Ever noticed mysterious bubbles popping up on your roof shingles? That’s shingle blistering – the unwanted “bubble wrap effect” that keeps roofing contractors busy. Think of it as your shingles getting a bad case of acne, where trapped moisture and air create those pesky bumps that spell trouble for your roof’s health.

Don’t let those innocent-looking blisters fool you! Starting as tiny pea-sized bumps, they’re like warning flares signaling potential roofing drama. These sneaky culprits typically show their faces within your shingles’ first year, masquerading as dark spots and uneven patches across your roofscape.

Why should you care? Well, these rooftop troublemakers can slash your roof’s expected lifespan in half and take a significant bite out of your property value. We’re talking about a 10-15% dip in home worth – not exactly pocket change!

The fix? You’ve got options, but they’ll require some investment in your roof’s future. Minor repairs might set you back $3-7 per square foot – think of it as giving your roof a quick medical checkup. For more severe cases, you might be looking at a complete roof makeover, ranging from $7,000 to $12,000.

Remember, catching these blisters early is like nipping a cold in the bud – it saves you headaches and wallet-aches down the road. Want to protect your roofing investment? Regular inspections and prompt attention to these bubbly bothers are your best defense.

Key Takeaways

Ever noticed those pesky bubbles popping up on your roof shingles? They’re not just unsightly – they’re telling you something’s up with your roof health! Think of them as your shingles’ way of saying “Hey, we’ve got a moisture problem here!”

Those bubble-like bumps, ranging from tiny pea-sized spots to quarter-sized blisters, typically show their faces within the first year after installation. It’s like having unwanted acne on your roof, and just like skin problems, these blisters have specific underlying causes.

Your attic’s breathing system (yes, it needs to breathe!) plays a crucial role here. When ventilation isn’t up to par, it’s like trapping steam in a pressure cooker – something’s got to give. Add installation hiccups or manufacturer oopsies to the mix, and you’ve got a recipe for shingle trouble.

Getting a pro to take a look? That’ll set you back $200-$500, but it’s worth every penny for peace of mind. If those blisters need fixing, you’re looking at $3-7 per square foot for minor cases. Worst-case scenario? A full roof replacement might run between $7,000-$12,000.

Smart homeowners stay ahead of the game with regular check-ups and proper ventilation – think of it as giving your roof a fighting chance against those pesky blisters. When it comes to insurance, keep in mind that most companies want to see significant damage (usually 30% of the roof) before they’ll consider your claim, and they’re pretty picky about what they’ll cover.

Want to protect your investment? Think prevention: proper installation, quality materials, and good ventilation are your roof’s best friends in the battle against blistering! Additionally, regular maintenance checks can help identify potential issues before they escalate into costly repairs. Familiarize yourself with roofing regulations in Texas to ensure your roof is compliant and adequately protected from the harsh climate. By taking these proactive steps, you can extend the lifespan of your roof and safeguard your investment for years to come.

What Is Roof Shingle Blistering?

Roof shingle blistering occurs when moisture or air becomes trapped beneath the surface layer of asphalt shingles, creating raised bubble-like protrusions that compromise the shingle’s structural integrity.

These blisters manifest as distinct bubbles on the shingle surface, typically appearing within the first year of installation.

Premium grade shingles with enhanced protection and stronger adhesives can help minimize the risk of blistering formation.

- Initial blisters range from pea-sized to quarter-sized protrusions, affecting the shingle’s adhesion to the underlayment

- Intact blisters primarily present a cosmetic issue until they rupture

- Ruptured blisters develop into pockmarks where protective granules have been lost

The condition is distinguishable from other forms of damage by its uniform, bubble-like appearance rather than sharp indentations.

When blisters break, they expose the underlying mat material, compromising the roof’s protective capabilities and potentially leading to more severe structural issues.

Architectural shingles last 24-30 years with proper maintenance when not compromised by blistering or other damage.

Common Roof Shingle Blistering Causes

Several factors contribute to the formation of shingle blisters, with trapped moisture and manufacturing defects being the primary culprits. Poor attic ventilation creates conditions where moisture becomes trapped beneath asphalt shingles, leading to expansion and eventual blistering. Temperature fluctuations exacerbate this problem, causing trapped air to expand and contract repeatedly. Regular maintenance including gutter cleaning 2-4 times per year helps prevent moisture-related damage to shingles.

| Cause | Impact | Prevention |

|---|---|---|

| Poor Ventilation | Moisture buildup | Install proper vents |

| Installation Errors | Trapped air pockets | Professional installation |

| Manufacturing Defects | Weak spots in shingles | Quality materials |

| Temperature Changes | Expansion/contraction | Climate considerations |

Improper installation techniques can create vulnerable areas where moisture infiltrates the roofing material. Additionally, substandard manufacturing processes may result in inconsistent asphalt application, creating weak points prone to roofing damage and shingle blistering over time. Regular professional roof inspections can help identify early signs of blistering and prevent major repairs that could cost between $75-$900.

Early Warning Signs Of Roof Shingles Blistering

Early detection of shingle blistering enables homeowners to address problems before extensive damage occurs. Key indicators include dark spots and circular patterns forming on asphalt shingles where granule loss begins. Trapped moisture creates spongy areas detectable when walking on the roof, while surface elevation changes produce an uneven surface with wavy appearances in previously flat sections. Warm region acceleration can significantly speed up the development of these warning signs, requiring more frequent monitoring. Professional inspectors typically spend 30-60 minutes thoroughly examining these warning signs during roof assessments.

| Warning Sign | Description | Severity Level |

|---|---|---|

| Surface Bubbles | Small raised blisters | Low |

| Dark Spots | Circular patterns with loose granules | Moderate |

| Texture Changes | Spongy or soft areas | High |

| Surface Irregularity | Uneven or wavy sections | Moderate |

| Granule Loss | Concentrated bare spots | High |

These early warning signs typically appear gradually, allowing time for intervention when properly monitored through regular roof inspections.

Progressive Stages Of Roof Blistering

The progression of shingle blistering occurs in three distinct phases, each marked by increasingly severe deterioration. Initially, tiny bubbles and raised bumps emerge due to trapped moisture beneath the shingle surface, compromising visual appeal. As the condition advances, these small imperfections develop into clustered blisters, indicating heightened damage severity. Without proper attic ventilation, the final stage results when blisters pop, exposing underlying materials to weather elements and accelerating premature deterioration. Early detection prevents up to 747% in costly damage claims through regular professional inspections. Public adjusters frequently identify hidden structural damage that homeowners might overlook during initial assessments.

| Stage | Characteristics | Visual Indicators | Recommended Action |

|---|---|---|---|

| Early | Small bubbles | Slight raised areas | Monitor closely |

| Intermediate | Medium blisters | Clustered formations | Professional inspection |

| Advanced | Ruptured blisters | Exposed material | Immediate repair |

| Critical | Widespread damage | Multiple failures | Complete replacement |

Negative Impact On Roof Lifespan & Property Value From Untreated Roof Blistering

Untreated roof blistering substantially diminishes both roof longevity and property market value through accelerated deterioration of shingle materials. When blistering shingles remain unaddressed, granule loss and UV damage reduce standard roof lifespan by up to 50%. Popped blisters create entry points for water damage, compromising structural integrity and necessitating premature roof replacement. Professional inspections using moisture detection technology can identify early signs of blister formation before severe damage occurs.

| Impact Category | Short-Term Effects | Long-Term Consequences |

|---|---|---|

| Physical Damage | Granule loss, UV exposure | Deck rot, ceiling damage |

| Financial Cost | 25-35% higher maintenance | $5,000-$15,000 value loss |

| Property Value | Reduced curb appeal | 10-15% decrease in value |

The compounding effects of untreated blisters create ideal conditions for moss growth and moisture penetration, accelerating deterioration and increasing the likelihood of extensive structural damage requiring costly repairs. Monthly debris removal maintenance helps prevent moisture accumulation that can worsen existing blister damage.

Professional Assessment & Inspection Methods

Professional inspection of roof shingle blistering requires systematic evaluation protocols and specialized diagnostic tools to accurately assess damage severity and underlying causes. A qualified roofing contractor employs multiple assessment methods, including thermal imaging and moisture detection equipment, to identify problem areas often invisible to the naked eye. Professional inspectors can help secure 350% higher settlements when documenting roof damage for insurance claims. Comprehensive inspections typically take 45-120 minutes to complete a thorough evaluation of all roofing components.

| Assessment Method | Purpose |

|---|---|

| Visual Examination | Surface damage identification |

| Moisture Detection | Subsurface water penetration |

| Thermal Imaging | Heat pattern irregularities |

| Structural Analysis | Support system integrity |

| Core Sampling | Material composition testing |

The professional evaluation process integrates data from these inspection techniques to generate thorough damage assessments and detailed repair estimates. This systematic approach guarantees accurate diagnosis of blistering extent, enabling contractors to recommend appropriate remediation strategies and preventive measures for long-term roof protection.

Cost Breakdown For Roof Blistering Repairs & Replacement

Following a thorough professional assessment, property owners must consider specific cost factors when addressing roof shingle blistering. Professional inspection fees range from $200-$500, including thermal imaging to detect moisture damage. For active leaks, emergency repairs cost between $500-$1,000, while minor blister repairs average $3-7 per square foot. Public adjusters can help identify hidden damages and maximize insurance claim payouts through expert negotiation.

| Repair Type | Cost Range |

|---|---|

| Full Roof Replacement | $7,000-$12,000 |

| Ventilation Upgrades | $300-$1,000 |

| Spot Repairs | $3-7/sq ft |

| Insurance Deductible | $500-$2,500 |

Insurance coverage typically requires 30% or more roof damage to qualify for claims. Property owners should factor in ventilation system upgrades, which may add $300-$1,000 to overall costs, but prove essential for preventing future blistering issues. Having a robust emergency savings fund is crucial since 56% of Americans cannot afford unexpected home repair expenses.

Does Homeowners Insurance Cover Roof Shingle Blistering Claims?

Homeowners insurance coverage for roof shingle blistering varies substantially based on policy specifics and damage circumstances.

Insurance providers generally examine whether the blistering resulted from a covered peril versus normal wear, with many standard policies excluding gradual deterioration or manufacturer defects. Professional claims assistance can lead to 800% higher settlements when navigating complex coverage disputes.

Understanding key policy elements helps determine potential coverage:

- Deductible amounts and coverage limits affect out-of-pocket costs for approved blistering claims

- Actual Cash Value (ACV) policies factor in depreciation while Replacement Cost Value (RCV) covers full repair expenses

- Named peril policies only cover specifically listed events, while all-risk policies may provide broader protection against hidden causes

Working with public insurance adjusters can increase settlement amounts by 30-50% through expert damage assessment and negotiation with insurance companies.

Insurance Deductibles, Coverage Limits, & Exclusions For Roof Blistering Claims

While filing an insurance claim for roof shingle blistering may seem straightforward, most standard homeowners policies exclude coverage for damage caused by manufacturing defects, poor installation, or inadequate ventilation. Insurance typically only covers blistering when resulting from covered perils like severe storms. Homeowners must pay their full deductible before coverage applies, and policies often limit protection based on roof age and condition. Working with licensed public adjusters can help maximize coverage for legitimate storm-related blistering claims. With contingency-based fees being standard practice, property owners pay nothing upfront for professional claim assistance.

| Coverage Factor | Typical Requirements | Common Exclusions |

|---|---|---|

| Deductibles | $500-$2500 payment | Manufacturing defects |

| Age Limits | 10-15 years maximum | Installation errors |

| Maintenance | Regular inspection proof | Ventilation issues |

| Coverage Type | Actual cash value for aging roofs | Normal wear and tear |

Regular roof inspections and documented maintenance are essential for maintaining valid coverage and avoiding claim denials.

Actual Cash Value Vs. Replacement Cost In Relation To Roof Blistering

Understanding the distinction between actual cash value (ACV) and replacement cost coverage proves critical when filing insurance claims for roof shingle blistering. Insurance providers calculate ACV by subtracting depreciation from the original roofing installation cost, while replacement cost covers the full expense of professional roofing repair without depreciation. Public insurance adjusters can increase claim settlements by up to 700% compared to independent claims.

| Factor | ACV vs. Replacement Cost |

|---|---|

| Coverage Amount | Depreciated Value vs. Full Cost |

| Repair Costs | Partial Payment vs. Complete Coverage |

| Affected Area | Limited Coverage vs. Total |

| Shingle Blisters | Minimal Compensation vs. Full Restoration |

| Roofing Contractors | Out-of-Pocket Difference vs. Full Payment |

Homeowners with replacement cost coverage typically receive sufficient funds to address damage through qualified contractors, while those with ACV policies often face significant out-of-pocket expenses for complete repairs. Extended replacement cost provides 10-50% additional coverage beyond standard dwelling limits for unexpected roofing expenses.

Named Vs. Hidden Perils Related To Roof Shingle Blistering Insurance Claims

Insurance coverage for roof shingle blistering hinges on the critical distinction between named and hidden perils in standard homeowners policies. While sudden damage from wind, hail, or falling objects typically qualifies for coverage, blistering caused by manufacturing defects, improper installation, or poor attic ventilation falls under hidden perils, usually resulting in denied claims.

| Coverage Type | Typically Covered | Usually Excluded |

|---|---|---|

| Named Perils | Storm Damage | Manufacturing Defects |

| Claims Process | Sudden Events | Wear and Tear |

| Alternative Options | Wind/Hail Damage | Poor Installation |

Water damage resulting from blistering presents a particular challenge, as insurers scrutinize whether the cause stems from a covered event or gradual deterioration. Homeowners often find better protection through manufacturer warranty coverage, especially for blistering that develops shortly after installation.

Homeowners Insurance Claim Process For Roof Blistering Claims

When filing an insurance claim for roof blistering, homeowners must recognize that insurance adjusters represent the interests of their employers rather than the claimant. Insurance adjusters utilize specific evaluation criteria and documentation requirements that serve to minimize the insurance company’s financial exposure. Understanding this dynamic enables homeowners to properly prepare their claims with thorough documentation, professional assessments, and evidence that supports their position.

| Adjuster Tactics | Recommended Homeowner Response |

|---|---|

| Attributing damage to normal wear | Document sudden changes with dated photos |

| Minimizing scope of repairs | Obtain independent contractor assessment |

| Claiming maintenance negligence | Maintain detailed maintenance records |

Dealing With Insurance Company Adjusters: No, They Are NOT Your Friend

Three critical facts homeowners must recognize when dealing with insurance company adjusters for roof blistering claims: adjusters represent the insurer’s interests, not the homeowner’s; their primary objective is minimizing claim payouts; and they often seek ways to attribute damage to non-covered causes.

To protect against unfavorable claim outcomes, homeowners should:

- Document all blisters and damage thoroughly with photos, videos, and independent inspection reports

- Obtain written explanations for any claim denials or partial coverage decisions

- Consider hiring a public adjuster if the insurance company’s assessment seems unfair

Professional documentation and representation substantially improve the likelihood of fair compensation for repairs.

Understanding that insurance adjusters work to minimize costs helps homeowners prepare appropriate evidence and documentation before initiating the claims process.

Getting Help From A Public Adjuster: Your Advocate & Ally

When addressing roof shingle blistering claims, homeowners face complex documentation requirements and negotiations with insurance companies that can impact settlement outcomes. Public insurance adjusters serve as dedicated advocates who specialize in maximizing claim settlements for roof damage, with studies showing substantially higher payouts for policyholders who utilize their services. These licensed professionals handle the entire claims process, from detailed damage documentation to final settlement negotiations, while working on a contingency fee basis that typically ranges from 10% to 20% of the total settlement amount.

| Service Aspect | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Represents | Policyholder | Insurance Company |

| Primary Goal | Maximum Settlement | Cost Control |

| Fee Structure | Contingency (10-20%) | Salary from Insurer |

| Claim Process Role | Full Documentation and Negotiation | Basic Assessment and Settlement |

The Role Of Public Claims Adjusters In Roof Blistering Repair & Replacement Insurance Claims

Dealing with insurance claims for roof shingle blistering can present significant challenges for homeowners seeking fair compensation. Public claims adjusters serve as expert advocates, charging 5-15% of the settlement amount while providing vital documentation and assessment services. These professionals distinguish blistering patterns from other damages, determine claim eligibility, and negotiate with insurance companies.

| Service Provided | Benefit to Homeowner |

|---|---|

| Damage Assessment | Distinguishes blistering from hail impact |

| Documentation | Records progression of deterioration |

| Coverage Analysis | Determines if damage resulted from covered perils |

| Structural Evaluation | Identifies shift from cosmetic to structural damage |

| Claim Negotiation | Maximizes settlement value through expert representation |

Their expertise helps establish accurate timelines, extent of damage, and proper classification for coverage under insurance policies, ensuring homeowners receive appropriate compensation for both repairs and replacements.

Benefits Of Using A Public Adjuster For Roof Shingle Blistering Repair & Replacement Claims

Homeowners facing roof shingle blistering claims can substantially benefit from engaging a public adjuster’s services. Research demonstrates that insurance settlements secured through public adjusters typically range 40-350% higher than unrepresented claims. These professionals specialize in maneuvering complex policy coverage and preventing claim denials through expert damage documentation and repair cost assessment.

| Key Benefits | Impact on Claims |

|---|---|

| Expert Documentation | Thorough evidence collection prevents claim denial |

| Policy Knowledge | Maximum coverage utilization for blistering damage |

| Claim Negotiations | Higher settlement amounts through skilled advocacy |

Public adjusters handle all aspects of the claims process, from initial damage assessment through final insurance settlement. Their expertise in claim negotiations and complete understanding of blistering damage valuation guarantees homeowners receive fair compensation while minimizing stress during repairs or replacement.

How Are Public Insurance Adjusters Paid & What Are Their Fees?

Understanding public adjuster compensation is essential for property owners considering professional claims assistance. These licensed professionals typically charge a percentage of the final settlement amount, ensuring their interests align with maximizing claim outcomes for costly repairs.

| Service Component | Fee Range | Value Provided |

|---|---|---|

| Damage Evaluation | 10-15% | Expert documentation and assessment |

| Claim Preparation | 15-18% | Detailed itemization and support |

| Negotiation | 15-20% | Maximum settlement outcomes |

Public adjuster fees generally range from 10% to 20% of the total insurance claim settlement. This compensation model motivates thorough documentation and aggressive negotiation with insurance carriers. When facing extensive roofing company estimates or complex damage scenarios, their expertise often yields settlements that substantially exceed the cost of their services.

Public Adjusters Vs. The Insurance Company Adjuster

When handling an insurance claim for roof damage, property owners face a critical choice between two types of adjusters with fundamentally different roles and motivations. Public adjusters serve as independent advocates, working solely for the policyholder to maximize legitimate compensation for blisters and other damage. Insurance company adjusters, conversely, represent their employer’s interests in minimizing claim payouts.

| Key Aspects | Public Adjuster | Company Adjuster |

|---|---|---|

| Represents | Policyholder | Insurance Company |

| Payment | 5-15% of Settlement | Company Salary |

| Objective | Maximize Claims | Minimize Payouts |

Statistical evidence shows public adjusters secure 30-40% higher settlements through extensive claim documentation, thorough damage assessment, and expert policy interpretation. Their expertise proves particularly valuable for complex roof repairs, ensuring property owners receive fair compensation while managing the entire claims process.

When to Contact Your Insurance Provider For Roof Blistering

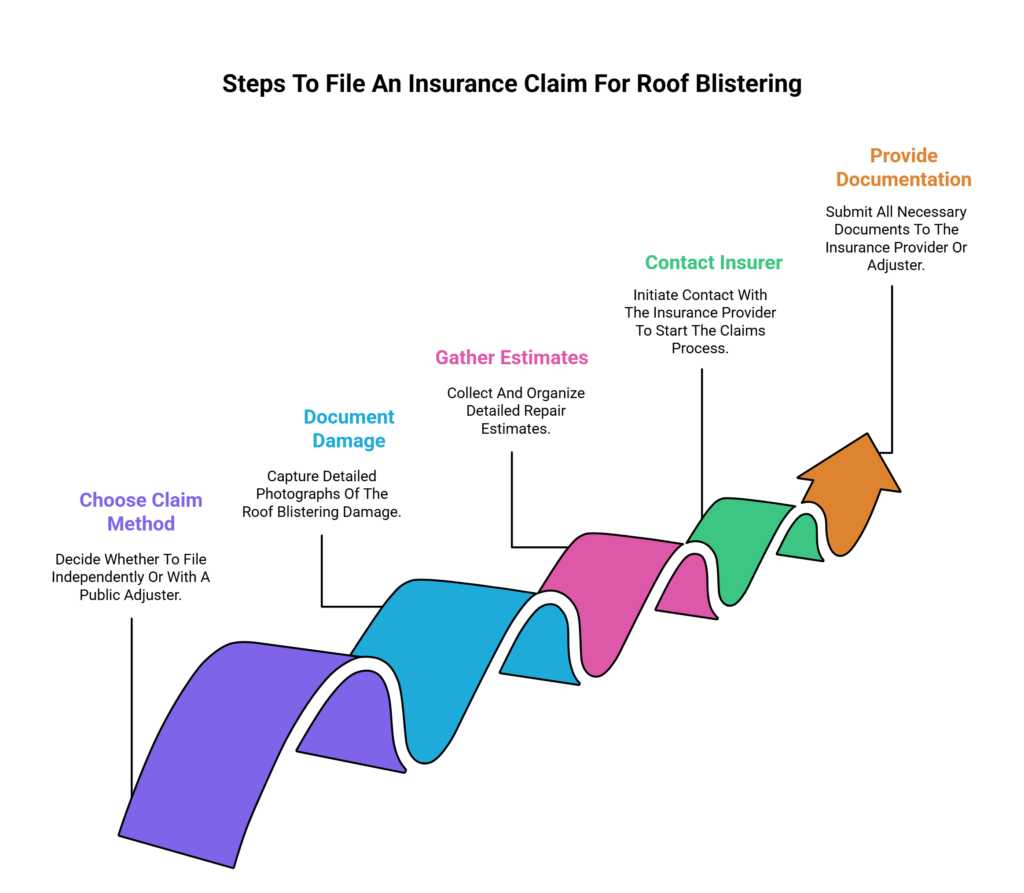

When pursuing an insurance claim for roof blistering damage, homeowners can choose between filing independently or utilizing a public adjuster‘s services.

Those working with a public adjuster should provide all documentation and allow the adjuster to initiate contact with the insurance provider on their behalf.

Homeowners filing claims independently must promptly document the damage with photographs, maintain detailed repair estimates, and contact their insurance provider directly to begin the claims process.

If Using A Public Adjuster

The decision to engage a public adjuster for roof shingle blistering requires careful timing and proper documentation. Homeowners should consider this option when insurance claims are initially denied despite evidence showing blistering damage across more than 30% of the roof surface.

Documentation of regular roof maintenance history is essential to demonstrate that damage isn’t due to neglect.

Public adjusters become particularly valuable when insurance providers attribute blistering to manufacturing defects rather than covered perils. Multiple professional damage assessments confirming compromised structural integrity strengthen the case.

The adjuster can help navigate disputes, especially when visible damage extends beyond cosmetic concerns to expose underlying matting material. This independent expertise often proves vital in achieving fair claim settlements for extensive roof damage requiring replacement.

If Filing On Your Own

Successful insurance claims for roof shingle blistering require precise timing and thorough documentation when filing independently. Property owners should contact their insurance provider immediately after discovering popped blisters that expose underlying materials.

Documentation must include detailed photos capturing both close-up views of individual blisters and wide-angle shots of affected areas, along with precise measurements of the damage.

Claims should be filed within the policy’s specified timeframe, typically 30-60 days after discovery. To support the claim, submit evidence demonstrating the damage is not due to normal aging or maintenance neglect.

When blistering affects more than 30% of the roof surface, provide exhaustive documentation to justify full replacement coverage rather than partial repairs. This evidence helps guarantee maximum policy coverage for extensive damage.

Filing Process For Roof Blistering Claims Using A Public Adjuster

A public adjuster streamlines the roof blistering claims process by conducting thorough inspections, reviewing policies, and managing communications with insurance companies.

The adjuster’s expertise helps maximize policy benefits while gathering essential documentation and professional assessments to support the claim. This systematic approach follows established protocols to properly validate storm-related shingle damage.

- Complete documentation of all visible storm damage through detailed photos and measurements

- Analysis of policy terms to identify applicable coverage and hidden benefits

- Collection of third-party professional evaluations and weather data to strengthen the claim

Public Adjuster Thoroughly Inspects & Documents Storm Damage To Roof

When filing insurance claims for storm-related roof blistering, public adjusters conduct thorough roof inspections to document and validate damage patterns. They examine visual indicators like pockmarks from hail damage and roof blisters while creating detailed diagrams of affected areas. The documentation includes exhaustive weather data and evidence of water infiltration through compromised sections.

| Inspection Component | Documentation Method | Purpose |

|---|---|---|

| Damage Patterns | Photos & Measurements | Verify Storm Impact |

| Weather Events | Historical Data | Link Damage to Storms |

| Cost Assessment | Detailed Estimates | Support Claim Value |

Professional adjusters compile their findings into detailed reports that differentiate storm-related damage from manufacturing defects, enabling them to effectively negotiate with insurance companies on behalf of property owners.

Public Adjuster Reviews Policy For Hidden Roofing Coverage & Helps Maximize Policy Benefits

Public adjusters systematically analyze insurance policies to uncover hidden coverage provisions that directly impact roof blistering claims. Through thorough policy reviews, they identify opportunities for maximum benefits by documenting manufacturing defects, installation errors, and secondary damage. Their involvement typically results in 30-40% higher claim settlements compared to homeowner-filed claims.

| Claim Process Component | Public Adjuster’s Role |

|---|---|

| Policy Review | Identifies hidden coverage provisions |

| Damage Assessment | Documents pre-existing conditions |

| Evidence Collection | Gathers proof of defects and errors |

| Claim Documentation | Prepares detailed proof of loss |

| Settlement Negotiation | Challenges claim denials and maximizes benefits |

Professional adjusters manage all carrier communications while ensuring compliance with policy terms and time limits, strengthening the policyholder’s position through methodical documentation and expert negotiation strategies.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Filing an insurance claim for roof blistering becomes streamlined when licensed public adjusters manage carrier communications and negotiations.

These professionals handle all documentation, policy coverage verification, and interaction with insurance company adjusters to pursue maximum settlement amounts.

- Public adjusters compile thorough evidence of perils, including detailed photos, measurements, and professional assessments

- Settlement negotiations typically span 2-6 months, varying with claim complexity and insurer response times

- Adjuster fees range from 5-15% of the final settlement amount

The public adjuster’s expertise guarantees proper claim documentation while relieving property owners of direct communication burdens.

Their focused approach to settlement negotiations helps maximize covered benefits while adhering to policy terms and documentation requirements for roof blistering claims.

Public Adjuster Gets Professional Assessments

Professional assessments form the foundation of successful roof blistering claims managed by public adjusters. Through extensive documentation, adjusters gather moisture readings, core samples, and photographic evidence to substantiate damage claims.

They evaluate manufacturing defects, installation records, and warranty information to determine coverage eligibility and liability.

Key components of professional assessments include:

- Detailed analysis of structural integrity through industry-standard evaluation methods

- Documentation of proper maintenance history and installation procedures

- Scientific measurement of moisture levels and material degradation

The thorough damage assessment process enables public adjusters to build compelling insurance claims that demonstrate the full extent of roof blistering impact.

This systematic approach typically results in claim settlements 30-40% higher than those filed without professional adjustment services, ensuring policyholders receive appropriate compensation for repairs or replacement.

Public Adjuster Gathers Supporting Evidence

Thorough evidence gathering forms the cornerstone of successful roof blistering claims. Public adjusters systematically collect extensive documentation, including detailed photographs of blister patterns and physical samples showing granule loss. Weather data correlation and inspection reports provide vital context for damage assessment.

| Evidence Type | Documentation Method |

|---|---|

| Physical | Shingle samples, measurements |

| Visual | Photographs, pattern analysis |

| Technical | Laboratory tests, expert reports |

The adjuster compiles multiple forms of evidence to build a strong case, incorporating laboratory analysis of damaged materials and expert assessments of installation methods. This systematic approach establishes clear links between observed damage and potential causes, whether from manufacturing defects, improper installation, or maintenance issues. Detailed records of attic ventilation conditions and historical maintenance further strengthen claim documentation.

Public Adjuster Submits Complete Claims Package

Once evidence collection is complete, the public adjuster assembles a detailed claims package that adheres to insurance carrier requirements. The documentation includes thorough technical reports demonstrating how blistering exceeds normal wear and results from covered perils. Evidence of granule loss, exposed matting, and interior damage strengthens the claim’s validity.

| Claims Package Components | Required Documentation | Purpose |

|---|---|---|

| Damage Assessment | Photos & Measurements | Verify Extent |

| Weather Data | Historical Records | Link to Perils |

| Installation Records | Contractor Documents | Prove Proper Setup |

| Maintenance History | Service Reports | Show Due Diligence |

| Cost Analysis | Local Repair Data | Support Settlement |

The adjuster leverages this documentation to negotiate with insurance carriers, ensuring settlements align with policy terms and actual replacement costs.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Licensed public adjusters shoulder the complete responsibility of managing ongoing insurance claim requirements and timelines for roof blistering damage.

They coordinate all necessary documentation, paperwork, and correspondence directly with insurance companies to guarantee proper claim processing and settlement negotiations.

Key services provided include:

- Managing the complete claim timeline from initial filing through final settlement

- Submitting required documentation, photographs, and estimates within specified deadlines

- Handling all follow-up communications and information requests from insurance representatives

The adjuster’s expertise in policy coverage and roof damage claims helps maximize settlement values while relieving property owners of complex administrative burdens.

Their professional management of deadline-driven requirements and technical documentation secures claims remain active and compliant throughout the process, increasing the likelihood of favorable outcomes.

Public Adjuster Enforces Policyholder’s Rights, & Negotiates Higher & More Fair Settlement

Professional public adjusters leverage their expertise to consistently secure higher settlement values for roof blistering claims while protecting policyholders’ contractual rights throughout the process.

Through exhaustive inspection and detailed documentation, they build strong evidence-based cases that distinguish covered damage from normal wear.

Key aspects of the public adjuster’s role include:

- Conducting thorough damage assessments with photographic evidence and professional evaluations

- Analyzing policy coverage terms to identify all applicable provisions supporting maximum claim value

- Leading claim negotiations with insurance carriers using documented evidence and industry expertise

Statistical data shows claims filed through public adjusters typically achieve settlements 40-350% higher than those submitted independently.

This significant difference stems from their specialized knowledge of policy coverage, strategic negotiation skills, and ability to properly document and present compelling evidence.

Public Adjuster Speeds Up Claim Settlement Time

Working with a public adjuster dramatically accelerates the settlement timeline for roof blistering claims through streamlined documentation and expert claim management.

Public adjusters complete insurance claims 30-50% faster than self-filed cases while securing settlements up to 700% higher through their expertise in negotiation and damage assessment.

- Professional documentation and evidence collection meets specific policy requirements, increasing approval rates substantially

- Structured claim process includes regular updates and thorough communication with insurance companies

- Timeline typically resolves in 30-90 days versus 6-12 months for self-filed claims

Their specialized knowledge of policy language, exclusions, and coverage limits guarantees efficient processing while maximizing settlement value.

Public adjusters handle all paperwork and insurance company interactions, allowing property owners to focus on other priorities during repairs.

How To Prevent Roof Shingles From Blistering

Effectively preventing roof shingle blistering requires a thorough approach focused on proper ventilation, installation, and maintenance. Critical components include balanced attic ventilation systems that promote air circulation beneath the roof deck and high-quality underlayment installed using correct techniques. Professional inspection annually helps identify potential issues before they escalate.

| Prevention Factor | Key Requirements |

|---|---|

| Ventilation | Balanced intake/exhaust system |

| Installation | Proper nailing, sealed deck contact |

| Temperature | Adequate insulation, heat escape |

Maintaining recommended attic temperatures through proper insulation and ventilation prevents excessive heat buildup that can cause shingle expansion. Proper installation techniques, including correct nailing patterns and installation during moderate temperatures, guarantee peak performance. These preventive measures substantially reduce the risk of shingle blistering while extending roof longevity.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) stands as a complete national organization of state-licensed public adjusters who specialize in property damage insurance claims. Operating across 40+ states, PCAN’s member adjusters handle over 30 different claim types, providing expert damage assessment and claims process guidance to policyholders.

PCAN maintains strict standards through a rigorous vetting process, ensuring all member public adjusters demonstrate professional expertise and maintain proper licensing.

The network conducts mandatory annual audits of licenses and complaints, upholding the highest levels of ethics and professionalism. This thorough approach to quality assurance makes PCAN a trusted resource for connecting policyholders with qualified licensed adjusters who can effectively navigate complex insurance coverage matters and property damage claims.

Frequently Asked Questions

Is Shingle Blistering Covered by Insurance?

Standard homeowner’s insurance only covers shingle blistering when it causes active leaks or results from covered perils. Manufacturing defects fall under manufacturer warranties rather than insurance coverage.

How Much Does It Cost to Repair a Roof Shingle?

A penny saved is a penny earned when addressing roof repairs. Individual shingle repairs cost $2-$5 per square foot, while larger section repairs range from $350-$1,500, depending on damage severity.

How to Fix Blistering on Roof?

Small blisters require cutting around damage and applying roofing cement underneath. Widespread blistering needs complete shingle replacement. Address underlying ventilation issues. Cover popped blisters immediately with temporary protection until professional repairs.

Why Are My Shingles Blistering?

Like bubbles rising in boiling water, shingle blistering occurs from trapped moisture and poor ventilation. Manufacturing defects, improper installation, and extreme temperature changes can also create pressure points beneath shingles.