Is your roof throwing a tantrum after that wild windstorm? Let's talk about what you need to know before those missing shingles turn into bigger headaches!

Wind damage isn't just about a few loose shingles – it's like giving your home an unwanted skylight. You'll spot the warning signs: shingles playing hide-and-seek, mysterious water spots dancing across your ceiling, and rafters that look like they've been through a wrestling match.

When it comes to fixing your storm-battered roof, your wallet's workout depends on your shingle choice. Think of it as a three-tier system: 3-tab shingles are your budget-friendly basics ($200-$700), architectural shingles offer that middle-ground sweet spot ($400-$1,000), and impact-resistant options are your premium defenders ($600-$1,500).

Here's the silver lining: your homeowners insurance likely has your back. Want to maximize your claim? Consider bringing a public adjuster into your corner – they're like professional negotiators who can boost your settlement by 20-50%. Pretty neat, right?

The key to winning this roofing battle? Quick action and smart choices. Don't let a few displaced shingles turn your attic into an indoor water park. Remember, your roof is your home's first line of defense against Mother Nature's mood swings, so treat it right!

Key Takeaways

Is Your Roof Ready to Weather the Storm? Understanding Wind Damage 101

When Mother Nature flexes her muscles, your roof takes the biggest hit. Think of wind speeds over 50mph as an uninvited guest trying to peel off your shingles – creating unwanted skylights where water can sneak in.

Got wind damage? Don't worry – your homeowners insurance likely has your back. Just remember to snap plenty of photos and file your claim pronto, because timing matters as much as documentation.

Let's talk money: fixing a few damaged shingles might set you back $200-$500 (about the cost of a new smartphone). But if you're looking at a full roof makeover, prepare for a $5,000-$15,000 investment, depending on whether you go budget-friendly asphalt or luxury materials.

Here's a pro tip: if the storm warrior left less than 30% of your roof battle-scarred, repairs should do the trick. But when damage spreads like wildfire across your rooftop, replacement becomes your best bet.

Navigating insurance claims? You've got options. Think of Actual Cash Value as getting what your old roof is worth today (minus depreciation), while Replacement Cost Value is like getting a brand-new roof without the age-related markdown. Choose wisely!

Common Types Of Wind Damage To Roofs

When severe weather strikes, wind can inflict several distinct types of damage to residential and commercial roofs. Understanding common wind patterns helps identify vulnerable roof types and potential areas of concern. High winds exceeding 50 mph frequently cause shingle displacement, creating entry points for water intrusion that manifest as ceiling and wall damage. Wind damage accounts for 34% of property claims and affects approximately 1 in 35 homes annually.

| Damage Type | Impact Level | Maintenance Strategy |

|---|---|---|

| Shingle Lift | Moderate | Regular Inspection |

| Material Tears | Severe | Immediate Repair |

| Debris Impact | Variable | Debris Removal |

| Water Intrusion | Progressive | Seasonal Preparation |

A thorough debris impact analysis reveals that flying objects during storms pose significant risks to roofing systems, particularly TPO and polymer-modified materials. Proper maintenance strategies include routine inspections, securing loose materials, and implementing seasonal preparation protocols to minimize potential damage during high-wind events.

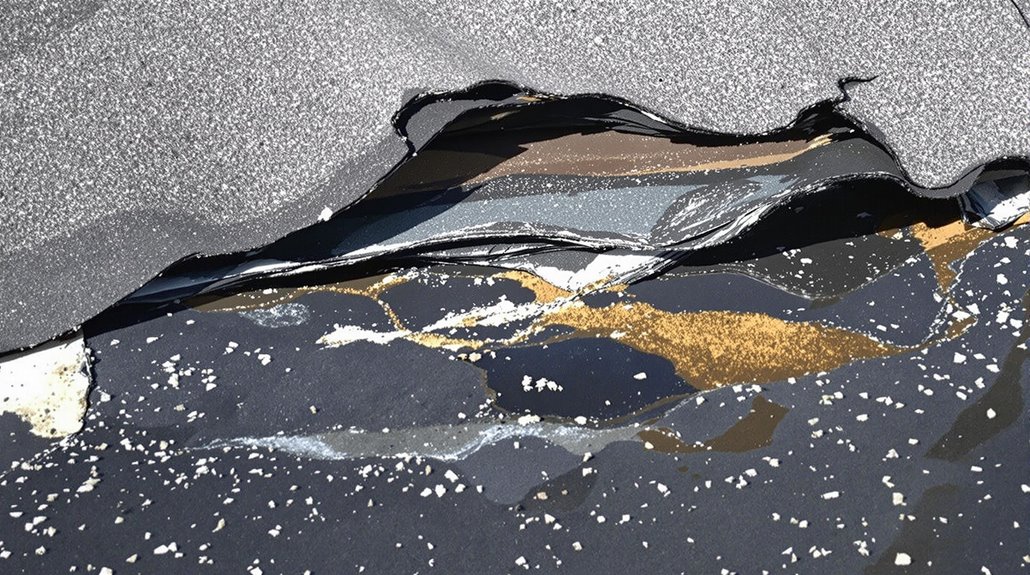

What Does Wind Damage Look Like On A Roof?

Visual identification of wind damage on roofs requires understanding specific indicators and patterns of deterioration. During a wind damage assessment, professionals examine key areas that commonly show signs of compromise. Regular roof maintenance tips emphasize monitoring these indicators as part of seasonal roof care protocols. Working with independent adjusters and appraisers helps ensure objective evaluations of roof damage claims.

| Damage Indicator | Typical Appearance |

|---|---|

| Shingle Condition | Missing or lifted shingles with granule loss |

| Interior Signs | Wet spots on ceilings and walls |

| Structural Status | Sagging headers and compromised rafters |

| Moisture Issues | Damp insulation and water-stained wood |

| Impact Evidence | Punctures from wind-blown debris |

Before initiating an insurance policy review or beginning the contractor vetting process, property owners should document all visible damage thoroughly. This documentation helps establish the extent of necessary repairs and supports potential insurance claims.

Does Homeowners Insurance Cover Wind Damage Roofing Claims?

Most standard homeowners insurance policies cover wind damage to roofs under dwelling coverage, though specific terms vary between insurers and policy types. It’s important for homeowners to review their policy details to understand the extent of their coverage for such incidents. After a storm, they should check for hurricane roof damage signs, including missing shingles, leaks, or visible dents. Reporting these issues promptly can help ensure that the necessary repairs are covered and prevent further damage to the home.

Coverage decisions frequently depend on factors like the age of the roof, maintenance history, and whether the policy provides Actual Cash Value (ACV) or Replacement Cost Value (RCV).

Wind damage claims require thorough documentation, adherence to filing deadlines, and may involve meeting deductibles before insurance payouts begin.

- Named perils policies specifically list covered wind events while all-risk policies cover wind damage unless explicitly excluded

- Percentage-based wind/hail deductibles typically range from 1-5% of the home's insured value

- ACV policies factor in depreciation, potentially leaving homeowners with significant out-of-pocket expenses

- Insurance carriers may require professional inspections to validate wind damage claims and determine coverage eligibility

Working with public adjusters can increase claim settlements by 20-50% compared to filing independently.

Insurance Deductibles, Coverage Limits, & Exclusions For Wind Damage Roofing Claims

Although homeowners insurance generally covers wind damage to roofs, policyholders must carefully review their deductibles, coverage limits, and specific exclusions to understand their financial responsibilities. Insurance policies typically require deductible amounts before coverage begins, which may be fixed or percentage-based. Coverage gaps can arise from policy limitations on specific types of damage, while exclusion types often encompass cosmetic issues, wear and tear, and neglect-related problems. Working with public insurance adjusters can result in 20-50% higher claim settlements compared to self-handled claims.

| Policy Component | Key Considerations | Impact on Claims |

|---|---|---|

| Deductibles | Fixed vs. Percentage | Out-of-pocket cost |

| Coverage Limits | Maximum payouts | Repair restrictions |

| Named Storms | Special provisions | Higher deductibles |

| Multiple Claims | Frequency impact | Premium increases |

| Exclusions | Non-covered damage | Claim denials |

Understanding these elements guarantees proper claims process navigation and helps homeowners prepare for potential repair expenses.

Actual Cash Value Vs. Replacement Cost In Relation To Wind Damaged Roofing

When homeowners experience wind damage to their roofs, the type of insurance settlement they receive greatly impacts their out-of-pocket expenses. Understanding Coverage Definitions between Actual Cash Value (ACV) and Replacement Cost Value (RCV) is vital for maximizing claim benefits. Policy Limits and Claim Types determine whether homeowners receive depreciated value or full replacement costs for wind damage repairs.

| Settlement Strategies | ACV Claims | RCV Claims |

|---|---|---|

| Initial Payment | Depreciated Value | Full Replacement |

| Inspection Tips | Age Documentation | Damage Assessment |

| Out-of-Pocket Costs | Higher | Lower |

| Coverage Impact | Single Payment | Two-Part Payment |

Insurance providers typically process RCV claims in two stages, first paying the ACV amount, then releasing the remaining balance once repairs are completed and documented. This settlement approach requires thorough documentation and proper damage assessment to guarantee maximum compensation. Working with public insurance adjusters can increase claim settlements by 20-50% compared to filing independently.

Named Vs. Hidden Perils Related To Wind Damage Roofing Claims

Understanding the distinction between named and hidden perils proves vital for homeowners seeking insurance coverage for wind-damaged roofs. While named perils like hurricanes and tornadoes typically receive straightforward coverage, hidden perils often require extensive roofing assessments to identify structural compromises not visible during initial inspections.

| Peril Type | Identification Method | Documentation Required |

|---|---|---|

| Named | Visual inspection | Photos, weather reports |

| Hidden | Professional assessment | Structural analysis |

| Combined | Thorough evaluation | Complete damage report |

| Time-Related | Historical tracking | Previous repair records |

The claims process demands meticulous damage documentation within 1-2 years of the incident. Insurance adjusters evaluate both visible and concealed damage, making professional assessments vital for identifying hidden structural issues that could affect long-term roof integrity. This extensive approach guarantees proper coverage determination and appropriate settlement calculations. Hiring public insurance adjusters can significantly increase claim settlements by 20-50% through their expertise in documenting and negotiating roof damage claims. Understanding the nuances of the claims process can be challenging, which is where roofing public adjusters explained become invaluable. They navigate the complexities of documentation, ensuring that every detail of the damage is recorded and addressed, which ultimately supports a stronger claim. Their expertise not only enhances the probability of higher settlements but also alleviates much of the stress for homeowners during what is often a difficult and overwhelming time.

Repair Vs. Replacement For Wind Damaged Roofing

Determining whether to repair or replace a wind-damaged roof requires careful evaluation of multiple factors including the extent of damage, age of existing materials, and cost considerations.

Professional assessment helps identify whether localized repairs can adequately address the damage or if full replacement offers the most cost-effective long-term solution. Insurance coverage may influence this decision, as policy terms often dictate repair versus replacement based on damage thresholds and depreciation calculations.

- Repairs are typically suitable for isolated damage affecting less than 30% of the roof surface.

- Replacement becomes necessary when structural integrity is compromised or multiple layers show extensive damage.

- Cost analysis should factor in remaining roof lifespan against repair investment.

- Documentation of wind damage patterns helps determine if repairs can effectively prevent future issues.

Thermal imaging detection and moisture analysis can help identify hidden structural problems that may not be visible during standard visual inspections.

When To Choose Roof Repair For A Wind Damaged Roof

Making an informed choice between roof repair and replacement after wind damage requires careful evaluation of several key factors. Professional consultation benefits include thorough wind damage assessments that determine the extent of structural compromise. When damage affects less than 30% of the roof's surface and the structure is within its expected lifespan, repairs often prove most cost-effective. Modern assessments using moisture detection systems help determine the full scope of wind damage.

| Repair Indicators | Replacement Indicators |

|---|---|

| Minor shingle damage | Multiple extensive leaks |

| Isolated leaks | Damp rafters present |

| Cost below deductible | 30%+ surface damage |

| Young roof age | Near end of lifespan |

| Limited area affected | Widespread damage |

Repair cost estimates typically fall below insurance deductibles for minor damage, making direct payment more practical than filing claims. Homeowner safety tips include regular inspections and prompt attention to visible damage to prevent escalation of issues.

When To Choose Roof Replacement For A Wind Damaged Roof

While minor wind damage often warrants repairs, severe structural compromise calls for complete roof replacement. Professional assessments determine replacement necessity by evaluating multiple factors, including roof lifespan, weather impacts, and extent of damage. Homeowners should be aware of the benefits and drawbacks associated with different repair options. A roof replacement vs repair comparison reveals that while repairs may be more cost-effective in the short term, they can lead to more significant issues down the line if the underlying problems are not fully addressed. Ultimately, investing in a complete roof replacement can offer greater peace of mind and longevity for your home’s structure.

| Replacement Indicators | Impact Assessment |

|---|---|

| Age > 15-20 years | Limited remaining service life |

| Multiple missing shingles | Compromised system integrity |

| Wet insulation | Internal moisture damage |

| Damaged rafters | Structural instability |

When repair costs exceed 20% of replacement value, installation of a new roof becomes more cost-effective. Material choices for replacement should prioritize wind resistance, while proper installation techniques guarantee maximum durability. Regular maintenance tips include documenting weather-related damage and conducting periodic inspections to assess ongoing deterioration. Insurance coverage evaluation helps homeowners understand financial implications before proceeding with full replacement. Working with public adjusters can increase insurance settlements by 50-350% for wind damage claims. Additionally, homeowners should review their damaged roof insurance policy details to ensure they are adequately covered for unexpected expenses during the replacement process. It may also be beneficial to consult with professionals who specialize in roofing and insurance to gain insights into the best approaches for securing fair compensation. By staying informed and proactive, homeowners can navigate the complexities of roof replacement and insurance claims more effectively. Homeowners should also be vigilant for hurricane damage roof inspection signs, which can indicate underlying issues that may not be immediately visible. Such signs include missing shingles, granule loss, and leaks, all of which can compromise the integrity of the roof. Addressing these issues promptly can prevent further damage and costs down the line, ensuring that the roof remains functional and secure against future storms.

Wind Damaged Shingle Roof: Damage Signs & Repair Costs

Wind damage to shingle roofs necessitates varying repair costs based on the specific shingle type and extent of damage. Different shingle grades command distinct price points, with architectural and impact-resistant varieties typically requiring higher repair investments than standard 3-tab options. Insurance coverage for wind-damaged shingles often follows a tiered reimbursement structure based on material quality and installation specifications. Public adjuster representation can increase damage settlements by up to 747% compared to handling claims independently.

| Shingle Type | Average Repair Cost | Full Replacement Cost |

|---|---|---|

| 3-Tab | $200-$700 | $5,000-$8,000 |

| Architectural | $400-$1,000 | $8,000-$12,000 |

| Impact-Resistant | $600-$1,500 | $10,000-$15,000 |

Costs For Wind Damaged Asphalt Shingles

The repair costs for wind-damaged asphalt shingles vary considerably based on the extent of damage, with minor fixes ranging from $200 to $500 and complete roof replacements potentially exceeding $5,000. Damage evaluation is essential for determining appropriate repair methods and insurance options.

| Cost Factor | Price Range |

|---|---|

| Minor Repairs | $200-$500 |

| Partial Replacement | $1,000-$3,000 |

| Complete Replacement | $5,000+ |

| Insurance Deductible | $500-$2,500 |

| Labor Costs | $45-$75/hour |

Professional assessment of roofing materials and damage severity influences total repair costs. Insurance claims for wind damage average $11,695, making thorough documentation vital. Regular maintenance can prevent extensive damage and reduce long-term expenses, as properly maintained asphalt shingles typically last 15-20 years when protected from severe weather conditions. Homeowners should be vigilant in identifying storm damage roof signs, such as missing shingles or granule loss, as these can indicate the need for immediate repairs. Timely intervention can not only safeguard the home’s structural integrity but also minimize the risk of more costly issues down the line, such as leaks and mold growth. By addressing these signs promptly and maintaining open communication with their insurance providers, property owners can ensure they are well-prepared for any necessary claims and repairs. Additionally, homeowners should be vigilant for wind damage signs on metal roofs, as these indicators can help identify issues early on. Early detection not only mitigates further damage but also streamlines the insurance claims process. Investing in professional inspections after severe weather can ensure that any potential problems are addressed promptly, ultimately safeguarding the investment in the home.

Costs For Wind Damaged Architectural Shingles

Repairing wind-damaged architectural shingles involves specific cost considerations based on the extent of damage and required restoration work. The selection of repair methods and shingle materials greatly impacts overall expenses, with individual repairs ranging from $200 to $500. When extensive damage occurs, complete roof replacement costs typically fall between $5,000 and $10,000, necessitating careful contractor selection and warranty options consideration. Homeowners should also take into account potential additional expenses, such as the removal of old shingles and any necessary structural repairs that may be revealed during the assessment process. It is essential to obtain multiple quotes to better understand the shingle roof repair costs overview and ensure that you are making an informed decision. Additionally, investing in high-quality materials and experienced contractors can help mitigate long-term repair needs and enhance the durability of the restored roof.

| Cost Factor | Range/Consideration |

|---|---|

| Single Repair | $200-$500 |

| Full Replacement | $5,000-$10,000 |

| Insurance Deductible | Policy Specific |

| Maintenance Tips | Regular Inspection |

Insurance coverage for wind damage typically requires thorough documentation, including detailed photographs and professional assessments. Homeowners should review their policies carefully, noting deductibles and claim limits while ensuring compliance with filing deadlines to maximize coverage benefits.

Costs For Wind Damaged 3-Tab Shingles

Identifying and addressing damage to 3-tab shingles requires careful assessment of repair costs, which typically range from $300 to $1,000 for basic wind-related issues. Full replacement costs can exceed $2,000 when multiple shingles are compromised or water damage occurs. Regular maintenance extends shingle lifespan and improves wind resistance.

| Damage Type | Repair Technique | Cost Breakdown |

|---|---|---|

| Missing Shingles | Individual replacement | $300-500 |

| Granule Loss | Surface treatment | $400-600 |

| Torn Sections | Partial repair | $500-700 |

| Water Damage | Underlayment repair | $800-1,000 |

| Multiple Issues | Full section replacement | $1,500-2,000+ |

Professional inspection and prompt repairs are essential maintenance tips to prevent escalating costs. Insurance claims should be considered when damage exceeds deductible thresholds, with thorough documentation of all affected areas.

Costs For Wind Damaged Performance Shingles

Performance shingles, while engineered for enhanced durability, can sustain wind damage that requires professional assessment and repair, with costs typically ranging from $100 to $300 per square. Repair techniques vary based on damage severity, with roofing warranties often influencing coverage options.

| Cost Factor | Impact on Repair Price |

|---|---|

| Shingle Materials | $45-125 per bundle |

| Labor Rates | $40-80 per hour |

| Regional Standards | 15-30% variance |

| Safety Precautions | $75-150 equipment |

| Warranty Status | 0-100% coverage |

Minor repairs involving a few damaged shingles may cost approximately $150, while extensive damage requiring complete replacement can exceed $1,200. Early detection through regular inspections can prevent escalating costs, particularly when addressing damage within 1-2 years of occurrence. Insurance coverage often applies, subject to policy deductibles and specific coverage limits.

Costs For Wind Damaged Impact Resistant Shingles

Impact-resistant shingles represent a significant advancement in roofing technology, with specialized materials designed to withstand wind speeds up to 130 mph. Despite their shingle durability, these materials can still sustain damage requiring professional attention. Cost estimation for repairs typically ranges from $300 to $1,000, with repair timeline averaging 1-2 days depending on damage extent.

| Factor | Impact | Consideration |

|---|---|---|

| Damage Type | Minor-Severe | Professional assessment needed |

| Material Cost | $300-$1,000 | Varies by damage extent |

| Labor Hours | 8-16 hours | Weather dependent |

| Insurance benefits | Coverage varies | Documentation required |

| Maintenance suggestions | Bi-annual | Extends 25-30 year lifespan |

Regular maintenance inspections help identify early signs of deterioration, potentially reducing long-term costs. Insurance benefits often cover wind-related damage, though coverage terms vary by policy.

Costs For Wind Damaged Luxury Designer Shingles

Luxury designer shingles, while offering superior aesthetics and protection, present unique cost considerations when damaged by wind. Repair expenses typically exceed standard asphalt shingles by 200%, with costs ranging from $15 per square foot compared to $5-$8 for conventional materials. Insurance documentation tips emphasize thorough damage assessment and professional estimates for claims processing.

| Damage Type | Cost Range | Required Action |

|---|---|---|

| Minor Tears | $1,000-$3,000 | Spot Repairs |

| Partial Loss | $5,000-$10,000 | Section Replacement |

| Major Damage | $15,000+ | Full Replacement |

Wind damage prevention through proper luxury shingle installation and regular roof maintenance strategies is essential. Common signs include granule loss, torn or missing shingles, and potential leak points. Roofing material comparison shows luxury shingles require specialized repair techniques and materials, affecting overall restoration costs.

Costs For Wind Damaged Metal Shingles/Shakes

Wind damage to metal shingles and shakes can occur when storms produce gusts exceeding 50 mph, despite their reputation for durability. Proper roofing installation techniques and regular metal roof maintenance are critical for wind damage prevention.

| Damage Type | Cost Range |

|---|---|

| Minor Dents | $300-$500 |

| Loose Panels | $400-$700 |

| Cracked Sections | $600-$1,200 |

| Panel Replacement | $1,500-$2,500 |

| Full Replacement | $2,500-$3,500 |

Storm preparedness tips include documenting pre-existing conditions and conducting bi-annual inspections. When damage occurs, thorough documentation with photographs helps facilitate insurance claims. An insurance policy review guarantees adequate coverage for metal roofing systems, as replacement costs can be substantial. Professional assessment of wind damage helps determine whether repairs or full replacement is necessary.

Costs For Wind Damaged Wood Shake Shingles

Wood shake shingles present unique vulnerabilities to storm damage, with repair costs ranging from $3 to $6 per square foot depending on severity and scope. Damage assessment techniques reveal common issues like splitting, cracking, and displacement, requiring thorough contractor evaluation for accurate repair cost analysis.

| Damage Type | Cost Impact |

|---|---|

| Missing Shakes | $3-4/sq ft |

| Split/Cracked | $4-5/sq ft |

| Water Damage | $5-6/sq ft |

| Full Section | $5-6/sq ft |

Maintenance strategies include regular post-storm inspections to identify early signs of deterioration. Roofing material selection impacts long-term durability, with proper documentation essential for insurance claims. Professional assessment helps determine whether localized repairs suffice or if complete replacement is necessary, particularly when water infiltration compounds initial wind damage.

Costs For Wind Damaged Solar Tile Shingles

Solar tile shingles, while offering innovative energy solutions, present unique repair challenges when damaged by severe weather conditions. Repair costs typically range from $800 to $2,500, with variations based on damage extent and replacement requirements. Professional assessments are essential for proper cost comparison analysis and wind damage prevention strategies.

| Aspect | Details |

|---|---|

| Repair Range | $800-$2,500 |

| Damage Signs | Missing tiles, cracks, granule loss |

| Assessment Needs | Structural integrity evaluation |

| Insurance Documentation Tips | Photos, estimates, timely filing |

| Homeowner Responsibilities | Professional inspection, maintenance |

Solar tile repair requires specialized expertise due to the integrated technology and complex installation methods. Insurance claims necessitate thorough documentation, including detailed photographs and professional evaluations. These factors contribute to higher overall repair costs compared to traditional roofing materials, making proper maintenance and prompt attention to damage vital for long-term cost management.

Costs For Wind Damaged Clay & Concrete Tile Shingles

Repairing clay and concrete tile shingles damaged by severe winds requires careful assessment of both visible and hidden structural issues. The repair methods vary based on damage severity, with costs typically ranging from $15 to $30 per square foot. Different tile styles impact replacement expenses, averaging $200 to $800 per individual tile.

| Cost Factors | Impact on Repairs |

|---|---|

| Damage Extent | $15-30/sq ft |

| Tile Style | $200-800/tile |

| Labor Complexity | 25-40% of total |

| Insurance Deductible | Varies by policy |

| Maintenance History | Affects coverage |

Regular maintenance tips include inspecting for cracked or missing tiles and monitoring interior surfaces for water damage signs. Insurance options typically cover wind damage, though coverage limits and deductibles influence out-of-pocket expenses. Cost factors depend on material quality, installation complexity, and local labor rates.

Costs For Wind Damaged Slate & Synthetic Slate Shingles

Slate and synthetic slate shingles present distinct cost considerations when damaged by severe winds, with natural slate repairs typically ranging from $15 to $30 per square foot and synthetic alternatives costing $6 to $12 per square foot. Material durability varies considerably between these options, affecting long-term roof maintenance requirements and storm preparedness strategies.

| Cost Factor | Natural Slate | Synthetic Slate |

|---|---|---|

| Materials/Labor | $15-30/sq ft | $6-12/sq ft |

| Water Damage | $1,000-5,000 | $1,000-5,000 |

| Insurance Claims | Documentation Required | Documentation Required |

| Contractor Selection | Specialist Required | Standard Roofer |

Proper contractor selection is essential for repairs, as natural slate requires specialized expertise. Additional costs may arise if water infiltration occurs, necessitating immediate preventive measures to protect the structure's integrity. Insurance claims typically require detailed documentation of wind-related damage.

Wind Damaged Flat Roof: Damage Signs & Repair Costs

Flat roofs are particularly susceptible to wind damage, with common signs including membrane tears, puckering, and displaced sections that can compromise the roof's structural integrity. Early detection through seasonal roof inspections is vital, as water pooling and interior leaks indicate potential structural issues requiring immediate attention.

| Damage Type | Signs | Average Repair Cost |

|---|---|---|

| Minor Tears | Surface Damage | $200-$300 |

| Membrane Puckering | Visible Bubbling | $300-$400 |

| Section Displacement | Missing Materials | $400-$500 |

| Water Pooling | Depression Areas | $500-$800 |

| Extensive Damage | Multiple Issues | $1,000-$1,500 |

Professional contractor selection is essential for proper repairs, ensuring warranty compliance and efficient flat roof maintenance. Emergency roofing services may be necessary for severe wind damage prevention, particularly following major storms that compromise roof integrity.

Wind Damaged Wood Roof: Damage Signs & Repair Costs

When exposed to severe weather conditions, wood roofs commonly exhibit distinct signs of wind damage that property owners must identify promptly. Implementing proper storm preparedness strategies can mitigate damage severity, while regular wind roof maintenance enhances wood roofing longevity.

| Damage Sign | Impact Assessment |

|---|---|

| Missing Shingles | $300-500 repair cost |

| Delamination | Requires board replacement |

| Wet Rafters | Indicates leak presence |

| Surface Cracks | Flying debris damage |

| Interior Spots | Advanced moisture damage |

Professional inspection determines whether DIY repair techniques suffice or if complete replacement becomes necessary. While roofing material options vary, wood roofs require particular attention to prevent moisture infiltration following wind events. Repair costs typically range from $300 for minor fixes to over $1,000 for extensive damage, necessitating thorough documentation for insurance claims. Furthermore, it’s essential to keep in mind that neglecting necessary repairs can lead to more significant issues down the line, resulting in higher expenses. Homeowners should also be aware of the financial implications of a full replacement, as typical roof replacement costs 2025 are projected to increase due to rising material and labor costs. By proactively addressing minor repairs and seeking professional assessments, homeowners can mitigate long-term expenses and maintain the integrity of their homes. In such scenarios, conducting a reroofing vs roof replacement analysis can be critical in deciding the most cost-effective solution for homeowners. If multiple layers of roofing materials exist or significant structural issues are found, a full replacement may be more prudent than patching. Ultimately, engaging a qualified inspector can help clarify the best course of action to maintain the integrity and longevity of the home. Understanding the various roof repair types and costs is essential for homeowners when assessing damage. Different materials can influence not only the repair strategy but also the overall expense involved. Therefore, it’s beneficial to obtain multiple quotes from licensed contractors to ensure a fair assessment and competitive pricing.

Wind Damaged Built-Up Roof (BUR): Damage Signs & Repair Costs

Built-up roofs (BUR) face unique vulnerabilities to wind damage, with their layered composition requiring specific assessment protocols and repair strategies. Common repair techniques focus on addressing loose layers, exposed felts, and surface punctures that compromise structural integrity assessment outcomes. Additionally, routine inspections are crucial to identify signs of wind damage on roofs, enabling timely interventions to prevent more extensive deterioration. Vulnerable areas, such as seams and edges, often show the earliest indications of wear, making them key targets for maintenance efforts. By implementing a proactive approach to repair and monitoring, building owners can significantly extend the lifespan of their built-up roofs and enhance overall safety.

| Damage Type | Signs | Repair Approach |

|---|---|---|

| Surface Tears | Visible membrane splits | Patch and reseal |

| Layer Separation | Lifted materials | Re-adhere layers |

| Moisture Issues | Water pooling | Drainage correction |

Professional inspection is essential for identifying hidden defects beneath the surface. Repairs typically cost $3-$5 per square foot, with roofing material choices impacting long-term durability. Severe weather precautions include regular roof maintenance tips such as drainage system cleaning and membrane inspection. Prompt repairs prevent moisture infiltration and minimize additional structural complications.

Wind Damaged Wood Roof: Damage Signs & Repair Costs

Understanding wind damage to wood roofs requires careful inspection of key warning signs and damage patterns. During a wind damage assessment, professionals look for torn shingles, granule accumulation in gutters, and water penetration points. Proper roofing maintenance tips include regular inspections and immediate repairs of minor issues before they escalate.

| Damage Type | Signs | Required Action |

|---|---|---|

| Surface Damage | Loose Granules | Weatherproofing |

| Structural Issues | Wet Ceiling Spots | Emergency Repair |

| Moisture Problems | Rafter Deterioration | Professional Assessment |

| Wind Uplift | Missing Shingles | Complete Replacement |

Insurance policy review is essential to understand coverage limits and deductibles. Contractor selection advice emphasizes choosing licensed professionals who document damage thoroughly for insurance claims, which typically require detailed photographic evidence and thorough repair estimates.

Wind Damaged Green Roof: Damage Signs & Repair Costs

Green roof systems face unique challenges when subjected to high winds, with damage patterns distinctly different from traditional roofing materials. Effective green roof maintenance requires vigilant monitoring of vegetation, waterproof membrane quality, and structural support evaluation after severe weather events.

| Component | Damage Signs | Repair Considerations |

|---|---|---|

| Vegetation | Dislodged plants, exposed soil | Species replacement with wind-resistant varieties |

| Membrane | Tears, uplift, pooling water | Waterproofing reinforcement, drainage repair |

| Structure | Compromised supports, shifting media | Load-bearing capacity assessment |

Wind resistance techniques include strategic vegetation selection strategies, enhanced drainage systems, and robust growing media stabilization. Regular inspections help identify early warning signs, preventing minor issues from escalating into costly repairs ranging from $500 for basic remediation to over $5,000 for thorough restoration.

Wind Damaged Membrane Roof: Damage Signs & Repair Costs

Membrane roofs face distinct vulnerabilities when exposed to high winds, with damage patterns that can quickly compromise their protective functionality. Wind speeds exceeding 50 mph can cause punctures, tears, and loose seams, leading to water infiltration and structural deterioration. Regular inspections and prompt repairs are essential for maintaining membrane roof integrity.

| Aspect | Impact | Action Required |

|---|---|---|

| Initial Damage | Punctures/Tears | Immediate Patch |

| Progressive Issues | Seam Separation | Professional Sealing |

| Water Infiltration | Interior Leaks | Moisture Assessment |

| Preventive Care | Structural Integrity | Quarterly Inspection |

Repair costs typically range from $1,500 to $5,000, varying with damage severity and material requirements. Professional maintenance programs should include regular inspection frequency, targeted repair techniques, and documented assessments to prevent escalating damage and maintain warranty compliance.

Wind Damaged Rolled Roof: Damage Signs & Repair Costs

Rolled roofing systems require careful monitoring for wind-related damage, as their continuous surface design makes them particularly vulnerable to specific types of deterioration. Regular inspection tips include checking for wrinkling, loose seams, and water spots on interior ceilings. Repair methods vary based on damage severity, with costs ranging from $300 to $1,500.

| Damage Aspect | Details |

|---|---|

| Common Signs | Tears, punctures, loose seams |

| Risk Factors | Flat design, age of material |

| Lifespan Impact | Reduces 10-20 year expectancy |

| Inspection Points | Wrinkles, missing sections, leaks |

| Cost Range | $300-$1,500 per repair area |

Professional assessment after severe weather events is essential for maintaining rolled roofing integrity and preventing water infiltration. Cost considerations should account for both immediate repairs and potential long-term replacement needs.

Wind Damaged Metal Roof: Damage Signs & Repair Costs

Metal roofing systems, while highly durable, can sustain specific types of wind damage that require prompt attention and repair. Structural integrity assessment reveals common issues including loose panels, fastener failure, and surface denting. Professional metal roof maintenance helps identify these problems early, reducing long-term repair costs.

| Damage Type | Repair Approach |

|---|---|

| Loose Panels | Fastener replacement |

| Surface Dents | Panel restoration |

| Rust Formation | Protective coating |

| Water Leaks | Seal reinforcement |

| Tear Damage | Section replacement |

Storm preparation tips include regular inspections and securing loose components. When compared to other roofing material, metal systems typically require less frequent repairs but demand specialized preventative repair techniques. Costs range from $300 for minor fixes to $1,500 for extensive damage, making thorough documentation essential for insurance claims.

Homeonwers Insurance Claim Process For Wind Damaged Roofing

Insurance company adjusters prioritize minimizing payouts rather than maximizing compensation for homeowners with wind-damaged roofs. Homeowners must maintain detailed documentation, including photos, maintenance records, and professional assessments, to counter potential claim reductions or denials. Understanding that adjusters represent the insurance company's interests highlights the importance of thorough preparation and possibly hiring an independent adjuster to advocate for fair compensation.

| Adjuster Tactics | Homeowner Countermeasures |

|---|---|

| Attributing damage to wear/age | Provide maintenance records |

| Underestimating repair costs | Get multiple contractor estimates |

| Claiming pre-existing conditions | Document with dated photographs |

| Delaying claim processing | Follow up with written correspondence |

Dealing With Insurance Company Adjusters: No, They Are NOT Your Friend

When dealing with roof damage claims, homeowners should understand that insurance adjusters primarily serve their employers' interests rather than the policyholder's needs.

Successful handling claims disputes requires extensive preparation and strategic documentation. Understanding adjuster tactics helps homeowners negotiate settlements effectively and avoid potential underpayment or claim denial.

- Document all roof damage extensively with detailed photos, notes, and measurements before preparing for inspections.

- Maintain thorough records of all communications with adjusters, including dates, times, and discussion points.

- Obtain independent contractor assessments to validate damage claims and estimated repair costs.

- Be prepared to challenge initial settlement offers with supporting evidence and professional opinions.

Homeowners who approach the claims process with diligence and proper documentation greatly improve their chances of receiving fair compensation for wind-damaged roofs.

Getting Help From A Public Adjuster: Your Advocate & Ally

Public insurance adjusters serve as dedicated advocates who represent homeowners' interests throughout the wind damage claims process, conducting thorough damage assessments and handling complex negotiations with insurance companies. Professional adjusters enhance settlement outcomes by leveraging their expertise in policy interpretation, documentation requirements, and claims valuation methodologies. While insurance company adjusters work for the insurer, public adjusters operate independently, charging a percentage-based fee only upon successful claim settlement.

| Service Aspect | Insurance Company Adjuster | Public Insurance Adjuster |

|---|---|---|

| Represents | Insurance Company | Policyholder |

| Compensation | Salary from Insurer | % of Claim Settlement |

| Primary Goal | Minimize Claim Payout | Maximize Claim Recovery |

| Independence | Limited by Employer | Independent Assessment |

The Role Of Public Claims Adjusters In Wind Damaged Roof Claims

Dealing with wind-damaged roof claims can be considerably less challenging with the assistance of a public claims adjuster. These professionals provide expertise in damage assessment importance and claims process tips, ensuring thorough documentation of all roof damage.

| Service Aspect | Benefit to Homeowner |

|---|---|

| Claim Evaluation | Thorough documentation and assessment |

| Insurance Navigation | Expert policy interpretation and guidance |

| Settlement Negotiation | Maximum compensation potential |

Public adjusters serve as dedicated advocates, specializing in home insurance navigation while working on a contingency basis. Their understanding of local policies and maximizing settlement opportunities often results in higher claim settlements. By managing interactions with insurance company adjusters, they reduce homeowner stress while ensuring proper compensation for all documented damage, from minor issues to major structural concerns.

Benefits Of Using A Public Adjuster For Wind Damaged Roof Repair & Replacement Claims

The decision to engage a public adjuster for wind-damaged roof claims can considerably impact the outcome of an insurance settlement. Public adjuster advantages include expert policy interpretation and strategic claims management, ensuring policyholder rights are protected throughout the process.

| Benefit Category | Impact | Outcome |

|---|---|---|

| Claims Process | Professional Documentation | Enhanced Settlement Chances |

| Negotiation | Strategic Advocacy | Maximized Compensation |

| Time Management | Streamlined Processing | Faster Resolution |

Understanding claims process intricacies requires specialized knowledge that public adjusters possess. Their insurance negotiation strategies often result in higher settlements through settlement maximization techniques, including thorough damage assessment and extensive documentation. Public adjusters handle all insurer communications, allowing homeowners to focus on recovery while ensuring their interests are professionally represented.

How Are Public Insurance Adjusters Paid & What Are Their Fees?

Understanding the fee structure of public insurance adjusters is essential for homeowners considering professional claims assistance. Public adjuster fees typically operate on a commission basis, ranging from 10% to 20% of the final settlement amount. This payment structure guarantees alignment between the adjuster's incentives and the policyholder's interests.

| Fee Component | Details |

|---|---|

| Payment Structure | Percentage of total claim settlement |

| Commission Rates | 10-20% standard range |

| Cost Transparency | Fees disclosed in written contract |

| Settlement Timing | Payment due after claim resolution |

The commission-based model motivates thorough adjuster negotiations and maximum claim recovery. Studies indicate that despite these fees, policyholders often receive notably higher settlements when utilizing public adjusters, with increases up to 800% documented in the Landmak OPPAGA Study. Cost transparency is maintained through detailed written agreements outlining all terms.

Public Adjusters Vs. The Insurance Company Adjuster

When homeowners face roof wind damage claims, key differences emerge between public adjusters and insurance company adjusters that can greatly impact settlement outcomes. Public adjuster benefits include expert damage assessment, dedicated homeowner advocacy, and typically higher settlements. Operating on contingency fee arrangements, public adjusters are incentivized to maximize claim values while streamlining insurance claim timelines.

| Comparison Factor | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Represents | Policyholder | Insurance Company |

| Primary Goal | Maximize Settlement | Minimize Costs |

| Fee Structure | Contingency Based | Company Salary |

| Expertise Focus | Extensive Claims | Company Guidelines |

Insurance company adjusters work to control costs for their employers, while public adjusters serve exclusively as advocates for homeowners, leveraging their expertise to identify and document all compensable damages.

When to Contact Your Insurance Provider For Roof Wind Damage

Homeowners pursuing insurance claims for roof wind damage should contact their provider promptly after documenting the damage, whether filing independently or through a public adjuster. Additionally, it’s crucial for homeowners to review their policy details, as coverage can vary significantly between providers. Searching for “homeowners insurance roof replacement tips” can provide valuable insights into maximizing claim outcomes and ensuring a smooth process. By staying organized and aware of their rights, homeowners can navigate their claims more effectively and secure the necessary funds for repairs.

When working with a public adjuster, they will typically handle direct communications with the insurance company while keeping the homeowner informed of progress and required actions.

Those filing claims independently must maintain consistent contact with their insurance provider, submit all required documentation within specified timelines, and follow up regularly to guarantee proper claim processing.

If Using A Public Adjuster

Maneuvering a roof wind damage claim becomes considerably more manageable with the assistance of a public adjuster. These professionals specialize in claim filing strategies and insurance negotiation tactics, helping homeowners maximize their settlements based on thorough damage assessments.

Public adjuster benefits include expert guidance through the complex claims process, detailed documentation of damages, and advocacy for homeowner rights during negotiations.

They can expedite claims by ensuring proper damage assessment techniques are employed and all necessary evidence is collected. If initial claims are denied or underpaid, public adjusters can strengthen appeals by providing additional documentation and professional justification for damages.

Their expertise proves particularly valuable within the standard 60-day claim filing window, as they understand how to navigate insurance policies effectively while protecting the policyholder's interests.

If Filing On Your Own

Filing a wind damage claim independently requires prompt action and meticulous documentation. Homeowners should contact their insurance provider immediately following significant wind events to initiate the claims process and secure proper coverage.

Thorough claim documentation, including detailed photos and videos of all visible damage, serves as vital evidence during insurance negotiations. Property owners must review their policy terms carefully, confirming coverage specifics and applicable deductibles.

A thorough damage assessment should be completed within the policy's specified timeline, typically 60 days. While managing repair strategies, maintain organized records of all communications with the insurer and potential contractors.

During contractor selection, obtain multiple estimates and verify credentials. This systematic approach helps guarantee successful claim resolution and appropriate compensation for necessary repairs.

Filing Process For Wind Damaged Roof Claims Using A Public Adjuster

When filing a wind damage claim for your roof, a public adjuster serves as your expert advocate throughout the entire claims process.

Public adjusters conduct thorough inspections to document all visible and hidden damage while analyzing your policy coverage for maximum benefits.

These professionals manage communications with insurance carriers, coordinate professional assessments, and compile supporting evidence to strengthen your claim.

- Detailed photographic documentation of all wind-related roof damage

- Analysis of policy terms to identify covered perils and applicable endorsements

- Coordination with licensed roofing contractors for accurate repair estimates

- Professional representation during insurance adjuster inspections and negotiations

Public Adjuster Thoroughly Inspects & Documents Wind Damage To Roof

A thorough inspection by a public adjuster forms the foundation of a successful wind damage roof claim. Through extensive documentation and assessment, adjusters evaluate visible damages while identifying potential coverage gaps. This systematic approach guarantees proper damage assessment and strengthens homeowner advocacy during the claims process.

| Inspection Phase | Documentation Required | Impact on Claim |

|---|---|---|

| Initial Assessment | Detailed Photos | Establishes Baseline |

| Damage Mapping | Written Reports | Supports Repair Timing |

| Hidden Issues | Professional Estimates | Prevents Claim Denial |

| Communication Log | Policy Review Notes | Guides Appeal Strategies |

| Final Evaluation | Settlement Proposals | Maximizes Coverage |

The adjuster's responsibilities include creating detailed reports with photographic evidence, analyzing policy terms for coverage verification, and developing thorough repair estimates. This extensive documentation becomes vital when negotiating with insurance carriers, particularly in cases requiring additional appeal strategies.

Public Adjuster Reviews Policy For Hidden Roofing Coverage & Helps Maximize Policy Benefits

Public adjusters enhance the claims process by conducting detailed reviews of homeowners' insurance policies to uncover hidden coverage benefits for wind-damaged roofs. Their expertise enables thorough analysis of policy terms and conditions to maximize potential settlements for property owners.

| Claims Support Element | Adjuster Expertise Impact |

|---|---|

| Policy Analysis | Identifies hidden coverage details |

| Documentation | Guarantees extensive evidence gathering |

| Settlement Negotiation | Increases compensation potential |

| Communication | Streamlines insurer interactions |

| Claims Processing | Expedites timeline and results |

Through strategic insurance negotiation, adjusters leverage their knowledge to secure ideal policy benefits for homeowners. Their specialized understanding of coverage provisions and claims support helps navigate complex policy language, resulting in more favorable outcomes for policyholders facing roof damage repairs.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Licensed public adjusters serve as dedicated intermediaries between policyholders and insurance companies during wind damage roof claims, managing all aspects of communication and documentation submission.

These professionals leverage their expertise in insurance negotiations strategies and claims documentation best practices to advocate for policyholder rights and secure ideal settlements.

- Files extensive damage reports with supporting photographic evidence

- Coordinates inspections between insurance company adjusters and roofing experts

- Challenges inadequate settlement offers through documented market-rate comparisons

- Oversees claim progression while adhering to policy timelines and requirements

Public adjuster roles typically involve contingency-based adjusting fees structures, usually ranging from 5-15% of the settlement amount, ensuring aligned interests in maximizing claim values while maintaining strict professional standards throughout the claims process.

Public Adjuster Gets Professional Assessments

Professional assessments form the cornerstone of successful wind damage roof claims, with experienced public adjusters orchestrating thorough evaluations that document both obvious and concealed structural issues.

Public adjuster benefits include expert claims assistance and extensive damage assessment protocols that maximize financial recovery opportunities during settlement negotiation.

- Detailed photographic documentation of all visible wind damage, including displaced shingles, punctures, and structural compromises

- Professional inspection reports highlighting hidden damage that could lead to future complications

- Certified cost estimates for complete repairs and necessary replacements

- Systematic documentation of all communication and correspondence with insurance providers

These assessments serve as critical evidence during the claims process, ensuring that insurance companies fully understand the extent of damage and provide appropriate compensation for necessary repairs.

Public Adjuster Gathers Supporting Evidence

When initiating a wind damage claim, the systematic gathering of supporting evidence stands as a vital step in the process, with public adjusters leading extensive documentation efforts to build a robust case. Evidence gathering encompasses thorough documentation, ensuring claim accuracy through detailed assessments.

| Documentation Type | Purpose | Impact |

|---|---|---|

| Photographs | Visual Evidence | Validates Damage Extent |

| Repair Estimates | Cost Assessment | Supports Claim Value |

| Inspection Reports | Professional Validation | Enhances Credibility |

| Correspondence Records | Communication Trail | Demonstrates Diligence |

| Temporary Repair Invoices | Emergency Measures | Proves Mitigation Efforts |

Adjuster expertise plays an important role in identifying hidden damage often overlooked during standard inspections. Their negotiation strategies, combined with extensive documentation importance, greatly increase the probability of securing ideal settlement outcomes for homeowners.

Public Adjuster Submits Complete Claims Package

Submitting a meticulous claims package represents an essential step in the wind damage claims process, with public adjusters methodically assembling all required documentation to support the policyholder's case. Through strategic document management strategies and extensive damage assessment techniques, adjusters compile detailed photographs, written descriptions, and repair estimates. Their negotiation tactics leverage this documentation to advocate for policyholder rights and maximize claim settlements.

| Claims Process Elements | Documentation Required | Impact on Settlement |

|---|---|---|

| Damage Assessment | Photos & Inspections | Establishes Scope |

| Property Value Analysis | Market Comparisons | Justifies Costs |

| Maintenance History | Service Records | Validates Care |

| Expert Opinions | Professional Reports | Strengthens Case |

Public adjusters guarantee every aspect of wind damage is meticulously documented, from visible exterior damage to potential structural compromises, creating a compelling case for fair compensation.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Public adjusters shoulder the critical responsibility of managing all follow-up communications and time-sensitive requirements throughout the wind damage claims process.

Their expertise in insurance negotiations and claims management guarantees homeowners receive ideal compensation while maintaining compliance with policy deadlines.

Key public adjuster benefits include:

- Professional oversight of the 30-day insurance adjuster inspection timeline

- Thorough damage documentation and evidence compilation

- Continuous communication management with insurance carriers

- Strategic homeowner advocacy throughout settlement negotiations

Operating on a contingency fee basis, public adjusters are incentivized to maximize claim settlements while handling all aspects of the process.

This allows homeowners to focus on recovery while guaranteeing their interests are professionally represented throughout the claims journey.

Public Adjuster Enforces Policyholder's Rights, & Negotiates Higher & More Fair Settlement

Professional experience in insurance negotiation empowers public adjusters to secure ideal settlements while protecting policyholder rights throughout wind damage claims. Their expertise in claims negotiation strategies and insurance policy review guarantees thorough coverage evaluation and maximum settlement outcomes.

- Conducts thorough policyholder education regarding coverage limits, exclusions, and potential compensation

- Implements settlement maximization techniques through detailed damage documentation and accurate valuation

- Applies specialized public adjuster responsibilities including policy interpretation and strategic claim presentation

- Utilizes proven negotiation methods to counter inadequate settlement offers and secure fair compensation

Public adjusters leverage their industry knowledge to advocate effectively, guaranteeing insurance companies honor policy terms and provide appropriate compensation for wind-damaged roofs.

Their involvement typically results in more favorable settlements compared to claims filed independently by property owners.

Public Adjuster Speeds Up Claim Settlement Time

Expediting the insurance claims process stands as one of the key advantages when utilizing a public adjuster for wind-damaged roof claims.

Through effective claim submission tips and thorough roof damage evaluation, public adjusters streamline documentation requirements and manage insurer communications efficiently.

Their expertise in insurance policy review guarantees all covered damages are properly identified and claimed.

- Conducts thorough property inspections to document visible and hidden wind damage

- Handles all correspondence with insurance carriers to prevent delays

- Implements proven negotiation strategies to accelerate settlement discussions

- Guarantees complete and accurate claim documentation from initial filing to final resolution

Professional public adjuster benefits include faster processing times, reduced paperwork burden, and expert guidance throughout the claims journey, ultimately leading to quicker settlement disbursement for property owners.

Common Reasons For Wind Damaged Roofing Claim Denials

Insurance companies commonly deny wind damage claims when pre-existing roof deterioration or inadequate maintenance records indicate negligence on the part of the homeowner.

Normal wear and tear is frequently cited as grounds for denial, particularly when insurers determine damage resulted from gradual degradation rather than specific storm events. Claims may also face rejection if filed after policy deadlines expire or when the documented weather conditions do not meet the specific criteria outlined in the coverage terms.

Pre-Existing Roof Damage

When filing insurance claims for wind-damaged roofs, pre-existing damage often emerges as a critical factor that can lead to claim denials. Insurance providers require documented evidence that damage occurred within the past 1-2 years and resulted directly from wind events rather than underlying issues.

| Factor | Impact | Requirement |

|---|---|---|

| Maintenance Records | Critical | Regular documentation |

| Inspection History | Essential | Professional assessments |

| Prior Repairs | Important | Detailed receipts |

| Age-Related Issues | Significant | Timeline verification |

Regular roof inspections and thorough maintenance records are fundamental to successful claim submissions. Insurers scrutinize evidence of proper upkeep, and claims may be rejected if documentation reveals neglect, aging issues, or corrosion predating the wind event. Homeowners must maintain detailed records of all repairs, inspections, and maintenance activities to demonstrate responsible property management and support coverage eligibility.

Poor Maintenance Records

Poor maintenance records represent a primary factor in denied wind damage claims for residential roofs.

Insurance companies require documented evidence of routine upkeep to validate claims, often scrutinizing maintenance checklists and roof inspection reports from previous years.

Homeowners must maintain thorough records demonstrating consistent care, including regular gutter cleaning and professional inspections typically performed annually.

Documentation importance extends beyond basic repair records, encompassing detailed maintenance logs that establish a clear timeline of responsible ownership.

Insurance requirements specifically mandate evidence that the roof received proper care prior to wind damage incidents.

Failure to provide adequate maintenance documentation can lead to claim denials, particularly when insurers determine that negligence or lack of preventive care contributed to the extent of wind-related damage.

Normal Wear & Tear

Roofing claims adjusters frequently cite normal wear and tear as grounds for denying wind damage claims. Insurance policy limitations typically exclude deterioration that occurs gradually over time, making it imperative for homeowners to distinguish between storm damage and routine aging. Proper wear tear assessment requires documented normal roof maintenance and regular inspections.

| Homeowner Responsibilities | Dispute Resolution Options |

|---|---|

| Regular roof inspections | Independent assessment |

| Maintain repair records | Mediation services |

| Document storm events | Appeals process |

| Address issues promptly | Legal consultation |

Understanding the difference between legitimate storm damage and normal weathering is essential for successful claims. Insurance companies expect homeowners to fulfill basic maintenance obligations, as neglect can void coverage. When disputes arise over wear versus storm damage, property owners may need to pursue multiple channels to resolve claim denials.

Missed Filing Deadlines

Meeting insurance claim filing deadlines is vital for homeowners seeking compensation for wind-damaged roofs, as missed deadlines represent one of the most frequent causes of claim denials.

Most insurance policies require claim submission within 60 to 90 days of damage discovery, making understanding policy timelines imperative. Maximizing claim efficiency requires immediate damage reporting and thorough documentation, including professional inspections and detailed assessments.

Homeowner communication strategies should include prompt notification to insurers and maintaining organized records of all correspondence.

To avoid missed deadlines consequences, property owners should implement filing claim reminders and carefully review their policy requirements. This systematic approach helps prevent automatic denials and guarantees compliance with insurance documentation standards, ultimately protecting homeowners from bearing unnecessary out-of-pocket repair costs.

Non-Covered Weather Events

Despite thorough insurance coverage for many weather-related incidents, homeowners frequently encounter claim denials when roof damage falls outside specifically covered weather events. Insurance exclusions often apply when wind speed impact falls below specified thresholds, typically under 50 mph. Maintenance negligence and inadequate storm protection can also void coverage, particularly when homeowners fail to implement basic safeguards.

| Weather Event Type | Common Exclusion Reasons |

|---|---|

| Normal Seasonal Winds | Below policy threshold |

| Minor Wind Gusts | Insufficient wind speed |

| General Wear | Maintenance related |

| Cosmetic Impact | Non-structural damage |

| Regular Weather | No extreme conditions |

Weather event definitions within policies strictly determine coverage eligibility, making it essential for homeowners to understand their policy's specific parameters and maintain proper documentation of all weather-related incidents.

Insurance Claim Appeals Process

Public adjusters serve as professional advocates who specialize in evaluating denied wind damage roofing claims and guiding intricate appeals processes. These licensed experts thoroughly analyze insurance policies, document roof damage evidence, and negotiate with insurance companies on behalf of property owners. Their expertise often results in higher claim settlements and successful appeals through detailed documentation, professional damage assessments, and strategic negotiation tactics.

| Service Provided | Benefit to Policyholder |

|---|---|

| Policy Analysis | Identifies coverage gaps and opportunities for maximum compensation |

| Damage Documentation | Creates thorough evidence files with expert assessments |

| Claim Negotiation | Leverages industry knowledge to secure fair settlements |

How Public Adjusters Help With Denied Roofing Wind Damage Claims

When insurance companies deny roofing wind damage claims, licensed public adjusters serve as valuable advocates for policyholders seeking fair compensation. These professionals leverage their insurance policy insights and negotiation strategies to maximize claim settlements through thorough documentation and expert assessment.

| Service Area | Public Adjuster Benefits |

|---|---|

| Documentation | Expert damage assessment and detailed evidence compilation |

| Policy Review | In-depth analysis of coverage terms and exclusions |

| Negotiation | Professional representation with insurance companies |

| Settlement | Contingency-based fees aligned with successful outcomes |

Public adjusters guide policyholders through the appeal process, ensuring all damage aspects are properly documented and presented. Their expertise in claim documentation importance considerably increases the likelihood of successful appeals, particularly in cases where initial claims were denied or underpaid. Their specialized knowledge helps navigate complex insurance requirements while advocating for fair compensation.

Choosing & Working With Trusted Roofing Contractors

Public adjusters maintain extensive networks of qualified roofing contractors who can provide accurate repair or replacement estimates for storm-damaged roofs. Professional estimates from licensed contractors serve as essential documentation for insurance claims while establishing fair market costs for necessary repairs. Having a public adjuster review contractor estimates helps guarantee pricing accuracy and prevents potential overcharging, leading to more successful claims outcomes.

| Contractor Selection Criteria | Documentation Requirements | Quality Assurance Steps |

|---|---|---|

| Valid state licensing | Detailed scope of work | References verification |

| Insurance coverage proof | Itemized cost breakdown | Project timeline review |

| Industry certifications | Material specifications | Warranty documentation |

| Claims handling experience | Photo documentation | Final inspection process |

Utilize Your Public Adjusters Extensive Professional Network

Leveraging a public adjuster's established network of roofing professionals can greatly streamline the contractor selection process while ensuring quality workmanship for wind damage repairs.

Public adjuster recommendations connect property owners with experienced contractors who specialize in storm-related repairs and understand insurance claim requirements.

Through collaborative repair planning, public adjusters facilitate relationships between property owners and trusted contractors, enabling efficient documentation and repair strategies.

This contractor networking strategy helps verify credentials, insurance coverage, and licensing requirements upfront.

Evaluating contractor credentials through a public adjuster's vetted network minimizes risks associated with selecting unreliable or inexperienced professionals.

Getting Professional Roof Repair Or Replacement Estimates

Obtaining accurate professional estimates stands as an essential first step in addressing roof wind damage effectively. When estimating roof damage, homeowners should document all visible issues thoroughly before contacting contractors. Hiring trustworthy contractors requires verifying credentials and reviewing past client experiences.

| Aspect | Requirements | Benefits |

|---|---|---|

| Documentation | Photos, damage notes | Accurate estimates |

| Contractor Selection | License, insurance, references | Quality assurance |

| Roof Inspection Tips | Multiple assessments | Comparative pricing |

| Material Decisions | Detailed specifications | Long-term durability |

Effective contractor communication strategies include requesting detailed written estimates and clear project timelines. Professionals should outline available roofing material options while explaining their durability and cost implications. Multiple estimates enable homeowners to make informed decisions about repairs or replacements while ensuring competitive pricing and extensive service coverage.

Letting Your Public Adjuster Review Estimates To Ensure Contractor Honesty

When homeowners receive contractor estimates for roof wind damage, engaging a qualified public adjuster to review the documentation serves as a critical safeguard against potential overcharging or undervaluation.

Public adjuster benefits include thorough analysis of repair estimates and skilled negotiation tactics to guarantee fair pricing aligned with industry standards.

These professionals enhance contractor credibility by identifying discrepancies and hidden damages that might otherwise go unnoticed.

Their expertise in estimate accuracy helps prevent both inflated costs and inadequate repairs. Through collaborative assessment with contractors, public adjusters guarantee repair transparency throughout the claims process.

Licensed adjusters provide an additional layer of accountability, serving as advocates for homeowners while maintaining detailed documentation of all contractor communications and ensuring repair costs reflect true market values.

Tips For Preventing Future Roof Wind Damage

Since high winds can pose significant threats to roof integrity, implementing preventive measures is crucial for long-term protection. A thorough storm impact strategy includes regular tree management practices, with careful trimming of overhanging branches that could damage roofing materials. Following a roofing maintenance checklist guarantees early detection of vulnerabilities, while proper home insurance preparedness involves documenting existing conditions.

| Prevention Focus | Action Required | Impact Level |

|---|---|---|

| Tree Management | Annual Trimming | High Priority |

| Gutter System | Monthly Clearing | Medium Priority |

| Landscaping | Material Selection | Ongoing Review |

Property owners should install protective features like storm shutters and maintain clear drainage systems to prevent water accumulation. Selecting appropriate landscaping materials and securing loose objects further reduces potential projectile damage during high-wind events, minimizing the need for emergency repair options.

About The Public Claims Adjusters Network (PCAN)

While preventive measures can minimize roof damage, professional assistance may still be necessary for insurance claims.

The Public Claims Adjusters Network (PCAN) serves as a nationwide resource for policyholder rights, connecting property owners with pre-vetted public adjuster advocacy experts across 40+ states.

PCAN maintains strict quality standards through rigorous licensing requirements explained during their intensive application process. Member adjusters must demonstrate expertise in property damage assessment and the insurance claim process across 30 different claim types.

The network conducts mandatory annual audits of licenses and complaint records to guarantee continued compliance with professional standards. This systematic vetting process helps guarantee policyholders receive qualified representation from experienced adjusters who maintain the highest levels of ethics and professionalism in managing insurance claims.