Is your roof trying to tell you something? Let’s decode those mysterious signals and tackle roof repairs together!

Think of your roof as your home’s protective helmet – when it needs fixing, costs can range from a modest $350-700 for basic shingle swaps to a weightier $1,000-3,000 for structural TLC. Just like reading your body’s warning signs, your roof speaks through water stains creeping across your ceiling, shingles playing hide-and-seek after storms, and those vulnerable valleys showing their age.

Good news: your home insurance has your back when Mother Nature throws a tantrum! Whether it’s an unexpected storm rampage, that neighbor’s tree deciding to visit, or fire damage, you’re typically covered. But here’s the catch – regular wear and tear? That’s on you, friend.

You’ll want to get cozy with your policy’s fine print, especially those deductibles ($500-2,000). And here’s a pro tip: know whether you’re rolling with an Actual Cash Value (ACV) or Replacement Cost Value (RCV) policy – it’s like choosing between a basic warranty and premium coverage. This knowledge is your secret weapon for maximizing your insurance claim and getting your roof back in fighting shape.

Remember, a well-maintained roof isn’t just about keeping dry – it’s about protecting your biggest investment with the smartest strategy possible. Ready to give your roof the attention it deserves?

Key Takeaways

Is Your Roof Trying to Tell You Something? Let’s Talk Repairs!

Think of your roof as your home’s protective helmet – when it needs fixing, you’ll want to know your options and costs. Let me break it down for you.

Minor fixes, like replacing those rebellious shingles or patching up worn flashing, typically run between $150-1,000. But when we’re talking major structural repairs, you’re looking at $3,000 or more – think of it as your roof’s equivalent of major surgery.

Wondering about insurance? Here’s the scoop: Your policy’s got your back for those unexpected surprises (hello, fallen tree!) but won’t help much with Father Time’s handiwork. It’s like car insurance – they’ll cover the fender-bender but not your routine oil changes.

Smart tip: Keep an eye on those policy details! RCV (Replacement Cost Value) policies are like getting a brand-new phone when yours breaks, while ACV (Actual Cash Value) policies factor in age – kind of like trying to sell your old smartphone.

Need a pro? Most roofing wizards charge $45-75 per hour, and they’ll typically wrap up your repair in about the time it takes to watch a movie (2-4 hours). If you’re wrestling with insurance claims, consider bringing in a public adjuster – these claim-whisperers often boost settlements by 20-30% and can fast-track your case from a snail’s pace to express lane speed.

Remember: Your roof is your home’s first line of defense – showing it some love today can save you from bigger headaches tomorrow!

Common Types Of Roof Repairs

A homeowner’s roof can require various types of repairs throughout its lifespan, with costs determined by the repair’s complexity and required materials. Professional repairs typically address issues ranging from damaged shingles to structural concerns involving rafters and trusses.

| Repair Type | Cost Range |

|---|---|

| Shingle Replacement | $350-700 |

| Flashing Repair | $200-500 |

| Leak Patching | $400-1,000 |

| Structural Work | $1,000-3,000 |

Common repairs include replacing damaged shingles and underlayment, fixing deteriorated flashing around chimneys and vents, and addressing leaks through patching and sealing affected areas. Modern inspection technologies like moisture detectors help professionals identify hidden damage before starting repairs. Gutter system maintenance often involves reattaching loose sections and sealing seams. More extensive repairs may require replacing damaged decking or reinforcing compromised structural components to maintain roof integrity and prevent water infiltration. When damage affects less than 30 percent of the roof surface, repairs are typically viable instead of full replacement.

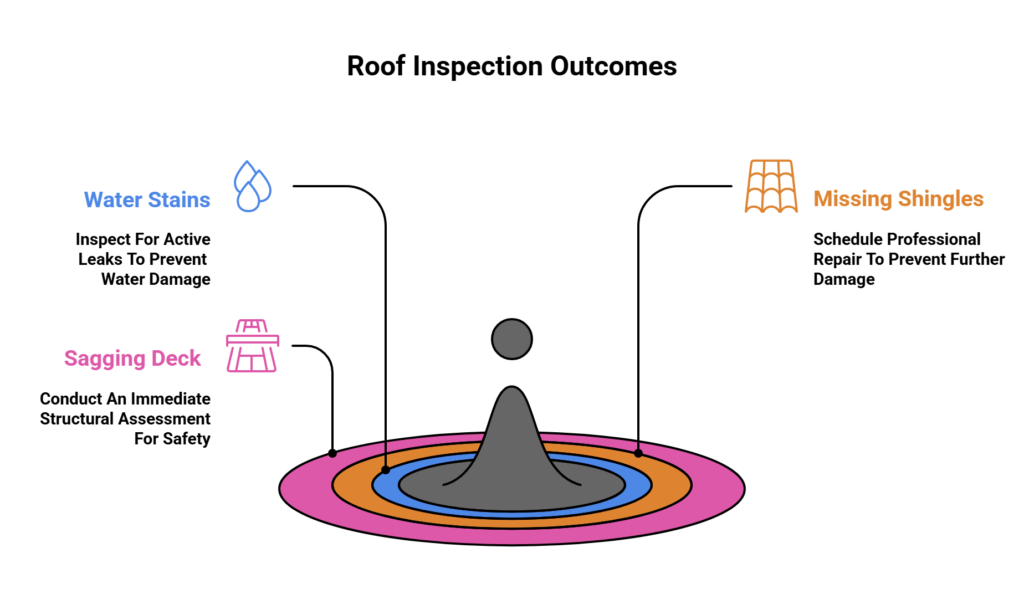

Warning Signs Your Roof Needs Immediate Repair

Several critical warning signs indicate when a roof requires immediate professional attention to prevent extensive structural damage and costly repairs. Homeowners should regularly inspect their roofs for these indicators and contact a qualified roofing contractor when issues arise, as early intervention can minimize repair costs and prevent insurance claim complications. Public insurance adjusters can help maximize claim settlements by up to 800% for serious roof damage.

| Warning Sign | Required Action |

|---|---|

| Water stains on ceiling | Inspect for active leaks |

| Missing/damaged shingles | Schedule professional repair |

| Sagging roof deck | Immediate structural assessment |

Regular maintenance inspections can identify wear and tear before it becomes severe enough to compromise the roof’s integrity. Insurance coverage often depends on addressing these warning signs promptly, as neglected maintenance issues may void coverage or increase deductible costs. Professional assessment guarantees proper documentation for potential claims while determining the most cost-effective repair strategy. Valley deterioration points account for over 90% of all roof leaks and require immediate professional inspection when damage is suspected.

Does Homeowners Insurance Cover Roof Repairs?

Understanding roof repair coverage under homeowners insurance requires familiarity with policy deductibles, coverage limits, and specific exclusions that affect claim payouts. Insurance providers typically differentiate between sudden, accidental damage from covered perils versus gradual deterioration or maintenance-related issues. The type of coverage—Actual Cash Value (ACV) or Replacement Cost Value (RCV)—significantly impacts reimbursement amounts for roof repairs, with RCV offering more complete protection against covered losses. Working with public adjusters increases settlements by an average of 574% compared to filing claims independently. Expert adjusters from PCAN membership networks undergo rigorous background checks and maintain stellar professional records to ensure quality claim handling.

| Coverage Type | Typical Inclusions | Common Exclusions |

|---|---|---|

| Storm Damage | Wind, hail, lightning strikes | Normal wear and tear |

| Falling Objects | Tree limbs, debris impact | Pest or animal damage |

| Fire & Smoke | Fire-related structural damage | Poor maintenance |

| Vandalism | Intentional third-party damage | Age-related deterioration |

Insurance Deductibles, Coverage Limits, & Exclusions For Roof Repair Claims

Homeowners insurance typically covers sudden, accidental roof damage while excluding normal wear and tear, making it essential to understand policy specifics before filing a claim. Before coverage begins, policyholders must meet their deductible, which ranges from $500-$2,000 for standard policies or 1-5% of home value in hurricane-prone regions. Many homeowners opt for a higher deductible amount to reduce their annual premium costs significantly. Public adjusters can help maximize claim payouts through experienced negotiation with insurance companies. It’s also important for homeowners to consider how roof replacement affects insurance rates, as a new roof can potentially lower premiums due to enhanced protection against damage. Additionally, upgrading to more durable materials may qualify homeowners for discounts, making the investment even more worthwhile. Overall, understanding these nuances can empower homeowners to make informed decisions regarding their insurance coverage and financial commitments.

| Coverage Type | Key Features | Common Exclusions |

|---|---|---|

| Actual Cash Value | Factors in depreciation | Earthquakes, floods |

| Replacement Cost | Full replacement value | Mold, pest damage |

| Limited Coverage | Age-restricted policies | Poor maintenance |

Claims require prompt filing and thorough documentation of damage. Insurance companies may deny coverage for roofs over 15-20 years old or those showing inadequate maintenance. Understanding these limitations helps homeowners prepare for potential out-of-pocket expenses and maintain appropriate coverage levels.

Actual Cash Value Vs. Replacement Cost In Relation To Roofing Repairs

Two primary insurance coverage types dramatically affect the financial outcome of roof repair claims: Actual Cash Value (ACV) and Replacement Cost Value (RCV). While both coverage types fall under dwelling coverage, their claim payouts differ considerably. ACV factors in depreciation based on roof age, while RCV provides full replacement cost, both minus the deductible. Public adjusters can assist homeowners in maximizing underpaid ACV or RCV claims for roof damage. High-value items often need additional scheduled coverage beyond standard ACV or RCV policies.

| Coverage Type | Premium Cost | Payout Example |

|---|---|---|

| ACV | Lower | $33,500 |

| RCV | Higher | $58,500 |

| Difference | Varies | $25,000 |

Insurance companies typically restrict older roofs (15-20 years) to ACV coverage, while newer roofs often qualify for RCV. Although RCV coverage commands higher premiums, it offers superior protection by eliminating depreciation from the insurance claim calculation, resulting in substantially larger payouts for homeowners.

Named Vs. Hidden Perils

When evaluating roof repair coverage through homeowners insurance, the distinction between named perils and hidden perils policies substantially impacts claim outcomes. Named perils policies specifically list 16 covered damage types, while hidden perils coverage protects against all damages except those explicitly excluded. The burden of proof differs markedly between these policy types. Experienced adjusters can achieve higher settlement amounts through detailed damage documentation and expert policy interpretation.

| Policy Type | Key Characteristics |

|---|---|

| Named Perils | Homeowner proves covered peril |

| Hidden Perils | Insurer proves exclusion |

| Named Perils | 15-20% lower premium cost |

| Hidden Perils | Broader default protection |

| Both Types | Dwelling structure coverage in HO-3 |

Most HO-3 insurance policies utilize hidden perils coverage for the dwelling structure, including the roof, while applying named perils coverage to personal property. This dual approach optimizes protection for the home’s structural elements while maintaining cost-effective coverage for contents. Working with public adjusters can increase claim settlements by 20-30% on average when navigating complex roof repair claims.

Average Cost Breakdown For Roofing Repairs By Type

Different roofing materials require varying repair costs based on material quality, installation complexity, and regional labor rates.

Professional roofing contractors typically charge more for specialized materials like metal or luxury shingles compared to standard asphalt options.

Personal safety equipment adds significant overhead costs to roofing projects, with gear requirements ranging from $200-400 per worker.

Understanding the cost variations across roofing types helps property owners make informed decisions about repairs and budget appropriately:

- Standard 3-tab asphalt shingle repairs: $150-$400 per 100 square feet

- Architectural shingle repairs: $350-$700 per 100 square feet

- Metal shingle/shake repairs: $600-$1,200 per 100 square feet

- Wood shake/shingle repairs: $450-$850 per 100 square feet

Working with public adjusters can increase insurance claim settlements by 40-700% while reducing processing time from 6-8 months to 2-4 months.

Average Asphalt Shingle Roof Repair Cost

Evaluating the cost of asphalt shingle roof repairs requires understanding the typical price ranges for various repair scenarios. Most homeowners spend approximately $650 for standard repair jobs, though costs can vary substantially based on the extent of damage and required work.

| Repair Type | Average Cost Range |

|---|---|

| Minor Shingle Replacement | $150-$400 |

| Flashing Repairs | $200-$500 |

| Leak/Water Damage | $400-$1,000 |

Labor costs for asphalt shingle repairs typically range from $45 to $75 per hour, with most projects requiring 2-4 hours to complete. Major repairs involving multiple shingles and underlying structural damage can reach $1,500-$3,000. Geographic location significantly impacts repair costs, with top-paying states like Massachusetts and Illinois charging up to 40% more than the national average. Ventilation repairs average $300-$600, while extensive repairs addressing multiple issues may cost up to $1,500, depending on the complexity and scope of work required. Since peak season summer roof repairs typically cost 10% more than off-season work, scheduling repairs during spring or fall can result in significant savings.

Average Architectural Shingle Roof Repair Cost

Architectural shingle roof repairs command varying price points based on the scope and complexity of the required work, with costs typically ranging from $360 to $1,550 per repair job. Labor costs average $45-$75 per hour, while complete roof replacement runs $5-$7 per square foot. Valley repairs, a common issue, typically cost $300-$600 per valley. Public adjuster services can increase insurance claim payouts by 20-50% for covered roof damage. Homeowners should also factor in additional expenses such as permits or inspections that may be required for roofing projects. Furthermore, it’s essential to consider that typical roof replacement costs 2025 may trend higher due to inflation and increased material prices. As such, seeking multiple quotes and staying informed about market changes can help homeowners make more prudent decisions regarding their roofing needs.

| Repair Type | Average Cost Range |

|---|---|

| Minor Shingle Replacement | $150-$400 |

| Valley Repairs | $300-$600 |

| Standard Repair Job | $360-$1,550 |

| Major Structural Repairs | $3,000+ |

Small-scale repairs, such as replacing damaged shingles, represent the lower end of the cost spectrum at $150-$400. However, when structural repairs become necessary, costs can escalate beyond $3,000, particularly when addressing extensive damage or complex roofing issues. Proper roof deck inspection after material removal is crucial for identifying potential underlying damage that could affect repair costs.

Average Luxury Shingle Roof Repair Cost

Luxury shingle roof repairs command substantially higher costs than standard roofing repairs, with typical repair incidents ranging from $1,000 to $3,500 and averaging $2,250 for premium materials and specialized labor. Individual luxury shingle replacements cost between $25-$75 per shingle, plus labor rates of $100-$200 hourly. Major structural repairs involving multiple layers can escalate to $5,000-$12,000 per section. Weather impact assessments significantly influence claim processing time and final coverage determination. Public adjuster involvement can increase insurance settlements by up to 800% for qualified luxury roof repair claims.

| Repair Type | Cost Range |

|---|---|

| Basic Repair | $1,000-$3,500 |

| Individual Shingles | $25-$75/shingle |

| Flashing Work | $400-$800/area |

| Emergency Service | $4,000-$7,000 |

Insurance coverage for luxury shingle repairs typically depends on damage cause, with storm damage generally covered while wear-and-tear exclusions apply. Emergency repairs carry premium rates, potentially doubling standard costs and requiring immediate attention to prevent further structural damage.

Average Metal Shingles/Shakes Roof Repair Cost

Metal shingle and shake roof repairs average between $850 and $2,500 per repair incident, reflecting the specialized nature of metal roofing systems. The extent of the damage and specific type of roofing material substantially influence repair costs. Insurance coverage for metal roofs typically addresses sudden damage from storms or impacts but excludes general wear.

| Repair Type | Average Cost |

|---|---|

| Panel replacement | $1,200-1,800 |

| Seam repairs | $400-900 |

| Fastener replacement | $200-500 |

| Flashing repair | $300-600 |

Metal roofs require specialized expertise and specific roofing materials for repairs, which contributes to higher service costs. Common issues include loose panels, damaged seams, and compromised fasteners. The durability of metal roofs often means fewer repairs over time, though when needed, they demand professional attention to maintain the roof’s integrity and weatherproofing capabilities.

Average Wood Shingle Roof Repair Cost

While wood shingle roof repairs vary in complexity, homeowners can expect to invest between $750 and $1,500 per 100 square feet for standard repair work. Understanding specific repair costs helps when filing homeowners insurance claims and planning maintenance budgets. Homeowners should be aware that shingle roof repair average costs may fluctuate based on factors such as the roof’s age, the extent of damage, and local labor rates. It’s also essential to consider the quality of materials used in the repairs, as higher-grade shingles might result in increased expenses but could offer better durability and longevity. By being informed about these factors, homeowners can make smarter decisions and potentially save on future repair costs.

| Repair Type | Average Cost Range |

|---|---|

| Single Shingle Replacement | $65-$120 |

| Water Damage Repair | $450-$1,200 |

| Moss Treatment | $250-$750 |

| Flashing Replacement | $300-$600 |

| Full Section Repair | $750-$1,500 |

Professional roofing contractors assess roof damage to determine the most cost-effective solution. Water damage often requires immediate attention to prevent structural deterioration, while preventive measures like moss treatment help extend roof longevity. When evaluating replacement cost versus repair, consider the age and overall condition of existing wood shingles, as well as potential insurance coverage for sudden damage.

Average Flat Roof Repair Cost

Depending on the type and extent of damage, flat roof repairs typically range from $300 for minor fixes to $3,000 for structural repairs, with basic patching costing $4-$10 per square foot. Insurance coverage varies based on damage cause, with sudden events often covered while general wear excluded. Emergency repairs during severe weather can increase costs by 50-100% above standard rates. Homeowners should always obtain multiple estimates to ensure they are getting a fair price, making a roof repair cost comparison essential when considering different contractors. Additionally, investing in preventive maintenance can help mitigate the risk of more extensive damage and higher costs in the future. Regular inspections and timely repairs can save homeowners significant money over time.

| Repair Type | Cost Range | Insurance Claim Potential |

|---|---|---|

| Minor Fixes | $300-$750 | Limited Coverage |

| Flat Roof Patching | $4-$10/sq ft | Case-by-Case Basis |

| Complete Resealing | $400-$1,200 | Typically Not Covered |

| Structural Repairs | $1,000-$3,000 | Coverage If Sudden Damage |

When filing an insurance claim, actual cash value policies factor in depreciation, while replacement cost coverage provides fuller compensation for approved repairs.

Average Solar Shingle Roof Repair Cost

Solar shingle roof repairs demand specialized expertise and typically range from $400 to $1,200 per incident, with costs varying based on the complexity of the integrated electrical systems. When filing a claim, homeowners insurance policies may cover damage caused by sudden events, but replacement cost versus actual cash value coverage substantially impacts reimbursement. A reputable contractor should assess repair needs through diagnostic testing ($150-300) before beginning work.

| Component | Standard Cost | Emergency Cost |

|---|---|---|

| Single Shingle | $150-300 | $225-450 |

| Electrical Parts | $200-600 | $300-900 |

| Diagnostic Test | $150-300 | $225-450 |

| Labor | $200-400 | $300-600 |

| Full Panel | $800-1,200 | $1,200-1,800 |

Insurance coverage often excludes wear and tear, making regular maintenance essential to prevent costly roof replacement.

Average Metal Roof Repair Cost

Metal roof repairs typically range from $550 to $1,350 nationally, with an average cost of $950 per repair incident. Labor costs for these repairs average $45-$75 per hour, with most jobs requiring at least 2-4 hours of work. Factors affecting repair costs include roof pitch, accessibility, and the need for specialized tools.

| Repair Type | Cost Range |

|---|---|

| Minor Leaks | $150-$400 |

| Loose Fasteners | $150-$400 |

| Single Panel | $1,500-$2,000 |

| Major Damage | $2,000-$3,000 |

The complexity of metal roof repairs varies substantially based on the extent of roof damage. Simple fixes like sealing leaks or securing loose fasteners fall on the lower end of the cost spectrum, while extensive repairs involving panel replacement or structural issues command higher prices due to increased labor and material requirements.

Average Clay & Concrete Tile Roof Repair Cost

While metal roofs demand specific repair approaches, clay and concrete tile roofs present their own set of cost considerations and repair requirements. Repair costs vary substantially based on the scope of work, with individual broken tile replacement ranging from $300 to $700 per repair job. Large-scale structural repairs can reach $5,000 when multiple sections require attention.

| Repair Type | Cost Range |

|---|---|

| Single Tile Replacement | $300-$700 |

| Loose Tile Repairs | $250-$500 |

| Major Structural Repairs | $1,500-$5,000 |

When undertaking tile roof repair, contractors must consider both surface-level issues and underlying components. The underlayment, essential for water protection, adds $4 to $7 per square foot to repair costs. Labor costs for clay and concrete tile repairs typically range from $8 to $20 per square foot, reflecting the specialized expertise required for these materials.

Average Slate & Synthetic Slate Roof Repair Cost

Repairs for slate roofing systems present distinct cost variations between natural and synthetic materials, with natural slate commanding higher prices due to its premium nature and installation complexity. Natural slate repair costs typically range from $1,500 to $4,000 per repair job, while synthetic slate repairs average $600 to $1,200. Labor costs constitute 60-70% of total expenses due to specialized labor and roofing expertise required.

| Cost Factor | Natural Slate | Synthetic Slate |

|---|---|---|

| Single Tile | $40-$60 | $20-$30 |

| Basic Repair | $1,500-$4,000 | $600-$1,200 |

| Large Section | $8,000-$15,000 | $4,000-$8,000 |

When obtaining repair estimates, homeowners should verify coverage with their home insurance provider, as policies may differ regarding slate roof repairs. Individual tile replacement costs highlight the substantial price difference between natural and synthetic options.

Average Built-Up Roof (Bur) Repair Cost

Built-up roofing systems typically incur repair costs between $4-$10 per square foot, with total project expenses ranging from $400 to $1,500 for standard repair areas. Basic membrane patching starts at $3-$4 per square foot for single-layer repairs, while complex multi-layer repairs involving gravel removal can reach $8-$12 per square foot.

| Repair Type | Cost Range (per sq ft) |

|---|---|

| Basic Patching | $3-$4 |

| Standard Repair | $4-$10 |

| Multi-layer/Gravel | $8-$12 |

Emergency repairs to built-up roofing typically command premium labor rates, averaging 25-50% higher than scheduled maintenance repairs. Insurance coverage may apply for sudden damage, but standard wear requires out-of-pocket payment. Property owners should consider regular maintenance to prevent costly emergency interventions and preserve their roof’s replacement cost value. By investing in routine inspections and preventive maintenance, property owners can significantly reduce the likelihood of unexpected repairs and ultimately save money in the long run. Various builtup roof repair types, including patching, resurfacing, and re-coating, can address minor issues before they escalate into major problems. Understanding these options and their benefits can help property owners make informed decisions that enhance the longevity and effectiveness of their roofing systems.

Average Wood Roof Repair Cost

Wood roofing systems command varying repair costs depending on the scope and complexity of the work required. Minor repairs involving individual wood shakes typically range from $250-$400, while extensive structural repairs, including water damage remediation, can reach $2,000-$4,000 per repair area. Labor costs constitute approximately 60% of total expenses at $50-$80 per hour. Emergency repairs often incur premium charges of 50-100% above standard repair rates.

| Repair Type | Cost Range | Coverage Notes |

|---|---|---|

| Minor Shake | $250-$400 | Often below insurance deductible |

| Standard Area | $600-$900 per 100 sq ft | May qualify for coverage |

| Major Structural | $2,000-$4,000 | Usually covered if sudden damage |

| Water Damage | $1,500-$3,000 | Coverage varies by cause |

| Emergency Service | +50-100% premium | Additional costs may apply |

Average Green Roof Repair Cost

While wood roofing systems require specific maintenance approaches, green roofs present their own unique set of repair considerations and costs. Repair costs vary substantially based on the complexity of extensive systems and required maintenance procedures. Insurance coverage may apply to sudden damage, though routine upkeep typically falls under owner responsibility.

| Green Roof Component | Repair Cost Range |

|---|---|

| Basic Vegetation | $200-500 |

| Root Barrier | $400-900 |

| Drainage Layer | $500-1,500 |

| Waterproofing Membrane | $800-2,500 |

| Complete System | $12-30/sq ft |

Access to damaged components often requires careful removal of the growing medium and vegetation layers. Critical repairs include addressing waterproofing membrane issues, maintaining proper drainage layer functionality, and ensuring root barrier integrity to protect the underlying structure. Regular maintenance of vegetation and monitoring system performance helps prevent more costly repairs.

Average Membrane Roof Repair Cost

Membrane roofing systems require specific repair approaches based on the material type and extent of damage. Cost variations depend substantially on the membrane type, repair scope, and installation complexity. For instance, TPO repairs range from $5-$25 per square foot, while EPDM repairs typically cost $3-$8 per square foot for patch work. Insurance coverage may apply for sudden damage but usually excludes normal wear.

| Membrane Type | Minor Repairs | Major Repairs |

|---|---|---|

| Modified Bitumen | $400-$700 | $700+ |

| PVC | $200-$350 | $350+ |

| TPO | $5-$10/sq ft | $12-$25/sq ft |

| EPDM | $3-$8/sq ft | $200-$400 |

BUR repairs average $4-$10 per square foot, with costs increasing based on layer count. Professional assessment is essential for determining appropriate repair methods and accurate cost estimation.

Average Rolled Roof Repair Cost

When considering rolled roofing repairs, costs typically range from $200 to $1,000 per installation, with an average expense of $400. Small patch repairs cost between $2-$4 per square foot, including labor and materials. Emergency repairs can increase costs by 50-100% above standard rates, making insurance coverage essential for sudden damage. Basic seam sealing and minor tear repairs generally fall between $100-$350.

| Repair Type | Material Cost/sq ft | Labor Cost/sq ft |

|---|---|---|

| Patching | $2-$4 | $1-$3 |

| Complete Replacement | $1.50-$3 | $1-$3 |

| Emergency Repair | $3-$6 | $2-$6 |

| Seam Sealing | $1-$2 | $1-$2 |

| Minor Tears | $2-$3 | $1-$2 |

Before filing an insurance claim, verify coverage details and replacement cost provisions, as policies typically exclude normal wear and tear.

Steps to Document Roof Damage For Your Claim

Proper documentation of roof damage serves as a critical foundation for successful insurance claims. A systematic approach to gathering evidence strengthens the claim process while ensuring all damage is accurately captured. Insurance adjusters rely heavily on thorough documentation when evaluating claims.

| Documentation Step | Required Items | Purpose |

|---|---|---|

| Visual Evidence | Photos/Videos | Detail damage extent |

| Written Records | Damage inventory | Map affected areas |

| Emergency Repairs | Receipts/Photos | Show mitigation efforts |

| Maintenance History | Inspection reports | Prove proper upkeep |

| Supporting Data | Weather reports | Verify cause of damage |

Homeowners should prioritize safety during documentation by conducting ground-level assessments and utilizing zoom lenses for elevated areas. Professional contractors can assist with detailed inspections while maintaining proper safety protocols. All photographic evidence should be dated, labeled, and backed up digitally for claim submission.

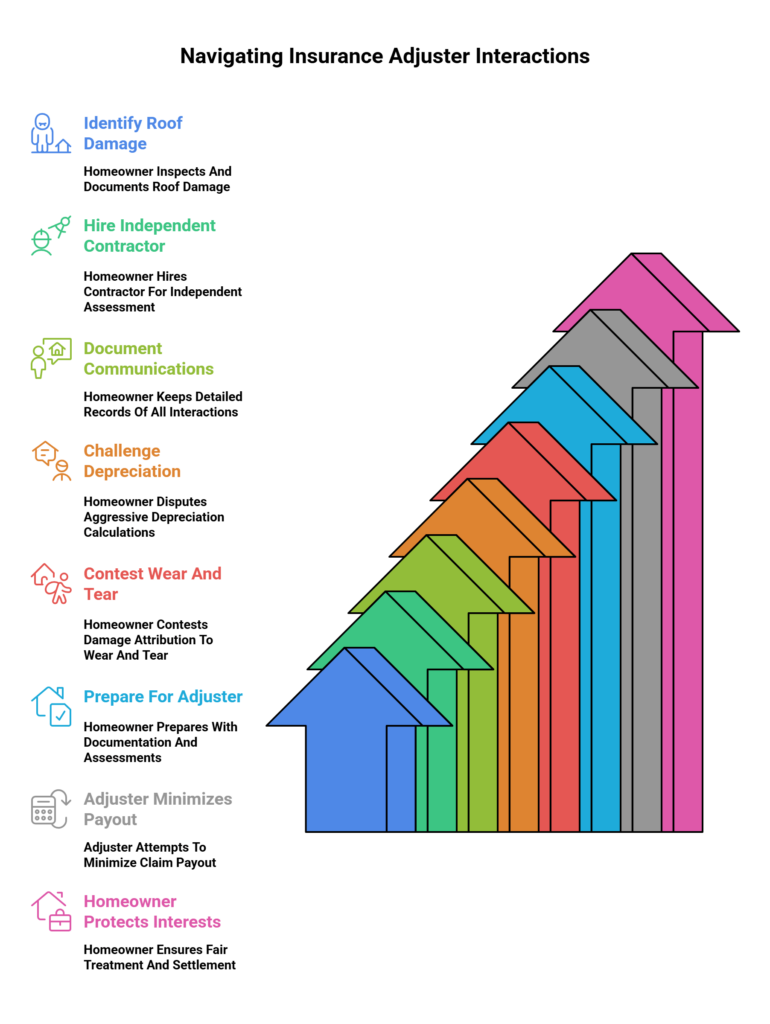

Dealing With Insurance Company Adjusters: No, They Are NOT Your Friend

After gathering thorough documentation of roof damage, homeowners must navigate the complex process of working with insurance adjusters.

Understanding that adjusters work for the insurance company, not the homeowner, is essential for protecting one’s interests during the claims process.

Key strategies when dealing with adjusters:

- Hire an independent contractor to inspect damage before the adjuster arrives

- Document all communications and maintain detailed records of damage

- Challenge aggressive depreciation calculations that reduce actual cash value settlements

- Contest determinations that attribute damage to wear and tear rather than covered events

Insurance adjusters often minimize claim payouts through various methods, including rapid depreciation calculations of 4-7% annually.

Their compensation typically correlates with keeping settlements low, making it essential for homeowners to approach interactions prepared with thorough documentation and professional assessments.

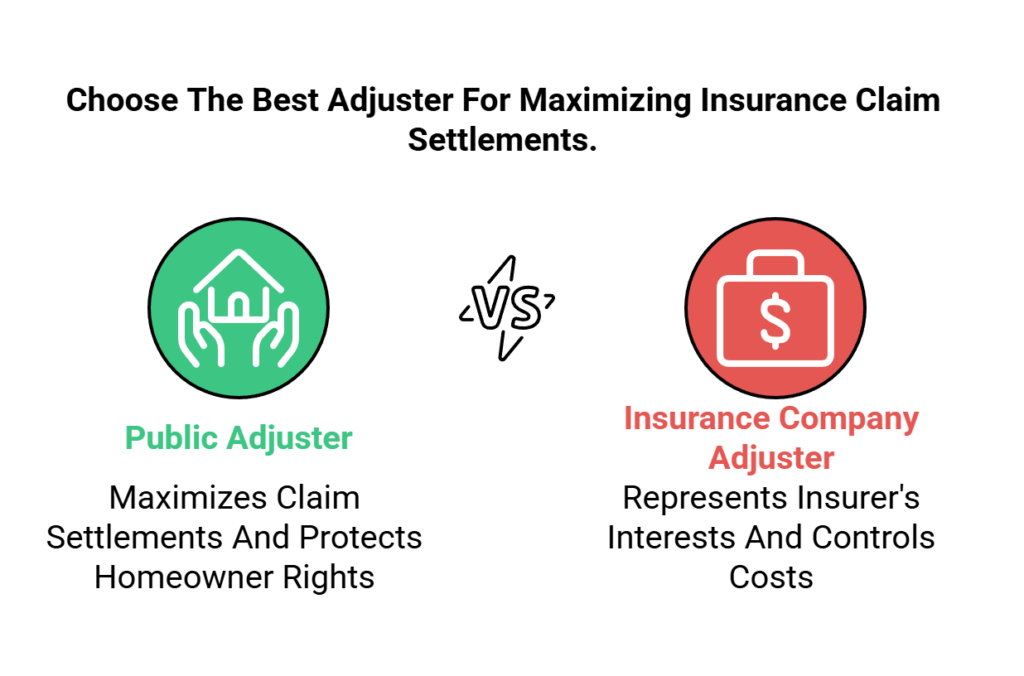

Getting Help From A Public Adjuster: Your Advocate & Ally

Public adjusters serve as licensed advocates who work exclusively for policyholders during roof repair insurance claims, providing expertise in damage assessment, policy interpretation, and settlement negotiations. These professionals typically achieve substantially higher claim settlements compared to unrepresented homeowners, with studies showing increases ranging from 40% to 700% over insurance company adjuster valuations. While insurance company adjusters represent the insurer’s interests, public adjusters protect homeowners’ rights throughout the claims process for a fee based on the final settlement amount.

| Comparison | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Represents | Policyholder | Insurance Company |

| Payment | % of Settlement (5-15%) | Salary from Insurer |

| Objective | Maximum Claim Payout | Control Company Costs |

| Loyalty | Homeowner | Insurance Company |

The Role Of Public Adjusters In Roof Repair Claims

When homeowners face significant roof damage and complex insurance claims, enlisting the services of a licensed public adjuster can substantially improve claim outcomes. These independent professionals specialize in insurance policy review, damage assessment, and claims advocacy, working solely on behalf of policyholders rather than insurance companies.

Public adjusters typically charge 5-15% of the claim settlement amount, but statistics indicate their involvement can increase payouts by 40-750%.

Their expertise in coverage interpretation and documentation helps guarantee all legitimate damages are identified and properly valued. Through detailed policy review and skilled negotiation, public adjusters help navigate complex claim processes, particularly valuable in cases involving multiple types of roof damage or when initial settlements appear insufficient. Their thorough approach to damage assessment and documentation often results in more exhaustive compensation for repairs.

Benefits Of Using A Public Claims Adjuster For Roof Repair Claims

Handling complex roof repair insurance claims becomes substantially more manageable with the assistance of a licensed public claims adjuster. These professionals specialize in maximizing settlement amounts through thorough documentation and expert negotiation with insurance companies, typically increasing payouts by 15-50%.

| Benefit | Impact | Value |

|---|---|---|

| Expertise | Complete damage assessment | Identifies hidden issues |

| Documentation | Proper claim filing | Reduces denials |

| Negotiation | Higher settlements | 15-50% increase |

Public adjusters navigate intricate policy coverage details, building codes, and depreciation calculations while managing all aspects of the claim process. Their specialized knowledge helps identify covered damages that homeowners might overlook, ensuring appropriate valuation of materials and labor costs. Working solely for policyholders, they handle complex paperwork and communications with insurers while charging a percentage of the final settlement.

How Are Public Insurance Adjusters Paid & What Are Their Fees?

The financial arrangement for public insurance adjuster services typically operates on a contingency fee basis, ranging from 10% to 20% of the final settlement amount. This payment structure guarantees alignment between the adjuster’s interests and maximizing the policyholder’s compensation.

| Service Component | Fee Consideration | Impact on Settlement |

|---|---|---|

| Damage Evaluation | Included in % | Thorough documentation |

| Claim Preparation | Part of contingency | Enhanced coverage details |

| Negotiation | Success-based | Higher settlement potential |

Since payment is contingent on claim success, public adjusters are motivated to conduct exhaustive damage evaluations, prepare detailed documentation, and negotiate effectively with insurance companies. This fee structure also means policyholders don’t pay upfront costs, making professional claim assistance accessible when needed most.

Public Adjusters Vs. The Insurance Company Adjuster

Understanding the key differences between public adjusters and insurance company adjusters proves essential for homeowners facing roof damage claims. Public adjusters serve as independent advocates, focusing on payout maximization while handling documentation, claims negotiation, and policy language interpretation. Insurance company adjusters, conversely, represent their employer’s interests during damage assessment and settlement processes.

| Aspect | Public Adjuster | Insurance Co. Adjuster |

|---|---|---|

| Represents | Policyholder | Insurance Company |

| Cost | 5-15% of settlement | No direct cost |

| Objective | Maximize payout | Assess per company guidelines |

While insurance company adjusters provide free evaluations, public adjusters offer independent evaluation services that frequently result in settlements 2-3 times higher than unrepresented claims. Their expertise in coverage terms and thorough documentation often justifies their contingency-based fees for complex roof damage claims.

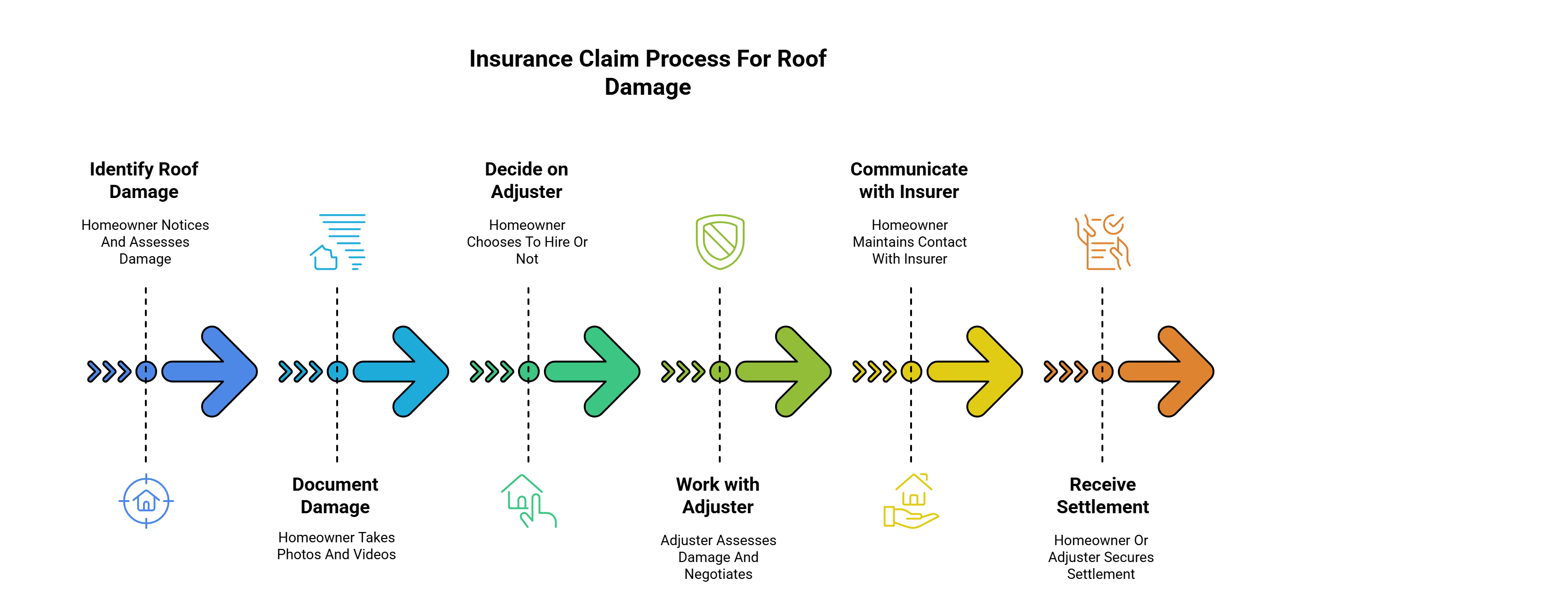

When to Contact Your Insurance Provider For Roof Repairs

Property owners pursuing insurance claims for roof damage can work directly with their provider or enlist the expertise of a public adjuster to navigate the process.

When filing independently, homeowners should promptly document all damage through photos and videos while maintaining clear communication with their insurance provider throughout the claims process.

Public adjusters serve as professional advocates who can thoroughly assess damage, negotiate with insurance companies, and potentially secure more favorable claim settlements, though their services typically require paying a percentage of the final settlement amount.

If Using A Public Adjuster

When insurance claims for roof damage appear undervalued or are denied, homeowners should consider enlisting a licensed public adjuster to advocate on their behalf. These licensed professionals typically help secure 15-40% higher settlement amounts compared to initial offers, making them particularly valuable for complex claims exceeding $10,000.

Public adjusters charge 5-15% of the final settlement amount and provide independent damage assessments separate from insurance company evaluations.

To maintain claim eligibility, homeowners must document all damage through photos and videos before temporary repairs begin. They should also retain receipts for emergency mitigation expenses.

Public adjusters can negotiate directly with insurance companies, but it’s essential to engage them within the policy’s specified timeframe, typically 30-60 days after the incident. Their expertise proves especially beneficial when handling contested claims or complex insurance coverage issues.

If Filing On Your Own

Homeowners should contact their insurance provider immediately after discovering significant roof damage from sudden events like storms, fallen trees, or other covered perils.

Before filing a claim, carefully inspect the roof to document the cause of damage and take detailed photos of affected areas.

Review your homeowners insurance policy to understand the type of coverage—whether replacement cost basis or actual cash value coverage—and verify your insurance deductible amount.

When ready to file your claim, provide the insurance company with thorough documentation, including the date of damage, description of the incident, and visual evidence.

The insurer will evaluate whether it qualifies as a covered claim and determine appropriate compensation based on policy terms.

Remember that wear and tear or maintenance-related issues typically fall outside standard coverage parameters.

Claiming Roof Repairs On Insurance (When Filing On Your Own)

Filing an insurance claim for roof repairs requires methodical documentation and proper procedure to maximize potential coverage.

Property owners must thoroughly photograph and video all damage, contact their insurance provider promptly, and obtain professional assessments to validate repair costs.

The following critical steps help guarantee a successful claims process:

- Document all interior and exterior damage with detailed photos/videos before attempting temporary repairs

- Submit claim through official channels while maintaining records of all insurance company communications

- Schedule professional roofing inspection to generate detailed repair estimates

- Compare contractor estimates and avoid signing contracts until insurance approval

Document Roof Damage Thoroughly

Proper documentation serves as the cornerstone of a successful roof damage insurance claim, requiring a systematic approach to capture and preserve essential evidence. Homeowners should collect thorough photographs and videos from multiple angles, while maintaining detailed records of all damage-related information.

| Documentation Type | Required Elements |

|---|---|

| Visual Evidence | Clear photos, videos of damage from various angles |

| Written Records | Damage inventory, measurements, timeline of events |

| Supporting Documents | Weather reports, inspection findings, repair receipts |

A thorough documentation process includes capturing timestamps of damage occurrence, weather conditions during incidents, and maintaining detailed correspondence with insurance adjusters. Professional inspection findings and contractor estimates should be preserved alongside emergency repair receipts. This systematic approach guarantees all necessary evidence is readily available during the claims process.

Contact Insurance

Once sufficient documentation has been gathered, initiating contact with the insurance provider requires a methodical approach to guarantee maximum claim processing.

Homeowners should review their policy details to understand coverage limits and confirm their deductible amount before filing.

When contacting the insurance company, policyholders need to provide clear details about the damage, including date of occurrence and suspected cause.

Throughout the claims process, maintaining a track record of all communications with the insurance provider is essential. This includes recording claim numbers, representative names, and discussion summaries.

Property owners should verify they understand whether their policy offers replacement cost or actual cash value for repair coverage.

If the damage requires immediate attention, homeowners should document any temporary repairs made to prevent further deterioration while awaiting claim approval.

Deal With Insurance Company Adjuster & Low Ball Assessments

Insurance company adjusters often present initial assessments that undervalue roof damage claims, requiring homeowners to navigate the negotiation process carefully.

Understanding your coverage terms, including whether the policy offers full replacement or actual cash value, is essential before engaging with adjusters.

When addressing wind and hail damage, homeowners should document all damage thoroughly and obtain an independent assessment from a reputable roofing contractor.

If the adjuster determines the roof is in poor condition or offers a low settlement, homeowners can appeal the decision by providing additional documentation and estimates.

Before accepting any settlement to repair or replace the roof, verify that it adequately covers damages minus the deductible. It’s essential to thoroughly assess the conditions of the offer to ensure it meets your specific needs. Additionally, consider the long-term implications of your decision, as proper roof maintenance can significantly influence the overall value of your property. Weighing the roof repair benefits and drawbacks will help you prioritize immediate repairs versus potential long-term costs associated with neglecting necessary improvements.

Homeowners insurance policies typically allow policyholders to dispute assessments through a formal review process if the initial offer seems insufficient.

Get Professional Assessment

Securing a professional roof assessment serves as a vital first step when filing an insurance claim independently. A licensed roofing contractor should conduct a thorough inspection to document all damage through detailed photos and videos. The contractor’s written estimate must include specific measurements, required materials, and itemized labor costs.

The assessment should exhaustive evaluate both visible damage and potential underlying issues.

Documentation from the inspection becomes essential evidence when filing the claim, particularly when comparing the contractor’s findings with the insurance adjuster’s damage evaluation. The professional assessment also provides essential technical details about the scope of repairs needed, helping guarantee accurate estimates and appropriate coverage. This detailed documentation strengthens the claim’s validity and helps prevent potential disputes over repair costs.

Gather Supporting Evidence

Building a strong insurance claim requires complete documentation beyond the professional assessment. Homeowners should gather exhaustive evidence by capturing detailed photos and videos of all damaged areas immediately after the incident. Creating a thorough timeline of events, including weather conditions and immediate remedial actions, strengthens the claim’s validity.

| Documentation Type | Required Elements | Purpose |

|---|---|---|

| Visual Evidence | Photos/Videos | Damage proof |

| Written Records | Timeline/Weather | Event context |

| Professional | Inspections | Expert validation |

| Historical | Maintenance logs | Upkeep evidence |

Maintain detailed records of all insurance communications, including representative names, claim numbers, and discussion summaries. Previous maintenance records and repair receipts demonstrate responsible homeownership and help counter potential negligence claims during the assessment process.

Submit Complete Claims Package

When submitting a complete roof repair insurance claim package, homeowners must systematically organize their documentation to maximize the likelihood of approval. Insurance will cover eligible damages when claims are properly supported with detailed photos, maintenance records, and thorough documentation of all damage.

To guarantee the information is complete, homeowners should include independent contractor estimates, weather data, and a chronological timeline of events.

The submission package must demonstrate that proper maintenance was performed and that damage occurred from a covered peril.

Financial protection depends on thorough documentation showing how the repair costs were determined. Homeowners should maintain copies of all correspondence with insurance representatives and organize materials in a clear, sequential manner that facilitates efficient review and processing of the claim.

Try To Negotiate Claim Settlement Offer

After receiving an initial settlement offer, homeowners should carefully evaluate the proposed amount and prepare to negotiate with their insurance company if the offer appears insufficient.

When negotiating claim settlements for roof damage, documentation of repair costs from multiple contractors can strengthen the homeowner’s position.

Understanding the homeowners policy terms regarding replacement cost versus actual cash value coverage is essential for effective negotiation.

Homeowners should highlight any storm damage evidence that supports their claim and document how the proposed settlement falls short of covering necessary repairs.

If the insurance company’s assessment differs substantially from contractor estimates, requesting a re-inspection may be warranted.

During negotiations, maintain detailed records of all communications and be prepared to demonstrate how the settlement offer, after accounting for the deductible, inadequately addresses the documented roof damage.

Filing Process For Roof Damage Repair Claims (When Using A Public Adjuster)

Public adjusters execute a methodical process to document and file roof damage claims while maximizing insurance coverage benefits.

The process begins with a thorough property inspection that includes detailed photographs, measurements, and professional assessments to establish the full scope of damage.

Licensed public adjusters then handle all communications with insurance carriers, acting as intermediaries throughout these key steps:

- Thorough documentation of roof damage through high-resolution photography, precise measurements, and detailed written reports

- In-depth analysis of insurance policy terms to identify all applicable coverage for roofing systems and related components

- Coordination with roofing contractors, engineers, and other specialists to obtain expert damage assessments

- Strategic presentation of evidence and negotiation with insurance adjusters to secure maximum claim settlements

Public Adjuster Documents Roof Damage Thoroughly

Through exhaustive documentation techniques, a professional public adjuster meticulously records all aspects of roof damage to build a robust insurance claim. The process involves thorough photography, video recording, and precise measurements of affected areas, complemented by specialized inspection methods like core sampling and moisture readings to establish damage extent.

| Documentation Type | Purpose |

|---|---|

| Visual Evidence | Photos and videos of damage |

| Technical Data | Core samples, moisture readings |

| Supporting Records | Weather data, maintenance history |

Public adjusters compile detailed scope-of-damage reports with line-by-line itemization using industry-standard pricing databases. Their thorough assessment encompasses both direct structural damage and consequential effects, such as interior water damage. This complete documentation, including weather data and maintenance records, establishes clear causation and timing relative to policy coverage periods.

Public Adjuster Reviews Policy For Hidden Roofing Coverage & Helps Maximize Policy Benefits

When reviewing insurance policies for roof damage claims, professional public adjusters meticulously analyze coverage terms, endorsements, and exclusions to identify all applicable benefits for policyholders. Through thorough policy review and damage assessment, they consistently uncover 15-50% higher legitimate claim values compared to insurance company adjusters. This detailed approach not only ensures that policyholders receive the compensation they deserve but also empowers them to better understand their rights under the policy. By maximizing your insurance claim, public adjusters help to alleviate the financial burden of repairs and replacements, allowing homeowners to focus on restoring their properties without added stress. Ultimately, their expertise and advocacy play a crucial role in navigating the complexities of insurance claims effectively.

| Process Step | Public Adjuster Actions |

|---|---|

| Initial Review | Analyze policy terms and coverage limits |

| Documentation | Catalog visible and hidden damage evidence |

| Assessment | Evaluate structural impacts and water intrusion |

| Valuation | Calculate full replacement and repair costs |

| Negotiation | Present detailed claim package to insurer |

Public adjusters manage all communications with insurers while coordinating inspections and challenging inadequate settlement offers. Their expertise in claim valuation and policy interpretation helps guarantee policyholders receive maximum benefits for both obvious and consequential roof damages.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Filing a roof damage claim becomes substantially more streamlined when policyholders engage licensed public adjusters to interface with insurance companies.

The claim resolution process typically spans 3-6 months and involves thorough documentation gathering, property inspection, and damage assessment protocols.

Key steps in the public adjuster’s claim handling process include:

- Conducting detailed property inspection and documenting all visible roof damage

- Performing thorough policy review to identify applicable coverage provisions

- Coordinating with contractors to obtain accurate repair estimates

- Managing negotiations with insurance company adjusters

Public adjusters charge 5-15% of the final insurance settlement while handling all aspects of the claim under policy terms. Their expertise helps guarantee maximum coverage benefits through proper documentation and professional negotiations with insurance representatives.

Public Adjuster Gets Professional Assessments

Professional assessments conducted by public adjusters form a critical component of the roof damage claims process, incorporating multiple layers of expert evaluation and documentation.

These specialists execute thorough damage assessments to maximize insurance claims and guarantee accurate settlement amounts.

Key elements of the professional assessment process include:

- Detailed roof inspection with photographic documentation of visible and hidden damage from multiple angles

- Analysis of policy coverage, comparing replacement cost versus actual cash value options

- Evaluation of repair requirements, determining whether partial repairs or complete replacement is necessary

- Thorough review of all findings to establish proper claim value and coordinate with contractors

This systematic approach typically spans 2-6 months but can increase claim payouts substantially, justifying the 5-15% fee charged by public adjusters for their expertise.

Public Adjuster Gathers Supporting Evidence

Every successful roof damage claim requires a thorough body of evidence, which public adjusters systematically collect and organize to support their clients’ cases. The documentation process includes exhaustive inspection reports detailing structural damage, damage patterns, and potential repair costs or full cost of roof replacement.

| Documentation Type | Purpose |

|---|---|

| Weather Reports | Verify extreme weather events |

| Maintenance Records | Establish property upkeep history |

| Contractor Estimates | Validate repair/replacement costs |

Public adjusters strengthen insurance claims by assembling detailed photographic evidence, professional assessments, and local damage comparisons. They document interior water infiltration, exterior deterioration, and surrounding property impacts. This exhaustive approach helps justify claim amounts while addressing potential coverage disputes through expert testimony and technical analysis of all documented structural damage.

Public Adjuster Submits Complete Claims Package

The exhaustive claims package represents a critical milestone in the roof damage claims process, where public adjusters compile and submit extensive documentation to the insurance carrier. Public adjusters meticulously document weather damage and repair costs through photographs, videos, and detailed estimates to justify the cost of roof replacement projects.

| Documentation Type | Purpose | Required Elements |

|---|---|---|

| Proof of Loss | Legal Claim Filing | Signed Forms, Policy Details |

| Damage Evidence | Verify Condition | Photos, Videos, Inspection Reports |

| Cost Analysis | Establish Value | Contractor Estimates, Price Breakdowns |

| Coverage Verification | Confirm Benefits | Policy Terms, Exclusions Review |

| Supporting Data | Validate Cause | Weather Reports, Engineering Studies |

The adjuster negotiates with the insurance company using industry-standard pricing software to guarantee homeowners receive appropriate coverage for their new roof or necessary repairs, meeting all policy requirements and documentation standards.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Following the submission of a complete claims package, public adjusters maintain active management of all subsequent communications and deadlines with insurance carriers.

Their thorough oversight guarantees strict adherence to policy deadlines while maximizing claim settlements.

Key responsibilities of public adjusters during the follow-up phase include:

- Managing all documentation requests and supplemental claims submissions from insurance companies

- Coordinating and scheduling required inspections between contractors and insurance representatives

- Submitting proof of loss documentation within mandatory policy timeframes

- Conducting settlement negotiations to secure maximum compensation for covered damages

This systematic approach eliminates the burden on homeowners while safeguarding compliance with insurance requirements.

Public adjusters leverage their expertise to navigate complex claim filing procedures, maintain precise documentation, and meet all established deadlines throughout the claims process.

Public Adjuster Enforces Policyholder’s Rights, & Negotiates Higher & More Fair Settlement

Licensed public adjusters serve as powerful advocates during roof damage claims by enforcing policyholder rights and negotiating substantially higher settlements through systematic documentation and skilled representation.

A thorough policy review helps you understand coverage for extreme weather damage and guarantees your roof is covered properly.

Public adjusters typically help save money by securing settlements 40-700% larger than self-filed claims.

Key steps in maximizing roof repair costs include:

- Exhaustive inspection to document all damage from new roofing needs

- Detailed assessment of related structural and interior damages

- Strategic negotiation with insurance carriers to cover roof repair fully

- Persistent follow-up to make sure the roofing project settlement is fair

Their expertise helps identify commonly overlooked damages while managing the entire claims process for maximum results.

Public Adjuster Speeds Up Claim Settlement Time

Working with a public adjuster substantially accelerates the roof damage claims process through systematic documentation and efficient management of insurance procedures.

Professional adjusters streamline settlement times by implementing a structured approach that includes:

- Conducting thorough damage assessment and detailed property inspection

- Gathering complete documentation and evidence of roof damage for valuation

- Managing all paperwork and insurance company communications

- Executing skilled negotiation strategies to maximize claim approval

This systematic process typically reduces settlement timeframes by 30-50% compared to self-filed claims, while simultaneously increasing settlement amounts by 15-50%.

Public adjusters handle all aspects of the claims process, from initial consultation through final resolution, allowing homeowners to focus on other priorities while ensuring their insurance claim receives thorough professional attention.

Choosing & Working With Trusted Roofing Contractors

When selecting a roofing contractor for repairs or replacement, homeowners must conduct thorough due diligence to guarantee quality workmanship and protect their investment. Licensed contractors should provide complete documentation including insurance coverage, references, and contractor credentials. Multiple written estimates enable cost comparison while detailed contracts specify material specifications, warranty terms, and payment schedule.

| Requirements | Documentation | Verification |

|---|---|---|

| License | Insurance proof | State registry |

| References | Past projects | Client contact |

| Estimates | Scope of work | Cost breakdown |

| Permits | Building codes | Inspection reports |

Professional contractors perform thorough pre-work inspections, obtain necessary building permits, and provide detailed inspection reports. Homeowners should avoid contractors who employ high-pressure sales tactics or fail to provide complete documentation. Post-completion documentation should include warranty information and maintenance guidelines.

Getting Professional Roofing Estimates

Professional roofing estimates require contractors to provide valid licensing documentation, proof of insurance, and detailed project specifications before work begins. Industry experts recommend obtaining 3-5 written bids from different contractors to effectively compare costs, timelines, and material specifications. Each estimate should include an itemized breakdown detailing labor costs, materials, removal fees, and potential structural repairs needed.

| Estimate Component | Required Details | Documentation |

|---|---|---|

| Contractor Info | License Number, Insurance | Copy of License, Insurance Certificate |

| Project Scope | Square Footage, Materials | Written Specifications, Measurements |

| Cost Breakdown | Labor, Materials, Disposal | Itemized List with Line-Item Pricing |

Licensed Roofer Documentation Requirements

Responsible homeowners should obtain detailed written estimates from licensed roofing contractors before proceeding with any repair work. Insurance coverage often requires licensed documentation to process claims, particularly for repair costs resulting from extreme weather damage. For both full new roof replacements and repairs to older roofs, contractors must provide information accurate to current building codes.

| Required Documentation | Purpose | Validity Period |

|---|---|---|

| Contractor License | Legal compliance | 1-2 years |

| Insurance Certificate | Liability coverage | Annual |

| Warranty Documents | Protection guarantee | 10-25 years |

When the team receives proper documentation, homeowners can proceed confidently with repairs while maintaining compliance with insurance requirements. This documentation also helps establish a wide range of protection against potential issues during and after the repair process.

Get Multiple Bids For Cost Comparison

Obtaining at least three competitive bids from licensed roofing contractors allows homeowners to evaluate market-appropriate costs and service offerings. Each estimate should detail material specifications, labor costs, and project timelines. When comparing bids, homeowners should factor in insurance coverage, deductible requirements, and potential long-term savings from quality workmanship.

| Bid Component | What to Compare |

|---|---|

| Materials | Quality and warranty terms |

| Labor | Experience and timeframe |

| Insurance | Coverage verification |

| Documentation | Licenses and permits |

Detailed quotes enable accurate comparison of repair options while guaranteeing contractors meet necessary qualifications. Homeowners should document visible damage and maintain records of all estimates for insurance purposes. Understanding the scope of repairs and associated costs helps prevent unexpected expenses and confirms appropriate coverage for identified damage.

Make Sure To Get A Detailed Breakdown Of All Estimate Costs

When evaluating roofing estimates, homeowners should insist on a detailed breakdown of all projected costs, including line-item details for materials, labor, equipment, permits, and disposal fees. This complete breakdown enables accurate comparison between contractors and helps verify insurance coverage requirements. A thorough estimate should clearly distinguish between repair and replacement costs while documenting existing damage.

| Cost Category | Typical Range | Insurance Coverage |

|---|---|---|

| Materials | $150-$800 | Yes, post-deductible |

| Labor | $45-$75/hour | Yes, if covered damage |

| Equipment | $100-$300 | Included in total |

| Permits/Fees | $100-$500 | Varies by policy |

Professional estimates should also include timeline projections, warranty information, and maintenance recommendations. This documentation proves essential when filing insurance claims or planning future repairs.

Preventing Future Roof Damage

Taking proactive steps to prevent roof damage can substantially extend the lifespan of roofing materials while minimizing costly repairs. Regular professional inspection every 2-3 years enables early detection of potential issues, while proper maintenance of ventilation and insulation prevents moisture-related problems. Managing environmental factors through routine gutter cleaning and tree branch trimming helps maintain structural integrity.

| Preventive Action | Recommended Frequency |

|---|---|

| Professional Inspection | Every 2-3 years |

| Gutter Cleaning | Twice annually |

| Tree Branch Trimming | As needed, maintain 6-10 ft clearance |

The installation of weather-appropriate, impact-resistant materials provides additional protection against storm damage. Ensuring proper drainage through clean gutters and downspouts prevents water accumulation that could compromise the roof structure. These preventive measures, combined with regular debris removal, create a complete approach to roof protection.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) operates as a nationwide alliance of state-licensed public adjusters who undergo rigorous vetting and verification processes. This network specializes in both residential claims and commercial claims, with member adjusters qualified to handle over 30 different claim types across 40+ states.

PCAN serves as a critical resource for policyholders seeking expert assistance with property damage insurance claims. Member adjusters must complete an intensive application and interview process to demonstrate their claim expertise.

The organization maintains strict professional standards through mandatory annual audits of licenses and complaint records. These licensed adjusters are selected based on their proven track record in successfully managing insurance claims, ensuring policyholders receive representation from highly qualified professionals in the field.

Frequently Asked Questions

Will Homeowners Insurance Pay for Roof Repair?

Homeowners insurance covers sudden, accidental roof damage from storms or fallen objects, but excludes normal wear and tear. Coverage depends on policy type, roof age, and meeting applicable deductibles. Homeowners should regularly inspect their roofs to identify any potential issues before they worsen, as many policies may not cover pre-existing conditions. If you find yourself needing to file a claim, it’s essential to document the damage thoroughly and understand the specifics of your policy. Homeowners can also explore various damaged roof insurance options to supplement their coverage and ensure they are fully protected against unexpected repairs.

What Is the 80% Rule in Homeowners Insurance?

“Better safe than sorry” rings true with the 80% rule, which requires homeowners to insure their property for at least 80% of its replacement value to receive full coverage for partial losses.

What Type of Roof Is the Cheapest to Insure?

Asphalt shingle roofs, particularly basic three-tab variants, represent the most cost-effective option for insurance coverage, typically commanding the lowest premiums due to their widespread availability and economical replacement costs.

Is It Worth Claiming Roof Damage on Insurance?

Minor damage warrants out-of-pocket repairs, while catastrophic incidents justify claims. Filing becomes cost-effective when repair expenses substantially exceed the deductible and potential premium increases won’t outweigh the insurance benefit.