Wondering what public adjusters charge? Let’s break down their fees in a way that won’t make your head spin! Public adjusters typically charge a percentage of the total settlement amount, usually ranging from 5% to 15%. This fee structure means that the more successful they are in negotiating your claim, the more they earn. Understanding how public adjusters are compensated can help you gauge the potential value they bring to your insurance claim process while ensuring that their interests align with yours.

Think of public adjusters like your insurance settlement advocates – they’ll fight for your claim, but their expertise comes at a price. Most charge a percentage of your final settlement, typically ranging from 5% to 40%, with the sweet spot falling between 15% and 25% for typical claims.

Your location plays a big role here. Some states keep things in check with fee caps – we’re talking 10% to 12.5% maximum. Got a major claim over $100K? You might snag a better deal, with percentages dropping to 10-20%. Smaller claims, however, might see higher rates up to 40% since they require similar effort but yield less payout.

Beyond percentage-based fees, some adjusters offer different payment structures. You could encounter hourly rates ($325-$750), flat fees, or contingency arrangements where they only get paid if you win. It’s like choosing between a buffet or à la carte menu – each has its perks depending on your situation.

Before you sign on the dotted line, make sure to check your state’s specific regulations. These rules are your safety net, ensuring you don’t overpay while getting the expert help you need for your insurance claim.

Key Takeaways

Want to know what public adjusters charge? Let’s break down the real costs – no sugar coating!

Think of public adjusters like your insurance claim champions who work on a success-fee basis. They typically earn a percentage of your settlement, similar to how real estate agents get paid when your house sells. They navigate the complexities of the claims process, ensuring that you receive the maximum compensation you are entitled to. This performance-based model aligns their interests with yours, providing motivation to advocate fiercely on your behalf. Essentially, how public adjusters receive payment allows them to prioritize your needs while alleviating the stress of dealing with insurance companies.

The fee landscape varies wildly across states – Texas keeps it tight at 10%, while Florida allows up to 20% during regular periods (this can change during disasters, so keep your eyes peeled!).

Interestingly, many adjusters use a sliding scale approach. Smaller claims might see higher percentages (25-40%), while bigger claims over $100,000 often come with more modest fees (10-20%). It’s like bulk buying – the more substantial your claim, the better the rate!

Looking for basic services? You’re looking at around 12.5% for straightforward claims. Need the premium treatment? Some adjusters charge hourly rates that could rival top attorneys, ranging from $325-$750.

Here’s the kicker – even with these fees, policyholders working with public adjusters often walk away with 20-50% higher settlements. It’s like having a skilled negotiator in your corner who knows all the insurance industry’s tricks and turns.

Remember: Fees aren’t just numbers – they’re investments in maximizing your claim’s potential. Choose wisely!

Understanding Public Adjuster Fee Structures

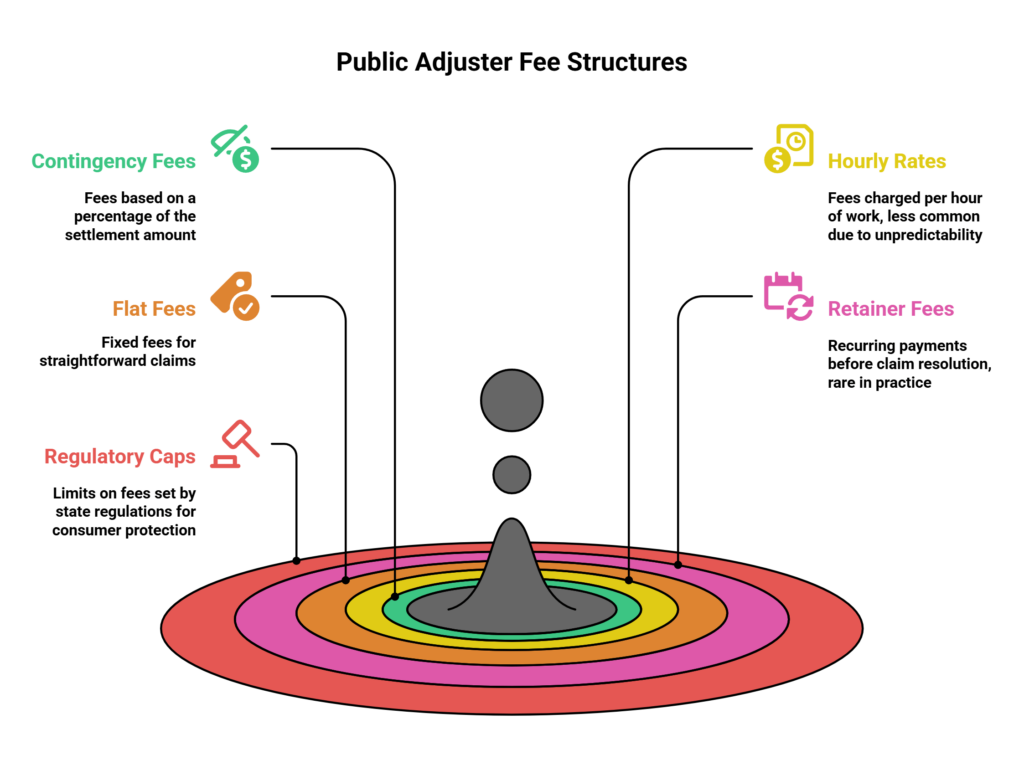

While public adjusters provide valuable services in insurance claim negotiations, their fee structures can vary substantially based on several factors and local regulations.

The most prevalent payment models in the industry are contingency fees, which are calculated as a percentage of the final settlement amount.

Less common fee structures include hourly rates, flat fees, and retainer arrangements.

Hourly rates are generally avoided due to the unpredictable nature of claim negotiation timelines, while flat fees may be suitable for smaller, straightforward claims.

Retainer fees, though rare, require recurring payments before claim resolution.

State regulations play a vital role in determining fee structures, with many jurisdictions implementing caps to protect consumers.

These regulatory frameworks guarantee transparency and prevent excessive charges, though specific limitations vary by state.

The complexity of claims, adjuster experience, and type of property damage can all influence the final fee arrangement.

Professional adjusters must maintain proper commission rates in accordance with local regulations while providing fair service to clients.

During state-declared emergencies, fees are capped at 10% of the final settlement for the first year.

Average Rates and Common Pricing Models

Building upon the regulatory framework that governs fee structures, public adjusters typically operate within established pricing models that reflect industry standards and market conditions. Rate comparisons reveal that hourly fees range from $325 to $750, while contingent fees generally fall between 10% to 12.5% of the settlement amount. Most public adjusters operate on 100% contingency fees, except those practicing in Louisiana.

| Service Tiers | Small Claims | Large Claims |

|---|---|---|

| Basic | 12.5% | 10% |

| Standard | $400/hr | $500/hr |

| Premium | Flat Fee | Custom Rate |

The pricing model chosen often depends on claim complexity, location, and market competition. Urban areas typically command higher rates than rural regions, while more experienced adjusters charge premium fees. Larger claims frequently benefit from economies of scale, resulting in lower percentage-based fees. Many adjusters offer flexible payment structures, including retainers for complex cases and flat fees for specific services, allowing clients to select the most suitable arrangement for their circumstances. In Texas, public adjuster fees are strictly regulated and cannot exceed 10% of the total claim settlement.

Geographical Differences in Public Adjuster Costs

The geographical landscape of public adjuster fees reveals significant variations across different states and regions in the United States. Regional differences are evident in state-mandated fee caps, with Texas limiting charges to 10% while Florida allows up to 20% for standard claims and 10% during disasters. Higher settlement amounts commonly justify these varying fee structures across regions.

State comparisons highlight Pennsylvania‘s unique approach, implementing a sliding scale based on claim size, where smaller claims may incur fees between 20-30%, while larger claims see reduced percentages.

These variations reflect each state’s response to local economic conditions, disaster frequencies, and consumer protection needs. The National Association of Insurance Commissioners (NAIC) Model Act supports this state-level flexibility, recognizing that regional factors substantially influence appropriate fee structures. States maintain individual regulatory frameworks, adjusting their caps and requirements based on specific market conditions, consumer complaints, and the need to balance adjuster compensation with policyholder protection. Working with PCAN Network adjusters ensures compliance with these varying state regulations while maintaining the highest professional standards across all regions.

The Impact of Experience on Public Adjuster Fees

Experienced public adjusters command higher fees due to their proven track record of handling complex claims efficiently and securing larger settlements.

Their industry knowledge and expertise often justify rates ranging from $325 to $750 per hour, particularly when managing intricate cases that require specialized skills.

While contingency fees typically range from 5-20% of the final settlement, these professionals bring valuable expertise to complex property damage assessments.

The value of seasoned adjusters lies in their ability to expedite claim processing and maximize payouts, ultimately offsetting their premium fees through improved settlement outcomes.

Studies show that public adjuster involvement typically increases insurance claim settlements by 20-50% compared to claims handled without professional assistance.

Expertise Drives Higher Rates

Professional expertise substantially influences public adjuster fee structures, with seasoned practitioners commanding premium rates that reflect their advanced knowledge and proven track record.

Specialty expertise in complex claims typically warrants hourly rates between $325 and $750, while contingency fees range from 10% to 20% of settlements.

This knowledge valuation is often justified by experienced adjusters’ ability to secure higher settlements and process claims more efficiently.

Geographic location further impacts fee structures, with urban markets generally commanding higher rates than rural areas.

Despite higher upfront costs, experienced adjusters’ proficiency in maneuvering through intricate claims often results in more favorable settlements, effectively offsetting their premium fees.

State regulations guarantee these rates remain within legal parameters while protecting consumer interests.

Unlike claims management systems used by insurance company adjusters, public adjusters rely heavily on independent repair estimates and comprehensive documentation to justify their settlement demands.

Public adjuster involvement typically leads to settlements that are 10-15% higher than claims filed without professional assistance.

Value of Industry Knowledge

Industry knowledge represents a foundational element in determining public adjuster fees, with extensive experience directly correlating to higher compensation rates and superior claim outcomes. The value of knowledge transfer from seasoned adjusters proves essential in complex claims, where experience value directly impacts settlement amounts. This expertise typically commands fees ranging from 5% to 20% of the settlement, varying by jurisdiction and claim complexity.

| Experience Level | Typical Fee Range | Key Value Drivers |

|---|---|---|

| Entry Level | 5-10% | Basic Claims |

| Intermediate | 10-15% | Policy Expertise |

| Advanced | 15-20% | Complex Cases |

| Expert | 20%+ | Specialized Work |

State regulations, such as the 10% cap in Texas and 20% in Florida, provide structure while recognizing the importance of professional expertise in claims management.

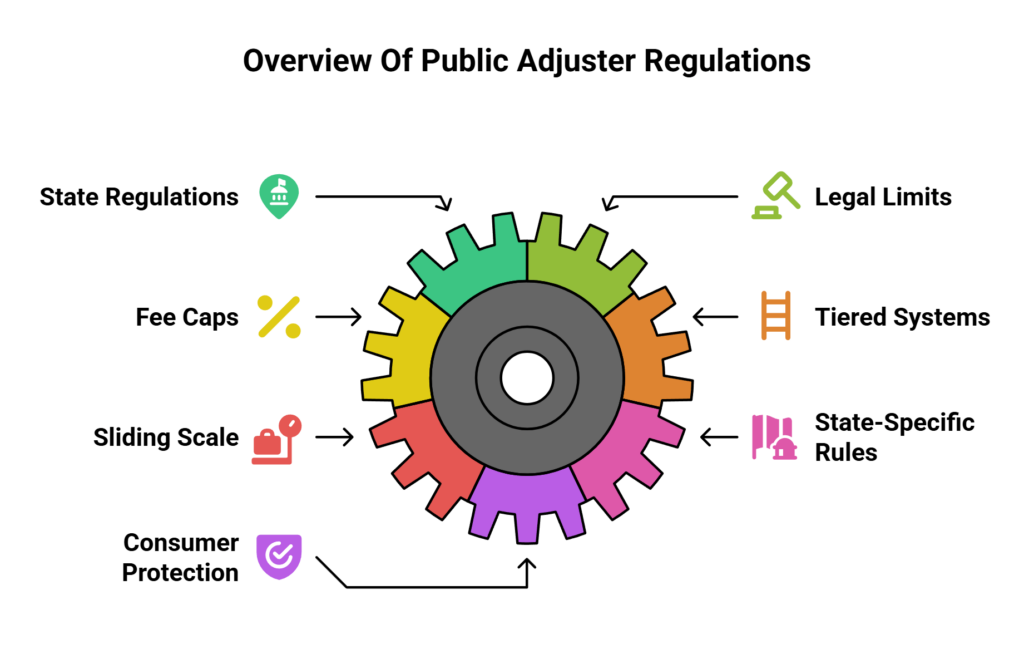

State Regulations and Legal Fee Limits

While public adjusters provide valuable services across the United States, their fees are subject to varying state regulations and legal limits that protect consumers from excessive charges. Fee caps differ dramatically among jurisdictions, with some states implementing strict controls while others maintain more flexible approaches.

Several states enforce specific fee caps, such as Texas and Illinois, which limit charges to 10% of the claim settlement for both residential and commercial properties.

Public adjusters face strict fee regulations in states like Texas and Illinois, where charges cannot exceed 10% of settlement amounts.

Florida implements a tiered system, capping fees at 10% during the first year following a state emergency declaration, increasing to 20% thereafter. Pennsylvania utilizes a sliding scale based on claim size, with higher percentages for smaller claims.

Some states, like Arkansas, prohibit public adjusters entirely, while others like Kansas restrict their services to commercial claims. These legal requirements guarantee transparency through mandatory written contracts detailing fee structures and payment terms.

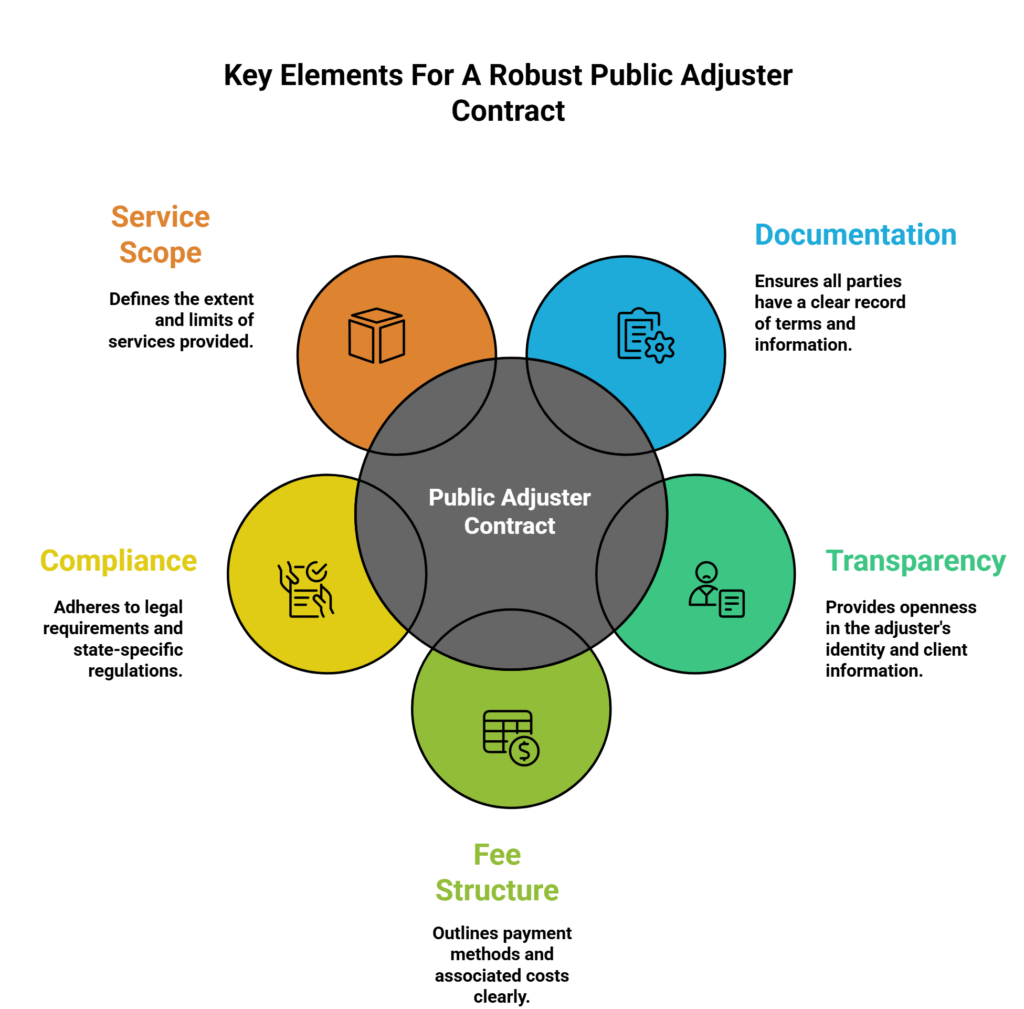

What Your Contract Should Include

A thorough public adjuster contract serves as the foundation for a successful claims process, protecting both the adjuster and the policyholder through detailed documentation of services, fees, and responsibilities.

Contract transparency requires clear documentation of the adjuster’s full name, address, and license number on every page, along with complete client information.

The agreement must specify the fee structure, whether contingency-based, hourly, or flat rate, and outline all associated costs. Legal requirements mandate inclusion of cancellation rights, typically within 72 hours, and conflict of interest disclosures.

The contract should detail service scope, timeframes, and accountability measures, including itemized billing procedures and dispute resolution protocols.

State-specific regulations may require additional elements such as surety bonds or separate disclosure documents.

To guarantee compliance and protect all parties, the contract must secure formal signatures and maintain proper documentation according to state guidelines.

Evaluating Cost vs. Benefit When Hiring an Adjuster

The decision to hire a public adjuster requires careful evaluation of costs versus potential benefits, as fee structures can substantially impact insurance claim settlements. When conducting a value comparison, consider that while fees typically range from 10% to 40% of the settlement, the adjuster’s expertise often leads to higher payouts that can offset these costs.

Large claims over $100,000 typically command lower percentage fees (10-20%) and may justify professional representation due to potential settlement increases. However, smaller claims face higher percentage rates (25-40%), potentially making self-representation more economical.

The cost-benefit analysis should also factor in time savings, stress reduction, and the adjuster’s experience level. Urban areas generally command higher rates than rural locations, and state regulations may cap maximum allowable fees, such as New York’s 12.5% limit.

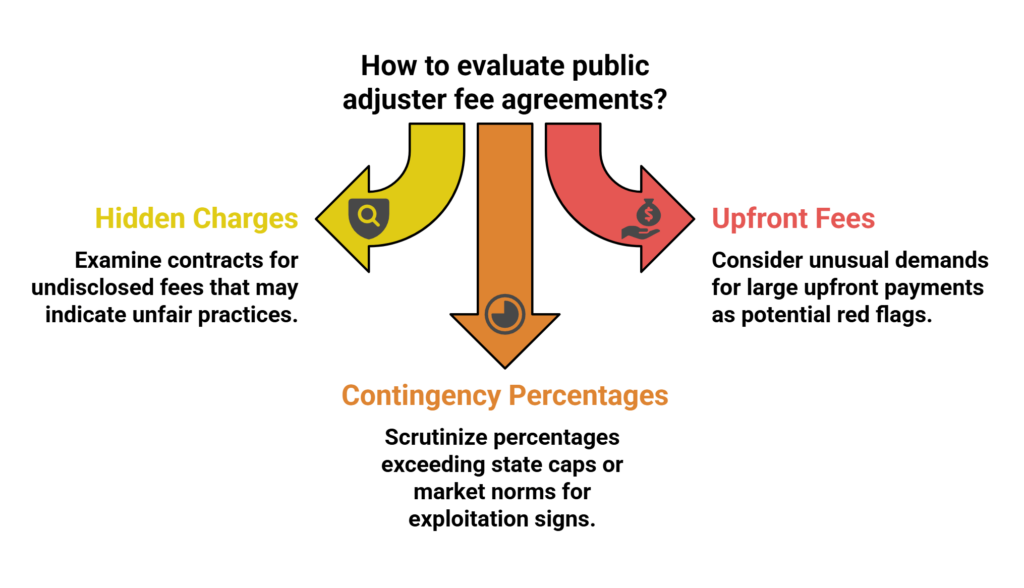

Red Flags and Warning Signs in Fee Agreements

When evaluating public adjuster fee agreements, clients should carefully examine contracts for hidden charges that may not be prominently disclosed in initial discussions.

Unusual payment requirements, such as demands for large upfront fees or full payment before services are rendered, often indicate questionable practices that deviate from industry standards.

Fee agreements containing contingency percentages that exceed state-regulated caps or seem unusually high compared to market norms warrant additional scrutiny and may signal potential exploitation.

Hidden Charges to Watch

Traversing public adjuster fee agreements requires careful attention to potential hidden charges and warning signs that could impact the final cost of services.

When reviewing expense breakdowns and setup policies, clients should be vigilant about additional fees beyond standard commissions.

Common hidden charges include:

- Third-party expert consultation fees

- Document processing and administrative costs

- Specialized expertise surcharges for specific claim types

Public adjusters must transparently disclose all fees upfront according to state regulations. Legitimate firms typically avoid requesting advance payments or non-refundable retainers.

Additional red flags include complex fee structures, unnecessary services, and the absence of written agreements detailing all charges. Clients should scrutinize any fees outside standard commission rates, particularly when they appear unrelated to the core claims process.

Unusual Payment Requirements

Carefully evaluating payment requirements in public adjuster contracts can reveal potential warning signs of problematic fee agreements.

Key concerns include contracts lacking transparency in fee structures, unclear payment verification processes, and retainer agreements that deviate from standard industry practices.

Policyholders should be wary of arrangements requiring pre-settlement payments or those imposing additional fees for basic services.

Red flags often appear in contracts that fail to specify maximum fee percentages allowed by state law or include arbitrary deductions from settlements.

Particularly concerning are payment schedules that diverge from traditional contingency-based models and contracts demanding public adjusters be named as co-payees without valid justification.

These unusual requirements may indicate non-compliance with state regulations or attempt to circumvent standard consumer protections.

Excessive Contingency Percentages

Identifying excessive contingency percentages represents an essential step in evaluating public adjuster fee agreements.

While state regulations establish capped margins to protect consumers, some adjusters may attempt to charge rates that exceed reasonable thresholds.

Industry experts warn against fees approaching or surpassing 30%, as these could indicate potential fraudulent percentages or inflated claims.

Key warning signs of excessive contingency fees include:

- Rates markedly higher than state-mandated caps (e.g., above 20% in Florida)

- Unexplained fee increases during the claims process

- Percentages that deviate substantially from the typical 10-12.5% industry standard

States implement varying fee restrictions, with Texas maintaining a 10% cap while other jurisdictions permit up to 40%.

These regulatory differences highlight the importance of understanding local guidelines when reviewing fee structures.

The Benefits Of Consulting A Public Adjuster

Consulting a public adjuster provides valuable expertise in handling complex insurance claims while ensuring objective damage assessments.

Their professional knowledge helps streamline the claims process through proper documentation and skilled negotiation with insurance companies.

Public adjusters often secure higher claim settlements by thoroughly identifying damages and leveraging their understanding of policy terms and entitlements.

Expertise In Insurance Claims

Insurance claim expertise represents a cornerstone benefit of working with public adjusters, who bring specialized knowledge in policy interpretation, claims processing, and settlement negotiations.

Their professional certification and thorough policy analysis skills guarantee accurate interpretation of complex insurance documents and favorable claim outcomes.

Public adjusters excel in three critical areas:

- Detailed documentation and evidence gathering to support claims

- Strategic negotiation with insurance companies to maximize settlements

- Recognition of hidden or overlooked damages that increase claim value

Their thorough understanding of state regulations and legal standards strengthens their ability to advocate effectively for policyholders.

This expertise particularly benefits those facing complex claims, large-scale losses, or disputed settlements, where professional guidance can substantially impact the final payout amount.

Objective Damage Assessment

A thorough objective damage assessment stands as one of the most valuable services provided by public adjusters. Through exhaustive inspections and precise measurements, these professionals document all visible and hidden property damage independently of insurance companies.

Their detailed evaluation process includes visual documentation of every affected area, guaranteeing no damage goes unnoticed. Public adjusters excel at identifying concealed issues that might otherwise be overlooked, such as structural compromises or developing mold problems.

This thorough approach typically results in higher settlement amounts and safeguards all necessary repairs are properly accounted for. Their expert reporting and documentation serve as powerful tools during insurance negotiations, helping policyholders receive fair compensation based on actual damages rather than rushed estimations.

Streamlined Claim Process

When property owners face complex insurance claims, engaging a public adjuster provides significant advantages through streamlined claims management.

Their expertise facilitates efficient process automation and digital documentation, reducing bureaucratic delays while ensuring thorough claim support.

Public adjusters implement systematic approaches that optimize claim resolution through:

- Centralized communication management, serving as a single point of contact between all parties

- Exhaustive digital documentation systems that organize and track all claim-related evidence

- Automated tracking solutions that monitor claim status and facilitate timely responses

This streamlined approach allows property owners to focus on recovery while the public adjuster handles technical aspects, negotiations, and documentation requirements.

Their professional oversight typically results in more accurate valuations and expedited settlements, maximizing coverage benefits for the policyholder.

Higher Claim Payouts & Settlements

Statistical evidence consistently demonstrates that engaging a public adjuster leads to substantially higher insurance claim settlements for policyholders. Studies reveal that catastrophic claims handled by public adjusters result in payouts averaging 747% higher than those without representation, while non-catastrophic claims see a 574% increase.

This significant payout maximization stems from public adjusters’ expertise in policy interpretation, thorough damage assessment, and skilled negotiation tactics.

Settlement analysis indicates that their exhaustive understanding of insurance complexities enables them to identify overlooked damages and guarantee all legitimate costs are included in claims. Their contingency-based fee structure further motivates them to secure the highest possible settlements, as their compensation directly correlates with the final payout amount, all while operating within state-regulated fee caps.

About The Public Claims Adjusters Network (PCAN)

Professional public adjusters seeking industry connections and resources may find limited publicly available information about the Public Claims Adjusters Network (PCAN), as specific details about this organization’s structure, membership, or operations are not well documented.

However, public adjusters typically operate within established professional networks that provide essential support and resources for their practice. These networks often offer training programs, access to industry research, and a platform for sharing best practices among peers. As a result, the effectiveness of public adjusters is enhanced, as they can stay informed about the latest trends and regulations impacting their field. In various forums, public adjusters explained how collaboration within these networks leads to more robust claims management and better outcomes for clients seeking compensation.

While specific Network Benefits and Membership Structure details for PCAN remain unclear, public adjusters generally participate in professional organizations that offer:

- Licensing compliance support and regulatory updates

- Access to industry-specific training and educational resources

- Networking opportunities with experienced professionals across multiple jurisdictions

These organizations help guarantee public adjusters maintain professional standards while serving both residential and commercial clients. They provide guidelines and ethical frameworks that ensure adjusters act in the best interest of their clients during the claims process. Understanding when to hire a public adjuster can significantly impact the outcome of an insurance claim, as these professionals possess the expertise to maximize settlements and navigate complex insurance policies effectively.

Most networks require members to hold appropriate state licenses and maintain compliance with local regulations, contributing to the industry’s credibility and effectiveness in representing policyholder interests during insurance claims.