Think of public adjusters as your insurance claim superheroes – but even heroes can stumble! Let’s dive into the red flags you need to watch out for and how to dodge them like a pro.

Ever hired someone only to discover they’re not quite who they claimed to be? That’s why checking your adjuster’s credentials is as crucial as checking your smoke detectors. Licensed, experienced adjusters are worth their weight in gold, so don’t skip this vital step! A qualified public adjuster can navigate the complexities of insurance claims, ensuring you receive the compensation you deserve. Knowing when to hire a public adjuster can make all the difference in the outcome of your claim, especially in the wake of a significant loss. Take the time to verify their skills and background, as the wrong hire can lead to costly mistakes that could have been easily avoided.

Documentation is your best friend in the claims world. Just like you wouldn’t go on a road trip without GPS, don’t navigate your claim without proper paperwork. Keep every email, photo, and receipt organized as if your claim depends on it – because it does!

Watch out for those eye-watering fees! Some adjusters might charge you more than your morning coffee habit. Before signing anything, understand their fee structure like you know your favorite recipe. Remember, reasonable fees typically range between 5-15% of your settlement.

Communication breakdowns? Not on your watch! Establish clear channels with your adjuster from day one. Think of it as setting ground rules for a successful partnership – regular updates, response timeframes, and preferred contact methods should be crystal clear.

Ready to maximize your claim? Create a battle plan: verify licenses, document everything, set communication expectations, and understand your policy inside and out. Your future self will thank you for being thorough today!

Key Takeaways

Let’s Talk Public Adjuster No-No’s: Your Guide to Dodging Common Mistakes

Think of documentation like your claim’s bulletproof vest – every email, call, and meeting with insurance companies needs to be recorded. Just as you wouldn’t delete those precious vacation photos, keep a digital paper trail of all your insurance interactions. Your future self will thank you!

Here’s a classic rookie move: jumping at the first settlement offer like it’s the last slice of pizza. Take a breath! A thorough damage assessment is your best friend here. Remember, insurance companies often test the waters with initial offers that barely scratch the surface of your actual losses.

Playing deadline roulette with your policy requirements? That’s like showing up to a dinner party a week late – it just doesn’t work. Dive into those policy terms like you’re binge-watching your favorite show. Understanding your coverage isn’t optional; it’s your insurance survival guide.

Picture this: you’re at the scene of the damage, but your phone’s in the car. Big mistake! Snap those photos like a tourist in Times Square – you can’t have too many. Fresh, detailed evidence is your golden ticket to a solid claim.

Operating without proper credentials? That’s like performing surgery without a medical license – it never ends well. Each jurisdiction has its own rules, and skipping the licensing process isn’t just risky – it’s a fast track to claim denial and legal headaches.

Understanding Your Insurance Policy: The First Line of Defense

Insurance policies serve as legally binding contracts that establish the foundation for any claims process, yet they often contain complex terminology and intricate provisions that can confound even experienced policyholders. Effective policy interpretation requires a thorough examination of key components, including the declarations page, insuring agreement, exclusions, conditions, and definitions.

A complete coverage analysis begins with understanding policy limits, deductibles, and premium obligations. Policyholders must carefully review renewal provisions and coverage periods to prevent unexpected lapses. Having actual cash value calculations readily available helps determine accurate compensation levels for damaged property.

Thorough review of policy specifics and renewal terms helps prevent coverage gaps and ensures continuous protection of insured assets.

The declarations page serves as a critical reference point, detailing essential information about covered risks and policy parameters. To avoid misunderstandings, policyholders should maintain detailed records of all policy-related communications and regularly review their coverage terms.

When complexities arise, consulting with qualified public adjusters can provide valuable assistance in interpreting policy language and identifying potential coverage gaps, ultimately helping policyholders maximize their insurance benefits while avoiding common pitfalls in the claims process.

Regular reviews of your declarations page can lead to policy bundling savings of 15-25% while ensuring your coverage remains adequate for your needs.

Documenting Property Damage: Essential Steps for Success

Complete documentation of property damage stands as a cornerstone of successful insurance claims, requiring meticulous attention to detail and systematic record-keeping practices.

Public adjusters emphasize the critical importance of capturing thorough damage photographs from multiple angles, guaranteeing proper lighting and clear visibility of all affected areas, both interior and exterior.

Successful documentation extends beyond visual evidence to include detailed written records of the incident, including weather verification when applicable, and precise chronological documentation of events.

Licensed professionals must undergo rigorous background checks and examinations to represent policyholders in insurance claims.

Financial documentation, including repair estimates and receipts for temporary fixes, must be meticulously maintained. Official reports, such as police documentation, provide additional verification of circumstances surrounding the damage.

Proper organization of this evidence through digital storage solutions and dedicated filing systems safeguards accessibility throughout the claims process. This systematic approach to documentation substantially enhances claim outcomes and minimizes potential disputes regarding damage extent and valuation.

Public adjuster services include conducting thorough damage assessments while maintaining complete independence from insurance companies.

Negotiating Initial Settlement Offers: Critical Considerations

Initial settlement offers from insurance companies frequently undervalue claims, requiring careful analysis against documented evidence and policy coverage terms.

Crafting strategic counteroffers demands thorough assessment of property damage, repair costs, and additional expenses while maintaining professional negotiation etiquette.

Public adjusters leverage their industry expertise to evaluate initial offers and develop data-driven counterproposals that align with policy entitlements and market-standard compensation.

Professional representation through a public adjuster can lead to 800% higher settlements compared to independently-filed insurance claims.

Public adjusters excel at identifying hidden losses that insurance company adjusters may overlook during their initial assessments.

Evaluate Initial Offer Value

Most settlement offers presented at the outset of an insurance claim require careful scrutiny, as they frequently undervalue the actual losses sustained by policyholders.

A thorough offer analysis must account for complete damage assessments, policy coverage limits, and applicable building codes.

Insurance companies often employ valuation methods that minimize their financial exposure, particularly in complex claims situations.

Public adjusters can identify when initial offers fall short by conducting detailed fair market value research and gathering substantiating evidence.

This evaluation process should examine both direct damages and associated costs, while considering potential future complications.

Understanding the adjuster’s authority levels and company negotiation tactics enables more effective counteroffer strategies.

Timely engagement of professional representation helps prevent acceptance of inadequate settlements driven by pressure tactics or expedited processing.

With standard claim determination deadlines of 30-60 days, policyholders must balance thorough evaluation against timely resolution requirements.

Policyholders who work with public adjusters typically receive settlement increases of 10-15% compared to handling claims independently.

Strategic Counteroffer Development

Developing strategic counteroffers requires a methodical approach grounded in exhaustive evidence and policy analysis. Public adjusters must carefully assess counteroffer timing and settlement psychology to maximize negotiation outcomes while avoiding common pitfalls that could undermine the claim’s value. The PCAN membership requirements help ensure that only experienced and ethical adjusters handle strategic negotiations.

| Strategic Element | Critical Considerations |

|---|---|

| Timing | Documentation readiness, adjuster authority levels |

| Evidence Support | Damage assessments, expert opinions, market values |

| Psychology | Adjuster negotiation style, resistance patterns |

Successful counteroffers integrate thorough documentation with strategic positioning. Public adjusters should incrementally advance negotiations through well-supported demands while maintaining flexibility in approach. This balanced strategy helps avoid the common mistake of presenting inflated counteroffers that lack substantiation, which can damage credibility and delay settlement progress. Claims involving hurricane damage settlements can increase by up to 800% when public adjusters employ effective counteroffer strategies.

Navigating Insurance Company Delays and Tactics

While insurance companies are obligated to process claims fairly and efficiently, they often employ various tactics to delay the claims process and minimize payouts.

Common documentation delays include claims of missing paperwork, repetitive information requests, and frequent changes in claims representatives.

These deliberate strategies can substantially impact claimants’ financial stability and mental well-being.

Insurance companies’ delay tactics create a domino effect, undermining both the financial security and psychological health of policyholders.

Effective response strategies require meticulous record-keeping and systematic documentation of all interactions with insurance companies.

Public adjusters must maintain thorough digital archives of submitted materials, correspondence, and evidence to counter claims of lost documentation.

Additionally, they should implement proactive follow-up protocols and establish clear communication channels to minimize delays.

Understanding these delay tactics enables public adjusters to develop targeted countermeasures, such as simultaneous submission of documentation through multiple channels and immediate escalation of unwarranted delays to supervisory personnel.

This systematic approach helps prevent common pitfalls while maintaining steady progress toward claim resolution.

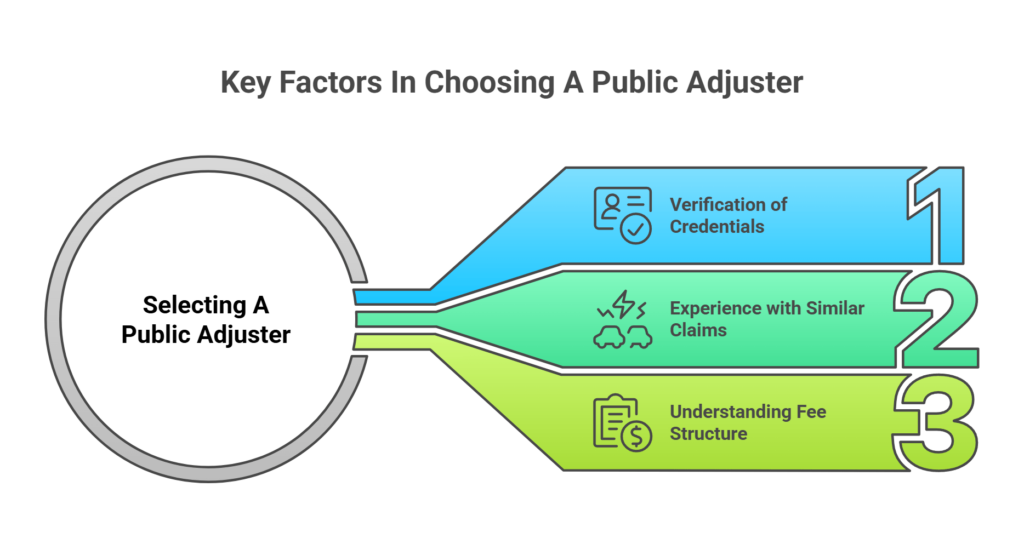

Selecting the Right Public Adjuster for Your Claim

When selecting a public adjuster, thorough verification of licenses, certifications, and professional affiliations establishes a baseline for competency and reliability.

Experience handling similar types of claims provides insight into an adjuster’s ability to navigate specific challenges unique to particular insurance scenarios.

Understanding the fee structure and contractual terms upfront helps avoid potential conflicts and guarantees transparency throughout the claims process.

Verify Licenses and Certifications

Since public adjusters play a crucial role in insurance claim negotiations, verifying their licenses and certifications is an essential first step for policyholders. Each state maintains distinct license verification processes and certification requirements through their respective insurance departments, with varying standards for examination, continuing education, and financial responsibility.

Most states require public adjusters to pass thorough examinations, maintain surety bonds, and complete ongoing education to retain their licenses. For instance, Colorado mandates a $20,000 surety bond, while Texas provides online resources for license verification through their Department of Insurance. Consumers should utilize state-specific verification tools and resources from organizations like NAPIA to confirm credentials, ensuring they work with qualified professionals who adhere to regulatory standards and ethical practices.

Experience in Similar Claims

Selecting a public adjuster with experience in similar claims substantially impacts the success of an insurance claim resolution. Claim patterns and prior case knowledge enable adjusters to identify potential complexities, hidden damages, and maximum negotiation strategies specific to certain types of losses.

Adjuster specialization in particular claim types, such as fire or water damage, demonstrates a depth of expertise that directly influences settlement outcomes. This specialized knowledge allows for thorough damage assessment, thorough documentation, and effective policy interpretation.

When evaluating potential adjusters, policyholders should examine their track record with similar claims, verified through references and documented settlement success rates. This targeted experience guarantees the adjuster possesses the specific skills needed to navigate the complexities of the claim type and secure favorable resolutions.

Fee Structure and Terms

The fee structure of a public adjuster represents a critical component in establishing a successful client-adjuster relationship. Most public adjusters operate on contingency structures, typically charging a percentage of the final settlement. These percentages vary by state, with Texas capping fees at 10% and Florida allowing up to 20% for standard claims.

One common pitfall is the lack of fee transparency between adjusters and clients. Clear understanding of fee arrangements, including potential hidden costs and deductibles, is essential before entering into any agreement.

State regulations govern these fee structures to protect policyholders, making it imperative to verify that proposed fees align with local laws. Careful review of contracts, understanding payment terms, and discussing fee arrangements openly can help avoid misunderstandings and guarantee a more successful claims process.

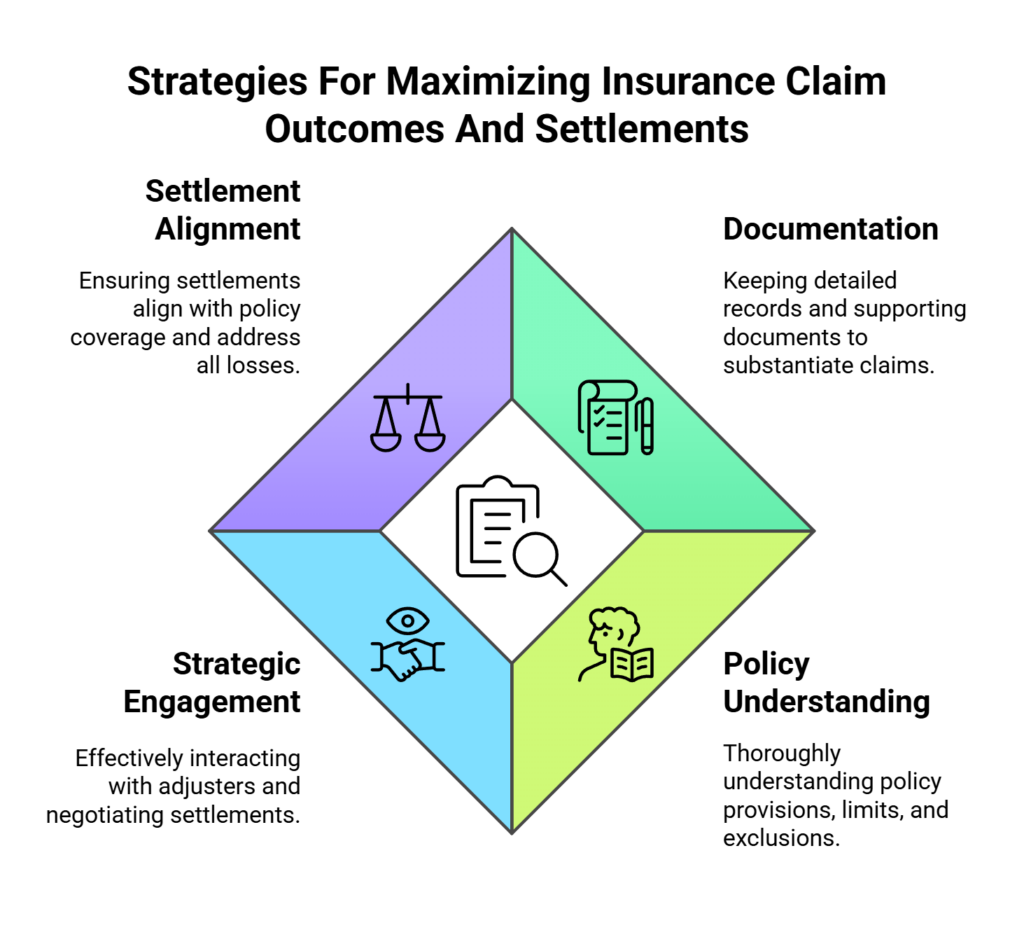

Maximizing Your Insurance Claim Benefits and Coverage

When policyholders understand their insurance coverage and take proactive steps to manage claims, they can substantially enhance their potential claim benefits. Effective claim planning involves thorough documentation of losses, complete understanding of policy provisions, and strategic engagement with insurance adjusters.

Benefit maximization requires meticulous attention to policy details, including coverage limits, endorsements, and exclusions.

Getting the most from your insurance means carefully reviewing every aspect of your policy coverage and limitations.

Policyholders should maintain detailed records of all damage, collect supporting documentation, and prepare complete proof of loss statements. Understanding contractual obligations and deadlines is essential for avoiding claim delays or denials.

For complex claims, engaging a licensed public adjuster early can provide valuable expertise in handling the claims process and negotiating settlements. However, policyholders must verify credentials and understand fee structures before engagement.

Settlement reviews should confirm alignment with policy coverage and adequately address all documented losses, including additional costs like temporary living expenses when applicable.

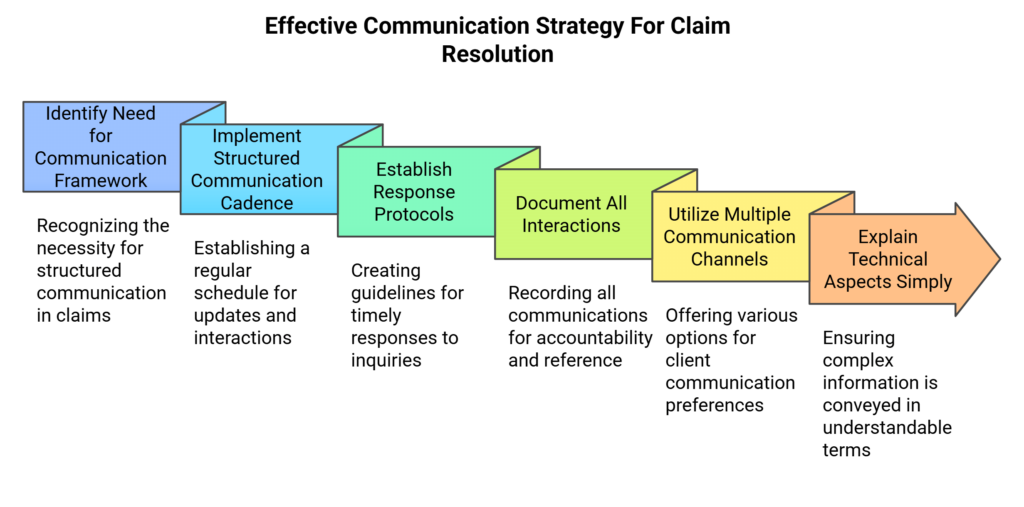

Building an Effective Communication Strategy With Your Adjuster

Successful claim resolution hinges on establishing an effective communication framework between policyholders and their public adjusters. This requires implementing a structured communication cadence that guarantees consistent information flow and accountability throughout the claims process.

A well-designed strategy incorporates clear response protocols, defining how and when adjusters will address client inquiries and provide status updates.

Essential elements include establishing initial expectations, documenting all interactions, and utilizing multiple communication channels to accommodate client preferences. Technical aspects of claims must be explained in plain language, while maintaining professional representation standards.

The framework should emphasize transparency in fee structures, policy interpretation, and claim progress reporting.

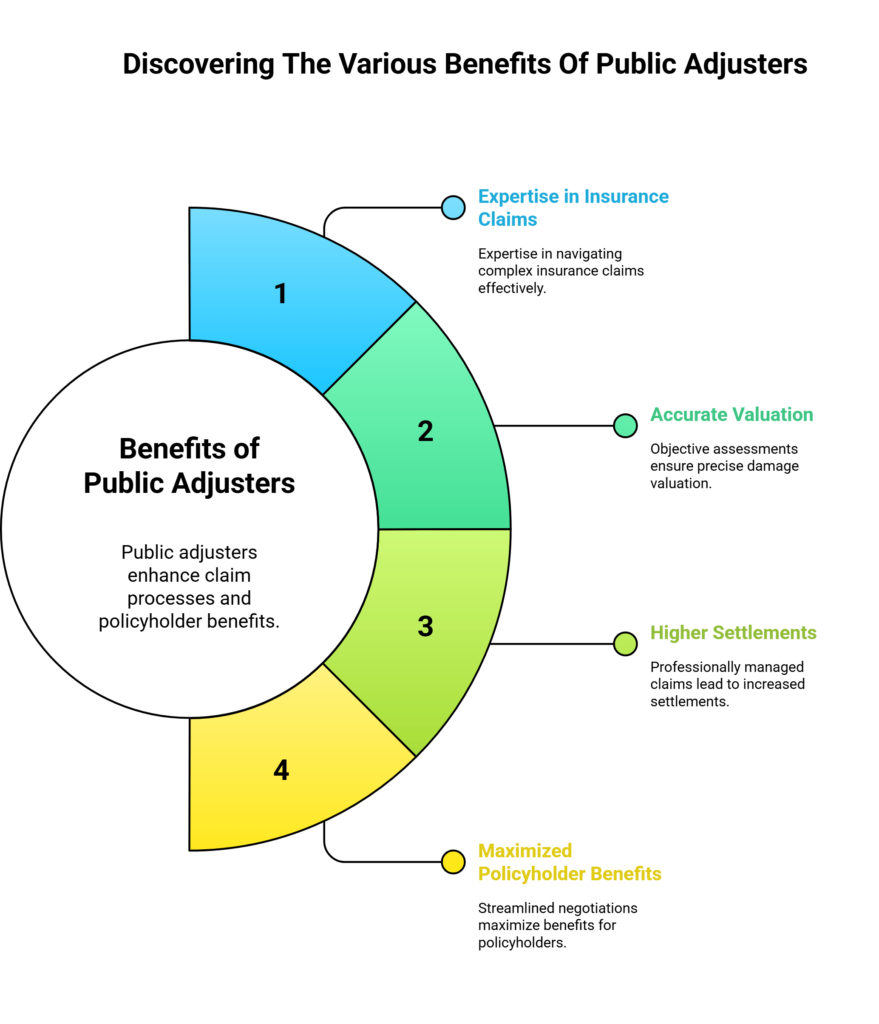

The Benefits Of Consulting A Public Adjuster

Public adjusters provide essential expertise in maneuvering complex insurance claims through their thorough understanding of policy language and industry regulations.

Their objective damage assessments and documentation methods help guarantee accurate valuation while removing emotional bias from the claims process.

Research demonstrates that professionally managed claims typically result in higher settlements, with public adjusters efficiently streamlining negotiations and paperwork to maximize policyholder benefits.

Expertise In Insurance Claims

Handling complex insurance claims requires deep expertise in policy interpretation and claims processing procedures. Public adjusters provide expertise assessment across multiple areas, including policy benefits, regulatory compliance, and settlement negotiations. Their specialized knowledge transfer helps policyholders navigate complex claims while avoiding common pitfalls in documentation and damage assessment.

This expertise translates into tangible benefits through higher settlement amounts and expedited claims processing. Public adjusters leverage their understanding of insurance company tactics and policy nuances to guarantee thorough coverage of damages.

Their proficiency in coordinating with experts, managing documentation, and negotiating with insurers dramatically reduces the administrative burden on policyholders. Studies consistently demonstrate that claims handled by public adjusters result in substantially higher settlements compared to those managed independently.

Objective Damage Assessment

When policyholders face property damage claims, objective assessment serves as the cornerstone of fair settlements and complete coverage. Public adjusters implement systematic damage mapping techniques and standardized assessment protocols to guarantee thorough documentation of all losses.

These professionals conduct thorough on-site inspections, utilizing advanced technology and expert consultations to identify both obvious and concealed damages. Their independent evaluations eliminate conflicts of interest, as they work solely for the policyholder’s benefit.

Through detailed documentation, photographic evidence, and precise cost estimations, public adjusters strengthen the negotiating position during claim settlements.

The unbiased nature of their assessment, combined with their expertise in policy interpretation, often leads to higher settlement amounts and faster claim resolutions while reducing potential disputes with insurance carriers.

Streamlined Claim Process

Insurance claim navigation represents one of the most challenging aspects of property damage recovery, making streamlined processes essential for ideal outcomes. Public adjusters facilitate process optimization through systematic management of complex documentation, policy interpretation, and communication channels with insurance providers.

Their expertise in time management substantially expedites claim resolution by efficiently handling multiple aspects simultaneously. This includes thorough damage documentation, detailed policy analysis, and strategic negotiation with insurers.

The professional oversight they provide guarantees that each phase of the claim proceeds according to established protocols, minimizing delays and potential complications. Their ability to simplify complex insurance terminology while maintaining clear communication channels creates a more efficient claims experience, allowing policyholders to focus on recovery rather than administrative complexities.

Higher Claim Payouts & Settlements

The engagement of public adjusters consistently yields substantial financial advantages for policyholders during insurance claim settlements.

Through exhaustive Settlement Analysis, these professionals identify overlooked damages and evaluate repair costs with precision, ultimately maximizing claim values.

Statistical evidence demonstrates markedly higher payouts for those utilizing public adjuster services, particularly in catastrophic cases where increases can reach 747%.

The Payout Benefits stem from public adjusters’ expert knowledge of policy complexities and strategic claims preparation.

Operating on contingency fees ranging from 5% to 20%, their compensation structure aligns with policyholder interests, motivating thorough damage assessments and aggressive advocacy.

Despite fee considerations, research indicates that claimants typically receive substantially higher net settlements compared to those handling claims independently.

About The Public Claims Adjusters Network (PCAN)

Professional networks stand at the forefront of public claims adjusting, with PCAN emerging as a significant organization connecting licensed adjusters across multiple jurisdictions.

Public adjusting networks like PCAN create vital connections between licensed professionals, enabling seamless claims handling across jurisdictional boundaries.

The network benefits extend beyond simple association, offering vital resources and standardized practices that enhance the quality of claims management across diverse geographic coverage areas.

- Access to extensive professional resources and industry expertise

- Enhanced capability to handle complex, multi-jurisdictional claims

- Strict adherence to professional standards and best practices

- Expanded reach through established adjuster partnerships

PCAN facilitates connections between qualified public adjusters and policyholders while maintaining high professional standards.

This network approach guarantees member adjusters stay current with industry regulations and continuing education requirements. By leveraging collective expertise and shared resources, PCAN members can more effectively navigate complex claims processes and deliver ideal outcomes for policyholders, particularly in cases involving multiple coverage layers or cross-state considerations.