Ever wondered how to turn a nightmare slab leak scenario into a winning insurance claim? Let's talk about your secret weapon: public adjusters. Think of them as your personal insurance detectives, fighting to get you every dollar you deserve.

These claims pros don't just file paperwork – they're like CSI investigators for your home damage, uncovering hidden issues that could boost your settlement significantly. Just imagine having a skilled translator who speaks fluent "insurance-ese" working on your behalf!

Want to know the best part? You don't pay a dime upfront. Public adjusters typically charge 10-20% of your final settlement, but they often help secure payouts that far exceed what homeowners get on their own. It's like having a seasoned poker player represent you at the insurance negotiation table.

While you focus on getting your life back to normal, these experts handle the heavy lifting – from documenting every crack and crevice to battling through policy fine print. They know exactly what evidence to gather, which damages to highlight, and how to present your case in a way insurance companies can't ignore.

Think of them as your personal claim architects, building a rock-solid case that stands up to even the toughest insurance scrutiny. Ready to transform your slab leak headache into a fair settlement? A public adjuster might just be your ticket to maximum compensation.

Key Takeaways

Dealing with a slab leak? Don't let insurance companies give you the drip-drip-drip treatment! Let's dive into how public adjusters can turn your water damage headache into a winning claim.

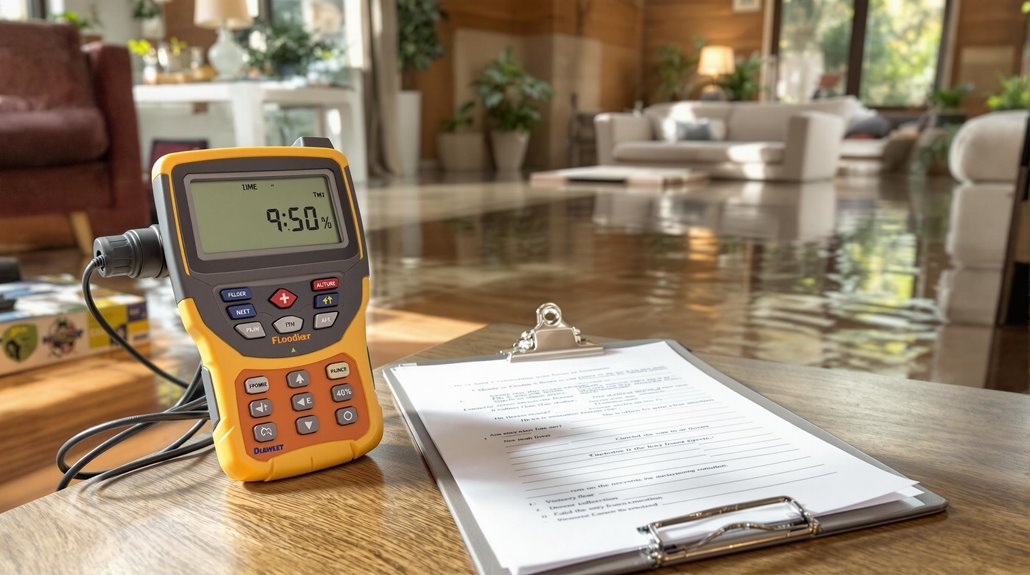

Think of public claims adjusters as your personal insurance detectives – they know exactly where to look and what to document. Using high-tech tools like acoustic sensors and thermal imaging (think CSI for your home), they uncover hidden damage that could boost your settlement by 3-4 times the initial offer.

Why stress over insurance jargon when you can have a pro in your corner? These claim experts speak "insurance-ese" fluently and handle all the paperwork maze while you focus on getting your life back to normal. The best part? You won't pay a dime upfront – they only earn when you win (typically 10-20% of the settlement).

Here's the real game-changer: Most homeowners miss crucial evidence between sudden pipe bursts and slow leaks. Your public adjuster knows this distinction is worth its weight in gold for claim approval. They'll build your case like a master storyteller, connecting every water drop to eligible coverage.

Got foundation cracks or warped floors? These aren't just cosmetic issues – they're valuable claim components that need proper documentation. Your adjuster will create a watertight case (pun intended!) that insurance companies can't easily dismiss.

Remember: Time is of the essence with water damage. The sooner you bring in a public adjuster, the stronger your position for maximum compensation. Don't let your slab leak claim wash away potential compensation – get professional backup on your side!

Chapter 1: Understanding Slab Leak Damage

Is your home trying to tell you something? Those mysterious wet spots and skyrocketing water bills might be warning signs of a sneaky slab leak wreaking havoc under your feet.

Think of your home's foundation like a giant concrete sandwich – with water pipes running through it. When these pipes decide to misbehave (thanks to old age, cranky water pressure, or Mother Nature's ground-shifting dance), they can turn your peaceful home into an unwanted water park.

What's really keeping plumbers up at night? It's how these hidden leaks play dirty:

- They quietly munch away at your foundation like termites at a wood buffet.

- Turn your walls and floors into a funhouse of cracks and warps.

- Create five-star hotels for nasty mold colonies.

- Make your water meter spin faster than a DJ's turntable.

The scariest part? By the time you spot visible damage, that tiny drip under your slab might've already thrown a full-blown underground pool party.

Left unchecked, these sneaky leaks can transform from a minor plumbing hiccup into a full-blown structural nightmare that'll have your wallet begging for mercy.

Want to stay ahead of the game? Keep your eyes peeled for warm spots on your floor, the sound of running water when everything's turned off, or that unexplained spike in your water bill.

Your home (and your bank account) will thank you later!

Professional plumbers can detect these troublesome leaks using acoustic detection devices and infrared cameras, usually within 1-24 hours.

Common Causes Of Slab Leak Damage

Ever wonder what's causing those mysterious wet spots on your floor? Let's dive into the hidden world of slab leaks – those sneaky plumbing problems that can turn your foundation into a water park (and not the fun kind!).

The Silent Troublemakers Behind Slab Leaks

Think of your home's plumbing like your body's circulatory system – when something goes wrong, you'll definitely feel it.

These underground menaces typically stem from three main culprits:

🔍 The Rust Monster: Corrosion

- Slowly eats away at your pipes like a hungry pac-man

- Especially loves older copper pipes

- Usually strikes after 20-30 years of service

⚡ The Pressure Cooker: Water Pressure Issues

- Too much pressure makes pipes scream for mercy

- Creates weak spots that eventually burst

- Often overlooked until it's too late

🏗️ The Foundation Fiasco: Construction Problems

- Poor initial installation (oops!)

- Pipes rubbing against concrete

- Shifting soil causing pipe stress

Smart Prevention Tips:

- Schedule annual plumbing check-ups (like a doctor's visit for your pipes)

- Install a pressure regulator to keep things flowing smoothly

- Monitor your water bill for unexpected spikes

When these issues surface, don't wait! Early detection can save thousands in repairs and protect your home's foundation.

Remember, your insurance may cover slab leak damage, but documentation is key – take photos, keep records, and consider working with a public adjuster who knows these claims inside and out.

Want to protect your home? Start with a professional inspection and catch these water warriors before they wage war on your wallet!

Engaging public adjuster services can significantly increase your chances of receiving a higher settlement while reducing the stress of navigating complex insurance claims.

The Impact Of Slab Leak Damage On Your Home

Dealing with a Slab Leak? Here's What Your Home Is Telling You

Ever wondered what's happening beneath your feet when a slab leak strikes? Think of your home's foundation as the body's circulatory system – when a pipe bursts under that concrete slab, it's like a silent troublemaker wreaking havoc from below.

Standard homeowners insurance typically covers sudden pipe bursts and resulting water damage.

The Ripple Effect of Slab Leaks

Just as one drop creates expanding circles in a pond, slab leak damage spreads through your home in multiple ways:

| Warning Sign | What's Really Happening | Smart Homeowner Move |

|---|---|---|

| Cracking Foundation | Your home's backbone weakens | Get immediate structural inspection |

| Buckling Floors | Water's pushing up your surfaces | Document with photos and videos |

| Musty Odors | Hidden mold party in progress | Schedule air quality testing |

| Sky-High Water Bills | Your money's literally going down the drain | Track usage patterns for claims |

| Dropping Home Value | Your investment's taking a hit | Request professional appraisal |

Don't Go It Alone

Think of public adjusters as your home's financial doctors – they speak the complex language of insurance claims. They're your secret weapon in translating water damage into fair compensation, making sure every drip and crack gets the attention it deserves.

Remember, what you see on the surface is just the tip of the iceberg. That innocent-looking wet spot might be telling a bigger story about what's happening beneath your feet. Ready to take action? Your home's health depends on your next move.

#SlabLeakRepair #HomeRepair #WaterDamage #InsuranceClaims #PropertyMaintenance

Chapter 2: How Much Will Professional Slab Leak Damage Restoration Cost?

Worried About Slab Leak Restoration Costs? Let's Break It Down!

Ever wondered what happens to your wallet when water decides to play hide-and-seek under your foundation? Slab leak restoration isn't just about fixing a pipe – it's like solving a puzzle where each piece comes with its own price tag.

The total cost typically lands between $3,300 and $8,000, but don't let that number shock you just yet. Think of it as layers of an onion, with each layer representing different services you might need:

First Layer: Finding the Culprit

Professional leak detection ($300-$1,000) uses high-tech equipment to pinpoint exactly where that sneaky water is escaping.

Second Layer: The Fix

Initial repairs ($2,000-$4,000) tackle the root problem, whether it's a corroded pipe or shifting foundation pressure.

Third Layer: Damage Control

- Water damage restoration ($1,000-$3,000): Drying out your space and preventing further issues

- Mold remediation ($500-$6,000): Tackling any unwanted fuzzy guests

- Structural repairs ($1,500-$10,000): Getting your foundation back to rock-solid condition

What impacts your final bill? Think of it like ordering a custom meal – your choices and circumstances matter:

- Emergency service needs (those midnight calls cost extra!)

- Local labor rates

- Material quality and availability

- Hidden damage extent (sometimes what lies beneath isn't pretty)

Pro tip: Check your insurance coverage before diving in – many policies cover slab leak damage, potentially saving you thousands!

A single 1/8-inch pipe crack can release 250 gallons of water daily, making immediate repair essential.

Typical Slab Leak Damage Restoration Costs

Dealing with a slab leak? Let's Break Down the Real Costs

Think of a slab leak as an unwelcome houseguest that's secretly causing chaos beneath your feet. The financial toll? It's not exactly pocket change, but understanding the costs can help you prepare for what's ahead.

The Detective Work

First things first – you'll need a professional leak detection service. Like a medical diagnosis, this crucial step typically runs between $150 to $500. It's the foundation for everything that follows.

The Main Event: Restoration Costs

Basic restoration work usually falls in the $2,000 to $4,000 range, but that's just scratching the surface.

When you factor in excavation needs (up to $5,000), water damage remediation ($1,500-$3,000), and potential foundation repairs ($300-$1,000), your wallet might feel a bit lighter.

Smart Insurance Strategy

Why leave money on the table? Public adjusters are like your personal financial advocates, diving deep into insurance policies to uncover every penny you're entitled to.

They understand the intricate dance between water damage, structural issues, and coverage limits.

Did you know? Most homeowners miss out on legitimate claims simply because they don't know what to look for.

Your insurance policy might cover more than you think – from temporary housing costs to long-term structural repairs.

With moisture detection equipment, public adjusters can identify damage that extends up to three times beyond what's visible to the naked eye.

Pro Tips for Managing Costs:

- Document everything (photos, videos, receipts)

- Get multiple restoration quotes

- Consider preventive measures for future protection

- Don't delay repairs – small leaks become big problems

Remember: While these numbers might seem daunting, investing in proper repairs now prevents more expensive headaches down the road.

Think of it as giving your home's foundation the care it deserves.

Emergency Service Price Factors

Ever wondered what makes emergency service prices skyrocket? Let's dive into the world of slab leak restoration costs and break down those head-scratching factors that can impact your wallet.

Think of emergency services like a 24/7 superhero team – they're ready to swoop in at 3 AM or during your holiday festivities, but that cape comes with a premium price tag. Just like a late-night pizza delivery costs more, emergency restoration services charge higher rates during these unconventional hours.

Your home's unique situation plays a starring role in the cost equation. Picture your property as a puzzle – the more complex the water damage scenario, the more pieces need fitting together. Hidden leaks behind walls, tricky access points, or unwanted guests like mold can turn a simple fix into a comprehensive restoration project.

Insurance can be your financial lifeline, but it's not always straightforward. While sudden burst pipes might have you covered, that slow drip you've ignored could leave you high and dry. That's where public adjusters enter the scene – think of them as your insurance translators, helping you squeeze every entitled penny from your policy.

The size and layout of your property? They're like the stage where this whole restoration drama unfolds. Larger spaces or complicated plumbing systems naturally demand more time, expertise, and resources.

Pro tip: document everything like a crime scene photographer – those details can make or break your insurance claim!

With public claims adjusters helping homeowners secure settlements up to 800% higher than initial offers, having professional representation can dramatically impact your restoration compensation.

Want to stay ahead of the game? Regular maintenance checks could help you dodge those middle-of-the-night emergency calls altogether. Remember, in the world of water damage, time is literally money flowing through your pipes!

Labor & Material Expenses

Ever wondered what really drives the cost of fixing those sneaky slab leaks? Let's crack open the numbers that make homeowners scratch their heads!

Think of slab leak restoration like a puzzle with two main pieces. The bigger piece? That's your labor costs, eating up about 50-70% of your budget – those skilled plumbers who work their magic beneath your floors. They're the leak-hunting detectives, charging anywhere from $45 to $150 per hour, depending on their expertise and your location.

The second piece of the puzzle is materials, and boy, can they vary! You're looking at $500 to $2,000 for pipes, fittings, and other essentials. It's like buying parts for a high-stakes underground operation – because, well, that's exactly what it is!

Tree roots and soil shifts can significantly increase repair costs by causing extensive damage to underground pipes.

| Cost Component | Typical Range |

|---|---|

| Labor Costs | $45-150/hour |

| Material Expenses | $500-2,000 |

| Total Restoration | $1,500-4,000 |

| Additional Repairs | $1,000-3,000 |

| Insurance Coverage | Varies by Policy |

The silver lining? Your homeowners insurance might be your financial superhero here. Most policies swoop in to save the day when it comes to sudden and accidental slab leaks. Just remember to keep every receipt and document like your wallet depends on it – because it does!

Pro tip: Always insist on detailed estimates from your contractor that break down labor and materials separately. It's like having a clear road map for your insurance claim, making the whole process smoother than a freshly poured concrete slab!

Hidden Damage Cost Variables

Think of slab leaks as icebergs – what you see is just the tip of the financial impact. When water sneaks beneath your foundation, it's quietly orchestrating a concert of chaos that can send your repair costs through the roof.

Why do these hidden damages pack such a wallet-crushing punch? Let's dive deeper:

Silent Destroyers Lurking Below

- Water seepage compromising your home's bones

- Electrical systems shorting out in slow motion

- Microscopic mold colonies staging a takeover

Insurance Coverage Breakdown:

- Mold Invasion: Not just gross, but requires specialized teams with proper documentation

- Structural Surprises: Engineers need to assess the full scope of foundation damage

- Electrical Nightmares: Certified pros must verify system safety

Smart homeowners know the secret weapon: public adjusters. These claim champions are like damage detectives, uncovering every costly detail insurance companies might miss. They're your ace in the hole for maximizing claim recovery.

| Hidden Threat | Why It Matters |

|---|---|

| Mold Growth | Health hazards + property value impact |

| Foundation Issues | Long-term stability concerns |

| Wiring Problems | Safety risks + system replacement needs |

Don't let these sneaky damages drain your wallet. Document everything – yes, even that tiny water stain you barely notice. Remember, insurance policies have their quirks, and what's covered today might not be tomorrow. Working with a public adjuster isn't just smart; it's your best defense against the hidden costs trying to ambush your bank account. Most policies won't cover any water damage over 14 days old, so acting quickly is essential.

Chapter 3: Insurance Basics For Homeowners

Let's Crack the Slab Leak Insurance Code!

Ever wondered if your homeowners insurance has your back when that sneaky slab leak strikes? Think of your insurance policy as a safety net – but one with some interesting fine print you'll want to know about.

Your policy's approach to slab leaks is like a detective solving a mystery: it's all about the "how" and "when." Did that pipe burst suddenly (like a surprise party you didn't plan for), or has it been slowly dripping away (more like a leaky faucet you've been ignoring)? These distinctions matter big time for your claim.

What's hiding in your policy's pages?

- Dwelling coverage (protecting your home's structure)

- Personal property protection (safeguarding your belongings)

- Special endorsements (those extra layers of protection)

Pro tip: Insurance companies love to separate "sudden and accidental" water damage from the slow-and-steady variety. Why? Because one typically gets the green light for coverage, while the other might leave you high and dry – pun intended!

Claims typically take 4-8 weeks to process from initial filing to final payment.

Ready to become a slab leak insurance ninja? Start by diving into your policy's water damage section.

And remember, just like reading the ingredients on your favorite snack, understanding these terms could save you from an unpleasant surprise when you need coverage most.

Understanding Your Homeowners Insurance Policy

Is Your Home Insurance Ready for a Slab Leak Surprise?

Let's crack open that homeowners insurance policy you've tucked away and decode what it really means for slab leak protection.

Think of your policy as a safety net – but like any net, it's important to know where the holes are!

When water decides to play hide-and-seek under your foundation, your insurance coverage becomes your best friend – or potentially your biggest headache.

Here's what you need to know:

The Good News:

- Sudden water bursts? You're typically covered

- Your soggy furniture and water-logged walls? Usually included

- Need a temporary home while repairs happen? Many policies have your back

The Plot Twist:

Your insurance company might give you the cold shoulder if that leak's been doing its sneaky damage for months.

It's like trying to buy an umbrella during a rainstorm – timing matters!

Smart Moves for Maximum Protection:

- Team up with a public adjuster (think of them as your claim's personal trainer)

- Document everything – be the Sherlock Holmes of your home damage

- Review your policy annually (because yesterday's coverage might not match today's needs)

Pro Tip: While standard policies have your back for burst pipes, they usually wave goodbye when it comes to flood damage.

Consider it your insurance's kryptonite – you'll need separate coverage for that!

Want to be a coverage superhero? Install water detection systems and maintain regular plumbing inspections.

Your wallet (and your insurance company) will thank you later.

Remember: The right coverage paired with quick action turns a potential disaster into just another home maintenance story to tell at dinner parties.

Key Terms & Definitions Related To Slab Leak Damage Claims

Navigating Slab Leak Insurance Terms: Your Plain-English Guide

Ever felt like you're decoding a foreign language when reading your insurance policy? Let's break down those head-scratching slab leak terms into bite-sized pieces you'll actually understand.

Think of insurance terminology as the building blocks of your claim – just like a house needs a solid foundation, your claim needs proper understanding of these essential terms:

🔍 The Big Five You Need to Know:

- Sudden & Accidental

- What it means: "Oops, this just happened!" events

- Why it matters: Your coverage often hinges on whether the damage was unexpected

- Pro tip: Document when you first noticed the leak

- Exclusions (The Fine Print)

- Think of these as your policy's "sorry, not sorry" list

- Common exclusions: gradual damage, maintenance issues

- Always read these first to avoid surprises

- Documentation (Your Claim's Best Friend)

- Photos, videos, maintenance records

- Time-stamped evidence is gold

- The more detailed, the stronger your case

- Repair Estimates

- Multiple quotes from licensed contractors

- Detailed breakdown of materials and labor

- Include both immediate fixes and long-term solutions

- Water Damage Classification

- Categories: clean, gray, or black water

- Extent: visible and hidden damage

- Long-term implications for your property

Pipe corrosion damage and shifting foundation issues are among the most common causes of slab leaks that may require insurance claims.

Remember, understanding these terms isn't just about speaking "insurance-ese" – it's about protecting your investment and ensuring you get fair compensation.

Working with a public adjuster? These terms will help you speak the same language and build a stronger case for your claim.

Ready to tackle that claim? Armed with this knowledge, you're already steps ahead in the process!

Chapter 4: Types Of Slab Leak Damage Covered By Homeowners Insurance

Dealing with Slab Leaks? Here's What Your Insurance Actually Covers

Ever wondered why that mysterious puddle in your living room might be your insurance company's problem? Let's dive into the world of slab leak coverage – it's not as dry as it sounds!

Think of your home's foundation like the roots of a tree. When water sneaks in where it shouldn't, it can wreak havoc from the ground up. Smart homeowners know which damages their insurance will back them up on, and I'm here to break it down for you.

Proper soil grading around your foundation can help prevent costly slab leaks from developing.

Major Insurance Coverage Areas for Slab Leaks:

- Structural Warriors

- Foundation repairs (when that concrete decides to play Jenga)

- Wall cracks (the unwanted modern art on your walls)

- Shifting floors (when your home starts doing the cha-cha)

What you'll need: Professional engineering reports and structural assessments

2. Water's Warpath

- Flooring casualties (goodbye, pristine hardwood)

- Drywall drama (when your walls become watercolor paintings)

- Cabinet catastrophes (kitchen nightmares, anyone?)

What you'll need: Before/after photos, moisture readings, detailed repair estimates

3. The Domino Effect

- Mold invasion (the unwelcome houseguest)

- Subflooring surprises (what lurks beneath)

- Electrical system chaos (when water meets wiring – yikes!)

What you'll need: Environmental testing results, specialist reports, comprehensive repair quotes

Pro tip: Document everything like a crime scene investigator – the more evidence you gather, the stronger your claim becomes. Your insurance adjuster isn't psychic, after all!

What Are The Most Common Slab Leak Damage Insurance Claims?

Dealing with Slab Leak Insurance Claims? Here's What You Need to Know

Ever wondered what keeps insurance adjusters up at night? Slab leaks rank among the most challenging home insurance claims they handle. Think of your home's foundation as a giant sponge – when water sneaks in where it shouldn't, chaos ensues.

Key Insurance Claim Categories for Slab Leaks:

| Damage Type | Coverage Category | Real-World Impact |

|---|---|---|

| Surprise Pipe Bursts | Dwelling | Cracked Foundation |

| Hidden Water Issues | Personal Property | Ruined Furniture & Valuables |

| Hidden Structural Damage | Building Coverage | Compromised Walls & Flooring |

| Underground Pipe Failures | Systems Coverage | Complete Plumbing Overhaul |

| Ripple Effects | Additional Living | Temporary Relocation Costs |

Why do these claims matter so much? Picture your home's foundation as the roots of a tree – when water damage strikes below, everything above ground becomes vulnerable. Insurance companies understand this domino effect, which is why they typically cover sudden, unexpected slab leaks.

But here's the catch – you'll need to prove your case. Like a detective gathering evidence, document everything: water spots, cracks, unusual sounds, and even those sky-high water bills. Working with a qualified public adjuster can be your secret weapon in navigating these complex claims.

Remember: While insurers might resist claims for slow-developing issues, they can't ignore well-documented sudden failures. Your best defense? Regular home inspections and quick action when you spot trouble brewing beneath your feet.

Pro tip: Take photos, keep maintenance records, and don't wait until small problems become foundation-threatening disasters. After all, protecting your home's foundation means protecting your entire investment.

Professional adjusters can help increase insurance claim settlements by up to 800 percent compared to self-managed claims.

Chapter 5: Coverage Exclusions & Limitations For Slab Leak Damage

Navigating Slab Leak Insurance: What Your Policy Won't Cover

Ever wondered why some slab leak claims get denied while others sail through? Let's dive into the murky waters of insurance exclusions and limitations that might leave you high and dry.

Think of your insurance policy as a safety net – but one with intentionally designed holes. Just like a chef needs to know which ingredients won't work in a recipe, you need to understand what your policy won't cover when it comes to slab leaks.

Common Coverage Roadblocks:

| Coverage Type | What You Should Know |

|---|---|

| Gradual Damage | The silent killer – insurers won't cover slow leaks |

| Maintenance Issues | DIY disasters or neglect? You're on your own |

| Flood Damage | Regular policies run from flood damage like cats from water |

| Water Backup | Limited protection – like an umbrella with holes |

| Documentation | Missing paperwork can sink your claim |

Enter public adjusters – your insurance claim sherpas. These pros know the difference between a covered sudden pipe burst and that sneaky leak that's been dripping for months. They're masters at spotting the fine line between "sudden and accidental" (usually covered) and "gradual deterioration" (typically excluded).

Want to protect yourself? Think detective work. Document everything, snap photos like a tourist, and keep maintenance records as if your wallet depends on it – because it does. Insurance companies aren't in the business of paying claims; they're in the business of managing risk. Your job? Make your legitimate claim impossible to deny.

Quick tip: Don't wait for problems to surface. Regular maintenance isn't just home care – it's claim protection. After all, the best slab leak claim is the one you never have to file.

Working with public adjuster services can result in substantially higher settlements compared to filing independent claims.

Chapter 6: Should You File A Slab Leak Damage Claim?

So, You've Got a Slab Leak – Should You File That Claim?

Let's face it – discovering a slab leak feels like finding an unwanted indoor pool beneath your home. Before you dive into filing an insurance claim, there's a lot to unpack here.

Think of your insurance claim like a chess game – every move matters. The key is making strategic decisions that protect both your home and your wallet. Here's what you need to know:

Smart Moves for Slab Leak Claims:

- Contact your insurer immediately – timing is everything when water's involved

- Snap photos like you're documenting a crime scene – the more detailed, the better

- Keep every receipt, report, and repair estimate – paper trails are your best friend

- Study your policy coverage like you're prepping for an exam

Why Partner with a Public Adjuster?

Think of them as your personal insurance translator and advocate. They'll help navigate the complex claims process and often secure better settlements than you might get flying solo.

Red Flags to Consider:

- Will your premiums skyrocket after filing?

- Does the damage cost exceed your deductible significantly?

- Are you dealing with gradual damage or sudden water issues?

Remember, water damage claims can be tricky – insurance companies often scrutinize them more closely than other types of claims. A well-documented, promptly reported claim stands a much better chance of approval.

Pro tip: Before making your decision, weigh the immediate repair costs against long-term insurance implications. Sometimes, smaller issues might be more cost-effective to handle out-of-pocket.

Working with public adjusters can increase your settlement by 20-50% compared to filing a claim on your own.

Chapter 7: Introduction To Public Adjusters

Think of public adjusters as your personal claims champions – the pros who go to bat for you when water damage turns your home into an unwanted indoor pool. Unlike insurance company adjusters who work for "the other team," these licensed experts are 100% in your corner.

Why should you care? Well, imagine trying to navigate complex insurance policies while dealing with a flooded home. That's where public adjusters shine! They're like having a seasoned GPS for your insurance claim journey, helping you avoid costly wrong turns and dead ends.

Did you know that homeowners working with public adjusters typically see settlement amounts skyrocket? Research shows claims can increase up to 800% compared to going it alone. But it's not just about the money – it's about getting what you're entitled to under your policy.

These claim wizards bring to the table:

- Deep expertise in property damage assessment

- Sharp negotiation skills with insurance companies

- Strategic documentation that speaks the insurers' language

- Clear understanding of when to bring in legal backup

Before you dive into hiring one, though, ask yourself: How extensive is my damage? What's my comfort level with insurance negotiations? Sometimes you might need a property damage attorney instead – and a good public adjuster will tell you straight up if that's the case.

Remember: Timing is everything when dealing with slab leaks and water damage. The sooner you get a public adjuster involved, the better your chances of securing a fair settlement that truly reflects your loss.

They can help identify when insurers apply excessive depreciation to deliberately lower your settlement offer.

The Role Of A Public Adjuster In Slab Leak Damage Insurance Claims

Is your home suffering from a slab leak nightmare? Let's talk about your secret weapon: public adjusters – the unsung heroes who can turn your insurance headache into a win.

Think of a public adjuster as your personal insurance detective. While you're stressing about water damage creeping through your foundation, they're busy cracking the code of your insurance policy and building an ironclad case for your claim.

They're like having a professional photographer, forensic investigator, and negotiation expert all rolled into one.

Why do you need one? Well, when that sneaky slab leak turns your home's foundation into a water park, insurance companies often see dollar signs – and not in your favor.

Public adjusters speak "insurance-ese" fluently, catching those hidden coverage gems buried in policy fine print that most homeowners wouldn't spot with a magnifying glass.

They'll document every drop of damage with military precision – from detailed snapshots that tell the whole story to comprehensive repair estimates that leave no stone unturned.

Plus, they've got the muscle to go toe-to-toe with insurance adjusters, ensuring you don't settle for peanuts when you deserve the whole jar.

Remember, navigating a slab leak claim without a public adjuster is like performing surgery on yourself – technically possible, but why would you?

Let these pros handle the heavy lifting while you focus on getting your home back to normal. Your foundation (and sanity) will thank you later.

With average repair costs hitting slab leak repairs around $2,300, having a public adjuster in your corner can make a significant difference in your settlement.

Benefits Of Using A Public Adjuster For Slab Leak Damage Claims

Dealing with a Slab Leak? Here's Why a Public Adjuster Is Your Secret Weapon

Ever felt like you're swimming upstream when handling a slab leak insurance claim? You're not alone! Think of a public adjuster as your personal insurance navigator – they're the GPS that guides you through the complex maze of property damage claims.

Why Your Slab Leak Claim Needs a Professional Touch

| Key Advantage | Real-World Impact |

|---|---|

| Detective-Level Documentation | Like CSI for your home – they uncover and record every bit of damage |

| Insurance-Speak Translation | Turn complex policy jargon into plain English you can understand |

| Money-Maximizing Magic | Fight for every dollar you deserve with proven negotiation tactics |

Let's face it – insurance companies speak their own language, and trying to handle a slab leak claim solo is like playing chess against a grandmaster. Public adjusters level the playing field by:

- Breaking down technical jargon into bite-sized pieces

- Spotting hidden damage that could boost your claim value

- Standing up to insurance companies' lowball offers

- Taking the paperwork headache off your plate

Think of them as your claim's personal trainer – they'll work out all the details while you focus on getting your life back to normal. With their expertise, you're not just filing a claim; you're building a rock-solid case for maximum compensation.

Remember: What might look like a simple water spot to you could signal much bigger issues to a trained eye. Public adjusters know exactly where to look and what documentation will make your case bulletproof.

Statistics show that working with public adjusters increases settlements by an average of $3,607 compared to handling claims independently.

How Are Public Adjusters Paid & What Are Their Fees?

Ever wondered how public adjusters get paid for fighting your insurance battles? Let's break down their fee structure in a way that won't make your head spin!

Think of public adjusters as your insurance claim champions who work on a contingency basis – meaning they only get paid when you win. Their fees typically range from 10% to 20% of your final settlement, which is like having a partner who's fully invested in maximizing your claim's value.

Standard policies cover sudden and accidental damage to your foundation, making a public adjuster's expertise even more valuable.

Let's peek under the hood at what you're really getting:

| Service Component | What's in it for You | Money Talk |

|---|---|---|

| Damage Detective Work | Complete loss documentation | Part of the package |

| Insurance Maze Navigation | Professional guidance | Zero upfront fees |

| Settlement Warriors | Significantly higher payouts | Success-based fee |

Here's the real kicker: even after their cut, most property owners end up with substantially more money in their pockets than if they'd gone solo. Why? Because these pros know every nook and cranny of insurance policies, like a master chef knows their kitchen. They're experts at spotting overlooked damages, documenting everything meticulously, and negotiating like seasoned pros.

The best part? Their payment structure means they're literally invested in your success. It's like having a financial partner who only wins when you win bigger. Their deep knowledge of policy language, building costs, and negotiation tactics often turns what might have been a modest settlement into something that truly covers your losses.

Public Adjusters Vs. The Insurance Company Adjuster

Let's Talk Public vs. Insurance Company Adjusters: What You Really Need to Know

Ever wondered who's truly in your corner when disaster strikes your home? Think of it like having two different coaches in a game – one's playing for your team, while the other represents the opposing side.

Public adjusters are your personal claims champions, working exclusively for you, the policyholder. They're like property damage detectives, leaving no stone unturned to uncover every bit of damage your home has sustained. Their mission? To help you score the maximum legitimate settlement possible.

On the flip side, insurance company adjusters are like referees employed by the insurance carrier. While they aim to be fair, their primary goal is to protect their employer's bottom line and follow strict company protocols.

Here's what sets them apart:

🏠 Public Adjusters:

- Your dedicated advocate in the claims process

- Perform microscopic damage assessments

- Dig deep into policy fine print to uncover hidden benefits

- Earn their fee as a percentage of your settlement

🏢 Insurance Company Adjusters:

- Represent their employer's interests

- Follow standardized evaluation procedures

- Focus on basic claim processing

- Receive a regular salary regardless of claim outcome

Why does this matter to you? When you're dealing with property damage, having someone who knows all the rules of the game and fights specifically for your interests can mean the difference between a basic settlement and one that truly covers all your losses.

Have you ever tried to navigate a complex insurance policy on your own? It's like trying to solve a puzzle in the dark. That's where public adjusters shine – they bring the flashlight!

Remember: Knowledge is power in the insurance game, and choosing the right player for your team can make all the difference in your claim's outcome.

Most public adjusters work on a contingency fee basis, typically charging between 10-20% of your final settlement amount.

Public Adjusters Vs. Bad Faith & Property Damage Lawyers – Which To Hire & When

Dealing with Property Damage? Let's Crack the Code: Public Adjusters vs. Lawyers

Ever found yourself staring at water damage from a nasty slab leak, wondering who to call? You're not alone! Think of your insurance claim journey like navigating a maze – you'll want the right guide by your side.

Data shows that claims with professional adjusters involved typically settle for $22,266 versus $18,659 without their expertise.

🔍 The Dynamic Duo in Property Claims:

Public Adjusters: Your Claims Whisperers

- Think of them as your personal claim negotiators

- They speak "insurance language" fluently

- Work on a percentage of your settlement

- Perfect for when you need to maximize standard claims

- Usually wrap things up faster than legal routes

Property Damage Lawyers: Your Legal Warriors

- Step in when insurance companies play hardball

- Masters of bad faith claims and courtroom battles

- Charge legal fees plus court costs

- Essential for denied claims or serious disputes

- May take longer but pack a stronger punch legally

Quick Decision Guide:

Choose a Public Adjuster when:

- Your claim is straightforward but needs optimization

- You want faster resolution

- You're comfortable with percentage-based fees

- Insurance company is cooperative but lowballing

Go for a Property Damage Lawyer when:

- Your claim gets denied

- Bad faith practices emerge

- You need legal muscle

- Complex disputes require court intervention

Remember, it's like choosing between a mediator and a warrior – each shines in different battlegrounds.

The key? Matching your situation's complexity with the right professional's expertise.

Pro Tip: Many start with public adjusters and bring in lawyers if things get dicey. It's not always an either-or situation!

When To Contact A Public Adjuster For A Slab Leak Damage Claim

Got a Slab Leak? Here's When You Need a Public Adjuster in Your Corner

Think of a public adjuster as your personal insurance detective – someone who fights in your corner when water decides to play hide and seek under your home's foundation. Let's dive into when you should bring one onto your team.

Critical Timing for Public Adjuster Involvement:

| When to Act | Why It Matters | What You Get |

|---|---|---|

| At First Sign | Captures real-time evidence | Professional documentation |

| Pre-Insurance Call | Strengthens your position | Strategic claim guidance |

| Before Repairs | Prevents coverage disputes | Accurate damage assessment |

| Post-Initial Denial | Challenges unfair decisions | Expert negotiation support |

Did you know that waiting too long to bring in a public adjuster can be like trying to solve a puzzle with missing pieces? Water damage from slab leaks can be sneaky, spreading silently while leaving a trail of costly destruction.

Smart Moves for Homeowners:

- Document everything (yes, even those small water spots!)

- Take photos before any cleanup begins

- Keep samples of damaged materials

- Track all communication with your insurance company

Remember, insurance companies have their own adjusters – shouldn't you have someone looking out for your interests too? A public adjuster brings professional expertise that can mean the difference between a denied claim and full compensation for your slab leak damage.

Quick Tip: Most successful claims involve public adjusters within the first 48-72 hours of damage discovery. The sooner they're involved, the stronger your position for fair compensation becomes.

PCAN member adjusters provide expert guidance while working on a contingency basis of approximately 10% of your settlement.

Chapter 8: When To Contact Your Insurance Provider For Slab Leak Damage Claims

Dealing with a Slab Leak? Let's break it down into bite-sized pieces that'll help you make the smart choice between DIY claims and professional help.

Think of a public adjuster as your personal insurance detective – they're pros at spotting hidden damage that might come back to haunt you later. Just like you'd want a mechanic to check your entire car after a fender-bender, these experts examine every nook and cranny of your slab leak situation.

Got your DIY hat on? That's totally fine, but you'll need to channel your inner detective too. Document everything like you're building a case file – photos, videos, timestamps, and every chat with your insurance company.

Remember, time isn't your friend when water's involved, so quick action is your best buddy.

Key action points to consider:

- Ring up your insurance provider or public adjuster the moment you spot water where it shouldn't be

- Snap pictures and videos before any cleanup begins

- Keep a digital paper trail of all communications

- Study your policy like it's your favorite Netflix series – know those coverage limits!

Pro tip: Whether you're flying solo or bringing in the pros, treating your slab leak like a ticking clock can make the difference between a smooth claim and a frustrating ordeal.

The sooner you act, the stronger your position when presenting your case to the insurance company.

Studies show that working with public adjusters typically results in higher settlement amounts compared to handling claims independently.

If Using A Public Adjuster

Timing is everything when it comes to slab leak claims, and that's where a public adjuster can be your secret weapon. Think of them as your personal claims detective – they know exactly where to look, what to document, and how to build a rock-solid case for your insurance company.

Why consider a public adjuster for your slab leak situation? Well, imagine trying to put together a complex puzzle without having all the pieces in front of you. That's what handling an insurance claim can feel like when you're going it alone.

These pros dive deep into your policy's fine print (yes, all those mind-numbing details!), gather evidence like seasoned investigators, and often spot hidden damage that you might miss.

But here's where it gets really interesting – public adjusters speak "insurance language" fluently. They're like skilled translators who can communicate the true extent of your slab leak damage in terms that insurance companies understand and respect.

They'll roll up their sleeves and negotiate on your behalf, armed with detailed documentation and industry expertise that often leads to better settlements.

Remember, just like you'd want an experienced mechanic for your luxury car, your home's slab leak claim deserves professional attention. A public adjuster's expertise could mean the difference between a basic claim settlement and one that truly covers all your damages.

Have you considered what might be lurking beneath the surface of your slab leak? These professionals are trained to look beyond the obvious water damage and identify potential long-term issues that could affect your home's structure and value.

Claims handled by public adjusters typically result in 20-30% higher settlements compared to those filed without professional representation.

If Filing On Your Own

Think of filing an insurance claim like building a winning case – you're the detective gathering evidence and the lawyer presenting your story. While public adjusters can be your claims sidekicks, you've got what it takes to handle this mission yourself.

First things first: Hit that speed dial to your insurance company the moment you spot trouble. Your smartphone becomes your most powerful tool here – snap clear photos of every water-damaged area like you're documenting a crime scene. Trust me, you can't have too much evidence!

Ready to decode your insurance policy? Don't let the fine print intimidate you. Grab a highlighter and mark those crucial sections about slab leak coverage. What's covered? What's not? Knowledge is your superpower here.

Keep your paper trail organized like a pro:

- Create a digital diary of every insurance conversation

- Log names, dates, and key discussion points

- Save emails and text messages

- Track your repair estimates and receipts

When you're ready to file, tell your story clearly and chronologically. Think of it as explaining to a friend who wasn't there – what happened, when it happened, and what you did about it.

Your evidence portfolio should be your backup singer, supporting every claim you make with solid documentation.

Consider using claims management software to streamline your documentation process and keep all your evidence organized in one place.

Chapter 9: Filing Process For Slab Leak Damage Insurance Claims (Without Public Adjuster)

Navigating a Slab Leak Insurance Claim? Let's Make It Less Painful!

Think of filing a slab leak claim like building your case as a detective – you'll need rock-solid evidence to crack this case! Your secret weapon? Documentation that's as watertight as your pipes should've been.

First things first: grab your smartphone and become a documentary filmmaker. Snap crystal-clear photos and videos of every water-damaged spot, from those sneaky wet patches to obvious puddles. Remember, you're telling a visual story that screams "this needs fixing!"

Pro tip: Create your "damage diary" – a digital spreadsheet that tracks:

- What's damaged (be specific!)

- When you noticed it

- Estimated replacement costs

- Pre-damage condition

Bring in the cavalry – get licensed plumbers and structural engineers to inspect the damage. Their professional reports are pure gold when dealing with insurance adjusters who might try to minimize your claim. These experts speak the technical language that makes insurance companies sit up and listen.

Keep your paper trail organized like a boss:

- Save every email (yes, even the boring ones)

- Record phone calls (date, time, who said what)

- Document every site visit from adjusters

- Store receipts for emergency repairs

Your insurance company needs proof? Hit them with a one-two punch of expert analysis and detailed documentation. Remember, you're not just filing a claim – you're building an airtight case for the compensation you deserve!

Stay sharp and engaged throughout the process. Think of yourself as the project manager of your own claim, keeping all the moving parts synchronized and documented. This isn't just about getting paid; it's about protecting your biggest investment – your home.

Working with professional claim assistance can increase your settlement by 19% compared to self-filed claims.

Document Slab Leak Damage Thoroughly

Got Water Under Your Floors? Here's Your Ultimate Slab Leak Documentation Guide

Think of documenting a slab leak like building your case for a courtroom – every detail matters! You'll want to create an airtight record that shows insurance companies exactly what you're dealing with.

Let's Break Down Your Documentation Arsenal:

🔍 Visual Evidence

- Before and after shots of affected areas

- Close-ups of water stains and structural damage

- Time-stamped videos of active leaks

- Moisture meter readings in action

📋 Expert Backup

- Plumber's diagnostic reports

- Structural engineer evaluations

- Environmental assessment findings

- Mold inspection results (if applicable)

💰 Financial Trail

- Detailed repair estimates

- Material and labor invoices

- Emergency service receipts

- Temporary housing costs

Pro Tips for Bulletproof Documentation:

- Create a digital folder system (think Marie Kondo for your leak records!)

- Record every conversation with professionals and insurance reps

- Keep a daily log of developments and observations

- Use a moisture mapping diagram to track spread patterns

Remember: Your documentation tells the story of your slab leak journey. The more detailed and organized you are, the smoother your insurance claim process will be.

Think of it as building your own leak detective case file – every piece of evidence strengthens your position!

Contact Insurance

Got a Slab Leak? Here's Your Insurance Game Plan

Ready to tackle your insurance claim for that pesky slab leak? Think of it as preparing for an important presentation – you'll want all your ducks in a row before making that crucial first call to your insurance provider.

First things first, let's talk about your battle plan. You've already documented the damage (high five for being proactive!), and now it's time to connect with your insurance company. Have your policy number and damage documentation at your fingertips – trust me, it'll make the conversation flow much smoother.

Pro tip: Treat your insurance communications like a detective's case file. Keep a detailed log of every chat, call, and email – who you talked to, when it happened, and what was discussed. It might seem like overkill now, but these notes can be worth their weight in gold later.

Before diving deep into the claims process, take a magnifying glass to your insurance policy. Understanding your coverage for slab leaks isn't exactly Netflix-binge worthy, but it's essential homework that'll help you navigate the process like a pro.

While the wheels of insurance are turning, don't let your property sit idle. Take necessary steps to prevent further damage – think of it as applying a bandaid while waiting for the doctor.

And speaking of professionals, considering a public adjuster? They're like having a personal trainer for your insurance claim – they know the moves to help you achieve maximum results.

Deal With Insurance Company Adjuster & Low Ball Assessments

Dealing with Insurance Adjusters: Your Guide to Fighting Lowball Slab Leak Estimates

Got that frustrating lowball estimate for your slab leak damage? Don't worry – you're not alone in this insurance tango! Think of insurance adjusters like poker players: they might start with a conservative hand, but you've got some aces up your sleeve.

Your Winning Strategy:

🔍 Document Everything Like a CSI Pro

- Snap crystal-clear photos from multiple angles

- Keep a detailed damage diary

- Create a digital timeline of events

Know Your Policy Inside Out

Ever tried reading a dictionary? Your insurance policy might feel just as dense, but understanding it is your secret weapon. Dive into those coverage details – they're your ammunition for negotiations.

Level Up Your Game with Pro Backup

- Hire independent assessors (they're like your damage detectives)

- Get multiple repair quotes from licensed contractors

- Consider bringing in a public adjuster for complex cases

Smart Communication Tips:

- Stay cool and collected (even when steam's coming out of your ears)

- Use email for important conversations (paper trails are your friends)

- Follow up regularly but professionally

When that initial offer makes you laugh (or cry), remember you've got options. Challenge those numbers with your rock-solid evidence. Think of it as building your case, just like a lawyer would.

Pro tip: Insurance companies often revise their estimates when faced with solid, professional documentation. Stand your ground – your home's proper repair depends on it!

Remember: This isn't just about getting money; it's about getting your home properly fixed. Don't settle for less than what your policy promises.

Get Professional Assessment

Why Risk It? Get Your Slab Leak Professionally Assessed

Think of a professional assessment as your secret weapon in the battle for a fair insurance claim. Just like you wouldn't diagnose a serious illness without a doctor's expertise, your slab leak deserves a trained eye to uncover its true extent.

A licensed plumber's evaluation isn't just another piece of paperwork – it's your claim's backbone. They'll dive deep beneath the surface (quite literally!) to map out every detail, from pinpointing that sneaky leak's origin to documenting hidden damage that could come back to haunt you later.

Want to know what makes insurance companies take notice? A comprehensive professional report that reads like a detective's case file. It connects all the dots, revealing how that seemingly small leak might be causing a domino effect of damage throughout your home.

Plus, when you're armed with expert documentation, you're not just telling your insurance company about the problem – you're showing them with concrete evidence.

Here's the kicker: quick professional assessments prove you're being proactive about the situation. Insurance providers love seeing homeowners who take immediate action rather than letting problems fester. It's like having a solid alibi in a mystery novel – the timing of your assessment can make or break your claim's credibility.

Gather Supporting Evidence

Want to Build an Ironclad Slab Leak Insurance Claim? Here's Your Evidence Playbook!

Think of gathering evidence like building a fortress – every piece of documentation is another brick in your defense. Let's dive into how you can create an airtight case that'll make insurance adjusters take notice.

Picture This: Your Evidence Arsenal

Just as a detective builds their case, you'll need your own investigation toolkit:

| Your Power Tools | What They Do For You |

|---|---|

| Visual Proof | Real-time snapshots and footage showing water damage in action |

| Smart Inventories | Your detailed battle plan of affected belongings |

| Expert Backup | Professional evaluations that pack a punch |

🔍 Pro Tips for Maximum Impact:

- Shoot high-res photos from multiple angles (think Instagram-worthy detail)

- Create time-stamped video walkthroughs

- Keep a digital paper trail of every conversation with your insurance company

- Track your damage control efforts like a hawk

Remember, you're not just collecting papers – you're telling your property's story. Each receipt, report, and photo adds another layer of credibility to your claim. And just like a good recipe, the right mix of evidence makes your case impossible to ignore.

Need extra muscle? Public adjusters love working with well-documented claims. They can transform your evidence collection into a compelling narrative that insurance companies can't brush aside.

Submit Complete Claims Package

Ready to Submit Your Slab Leak Claim? Here's Your Complete Package Checklist!

Think of your claims package as a compelling story – one that leaves no questions unanswered. You'll want to build your case like a detective, gathering every piece of evidence that supports your claim.

First, snap crystal-clear photos of your slab leak damage – imagine you're creating a before-and-after home renovation show, but with a focus on the problems. These visual elements are your claim's backbone, showing exactly what went wrong and where.

Your documentation arsenal should include:

- Detailed repair estimates from licensed contractors

- A day-by-day timeline of events (from leak discovery to present)

- Records of emergency measures you've taken

- A comprehensive list of damaged items (think price tags, purchase dates, and current values)

- Every email, text, or letter between you and your insurance company

Pro tip: Organization is your secret weapon! Label everything clearly and create a logical flow of information – just as you'd organize your favorite recipes or photo albums. Your insurance adjuster will thank you for making their job easier.

Try To Negotiate Claim Settlement Offer

Don't Let That Slab Leak Settlement Leave You High and Dry!

Got a settlement offer for your slab leak damage? Think of it as round one in a friendly boxing match – you're just getting started! Let's turn you into a negotiation pro who knows exactly how to land those winning punches.

First things first: you'll want to gather your ammunition (and by that, we mean documentation!). Picture yourself as a detective building an airtight case. Snap those crystal-clear photos of the damage, collect expert opinions like they're trading cards, and stack up those repair estimates from trusted professionals.

Ready to counter that initial offer? Here's where things get interesting. Think of your insurance policy as your playbook – it's packed with valuable moves you can use. When you spot something the adjuster missed (trust me, it happens!), don't be shy about pointing it out. Remember, you're not being difficult; you're being thorough!

Pro tip: Keep your communication style clear and confident, like you're explaining something to a friend. Spotted some hidden damage behind that wall? Found an overlooked expense? These are your power moves in the negotiation game.

Want to really amp up your chances of success? Create what I call a "damage diary" – a detailed timeline of everything that's happened, complete with dates, conversations, and discoveries. Insurance adjusters love organization, and this approach shows you mean business.

Remember: Negotiating isn't about winning or losing – it's about reaching a fair deal that truly covers your damage. Stay persistent, stay professional, and don't settle for less than what your policy promises. After all, that's why you've been paying those premiums!

Chapter 10: Filing Process For Slab Leak Damage Insurance Claims (With A Public Adjuster)

Navigating Slab Leak Insurance Claims? A Public Adjuster Is Your Secret Weapon!

Think of a public adjuster as your personal claims detective – they're experts at uncovering every detail that could maximize your slab leak compensation. Instead of wrestling with insurance paperwork alone, these pros become your dedicated advocates, turning a complex claims process into a well-orchestrated strategy.

Why does this matter for your slab leak claim? Let's break it down:

🔍 Evidence Gathering Masters

Your adjuster dives deep into the damage scene, capturing crystal-clear photos, videos, and detailed notes that tell your property's story. They're like CSI investigators for your home, leaving no stone unturned!

📋 Policy Whisperers

Ever tried decoding insurance jargon? Your adjuster knows exactly where to look in those dense policy documents to uncover hidden benefits you might never have known existed.

🤝 Expert Network Builders

They don't work alone – think of them as project managers who bring in structural engineers, plumbers, and contractors at just the right moments to strengthen your claim with professional backup.

By handling direct communications with insurance companies and building an ironclad case, public adjusters typically help homeowners secure significantly better settlements than going solo.

They're not just filing paperwork; they're crafting a compelling narrative about your property damage that insurance companies can't ignore.

Remember: The sooner you bring in a public adjuster after discovering a slab leak, the stronger your position becomes in the claims process.

Public Adjuster Documents Slab Leak Damage Thoroughly

Think of a public adjuster as your personal damage detective when dealing with slab leaks – they leave no stone unturned! Let's dive into how these pros make your insurance claim bulletproof with their documentation superpowers.

Why is killer documentation so crucial? Well, just like building a winning court case, you need rock-solid evidence to back up every penny you're claiming. Your public adjuster knows this game inside and out!

🔍 Essential Documentation Arsenal:

| Documentation Tool | Why It's Your Best Friend |

|---|---|

| High-Res Photos | Captures the whole story when words aren't enough |

| Expert Estimates | Shows insurance companies you mean business |

| Engineering Reports | Brings technical muscle to your claim |

| Digital Paper Trail | Keeps everyone honest and accountable |

| Repair Roadmap | Charts the path from damage to restoration |

Ever tried explaining water damage without pictures? It's like describing a sunset over text! That's why public adjusters snap detailed photos from every angle, creating a visual narrative that speaks volumes to insurance companies.

They're also masters at connecting the dots – linking that sneaky slab leak to every bit of damage it caused. Think of them as insurance claim architects, building your case layer by layer with precision and expertise.

Remember: The difference between a good claim and a great one often comes down to documentation. With a public adjuster in your corner, you're not just filing paperwork – you're crafting a compelling story that demands fair compensation.

Want insurance companies to take your claim seriously? Let your public adjuster’s thorough documentation do the heavy lifting! A public adjuster possesses the expertise to meticulously assess your property and gather all necessary evidence to support your claim. This ensures that your case is not only taken seriously but also stands out in a competitive landscape. For those dealing with such incidents, understanding the nuances of ‘wind damage insurance claims explained‘ can be invaluable in navigating the complexities of the claims process and maximizing your compensation.

Public Adjuster Reviews Policy For Hidden Slab Leak Damage Coverage & To Maximize Policy Benefits

Got a Slab Leak? Here's How Public Adjusters Unlock Hidden Insurance Gold

Think of your insurance policy as a treasure map – there's often more buried coverage than meets the eye, especially for those tricky slab leaks. That's where public adjusters become your personal insurance detectives, diving deep into policy fine print to maximize your claim's value.

Ever wondered what these insurance pros look for? Let's crack the code:

📋 Smart Policy Investigation Strategy

- Coverage Detective Work: They spot those "between the lines" benefits you might miss.

- Damage Deep-Dive: Like CSI for your home, documenting every crack and drip.

- Policy Language Translation: Turning insurance-speak into plain English.

- Evidence Arsenal: Building an airtight case for your claim.

- Power Negotiation: Going to bat for your best possible settlement.

Why This Matters For Your Wallet:

✓ Discover coverage you didn't know you had.

✓ Get repairs done right the first time.

✓ Avoid costly coverage exclusion pitfalls.

✓ Strengthen your position with solid evidence.

✓ Achieve optimal claim outcomes.

Think of public adjusters as your slab leak superheros – they're not just reviewing your policy; they're unlocking its full potential.

While insurance companies might skim the surface, these pros dig deeper to ensure you don't leave money on the table.

Remember: Just like you wouldn't perform your own surgery, navigating complex slab leak claims without expert help could leave you high and dry.

Let the professionals decode your policy's hidden benefits while you focus on getting your home back to normal.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Need a Guardian Angel for Your Insurance Claim? That's Where Public Adjusters Shine!

Think of public adjusters as your personal insurance claim champions – they're the pros who speak "insurance-ese" fluently and go to bat for you when dealing with those tricky claims. Instead of wrestling with confusing paperwork and endless phone calls, you get to breathe easier while they work their magic.

Why do homeowners love having a public adjuster in their corner?

- They're your communication firewall – handling every single interaction with insurance companies while you focus on getting your life back to normal.

- Like skilled detectives, they document every crack, leak, and damage with laser-focused precision.

- They're master negotiators who know exactly how to translate your policy's fine print into maximum compensation.

Here's the real game-changer: these claims experts understand the insurance industry's inner workings. When your insurance company says "no," they know exactly how to turn that into a "yes" with rock-solid evidence and expert negotiation strategies.

It's like having an insider on your team who knows all the rules – and how to play by them to your advantage.

Public Adjuster Gets Professional Assessments

Why Do Professional Assessments Matter in Your Slab Leak Claim?

Think of professional assessments as your secret weapon in the insurance claim battlefield. When you're dealing with frustrating slab leaks, having a public adjuster armed with expert evaluations is like bringing a microscope to examine every crack, drip, and damaged corner of your property.

Let's break down why these assessments are game-changers:

🔍 Deep-Dive Damage Detection

- Uncovers sneaky water damage hiding beneath surfaces

- Maps out the complete damage trajectory, from source to spread

- Reveals structural impacts you might never spot with the naked eye

💪 Building Your Bulletproof Claim

Your public adjuster uses these assessments to:

- Create a comprehensive repair roadmap

- Stack evidence that insurance companies can't easily dismiss

- Identify long-term implications of water damage on your property

Want to know what makes these evaluations so powerful? They speak the insurance industry's language. When your public adjuster walks into negotiations with detailed professional assessments, it's like bringing scientific proof to back up every dollar you're claiming.

Remember: Just as you wouldn't go to court without solid evidence, you shouldn't face insurance companies without professional backing. These assessments aren't just papers – they're your property's voice in the claim process.

Pro Tip: The sooner you get professional assessments after discovering a slab leak, the stronger your position becomes in securing fair compensation.

Public Adjuster Gathers Supporting Evidence

Want to Know What Makes a Slab Leak Insurance Claim Rock-Solid? It's All About the Evidence!

Think of your public adjuster as a master detective, piecing together a compelling story of your property damage. They're not just collecting evidence – they're building an airtight case to help you get the compensation you deserve.

Let's Break Down the Evidence Powerhouse:

🔍 Visual Storytelling

- High-resolution photos that capture every crack and water trail

- Video documentation showing active leaks and their impact

- Time-stamped imagery tracking damage progression

💡 Expert Backup

- Detailed reports from licensed plumbers

- Professional damage assessments

- Technical evaluations of repair scope

- Cost breakdowns from industry specialists

📋 Property Portfolio

- Room-by-room inventory lists

- Documentation of affected items

- Value assessments with purchase records

- Maintenance history timeline

Your public adjuster doesn't just throw these pieces together – they weave them into a compelling narrative that insurance companies can't ignore.

Think of it as building a puzzle where every piece strengthens your claim's foundation.

Pro Tip: The magic lies in the details! Your adjuster tracks every communication, documents each damaged item, and creates a chronological trail that connects all the dots.

Remember, in the world of insurance claims, solid evidence speaks louder than words.

Why does this matter? Because when you're facing a slab leak, you need more than just proof – you need a watertight case that stands up to scrutiny and leads to fair compensation.

Public Adjuster Submits Complete Claims Package

The Secret Weapon in Insurance Claims: Your Public Adjuster's Complete Package

Ever wondered what makes insurance claims sail through smoothly? It's all in the package! When your public adjuster creates a claims package, they're essentially crafting your ticket to fair compensation.

Think of your claims package as a well-organized puzzle where every piece matters. Let's break down what makes it shine:

🔍 The Power Players in Your Claims Package:

| Essential Element | What It Does | Why It Matters |

|---|---|---|

| Before & After Photos | Tells Your Story Visually | Shows Clear Proof of Loss |

| Detailed Cost Breakdowns | Maps Out Recovery Costs | Makes Your Case Bulletproof |

| Personal Property Lists | Tracks Your Belongings | Ensures Nothing's Missed |

| Professional Assessments | Provides Expert Backing | Adds Credibility |

Your public adjuster doesn't just throw papers together – they're orchestrating a compelling narrative about your loss. Like a skilled attorney building a case, they weave together evidence that insurance companies can't ignore.

Pro tip: The magic isn't just in collecting documents – it's in the timing and presentation. Your adjuster knows exactly when to submit each piece, how to highlight crucial details, and which additional coverage angles might have slipped past your notice.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Wondering who'll handle all that back-and-forth with your insurance company after a slab leak? That's where your public adjuster becomes your claims superhero!

Think of a public adjuster as your personal insurance navigator – they take the wheel while you focus on getting your life back to normal. No more stressing about missed deadlines or drowning in paperwork. They're like having a dedicated claims concierge who speaks fluent "insurance-ese."

Your public adjuster will:

- Keep the insurance company's timeline on track (because nobody likes playing phone tag)

- Document every single detail about your water damage claim (think of them as your claim's historian)

- Tackle those mind-numbing forms and verification requirements (so you don't have to)

They're constantly working behind the scenes, making sure your slab leak claim stays on the fast track to settlement.

While they're wrestling with policy jargon and negotiating with adjusters, you can concentrate on what really matters – getting your home back in shape.

Remember those dreaded insurance deadlines that keep you up at night? Your public adjuster has them memorized like their favorite playlist.

They'll ensure every "i" is dotted and every "t" is crossed, maximizing your chances of a fuller settlement.

It's like having a skilled conductor leading an orchestra – they know exactly when each instrument should play to create the perfect symphony of a successful claim.

Public Adjuster Enforces Policyholder's Rights, & Negotiates Higher & More Fair Claim Settlement Offer

Think of a public adjuster as your personal insurance claim superhero – someone who fights for your rights when dealing with tricky slab leak claims.

Let's face it: going toe-to-toe with insurance companies can feel like David versus Goliath, but that's where these pros shine!

What makes public adjusters worth their weight in gold? They're master negotiators who know exactly how to document your property damage and turn that evidence into a winning claim.

Picture them as detectives, methodically building your case with:

- Crystal-clear photos that tell the whole story

- Rock-solid repair estimates from trusted professionals

- Hidden policy benefits you might've missed

Wondering why insurance companies often change their tune when public adjusters step in? It's simple – these experts speak the complex "insurance language" fluently and know all the industry's ins and outs.

They're like skilled chess players, always thinking several moves ahead during negotiations.

But here's what really sets them apart: public adjusters don't just file paperwork – they're your dedicated advocates who:

- Break down confusing policy jargon into plain English

- Spot coverage opportunities others might miss

- Push back when insurers try to lowball your settlement

Remember, you wouldn't go to court without a lawyer, so why face an insurance claim alone?

With a public adjuster in your corner, you're not just filing a claim – you're maximizing your chances of getting what you truly deserve for your property damage.

Public Adjuster Speeds Up Claim Settlement Time

Wondering why your slab leak insurance claim is taking forever? Let a public adjuster be your claim's personal speedster!

Think of public adjusters as your insurance claim's GPS – they know exactly which routes to take, avoiding those pesky traffic jams that slow down settlements.

These pros work their magic by:

Mastering the Documentation Dance

- They're like expert choreographers, orchestrating every document with precision

- No more scrambling for paperwork – they've got your back with laser-focused organization

- They speak "insurance-ese" fluently, translating complex requirements into action

Supercharging Communication

- Say goodbye to endless phone tag with insurance companies

- They're your dedicated liaison, keeping conversations flowing smoothly

- Quick responses become the norm, not the exception

Negotiation Ninjas at Work

- Skip the awkward back-and-forth with adjusters

- They know exactly what your claim is worth and won't settle for less

- While they handle the heavy lifting, you can focus on getting your life back to normal

The best part? Their systematic approach typically cuts through red tape like a hot knife through butter, getting you from claim to settlement faster than you might manage solo.

It's like having a VIP pass in the insurance world – who wouldn't want that?

Remember, time is money when dealing with slab leak damage.

Having a public adjuster in your corner means you've got an expert who makes the system work for you, not against you.

Chapter 11: Legal Rights When Slab Leak Damage Claims Are Denied

Fighting a Denied Slab Leak Claim? Here's How Public Adjusters Can Save the Day!

Ever felt like you're hitting a brick wall with your insurance company over a slab leak claim? You're not alone! Think of public adjusters as your personal insurance detectives – they're the pros who know exactly where to look and what buttons to push when your claim gets the dreaded "denied" stamp.