Dealing with sewer line damage? Let's talk about your secret weapon: public adjusters. Think of them as your insurance claim superheroes, swooping in to save the day when your pipes decide to throw a tantrum!

Ever wonder why some homeowners get better settlements? Public adjusters are like insurance detectives – they dig deep (pun intended!) to uncover every bit of damage that might affect your property. They're not just looking at the obvious pipe problems; they're checking for hidden moisture damage, foundation issues, and other sneaky complications you might miss.

What's really cool? These pros work on contingency, which means they're invested in maximizing your claim. Like a skilled chess player, they know exactly how to navigate the complex world of insurance policies, turning potential claim denials into winning settlements.

Want to know the game-changer? When you've got a public adjuster in your corner, settlements typically jump by 20-50% compared to handling it alone. Sure, they'll take a 10-20% fee, but wouldn't you rather get 80% of a much bigger pie?

Here's the tricky part – you need to prove your sewer damage was sudden, not just wear and tear over time. That's where these experts shine, building rock-solid cases with detailed documentation and professional assessments that insurance companies can't ignore.

Remember, when your sewer line goes rogue, you don't have to face the insurance giants alone. Having a professional advocate can transform your claim from a messy situation into a successful resolution.

Key Takeaways

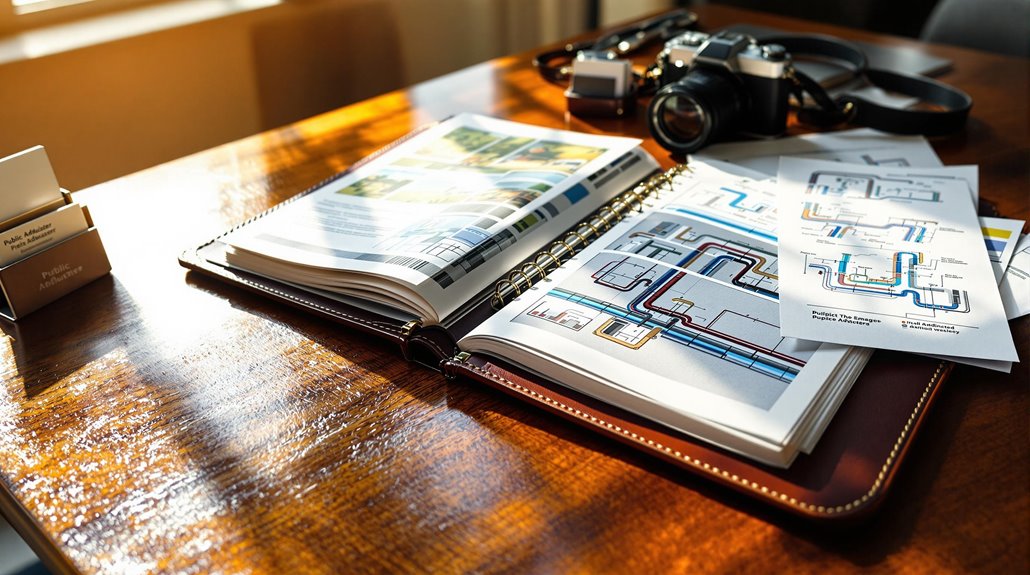

Got Sewer Damage? Here's Why Public Adjusters Are Your Secret Weapon

Think of public adjusters as your personal insurance detectives – they'll dig deep (pun intended!) to uncover every bit of sewer damage your regular adjuster might miss. Most homeowners don't realize they're leaving money on the table until a public adjuster steps in, often securing 3-5 times larger settlements.

Ever wondered what's really lurking behind those walls after a sewer backup? Public adjusters are like CSI investigators for your home, using sophisticated tools and expertise to reveal hidden moisture, mold, and structural issues that could cost you big-time down the road.

You won't pay a dime upfront – these pros work on contingency, meaning they only get paid when you win. It's like having a skilled negotiator in your corner who's equally invested in maximizing your claim.

Drowning in insurance paperwork? Public adjusters handle the heavy lifting, translating complex policy jargon into plain English and building rock-solid cases for coverage. They're especially savvy at tackling those tricky "gradual damage" denials that insurance companies love to use.

Remember those stubborn tree roots wreaking havoc on your sewer line? Your adjuster knows exactly how to document and present these claims, ensuring you're not left holding the bill for what should be covered damage. They're not just claim handlers – they're your advocacy team in the complex world of insurance settlements.

Chapter 1: Understanding Sewer Line Damage

Think of your sewer line as your home's underground superhighway – when it's damaged, everything comes to a messy standstill. You might be sitting on a ticking time bomb, especially if your house was built before 1980 when cast iron pipes were the go-to choice.

So, what's eating away at your pipes? Three main culprits are wreaking havoc down there. Tree roots, nature's persistent plumbers, can sneak through the tiniest cracks like determined burglars. Then there's pipe corrosion, slowly but surely turning your sturdy lines into swiss cheese. And let's not forget those notorious system backups – imagine a traffic jam, but with way worse consequences!

Your home might already be waving red flags: drains moving slower than a snail's pace, mysterious swamp-like spots in your yard, or that unmistakable sewer smell that no amount of air freshener can mask.

Don't ignore these warning signs – they're your pipes' desperate SOS signals!

The stakes? They're higher than you might think. We're talking potential foundation damage that could turn your dream home into a nightmare, health risks from sewage exposure (yeah, it's as bad as it sounds), and repair bills that could make your wallet weep.

The good news? Catching these issues early through proper inspection and maintenance can save you from a catastrophic plumbing apocalypse. With PVC pipes lasting 20-40 years on average, knowing your plumbing system's age is crucial for preventive maintenance.

Common Causes Of Sewer Line Damage

Ever wondered what's lurking beneath your feet, threatening your home's plumbing system? Let's dive into the underground world of sewer line problems that could be brewing right now.

Think of your sewer system as your home's circulatory system – when it fails, the whole house feels it. Whether you're a new homeowner or a seasoned property veteran, understanding these sneaky culprits can save you from a messy (and expensive) disaster.

Key Sewer Line Destroyers and Their Warning Signs:

1. Father Time's Touch

Your pipes aren't immortal – they typically last 30-50 years before age-related corrosion kicks in. Just like wrinkles on our faces, pipes show their age through rust, cracks, and weakening walls.

2. Nature's Underground Invasion

Tree roots are like nature's pipe-seeking missiles. They sense water, break through tiny cracks, and create massive blockages. It's like having an unwanted guest who keeps expanding their stay!

3. Earth's Shifting Dance

Ground movement is the silent choreographer of pipe misalignment. Whether from earthquakes, soil settlement, or construction, your pipes can twist, bend, or snap under pressure.

4. Daily Strain and Drain

How you use your plumbing matters! Think of it as a highway – too much traffic (or the wrong kind) leads to system gridlock and backups.

5. Installation Shortcuts

Poor installation is like building a house on sand – it's bound to cause problems sooner rather than later.

Basic cleaning services can cost between $100-$300 and serve as an essential preventative measure against serious damage.

Pro Tip: Keep a "plumbing diary" documenting maintenance and repairs. This golden ticket helps insurance adjusters assess damage accurately and could boost your claim value significantly.

Remember: A stitch in time saves nine – regular inspections and maintenance can catch these issues before they turn your basement into an unwanted indoor pool!

The Impact Of Sewer Line Damage On Your Home

Sewer Line Damage: What's Really at Stake for Your Home?

Ever wondered what happens when your sewer line decides to throw a tantrum? Let's dive into the not-so-pretty but absolutely crucial ways it can impact your sweet home. Think of your sewer line as your house's digestive system – when it fails, things can get messy fast!

| Impact Area | Real-World Effects | Insurance Tips |

|---|---|---|

| Structural Integrity | Foundation cracks, sagging floors | Get detailed assessment |

| Family Health | Mold growth, bacterial exposure | Document everything |

| Wallet Impact | Emergency repairs, property value drop | Review policy limits |

Your home's health hangs in the balance when sewer lines act up. Water doesn't just stay put – it's like an uninvited guest who makes themselves at home in your walls, floors, and foundation. And trust me, it's not the kind of house guest you want to host!

Smart homeowners partner with public adjusters – think of them as your insurance claim superheroes. They're the pros who know exactly where to look, what to document, and how to speak the complex insurance language that often leaves the rest of us scratching our heads.

Pro tip: Don't wait for disaster to strike! Regular sewer line check-ups are like annual health screenings for your home. They might seem unnecessary when everything's flowing smoothly, but they're your best defense against major headaches down the road. Remember, what you can't see underground can definitely hurt your home – and your bank account – above ground!

With public adjusters' expertise, insurance settlements average 747% higher compared to self-managed claims.

Chapter 2: How Much Will Professional Sewer Line Damage Restoration Cost?

Wondering What Professional Sewer Line Repairs Will Cost You? Let's Break It Down!

Think of sewer line damage like a broken bone – it needs immediate attention and proper healing to prevent long-term issues. Your wallet's about to take a hit between $1,500 to $5,000, but don't panic just yet! We'll help you understand where every dollar goes.

You've got two main repair routes: trenchless technology (the modern ninja approach) or traditional excavation (the old-school dig-it-up method). Trenchless repairs run $80-250 per linear foot – pricier upfront but gentler on your landscape. Traditional excavation costs $50-200 per linear foot and might leave your yard looking like a monster truck rally aftermath.

Did you know emergency calls can bump up your bill by 20%? Those midnight pipe disasters require specialized equipment and teams ready to spring into action. It's like calling for a plumbing SWAT team – they'll solve the crisis, but premium rates apply!

Smart homeowners plan ahead by understanding the full scope:

- Required permits and inspections ($200-500)

- Labor costs (varies by region)

- Materials needed

- Landscape restoration

- Insurance coverage potential

Pro tip: Document everything! Whether you're dealing with insurance or budgeting for repairs, detailed records are your best friend in navigating these murky waters. Working with public adjusters can increase your settlement by up to 800% compared to filing claims independently.

Typical Sewer Line Damage Restoration Costs

Feeling the Pain of Sewer Line Problems? Let's Break Down the Costs

Ever wondered what hits your wallet when that underground pipeline decides to throw a tantrum? Sewer line restoration isn't just a headache – it's a financial puzzle that needs solving.

Think of it as emergency surgery for your home's digestive system, where costs can quickly add up.

Your Sewer Repair Price Guide:

✓ Quick Fixes and Patches: $1,000-$2,000

✓ Complete Pipe Collapse Solutions: $2,500-$4,000

✓ Modern Trenchless Surgery: $3,000-$4,000

✓ Temporary Living Solutions: $500-$1,500

✓ Professional Eye Check (Inspection): $250-$500

Why such a wide range? Just like a doctor's diagnosis, each sewer situation tells its own story.

Your final bill depends on whether you're dealing with a minor crack (think paper cut) or a full-blown pipe collapse (more like a broken bone). The good news? Insurance might have your back – if you play your cards right.

Smart homeowners know the secret sauce: document everything like a crime scene investigator.

Take photos, keep receipts, and maintain a detailed timeline. Your insurance adjuster will thank you, and your wallet might hurt less.

Pro tip: Regular check-ups (maintenance) for your sewer line are like dental visits – a little prevention now saves major pain later.

And when choosing repair methods, consider them like treatment options – sometimes the modern, less invasive approach (trenchless) might be worth the extra investment.

Remember, location matters too – just as beachfront property costs more, accessing pipes under your prized rose garden might require extra care (and cash).

Working with a public adjuster can increase your insurance settlement by up to 500% compared to handling the claim yourself.

Ready to tackle that sewer situation? Let's get your home's plumbing back on track!

Emergency Service Price Factors

When Disaster Strikes: Understanding Emergency Sewer Repair Costs

Ever wondered why that midnight sewer emergency feels like it's draining your wallet faster than your pipes? Let's dive into the world of emergency plumbing costs – it's not as murky as you might think!

Think of emergency sewer repairs like calling for a taxi during surge pricing – you're paying a premium for immediate service. These urgent calls typically run 20-30% higher than planned repairs, but there's more to the story than just the rush factor.

What's driving those costs up? Picture a puzzle with multiple pieces:

- The "right now" factor – teams dropping everything to reach you

- Technical complexity of rapid solutions

- After-hours and weekend response teams

- Specialized emergency equipment deployment

- Accessibility challenges (think tight spaces or deep digging)

Smart money moves for handling the crisis:

- Document everything with photos and videos

- Get detailed quotes from multiple contractors

- Contact your insurance provider immediately

- Consider hiring a public adjuster for complex claims

- Keep receipts for temporary housing if needed

Pro tip: Your homeowner's insurance might cover more than you think, including temporary relocation costs while your home gets back to normal. Working with a public adjuster could help unlock additional coverage options you didn't even know existed.

Remember: The best emergency repair is the one you prevent. Regular maintenance might save you from that 3 AM emergency call – and the premium pricing that comes with it!

While standard repair costs average $3,000-$6,000, working with public adjusters increase settlements by 30-50% compared to handling claims alone.

Labor & Material Expenses

Breaking Down Your Sewer Line Repair Budget: What's Really Eating Your Wallet?

Ever wondered why sewer line repairs can make your bank account cry? Let's dive into the nitty-gritty of what you're actually paying for when disaster strikes underground.

The biggest chunk of your repair bill? That's labor costs, my friend. Think of it as the skilled hands that'll get your pipes flowing again, taking up about 40-60% of your total expenses.

Professional plumbers don't come cheap – they charge between $45-$150 per hour, but trust me, this isn't where you want to cut corners!

Your materials budget is like buying parts for a underground puzzle. These essential components typically eat up 25-35% of your costs, ranging from $500-$3,000 depending on what your line needs.

Remember, quality materials mean fewer headaches down the road.

Then there's the excavation – your yard's temporary makeover, if you will. This necessary evil accounts for 15-25% of the project, usually costing between $400-$1,500.

It's like giving your yard minor surgery to fix what's beneath.

Want to make sure your insurance has your back? Keep those receipts! A well-documented claim is your golden ticket to proper coverage.

Think of your damage assessment as telling a story – the more detailed it is, the better your insurance provider can understand and process your claim.

Working with public adjusters can increase your settlement by up to 500% compared to handling the claim alone.

Hidden Damage Cost Variables

Wondering Why Your Sewer Repair Bill Keeps Growing? Let's Dig Into Those Hidden Costs!

Think of your sewer system like an iceberg – what you see is just the tip of potential problems lurking beneath. When it comes to repairs, those sneaky hidden damages can turn a simple fix into quite the adventure for your wallet.

Did you know that what starts as a straightforward repair estimate often transforms into a complex puzzle? Here's what might be hiding underground:

🚨 The Secret Cost Culprits:

| Hidden Damage Type | Impact on Costs | Documentation Needed |

|---|---|---|

| Root Intrusion | $2,000-4,000 | Video Inspection |

| Pipe Collapse | $5,000-10,000 | Structural Report |

| Corrosion Damage | $3,000-7,000 | Material Analysis |

Picture tree roots as nature's determined burglars – they'll find any weak spot in your pipes and make themselves at home. And that's just one piece of the underground mystery! From sneaky pipe collapses to silent corrosion eating away at your lines, these issues love to play hide and seek with your budget.

Smart homeowners know the secret weapon: thorough documentation. Insurance companies aren't mind readers – they need concrete evidence of every crack, break, and corroded spot. Think of it as building your case with an underground detective story, where every piece of evidence counts toward your claim's success.

Remember: catching these issues early is like stopping a leaky faucet before it floods your bathroom. Regular inspections might feel like overkill, but they're your best defense against those budget-busting surprises hiding beneath your feet.

Professional video inspections cost between $60-250 per linear foot and are essential for identifying hidden damage before it becomes catastrophic.

Chapter 3: Insurance Basics For Homeowners

Is Your Home Protected? The Ultimate Guide to Sewer Line Insurance Coverage

Let's dive into the world of homeowners insurance and sewer lines – it's not as murky as it sounds! Think of your insurance policy as a safety net, but one with specific rules about when it catches you and when it doesn't.

You'll want to get cozy with your policy's fine print because sewer coverage can be tricky. Insurance companies speak their own language, kind of like learning the difference between a latte and an americano – similar but definitely not the same!

They're particularly picky about what counts as "sudden damage" (like a tree root bursting your pipe) versus "wear and tear" (those slow leaks that develop over time).

Here's what makes a huge difference in your coverage:

- Sudden accidents vs. gradual problems

- Water backup vs. overflow scenarios

- Interior vs. exterior damage

Pro tip: When you're reading your policy, imagine you're a detective solving a mystery. Look for key phrases like "water damage exclusions" and "sewer backup endorsements."

Understanding these terms isn't just about being insurance-savvy – it's your ticket to smoother claims and better conversations with adjusters when things go wrong.

Remember, your policy isn't just a boring document – it's your financial shield against sewer disasters.

If you're facing a complex claim, consider that public adjusters can help maximize your insurance settlement for covered damages.

Ready to become a sewer insurance expert? Let's roll up our sleeves and dig deeper!

Understanding Your Homeowners Insurance Policy

Navigating Your Homeowners Insurance: A No-Nonsense Guide to Water Damage Coverage

Ever felt like your insurance policy reads like a foreign language? Let's break down what you really need to know about protecting your home from water-related disasters.

Think of your homeowners insurance as your home's financial umbrella – but not all water damage gets the same protection. Here's what makes waves in the insurance world:

Quick Hits on Water Coverage:

- Sudden bursts? You're usually covered (like that washing machine hose that decided to give up mid-cycle)

- Slow leaks over time? Not so much (those sneaky drips that gradually wreak havoc)

- Sewer backup? Check your policy – this often needs additional coverage

Your Coverage Twin Pillars:

- Structure Protection: Shields your home's bones (walls, floors, foundation)

- Personal Property Shield: Guards your belongings (furniture, electronics, family heirlooms)

Leak detection systems can provide early warnings before water damage becomes catastrophic.

Pro Tips for Claims Success:

- Document everything like you're creating a crime scene investigation

- Time matters! Report issues faster than you'd post about them on social media

- Partner with adjusters who know the insurance maze better than you know your Netflix queue

Want to become a claims champion? Start by diving into your policy details. The better you understand your coverage, the stronger your position when negotiating with insurers.

Key Terms & Definitions Related To Sewer Line Damage Claims

Navigating the Maze of Sewer Line Insurance Claims: Your Essential Guide

Ever felt like you're drowning in insurance jargon when dealing with a sewer line disaster? Let's break down these crucial terms together – think of it as your personal translation guide from "insurance speak" to plain English!

| Term | What It Really Means |

|---|---|

| Sudden and Accidental | Think lightning strike versus slow rust – it's the difference between "Oops, that just happened!" and "We saw that coming." Insurance typically covers the former. |

| Additional Living Expenses (ALE) | Your temporary "Plan B" budget when sewer issues force you to crash elsewhere. Yes, that hotel stay might actually be covered! |

| Public Adjusters | Your insurance claim champions – these pros know the system inside out and fight for your fair share (while speaking fluent insurance-ese) |

| Documentation | Your claim's backbone – everything from smartphone pics to expert assessments that tell your drainage drama's story |

| Claim Denials | When insurance says "no" – but remember, it's not always the final answer |

Why master these terms? Because in the world of sewer line claims, speaking the language can mean the difference between a swift resolution and endless frustration. Whether you're dealing with a burst pipe or backing up blues, understanding these concepts helps you navigate the claims maze like a pro.

Remember: Insurance companies speak their own language, but you don't have to be fluent – just familiar enough to protect your interests and get the coverage you deserve.

With professional guidance and proper documentation, insurance settlements can reach 20-50% higher payouts than initial offers from carriers.

Chapter 4: Types Of Sewer Line Damage Covered By Homeowners Insurance

Wondering if Your Sewer Line Nightmare is Covered? Let's Decode Your Insurance Policy!

When your sewer line decides to throw a tantrum, knowing what your homeowners insurance covers can feel like solving a puzzle. Think of your policy as an umbrella – it shields you from specific types of sewer disasters, but not every puddle in the path.

With professional adjuster assistance, claims settlements typically increase by 20-30% compared to filing alone.

Ready to navigate the murky waters of sewer line coverage? Let's break it down:

Sudden Ruptures & Breaks

Those sneaky tree roots and shifting soil can wreak havoc on your pipes. Good news? If these external forces cause an unexpected break, you're typically covered.

Nature's Mood Swings

Winter's freeze-thaw dance or summer storms can leave your sewer line vulnerable. Insurance usually has your back when Mother Nature gets temperamental.

Backup Blues

Yep, that nasty sewage backup scenario nobody wants to discuss. While not included in standard policies, you can add this coverage – think of it as an insurance safety net for the "what-ifs."

Construction Chaos

Did that neighborhood construction project turn your sewer line into modern art? When third parties or heavy equipment damage your pipes, insurance typically steps in.

| Incident Type | What You Should Know |

|---|---|

| Sudden Breaks | ✓ Covered for external damage |

| Weather Impact | ✓ Protection against natural forces |

| Backups | * Requires additional coverage |

| External Damage | ✓ Third-party incidents included |

| Impact Events | ✓ Construction-related coverage |

Pro tip: Having a professional assess your sewer damage isn't just smart – it's your ticket to a smoother claims process. They'll speak your insurance company's language and help classify the damage correctly.

What Are The Most Common Sewer Line Damage Insurance Claims?

Ever wondered what keeps insurance adjusters busy when it comes to sewer line catastrophes? Let's dive into the underground world of pipe problems that make homeowners lose sleep!

Think of your sewer line as your home's digestive system – when it fails, things get messy fast. The most frequent claims often read like a plumbing horror story, but knowing what's typically covered can save you from financial drainage.

Picture this: tree roots, nature's persistent plumbers, sneaking their way into your pipes like tiny underground burglars. They're responsible for a huge chunk of insurance claims, and surprisingly, most policies have your back on this one.

🚰 The Big Three Sewer Villains:

| Problem | Why It Happens | Insurance Take |

|---|---|---|

| Sneaky Tree Roots | Mother Nature's Invasion | Usually Got You Covered |

| Old Cast Iron Giving Up | Father Time (Especially Pre-1980) | Typically Yes |

| Overwhelming Backup | Storm Drama | Most Plans Include |

Your aging cast iron pipes, particularly in homes built before 1980, are like retired warriors – they've fought the good fight but sometimes wave the white flag through corrosion. When multiple family members flush, shower, or run appliances simultaneously, it's like rush hour in your pipes – and that's when backup chaos can strike.

While complete sewer line collapse might be rarer, it's the heavyweight champion of claims. Think of it as the grand finale nobody wants – requiring extensive detective work, documentation, and often a complete underground overhaul to get your home's plumbing back in business.

Remember: Your insurance policy is like a treasure map – you've got to know how to read it to find the coverage gold!

Working with public insurance adjusters can increase your settlement amounts by up to 800% compared to handling claims yourself.

Chapter 5: Coverage Exclusions & Limitations For Sewer Line Damage

Sewer Line Coverage: What Your Insurance Company Isn't Telling You

Think your home insurance has you covered for those pesky sewer problems? Let's dig into the truth about what's really protected – and what's not.

Ever wondered why insurance companies get squeamish about sewer line claims? It's because they're dealing with a complex underground network that's often out of sight and out of mind. Just like your car needs regular maintenance, your sewer lines aren't covered for gradual wear and tear or those sneaky tree roots that creep in over time.

Quick Reference: Sewer Coverage Breakdown

| Coverage Type | Insurance Response |

|---|---|

| Gradual Deterioration | Usually Excluded |

| Tree Root Damage | Typically Not Covered |

| Installation Issues | Limited Coverage |

| Natural Disasters | May Be Covered |

| Additional Living Expenses | Often Restricted |

Here's the scoop: your standard policy typically kicks in for sudden, unexpected events – think dramatic pipe collapses or accidental breaks. But those slow-developing issues? You're probably on your own. It's like having car insurance that only covers crashes but not oil changes.

Like most water damage claims, you'll need to provide thorough documentation and photos to validate your sewer line damage claim with the insurance company.

Want to protect yourself? Documentation is your best friend. Keep detailed records of maintenance, repairs, and any sudden changes in your sewer system. Remember, insurance companies aren't mind readers – they need solid evidence to process your claim.

Smart homeowners stay ahead of the game by:

- Understanding their policy's fine print

- Maintaining regular sewer line inspections

- Considering supplemental coverage options

- Documenting all maintenance and repairs

Don't wait for a backup to learn about your coverage gaps. Take control of your sewer line protection today and avoid those expensive surprises tomorrow.

Chapter 6: Should You File A Sewer Line Damage Claim?

Dealing with Sewer Line Damage? Here's When to Pull the Insurance Trigger

Let's face it – sewer line problems can feel like opening Pandora's box of homeowner headaches. But before you rush to file that insurance claim, let's walk through what really matters.

Think of insurance claims like a game of chess – every move counts. Your winning strategy? Focus on these game-changing factors:

✓ Is it a "Surprise Attack" or "Slow Burn"?

Insurance companies love sudden, unexpected damage (think tree root invasions or pipe bursts) but aren't fans of gradual wear-and-tear issues. Your mission is proving the "sudden and accidental" nature of the damage.

Smart Steps to Strengthen Your Claim:

- Snap photos and videos like you're documenting a crime scene

- Keep your maintenance receipts – they're your defense against negligence accusations

- Act fast – insurance companies view delayed reporting like expired milk

- Consider bringing in a public adjuster, your personal claims navigator

Pro Tip: Public adjusters are like having a secret weapon in your arsenal. They speak "insurance language" and can often spot compensation opportunities you might miss.

Remember: Insurance claims are like building a case – the stronger your evidence, the better your chances of success.

And just like a good detective, documenting everything thoroughly can make the difference between a claim approval and denial.

Want to maximize your chances? Time and proof are your best friends. The sooner you start gathering evidence and notify your insurance company, the stronger your position becomes in the claims chess game.

Working with public adjusters can lead to higher claim settlements compared to handling the process yourself.

Chapter 7: Introduction To Public Adjusters

Think of public adjusters as your personal insurance detectives – they're the pros who'll fight for every penny you deserve when your sewer system goes haywire. Unlike those insurance company adjusters who might rush through your claim, these independent experts have your back 100%.

Why should you care? Well, imagine trying to navigate the complex world of insurance claims while dealing with a backed-up sewer. Not fun, right? That's where public adjusters shine, and they're particularly savvy when it comes to:

✓ Uncovering hidden damage that insurance companies often miss

✓ Speaking the complex "insurance language" so you don't have to

✓ Building bulletproof documentation that gets results

✓ Negotiating like seasoned pros (because that's exactly what they are)

Did you know homeowners who work with public adjusters typically see significantly higher settlements? While they'll take a percentage of your claim (usually 10-20%), their expertise often means you'll still walk away with more than handling it solo.

Think of it this way: You wouldn't represent yourself in court, so why face off against insurance giants alone? Public adjusters are your ace in the hole, bringing years of experience in:

- Detailed property damage assessment

- Insurance policy interpretation

- Strategic claim timing and filing

- Expert negotiation tactics

The best part? They only get paid when you do, so their success is literally tied to yours. It's like having a dedicated insurance whisperer in your corner, fighting for every dollar you deserve.

When faced with resulting damage costs, public adjusters can help maximize your settlement while insurance typically excludes the actual pipe repairs themselves.

The Role Of A Public Adjuster In Sewer Line Damage Insurance Claims

Dealing with sewer line damage? A public adjuster might be your secret weapon in the insurance claims battlefield! Think of them as your personal insurance detectives – they know exactly where to look and what evidence to gather to build a rock-solid case.

Ever wonder why insurance companies sometimes play hard to get with your claim? That's where these claims champions step in. They're masters at capturing every detail – from snapping crucial photos to crunching numbers for repair costs.

Like skilled chess players, they anticipate insurance company moves and know how to counter coverage limitations or claim denials.

What makes public adjusters truly shine? They've got direct lines to the insurance company decision-makers, cutting through the red tape that often tangles up homeowners. Instead of getting lost in the maze of customer service representatives, they zoom straight to the folks who can actually sign off on your settlement.

Sure, hiring a public adjuster comes with a fee, but think of it as investing in a property damage translator who speaks fluent "insurance-ese."

They're often able to unlock significantly higher settlements because they understand the fine print that most homeowners might miss. These pros transform the headache-inducing claims process into a straightforward path to fair compensation, making sure you don't leave money on the table when disaster strikes your sewer line. With increased settlement rates of 20-50%, public adjusters consistently deliver better outcomes for policyholders.

Benefits Of Using A Public Adjuster For Sewer Line Damage Claims

Dealing with Sewer Line Damage? Here's Why a Public Adjuster Could Be Your Best Friend

Ever wondered why some homeowners breeze through insurance claims while others struggle? The secret weapon might just be a public adjuster, especially when you're facing the messy business of sewer line damage.

Think of a public adjuster as your personal insurance detective – someone who knows exactly where to look and what buttons to push to get you the compensation you deserve. They're like having a seasoned pro in your corner during a heavyweight boxing match with insurance companies.

| Game-Changing Benefits | Real-World Impact |

|---|---|

| Insurance Policy Wizardry | Uncovers hidden coverage you didn't know existed |

| Evidence Powerhouse | Captures every detail that could boost your claim |

| Strategic Negotiation | Fights for your interests like a seasoned chess player |

Let's face it – when your sewer line goes haywire, the last thing you want is to wrestle with insurance jargon and complex claim forms. Public adjusters dive deep into the nitty-gritty, translating insurance-speak into plain English and turning your damage nightmare into a manageable process.

What's more, they're masters at spotting potential issues that could affect your home's long-term value. From hidden water damage to structural concerns, they'll make sure nothing flies under the radar. It's like having X-ray vision for property damage!

Operating on a 100% contingency basis, public adjusters only get paid when you receive your settlement, typically charging 10-20% of the final amount.

How Are Public Adjusters Paid & What Are Their Fees?

Ever wondered how public adjusters make their money? Let's break down their fee structure in a way that won't make your head spin!

Think of public adjusters as your insurance claim's personal trainers – they only win when you win. Their fees typically land between 10% to 20% of your final settlement, but here's the kicker: you don't pay unless they successfully resolve your claim.

What's really in it for you?

🏠 Professional Damage Assessment: They'll spot issues you might miss

📋 Expert Documentation: No detail left behind

💪 Skilled Negotiation: Your champion against insurance companies

⚡ Full Process Management: They handle the headaches while you focus on recovery

The real eye-opener? Even after paying their fees, you're likely to come out ahead. The game-changing Landmak OPPAGA research revealed that claims handled by public adjusters secured settlements up to 800% higher than DIY attempts. It's like having a seasoned poker player at your table – they know all the cards to play.

| Service | What You Get | Cost Structure |

|---|---|---|

| Initial Review | In-depth Analysis | No Extra Cost |

| Paperwork | Complete Files | Part of Package |

| Fighting for You | Pro Negotiation | Included |

| Full Management | Start-to-Finish Care | All-in-One |

| Final Results | Maximum Payout | Success-Based Fee |

Remember: You wouldn't represent yourself in court, so why face insurance giants alone? A public adjuster's expertise could be the difference between a fair settlement and leaving money on the table.

With their expertise in water backup coverage, public adjusters can help ensure you receive proper compensation for sewer backups and sump pump failures that standard policies typically exclude.

Public Adjusters Vs. The Insurance Company Adjuster

The Battle of the Adjusters: Your Guide to Insurance Claim Success

Ever wondered who's really on your side when dealing with sewer line damage claims? Let's dive into the world of insurance adjusters – it's like having two coaches in your corner, but only one is truly fighting for your team!

Think of public adjusters as your personal claims champions. These independent pros work solely for you, the homeowner, and only get paid when you win (typically a percentage of your settlement). They're like skilled treasure hunters, uncovering every possible damage detail to maximize your claim's value.

On the flip side, insurance company adjusters are like company referees – they're trained to play by their employer's rulebook. While they're professionals too, their primary goal is to protect the insurance company's bottom line.

property damage liability is required for most drivers in case your sewer line issues affect neighboring properties.

Key Differences That Matter to Your Wallet:

| Role Focus | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Loyalty | Your best interests | Company's interests |

| Payment Structure | Success-based fee | Company salary |

| Claim Approach | Comprehensive review | Standard assessment |

| Goal | Maximum fair payout | Cost-effective settlement |

| Strategy | Independent investigation | Company protocol |

Why does this matter? Imagine playing chess – would you rather have a grandmaster coaching you, or rely on your opponent's advice? Public adjusters bring expert-level knowledge to your claim, often spotting damage elements that might otherwise go unnoticed. Their deep understanding of policy language and negotiation skills can transform a basic claim into a comprehensive settlement that truly covers your sewer line damage.

Remember: While insurance company adjusters aren't the enemy, they're not your personal advocates. When significant property damage is at stake, having your own expert can make all the difference in your claim's outcome.

Public Adjusters Vs. Bad Faith & Property Damage Lawyers – Which To Hire & When

Dealing with Property Damage? Let's Break Down Your Expert Options!

Ever wonder why choosing between a public adjuster and a property damage lawyer feels like deciding between a GPS and a defense attorney for your insurance journey? Let's dive into this crucial decision that could make or break your claim.

Think of public adjusters as your claims navigation experts – they're your first line of defense when disaster strikes. They speak the complex language of insurance policies and know exactly how to document every drip, crack, and crumble. On the flip side, property damage lawyers are your legal warriors, stepping in when insurance companies play hardball or slam the door on your claim.

| Key Factor | Public Adjuster | Property Damage Lawyer |

|---|---|---|

| Best Timing | Right after damage occurs | When insurers deny or lowball |

| Payment Style | Takes a slice of your settlement | Legal fees or "no win, no fee" |

| Expertise Sweet Spot | Claims maximization & documentation | Legal battles & bad faith cases |

| Results Timeline | Weeks to months | Months to years |

| Daily Tasks | Number-crunching & damage assessment | Court battles & legal strategizing |

Want to maximize your chances of success? Here's the inside scoop: Public adjusters shine brightest when you need someone to build an ironclad claim from the ground up. They're like property damage detectives, uncovering every detail that could boost your settlement.

But when your insurance company starts playing games or flat-out denies your claim? That's when a property damage lawyer becomes your MVP. They're equipped with legal firepower to challenge bad faith practices and fight for your rights in court.

Remember: Your choice isn't just about who to hire – it's about when to bring them in. Think of it as assembling your dream team at exactly the right moment in your insurance claim journey.

Working with a public adjuster typically results in 574% higher settlements compared to handling claims independently.

When To Contact A Public Adjuster For A Sewer Line Damage Claim

Has Your Sewer Line Gone Rogue? Know When to Call a Public Adjuster

Let's face it – dealing with sewer line damage feels like navigating a maze blindfolded. But here's the game-changer: bringing in a public adjuster at the right moment can turn that maze into a straight path to fair compensation.

Think of public adjusters as your personal claim champions. They're the pros who know exactly how to translate that messy sewer situation into insurance-speak, making sure you don't leave money on the table.

When Should You Pick Up That Phone?

🚨 Red Flag Scenarios:

- Your insurance company's playing the "partial coverage" card

- The damage looks like a spider web – spreading everywhere

- You're stuck in the "what caused this?" mystery

- Your claim's moving slower than molasses

Real Talk: Timing is Everything

| Situation | Why It Matters | Smart Move |

|---|---|---|

| First Signs of Trouble | Fresh evidence is strongest | Early adjuster involvement |

| Insurance Pushback | Leverage professional expertise | Immediate consultation |

| Multiple Issues | Need expert documentation | Comprehensive evaluation |

| Settlement Offers | Maximize compensation | Professional negotiation |

Your public adjuster brings more than just paperwork skills to the table – they're your strategic partner who speaks fluent insurance. They'll dig deep into policy details that most homeowners might miss, kind of like a detective piecing together crucial evidence.

And here's the kicker: while you focus on getting your life back to normal, they're working behind the scenes, turning complex claim language into real results. They're not just filing paperwork; they're building your case with the precision of a master architect.

Remember: The sooner you bring in a public adjuster, the better your chances of turning that sewer disaster into a success story.

Working on a contingency fee basis, public adjusters typically charge 10-20% of your final settlement amount.

Chapter 8: When To Contact Your Insurance Provider For Sewer Line Damage Claims

Ever wondered when's the perfect time to ring up your insurance company about that pesky sewer line problem? Let's dive into this not-so-glamorous but super important topic!

Think of insurance claims like a chess game – your first move can make or break your success. Whether you're flying solo or bringing in a professional adjuster, here's what you need to know to play it smart:

DIY Claims Route:

- Pick up that phone immediately – insurance companies love prompt reporting

- Transform into a detective: snap photos, shoot videos, and document everything

- Keep communication channels wide open with your insurer

The Professional Path:

- Team up with a public adjuster first (they're like your personal insurance translators)

- Let them conduct their expert damage assessment (they know where to look!)

- Sit back while they navigate the insurance maze for you

Red Alert Situations:

- Water gushing everywhere? Don't wait – alert your insurer ASAP

- Document emergency fixes like your life depends on it

- Save every receipt (yes, even that coffee run during repairs)

Your Evidence Arsenal:

- Create a digital damage diary with time-stamped photos

- Collect contractor quotes like Pokemon cards

- Pull out those maintenance records you've been hoarding

Remember: Just like you wouldn't wait to patch a leaky boat, don't delay in starting your sewer line claim. Your quick action could be the difference between smooth sailing and a sinking ship!

Working with public adjusters can increase your insurance settlement by up to 800% compared to handling the claim yourself.

If Using A Public Adjuster

Thinking About Hiring a Public Adjuster? Here's Your Game Plan

Want to maximize your sewer line damage claim? A public adjuster might be your secret weapon – but timing is everything! Think of them as your personal claims quarterback, jumping into action right when disaster strikes.

These insurance claim pros know exactly how to play the game, speaking the insurance company's language while fighting in your corner. Just like a skilled detective, they'll meticulously document every drop of water damage, decode your policy's fine print, and build an airtight case for maximum compensation.

Why go solo when you can have an expert navigator steering your claim through choppy insurance waters? Public adjusters bring years of experience to the table, helping you:

- Capture crucial evidence before it disappears

- Understand complex policy language in plain English

- Keep detailed records that insurance companies can't ignore

- Turn frustrating negotiations into productive conversations

Remember, this isn't just about filing paperwork – it's about protecting your investment. Your public adjuster works exclusively for you, not the insurance company, ensuring every legitimate damage gets proper attention and fair compensation.

Want better results? Get them involved early. The sooner your public adjuster starts documenting and managing your claim, the stronger your position becomes. They'll create a clear paper trail and handle those nerve-wracking insurance discussions while you focus on getting your property back to normal.

With claim windows typically ranging from 30-90 days after an incident, quick action with a public adjuster can make all the difference.

If Filing On Your Own

Let's face it – dealing with sewer line damage feels like navigating a maze blindfolded. But don't worry, you've got this! Think of filing your claim like building a rock-solid court case: the more evidence you gather, the stronger your position.

First things first: ring up your insurance provider faster than you can say "backed-up pipes." Why? Because timing is everything in the claims world. While you're at it, become a documentation ninja – snap photos from every angle, get those inspection reports, and keep your paper trail cleaner than your soon-to-be-fixed sewer line.

Here's the tricky part: most insurance policies are pickier than a toddler at dinnertime when it comes to coverage. They typically wave their magic wand for sudden disasters but turn their nose up at slow-developing problems. So, put on your detective hat and really dig into your policy's fine print.

Want to boost your chances of success? Channel your inner secretary and log everything:

- Every phone call (yes, even those "on hold" moments)

- Insurance rep names (they'll become your new pen pals)

- Conversation highlights (because memory can be as unreliable as old plumbing)

Sure, you could hire a public adjuster, but if you're flying solo, remember this: clear communication is your superpower. Break down the damage details like you're explaining them to your best friend, and match those repair estimates to your policy like pieces in a puzzle.

Most standard policies offer sewer backup coverage ranging from $5,000 to $25,000 in protection.

Stick to these steps, and you'll transform from a DIY claims rookie to a seasoned pro faster than you can say "insurance approved!"

Chapter 9: Filing Process For Sewer Line Damage Insurance Claims (Without Public Adjuster)

Is Your Sewer Line Damage Giving You a Headache? Here's Your No-Fuss Claims Guide

Think of filing a sewer line damage insurance claim as building your case for a courtroom – you'll want every piece of evidence in your corner.

Let's break down this often-overwhelming process into bite-sized, actionable steps that'll boost your chances of getting that much-needed approval.

Step 1: Become a Documentation Detective

- Snap clear photos of every affected area (think "before and after" crime scene photos)

- Record video evidence, especially of active leaks or backups

- Write detailed notes about when you discovered the damage

- Keep a running timeline of events and observations

Step 2: Ring the Insurance Alarm

- Don't wait! Contact your insurance provider as soon as you spot trouble

- Get your claim number and assigned adjuster's direct contact info

- Ask about emergency service coverage if you need immediate repairs

- Take notes during every conversation (trust me, you'll thank yourself later)

Step 3: Bring in Your Independent Expert

- Hire a licensed plumber for a thorough inspection

- Request a detailed written assessment of damage and repair needs

- Get multiple repair quotes to strengthen your position

- Consider a structural engineer's report for severe cases

Step 4: Build Your Evidence Portfolio

- Gather past maintenance records showing proper upkeep

- Collect repair estimates from licensed contractors

- Include any relevant home inspection reports

- Document secondary damage to furniture, flooring, or belongings

Pro Tip: Create a digital folder for all your claim-related documents – it's easier to track and share than a mountain of paperwork!

Document Sewer Line Damage Thoroughly

Don't Let Your Sewer Line Drama Become a Documentation Crisis!

Think of documenting sewer line damage like building your case as a home detective – every photo, note, and receipt tells part of your story. Let's make sure your insurance claim is bulletproof!

📸 Smart Documentation Strategy:

- Snap crystal-clear photos from multiple angles

- Record video walkthroughs with narration

- Time-stamp your visual evidence

- Include a measuring tape in photos for scale

Your Documentation Power Pack:

| Must-Have Items | Why It Matters |

|---|---|

| Visual Evidence | Your "before and after" story in pixels |

| Insurance Chats | Every call, email, and message counts |

| Damage Catalog | From pipes to property, track it all |

Pro Tips for Success:

- Create a digital folder system (think Marie Kondo for your claim!)

- Keep a daily log of sewage-related issues

- Save contractor assessments and quotes

- Archive neighborhood history of similar problems

Remember, you're not just collecting paperwork – you're building an airtight case for your claim. Think like an investigator: What would convince you if you were reviewing this claim? Your detailed documentation isn't just helpful; it's your insurance claim's best friend!

🔍 Expert Insight: Insurance adjusters love organized documentation almost as much as they love their morning coffee. Make their job easier, and you'll likely get faster, better results.

Bottom line: When it comes to sewer line claims, the devil's in the details. Document everything as if you're preparing for the world's most important show-and-tell – because for your wallet, it kind of is!

Contact Insurance

Discovered sewer line damage? Let's tackle that insurance claim like a pro! Your first move – and trust me, it's a game-changer – is reaching out to your insurance provider ASAP. Think of it as sending up a flare for help: you'll need your policy number handy and a clear explanation of what went wrong.

Want to build an ironclad claim? Document everything like you're creating a CSI crime scene! Snap photos from every angle, list affected areas, and don't forget those repair estimates.

Pro tip: dig up any maintenance records you've kept – they're worth their weight in gold when proving your case.

Living room turned into an unwanted indoor pool? Keep those receipts for temporary housing or other unexpected expenses. Many policies cover these costs, but you'll need proof to get reimbursed.

Stay on your insurance company's radar like a friendly (but persistent) neighbor. When they ask for more details, respond faster than a plumber to a burst pipe.

Remember, a smooth-running claim is like a well-maintained sewer line – it flows better when you keep things moving!

Need-to-know keywords: sewage backup coverage, water damage claim, home insurance policy, emergency repairs, property damage documentation, claim adjuster inspection

Deal With Insurance Company Adjuster & Low Ball Assessments

Dealing with Insurance Adjusters: Don't Let Low-Ball Offers Sink Your Sewer Claim!

Ever felt like you're playing poker with an insurance adjuster who's holding all the cards? When it comes to sewer line damage, their initial offers often leave you high and dry. But don't worry – you've got more leverage than you think!

Think of your claim documentation as building a bulletproof case. You'll want to:

- Snap crystal-clear photos of every water-damaged area

- Gather multiple repair estimates from licensed plumbers

- Create a day-by-day timeline of the incident and aftermath

- Document every conversation with your insurance company

Here's your power move: understand the fine print about "sudden and accidental damage" in your policy. It's like knowing the rules of the game before you play. When that low-ball offer lands on your desk, you'll be ready to counter with rock-solid evidence.

Pro tip: Treat your claim like a detective building a case. Keep detailed records of:

- Emergency repair receipts

- Professional damage assessments

- Water damage restoration costs

- Plumbing inspection reports

Remember, you're not just showing what broke – you're painting a complete picture of the impact on your home. By backing up your claim with expert evaluations and comprehensive documentation, you'll transform that initial lowball offer into a fair settlement that actually covers your repairs.

Want to really strengthen your position? Get a third-party plumbing expert to evaluate the damage. Their professional opinion can be worth its weight in gold when negotiating with adjusters.

Get Professional Assessment

Got Sewer Line Troubles? Get a Pro Assessment First!

Think of a professional assessment as your secret weapon in battling sewer line damage claims. Just like you wouldn't diagnose a complex medical condition without a doctor's expertise, you shouldn't tackle sewer issues without a licensed plumber's trained eye.

Want to make your insurance claim rock-solid? Here's why a professional evaluation matters:

- Licensed plumbers act as your damage detectives, documenting every crack, leak, and worn-out pipe.

- Their detailed reports pack the punch you need when negotiating with insurance companies.

- High-quality photos and technical analysis serve as your evidence arsenal.

Pro tip: Keep your assessment documentation as detailed as your favorite recipe book. Include:

- Crystal-clear photographs of damaged areas

- Technical specifications that tell the whole story

- Repair estimates broken down to the last penny

- Root cause analysis of the damage

Remember, you're building a case here! Keep open lines of communication flowing between you, your plumber, and your insurance provider – just like a well-functioning sewer system. The clearer the communication, the smoother your claim process will flow, potentially leading to better settlement outcomes.

Bonus: Having a professional assessment in your back pocket becomes invaluable if you need to bring in public adjusters later. It's like having an ace up your sleeve when the stakes get high.

Gather Supporting Evidence

Protecting Your Insurance Claim: Building an Ironclad Case for Sewer Line Damage

Think of gathering evidence for your insurance claim like building a bulletproof legal case – every detail matters! When your sewer line throws you a curveball, you'll want to become a documentation detective, capturing every drip, crack, and repair quote along the way.

Ready to strengthen your claim? Let's break down your evidence arsenal:

Visual Storytelling:

- Snap crystal-clear photos and videos (yes, even the yucky stuff!)

- Capture damage from multiple angles

- Include timestamps and location markers

Paper Trail Power:

- Save every email, text, and voicemail from contractors and adjusters

- Track conversations in a dedicated notebook or digital file

- Flag important dates and deadlines

Money Matters:

- Collect detailed repair quotes from licensed professionals

- Keep receipts for emergency repairs or temporary fixes

- Document any related expenses (hotel stays, property protection)

Expert Backup:

- Schedule professional assessments

- Request written reports from plumbers and contractors

- Get engineering evaluations if structural damage occurs

Remember, insurance companies love a well-organized claim like bees love honey! By maintaining these records meticulously, you're not just filing a claim – you're telling your property's damage story in vivid, undeniable detail.

Each piece of evidence works like a puzzle piece, creating a complete picture that makes your claim hard to dispute.

Want to go the extra mile? Create a digital backup of everything. Trust me, your future self will thank you!

Submit Complete Claims Package

Ready to Nail Your Sewer Line Insurance Claim? Here's Your Complete Package Guide

Think of your insurance claims package as your golden ticket to getting fair compensation for that frustrating sewer line damage. Just like building a winning case, you'll need all your ducks in a row to make it bulletproof.

Let's dive into what makes your claim package irresistible:

- Document Everything Like a Pro

- Crystal-clear damage descriptions (think detective-level detail)

- High-quality photos from multiple angles

- Professional repair estimates (get at least three)

- Timeline of events (your story matters!)

- Paint the Complete Picture

- Root cause analysis (what exactly went wrong?)

- Communication trail with your insurer

- Property damage inventory with values

- Emergency expense receipts (keep every single one!)

- Stay on Top of Your Game

- Track your claim's progress weekly

- Respond to questions lightning-fast

- Keep a digital backup of everything

- Follow up strategically (persistent but professional)

Remember, your claims package isn't just paperwork – it's your ticket to recovery. Just like a chef needs all ingredients prepped before cooking, you need all these elements ready before submission.

The more organized and thorough you are now, the smoother your path to settlement will be.

Pro tip: Create a digital folder system for easy access and sharing with your insurance provider. This way, you're always ready to respond with exactly what they need, when they need it.

Try To Negotiate Claim Settlement Offer

Ready to Master Your Insurance Claim Negotiation? Let's Get You What You Deserve!

Think of negotiating an insurance claim like playing chess – every move matters, and strategy is key. You've got your claims package ready, but how do you turn it into the settlement you deserve?

First, build your power position with rock-solid documentation. Snap those high-resolution photos showing every angle of the damage, and don't forget to get at least three detailed estimates from reputable contractors.

This will not only support your claim but also demonstrate to the insurance company that you are serious and well-prepared.

Next, familiarize yourself with your policy. Understand what is covered and what isn't. This knowledge will empower you during negotiations and help you counter any lowball offers.

Finally, be patient and persistent. Negotiation is often a back-and-forth process, and it may take time to reach a satisfactory settlement.

Stay calm, stick to your strategy, and remember that you deserve fair compensation for your losses.

Chapter 10: Filing Process For Sewer Line Damage Insurance Claims (With A Public Adjuster)

Dealing with Sewer Line Damage? A Public Adjuster Can Be Your Secret Weapon!

Think of a public adjuster as your personal insurance claim superhero – they're experts who know exactly how to navigate the maze of sewer damage claims.

Let's break down how they'll fight for your rights and maximize your settlement:

Your Claim Journey Made Simple:

- CSI-Level Investigation

- Your adjuster conducts a forensic-style inspection (because what's visible is just the tip of the iceberg!)

- Creates a bulletproof documentation trail

- Spots hidden damage that untrained eyes might miss

- Policy Detective Work

- Dives deep into your insurance policy's fine print

- Identifies every possible coverage angle

- Uncovers benefits you didn't even know existed

- Dream Team Assembly

- Brings in the heavy hitters: expert plumbers, structural engineers

- Coordinates professional assessments

- Builds an iron-clad case for maximum compensation

- Insurance Company Liaison

- Speaks their language (so you don't have to)

- Handles all those frustrating back-and-forth negotiations

- Protects your interests like a watchdog

Working with a public adjuster isn't just smart – it's like having an insurance whisperer in your corner.

They transform what could be a nightmare process into a structured path toward fair compensation.

Ready to turn the tables in your favor?

Public Adjuster Documents Sewer Line Damage Thoroughly

Think of a public adjuster as your property damage detective, especially when it comes to sneaky sewer line problems! They're the pros who leave no pipe unturned when building your insurance claim.

Did you know that proper documentation can make or break your sewer damage claim? Let's dive into how these claims champions work their magic:

First Steps: The Scene Investigation

Your adjuster hits the ground running with a comprehensive damage assessment – they're like CSI for your property! Using state-of-the-art tools and their trained eyes, they spot issues you might miss.

Picture Perfect Evidence

They don't just take random photos – they create a visual story of your damage. Every crack, leak, and backup gets captured from multiple angles, building an airtight case for your claim.

Breaking Down the Numbers

This is where science meets strategy. Your adjuster:

- Calculates precise repair costs

- Maps out restoration plans

- Analyzes long-term impact

- Evaluates secondary damage

The Coverage Detective Work

By matching your policy details with documented damage, they unlock maximum claim potential. It's like solving a puzzle where every piece means potential compensation!

| Documentation Step | Purpose | Outcome |

|---|---|---|

| Visual Inspection | Assess Damage Extent | Detailed Damage Report |

| Photo Evidence | Create Visual Record | Support Claim Validity |

| Cost Analysis | Calculate Repairs | Accurate Settlement Value |

| Policy Review | Identify Coverage | Maximum Compensation |

Remember: Water damage claims are time-sensitive, so having a public adjuster document everything properly from day one can save you headaches (and dollars) down the road!

Public Adjuster Reviews Policy For Hidden Sewer Line Damage Coverage & To Maximize Policy Benefits

Think your insurance policy is like a treasure map? A public adjuster is your expert navigator when it comes to uncovering those hidden gems of sewer line coverage you didn't even know existed!

Why Your Policy Might Hold Surprising Coverage Secrets

Let's dive into how these insurance detectives work their magic:

🔍 Policy Deep-Dive Elements | What's in it for You?

———————————-|————————-

Coverage Treasure Hunting | Spots those "buried" benefits you might miss

Smart Claims Architecture | Makes your case bulletproof

Power Negotiation Tactics | Gets you what you truly deserve

Ever wondered why insurance companies write policies in such complex language? That's where your public adjuster becomes your personal translator. They're like skilled code-breakers, turning insurance-speak into plain English while spotting those sneaky coverage opportunities others might miss.

Got a sudden sewer disaster? These pros know exactly where to look in your policy for those "sudden and accidental" clauses that could save your wallet. They're not just reading your policy – they're building your case like a master strategist, gathering everything from detailed repair quotes to rock-solid evidence of damage.

Remember: Insurance companies have their experts, so why shouldn't you have yours? A public adjuster is basically your insurance-savvy best friend who knows all the rules of the game and isn't afraid to go to bat for you. They'll help you navigate the claims maze and unlock the maximum benefits you're entitled to – no detective badge required!

Want to turn a potential claim denial into a victory? These pros have seen it all and know exactly how to present your case in a way that gets results. It's like having an insurance whisperer in your corner!

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Ever wondered how public adjusters become your insurance claim superheroes? When sewer line damage strikes, these pros step in as your personal claims advocates, creating a protective shield between you and your insurance company.

Think of them as your skilled negotiation ninjas – they speak the complex language of insurance and know exactly how to navigate the claims maze. Just like a chess grandmaster planning their moves, public adjusters strategically manage every aspect of your claim.

Here's what these insurance experts do when they're in your corner:

- They dive deep into your policy's fine print, uncovering hidden coverage gems you might not know exist.

- Document everything meticulously – like CSI investigators at a crime scene.

- Build rock-solid cases with compelling evidence and repair estimates.

- Go toe-to-toe with insurance representatives to maximize your settlement.

The best part? You can focus on getting your life back to normal while your public adjuster handles the heavy lifting.

They're particularly valuable during sewer line claims, where damage assessment can be tricky and repairs costly.

By leveraging their industry expertise and negotiation skills, public adjusters ensure you don't leave money on the table. They transform what could be an overwhelming insurance battle into a structured, professional process that works in your favor.

Remember: Insurance companies have their adjusters – shouldn't you have someone in your corner too?

Public Adjuster Gets Professional Assessments

Ever wondered how public adjusters crack the code on sewer damage claims? Let's dive into their secret weapon: professional assessments that pack a serious punch!

Think of your public adjuster as a detective, methodically gathering evidence to build your case. When disaster strikes – whether it's a sneaky burst pipe or a full-blown flood scenario – they're your boots on the ground, armed with a strategy to document every drop of damage.

Your Claims Arsenal Includes:

- Deep-dive plumbing inspections (because "the pipe just broke" won't cut it with insurance companies)

- High-tech sewer line videos that tell the whole story (like a CSI episode, but for your pipes!)

- Real-world repair quotes from certified contractors who know their stuff

- Expert structural assessments that reveal hidden foundation threats lurking beneath the surface

But here's what makes these assessments truly powerful: they speak the insurance company's language. Your adjuster transforms technical jargon into compelling evidence that's harder to dispute than a concrete foundation.

Like building a winning court case, each assessment adds another layer of proof to your claim. And when you're dealing with tricky situations like flood insurance requirements or sewage backups, you'll want this rock-solid documentation in your corner.

Public Adjuster Gathers Supporting Evidence

Want to Know How Public Adjusters Build Bulletproof Sewer Damage Claims?

Think of public adjusters as master detectives, gathering critical evidence that makes your sewer line damage claim rock-solid. They're like puzzle masters, piecing together a compelling story that insurance companies can't ignore.

Let's dive into their evidence-gathering arsenal:

Real-World Evidence That Makes Your Claim Shine:

- Picture-Perfect Documentation

- Before and after snapshots

- Video walkthroughs

- Detailed damage close-ups

- Dollars & Sense

- Multiple contractor estimates

- Material cost breakdowns

- Labor projections

- History Matters

- Maintenance paper trail

- Previous repair records

- Service documentation

- Professional Backup

- Engineering assessments

- Plumber certifications

- Environmental impact reports

Here's the secret sauce: They don't just collect evidence – they weave it into a powerful narrative that connects the dots between cause, damage, and necessary repairs.

It's like building a courtroom case, but instead of a jury, you're convincing insurance adjusters.

Remember how a good recipe needs all its ingredients? Your claim needs every piece of evidence working together.

By creating this comprehensive paper trail, public adjusters help you navigate the often-murky waters of insurance claims with confidence.

This methodical approach isn't just about getting paid – it's about protecting your property's future and ensuring you receive fair compensation for both visible damage and potential long-term effects.

Public Adjuster Submits Complete Claims Package

Public Adjusters: Your Claims Package Heroes

Ever wonder how scattered documents transform into a winning insurance claim? That's where public adjusters shine! They're like master storytellers who weave your sewer damage evidence into a compelling narrative that insurance companies can't ignore.

Think of a claims package as a puzzle – every piece matters. Your adjuster knows exactly which pieces fit where:

| Documentation Type | Purpose | Impact |

|---|---|---|

| Damage Photos | Visual Evidence | Substantiates Claim |

| Repair Estimates | Cost Analysis | Justifies Payment |

| Cause Reports | Coverage Verification | Confirms Eligibility |

You wouldn't build a house without blueprints, right? Similarly, your public adjuster creates a rock-solid foundation with expertly organized documentation. They're fluent in "insurance-speak" and know how to translate your water damage woes into terms that get results.

From soggy kitchen cabinets to sneaky mold growth, they document everything. It's like having a detective who specializes in property damage – they'll spot issues you might miss and ensure they're properly recorded. They'll navigate policy language like a seasoned captain steering through rough waters, making sure you don't leave any compensation on the table.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Think of a public adjuster as your claim's personal project manager – they don't just submit paperwork and vanish! Instead, they become your claim's guardian, keeping the insurance process moving like a well-oiled machine.

When it comes to follow-up, these pros are relentless (in the best way possible). They're constantly juggling multiple balls:

🕒 Timeline Management

- Tracking every deadline like a hawk

- Setting up smart reminder systems

- Preventing those dreaded claim delays

📞 Insurance Company Communication

- Making those "friendly but firm" check-in calls

- Responding lightning-fast to information requests

- Speaking the insurance lingo that gets results

Ever wondered what happens behind the scenes? Your public adjuster is:

- Dancing through the paperwork tango

- Playing chess with timing and strategy

- Building a paper trail that could circle the moon

The best part? You don't have to worry about playing phone tag with insurance representatives or decoding insurance-speak. Your adjuster handles everything while you focus on getting back to normal.

Remember: Insurance claims are like marathons, not sprints. Having a public adjuster means you've got an experienced pacesetter who knows exactly when to push and when to pace, ensuring your claim crosses the finish line successfully.

This hands-on management style doesn't just keep things moving – it maximizes your chances of a fair settlement while minimizing those hair-pulling moments of frustration that often come with insurance claims.

Public Adjuster Enforces Policyholder's Rights, & Negotiates Higher & More Fair Claim Settlement Offer

Why Battle Your Sewer Line Insurance Claim Alone? Here's How a Public Adjuster Has Your Back

Ever felt like David facing Goliath when dealing with your insurance company? That's where a public adjuster becomes your secret weapon in the fight for fair sewer line damage compensation.

Think of a public adjuster as your personal insurance detective and negotiator rolled into one. They're experts at cracking the code of complex policy language and turning it into real dollars in your pocket. While you might see a standard repair cost, they'll spot hidden coverage gems that could dramatically boost your settlement.

Let's break down how they work their magic:

- Policy Deep-Dive: They don't just read your policy – they dissect it like a master chef finding premium ingredients for the perfect recipe of coverage

- Damage Documentation: Armed with industry-grade tools and know-how, they build an airtight case that's harder to dispute than a fingerprint at a crime scene

- Smart Negotiation: Using their insider knowledge, they speak the insurance company's language while fighting for your rights

- Regulatory Shield: They ensure insurance companies play by the rules, acting as your personal watchdog throughout the claims process

Remember when that friend helped you negotiate your first car purchase? A public adjuster does that, but with the professional muscle to tackle insurance giants. They typically help homeowners secure settlements that are significantly more generous than going it alone – because let's face it, the insurance company isn't exactly eager to write bigger checks without someone holding them accountable.

Ready to level the playing field? That's exactly what a public adjuster does for your sewer line claim.

Public Adjuster Speeds Up Claim Settlement Time

Want to Fast-Track Your Insurance Claim? Here's How Public Adjusters Make It Happen

Think of a public adjuster as your personal insurance claim speedrunner – they know all the shortcuts, tricks, and optimal paths to get you from "disaster" to "done" in record time.

While most homeowners might get stuck in the claims labyrinth, these pros have mapped out every turn.

Why You'll Get Your Settlement Faster:

📋 They're Documentation Ninjas

No more playing hide-and-seek with paperwork! Your public adjuster swoops in with a battle-tested system that catches every detail insurance companies need.

It's like having a master chef who preps all ingredients before cooking – everything's ready to go when needed.

🔍 They Speak "Insurance-ese" Fluently

Remember playing telephone as a kid? That's what claim communication can feel like.

Public adjusters cut through the jargon jungle, translating complex policy language into crystal-clear terms both you and your insurer understand.

⚡ Direct Lines of Communication

Instead of waiting on hold or playing email tag, your adjuster maintains open channels with insurance companies.

Think of them as your VIP backstage pass to faster claim processing.

🎯 One-and-Done Submissions

Rather than the usual back-and-forth dance, public adjusters nail it the first time.

They package your claim like a well-organized presentation that answers questions before they're even asked.

By streamlining these crucial steps, public adjusters can slash weeks or even months off your claim settlement time.

Just imagine getting back to normal life while others are still filling out their first round of paperwork!

Chapter 11: Legal Rights When Sewer Line Damage Claims Are Denied

Fighting Back: Your Legal Arsenal When Sewer Line Claim Denials Hit Home

Ever felt like you're drowning in paperwork after your insurance company denies your sewer line claim? You're not alone! Think of public adjusters as your personal insurance detectives – they're the pros who know how to turn those frustrating "claim denied" letters into approved settlements.

Why You Need a Public Adjuster in Your Corner

Just like having a skilled mechanic for your car, a public adjuster brings specialized tools to decode complex insurance policies and fight for your rights. They speak the insurance language fluently and know exactly where to look for coverage loopholes that could work in your favor.

Smart Strategies to Challenge Claim Denials:

- Policy Deep Dive

- Think of your policy as a treasure map – public adjusters know where X marks the spot