Is your roof taking direct hits from Mother Nature’s light show? Let’s talk about how lightning can zap your home’s first line of defense. Think of your roof as a shield that sometimes has to face Zeus’s wrath head-on!

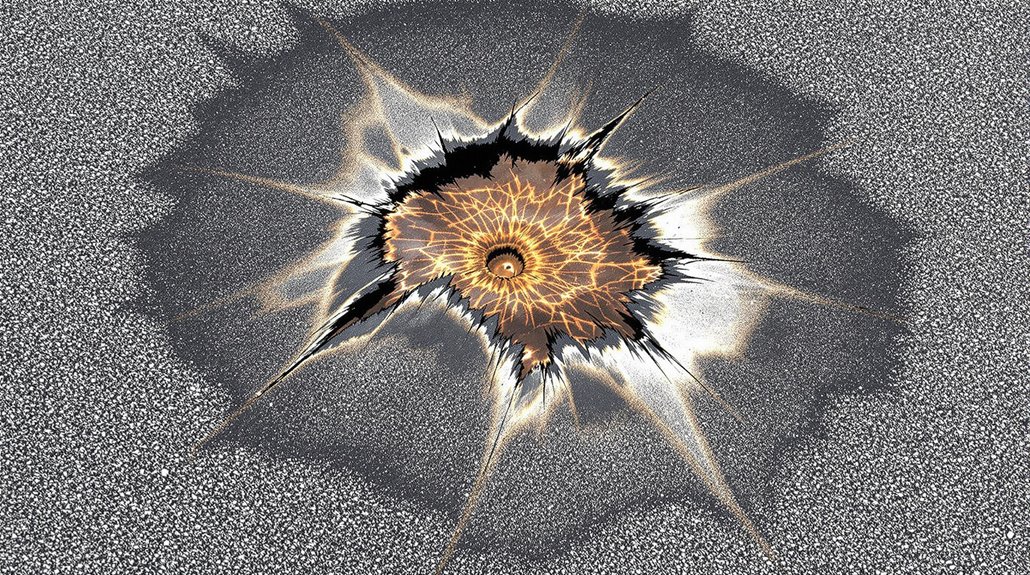

When lightning strikes, it leaves quite a calling card. You might spot angry black scorch marks where shingles once peacefully lived, or discover sneaky hidden damage that creeps through your roof’s layers. Just like a detective, you’ll want to look for telltale signs: crispy, charred shingles, mysterious cracks in your roof deck, and even melted metal components that look like they’ve been through a blowtorch party.

The financial thunderbolt? Repairs can strike your wallet anywhere from $500 for quick fixes to $15,000 if you’re looking at a full roof replacement. But here’s the silver lining – your homeowner’s insurance typically has your back when it comes to lightning damage. Just remember to document everything like you’re building a case file!

Want to weather the storm like a pro? Keep an eye out for those subtle hints your roof might be giving you after a lightning strike. A quick inspection could save you from bigger headaches down the road. After all, wouldn’t you rather catch a small problem before it turns into a full-blown roofing emergency?

Key Takeaways

Is Your Roof Under Attack? Understanding Lightning Damage 101

When lightning strikes your home, it’s like nature’s own electrical drama unfolding above your head. Let’s break down what you need to know about this powerful force:

Think of lightning damage as having four personalities:

- The Direct Hit: Think of it as a cosmic punch straight to your roof

- The Sneaky Ground Surge: Electricity traveling through the ground to your home

- The Heat Wave: Burns and melts materials like a blowtorch

- The Chain Reaction: When one problem triggers another (like damaged wiring)

How do you know your roof’s been zapped? Look for these telltale signs:

✓ Shingles that look like they’ve been through a barbecue

✓ Spider-web cracks in your roof’s structure

✓ Melted metal components (like vents or gutters)

✓ Peeling or bubbling surface materials

✓ Scattered roof debris around your yard

Your wallet might feel the shock too. Small fixes might set you back $200-$3,000, while a complete roof overhaul could strike your savings for $15,000+. The good news? Your home insurance likely has your back, but you’ll need to play detective – snap photos and get a pro’s assessment.

Want to stay one step ahead of Mother Nature? Install surge protectors, schedule regular roof check-ups, and ensure your home’s grounding system is up to par. Think of it as giving your house a lightning-proof shield!

Remember: Prevention is way cheaper than repairs, and your roof deserves all the protection it can get against nature’s light show.

Common Types Of Lightning Damage To Roofs

Several distinct types of lightning damage can affect residential and commercial roofs when strikes occur. Direct strikes often result in visible damage including charred materials, holes, and structural damage that compromises roof integrity. Metal elements like flashing and vents are particularly vulnerable due to their conductivity. Documentation of these damages is vital for insurance claims.

| Damage Type | Impact Level | Insurance Coverage |

|---|---|---|

| Direct Strike | Severe | Full Coverage |

| Ground Surge | Moderate | Variable Coverage |

| Thermal Damage | High | Standard Coverage |

| Secondary Effects | Low-Moderate | Case-by-Case |

The repair costs associated with lightning-induced roof damage vary greatly based on severity and materials affected. Homeowners insurance policies typically cover lightning strikes, but proper documentation of visible damage is essential for successful claims processing. Early detection through regular inspections can help minimize long-term structural damage and associated expenses.

What Does Lightning Damage Look Like On A Roof?

Lightning damage on residential and commercial roofs presents distinct visual indicators that property owners should recognize. Professional inspection reveals characteristic signs that affect insurance coverage and repair costs. A thorough examination of the roof surface can identify multiple forms of damage that should be documented for home insurance policy claims. Public adjusters can increase damage claim settlements by up to 800% through expert assessment and documentation.

| Damage Type | Visual Indicators | Impact Areas |

|---|---|---|

| Thermal | Visible charring | Shingles |

| Structural | Cracks or holes | Decking |

| Material | Melted components | Flashing and gutters |

| Physical | Damaged shingles | Surface layer |

| Secondary | Residual debris | Surrounding area |

The presence of these indicators warrants immediate professional assessment to prevent further deterioration and guarantee proper documentation for insurance purposes. Swift identification of lightning damage enables timely repairs and appropriate claim submissions. Using thermal imaging technology, professionals can detect hidden moisture damage and structural issues that may not be visible to the naked eye.

Does Homeowners Insurance Cover Lightning Damage Roofing Claims?

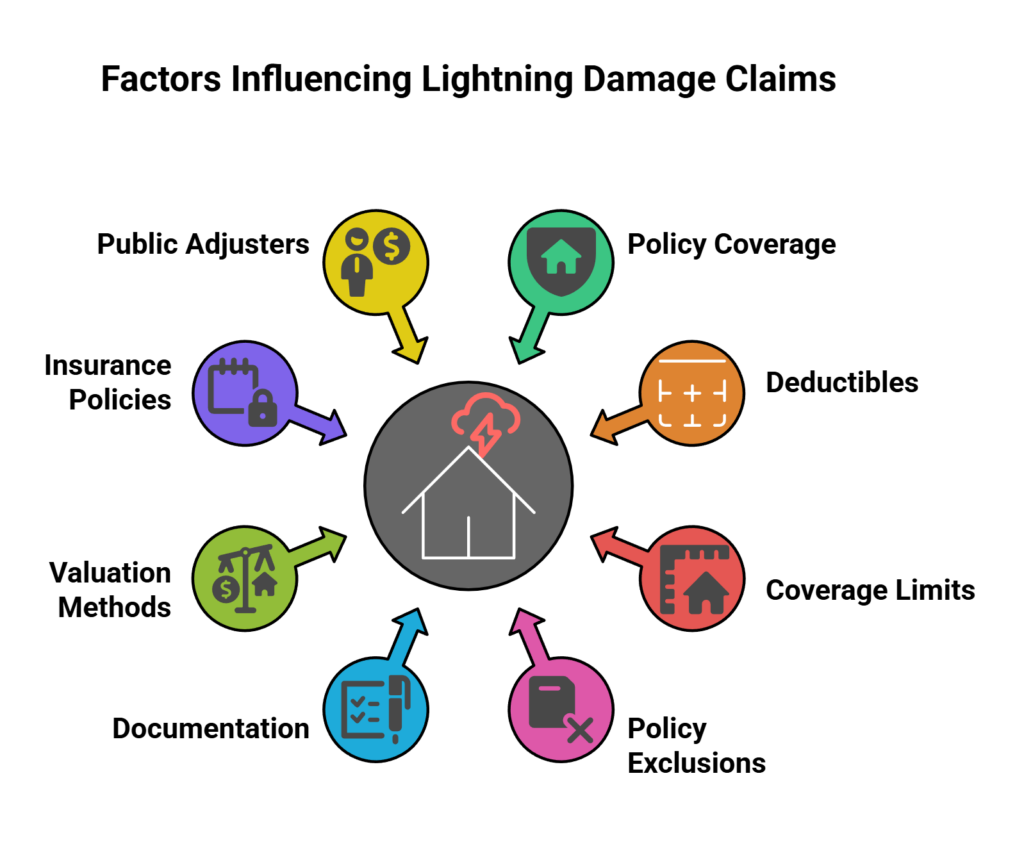

Homeowners insurance policies typically provide coverage for lightning-induced roof damage through both dwelling and personal property protection components.

Insurance providers evaluate lightning damage claims based on factors including policy deductibles, coverage limits, and specific exclusions outlined in the policy terms. Thorough documentation of all damage is essential for maximizing claim approval chances.

Understanding the distinction between actual cash value versus replacement cost coverage proves critical when filing lightning damage claims, as these valuation methods directly impact the final settlement amount.

- Standard homeowners policies cover direct lightning strikes causing fire, structural damage, and electrical system failures.

- Named peril policies explicitly list lightning as a covered event, while all-risk policies cover lightning damage unless specifically excluded.

- Most insurers require documented proof of lightning damage through photos, inspector reports, or weather data before processing claims.

Working with a public adjuster can increase lightning damage claim settlements by up to 574% compared to self-filing claims.

Insurance Deductibles, Coverage Limits, & Exclusions For Lightning Damage Roofing Claims

When lightning strikes cause roof damage, standard homeowners insurance policies typically provide coverage under their dwelling protection provisions. Understanding deductibles, coverage limits, and exclusions is important for managing claims effectively. Policy limits determine maximum compensation, while deductibles represent out-of-pocket expenses before coverage applies. Reviewing your policy for liability coverage limits is essential since lightning damage could affect other properties.

| Insurance Component | Key Considerations | Impact on Claims |

|---|---|---|

| Deductibles | Policy-specific amounts | Initial out-of-pocket cost |

| Coverage Limits | Overall policy maximum | Total available compensation |

| Documentation | Damage evidence required | Affects claim approval |

| Exclusions | Pre-existing conditions | May void coverage |

| Maintenance | Regular upkeep needed | Influences eligibility |

Insurance providers may deny claims if damage results from neglect or poor maintenance. Thorough documentation of structural damage and prompt reporting are essential for successful claims processing. Homeowners should review their policies carefully to understand specific coverage parameters and requirements. Working with public insurance adjusters can increase settlement amounts by 20-50% compared to filing claims independently.

Actual Cash Value Vs. Replacement Cost In Relation To Lightning Damaged Roofing

Understanding the distinction between Actual Cash Value (ACV) and Replacement Cost Value (RCV) coverage proves critical for insurance claims involving lightning-damaged roofs. Homeowners insurance policies offer these two primary types of reimbursement for roof repairs, each considerably impacting claim settlements.

| Coverage Type | Key Aspects |

|---|---|

| ACV | Factors in depreciation |

| RCV | Full replacement cost |

| ACV | Lower payouts for aging roofs |

| RCV | Higher claim settlements |

| Both | Require evidence of damage |

When filing claims for lightning damage, policyholders with ACV coverage receive reimbursement based on their roof’s depreciated value. In contrast, RCV coverage provides compensation for the complete cost of replacing the damaged roof without considering depreciation. Professional adjusters can increase settlements by up to 700% compared to independent claims. Understanding these coverage options enables homeowners to make informed decisions about their insurance policies and anticipate potential reimbursement amounts during claims. Public adjusters help homeowners navigate complex claims and review potentially underpaid settlements.

Named Vs. Hidden Perils Related To Lightning Damage Roofing Claims

Insurance policies distinguish between named and hidden perils in lightning damage claims, with direct strikes typically classified as named perils that receive straightforward coverage approval. Hidden perils, such as ground surges or secondary effects, require more detailed documentation for successful roofing claims. Impact-resistant materials can qualify homeowners for discounts between 5-35% on their insurance premiums.

| Peril Type | Documentation Needed | Coverage Likelihood |

|---|---|---|

| Direct Strike | Photographic Evidence | High |

| Structural Damage | Expert Assessment | High |

| Ground Surge | Technical Analysis | Moderate |

| Secondary Effects | Detailed Documentation | Moderate |

| Indirect Damage | Thorough Report | Variable |

Claims adjusters evaluate both visible and concealed lightning damage when processing insurance claims. While named perils enjoy clear coverage parameters, hidden perils demand extensive investigation and substantiation. Homeowners must understand their policy’s exclusions and limitations regarding both types of perils to guarantee adequate protection against lightning-related roof damage. Working with public insurance adjusters can increase settlement amounts by 20-50% through their professional systematic evaluation of both named and hidden perils.

Solar Panel Lightning Damage: Types Of Damage, Repair Costs, & Home Insurance Coverage

Lightning strikes pose significant risks to rooftop solar panel systems, potentially causing physical damage to panels, electrical component failures, and system-wide performance issues. The repair costs for lightning-damaged solar installations typically range from minor component replacements to complete system overhauls, with most standard homeowners insurance policies providing coverage for such damage. Modern solar panel systems incorporate various protective features, including surge protection devices and grounding systems, though complete lightning resistance remains challenging. Professional documentation with public adjusters increase settlements by up to 700% when filing insurance claims for lightning-damaged solar panels. Standard processing time takes between 14-30 days for most roof-related insurance claims.

| Damage Type | Common Issues | Typical Repair Costs |

|---|---|---|

| Physical | Shattered glass, burn marks | $500-2,000 per panel |

| Electrical | Inverter failure, wiring damage | $1,000-4,000 |

| System | Performance degradation, monitoring issues | $2,000-5,000 |

| Component | Micro-inverters, optimizers | $200-800 per unit |

Types Of Solar Panel Damages Caused By Lightnings

When severe weather strikes, solar panels can sustain various types of lightning-related damage that range from minor surface issues to catastrophic system failure. Direct strikes can result in shattered glass and melted components, while indirect strikes often cause power surges affecting inverters and electrical systems. Regular maintenance helps identify vulnerabilities, while proper grounding systems provide essential protection against electrical surges. Studies show that utilizing public insurance adjusters can increase claim settlements by up to 574% for solar panel damage claims. Early consultation with licensed professionals during the claims process ensures proper documentation and maximum settlement potential.

| Damage Type | Impact Level | Insurance Coverage |

|---|---|---|

| Direct Strike | Severe | Covered |

| Power Surge | Moderate | Covered |

| Glass Damage | High | Covered |

| Component Failure | Variable | Covered with Documentation |

Homeowners insurance typically covers both direct and indirect lightning damage to solar panels, provided proper documentation is maintained and claims are filed promptly. Repair costs vary greatly based on damage severity, ranging from $1,000 to $5,000 for component replacements.

How Much Does It Cost To Repair Or Replace Lightning Damaged Solar Panels?

Determining the exact cost of repairing or replacing lightning-damaged solar panels depends on multiple variables, including the severity of damage and specific components affected. Direct lightning strikes can necessitate complete panel replacement, while indirect damage may only require component repairs.

| Damage Type | Cost Range |

|---|---|

| Single Panel Replacement | $500-$3,000 |

| Inverter Repair/Replace | $1,000+ |

| Surge Protector Installation | $200-$500 |

| Electrical System Repairs | $300-$800 |

Homeowners insurance typically covers lightning damage to solar panels under dwelling coverage, but documentation is essential for successful claims. Coverage A protection specifically includes solar panels as part of the home’s structural components. Property owners should photograph damage and retain repair receipts. Installing preventative measures like surge protectors can reduce future repair costs and protect the solar panel investment from lightning-related damage. Regular professional inspections reduce premiums and help ensure comprehensive coverage for lightning-related incidents.

Does Home Insurance Cover Lightning Damage To Solar Panels?

Most homeowners insurance policies provide coverage for lightning-related damage to solar panel systems under standard dwelling protection. Insurance policy covers typically extend to both physical and electrical damage caused by lightning strikes. To guarantee proper coverage, homeowners must verify their solar installation is listed under dwelling coverage and maintain thorough documentation. Working with public insurance adjusters can help maximize claim settlements for solar panel damage by 30-50%. Actual cash value payments factor in depreciation when determining claim amounts.

| Coverage Aspect | Insurance Requirements |

|---|---|

| Physical Damage | Document condition with photos |

| Electrical Damage | Maintain system records |

| System Components | List specific installations |

When homeowners need to file an insurance claim for roof-mounted solar panels, proper documentation becomes vital. Insurance policies may cover repair costs ranging from minor electrical issues to complete system replacement. Homeowners should review their policy details carefully and ascertain their solar investment is adequately protected against lightning-related incidents.

Can Solar Panels Withstand Lightnings?

Solar panels incorporate protective design features to withstand various weather conditions, including lightning strikes. However, both direct and indirect lightning damage can affect solar energy systems, requiring thorough protection measures and insurance coverage.

Key types of lightning-related solar panel damage include:

- Direct strikes causing physical cracks or fractures in panels

- Electrical surge damage to inverters and system components

- Secondary damage to grounding systems and wiring

While repair costs typically range from hundreds to thousands of dollars, most homeowners insurance policies cover lightning damage to solar panels. Professional contractors can increase insurance claim settlements by up to 747% compared to independently filed claims.

Installing surge protection devices and proper grounding systems helps mitigate potential damage. Property owners should verify their insurance policy details to confirm adequate coverage for both direct physical damage and electrical system repairs.

Working with a public adjuster service can help maximize insurance settlements for lightning-related solar panel claims through expert damage assessment and negotiation.

Are There Lightning Resistant Solar Panels?

While completely lightning-proof solar panels do not exist, manufacturers have developed advanced lightning-resistant models that incorporate sophisticated protection features.

These systems include integrated grounding mechanisms and protective enclosures designed to minimize damage due to lightning strikes.

Key features of lightning-resistant solar panels include:

- Advanced grounding systems that redirect electrical surges

- Reinforced protective enclosures for critical components

- Enhanced electrical isolation to prevent system-wide damage

Homeowners insurance typically covers lightning damage to solar installations, though specific insurance policies cover varying degrees of damaged property.

Repair costs for damaged panels can range considerably, depending on the extent of damage.

Installing a thorough lightning protection system is recommended to safeguard the investment.

Regular inspections help guarantee the continued effectiveness of these protective measures and early detection of potential issues.

Repair Vs. Replacement For Lightning Damaged Roofing

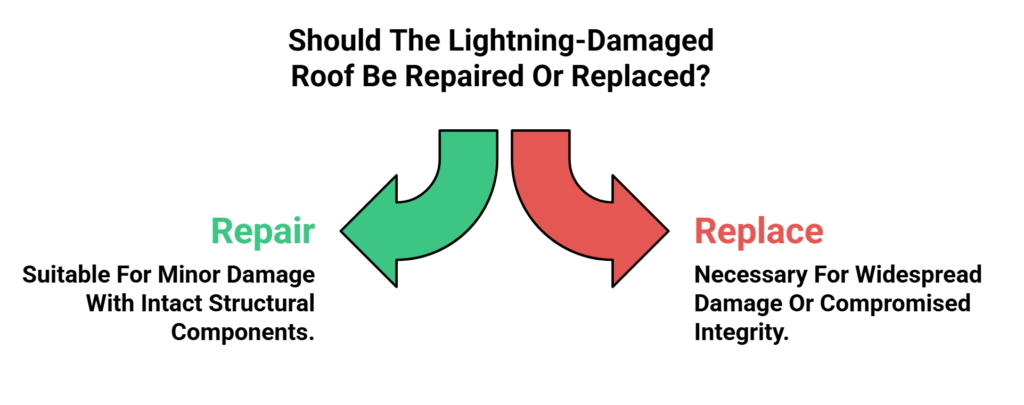

The decision between repairing or replacing a lightning-damaged roof depends on specific factors including damage severity, material integrity, and cost-effectiveness.

Professional assessment by certified roofing contractors enables property owners to determine the most appropriate course of action based on documented lightning strike effects.

Insurance coverage considerations and long-term structural implications also influence the repair versus replacement determination.

- Minor damage confined to a small area with intact structural components typically warrants repair.

- Multiple points of impact or widespread damage across roofing sections often necessitates replacement.

- Evidence of electrical system damage or compromised structural integrity requires full replacement.

When To Choose Roof Repair For A Lightning Damaged Roof

Deciding between repair and replacement for a lightning-damaged roof requires careful evaluation of multiple factors, including damage extent, structural integrity, and cost implications. Repair becomes a viable option when the lightning damage is localized and the overall roof structure remains sound.

| Repair Considerations | Assessment Criteria | Action Required |

|---|---|---|

| Damage Extent | Limited to few shingles | Document damage |

| Structural Impact | No internal damage | Inspect thoroughly |

| Cost Factor | Under 50% of roof value | Compare estimates |

| Insurance Coverage | Within policy limits | Review details |

Homeowners should document all visible damage with photographs and detailed notes for insurance purposes. When repair expenses remain below 50% of the roof’s value and structural integrity is maintained, choosing repair over replacement proves cost-effective while ensuring proper restoration of the affected areas.

When To Choose Roof Replacement For A Lightning Damaged Roof

Severe lightning strikes that compromise a roof’s structural integrity often necessitate complete replacement rather than localized repairs. When lightning damage results in extensive charring, structural cracks, or multiple compromised areas, homeowners insurance typically covers the cost of a full roof replacement. Insurance companies will send adjusters to evaluate the damage and determine appropriate compensation.

| Factors | Repair Indication | Replacement Indication |

|---|---|---|

| Damage Extent | Limited area | Multiple sections |

| Structural Impact | Surface only | Deep penetration |

| Cost Analysis | Below 30% of roof value | Exceeds 30% of roof value |

| Age of Roof | Newer roof | Aging roof |

| Safety Concerns | Minimal risk | Significant hazard |

Signs that a roof may need replacement include visible sagging, widespread shingle damage, and compromised decking. Consulting with a professional roofing contractor helps determine whether repair estimates justify full replacement when damaged by lightning.

Lightning Damaged Shingle Roof: Damage Signs & Repair Costs

Lightning damage to shingle roofs presents distinctive patterns that differ from typical blistering, with charred marks and melted material being key identifiers. The repair costs vary considerably based on shingle type, with architectural shingles typically incurring higher replacement expenses than standard 3-tab varieties. Insurance claims for lightning-damaged shingles require thorough documentation of both direct strike damage and secondary effects such as electrical system impacts.

| Shingle Type | Damage Signs | Average Repair Cost |

|---|---|---|

| Asphalt | Charred spots, melted granules | $300-$500 |

| Architectural | Split layers, thermal cracking | $500-$800 |

| 3-Tab | Surface burns, warped edges | $350-$600 |

| Performance | Delamination, scorch marks | $600-$900 |

| Impact-Resistant | Puncture holes, heat stress | $700-$1,000 |

Lightning Damage VS. Shingle Blistering

When examining a damaged roof, distinguishing between lightning strikes and shingle blistering requires careful attention to specific visual indicators. Lightning damage typically presents as char marks, melted areas, or distinct holes, while blistering manifests as raised bubbles without burn evidence. Insurance coverage and repair approaches differ markedly between these conditions.

| Characteristic | Lightning Damage | Shingle Blistering |

|---|---|---|

| Visual Signs | Char marks, holes | Raised bubbles |

| Cause | Direct strikes | Heat/moisture |

| Insurance | Usually covered | May be excluded |

| Repair Scope | Often extensive | Limited patches |

| Documentation | Photos required | Age assessment |

Professional assessment and thorough documentation through photographs are essential for insurance claims, particularly with lightning damage, as repair costs can vary greatly based on damage extent. Homeowners should note that while lightning strikes typically qualify for coverage, blistering may be considered normal wear.

Costs For Lightning Damaged Asphalt Shingles

Determining repair costs for lightning-damaged asphalt shingles requires careful assessment of both visible and hidden damage patterns. Professional roofers examine not only surface-level signs of damage but also evaluate the underlying roof structure for potential issues. Repair costs typically range from $200 to $1,500, varying based on damage extent and roof size.

| Damage Aspect | Cost Implications |

|---|---|

| Surface Damage | $200-$500 |

| Structural Impact | $500-$800 |

| Material Replacement | $300-$600 |

| Labor Costs | $200-$400 |

| Insurance Deductible | Variable |

Most homeowners insurance policies cover lightning damage to asphalt shingles, but proper documentation is essential for successful claims. Property owners should photograph all signs of damage and obtain a detailed assessment from a professional roofer before filing insurance claims.

Costs For Lightning Damaged Architectural Shingles

Architectural shingles present unique challenges when affected by lightning strikes, with repair costs typically exceeding those of standard asphalt shingles. Professional inspections are essential to assess the full extent of lightning damage and determine whether partial repairs or complete roof replacement is necessary. Insurance claims for architectural shingles typically require thorough documentation of visible damage, including char marks and warping.

| Damage Level | Cost Range | Insurance Coverage |

|---|---|---|

| Minor | $500-$800 | Typically Covered |

| Moderate | $800-$1,500 | Covered with Documentation |

| Severe | $1,500-$2,000 | Full Coverage |

| Complete | $2,000-$2,500 | Replacement Coverage |

Homeowners should promptly contact their insurance provider after a lightning strike, ensuring all covered perils are properly documented to facilitate the cost of repairs.

Costs For Lightning Damaged 3-Tab Shingles

Most incidents of lightning damage to 3-tab shingles require immediate professional assessment and repairs ranging from $200 to $1,500. When lightning strikes occur, homeowners should document visible damage and contact their insurance company promptly, as most homeowners insurance policies cover roof repairs. Professional roofing contractors can identify underlying issues that may not be immediately apparent.

| Damage Type | Signs of Damage | Required Action |

|---|---|---|

| Surface Burns | Charred areas, discoloration | Immediate inspection |

| Heat Damage | Warped or melted shingles | Document and report |

| Impact Damage | Missing or loose shingles | Contact insurance |

| Structural Issues | Cracked or split materials | Professional repair |

The severity of lightning damage to 3-tab shingles can vary markedly, making thorough assessment essential for determining accurate repair costs and necessary restoration steps.

Costs For Lightning Damaged Performance Shingles

Performance shingles struck by lightning require professional assessment and typically incur repair costs ranging from $300 to $1,500, with full roof replacements potentially reaching $15,000. Homeowners insurance generally covers lightning strikes to performance shingles, but proper documentation of visible signs and photographic evidence is essential for successful claims processing. To ensure that homeowners are fully prepared for such incidents, it’s advisable to familiarize themselves with the shingle roof repair costs breakdown. This includes not only the initial assessment fees but also potential costs associated with materials and labor for repairs or replacements. Additionally, homeowners should maintain regular inspections and maintenance of their roofs to mitigate the risks of damage from severe weather events, which can lead to costly repairs in the future.

| Damage Type | Repair Cost | Insurance Coverage |

|---|---|---|

| Minor Burns | $300-$500 | Yes, post-deductible |

| Partial Damage | $500-$1,000 | Yes, post-deductible |

| Structural Cracks | $1,000-$1,500 | Yes, post-deductible |

| Section Replacement | $2,500-$7,000 | Yes, post-deductible |

| Total Replacement | $7,000-$15,000 | Yes, post-deductible |

The severity of roof damage determines repair costs, with factors including affected area size, material type, and local labor rates influencing final expenses. In many cases, homeowners face the dilemma of whether to pursue a roof replacement or repair. Understanding the nuances of roof replacement vs repair explained is crucial, as it can significantly impact both short-term budget and long-term investment. Additionally, timely repairs can prevent further damage and potentially extend the life of your roof, making it essential to assess the situation promptly and consult with a professional.

Costs For Lightning Damaged Impact Resistant Shingles

Impact-resistant shingles damaged by lightning require specialized assessment and repair, with costs typically ranging from $300 to $1,000 per square (100 square feet). The cost of repairing these premium materials varies based on damage severity and labor rates. Insurance coverage typically includes repair or replace options, subject to the policy’s deductible.

| Damage Type | Signs | Cost Factors |

|---|---|---|

| Direct Strike | Visible burn marks | Material replacement |

| Heat Damage | Melted surfaces | Labor rates |

| Structural | Cracking/splitting | Location access |

| Secondary | Water damage | Additional repairs |

| Hidden | Internal deterioration | Inspection needs |

Secondary issues, such as water damage, can increase overall repair costs considerably. Professional assessment is essential to identify all lightning damage manifestations and determine whether partial repairs or complete replacement is necessary for affected impact-resistant shingles.

Costs For Lightning Damaged Luxury Designer Shingles

Lightning damage to luxury designer shingles presents unique repair challenges and higher replacement costs compared to standard roofing materials. When lightning strikes these premium materials, visible charring, structural deformation, and melting can occur, requiring immediate professional assessment. Repair costs typically range from $1,000 to $5,000, with specialized contractors often necessary for proper restoration.

| Damage Type | Signs | Cost Range |

|---|---|---|

| Minor Surface | Slight charring | $1,000-$2,000 |

| Moderate | Blistering/melting | $2,000-$3,500 |

| Severe | Structural damage | $3,500-$5,000 |

| Complete Section | Full replacement | $4,000-$5,000 |

| Multiple Areas | System damage | $5,000+ |

Homeowners should thoroughly document all damage through photos and professional assessments before filing a home insurance claim, as most policies cover lightning-related incidents.

Costs For Lightning Damaged Metal Shingles/Shakes

Metal shingles and shakes, while highly durable, can sustain substantial damage when struck by lightning, often requiring specialized repairs that range from $1,500 to $5,000. Insurance claims for metal roofing damage require extensive documentation of visible signs, including charring, deformation, or holes. Preventative measures, such as lightning rods, become essential when metal roofs are exposed to heightened strike risks due to surrounding tall structures or trees.

| Damage Type | Signs to Document | Insurance Coverage |

|---|---|---|

| Burns | Char marks | Typically covered |

| Holes | Penetrations | Full coverage |

| Deformation | Warped metal | Standard claim |

| Melting | Material fusion | Included damage |

| Structural | Support damage | Thorough |

Homeowners insurance generally covers repair costs for lightning-damaged metal shingles, but immediate inspection and documentation are vital for successful claims processing and preventing further structural deterioration.

Costs For Lightning Damaged Wood Shake Shingles

Traditional wood shake shingles face considerable vulnerability to lightning strikes, with repair costs typically ranging from $300 to $1,500 per square (100 square feet). Homeowners must document visible damage thoroughly when filing insurance claims, as lightning-related roof damage generally falls under standard homeowners insurance coverage.

| Damage Type | Signs | Cost Impact |

|---|---|---|

| Surface Damage | Burn marks, discoloration | Low to moderate |

| Structural Damage | Cracks, splits, missing shakes | Moderate to high |

| Severe Damage | Exposed underlayment, complete destruction | Highest repair costs |

Regular maintenance and inspections help identify potential vulnerabilities in wood shake roofs before lightning strikes occur. Early detection of weakened areas can considerably reduce repair costs and prevent more extensive damage during severe weather events.

Costs For Lightning Damaged Solar Tile Shingles

Solar tile shingles present unique challenges when struck by lightning, with repair costs typically ranging from $1,000 to $5,000 per incident. Homeowners must document visible damage thoroughly, including power surges affecting performance, charring, and physical cracks, to support insurance claims.

| Damage Type | Signs to Look For | Documentation Needed |

|---|---|---|

| Physical | Cracks, melting, charring | Detailed photos |

| Electrical | Power surge indicators | Performance logs |

| Structural | Displaced tiles, leaks | Inspection report |

| System | Efficiency drops | Output measurements |

Most homeowners insurance policies cover lightning damage to solar tile shingles, but verification of coverage details is essential before initiating repairs. Professional assessment helps determine the full extent of damage and precise repair costs, ensuring appropriate compensation through insurance claims.

Costs For Lightning Damaged Clay & Concrete Tile Shingles

Clay and concrete tile shingles present distinct vulnerabilities when struck by lightning, with repair costs typically ranging from $1,000 to $3,000 per incident. Signs of lightning damage include visible charring, cracking, and tile dislodgment, which require prompt documentation for insurance claims.

| Damage Type | Signs | Required Action |

|---|---|---|

| Surface Damage | Charring/Discoloration | Document/Assess |

| Structural Damage | Cracks/Chips | Replace Tiles |

| Material Failure | Dislodged Tiles | Full Section Repair |

| Hidden Damage | Underlayment Issues | Inspection Required |

| Water Intrusion | Visible Leaks | Immediate Repair |

Regular inspections of roofing materials can identify potential vulnerabilities before storm damage occurs. Proper maintenance and swift response to visible damage help minimize repair costs and prevent secondary issues from developing in the underlying structure.

Costs For Lightning Damaged Slate & Synthetic Slate Shingles

Lightning damage to slate and synthetic slate shingles presents unique challenges due to the distinctive properties of these materials. Both natural and synthetic slate shingles can suffer visible burn marks, structural deformities, and complete material loss when struck by lightning. Repair costs typically range from $500 to $2,500 for natural slate and $1,000 to $3,500 for synthetic slate installations.

| Material Type | Damage Indicators | Repair Cost Range |

|---|---|---|

| Natural Slate | Charring, Cracks | $500-$2,500 |

| Synthetic Slate | Melting, Warping | $1,000-$3,500 |

| Both Types | Structural Damage | Varies by Severity |

Homeowners insurance generally covers the cost of replacing shingles damaged by lightning strikes, subject to policy terms and deductibles. Professional assessment is essential for accurate insurance claims documentation and determining the full extent of damage.

Lightning Damaged Flat Roof: Damage Signs & Repair Costs

When a powerful electrical discharge strikes a flat roof, it can result in extensive structural damage that requires immediate professional attention. Common damage signs include visible burn marks, melted materials, punctures, and water leaks from compromised roofing integrity. Homeowners should document damage thoroughly and seek professional inspection to assess the full impact.

| Damage Type | Signs | Action Required |

|---|---|---|

| Structural | Punctures, Cracks | Engineering Assessment |

| Surface | Burns, Melting | Material Replacement |

| Hidden | Water Leaks, Weakening | Thermal Imaging |

| Electrical | System Failure | Circuit Inspection |

Repair costs typically range from hundreds to thousands of dollars, depending on damage severity. Most homeowners insurance policies cover lightning damage to flat roofs, but proper documentation and meeting deductibles are essential for successful claims processing. It’s crucial for homeowners to be vigilant after a storm, as many may overlook initial signs of damage. Notable storm damage roof signs include missing shingles, leaks, and unusual granule loss in gutters, which should be reported promptly to their insurance provider. By recognizing these indicators early, homeowners can facilitate smoother claims and ensure their roofs are repaired before further issues arise. Homeowners should also consider the long-term implications of lightning damage on their property, as it can lead to additional issues if not addressed promptly. Understanding how to negotiate with insurance can significantly impact the amount of reimbursement received, so it is crucial to document all damage thoroughly and involve professionals when necessary. By presenting a clear case to the insurance provider, homeowners can ensure they receive the compensation needed to restore their roofs to optimal condition. Homeowners should take the time to review their damaged roof insurance coverage details to ensure they understand what is included in their policy. It’s advisable to take photos of the damage immediately after an incident, as this can serve as crucial evidence when filing a claim. Additionally, consulting with a professional contractor can help assess the extent of the damage and provide an estimate that may be required by the insurer. It’s crucial for homeowners to keep detailed records of any damage, including photographs and repair estimates, to support their insurance claims. Additionally, understanding the roof repair cost breakdown can help homeowners budget effectively and make informed decisions about their options. By being proactive and knowledgeable about their insurance policies and potential expenses, homeowners can more easily navigate the repair process following lightning damage. Additionally, homeowners should ensure they are aware of the specific terms and conditions outlined in their insurance policy, as these can vary significantly. For those unfamiliar with the claims process, researching how to file a roof claim can streamline the experience and prevent potential delays. It’s advisable to take photographs of the damage as soon as it is safe to do so, which can serve as critical evidence during much-needed discussions with your insurance provider.

Lightning Damaged Wood Roof: Damage Signs & Repair Costs

A powerful electrical discharge striking a wood roof can create immediate and severe structural damage, often manifesting as charred sections, splintered beams, or compromised shingles. Inspecting wood roofs after lightning strikes requires identifying specific damage signs, including dark burn marks, holes, and material discoloration. Repair costs typically range from $500 to $5,000, depending on damage severity.

| Aspect | Characteristics | Action Required |

|---|---|---|

| Visible Damage | Charring, burns, holes | Document immediately |

| Structural Issues | Splintering, cracks | Professional assessment |

| Material Impact | Melted shingles, discoloration | Replace affected areas |

| Insurance Claims | Coverage verification | Submit detailed evidence |

| Prevention | Regular maintenance | Schedule inspections |

Homeowners insurance generally covers lightning damage, making thorough documentation essential for successful claims processing. Regular maintenance helps identify vulnerabilities before severe structural compromise occurs.

Lightning Damaged Built-Up Roof (BUR): Damage Signs & Repair Costs

Built-up roofs face unique vulnerabilities to lightning strikes due to their multi-layered composition of bitumen and reinforcing fabrics. When lightning strikes a BUR, it can cause visible burn marks, membrane punctures, and compromised waterproofing integrity. Homeowners should conduct thorough inspections after storms to identify potential damage signs.

| Damage Signs | Repair Considerations | Cost Range |

|---|---|---|

| Visible Burns | Material Replacement | $500-$900 |

| Membrane Holes | Patch or Section Repair | $800-$1,500 |

| Water Infiltration | Full Layer Restoration | $1,500-$2,500 |

For insurance claims, documenting damage through detailed photographs and professional assessments is essential. Early detection of lightning damage prevents escalating repair costs and protects the roof’s structural integrity. Prompt repairs help maintain the BUR’s effectiveness and prevent secondary issues like moisture penetration.

Lightning Damaged Wood Roof: Damage Signs & Repair Costs

Lightning strikes pose distinct challenges for wood roofs, where the natural conductivity and organic composition of timber materials create unique vulnerabilities. Homeowners should monitor for damage signs including visible burn marks, smoke stains, and structural warping. Regular storm inspections help identify potential issues before they escalate into major structural problems.

| Aspect | Characteristics | Impact |

|---|---|---|

| Damage Signs | Charring, Splintering | Immediate Assessment Required |

| Repair Costs | $500-$2,500 | Varies by Damage Extent |

| Insurance | Dwelling Coverage | Documentation Necessary |

Insurance coverage typically addresses lightning damage to wood roofs, but proper documentation remains essential for claims processing. Repair costs fluctuate based on damage severity and material requirements, making thorough assessment vital for accurate cost estimation.

Lightning Damaged Green Roof: Damage Signs & Repair Costs

Green roofs present unique vulnerabilities to lightning strikes due to their layered composition of vegetation, growing medium, and waterproofing materials. When lightning impacts these specialized structures, it can cause extensive damage to multiple components, requiring thorough assessment and targeted repairs.

| Component | Signs of Damage |

|---|---|

| Vegetation | Charred plants, wilted growth |

| Soil Medium | Scorched areas, deformation |

| Waterproofing | Compromised seals, burns |

| Structure | Cracks, thermal damage |

| Drainage | Blocked flow, material melting |

Repair costs typically range from hundreds to thousands of dollars, depending on damage severity. Property owners should conduct regular maintenance inspections and promptly document any lightning damage through photographs and professional assessments to support insurance claims. Special attention must focus on compromised waterproofing layers, as these can lead to secondary moisture-related issues if not addressed promptly.

Lightning Damaged Membrane Roof: Damage Signs & Repair Costs

Modern membrane roofs, while durable and weather-resistant, remain susceptible to significant damage from lightning strikes. When lightning impacts a membrane roof, it can create punctures, burns, and tears that compromise the roofing system’s integrity. Regular inspections following severe storms help identify potential structural issues early.

| Aspect | Details |

|---|---|

| Damage Signs | Visible burns, melting, charring |

| Common Issues | Surface punctures, material tears |

| Repair Costs | $500-$3,000 range |

| Required Actions | Document visible damage, contact insurance |

Homeowners should thoroughly document any visible damage and promptly contact their insurance provider, as lightning damage is typically covered under homeowners insurance policies. Early detection through regular inspections can prevent escalating repair costs and maintain the roof’s protective capabilities.

Lightning Damaged Rolled Roof: Damage Signs & Repair Costs

Rolled rooftop systems face significant vulnerabilities when subjected to direct lightning strikes, which can result in immediate structural compromise and costly repairs. Property owners should inspect for visible burns, unusual indentations, and material blistering to assess the extent of damage to roof integrity.

| Damage Aspect | Characteristics | Action Required |

|---|---|---|

| Visual Signs | Burns, Melting, Punctures | Photo Documentation |

| Structural Impact | Indentations, Blistering | Professional Inspection |

| Cost Factors | $500-$3,000 Range | Insurance Claims Filing |

When lightning damage occurs, thorough documentation through photographs and detailed descriptions is essential for homeowners insurance claims. Most policies cover roof repairs resulting from lightning strikes, making proper assessment and documentation vital for claim approval and subsequent restoration of the rolled roof system.

Lightning Damaged Metal Roof: Damage Signs & Repair Costs

When lightning strikes a metal roof, it can create distinctive patterns of damage that require immediate professional assessment. Visible signs include charring, discoloration, and structural deformation, which may compromise the roof’s integrity. A thorough roof inspection after storms helps identify potential issues before they escalate into more severe problems.

| Aspect | Description | Action Required |

|---|---|---|

| Visible Signs | Burn marks, melting | Photo documentation |

| Structural Impact | Punctures, warping | Professional evaluation |

| Cost Range | $100s to $1000s | Get multiple quotes |

| Insurance | Standard coverage | Review policy limits |

| Documentation | Damage evidence | Detailed photographs |

Homeowners should promptly document damage for insurance claims, considering coverage limits and deductibles under their homeowners policies. Repair costs vary greatly based on damage severity, ranging from minor repairs to extensive reconstruction.

Homeonwers Insurance Claim Process For Lightning Damaged Roofing

Insurance adjusters work for the insurance company and prioritize minimizing claim payouts rather than maximizing homeowner compensation. Homeowners must maintain detailed documentation, photographs, and professional assessments to effectively counter potential claim minimization efforts. Understanding common adjuster tactics helps property owners better advocate for fair compensation during the claims process.

| Adjuster Tactics | Homeowner Counter-Measures | Documentation Needed |

|---|---|---|

| Attributing damage to wear/age | Get independent inspection report | Dated photos of damage |

| Proposing minimal repairs | Obtain multiple contractor estimates | Weather report data |

| Disputing claim scope | Document all damage thoroughly | Professional assessments |

| Delayed responses | Maintain communication log | Written correspondence |

Dealing With Insurance Company Adjusters: No, They Are NOT Your Friend

Although homeowners may initially perceive insurance adjusters as helpful allies during the claims process for lightning-damaged roofs, these professionals fundamentally serve their employers’ financial interests rather than the policyholder’s needs.

Effective preparation when dealing with insurance adjusters requires:

- Thorough documentation of all roof damage through detailed photographs and written descriptions.

- Extensive understanding of policy terms, coverage limits, and deductibles.

- Maintenance of complete records documenting all communications with the insurance company.

Homeowners must actively advocate for their claims, as adjusters typically present initial settlement offers below actual damage values.

Strategic negotiation becomes essential, supported by evidence of damage extent and repair costs.

Understanding that adjusters represent the insurer’s interests enables policyholders to approach the claims process with appropriate caution and preparation.

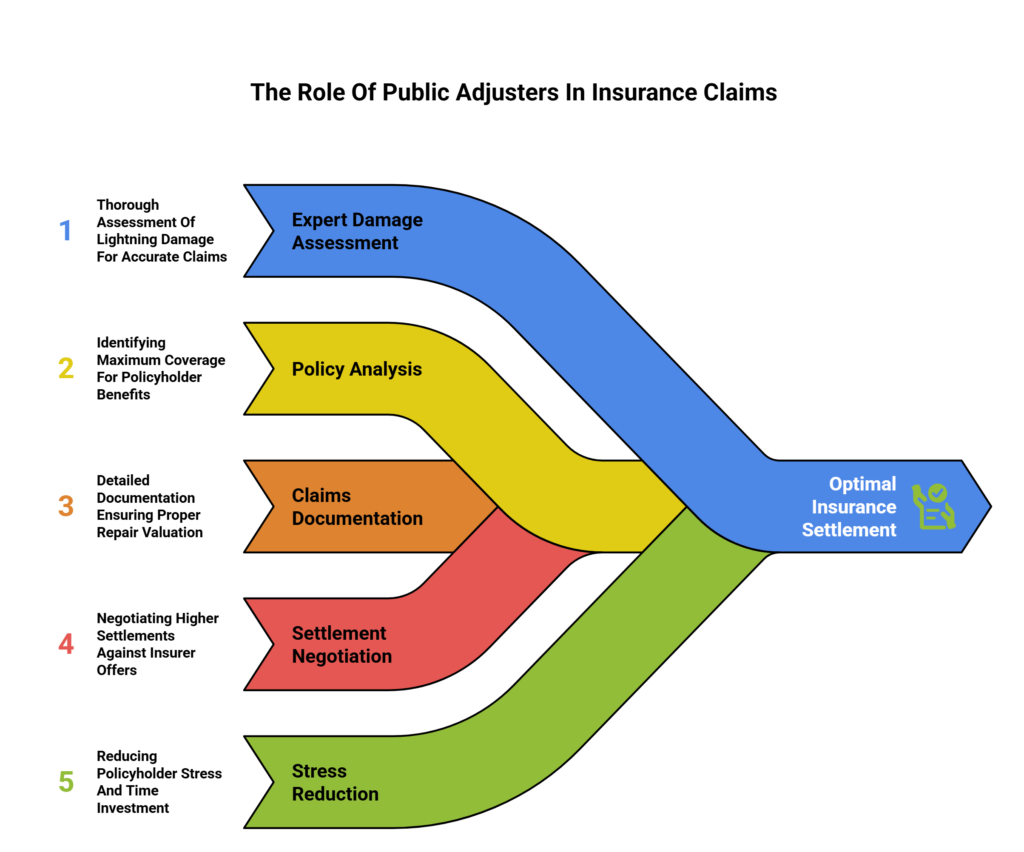

Getting Help From A Public Adjuster: Your Advocate & Ally

Insurance claims for lightning-damaged roofs often require specialized expertise to guarantee fair compensation, making public adjusters valuable allies in the claims process. Public adjusters serve as dedicated advocates who work exclusively for policyholders, conducting thorough damage assessments and managing complex claim documentation. Studies indicate that claims handled by public adjusters typically result in notably higher settlements, with increases up to 800% compared to unrepresented claims. Their in-depth knowledge of insurance policies and damage evaluation allows public adjusters to navigate the intricacies of the claims system effectively. Additionally, they can provide insights into roof repair and replacement strategies that align with the specific needs of the homeowner. This ensures that policyholders not only receive appropriate compensation but also make informed decisions about restoring their property to its optimal condition. These professionals possess in-depth knowledge of insurance policies and the various nuances of the claims process, which can significantly enhance the likelihood of a successful outcome. By providing roof damage insurance claims assistance, public adjusters ensure that policyholders are not left to navigate the often daunting claims landscape on their own. Their expertise can also help identify hidden damages and push back against lowball offers from insurers, ultimately aiming to secure the best possible compensation for homeowners.

| Public Adjuster Services | Benefits to Policyholder |

|---|---|

| Expert Damage Assessment | Complete documentation of all lightning damage |

| Policy Analysis | Maximum coverage identification |

| Claims Documentation | Proper valuation of repairs/replacement |

| Settlement Negotiation | Higher settlement amounts |

| Claims Management | Reduced stress and time investment |

The Role Of Public Claims Adjusters In Lightning Damaged Roof Claims

When faced with the complexities of a lightning-damaged roof claim, homeowners can greatly benefit from enlisting the services of a public claims adjuster. These licensed professionals specialize in managing the insurance claims process, ensuring that lightning damage is accurately assessed and properly compensated.

| Service Aspect | Benefits |

|---|---|

| Documentation | Detailed damage reports and evidence collection |

| Negotiation | Expert handling of insurance company interactions |

| Code Compliance | Knowledge of local building codes and standards |

| Settlement | Higher potential claims amounts through expertise |

Public claims adjusters serve as dedicated advocates, leveraging their expertise to maximize settlement amounts while alleviating the stress of claim management. Their understanding of repair costs and policy nuances enables homeowners to receive fair compensation for lightning-damaged roofs while ensuring compliance with local building codes.

Benefits Of Using A Public Adjuster For Lightning Damaged Roof Repair & Replacement Claims

Seeking assistance from a public adjuster during a lightning-damaged roof claim offers homeowners significant advantages in maneuvering the complex insurance settlement process. These licensed professionals specialize in damage assessment and policy interpretation, ensuring thorough documentation of all repair needs.

| Benefits | Impact |

|---|---|

| Expert Evaluation | Thorough identification of lightning damage extent |

| Policy Navigation | Enhanced understanding of home insurance coverage |

| Claim Optimization | Higher likelihood of successful claim outcomes |

| Financial Return | Increased settlement amounts for roof repairs |

Public adjusters serve as dedicated advocates throughout the claim process, handling negotiations with insurance companies and streamlining documentation requirements. Their expertise in homeowners insurance policies often results in more favorable settlements, making their services particularly valuable for substantial lightning damage claims requiring extensive roof repairs or replacement.

How Are Public Insurance Adjusters Paid & What Are Their Fees?

Public adjusters typically operate on a contingency fee basis, charging a percentage of the final insurance settlement amount rather than upfront costs. Their fees generally range from 10% to 20% of the total settlement, which incentivizes them to maximize claim outcomes for policyholders.

| Service Phase | Duration | Adjuster Activities |

|---|---|---|

| Initial Review | 1-3 Days | Damage evaluation, documentation collection |

| Claim Filing | 2-4 Weeks | Claim preparation, cost analysis |

| Settlement | 1-3 Months | Negotiation with insurance company |

Research indicates that despite these fees, policyholders often receive considerably higher settlement amounts when utilizing public adjusters, particularly for complex claims or disputed cases. The Landmak OPPAGA Study demonstrated settlements up to 800% higher with public adjuster representation compared to unrepresented claims.

Public Adjusters Vs. The Insurance Company Adjuster

The fundamental distinction between public adjusters and insurance company adjusters lies in their representation and priorities. While insurance company adjusters serve their employers’ interests, public adjusters advocate exclusively for policyholders, focusing on maximizing compensation for complex claims and disputed claims.

| Aspect | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Represents | Policyholder | Insurance Company |

| Priority | Maximum Settlement | Company Cost Control |

| Approach | Thorough Documentation | Standard Assessment |

Public adjusters conduct thorough damage evaluation, meticulous claim preparation, and skilled negotiation and settlement processes. Their expertise in insurance claims often results in settlements up to 800% higher than unrepresented cases. This significant difference stems from their specialized knowledge in policy interpretation, documentation requirements, and strategic negotiation techniques, making them valuable allies for policyholders seeking fair compensation.

When to Contact Your Insurance Provider For Roof Lightning Damage

Contacting an insurance provider after roof lightning damage requires different approaches depending on whether a public adjuster is involved or the claim is filed independently.

When working with a public adjuster, they will typically manage insurance communications and documentation requirements, acting as an intermediary between the homeowner and insurance company.

Homeowners filing claims independently must initiate immediate contact with their insurance provider, thoroughly document all visible damage, and maintain clear communication throughout the claims process.

If Using A Public Adjuster

When considering a public adjuster for roof lightning damage, homeowners should contact their insurance provider immediately after the incident while simultaneously engaging professional assistance.

Public adjusters can help maximize claim outcomes by thoroughly documenting the extent of damages and presenting thorough evidence to insurance companies.

The adjuster’s expertise proves valuable during the assessment process, ensuring all eligible damages are identified and properly evaluated.

They assist in preparing detailed documentation, including photographs and repair estimates, while understanding policy coverage limits and deductibles.

This professional support becomes particularly important during insurance company inspections, as public adjusters can effectively advocate for homeowners’ interests and help navigate the complexities of the claims process, ultimately working to secure appropriate compensation for necessary repairs.

If Filing On Your Own

Should homeowners discover potential lightning damage to their roof, immediate contact with their insurance provider becomes vital for initiating the claims process.

When filing a claim independently, thorough documentation of all visible signs of damage is important, including photographs of charring, cracks, or missing shingles.

Homeowners must review their policy carefully to understand deductibles for lightning damage claims and coverage limitations.

Most insurance companies allow property owners to file their claim online, though maintaining direct communication with the assigned insurance adjuster is recommended.

Before finalizing the claim, obtaining multiple repair estimates from licensed contractors helps establish accurate costs to repair or replace items.

This documentation strengthens the case for compensation and guarantees a thorough assessment of the roof damage from lightning strikes.

Filing Process For Lightning Damaged Roof Claims Using A Public Adjuster

Filing an insurance claim for lightning-damaged roofs through a public adjuster follows a systematic process designed to maximize claim settlements.

Professional public adjusters conduct detailed property inspections while gathering essential documentation, including photographs, repair estimates, and engineering assessments to build a thorough claim.

The adjuster manages all communications with insurance carriers while leveraging their expertise to identify additional coverage opportunities within the policy terms.

- Thorough documentation of visible and hidden damage through professional assessment tools

- Strategic policy review to uncover all applicable coverage benefits

- Direct negotiation with insurance adjusters to optimize settlement value

Public Adjuster Thoroughly Inspects & Documents Lightning Damage To Roof

A public adjuster’s extensive inspection and documentation process plays a critical role in securing thorough compensation for lightning-damaged roofs. Their systematic approach includes capturing detailed photographs, noting structural impacts, and compiling supporting evidence such as weather reports and fire department records. This thorough documentation strengthens the insurance claim by providing irrefutable proof of damage.

| Inspection Component | Documentation Method | Impact on Claim |

|---|---|---|

| Visual Damage | Photographs & Notes | Establishes Extent |

| Structural Issues | Technical Assessment | Validates Severity |

| Weather Data | Official Reports | Confirms Cause |

| Property Records | Historical Documents | Proves Condition |

Public Adjuster Reviews Policy For Hidden Roofing Coverage & Helps Maximize Policy Benefits

When homeowners experience lightning damage to their roofs, public adjusters provide invaluable expertise in uncovering hidden policy benefits that might otherwise go unclaimed. These professionals meticulously assess the damage while reviewing insurance policies to identify all applicable coverage options. Their specialized knowledge enables efficient navigation of complex claims processes and maximizes settlement outcomes.

| Process Step | Public Adjuster Action | Benefit to Homeowner |

|---|---|---|

| Policy Review | Analyzes coverage details | Identifies hidden benefits |

| Damage Assessment | Documents all damage types | Guarantees complete claim |

| Claims Navigation | Manages filing process | Reduces stress and time |

| Settlement Negotiation | Advocates for maximum benefits | Optimizes compensation |

Public adjusters streamline the entire claims process, from initial documentation through final settlement, guaranteeing homeowners receive thorough coverage for all lightning-related roof damage.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Professional public adjusters serve as essential intermediaries between policyholders and insurance companies during lightning-related roof damage claims.

These experts streamline the claims process by managing all communications and negotiations with insurance carriers, allowing homeowners to focus on necessary repairs.

Key responsibilities of public adjusters include:

- Thoroughly documenting lightning damage through detailed photographs, reports, and evidence collection

- Filing extensive insurance claims that maximize policy benefits

- Negotiating directly with insurance company adjusters to secure fair settlements

Working on a contingency basis, public adjusters are incentivized to obtain ideal settlements for their clients.

Their expertise in insurance policies and claims procedures proves invaluable when maneuvering through complex lightning damage cases, ensuring policyholders receive appropriate compensation for their damaged roofs.

Public Adjuster Gets Professional Assessments

Public adjusters initiate the claims process by coordinating thorough professional assessments of lightning-damaged roofs.

These experts work on a contingency fee basis, ensuring their commitment to maximizing the settlement value for homeowners filing insurance claims.

Key aspects of the professional assessment process include:

- Detailed documentation of all visible and hidden lightning damage through detailed photographs and reports

- Collection of expert evaluations to substantiate the full scope of documented damages

- Preparation of itemized estimates that align with current insurance policies and industry standards

The public adjuster’s expertise in obtaining professional assessments proves invaluable during the home insurance claims process.

Their systematic approach to damage evaluation helps identify all affected areas, ensuring no potential claim elements are overlooked during settlement negotiations.

Public Adjuster Gathers Supporting Evidence

Building upon the professional assessment phase, the evidence-gathering process requires meticulous documentation and thorough supporting materials. Public adjusters execute extensive assessments by documenting lightning damage through expert evaluations and detailed photographic evidence. They compile critical documentation to support insurance claims, including weather data and official reports, while negotiating with insurance companies on behalf of homeowners.

| Evidence Type | Purpose | Impact on Claim |

|---|---|---|

| Photographic Documentation | Visual Proof of Damage | Validates Extent of Loss |

| Weather Records | Confirms Lightning Event | Establishes Cause |

| Fire Department Reports | Official Documentation | Verifies Incident |

| Property Assessments | Technical Evaluation | Determines Eligible Damages |

This systematic approach guarantees all eligible damages are identified and properly documented, maximizing the potential for successful claims resolution.

Public Adjuster Submits Complete Claims Package

Following meticulous evidence gathering, the thorough claims package represents a critical milestone in the lightning damage claims process. The public adjuster compiles extensive documentation, including photographs, repair estimates, and detailed inspection reports to substantiate the claim with the insurance company.

| Claims Package Components | Purpose | Impact |

|---|---|---|

| Photographs & Reports | Document Damage | Verify Claim |

| Repair Estimates | Assess Costs | Justify Settlement |

| Expert Analysis | Technical Support | Strengthen Case |

The public adjuster’s expertise in negotiating with insurers often leads to higher settlements for homeowners. Their understanding of claims procedures helps expedite the process, while their contingency-based fee structure guarantees aligned interests. This professional approach maximizes the likelihood of successful claim resolution for lightning-damaged roofs.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Throughout the claims process, a dedicated public adjuster maintains consistent communication with the insurance company, ensuring all time-sensitive requirements are met promptly. Their expertise in documenting lightning damage and understanding insurance policies allows for efficient handling of all correspondence and deadlines.

Public adjusters streamline the claims process by:

- Submitting professional assessments and detailed documentation within required timeframes

- Managing ongoing negotiations to maximize settlement amounts

- Addressing insurance company inquiries and requests immediately

This thorough management enables homeowners to focus on repairs and recovery rather than administrative tasks.

The public adjuster’s thorough understanding of insurance claims procedures and time requirements helps prevent delays that could potentially impact the claim’s success, ensuring a more expeditious resolution for the property owner.

Public Adjuster Enforces Policyholder’s Rights, & Negotiates Higher & More Fair Settlement

Professional public adjusters serve as powerful advocates for policyholders during lightning-damaged roof claims, consistently securing settlements that are 30% higher on average than self-filed claims.

These experts maximize settlements by leveraging their deep understanding of insurance policies and claims processes.

Key advantages of utilizing public adjusters include:

- Thorough identification of all covered damages that policyholders might overlook

- Expert negotiation skills to secure higher compensation based on policy terms

- Streamlined documentation process leading to faster claim resolutions

Public adjusters protect policyholder’s rights throughout the entire claims process, ensuring fair treatment from insurance companies.

Their contingency-based fee structure aligns with the policyholder’s interests, as compensation is directly tied to successfully negotiating favorable settlement amounts.

Public Adjuster Speeds Up Claim Settlement Time

Expediting the claims process for lightning-damaged roofs, public adjusters considerably reduce settlement times through their systematic approach to documentation and negotiation.

Their expertise in property damage assessment and insurance coverage guarantees extensive claim packages that meet insurers’ requirements, often resulting in faster approvals.

Public adjusters streamline the process through:

- Thorough documentation of all damage evidence and potential losses

- Direct negotiation with insurance companies using established professional relationships

- Expert interpretation of policy coverage to maximize legitimate claims

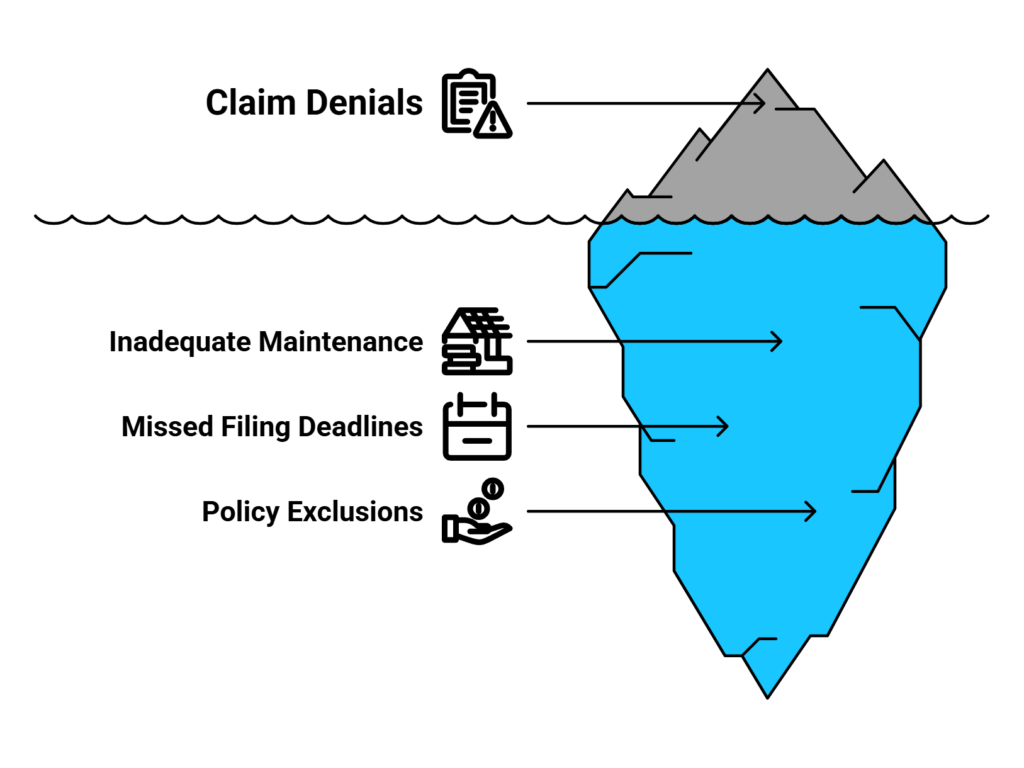

Common Reasons For Lightning Damaged Roofing Claim Denials

Insurance companies frequently deny roof lightning damage claims due to several common factors, including evidence of pre-existing damage and inadequate maintenance documentation.

Claims adjusters scrutinize filing timelines, as missed deadlines can result in automatic denial regardless of damage severity.

The distinction between lightning-induced damage and normal wear and tear presents a significant challenge, particularly when weather events fall outside specific policy coverage parameters.

Pre-Existing Roof Damage

When evaluating lightning damage claims for roofs, pre-existing conditions often emerge as a critical factor in claim denials. Insurance companies carefully assess maintenance history and existing deterioration before processing claims. Documentation of regular inspections and repairs proves essential for validating coverage, particularly for older roofs facing coverage limitations.

| Pre-Existing Condition | Impact on Claims | Required Documentation |

|---|---|---|

| Rusted Flashing | Potential Denial | Inspection Records |

| Missing Shingles | Limited Coverage | Maintenance History |

| Deteriorated Materials | Claim Reduction | Repair Receipts |

| Age-Related Wear | Coverage Exclusion | Age Certification |

Homeowners must demonstrate proper roof maintenance through thorough records to prevent claim denials. Insurance providers frequently attribute damage to neglect or unaddressed issues rather than lightning strikes when evidence of pre-existing conditions exists, greatly affecting claim outcomes.

Poor Maintenance Records

Maintaining detailed records of roof maintenance and repairs stands as a fundamental requirement for successful lightning damage claims. Insurance providers scrutinize documentation when evaluating coverage for lightning strike damage, often denying claims where poor maintenance records indicate neglect.

Homeowners must demonstrate through receipts, inspection reports, and repair documentation that their roof received proper upkeep prior to the incident. Claims frequently face rejection when inspections reveal undocumented wear and tear or pre-existing conditions that weren’t addressed.

Insurance companies require evidence that damage resulted directly from the lightning strike rather than chronic maintenance issues. To secure coverage, property owners should maintain thorough records of all roof-related services, repairs, and inspections, establishing a clear history of responsible maintenance practices that distinguishes new lightning damage from pre-existing deterioration.

Normal Wear & Tear

Normal wear and tear greatly complicates lightning damage claims, as insurers carefully distinguish between storm-related destruction and pre-existing deterioration. Insurance providers scrutinize claims for lightning damage against documentation of regular maintenance to determine coverage eligibility. The Insurance Information Institute reported that claims denials often stem from inadequate roof upkeep rather than the lightning incident itself.

| Maintenance Factor | Impact on Claims |

|---|---|

| Regular Inspections | Supports Coverage |

| Repair Records | Validates Maintenance |

| Age Documentation | Proves Condition |

| Previous Claims | Shows History |

| Maintenance Schedule | Demonstrates Care |

Pre-existing issues must be addressed promptly, as policy includes specific exclusions for deterioration. Insurance agents emphasize that thorough maintenance and repairs documentation greatly improves claim approval likelihood, while poor record-keeping often leads to denials based on normal wear and tear.

Missed Filing Deadlines

Insurance claims for lightning-damaged roofing frequently face denial due to missed filing deadlines, which typically range from 30 to 90 days after the incident.

Homeowners must understand their policy terms regarding specific deadlines and requirements for filing a claim to avoid rejection.

Timely action is vital when dealing with lightning damage to roofing systems.

Failure to report damage within the designated timeframe can result in claim denials, regardless of the incident’s severity.

Property owners must thoroughly document the damage, including photographs and the date of the lightning strike, to support their claims.

Additionally, immediate notification to the insurance agent is essential, as delays in communication can exceed policy limits for claim submissions, potentially leaving homeowners responsible for costly repairs.

Non-Covered Weather Events

Beyond timely filing requirements, homeowners must navigate the complexities of weather-related claim denials. Insurance providers frequently scrutinize claims to determine whether the damage resulted from lightning or non-covered weather events. Understanding policy exclusions and documentation requirements is vital for successful claims processing.

| Common Denial Factors | Impact on Claims |

|---|---|

| Weather Exclusions | Hail/wind damage mistaken for lightning |

| Maintenance Neglect | Pre-existing wear and tear |

| Roof Condition | Age-related restrictions |

| Documentation Issues | Insufficient evidence linking to lightning |

| Claims Process | Improper reporting procedures |

Insurance companies may deny claims when damage cannot be definitively attributed to lightning strikes or when evidence suggests other weather events are responsible. Thorough documentation, proper maintenance records, and understanding policy exclusions are fundamental for protecting against claim denials.

Insurance Claim Appeals Process

Public adjusters serve as professional advocates who can evaluate denied lightning damage claims and identify opportunities for successful appeals. These licensed professionals possess extensive knowledge of insurance policies, documentation requirements, and negotiation strategies necessary to challenge claim denials effectively. Their expertise enables thorough damage assessments, accurate cost evaluations, and strategic presentation of evidence to insurance companies.

| Service Provided | Benefit to Policyholder |

|---|---|

| Damage Assessment | Detailed documentation of all lightning-related roof damage |

| Policy Analysis | Clear interpretation of coverage terms and exclusions |

| Claim Negotiation | Professional representation during appeals process |

How Public Adjusters Help With Denied Lightning Damage Roofing Claims

When homeowners face denied lightning damage roofing claims, professional public adjusters serve as valuable advocates throughout the appeals process. These experts assist by conducting detailed policy reviews, documenting damage evidence, and negotiating with insurance companies. Their expertise in identifying covered perils helps guarantee all lightning-related damage is properly assessed.

| Service | Process | Outcome |

|---|---|---|

| Policy Review | Analyze coverage details | Identify applicable benefits |

| Damage Assessment | Document evidence & photos | Create extensive report |

| Expert Consultation | Gather professional opinions | Validate repair estimates |

| Claim Negotiation | Present findings to insurer | Maximize settlement value |

Public adjusters systematically build strong cases for homeowners by collecting technical documentation, securing expert testimonials, and leveraging their understanding of insurance practices to demonstrate the necessity of repairing or replacing damaged roofing components.

Choosing & Working With Trusted Lightning Damage Contractors

Working with a public adjuster provides access to an established network of qualified lightning damage contractors who have proven track records of quality repairs. Professional estimates from these vetted contractors help guarantee accurate documentation of all necessary repairs and material costs associated with lightning damage restoration. Public adjusters can review contractor estimates to verify pricing fairness and completeness while identifying any potential oversights or unnecessary charges.

| Contractor Verification | Documentation Review | Cost Analysis |

|---|---|---|

| License & Insurance | Detailed Scope of Work | Market Rate Comparison |

| Experience History | Material Specifications | Line Item Validation |

| Client References | Timeline Requirements | Change Order Review |

Utilize Your Public Adjusters Extensive Professional Network

Through their years of industry experience, public adjusters develop extensive networks of trusted contractors who specialize in lightning damage repair.

These professional relationships enable homeowners to access vetted, licensed and insured contractors who understand the complexities of insurance claims. Contractors within these networks possess expertise in conducting thorough inspections to assess the extent of damage, including identifying hidden issues that may not be immediately apparent.

Public adjusters facilitate connections with multiple trusted contractors, enabling homeowners to obtain competitive estimates for repair work.

This network approach helps streamline the repair process by ensuring proper documentation for insurance claims while maintaining high service quality standards.

The established relationships between public adjusters and contractors create an efficient system that benefits homeowners seeking reliable lightning damage repairs.

Getting Professional & Detailed Estimates

Professional estimates serve as the foundation for successful lightning damage repairs and insurance claims. When dealing with roof damage from lightning strikes, obtaining detailed quotes from licensed contractors is essential for accurate repair costs and smooth insurance company processing. Experienced contractors specializing in lightning damage repairs provide thorough assessments that detail all necessary work.

| Component | Requirements | Importance |

|---|---|---|

| Contractor | Licensed & Insured | Essential |

| Estimates | Minimum 3 Quotes | Required |

| Experience | Lightning Repair History | Critical |

| Documentation | Written Details & Photos | Mandatory |

| Communication | Clear & Documented | Necessary |

To guarantee transparency throughout the process, property owners should document communications with contractors and maintain organized records of all estimates. This detailed documentation supports lightning claims and helps establish clear expectations for both the repair work and associated costs.

Letting Your Public Adjuster Review Estimates To Ensure Contractor Honesty

Public adjusters serve as invaluable intermediaries when reviewing contractor estimates for lightning-related roof damage. Their expertise helps homeowners identify potential discrepancies in repair estimates and guarantees that proposed costs align with fair market values.

These professionals understand the complexities of storm damage claims and can effectively negotiate with contractors on behalf of property owners.

When evaluating lightning damage, public adjusters verify that contractor estimates accurately reflect the scope of necessary repairs covered by homeowners insurance. Their unbiased assessment promotes transparency throughout the claims process and helps prevent unexpected expenses.

Tips For Preventing Future Roof Lightning Damage