium |

| Missing Sections | Aerial Survey | High |

| Seam Damage | Close Examination | Medium |

| Water Infiltration | Interior Checks | Medium-High |

Regular inspections help identify early issues, potentially reducing roof replacement expenses. Homeowners insurance typically covers storm damage, though deductibles range from $500 to $2,000. Prompt reporting and thorough documentation strengthen insurance claims for metal shingle repairs.

Costs For Storm Damaged Wood Shake Shingles

Wood shake shingle damage from storms presents distinctive warning signs that homeowners need to identify for timely intervention. Cracked, split, or curling shingles signal the necessity for replacement, with costs ranging from $6 to $12 per square foot. Filing a storm damage insurance claim requires clear documentation, contractor estimates, and thorough evidence of the damage.

| Aspect | Requirement | Impact |

|---|---|---|

| Documentation | Photos & Reports | Facilitates Claims |

| Maintenance | Regular Inspection | Extends Lifespan |

| Insurance | Policy Review | Coverage Assurance |

Insurance policies cover storm-damaged wood shake shingles when properly documented and reported promptly. Determining replacement cost value (RCV) depends on factors including labor, materials, and accessibility. Regular maintenance helps prevent extensive damage, potentially reducing long-term costs while ensuring homeowners insurance cover roof repairs effectively.

Costs For Storm Damaged Solar Tile Shingles

Solar tile shingle damage from storms requires immediate assessment due to its potential impact on both roofing integrity and energy production capabilities. Replacement costs typically range from $15 to $30 per square foot, with additional labor charges of $50-$100 per hour. Documentation through professional inspection reports and photographs is vital for insurance claims processing.

| Aspect | Details | Cost Impact |

|---|---|---|

| Damage Signs | Cracked/Missing Tiles | Immediate Repair Needed |

| Labor Costs | Professional Installation | $50-$100/hour |

| Insurance Coverage | Policy Dependent | ACV vs. Full Replacement |

Homeowners should review their insurance policies carefully, as coverage variations exist between actual cash value and full replacement cost compensation. Professional inspection reports help validate claims and guarantee proper assessment of storm damage extent, facilitating accurate cost estimates for solar tile shingle replacement.

Costs For Storm Damaged Clay & Concrete Tile Shingles

Clay and concrete tile shingles subjected to storm damage require careful assessment to determine replacement costs, which typically range from $300 to $1,000 per square. Homeowners should thoroughly document visible damage through photos and detailed descriptions to support insurance claims. Professional roofing contractors can identify specific issues requiring repair or replacement.

| Damage Type | Cost Impact |

|---|---|

| Cracked Tiles | $300-500/square |

| Missing Tiles | $400-600/square |

| Water Damage | $500-700/square |

| Structural Issues | $700-900/square |

| Complete Replacement | $800-1000/square |

Insurance coverage for storm-damaged clay and concrete tile shingles typically includes repair or replacement costs when claims are filed within policy terms. Extensive damage may necessitate complete roof replacement, potentially exceeding $10,000 for average-sized installations.

Costs For Storm Damaged Slate & Synthetic Slate Shingles

Moving beyond clay and concrete options, storm damage to slate and synthetic slate shingles presents distinct challenges and cost considerations for homeowners. Replacement costs range from $900 to $2,500 per square, reflecting the specialized labor required for installation and material costs. Insurance coverage typically extends to damage from hail, wind, and falling debris, subject to policy terms.

| Aspect | Natural Slate | Synthetic Slate |

|---|---|---|

| Cost Range | $1,500-2,500/sq | $900-1,800/sq |

| Damage Signs | Cracks, chips | Surface abrasions |

| Labor Requirements | Highly specialized | Semi-specialized |

| Installation Complexity | Complex | Moderate |

When storm damage occurs, homeowners should document visible damage thoroughly with photographs and promptly contact their insurance company. This documentation facilitates efficient processing of claims and guarantees proper coverage for necessary replacements or repairs.

Storm Damaged Flat Roof Replacement: Damage Signs & Replacement Costs

Identifying storm damage on a flat roof requires careful inspection of specific vulnerabilities these structures face. Common indicators include ponding water, membrane tears, and blistering that can compromise structural integrity. Wind damage poses a particular threat, potentially lifting membranes and creating water entry points.

| Damage Type | Indicators | Action Required |

|---|---|---|

| Water Damage | Ponding, leaks | Immediate drainage repair |

| Wind Impact | Lifted membrane | Secure and reseal |

| Impact Damage | Tears, punctures | Patch or replace sections |

| Surface Issues | Blistering, cracks | Evaluate membrane integrity |

Replacement costs typically range from $3-$10 per square foot, varying by material selection and labor requirements. For insurance claims, thorough documentation of visible damage through photos and detailed notes is essential. Most policies cover storm-related perils, though exclusions may apply for age-related deterioration or maintenance neglect.

Storm Damaged Wood Roof Replacement: Damage Signs & Replacement Costs

While flat roofs present distinct challenges, wood roofs face their own set of vulnerabilities when impacted by severe storms. Regular wood roof inspections are essential for identifying signs of storm damage, including cracked shingles, water stains, and compromised flashing around vents and chimneys. When filing an insurance claim, homeowners must thoroughly document damage to guarantee covered damage is properly assessed by insurance companies.

| Aspect | Details |

|---|---|

| Common Damage Signs | Missing shingles, water stains |

| Key Areas | Chimney flashing, roof vents |

| Replacement Costs | $8,000-$15,000 |

| Prevention | Regular roof maintenance |

Prompt action in addressing storm damage through professional assessment helps prevent secondary issues like rot and mold, which can greatly impact roof replacement costs and complicate insurance claims.

Storm Damaged Built-Up Roof (BUR) Replacement: Damage Signs & Replacement Costs

Built-Up Roofs (BUR) face unique challenges when subjected to severe storm conditions, requiring careful inspection and assessment for potential damage. Key signs of damage include blisters, cracks, and tears in the roofing membrane, along with interior leaks and water pooling. Prompt identification and documentation of storm damage is essential for successful insurance claims.

| Aspect | Details | Impact |

|---|---|---|

| Damage Signs | Membrane tears, blisters | Immediate repair needed |

| Cost Range | $3.50-$6.50/sq ft | Varies by complexity |

| Documentation | Photos, contractor reports | Vital for claims |

| Insurance | Policy coverage review | Time-sensitive filing |

Professional roofing contractors should assess the extent of damage to determine replacement costs and provide detailed documentation for insurance claims. Delaying repairs can lead to structural issues and increased costs due to water damage progression.

Storm Damaged Wood Roof Replacement: Damage Signs & Replacement Costs

Severe storms pose significant risks to wood roofs, with damage manifesting through distinct signs that require prompt attention. Homeowners should monitor for missing or cracked shingles, water stains, and visible mold resulting from moisture exposure. Professional inspection helps document these damage signs for insurance claims.

| Aspect | Details |

|---|---|

| Lifespan | 20-30 years |

| Cost Range | $3.50-$6.50/sq ft |

| Common Damage | Missing shingles, water stains |

| Required Documentation | Photos, inspection report |

When pursuing roof replacement, property owners must review their insurance policy coverage for wood roof storm damage. Thorough documentation, including photographs and professional assessment reports, supports successful claims processing. Regular inspections help identify issues early, potentially preventing extensive damage and ensuring the roof maintains its expected lifespan.

Storm Damaged Green Roof Replacement: Damage Signs & Replacement Costs

Green roofs present unique challenges when evaluating storm damage, requiring careful evaluation of both living and structural components. Common indicators include vegetation distress, soil erosion, and compromised drainage systems. Insurance claims require thorough documentation through photos and inspection reports to assess both plant material and structural integrity. In addition to these challenges, wind damage to green roofs can exacerbate existing vulnerabilities, leading to further degradation of the structural components and the vegetation. Assessors must pay particular attention to the strength of the anchoring systems and the condition of the plants after severe weather events. A comprehensive evaluation will ensure that all aspects of the green roof are addressed, facilitating fair compensation and necessary repairs.

| Damage Type | Assessment Requirements |

|---|---|

| Vegetation | Plant wilting/browning |

| Structural | Waterproofing integrity |

| Drainage | System functionality |

| Foundation | Load-bearing capacity |

Replacement costs typically range from $10-$30 per square foot, varying based on damage severity and required plant materials. Post-storm assessment should prioritize drainage system inspection, as blocked or damaged components can accelerate deterioration. Professional evaluation guarantees accurate damage assessment and appropriate repair strategies, maximizing insurance claim potential while maintaining roof functionality.

Storm Damaged Membrane Roof Replacement: Damage Signs & Replacement Costs

When storm damage compromises a membrane roof, immediate identification of key warning signs allows property owners to take swift action and prevent further deterioration. Regular inspections can reveal visible tears, punctures, blisters, and water pooling that indicate potential structural issues. Hidden damage may not be apparent initially but can lead to significant problems if left unaddressed.

| Aspect | Details | Impact |

|---|---|---|

| Damage Signs | Tears, Punctures | Immediate Repair Needed |

| Cost Range | $6-$12 per sq ft | Budget Planning |

| Insurance Claims | Policy Coverage | Documentation Required |

| Maintenance | Regular Inspection | Prevention Focus |

| Hidden Issues | Structural Damage | Professional Assessment |

Replacement costs vary based on material type and installation complexity, while insurance coverage depends on policy specifics and timely reporting. Proper maintenance extends roof lifespan and minimizes storm damage impact. Furthermore, understanding the roof replacement vs repair benefits is crucial for homeowners facing roofing issues. While repair may offer a more immediate and cost-effective solution, replacement can provide a longer-term investment and enhanced protection against future damage. Ultimately, evaluating the extent of wear and tear, alongside financial considerations, will help homeowners make the most informed decision regarding their roofing needs.

Storm Damaged Rolled Roof Replacement: Damage Signs & Replacement Costs

Storm-ravaged rolled roofing presents distinct warning signs that property owners must recognize for timely replacement decisions. Key indicators include tears, cracks, or punctures in the membrane, along with water pooling that signals compromised integrity. Wind damage may displace sections of the rolled roof, necessitating immediate inspection.

| Aspect | Action | Impact |

|---|---|---|

| Visible Damage | Document with photos | Supports insurance claims |

| Maintenance | Regular inspection | Prevents claim denial |

| Replacement | Professional assessment | Guarantees proper coverage |

Replacement costs typically range from $3 to $5 per square foot, varying by damage extent and local labor rates. While insurance policies generally cover storm damage, claims may be denied for maintenance-related issues. Property owners should maintain thorough documentation of visible damage to facilitate successful insurance claims and secure appropriate coverage for roof replacement. It’s also essential for property owners to understand how to negotiate with insurance adjusters, as effective communication can significantly impact the outcome of a claim. Gathering estimates from reputable contractors can strengthen your position during negotiations. Additionally, being prepared to provide evidence of regular maintenance can help counter any allegations that damage resulted from neglect, ensuring that your claim is more likely to be approved.

Storm Damaged Metal Roof Replacement: Damage Signs & Replacement Costs

Metal roofs, renowned for their durability, can sustain significant damage during severe weather events. Common indicators include visible dents from hail, water leaks manifesting as ceiling stains, and compromised panels from wind damage. Professional roof inspections can identify these issues and determine repair needs.

| Damage Assessment | Action Required |

|---|---|

| Visible Dents | Document/Photo |

| Water Leaks | Immediate Fix |

| Missing Panels | Full Section |

| Surface Scratches | Evaluate Depth |

Replacement costs typically range from $5,000 to $15,000, varying by roof size and material quality. When filing a storm damage insurance claim, thorough documentation is essential. Homeowners should review their insurance policy coverage, understanding deductibles and exclusions before proceeding. Photos, detailed descriptions, and professional assessments strengthen claims for metal roof replacement cost reimbursement. Additionally, homeowners should be vigilant for hurricane roof damage signs, such as missing shingles, leaks, or visible dents, as these can significantly impact the claim process. Engaging a qualified roofing contractor for a comprehensive inspection can provide invaluable insights into the extent of the damage and necessary repairs. Ultimately, a proactive approach to documenting and addressing roof issues will facilitate a smoother claims experience and ensure adequate financial compensation. Furthermore, homeowners should keep records of all communications with their insurance companies, as these can prove crucial during the claims process. It is also advisable to act quickly in reporting the damage and initiating repairs, as delays may hinder the claim’s effectiveness. By being aware of evident hurricane roof damage signs and promptly addressing them, property owners can enhance their chances of receiving full compensation for their roofing needs.

Homeonwers Insurance Claim Process For Storm Damaged Roofing Replacements

Insurance adjusters work for their company's interests rather than the homeowner's financial benefit when evaluating storm damage claims. Homeowners must approach interactions with adjusters strategically by maintaining detailed documentation and avoiding casual discussions about the damage or repairs. A qualified roofing contractor's presence during adjuster inspections helps guarantee accurate damage evaluation and appropriate claim values.

| Adjuster Interaction Tips | What to Avoid | What to Document |

|---|---|---|

| Schedule inspections during daylight | Agreeing to immediate settlements | Photos of all visible damage |

| Have contractor present | Signing waivers without review | Written contractor estimates |

| Take detailed notes | Verbal agreements | Weather reports from incident |

| Record all communications | DIY temporary repairs | Timeline of damage discovery |

Dealing With Insurance Company Adjusters: No, They Are NOT Your Friend

When dealing with roof damage claims, homeowners should understand that insurance adjusters work primarily for their employers, not the policyholder.

To effectively advocate for fair compensation, property owners must take an active role in the claims process and maintain detailed documentation of all storm damage.

Key strategies for dealing with insurance adjusters:

- Be present during inspections to point out all areas of damage and guarantee thorough documentation

- Review coverage limits and policy terms before the adjuster's visit to understand your rights

- Challenge repair costs estimates that appear incomplete or inadequate

- Maintain records of all communication and support claims with extensive photo evidence

This proactive approach helps guarantee the adjuster's assessment accurately reflects the full scope of necessary repairs and increases the likelihood of fair compensation.

Getting Help From A Public Adjuster: Your Advocate & Ally

When dealing with storm-damaged roof replacement claims, public adjusters serve as independent advocates who work solely for the policyholder's interests, unlike insurance company adjusters who represent the insurer. Professional public adjusters typically secure settlements up to 800% higher than unrepresented claimants while handling all aspects of claim documentation, damage assessment, and negotiations with insurance companies. Although public adjusters charge 10-20% of the final settlement, their expertise in maximizing claim values often results in substantially higher net compensation for homeowners.

| Comparison Area | Public Adjuster | Insurance Co. Adjuster |

|---|---|---|

| Represents | Policyholder | Insurance Company |

| Settlement Focus | Maximum Recovery | Company Cost Control |

| Fee Structure | % of Settlement | Company Salary |

The Role Of Public Claims Adjusters In Storm Damaged Roof Replacement Claims

Professional guidance during roof damage claims can make a significant difference in the outcome of an insurance settlement. Public claims adjusters serve as advocates for homeowners, specializing in maneuvering through the complex insurance claims process. These licensed professionals conduct thorough inspection and assessment of roof damage, ensuring all storm-related issues are properly documented and evaluated.

| Adjuster Services | Benefits | Impact |

|---|---|---|

| Damage Assessment | Complete Documentation | Higher Accuracy |

| Policy Review | Coverage Understanding | Better Protection |

| Claim Filing | Professional Handling | Reduced Stress |

| Insurance Communication | Expert Negotiation | Fair Settlement |

| Settlement Review | Maximum Value | Best Possible Payout |

Working on a contingency fee basis, public adjusters align their interests with homeowners' rights, managing communication with insurance companies while maximizing claim payouts for storm damage repairs.

Benefits Of Using A Public Adjuster For Storm Damaged Roof Replacement Claims

Why do homeowners increasingly turn to public adjusters after storm damage to their roofs? Public adjusters serve as dedicated advocates during insurance claims, offering expertise in maneuvering complex policy coverage and maximizing settlement amounts for storm-damaged roofs. Their professional services prove invaluable through thorough documentation of damage and skilled negotiations with insurance companies.

| Benefit | Impact | Value |

|---|---|---|

| Expert Advocacy | Professional representation | Maximum claim potential |

| Documentation | Thorough damage assessment | Complete coverage |

| Policy Management | Understanding coverage terms | ideal settlements |

| Financial Access | Contingency basis payment | No upfront costs |

Working with a public adjuster allows homeowners to focus on recovery while ensuring their claims process is handled efficiently and effectively. Their specialized knowledge in identifying eligible claims and managing insurance negotiations provides peace of mind during challenging circumstances.

How Are Public Insurance Adjusters Paid & What Are Their Fees?

Understanding the fee structure of public insurance adjusters helps homeowners make informed decisions about engaging their services for storm-damaged roof claims. These professionals typically charge a percentage of the final settlement amount, ranging from 10% to 20%, which incentivizes them to secure maximum compensation for policyholders.

| Service Phase | Activities | Value Added |

|---|---|---|

| Initial | Damage evaluation, Documentation | Thorough assessment |

| Middle | Claim preparation, Policy review | Accurate filing |

| Final | Negotiation, Settlement | Higher compensation |

| Outcome | Payment processing | Maximized settlement |

Research shows that engaging public adjusters for complex claims or disputed cases can result in settlements up to 800% higher than claims handled without their expertise. Their extensive approach to insurance claims includes detailed damage evaluation, professional claim preparation, and skilled negotiation with insurance companies.

Public Adjusters Vs. The Insurance Company Adjuster

When homeowners face storm-related roof damage, the stark differences between public adjusters and insurance company adjusters become pivotal in determining claim outcomes. The key distinction lies in their allegiance and objectives during the claims process.

| Aspect | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Represents | Homeowner | Insurance Company |

| Primary Goal | Maximize Settlement | Control Costs |

| Fee Structure | Contingency Based | Company Salary |

| Expertise Focus | Policy Benefits | Company Guidelines |

| Risk Assessment | Thorough | Company Parameters |

Public adjusters serve as dedicated advocates, conducting detailed damage assessments while maneuvering through complex insurance policy terms. Their contingency-based fee structure aligns with successful claim outcomes, minimizing financial risk for homeowners. This arrangement, coupled with their specialized expertise, often results in higher settlements while providing stress alleviation throughout the claims process.

When to Contact Your Insurance Provider For Roof Storm Damage Replacements

Homeowners have two primary options when pursuing insurance claims for storm-damaged roofs: working directly with their insurance provider or enlisting the services of a public adjuster. Working directly with their insurance provider can streamline the homeowners insurance roof replacement process, allowing policyholders to communicate their damages and needs efficiently. However, enlisting the services of a public adjuster can provide homeowners with expert representation and advocacy, ensuring that they receive a fair settlement. Ultimately, the choice between these two options depends on the complexity of the claim and the homeowner’s comfort level with the insurance claims process.

Filing independently requires thorough documentation, prompt notification to the insurer, and direct communication with the insurance adjuster throughout the claims process.

Those who choose to work with a public adjuster benefit from professional expertise in claim documentation, negotiation with insurance companies, and maximized settlement potential, though this service typically costs a percentage of the final settlement.

If Using A Public Adjuster

Although homeowners can file insurance claims independently, engaging a public adjuster before contacting the insurance provider can greatly improve the claims process for storm-damaged roofs.

These professionals specialize in evaluating roof damage and ensuring extensive documentation of all storm-related issues, which is vital for maximizing insurance settlements for roof replacement.

Public adjusters serve as intermediaries between homeowners and insurance companies, providing expertise in properly documenting damages and traversing the claims process.

They meticulously assess storm damage, prepare detailed reports, and maintain records of all communications throughout the claim. Their involvement often leads to more thorough evaluations and potentially higher settlement amounts.

For ideal results, homeowners should engage a public adjuster promptly after discovering storm damage, as timely reporting remains essential for successful claims.

If Filing On Your Own

Filing a storm damage claim independently requires swift action and meticulous documentation to maximize the chances of approval. Homeowners should immediately contact their insurance provider and thoroughly document damage with clear photographs before initiating temporary repairs.

Understanding policy coverage limits and deductibles is vital for evaluating potential out-of-pocket expenses.

To strengthen the insurance claims process, obtain a professional assessment from a qualified roofing contractor who can provide detailed estimates for necessary repairs. This evaluation helps guarantee all damage is properly identified and documented.

Regular roof maintenance and inspections are important, as evidence of neglect could affect claim validity. Keep organized records of all communications, estimates, and documentation throughout the claims process to support your case for roofing replacement or repairs.

Filing Process For Storm Damaged Roof Replacement Claims Using A Public Adjuster

A public adjuster serves as a valuable advocate when filing roof damage claims by conducting extensive inspections and documenting all storm-related deterioration.

These licensed professionals review insurance policies to identify coverage benefits while professionally managing communications with insurance carriers throughout the claims process. Their expertise helps maximize claim settlements through detailed documentation, contractor estimates, and strategic negotiations with insurance adjusters.

- Performs thorough roof inspections to identify and photograph visible and hidden storm damage

- Reviews policy language to uncover applicable coverage benefits for roof replacement

- Coordinates professional contractor assessments and detailed repair estimates

- Handles all communication and negotiation with insurance carriers to optimize settlement outcomes

Public Adjuster Thoroughly Inspects & Documents Storm Damage To Roof

When storm damage occurs to a residential roof, engaging a public adjuster provides essential expertise in documenting and filing thorough insurance claims. Through extensive roof inspections, public adjusters identify and document all storm-related damage, guaranteeing no detail is overlooked that could affect claim outcomes.

| Inspection Phase | Documentation | Benefit |

|---|---|---|

| Initial Assessment | Visual Review | Identifies Visible Damage |

| Detailed Analysis | Photo Evidence | Supports Claim Validity |

| Policy Review | Written Report | Guarantees Coverage Match |

| Final Evaluation | Damage List | Maximizes Settlement |

Public adjusters leverage their understanding of insurance policies and claims processes to advocate for homeowners' interests. Their expertise in documenting damage through detailed photographs and reports strengthens the case for maximum coverage, greatly improving the likelihood of successful claims and fair settlements.

Public Adjuster Reviews Policy For Hidden Roofing Coverage & Helps Maximize Policy Benefits

Public adjusters expand their value beyond physical inspections by conducting thorough reviews of homeowners' insurance policies to uncover hidden coverage provisions for storm-damaged roofs. Their expertise helps maximize policy benefits while preventing claim denials due to documentation errors.

| Policy Review Elements | Benefits to Homeowner |

|---|---|

| Hidden Coverage Analysis | Identifies overlooked replacement provisions |

| Documentation Requirements | Prevents claim rejection due to missing evidence |

| Damage Assessment Protocol | Guarantees extensive damage reporting |

| Coverage Limitations | Clarifies policy restrictions and exceptions |

| Settlement Guidelines | Determines fair compensation parameters |

These professionals create detailed reports that justify full roof replacement costs when warranted, advocating for fair settlements that accurately reflect storm damage extent. Their systematic approach to policy interpretation and claims management greatly improves outcomes for homeowners seeking insurance coverage for roofing repairs.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Professional representation through a licensed public adjuster transforms the insurance claims process for storm-damaged roofs into a systematic and well-documented procedure. The adjuster manages communications with the insurance company, ensuring thorough documentation of property damage while advocating for the homeowner's interests.

- Conducts detailed property inspections to document all storm damage evidence

- Files extensive claims reports with supporting documentation and photographs

- Negotiates directly with insurance company adjusters to secure fair settlements

- Manages all communication throughout the claims process, reducing stress on homeowners

Public adjusters leverage their expertise to navigate complex insurance claims, ensuring that storm damage is properly assessed and documented.

Their professional representation helps homeowners receive appropriate compensation for roof repairs or replacement while maintaining compliance with policy requirements and deadlines.

Public Adjuster Gets Professional Assessments

Building upon the foundation of direct insurance company negotiations, thorough professional assessments serve as the cornerstone of successful storm damage claims. Public adjusters facilitate extensive evaluations that guarantee all damage is properly documented and valued.

- Professional assessments identify visible storm damage along with hidden issues that may affect long-term roof integrity.

- Detailed documentation includes measurement data, photographic evidence, and cost analysis for repair estimates.

- Technical evaluations help determine if damage exceeds coverage limits and supports negotiations with insurance carriers.

- Assessment reports outline specific repair costs and necessary replacements, strengthening the homeowner's position for a fair settlement.

This methodical approach to damage assessment enables public adjusters to advocate effectively for homeowners, often resulting in more favorable claim outcomes compared to self-managed claims.

Public Adjuster Gathers Supporting Evidence

Gathering compelling evidence forms the foundation of a successful storm damage claim, making a public adjuster's systematic approach invaluable. Through extensive documentation and detailed inspections, public adjusters create a thorough record of roof damage to support insurance claims.

| Documentation Type | Purpose |

|---|---|

| Photo Evidence | Captures visible storm damage and deterioration |

| Property Inventory | Details specific areas requiring roof replacement |

| Policy Analysis | Identifies applicable coverage specifics |

Public adjusters streamline the claims process by organizing evidence methodically, interpreting insurance policy language, and maintaining clear communication with insurers. Their expertise guarantees all damage is properly documented, from missing shingles to structural issues, maximizing potential settlements. This systematic approach to documentation greatly improves the likelihood of claim approval and expedites the roof replacement process.

Public Adjuster Submits Complete Claims Package

Once the evidence is collected, a public adjuster assembles and submits an extensive claims package to the insurance company for roof replacement coverage. This thorough submission includes detailed documentation of storm damage, meticulous inspection findings, and repair estimates to support the claim.

| Claims Package Components | Purpose |

|---|---|

| Damage Documentation | Provides visual evidence of storm impact |

| Inspection Reports | Details extent of structural damage |

| Repair Cost Estimates | Outlines expected replacement costs |

The public adjuster maintains direct communication with your insurance company throughout the process, helping navigate complex insurance policies and advocate for fair settlement. Their expertise in preparing and submitting all necessary paperwork, including supplemental claims for additional damages, greatly improves the likelihood of a successful claim approval.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

After initiating the claims process, a public adjuster diligently manages all communication and follow-up requirements with the insurance company. Their expertise guarantees compliance with deadlines while protecting homeowner rights throughout the claims journey.

Key responsibilities of the public adjuster include:

- Maintaining detailed records of all communications and documenting damages

- Following up on claim submissions and addressing insurance company inquiries

- Negotiating with insurance adjusters to maximize payout potential

- Guaranteeing adherence to insurance policies and procedural requirements

The public adjuster's involvement streamlines the process toward a favorable settlement, allowing homeowners to focus on recovery.

Their thorough understanding of insurance policies and claims procedures helps navigate complex requirements while advocating for the policyholder's interests throughout the settlement process.

Public Adjuster Enforces Policyholder's Rights, & Negotiates Higher & More Fair Settlement

Public adjusters leverage their expertise to enforce policyholders' rights and secure ideal settlements for storm-damaged roof claims.

Working on a contingency basis, they thoroughly review the insurance policy to guarantee all coverages are properly enforced during the claim process. Their extensive approach includes detailed documentation of storm damage and strategic negotiations with insurance companies to maximize settlement outcomes.

Key services provided by public adjusters include:

- Conducting detailed policy reviews to identify all applicable coverage

- Creating thorough documentation with photos and reports of storm damage

- Negotiating directly with insurance companies to secure higher settlements

- Protecting policyholder's rights throughout the entire claims process

This professional representation often results in markedly higher payouts compared to self-managed claims, while removing the burden from property owners.

Public Adjuster Speeds Up Claim Settlement Time

Filing storm-damaged roof replacement claims becomes considerably more efficient when working with a licensed public adjuster.

These professionals streamline the claims process by managing all communication with the insurance company and expertly documenting damages to support the claim.

Public adjusters help homeowners expedite claim settlements through:

- Thorough documentation of storm damage using industry-standard methods

- Direct handling of all correspondence and negotiations with insurance companies

- Professional compilation of evidence and damage assessment reports

- Strategic presentation of claim documentation to maximize settlement potential

Statistical evidence shows that homeowners who engage public adjusters typically receive higher settlements and faster resolutions compared to those handling claims independently.

Their expertise in maneuvering the complexities of insurance claims guarantees a more efficient path to roof replacement approval and compensation.

Common Reasons For Storm Damage Roof Replacement Claim Denials

Insurance companies frequently deny roof replacement claims due to evidence of pre-existing damage, insufficient maintenance documentation, or conditions classified as normal wear and tear rather than storm damage.

Claims can also face rejection when homeowners miss critical filing deadlines outlined in their policies or fail to report damage within specified time frames.

Coverage denials often stem from weather events specifically excluded in policy terms, making it essential for homeowners to thoroughly understand their insurance coverage and maintain detailed maintenance records.

Pre-Existing Roof Damage

When homeowners seek compensation for storm-related roof damage, pre-existing issues can greatly impact their insurance claims’ success. Insurance companies carefully evaluate maintenance records and prior conditions before approving roof replacement coverage. Gradual wear and tear, aging materials, and unresolved previous damage often lead to denied claims. Homeowners must ensure they maintain comprehensive documentation of their roof’s condition to support their claims effectively. In addition, understanding the various roof wind damage repairs options available can significantly influence both the assessment process and the likelihood of approval. By addressing minor issues promptly, homeowners can strengthen their position when facing insurance evaluations after a storm.

| Pre-Existing Condition | Impact on Claims | Required Action |

|---|---|---|

| Missing Shingles | Often Denied | Document Repairs |

| Visible Moss Growth | Coverage Limited | Regular Cleaning |

| Previous Leaks | Claim Reduction | Maintenance Proof |

Proper documentation of regular maintenance, timely repairs, and professional inspections strengthens a homeowner's position when filing storm damage claims. Insurance providers require clear distinction between new storm damage and pre-existing conditions, making detailed maintenance records essential for successful claims processing.

Poor Maintenance Records

Poor maintenance records stand as a significant obstacle for homeowners seeking approval for storm damage roof replacement claims. Insurance companies scrutinize documentation of regular roof inspections and upkeep when evaluating claims. Signs of water damage, moss buildup, or missing shingles often indicate neglect, leading to claim denials.

Homeowners insurance policies typically exclude coverage for gradual deterioration resulting from poor maintenance. Insurance companies expect property owners to demonstrate proactive care through detailed maintenance records and professional inspection reports.

This becomes particularly important for aging roofs, where insurers carefully examine the relationship between storm damage and pre-existing wear. To protect their investment and guarantee valid claims, homeowners should maintain thorough documentation of all roof maintenance activities, including dates, services performed, and contractor information.

Normal Wear & Tear

Throughout the insurance claims process, distinguishing between storm-related damage and normal wear and tear presents a critical challenge for homeowners seeking roof replacement coverage. Insurance companies carefully evaluate claims to determine whether damage resulted from specific storm events or gradual deterioration. Aging roofs and lack of maintenance often lead to claim denials.

| Condition | Insurance Response | Impact on Claims |

|---|---|---|

| Age-related deterioration | Not covered | Automatic denial |

| Storm damage | Covered if documented | Approved with evidence |

| Moss/algae growth | Not covered | Denial due to neglect |

| Missing shingles | Case-by-case basis | Requires investigation |

Regular maintenance inspections and proper documentation help homeowners maintain valid coverage and avoid claim denials. Understanding the difference between covered damage and normal wear guarantees realistic expectations when filing storm damage insurance claims.

Missed Filing Deadlines

Insurance companies frequently deny roof replacement claims because homeowners miss critical filing deadlines after storm damage occurs. Most policies require notification within 30 days of the incident, and failing to meet this timeline can result in automatic claim denials.

Additionally, insurance providers establish specific timelines for inspections and repairs that must be strictly followed.

To prevent missed filing deadlines, homeowners should thoroughly review their insurance policy details immediately after discovering storm damage.

Prompt action is essential: document the damage with photos, notify the insurance company without delay, and submit detailed claims with supporting evidence.

Understanding and adhering to policy-mandated deadlines for filing claims guarantees the best chance of approval and prevents unnecessary denials due to procedural oversights.

Non-Covered Weather Events

While meeting filing deadlines is essential, understanding which weather events qualify for coverage presents another significant challenge for homeowners. Insurance claims for storm damage often face denials when the events fall outside policy parameters. Understanding these non-covered weather events helps homeowners navigate the insurance process effectively.

| Weather Event | Coverage Status |

|---|---|

| Minor Wind | Generally Not Covered |

| Regular Rain | Not Covered |

| Severe Storms | Usually Covered |

| Hail Damage | Typically Covered |

| Age-Related Wear | Not Covered |

Insurance providers carefully assess whether roof damage stems from qualifying storm events or excluded causes. Regular maintenance documentation becomes vital, as insurers may deny claims for aging roofs or those showing signs of neglect. Homeowners should thoroughly review their policies to understand specific coverage limitations and maintain detailed records of all roof-related maintenance activities.

Insurance Claim Appeals Process

Public adjusters serve as valuable advocates when insurance companies deny storm damage roof replacement claims. These licensed professionals thoroughly examine denied claims, gather supporting evidence, and negotiate directly with insurance companies on behalf of homeowners. Their expertise in policy interpretation and claims documentation can greatly improve the chances of a successful appeal.

| How Public Adjusters Help | Benefits to Homeowners |

|---|---|

| Detailed damage assessment | Professional documentation |

| Policy coverage analysis | Clear understanding of rights |

| Evidence compilation | Stronger appeal case |

| Direct insurer negotiations | Reduced stress and time |

| Claims process management | Higher settlement potential |

How Public Adjusters Help With Denied Storm Damaged Roof Replacement Claims

When homeowners face denied storm damage roof claims, professional public adjusters serve as powerful advocates who can greatly improve the chances of a successful appeal. Their expertise in insurance policy interpretation and claim documentation considerably enhances settlement outcomes, with studies showing 20-50% higher payouts for claims handled by these professionals.

| Public Adjuster Services | Benefits to Homeowner |

|---|---|

| Policy Review | Identifies coverage gaps and opportunities |

| Damage Assessment | Documents all storm damage thoroughly |

| Claims Documentation | Guarantees complete evidence submission |

| Insurance Negotiations | Represents homeowner's interests professionally |

| Appeals Management | Handles paperwork and process coordination |

Public adjusters strengthen denied claims through detailed damage assessments, expert policy interpretation, and skilled negotiations with insurance companies. Their thorough understanding of the appeals process helps homeowners navigate complex claim requirements while maximizing settlement potential.

Choosing & Working With Trusted Storm Damage Contractors

Public adjusters maintain extensive networks of reputable storm damage contractors who consistently deliver quality roof replacements. Professional estimates from these vetted contractors provide detailed assessments of damage and necessary repairs while adhering to industry standards. A public adjuster's review of contractor estimates helps identify potential discrepancies and guarantees fair pricing for all replacement materials and labor costs.

| Contractor Selection Criteria | Key Considerations |

|---|---|

| Insurance Claim Experience | Verify track record handling storm damage claims |

| Licensing & Credentials | Current licenses, bonds, and insurance coverage |

| Cost Estimates | Detailed breakdown of materials and labor costs |

| Customer Reviews | Storm damage specific testimonials and ratings |

| Contract Documentation | Complete scope of work and timeline agreements |

Utilize Your Public Adjusters Extensive Professional Network

Through established networks of vetted contractors, a public adjuster can connect homeowners with trusted professionals who specialize in storm damage repairs. This network of qualified contractors understands insurance requirements and procedures, streamlining the roof replacement process while guaranteeing compliance with claim specifications.

Leveraging a public adjuster's professional network offers multiple advantages in storm damage situations. Contractors within these networks typically have extensive experience working with insurance claims processes, which can expedite repairs and increase the likelihood of successful claims.

Additionally, these established relationships help maintain fair pricing standards and guarantee repair quality meets industry benchmarks. The collaboration between public adjusters and their trusted contractors creates an efficient system that benefits homeowners by providing access to experienced professionals who understand both technical requirements and insurance documentation needs.

Getting Professional Roof Replacement Estimates

Selecting qualified contractors for professional roof replacement estimates requires careful consideration of several critical factors. To guarantee ideal results, homeowners should obtain multiple estimates from licensed and insured contractors experienced in storm damage claims. Evaluating contractors should include verification of references and past work quality.

| Selection Criteria | Contractor Requirements |

|---|---|

| Credentials | Licensed and insured status |

| Experience | Storm damage claims expertise |

| Documentation | Detailed written estimates |

| Track Record | Verifiable references |

| Insurance | Willingness to work with carriers |

A thorough evaluation process helps secure contractors who can effectively manage roof replacement projects while facilitating the insurance claims process. Quality contractors should provide itemized estimates covering labor, materials, and additional costs, guaranteeing transparency throughout the project and supporting fair settlement negotiations with insurance companies.

Let Your Public Adjuster Review Replacement Estimates To Ensure Contractor Honesty

Vigilance in the roof replacement process requires homeowners to engage public adjusters for thorough review of contractor estimates.