Is your metal roof showing battle scars from Mother Nature's ice pellets? Let's talk about hail damage – it's more than just a few dimples on your rooftop!

When hailstones bigger than a quarter come crashing down, they can leave your metal roof looking like a golf ball practice session gone wrong. Think dents, dings, and in severe cases, structural weak spots that could compromise your home's protective shield.

Got damage? You're probably wondering about the hit to your wallet. Minor to moderate repairs typically start around $1,000, while extensive damage might set you back $3,000. In worst-case scenarios where you're looking at a full replacement, costs can climb north of $30,000.

Here's the silver lining: your homeowner's insurance likely has your back. But navigating claims can feel like solving a puzzle blindfolded. That's where public adjusters come in – they're like your personal damage detectives, often securing better settlements than you might get flying solo with your insurance company.

Want to stay ahead of the game? Having a pro assess your roof's condition after a hailstorm isn't just smart – it's essential for maintaining your home's defense system. Remember, what looks like a harmless dimple today could become tomorrow's leak if left unchecked.

Smart homeowners know: catching and addressing hail damage early keeps both your roof and your savings account weatherproof for the long haul.

Key Takeaways

Think your metal roof just took a beating from Mother Nature's ice cubes? Let's explore what hail can do to your roofing investment and how to handle it like a pro.

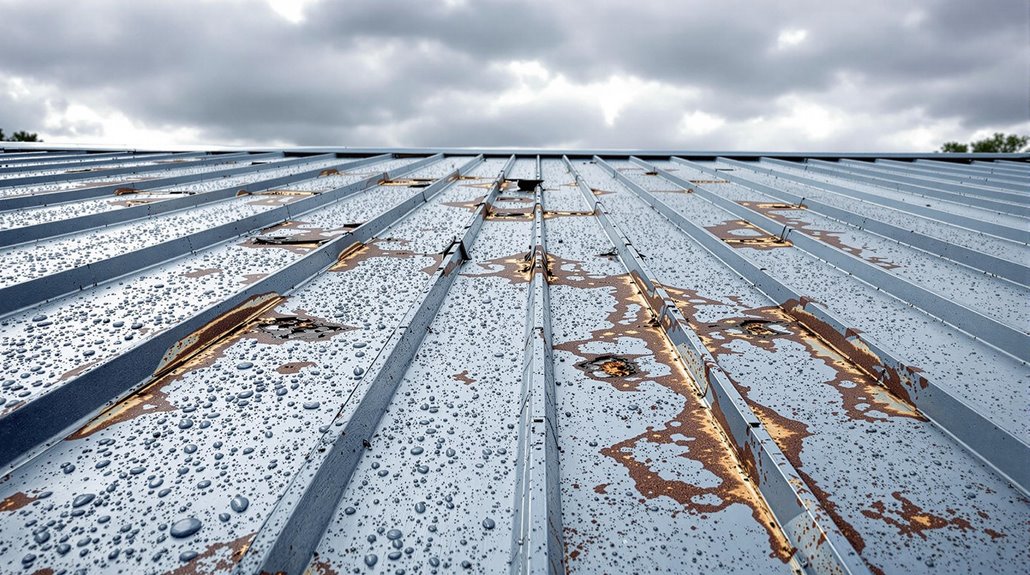

When hailstones pack a punch (especially those bigger than a quarter), they leave their calling cards: nasty dents, scratches that look like cosmic claw marks, and patches where paint decided to take an early retirement. Don't play rooftop detective yourself – get a certified inspector to assess the situation safely.

Your wallet's burning question: "What's this going to cost me?" Minor battle scars might set you back $300, while major damage could reach $3,000. For those "time-for-a-fresh-start" scenarios, a complete roof replacement ventures into the $15,000-$45,000 territory.

Here's the silver lining: your homeowner's insurance likely has your back. You'll typically encounter two coverage flavors: Actual Cash Value (accounting for age and wear) or Replacement Cost Value (the whole enchilada). Pro tip: partnering with a public adjuster often leads to beefier settlements than flying solo with the insurance company's initial offer.

Damage comes in three flavors: surface denting (like dimples on a golf ball), cosmetic wear (think weathered leather), and structural issues (the serious stuff that compromises your roof's integrity). Each battle scar requires its own healing strategy, so don't assume one fix fits all.

Does Hail Damage Metal Roofs?

Metal roofs can sustain damage from hailstones larger than 1 inch in diameter, with the severity depending on factors like material thickness, protective coatings, and roof pitch.

Hail-resistant metal roofs are available with specialized coatings, reinforced structural support, and thicker gauge materials that can withstand impacts from hailstones up to 2.5 inches in diameter.

Regular inspections and maintenance of metal roofs help identify potential vulnerabilities and guarantee peak performance during severe weather events.

Professional damage assessments from qualified contractors are essential to identify both visible and concealed hail impacts that could affect insurance claims.

Metal roof repairs after hail damage can range from minor fixes at $5,000 to complete replacements exceeding $20,000 depending on severity. When evaluating the best course of action, homeowners should consider the extent of the damage along with their budget. It’s essential to weigh the costs and benefits involved in roof replacement vs repair options, as a complete replacement might offer greater long-term value and durability. Consulting with a professional can provide insight into the most cost-effective solution tailored to the specific situation. Homeowners should first assess the extent of the damage and consult with a professional roofer to identify the necessary repairs. It’s also essential to understand your policy, as this can significantly impact your out-of-pocket expenses. For those looking to navigate the claims process effectively, ‘damaged roof insurance coverage explained‘ can provide valuable insights into what costs may be covered.

What Size Hail Will Damage A Metal Roof?

While most metal roofs demonstrate excellent resilience against severe weather, hailstones exceeding 1 inch in diameter can potentially cause damage to these surfaces. The hail size impact directly correlates with metal roof durability, with larger hailstones posing greater risks of denting or deformation. Early detection of dark granule deposits can help assess the severity of hail damage on metal roofs. Public insurance adjusters can increase claim settlements by 300-400% for metal roof hail damage.

| Hail Size | Typical Damage | Risk Level |

|---|---|---|

| Under 1" | Minimal to none | Low |

| 1" to 1.5" | Surface denting | Moderate |

| 1.5" to 2" | Visible dents | High |

| Over 2" | Severe denting | Critical |

The roof's susceptibility to damage also depends on factors such as metal thickness, with 22-gauge metal offering superior protection compared to 29-gauge. Steeper roof slopes can help minimize damage by reducing the direct impact force of falling hailstones, while proper structural support enhances overall resistance to denting.

Are There Hail Resistant Metal Roofs?

Indeed, hail-resistant metal roofs exist and offer superior protection against severe weather conditions compared to traditional roofing materials. These systems combine enhanced material thickness, specialized coatings, and engineered designs to maximize impact resistance and hurricane resistance.

Modern metal roofing options feature varying levels of hail protection, with some achieving the highest impact resistance ratings available. Paintless dent repair may be possible for minor hail damage on metal roofs.

The effectiveness of hail-resistant metal roofs depends on several factors, including gauge thickness, protective treatments, and proper maintenance techniques.

Steeper roof pitches can provide additional protection by deflecting hailstones more effectively.

While no roof is completely impervious to extreme hail damage, metal roofing systems with proper impact ratings and regular maintenance can considerably minimize potential damage, leading to reduced repair costs and lower insurance premiums over time.

Installing metal roofs with hail-resistant materials can qualify homeowners for substantial insurance premium discounts.

Common Types Of Hail Damage To Metal Roofing

Most metal roofing systems are susceptible to three primary categories of hail damage: denting, cosmetic deterioration, and structural compromise. The severity and type of damage depend on factors including hailstone size, roof slope, and metal gauge thickness.

| Damage Type | Primary Indicators | Common Solutions |

|---|---|---|

| Denting | Surface depressions | Dent repair, panel replacement |

| Cosmetic | Paint chips, scratches | Cosmetic restoration, recoating |

| Structural | Punctures, integrity issues | Support reinforcement, full replacement |

Impact location considerably influences damage severity, with flatter surfaces being more susceptible to denting. While structural damage is rare, it requires immediate attention when identified. Steeper roof slopes typically experience less severe damage due to their natural deflection capabilities, while proper support systems can minimize potential structural impacts. Similar to shingle roofs, dark spots or dimples can indicate potential damage requiring professional inspection. Thermal imaging helps identify hidden damage that may not be visible during standard visual assessments.

Warning Signs Your Metal Roof Needs Repairs From Hail Damage

Identifying warning signs of hail damage to metal roofs enables property owners to take swift corrective action and prevent further deterioration. Signs of Dents and structural issues manifest through various visual and functional indicators that require immediate attention.

| Warning Category | Key Indicators | Required Action |

|---|---|---|

| Surface Damage | Visible dents, scratches, coating damage | Professional inspection |

| Structural Issues | Fastener Issues, loose panels, compromised seams | Immediate repair |

| Water Infiltration | Leaks, moisture spots, rust formation | Waterproofing assessment |

| Performance Issues | Reduced drainage, trapped debris, granule loss | System evaluation |

Regular inspection of these warning signs helps maintain roof integrity and prevents costly repairs. Property owners should document visible damage through photographs and contact qualified professionals for thorough assessment, particularly after significant hail events. Similar to window damage, public adjusters can provide unbiased evaluations of metal roof damage to ensure accurate insurance claims. Timestamped photos and detailed written descriptions are essential for documenting metal roof damage before an insurance adjuster's visit.

Does Homeowners Insurance Cover Metal Roof Hail Damage Claims?

Standard homeowners insurance policies typically cover metal roof hail damage, though coverage depends heavily on specific policy terms, deductibles, and exclusions. The type of coverage – Actual Cash Value (ACV) versus Replacement Cost Value (RCV) – considerably impacts claim payouts, with RCV offering more extensive coverage for current replacement costs. Insurance policies classify hail damage either as a named peril or hidden peril, which affects how claims are processed and approved. Consulting a public adjuster can increase settlement amounts by 300-400% compared to initial insurance offers. Weather-related claims like hail damage losses represent over half of all insurance claims for roof systems.

| Coverage Type | Key Considerations |

|---|---|

| Actual Cash Value | Factors in depreciation, lower premiums, reduced payouts |

| Replacement Cost | Full replacement coverage, higher premiums, no depreciation |

| Named Perils | Explicitly listed coverage, specific damage types, clear terms |

Insurance Deductibles, Coverage Limits, & Exclusions For Metal Roof Hail Damage Claims

Understanding your homeowners insurance coverage for metal roof hail damage requires careful attention to policy details, deductibles, and exclusions. Deductible considerations vary by provider, with homeowners responsible for paying this amount before coverage begins. Most policies exclude cosmetic damage while covering functional impairment that affects the roof’s protective capabilities. Homeowners in high-risk geographic zones should carefully review their coverage limits due to increased exposure to severe hail events. The average hail damage claim settlement with public adjuster assistance is $22,266 compared to $18,659 for independently handled claims. Homeowners should explore various roof hail damage repair options to effectively restore their roofs while minimizing out-of-pocket expenses. It’s advisable to obtain multiple estimates from reputable contractors to ensure fair pricing and quality workmanship. Additionally, investing in preventive measures, such as installing impact-resistant roofing materials, may help mitigate future hail damage risks and potentially lower insurance premiums.

| Coverage Element | Key Considerations |

|---|---|

| Deductibles | Must be paid before insurance coverage applies |

| Cosmetic Damage | Generally excluded from coverage |

| Functional Damage | Typically covered if performance impaired |

| Age Restrictions | Coverage may be limited for older roofs |

| Documentation | Detailed evidence required for claims |

Coverage comparisons between insurers reveal varying terms regarding hail damage assessment, claim procedures, and potential premium impacts. Policy conditions may restrict coverage based on roof age, maintenance history, and impact resistance ratings.

Actual Cash Value Vs. Replacement Cost In Relation To Metal Roof Hail Damage

When evaluating insurance coverage for metal roof hail damage, homeowners face a significant choice between Actual Cash Value (ACV) and Replacement Cost Value (RCV) policies. Understanding the key differences helps in making informed coverage decisions.

| Factor | ACV | RCV |

|---|---|---|

| Initial Cost | Lower premiums | Higher premiums |

| Payout Method | Single payment minus depreciation | Two-part payment process |

| Coverage Level | Depreciated value only | Full replacement cost |

| Risk Exposure | Higher out-of-pocket expenses | Lower financial burden |

While ACV advantages include lower premium costs and simpler claim processes, policyholders bear more financial responsibility during replacement. RCV risks primarily involve higher premium costs, but extensive coverage guarantees full replacement without depreciation deductions. Professional assessments showing third-party validation can significantly strengthen both types of claims. The choice ultimately depends on the homeowner's risk tolerance, budget constraints, and the metal roof's current condition. Public adjusters can help maximize settlement amounts for both ACV and RCV claims by advocating solely for the policyholder's interests.

Named Vs. Hidden Perils

Insurance coverage for metal roof hail damage hinges on whether the damage falls under named or hidden perils in the homeowner's policy. While hail damage is typically a named peril with explicit coverage, certain conditions may limit or exclude compensation. Public insurance adjusters can help optimize settlement amounts by providing objective damage assessments. State regulations vary significantly regarding claim filing deadlines, from six months to two years.

| Coverage Aspect | Named Perils | Hidden Perils |

|---|---|---|

| Visibility | Obvious dents and marks | Pre-existing conditions |

| Documentation | Easily photographed | Requires expert assessment |

| Approval Likelihood | Generally covered | Often disputed |

| Claims Process | Straightforward | Complex evaluation |

| Cost Impact | Standard deductible | Possible denial |

Understanding these distinctions is essential as insurers may reject claims involving hidden perils such as poor maintenance or undisclosed pre-existing damage. Professional inspections and thorough documentation help establish whether damage qualifies under named perils coverage, ensuring proper claim processing and appropriate compensation.

Metal Roof Hail Damage Repair Vs. Replacement

Determining whether to repair or replace a hail-damaged metal roof requires careful evaluation of multiple factors to guarantee the most cost-effective and durable solution.

Professional assessors examine key indicators to recommend either targeted repairs for minor damage or complete replacement for severe cases.

Working with public insurance adjusters can lead to settlements up to 800% higher than filing claims independently.

The decision typically depends on:

- Extent of damage – isolated dents versus widespread structural compromise

- Age and condition of existing roof – newer roofs favor repair while aged systems warrant replacement

- Cost comparison between repair and replacement, including long-term maintenance implications

- Insurance coverage and policy terms affecting financial feasibility of each option

Getting independent roofing assessments can help verify damage extent and strengthen your case if an insurance adjuster initially denies your claim.

When To Choose Roof Repair For A Hail Damaged Metal Roof

Making the right choice between repairing or replacing a hail-damaged metal roof depends on several critical factors that property owners must evaluate. The benefits of repairs become apparent when damage is localized and structural integrity remains intact. Key signs needing repairs include surface dents, coating damage, and minor leaks without punctures.

| Decision Factor | Repair Suitable | Replacement Needed |

|---|---|---|

| Damage Extent | Localized areas | Widespread damage |

| Structural Issues | None to minimal | Significant compromise |

| Cost Impact | $1,000-$3,000 | Multiple times higher |

| Insurance Coverage | Usually covered | May require assessment |

When repairs are viable, they offer cost-effective solutions while maintaining warranty compliance. Professional inspection helps identify suitable repair candidates, ensuring proper documentation for insurance claims and long-term maintenance planning.

When To Choose Roof Replacement For A Hail Damaged Metal Roof

Property owners facing extensive hail damage to their metal roofs must evaluate specific critical indicators when deciding if full replacement is necessary. Key roof longevity considerations include the severity of dents, compromised water-shedding capability, and damage to overlapping seams. When structural integrity is greatly compromised, replacement material options should be explored.

| Decision Factors | Repair Indicators | Replacement Indicators |

|---|---|---|

| Damage Extent | Isolated dents | Widespread damage |

| Seam Integrity | Minor disruption | Major compromise |

| Water Protection | Minimal impact | Significant reduction |

| Coating Status | Surface scratches | Deep penetration |

| Age of Roof | Early lifespan | Near end of life |

Professional assessment of these factors, combined with insurance coverage analysis and local climate considerations, determines the most cost-effective long-term solution for maintaining roof protection.

Hail Damage Metal Roof Repair Cost Breakdown

To effectively assess metal roof repair expenses after hail damage, homeowners must consider several key cost factors that influence the final price. The extent of damage directly correlates with repair costs, ranging from minor fixes to complete replacement needs. Understanding these cost tiers helps in planning appropriate metal roof repair strategies and implementing hail damage prevention measures.

| Damage Level | Cost Range | Common Issues | Required Action |

|---|---|---|---|

| Minor | $300-$1,000 | Small dents, punctures | Spot repairs |

| Moderate | $1,000-$3,000 | Multiple dents, leaks | Section replacement |

| Major | $10,000-$30,000 | Structural damage | Full replacement |

| Emergency | Varies | Active leaks, safety hazards | Immediate intervention |

Material costs typically range from $300-$600 per square, while labor rates vary by location and roof accessibility. Insurance coverage can greatly offset these expenses when properly documented.

Hail Damage Metal Roof Replacement Cost Breakdown

Thorough metal roof replacement after hail damage involves substantial financial considerations and strategic planning. Key cost factors include material selection, labor expertise, and structural requirements. Understanding these components helps property owners make informed decisions about roof maintenance and replacement strategies.

| Cost Component | Typical Range |

|---|---|

| Materials | $10,000-$30,000 |

| Specialized Labor | $5,000-$15,000 |

| Equipment Rental | $1,000-$3,000 |

| Permits/Inspections | $500-$1,500 |

| Removal/Disposal | $1,500-$4,000 |

The total investment varies based on roof size, complexity, and regional factors. While initial costs exceed traditional roofing materials, metal roofs offer enhanced durability and potential insurance premium reductions. Regular inspections and documentation of damage help optimize replacement timing and maximize insurance coverage benefits. Additionally, homeowners should consider the long-term savings associated with metal roofing, as they often require fewer roof repair types and costs compared to asphalt or tile alternatives. Understanding the various roof repair types and costs can help in budgeting for future maintenance. Ultimately, investing in a metal roof not only enhances property value but also contributes to long-lasting performance and peace of mind for homeowners.

Insurance Company Adjusters: They Work For The Insurance Company's Benefit … NOT YOURS

Understanding the role of insurance company adjusters represents a substantial factor in maneuvering metal roof hail damage claims.

Insurance adjusters primarily serve their employers' interests, often employing various adjuster tactics to minimize claim payouts. During claim negotiations, they evaluate whether damage affects the roof's functionality rather than just aesthetics.

Key points homeowners should recognize:

- Adjusters focus on identifying grounds for claim denial or reduction based on policy terms

- They may classify damage as cosmetic to avoid coverage under certain policy exclusions

- Documentation and photographs greatly strengthen homeowner positions

- Having an independent roofing expert present during inspections helps guarantee accurate damage assessment

To protect their interests, homeowners should consider engaging a public adjuster or roofing professional to counterbalance the insurance company adjuster's evaluation and enhance their chances of fair claim settlement.

Getting Help From A Public Adjuster: Your Advocate & Ally

Public adjusters serve as independent advocates who work exclusively for the policyholder's benefit when filing metal roof hail damage claims, offering expertise in damage assessment, policy interpretation, and claim negotiation.

These professionals typically charge a percentage of the final settlement amount, usually between 5-15%, and can often secure considerably higher compensation than homeowners might obtain on their own.

Their thorough documentation methods, combined with extensive knowledge of insurance policies and claim procedures, provide a strategic advantage when challenging insurance company adjusters' assessments of metal roof hail damage.

The Role Of Public Adjusters In Hail Damaged Metal Roof Claims

When dealing with hail-damaged metal roofs, a licensed public adjuster serves as a valuable advocate for property owners maneuvering complex insurance claims.

These professionals bring specialized expertise in evaluating metal roof damage, documenting evidence, and negotiating with insurance companies to secure fair compensation.

Public adjuster benefits include thorough damage evaluations, professional documentation, and expert claim negotiation strategies. They conduct detailed inspections to identify all hail-related damage, including subtle dents and potential structural impacts.

Operating independently from insurance companies, public adjusters work solely for policyholders, ensuring unbiased representation throughout the claims process. Their commission-based payment structure aligns with client interests, motivating them to maximize settlement values while maneuvering policy terms, deductibles, and coverage limits effectively.

Benefits Of Using A Public Claims Adjuster For Hail Damaged Metal Roof Repair Or Replacement Claims

Securing proper compensation for hail-damaged metal roofs becomes considerably more manageable through the expertise of a public claims adjuster. These professionals enhance claims process efficiency while guaranteeing thorough damage assessment and fair settlements.

| Public Adjuster Advantages | Policyholder Benefits |

|---|---|

| Expert Damage Assessment | Complete Documentation |

| Policy Interpretation | Maximum Coverage |

| Professional Negotiation | Better Settlements |

| Technical Knowledge | Reduced Stress |

| Claims Process Management | Faster Resolution |

Public adjusters specialize in identifying both visible and hidden hail damage, interpret complex policy language, and negotiate effectively with insurance companies. Their technical proficiency helps counter insurance company disputes about damage scope, while their understanding of depreciation factors guarantees fair valuations. Through methodical documentation and evidence collection, they strengthen claims and expedite the settlement process, ultimately protecting the policyholder's interests.

How Are Public Insurance Adjusters Paid & What Are Their Fees?

Understanding the cost structure of public insurance adjusters helps property owners make informed decisions about representation for their metal roof hail damage claims. Most adjusters operate on contingency-based payment models, typically charging between 5-15% of the final settlement amount. State regulations govern maximum adjusting fees and payment timing, often prohibiting upfront payments.

| Payment Structure | Description |

|---|---|

| Contingency Fee | 5-15% of final settlement |

| Flat Rate | Fixed price for straightforward claims |

| Hourly Rate | Time-based billing for complex cases |

| Payment Timing | After settlement completion |

| Fee Regulations | State-specific maximum limits |

The contingency model aligns the adjuster's interests with the property owner's, as their compensation directly relates to the claim's success. This arrangement guarantees thorough documentation and aggressive negotiation for maximum settlement value.

Public Adjusters Vs. The Insurance Company Adjuster

A fundamental distinction exists between public adjusters and insurance company adjusters in their roles, responsibilities, and allegiances during metal roof hail damage claims. Public adjusters serve as independent advocates working solely for policyholders' interests, while insurance company adjusters represent their employers' interests in minimizing claim payouts.

| Aspect | Public Adjusters | Insurance Company Adjusters |

|---|---|---|

| Allegiance | Policyholder | Insurance Company |

| Primary Goal | Maximize Settlement | Minimize Payout |

| Training | Extensive Independent | Company-Specific |

| Objectivity | Impartial Assessment | Company-Aligned |

Understanding these differences is essential when filing metal roof hail damage claims. Public adjusters benefits include specialized expertise, detailed damage documentation, and stronger negotiating positions. Insurance adjusters limitations stem from their company obligations, potentially affecting claim assessments and settlement offers. This makes public adjusters valuable allies in securing fair compensation for roof damage.

When To Contact A Public Adjuster For Metal Roof Hail Damage

With clear distinctions between adjuster types established, property owners must recognize specific situations that warrant contacting a public adjuster for metal roof hail damage. Public adjuster qualifications become particularly valuable when dealing with extensive damage, stalled negotiations, or claim denials.

| Situation | Challenge | Solution |

|---|---|---|

| Extensive Damage | Difficult damage assessment | Professional documentation and evaluation |

| Stalled Claims | Insurance company resistance | Expert negotiation and policy interpretation |

| Claim Denials | Coverage disputes | Independent assessment and appeals support |

Understanding claims processes becomes critical when insurers dispute damage extent or settlement amounts. Public adjusters provide essential expertise in documenting damage, interpreting policies, and developing effective settlement strategies. Their specialized knowledge proves invaluable when structural damage raises concerns about repair costs or when insurance companies classify significant damage as merely cosmetic.

When to Contact Your Insurance Provider For Metal Roof Hail Damage

Property owners have two primary options when contacting insurance providers about metal roof hail damage: working with a public adjuster or handling the claim independently. Both options come with their own set of pros and cons. When homeowners choose to work with a public adjuster, they can benefit from the expertise of a professional who understands how to navigate the claims process effectively. On the other hand, those who decide to manage the claim themselves may have more control over the process but might struggle with understanding how homeowners insurance covers roof replacement and the specific details involved in filing a successful claim. Ultimately, the choice depends on the property owner’s comfort level and familiarity with insurance procedures.

Public adjusters can manage the entire claims process, including initial contact with insurance companies, documentation, and negotiations on behalf of the property owner.

Those who choose to file independently should contact their insurance provider immediately after documenting the damage and obtaining a professional inspection, following their policy's specific reporting requirements.

If Using A Public Adjuster

The decision to engage a public adjuster should be carefully evaluated when dealing with metal roof hail damage claims. Public adjuster benefits include expert policy interpretation, thorough damage documentation, and skilled claim negotiation strategies with insurance companies.

Consider hiring a public adjuster when insurance companies deny claims, provide insufficient settlement offers, or when damage complexity warrants professional expertise.

While public adjusters charge a percentage of the final settlement, their involvement often results in higher payouts that can offset their fees.

Timing is significant – homeowners should consider engaging a public adjuster after the initial insurance inspection but before signing any repair agreements.

These professionals can provide independent damage assessments, navigate policy exclusions, and handle necessary documentation to strengthen the claim's validity.

If Filing On Your Own

Filing an insurance claim for metal roof hail damage requires careful timing and extensive preparation to maximize the likelihood of claim approval. The insurance claim process should begin with a detailed documentation of the damage through photos, videos, and professional assessment reports.

Key claim filing tips include conducting a thorough post-storm inspection, gathering evidence of the hailstorm event, and reviewing policy coverage specifics before contacting the insurance provider.

Property owners should verify whether their policy covers cosmetic damage versus functional damage, and understand their deductible obligations.

It’s essential to assess if the damage severity warrants a claim by considering the roof’s current condition and age. If the roof is already nearing the end of its lifespan or has had previous repairs, the decision to file a claim may be influenced by the cost-effectiveness of roof wind damage repairs. Homeowners should also take into account the extent of the damage and any potential long-term implications for safety and structural integrity. Ultimately, a thorough evaluation can help determine whether pursuing insurance is a practical choice.

Prompt reporting combined with all-encompassing documentation strengthens the position when filing without third-party assistance.

Filing Process For Hail Damaged Metal Roof Claims Using A Public Adjuster

Working with a qualified public adjuster can streamline the metal roof hail damage claims process through exhaustive documentation and expert negotiation.

A public adjuster conducts thorough inspections while managing all communications with insurance companies to maximize policy benefits.

Key advantages of using public adjusters include:

- Professional assessment of damage extent and accurate valuation of repair costs

- Detailed review of insurance policies to identify all applicable coverage benefits

- Collection and organization of supporting evidence including photos, videos, and expert reports

- Direct handling of negotiations with insurance adjusters to guarantee fair claim settlements

Public Adjuster Thoroughly Inspects & Documents Hail Damage To Your Metal Roof

When facing potential hail damage to a metal roof, engaging a public adjuster provides homeowners with expert documentation and complete inspection services critical for successful insurance claims. Public adjusters employ systematic inspection techniques to identify and document all forms of hail damage, from visible dents to hidden structural issues.

| Inspection Area | Documentation Method |

|---|---|

| Surface Damage | Detailed Photos |

| Hidden Issues | Technical Reports |

| Impact Points | Measurement Data |

The adjuster's thorough assessment includes examining roof slopes, checking for water accumulation points, and identifying potential leak areas. Their expertise guarantees that both obvious and subtle damage is properly recorded, maximizing the likelihood of successful claim resolution. This detailed documentation becomes essential when negotiating with insurance companies and validating the extent of necessary repairs.

Public Adjuster Reviews Policy For Hidden Roofing Coverage & Helps Maximize Policy Benefits

A thorough policy review by a public adjuster serves as the foundation for maximizing insurance benefits on metal roof hail damage claims. Through expert policy interpretation, adjusters identify hidden coverage options and additional endorsements that homeowners might overlook. They analyze coverage limits, exclusions, and depreciation calculations to guarantee extensive claim submissions.

| Policy Review Elements | Benefits to Homeowner |

|---|---|

| Coverage Interpretation | Identifies hidden benefits |

| Exclusion Analysis | Prevents claim denials |

| Endorsement Review | Maximizes compensation |

Public adjusters strategically document damage, collaborate with insurance representatives, and negotiate claim settlements. Their expertise guarantees compliance with policy requirements while maximizing available benefits. When disputes arise, they guide homeowners through the appeal process, supporting claims with thorough documentation and professional assessments of metal roof damage. By providing clear communication and advocating for the homeowner’s interests, public adjusters play a crucial role in simplifying the claims experience. Additionally, they often share roof repair and replacement tips that help property owners make informed decisions about mitigating further damage. This comprehensive approach not only facilitates quicker resolution of claims but also empowers homeowners to maintain the integrity of their properties long after the initial damage has been addressed. By ensuring that every detail is meticulously recorded, public adjusters streamline the roof damage insurance claims process, which can often be overwhelming for homeowners. They provide essential insights that empower clients to make informed decisions, transforming what could be a daunting experience into a manageable one. Ultimately, their dedicated advocacy helps secure fair compensation for repairs and mitigates the stress associated with navigating the complexities of insurance claims.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Professional representation through a public adjuster initiates the metal roof hail damage claims process by establishing direct contact with insurance providers. The public adjuster roles encompass extensive documentation, policy interpretation, and strategic negotiation with insurance company adjusters.

Key insurance claim strategies implemented by public adjusters include:

- Coordinating detailed property inspections and damage assessments

- Collecting and presenting compelling evidence of hail damage

- Managing communication between policyholders and insurance adjusters

- Negotiating settlement amounts based on thorough repair estimates

This professional representation guarantees an independent evaluation of the damage while maximizing potential claim benefits.

Public adjusters streamline the often complex claims process by leveraging their expertise in policy interpretation and industry-standard repair costs, ultimately working to secure fair settlements for metal roof hail damage.

Public Adjuster Gets Professional Assessments

The filing process for metal roof hail damage claims advances considerably through expert assessments coordinated by public adjusters. Assessment significance becomes evident as professionals thoroughly document both cosmetic and structural damage, ensuring accurate claim valuations.

Through professional collaboration, public adjusters work with specialized contractors, engineers, and architects to create extensive damage reports.

Key aspects of professional assessments include:

- Detailed photographic and video documentation of all impact points

- Written evaluation of roof components including vents, gutters, and flashing

- Structural integrity analysis by qualified engineers

- Itemized cost estimates for repairs or replacement

This systematic approach provides the necessary evidence to support insurance claims and negotiate fair settlements, preventing potential claim undervaluation by insurance company adjusters. The documentation serves as a vital foundation for successful claim resolution.

Public Adjuster Gathers Supporting Evidence

Successful hail damage claims require thorough supporting evidence gathered by public adjusters through meticulous documentation protocols. During evidence collection, adjusters systematically document all roof damage using photos, videos, and detailed measurements. Their damage assessment includes extensive documentation of repair estimates, maintenance records, and policy details.

| Documentation Type | Purpose | Critical Elements |

|---|---|---|

| Visual Evidence | Claim Verification | Photos, Videos, Size References |

| Financial Records | Cost Documentation | Estimates, Invoices, Receipts |

| Technical Reports | Damage Validation | Inspection Findings, Expert Assessments |

Public adjusters organize this evidence systematically, categorizing damage by location and severity. They verify all documentation meets insurance company requirements while maintaining a clear chain of evidence. This methodical approach strengthens the claim's validity and increases the likelihood of fair settlement.

Public Adjuster Submits Complete Claims Package

Submitting an extensive claims package requires meticulous attention to detail from public adjusters who compile and organize essential documentation for metal roof hail damage. The claims process benefits from professional representation, ensuring all necessary evidence is properly presented to insurance carriers.

| Claims Package Components | Public Adjuster Benefits |

|---|---|

| Detailed Photos & Videos | Expert Policy Review |

| Contractor Estimates | Professional Negotiations |

| Damage Documentation | Maximum Settlement Value |

Public adjusters submit thorough evidence packages that include thorough damage assessments, cost estimates, and supporting documentation. They manage administrative follow-up and handle adjuster negotiations to pursue fair settlements. Their expertise helps navigate policy terms, coverage limits, and potential appeals processes, while ensuring timely reporting and proper completion of all required forms.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Professional public adjusters take charge of managing strict filing deadlines and maintaining consistent communication with insurance carriers throughout metal roof hail damage claims. Their public adjuster communication strategies guarantee all documentation and responses meet required timelines while keeping claims on track.

Key aspects of public adjuster claim timelines include:

- Monitoring and meeting all insurance carrier deadlines for documentation submission

- Providing prompt responses to insurer requests for additional information

- Scheduling and coordinating necessary inspections with insurance representatives

- Maintaining detailed records of all communications and claim developments

Public adjusters utilize digital platforms and specialized software to track claim progress, assuring no critical deadlines are missed.

Their systematic approach helps prevent delays that could potentially compromise the settlement of metal roof hail damage claims.

Public Adjuster Enforces Policyholder's Rights, & Negotiates Higher & More Fair Settlement

Public adjusters leverage their expertise to safeguard policyholders' rights and secure ideal settlements for metal roof hail damage claims. Their extensive knowledge of claim negotiation techniques and insurance policies enables them to maximize settlement values through detailed documentation and professional assessments.

Key public adjuster roles in metal roof claims include:

- Conducting independent damage evaluations to establish accurate repair costs

- Reviewing policy terms to identify all applicable coverage benefits

- Challenging unfair claim denials or inadequate settlement offers

- Negotiating with insurers using documented evidence and industry expertise

Public adjusters work on a contingency basis, aligning their compensation with the policyholder's interests. This arrangement guarantees they pursue the highest possible settlement while advocating for the full extent of coverage under the insurance policy.

Public Adjuster Speeds Up Claim Settlement Time

The filing process for metal roof hail damage claims can be considerably accelerated when policyholders engage a public adjuster's services. Public adjuster benefits include extensive claim management and efficient communication channels that streamline the settlement process.

Key advantages of utilizing a public adjuster during the claim process include:

- Immediate response to damage assessment and documentation requirements

- Expert policy interpretation and thorough claim preparation

- Professional coordination with contractors for accurate repair estimates

- Strategic communication management between all involved parties

Public adjusters expedite settlements through their systematic approach to claims handling, ensuring all necessary documentation is properly filed and following up consistently with insurance companies.

Their expertise in claim procedures and policy requirements helps avoid common delays that often plague the settlement process.

Choosing & Working With Trusted Metal Roof Contractors

While working with metal roof contractors, having a public adjuster review repair estimates helps prevent overcharging and guarantees alignment with insurance coverage limits. Public adjusters can identify inflated costs, unnecessary work items, and verify that proposed repairs meet industry standards. This third-party validation protects homeowners' interests and facilitates fair pricing for hail damage repairs.

| Estimate Component | Public Adjuster Review Points |

|---|---|

| Labor Costs | Verification against regional rates and industry standards |

| Material Specifications | Confirmation of appropriate grade and quality for repairs |

| Scope of Work | Assessment of necessity for all proposed repairs |

| Timeline | Evaluation of project duration reasonableness |

| Warranty Terms | Review of coverage periods and conditions |

Let Your Public Adjuster Review Estimates To Ensure Contractor Honesty

Partnering with a qualified public adjuster provides essential oversight when reviewing contractor estimates for metal roof hail damage repairs.

Public adjuster benefits include thorough analysis of repair costs, verification of damage extent, and protection against potential overcharging or unnecessary work recommendations.

To guarantee contractor honesty, public adjusters meticulously examine proposed repair estimates against industry standards and local market rates.

They verify that all specified repairs align with documented hail damage and validate material costs. This independent review helps prevent common issues such as scope padding or inflated pricing.

Public adjusters also confirm that estimates include all necessary repairs covered by the insurance policy, protecting property owners from both overcharging and underbidding that could compromise repair quality.

Preventing Future Metal Roof Damage From Hail

Proactive measures can greatly reduce the risk of hail damage to metal roofs through a combination of protective coatings and structural reinforcements. Preventive measures include impact-resistant and UV-resistant coatings that shield against both immediate damage and long-term deterioration. Regular professional inspections guarantee roof durability by identifying vulnerabilities before severe weather events occur.

| Protective Element | Purpose |

|---|---|

| Impact Coatings | Prevent denting and cracking |

| UV Protection | Reduce sun deterioration |

| Anti-corrosion | Guard against rust formation |

| Reinforced Materials | Enhance structural integrity |

| Embossed Systems | Conceal minor damage |

Critical reinforcement areas include roof seams, fastener points, and flashing intersections. These improvements, combined with proper maintenance, can greatly extend roof lifespan and may qualify property owners for reduced insurance premiums, particularly with Class 4 rated materials.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) serves as a professional organization dedicated to representing policyholders during insurance claims related to metal roof hail damage.

These licensed professionals work independently from insurance companies, focusing solely on protecting policyholder interests throughout the claims process.

Public Adjuster Benefits include expert policy interpretation, detailed damage investigation, and skilled negotiation with insurance carriers.

Public adjusters deliver essential expertise in policy analysis, thorough damage assessment, and effective carrier negotiations to maximize claim settlements.

PCAN members typically secure more favorable settlements by documenting damage thoroughly and ensuring all policy provisions are properly applied. Their fee structure is percentage-based, determined by the final settlement amount.

When selecting a PCAN adjuster, property owners should verify state licensing, review past client experiences, and confirm fee transparency.

These professionals reduce claim-related stress while maintaining insurance company accountability through their specialized knowledge and advocacy.

References

- https://firstamericanroofing.com/hail-damage-metal-roofs/

- https://www.roof-crafters.com/learn/hail-damage-metal-roof

- https://1stcoastmrs.com/why-metal-roofs-are-resistant-to-hail-damage/

- http://smrhomepros.com/hail-damage-metal-roof/

- https://watertightroofinginc.com/hail-damage-to-a-metal-roof/

- https://sheffieldmetals.com/learning-center/metal-roofing-and-hail/

- https://www.billraganroofing.com/blog/what-size-hail-damage-roof

- https://www.westernstatesmetalroofing.com/blog/hail-damage-impact-resistant-metal-roof

- https://wernerroofing.com/blog/metal-roofs-and-hail-what-you-need-to-know/

- https://eriehome.com/blog/can-metal-roofs-withstand-hail-damage/