Is your roof telling you storm stories? Let's decode those weather-worn signals together with this essential inspection guide.

Think of your roof as a shield that just faced battle – it needs a proper health check after every storm. Before you grab that ladder, make sure you've got your safety gear ready and wait for Mother Nature to provide good lighting (yes, daylight is your best friend here).

What should you look for? Start with the obvious suspects: those sneaky missing shingles playing hide-and-seek, dimpled surfaces from hail's unwelcome dance, and any uninvited debris taking up residence. Inside your home, keep an eye out for ceiling stains or drips – they're like your roof's way of waving a red flag.

Walking the perimeter of your house (safely on the ground!) can reveal a lot about your roof's condition. Don't forget to check your gutters – they're like your roof's drainage system, and storm damage can turn them from helpful channels into troublesome obstacles. Those roof vents? They're the lungs of your attic, and storm damage can leave them gasping.

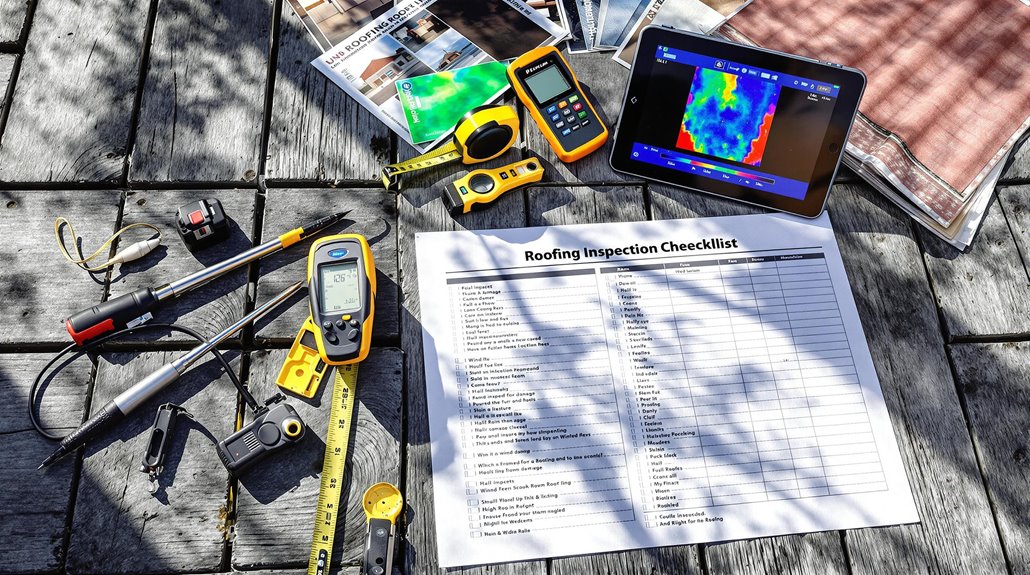

While DIY inspection is great for initial assessment, remember that professional roofers bring specialized tools like core sampling equipment and technical expertise to the table. If you're planning an insurance claim, you'll want their detailed documentation and timing expertise – it's like having a good lawyer in court, but for your roof!

Remember to act fast but smart – storms may be quick, but their aftermath requires thorough attention to detail.

Key Takeaways

Is Your Roof Storm-Ready? Your Ultimate Inspection Guide

Think of your roof as a shield-bearing warrior – it needs a thorough checkup after battling Mother Nature's fury. Let's walk through this together:

Ground-Level Detective Work

- Start your mission from terra firma – scan for displaced shingles dancing in the wind

- Look for telltale pockmarks (those pesky hail calling cards)

- Spot any unwanted gifts from the storm (branches, debris, or neighborhood trampolines)

Document Everything Like a Pro

- Grab your smartphone and become a damage paparazzi

- Track those dark clouds' tantrum with local weather reports

- Create a storm diary – date, time, and intensity matter for your insurance buddies

Indoor Warning Signals

- Playing "spot the spots"? Those ceiling stains are your roof's cry for help

- Follow your nose – musty attic smell means unwanted moisture

- Watch for paint bubbles doing the cha-cha on your ceiling

Gutter Health Check

- Are your gutters playing "hanging by a thread"?

- Check for nature's obstacle course (leaves, twigs, and storm debris)

- Ensure downspouts aren't performing interpretive dance moves

Ventilation Vital Signs

- Your roof needs to breathe – check those vents

- Look for blocked airways (think of it as your roof's respiratory system)

- Proper airflow prevents your attic from becoming a sauna

Essential Safety Precautions Before Storm Damage Inspections

Before conducting any post-storm roof inspection, safety protocols must be strictly followed to prevent accidents and injuries during the assessment process.

Inspectors must wait for daylight hours and clear weather conditions to guarantee optimal visibility.

A thorough site assessment is required to identify potential hazards like downed power lines or unstable tree limbs before proceeding.

Professional inspectors increasingly rely on drone surveillance for safer elevated assessments.

- Wear appropriate slip-resistant footwear and secure all inspection tools, including binoculars and cameras, to prevent dropping risks

- Test ladder stability on level ground and maintain a 75-degree angle placement, ensuring three points of contact during ascent

- Utilize proper fall protection equipment when accessing elevated areas and avoid inspection during wet or windy conditions

The methodical implementation of these safety measures creates a secure environment for exhaustive storm damage assessment while minimizing risk exposure.

Exterior Signs Of Storm Damage

Identifying exterior storm damage requires systematic visual examination of the entire roof surface and its components. Key indicators include missing shingles, particularly along edges and corners where wind damage commonly occurs. Hail damage manifests as circular dents or pockmarks, often accompanied by granule loss visible as dark spots. Wind-driven debris can create distinct impact zones and roof punctures. Certified roofing contractors should assess damage within the first few days to maximize insurance claim potential.

| Damage Type | Visual Indicators | Common Locations |

|---|---|---|

| Wind Damage | Lifted/curled shingles | Edges/corners |

| Hail Impact | Circular dents/granule loss | Field of roof |

| Debris Damage | Tears/punctures | Random patterns |

Inspectors should carefully assess flashing damage around roof penetrations, noting any separation or displacement. Examination of gutter debris, specifically accumulated granules, helps quantify the extent of shingle deterioration from storm impact.

Interior Warning Signs Of Storm & Water Damage

Detecting interior storm damage requires careful observation of telltale signs that manifest throughout the building's upper spaces. Key indicators of water infiltration include dark stains on ceiling surfaces, peeling paint, and structural deformation. Early detection of these warning signs helps prevent extensive damage. Working with public insurance adjusters can significantly increase damage claim settlements by up to 800% compared to unrepresented claims.

| Warning Sign | Potential Issue |

|---|---|

| Ceiling Stains | Active water leaks through damaged roofing |

| Paint Bubbling | Moisture penetration behind walls |

| Visible Mold | Chronic moisture exposure |

Professional inspectors examine interior spaces for these critical indicators while evaluating storm impact. The presence of daylight beams in attic areas signals compromised roofing integrity, while musty odors often indicate hidden moisture damage. Sagging or warped ceiling materials suggest serious structural concerns requiring immediate attention.

Critical Shingle Damage Assessment Points After A Storm

Storm-ravaged shingles exhibit distinct patterns of damage that require systematic evaluation during post-event inspections. When conducting a roof inspection, assessors must identify critical indicators of compromise that affect waterproofing integrity. Common signs include granule displacement, wind damage patterns, and hail impact marks.

| Damage Type | Assessment Criteria |

|---|---|

| Granule Loss | Dark patches, bare spots on surface |

| Wind Effects | Curled edges, broken seals, loose nails |

| Hail Impact | Circular depressions with bruising |

| Delamination | Layer separation, visible gaps |

| Underlayment Exposure | Missing or torn shingle sections |

Thorough evaluation of these damage points helps determine the extent of storm impact and necessary repairs. Inspectors should document areas where compromised shingles may lead to leaks, focusing particularly on zones showing multiple types of deterioration that could accelerate water infiltration risks. Maintaining detailed documentation trails throughout the inspection process is crucial for successfully filing insurance claims and obtaining coverage approval.

Storm Damaged Gutter & Drainage System Evaluation

While shingle damage assessment provides key indicators of roof integrity, a thorough inspection must extend to the gutter and drainage systems that protect the structure's foundation. Storm impact often compromises gutter functionality through separation from fascia boards, bent sections, and damaged brackets. Professional evaluation requires systematic examination of critical components and potential failure points.

| Inspection Area | Assessment Points |

|---|---|

| Connection Points | Fascia attachment, bracket integrity |

| Water Flow | Proper slope, downspout function |

| Physical Damage | Dents, cracks, separation at seams |

| Debris Impact | Clogging, blockages, overflow signs |

Inspectors must verify drainage paths and splash block positioning while checking for soil erosion patterns that indicate compromised water dispersal. Particular attention should focus on seam integrity, downspout connections, and evidence of overflow that could affect foundation stability. Temporary support brackets may be required to stabilize compromised gutter sections during the inspection and repair process.

Storm Damaged Flashing & Joint Vulnerability Checks

Professional assessment of flashing and joint vulnerabilities represents a critical component of post-storm roof evaluation. A professional roofing contractor must systematically inspect all flashing components, particularly at valley intersections where high winds commonly compromise watertight seals. Storm damage often manifests through separated metal sections and deteriorated sealants, leading to leaks and water spots in the underlying structure.

| Area | Vulnerability | Inspection Focus |

|---|---|---|

| Valleys | Wind uplift | Joint separation |

| Chimneys | Seal failure | Top/base connection |

| Wall joints | Step flashing | Overlap integrity |

| Vents | Metal deformation | Perimeter seals |

Critical inspection points include vertical flashing around roofing accessories, examining both upper and lower sections where wind-driven rain can penetrate. Visible damage to step flashing requires individual segment verification to guarantee proper overlap patterns remain intact and protect your home from water infiltration. Proper assessment of roof pitch factors can increase replacement costs by 10-30% when addressing storm-damaged flashing.

Ventilation Components & Impact Areas From Storm Damage

Building upon proper flashing inspection, a thorough examination of ventilation components reveals distinct storm impact patterns that require specific attention. High winds and hail frequently compromise roof vents, exhaust fans, and turbines, creating vulnerabilities in the roof deck. Inspectors must systematically evaluate ridge vents, soffit vents, and gable vents for storm-related damage that could impair attic ventilation and lead to moisture problems.

| Component Type | Critical Damage Indicators |

|---|---|

| Ridge Vents | Denting, separation, seal breaks |

| Soffit Vents | Compression, blockage, water stains |

| Turbines | Bent components, seized rotation |

| Exhaust Fans | Loose housings, damaged covers |

Storm-driven debris can obstruct ventilation openings, while lightning strikes may melt or warp components. Proper airflow assessment guarantees early detection of compromised ventilation systems that could lead to extensive moisture damage. When damage affects less than 30% of the ventilation system, repairs can often be made without requiring complete roof replacement.

Professional Storm Damage Assessment Guidelines

To guarantee accurate assessment of storm-related roof damage, certified inspectors must follow standardized evaluation protocols that encompass detailed documentation and systematic analysis procedures. Professional roofing contractors utilize an exhaustive roof storm damage checklist when evaluating visible signs of significant damage around the perimeter. This safeguards proper documentation for insurance providers when property owners need to properly file a claim. Working with public insurance adjusters can increase settlement amounts by up to 800% compared to filing claims independently.

| Assessment Area | Inspection Focus | Documentation Required |

|---|---|---|

| Exterior Surface | Shingle granules, strong winds impact | Photos, measurements |

| Structural Elements | Load-bearing capacity, decking | Core samples, diagrams |

| Water Infiltration | Flashing, seals, drainage | Moisture readings, maps |

Core sampling and detailed photography supplement visual inspections, allowing assessors to differentiate between pre-existing conditions and new storm damage while maintaining rigorous documentation standards.

Homeonwers Insurance Claim Process For Storm Damage Claims

Insurance adjusters represent the financial interests of their employer rather than the homeowner during storm damage claims. A professional and documented approach when interacting with adjusters helps protect the homeowner's interests and supports maximum claim recovery. Maintaining detailed records, photographs, and contractor assessments provides critical leverage during adjustment negotiations. Initial claim reviews typically require 10 to 30 days for proper acknowledgment and processing.

| Adjuster Interaction Strategy | Purpose | Homeowner Action |

|---|---|---|

| Document all communications | Create paper trail | Save emails, record calls |

| Present organized evidence | Support damage claims | Compile photos, reports |

| Challenge low assessments | Maximize settlement | Get independent estimates |

Dealing With Insurance Company Adjusters: No, They Are NOT On Your Side

Many homeowners mistakenly assume insurance adjusters work to maximize their storm damage claims, when adjusters actually serve the financial interests of insurance companies.

Before the adjuster arrives to assess storm damage to your roof and home, hire a professional roofing contractor to document all damage independently.

Key strategies when dealing with insurance adjusters:

- Document all unseen damage and missing shingles through detailed photos before the adjuster's walk around inspection

- Avoid signing any paperwork from repair companies until after thoroughly reviewing with your contractor

- Request a second inspection if the initial assessment seems too good to be true or inadequate

This methodical approach helps guarantee proper compensation for legitimate storm damage while protecting homeowners from potentially unfavorable claim settlements.

Considering that insurance adjusters focus on minimizing payouts, homeowners may benefit from hiring a public adjuster who advocates specifically for policyholder interests.

Getting Help From A Public Adjuster: Your Advocate & Ally

Public insurance adjusters serve as dedicated advocates who represent homeowners' interests during storm damage claims, unlike insurance company adjusters who work for the insurer. Studies demonstrate that utilizing a public adjuster can increase settlement amounts by up to 800% compared to handling claims independently. Professional public adjusters typically charge 10-20% of the final settlement while providing complete damage evaluation, documentation, negotiation, and settlement services.

| Public Adjuster Services | Key Benefits |

|---|---|

| Thorough Damage Assessment | Maximum Claim Recovery |

| Expert Policy Analysis | Reduced Stress & Time |

| Complete Documentation | Enhanced Settlement Odds |

| Strategic Negotiation | Professional Advocacy |

The Role Of Public Claims Adjusters In Storm Damage Home Insurance Claims

When dealing with complex storm damage insurance claims, licensed public adjusters serve as invaluable advocates who work exclusively on behalf of homeowners to maximize their claim settlements. These professionals thoroughly check your roof and home after a storm, documenting damage to parts of your roof, patios and decks while walking around to indicate roof vulnerabilities that hail can cause unseen.

| Service Aspect | Public Adjuster Role |

|---|---|

| Documentation | Detailed damage assessment reports |

| Policy Analysis | Expert coverage interpretation |

| Negotiation | Direct insurance company liaison |

Unlike insurance company adjusters, public adjusters typically charge 5-15% of the final settlement. Research demonstrates their involvement often results in substantially higher claim settlements, making their expertise valuable when significant storm damage requires calling your homeowners insurance for compensation.

Benefits Of Using A Public Adjuster For Storm Damage Home Insurance Claims

Securing professional representation through a licensed public adjuster can substantially enhance the outcome of storm damage insurance claims. When severe weather conditions wreak havoc on homes across the United States, these specialists meticulously document everything from broken glass to missing fence posts. Their expertise guarantees no damage goes unnoticed, from loose weather-stripping to damaged light fixtures and fallen tree limbs.

| Benefit | Impact | Value |

|---|---|---|

| Expert Documentation | Thorough Analysis | 30-40% Higher Claims |

| Policy Knowledge | Maximized Coverage | No Overlooked Damages |

| Direct Negotiation | Stronger Position | Better Settlements |

| Claims Management | Streamlined Process | Faster Resolution |

While it may sound too good to be true, public adjusters don't offer discounts or deals – they work on contingency, earning a percentage of the final settlement while consistently delivering superior results.

How Are Public Insurance Adjusters Paid & What Are Their Fees?

Understanding the fee structure of public insurance adjusters is essential for property owners contemplating professional claim assistance. These licensed professionals typically charge a percentage-based fee ranging from 10% to 20% of the final settlement amount, which guarantees their interests align with maximizing claim outcomes.

| Fee Structure | Details |

|---|---|

| Standard Range | 10-20% of settlement |

| Payment Timing | Upon claim settlement |

| Value Added | Up to 800% higher settlements |

Research demonstrates the cost-effectiveness of engaging public adjusters, with studies showing substantially higher settlement amounts compared to unrepresented claims. The Landmak OPPAGA Study revealed settlements up to 800% higher when utilizing public adjusters' services. This compensation model incentivizes thorough documentation, effective negotiation, and maximum claim outcomes, making their services a strategic investment for property owners facing complex storm damage claims.

Public Adjusters Vs. The Insurance Company Adjuster

The fundamental distinction between public adjusters and insurance company adjusters lies in their professional allegiance and operational objectives. Public adjusters work independently as policyholder advocates, conducting thorough inspections to maximize legitimate claim values. They typically charge 5-15% of the final settlement while providing expertise in policy interpretation, documentation, and negotiation.

| Aspect | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Represents | Policyholder | Insurance Company |

| Compensation | % of Settlement | Salary from Insurer |

| Objective | Maximum Claim Value | Control Claim Costs |

| Inspection Focus | Thorough Documentation | Basic Assessment |

Licensed public adjusters maintain professional liability insurance and state certifications, ensuring qualified representation during complex claims processes. Their thorough approach to storm damage assessment often results in substantially higher settlement amounts compared to policyholder-managed claims.

When to Contact Your Insurance Provider For Storm Damage

Property owners have two primary options when contacting insurance providers about storm damage: working directly with the insurance company or enlisting a public adjuster's expertise.

Filing a claim independently requires thorough documentation of all visible damage, precise timeline tracking, and direct communication with insurance representatives throughout the process.

Public adjusters serve as professional advocates who handle claim documentation, damage assessment, and insurer negotiations on the property owner's behalf while working to maximize coverage benefits.

If Using A Public Adjuster

When storm damage occurs, homeowners should contact both their insurance provider and a qualified public adjuster within 24-72 hours of discovering roof damage. Public adjusters become particularly valuable when damage estimates exceed $10,000 or involve complex structural issues requiring expert evaluation. Recognizing the storm damage roof signs early can significantly impact the claim process and the overall recovery experience. Homeowners should carefully document any visible damage, such as missing shingles, leaks, or sagging areas, as this evidence will be crucial for both the insurance claim and the adjuster’s assessment. By acting quickly and enlisting the help of experienced professionals, homeowners can ensure they receive fair compensation for the repairs needed to restore their property.

These professionals typically charge 5-15% of the final settlement amount and serve as intermediaries during claim negotiations.

Before initiating temporary repairs, homeowners must document all damage through detailed photographs and videos, allowing the public adjuster to properly assess the situation. The adjuster's expertise proves essential in preventing evidence deterioration and ensuring thorough documentation of storm impacts. They can effectively dispute claim denials and negotiate with insurance companies while maintaining compliance with policy-specified timeframes and reporting requirements.

If Filing On Your Own

As severe weather events pass through an area, homeowners should promptly conduct a preliminary assessment of their roof's condition from ground level to identify potential storm damage.

When visible damage is detected, such as missing shingles, hail impact marks, or water infiltration, property owners must contact their insurance provider immediately.

Documentation is essential – thorough photos and videos of all damaged areas should be captured before filing. This includes detailed close-ups and wide-angle shots showing the full scope of impact.

Claims must be filed within the policy's stipulated timeframe, typically 30-60 days post-storm.

Supporting evidence, including local weather reports and emergency declarations, should accompany the claim submission.

While awaiting insurance response, temporary protection measures must be implemented for severely damaged areas to prevent additional deterioration.

Filing Process For Storm Damage Claims Using A Public Adjuster

A licensed public adjuster serves as an invaluable advocate during the storm damage claims process by thoroughly documenting all visible and hidden roof damage through extensive inspections and professional assessments.

The adjuster conducts a detailed review of the insurance policy to identify all applicable coverages while gathering supporting evidence like weather data, photos, contractor estimates, and expert reports.

Working directly with the insurance company, the public adjuster handles all negotiations and paperwork to guarantee maximum claim settlement based on properly documented damages.

- Maintains detailed documentation including photos, videos, measurements, and written descriptions of all storm-related roof damage

- Identifies coverage provisions, exclusions, and endorsements that affect claim value

- Coordinates with roofing specialists and engineers to validate damage assessments and repair estimates

Public Adjuster Thoroughly Inspects & Documents Storm Damage

Professional public adjusters serve as critical advocates during storm damage claims by conducting systematic roof inspections and managing the entire insurance filing process. Their exhaustive approach incorporates detailed documentation through photographs, measurements, and written assessments of all visible storm impacts.

| Inspection Component | Documentation Required |

|---|---|

| Exterior Assessment | Photos of damaged shingles, flashing, vents |

| Interior Evaluation | Evidence of water infiltration, structural issues |

| Cost Analysis | Current material/labor estimates, repair scope |

The adjuster creates an itemized inventory while gathering supporting weather data to establish causation. Through methodical documentation and expert analysis, they develop a thorough claim file that validates coverage under the policy terms. Their systematic process guarantees proper valuation of damages while managing all communications with insurance carriers throughout settlement negotiations.

Public Adjuster Reviews Policy For Hidden Roofing Coverage & Helps Maximize Policy Benefits

Building upon thorough documentation practices, public adjusters conduct exhaustive insurance policy reviews to uncover hidden coverage provisions that many policyholders might miss. Their specialized knowledge of insurance terminology and coverage clauses enables complete claim documentation for both direct and consequential damages.

| Claims Process | Public Adjuster Benefits |

|---|---|

| Policy Review | Identifies hidden coverage provisions |

| Documentation | Systematically records all damage evidence |

| Communication | Manages all carrier interactions |

| Negotiation | Advocates for maximum settlement value |

| Settlement | Secures comprehensive compensation |

Public adjusters streamline the claims process by managing all carrier communications while applying their expertise to identify additional coverage for indirect damages such as water intrusion and structural stress. Their systematic approach to policy analysis and damage documentation typically results in more favorable settlement outcomes compared to policyholder-filed claims.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Once engaged by a policyholder, licensed public adjusters initiate direct communication with insurance carriers to manage all aspects of the storm damage claim process.

Working for a fee of 5-15% of the final settlement, these professionals leverage their expertise to maximize compensation for covered storm damage while handling all paperwork and negotiations.

Key responsibilities include:

- Conducting thorough property inspections and documenting all storm-related damage through detailed evidence gathering

- Reviewing policy language, coverage limitations, and exclusions to guarantee valid claims receive proper consideration

- Presenting exhaustive claim documentation to insurance carriers and negotiating settlement terms to prevent underpayment

Their involvement typically results in higher settlement amounts compared to policyholder-filed claims due to their understanding of complex policy terms and valuation methods.

Public Adjuster Gets Professional Assessments

Licensed public adjusters systematically gather expert assessments from qualified contractors, engineers, and other building specialists to thoroughly document storm-related property damage.

These professionals conduct extensive inspections and provide detailed reports that strengthen insurance claims.

- Roofing contractors evaluate shingle damage, flashing integrity, and structural components while documenting specific areas requiring repair or replacement

- Structural engineers assess load-bearing elements, potential weakening of roof supports, and verify building code compliance requirements

- Licensed building inspectors examine ventilation systems, drainage components, and interior damage patterns to establish storm impact causation

The public adjuster compiles these professional evaluations into a complete damage assessment package that includes repair cost estimates, photographic evidence, and technical specifications.

This documentation helps validate claim amounts and expedite the settlement process.

Public Adjuster Gathers Supporting Evidence

Professional claim documentation begins with a public adjuster's systematic collection of storm damage evidence. Through detailed photography, videography, and physical measurements, adjusters create complete records of all visible roof damage. Weather data and radar imagery are obtained to establish direct links between documented damage and specific storm events.

| Evidence Type | Documentation Method |

|---|---|

| Visual Damage | Photos & Videos |

| Structural Impact | Measurements & Diagrams |

| Weather Events | Radar & Storm Reports |

| Physical Samples | Damaged Materials |

The adjuster compiles all findings into detailed written reports that outline damage extent, repair costs, and policy coverage validation. Physical samples of damaged roofing materials may be preserved as tangible evidence to support claim legitimacy. This systematic approach guarantees thorough documentation of all storm-related roof damage for insurance processing.

Public Adjuster Submits Complete Claims Package

After gathering exhaustive evidence, a public adjuster assembles the complete claims package for submission to the insurance company. The package includes extensive documentation, line-item estimates using industry-standard pricing software, and meteorological data confirming storm conditions during the loss event. A formal demand letter outlines coverage arguments and relevant policy provisions.

| Claims Package Components | Supporting Documentation |

|---|---|

| Proof of Loss Statement | Photos and Videos |

| Detailed Cost Estimates | Maintenance Records |

| Demand Letter | Weather Data Reports |

The public adjuster then manages all subsequent communications with the insurer's representatives, negotiating settlement terms on the policyholder's behalf while ensuring adherence to policy provisions and coverage limits. This professional representation helps maximize claim recovery while maintaining compliance with insurance requirements.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Timely communication and consistent follow-up represent critical responsibilities of the public adjuster during the claims process.

The adjuster maintains strict adherence to insurance company deadlines while managing all correspondence and documentation requirements throughout the claim's lifecycle.

Professional public adjusters systematically handle time-sensitive obligations including:

- Monitoring and responding to all insurance carrier requests for additional documentation, estimates, or clarification within specified timeframes

- Tracking and meeting critical filing deadlines for supplemental claims, appeals, or proof of loss requirements

- Maintaining detailed records of all communications, submissions, and response times to guarantee compliance with policy terms

This methodical approach helps prevent claim delays or denials due to missed deadlines while allowing property owners to focus on storm damage repairs rather than administrative processes.

Public Adjuster Enforces Policyholder's Rights, & Negotiates Higher & More Fair Settlement

By engaging a licensed public adjuster, property owners gain a dedicated advocate who enforces their policy rights and negotiates substantially higher settlements for storm damage claims.

Public adjusters work exclusively for policyholders, typically securing 20-40% higher claim settlements through specialized expertise in policy interpretation and damage assessment.

Key advantages of public adjuster representation include:

- Thorough documentation of both obvious and hidden storm damages through detailed assessments, photographs, and expert analysis

- Strategic negotiation with insurance carriers based on thorough policy analysis and professional damage estimates

- Contingency-based compensation (usually 5-15% of settlement), guaranteeing aligned interests in maximizing claim recovery

This specialized advocacy helps safeguard fair compensation for all covered storm damages while relieving property owners of complex claim management responsibilities.

Public Adjuster Speeds Up Claim Settlement Time

Professional representation through a licensed public adjuster substantially accelerates the storm damage claims process while maximizing settlement outcomes.

Public adjusters streamline settlements through meticulous documentation, expert policy interpretation, and focused negotiations, reducing average resolution times from 6-12 months to 2-4 months.

Key advantages of public adjuster representation include:

- Independent documentation and detailed repair estimates that expedite insurance review

- Expert handling of all insurer communications, eliminating back-and-forth delays

- Professional claim preparation that prevents common filing mistakes and rejection risks

Their specialized expertise typically results in settlements 40-80% larger than direct filing with insurance companies.

Emergency Temporary Protection Measures

After identifying storm damage through inspection, implementing immediate protective measures becomes critical to prevent further deterioration of the roof structure. Professional assessment guides the application of heavy-duty tarps secured with proper fasteners over compromised areas to establish temporary waterproofing.

Essential protection measures include installing plywood panels over vulnerable openings and creating temporary water diversion systems using properly anchored plastic sheeting.

Careful removal of loose debris prevents secondary damage while maintaining safety protocols through appropriate protective equipment.

Small punctures or tears require emergency patching with roofing cement and reinforcement materials applied according to manufacturer specifications. These interim solutions help maintain structural integrity and minimize interior damage until permanent repairs can be completed by qualified contractors.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) operates as a nationwide alliance of state-licensed public adjusters who undergo rigorous vetting and maintain strict professional standards. With coverage spanning over 40 states and expertise in more than 30 claim types, PCAN member adjusters specialize in both residential and commercial property damage insurance claims.

PCAN serves as a vital intermediary, connecting policyholders with qualified public adjusters who have demonstrated excellence in their field through an intensive application and interview process.

The network maintains quality assurance through mandatory annual audits of licenses and complaint records. All member adjusters must consistently demonstrate the highest levels of ethics, morals, and professionalism to retain their network affiliation and continue serving policyholders requiring expert claim assistance.

Frequently Asked Questions

How to Check for Roof Damage After a Storm?

Inspectors should examine shingles, gutters, flashing, and vents from ground level, then assess attic spaces for water penetration. Documentation through photographs supports identification of structural damage and insurance claims.

How Do Home Inspectors Check for Roof Damage?

Professional inspectors conduct visual assessments, utilize moisture meters, infrared cameras, and specialized tools to examine shingles, flashing, ventilation, structural integrity, and water damage indicators from exterior and interior vantage points.

What Does a Storm Damage Roof Inspector Do?

Like a detective piecing together evidence, a storm damage roof inspector systematically examines exterior and interior components, documenting shingle damage, water infiltration, structural integrity, and ventilation issues for insurance claims.

What Is Checked During a Roof Inspection?

Inspectors examine shingles, gutters, flashing, and ventilation components for damage or deterioration. Assessment includes checking for missing materials, granule loss, compromised connections, water penetration signs, and structural vulnerabilities.