Ever wonder what happens if a tree crashes through your roof during a storm, making your home temporarily unlivable? That's where Loss of Use coverage – your insurance policy's unsung hero – steps in to save the day!

Think of Loss of Use as your financial safety net when life throws you a curveball. This essential coverage helps you maintain your normal lifestyle by covering extra expenses while you're displaced from your home due to covered disasters. It's like having a backup plan that keeps you from camping in your backyard!

What's covered? Picture this: Your temporary hotel stays or rental home costs, those unexpected restaurant bills (when you can't use your kitchen), higher utility expenses, and even parking fees if you're relocated downtown. Pretty neat, right?

Most insurance policies set Loss of Use limits between 10-20% of your dwelling coverage – so if your home is insured for $300,000, you could have up to $30,000-$60,000 for temporary living expenses. But remember: this isn't a blank check for a luxury vacation! The coverage kicks in only for necessary expenses above your normal living costs.

Pro tip: Document everything! Keep those receipts and track your regular monthly expenses versus displacement costs. Your future self will thank you when filing claims becomes a breeze rather than a headache.

Got pets? Loss of Use typically covers their temporary boarding too. After all, Fido needs a roof over his head just as much as you do!

Key Takeaways

- Loss of Use Coverage, also known as Additional Living Expenses, provides financial support when a residence is uninhabitable due to a covered loss.

- This coverage helps maintain a standard of living while home repairs are underway, ensuring homeowners are not financially burdened during such times.

- Loss of Use Coverage typically covers temporary living arrangements, increased food expenses, essential needs, pet care costs, and miscellaneous expenses.

- Coverage is usually capped at 10% to 20% of the dwelling coverage amount, without a separate deductible, and excludes ongoing mortgage or rent payments.

- To file a claim, homeowners must notify the insurance company immediately and document all expenses incurred during displacement.

What Is Loss of Use Coverage in Homeowners Insurance?

Homeowners insurance policies typically comprise a multifaceted set of coverages designed to protect policyholders from various risks associated with homeownership.

Loss of Use Coverage, also known as Additional Living Expenses or Coverage D, is a critical component of a homeowners insurance policy that provides financial support when a residence becomes uninhabitable due to a covered loss.

This coverage encompasses costs for temporary living arrangements, such as hotel stays and rental units, as well as reimbursement for increased food and utility expenses during the displacement period.

The coverage limit for Loss of Use is generally set at 10% to 20% of the dwelling coverage limit. For instance, a $300,000 dwelling policy would offer between $30,000 and $60,000 in Loss of Use coverage.

This coverage enables policyholders to maintain a standard of living while their home is being repaired or rebuilt, mitigating the financial burden of additional living expenses.

Working with public adjusters can help ensure fair compensation for loss of use claims during complex displacement situations.

How Does Loss of Use Coverage Work?

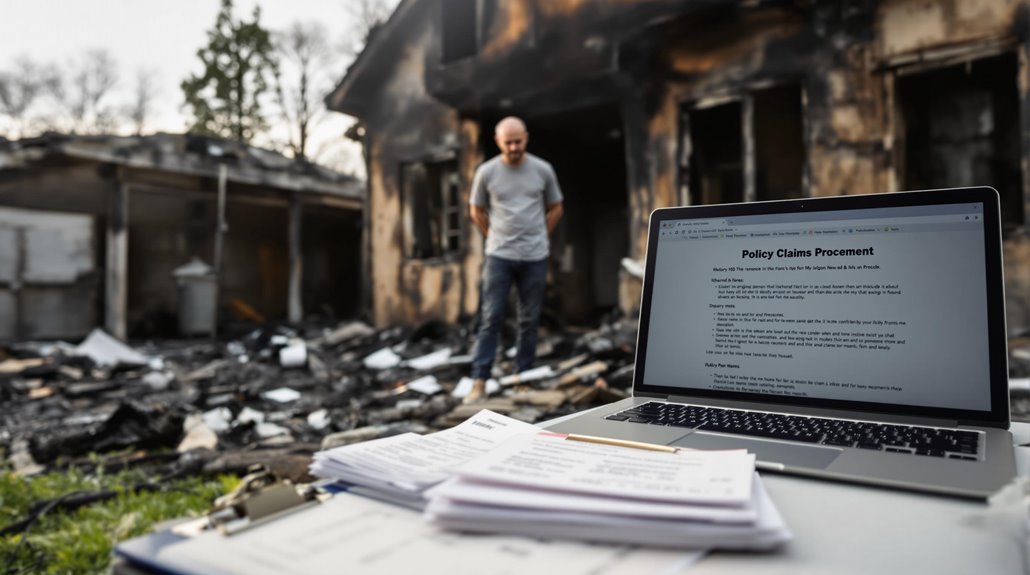

Loss of Use Coverage is triggered when a homeowner is forced to vacate their premises due to a covered event, such as a fire or natural disaster, and is designed to provide financial assistance for temporary living arrangements.

The coverage is typically capped at a percentage of the dwelling coverage amount, ranging from 10% to 20%, and reimburses homeowners for reasonable additional living expenses incurred during the repair period.

To effectively utilize Loss of Use Coverage, it is essential for homeowners to comprehend the scope of insurance benefits, coverage limitations, and the process for filing claims.

How Loss of Use Works

When certain covered events render a home uninhabitable, requiring temporary relocation, Loss of Use coverage – also referred to as additional living expenses (ALE) or Coverage D – is triggered, providing financial relief to alleviate the resultant living expenses.

This coverage supports homeowners in maintaining a standard of living while displaced due to a covered loss.

Key aspects of Loss of Use coverage include:

- Temporary Housing Costs: Reimbursement for temporary accommodations, such as hotel stays or rental properties.

- Increased Food Expenses: Compensation for additional food costs incurred due to the displacement.

- Essential Needs: Coverage for other necessary expenses, such as clothing and toiletries.

- No Separate Deductible: Loss of Use claims are processed under the existing homeowners policy, streamlining the claims process.

Insurance Coverage and Benefits

Underlying a homeowners insurance policy, Loss of Use coverage serves as an essential component in alleviating the financial strain that accompanies a covered loss, thereby enabling individuals to maintain a comparable standard of living in the event of temporary relocation.

This coverage provides reimbursement for living costs, including temporary housing, food expenses, and other necessary expenditures incurred due to a covered peril. Insurance coverage limits for Loss of Use are generally set at 10% to 20% of the dwelling coverage.

To qualify, homeowners must experience a covered loss, such as fire or natural disaster. Unlike other coverages, Loss of Use does not have a separate deductible, applying the existing homeowners insurance deductible to overall claims, simplifying the claims process for policyholders.

Working with public adjusters can help maximize Loss of Use claims settlements by 30-50% compared to handling the claim alone.

When to File Claims

Loss of use covers expenses incurred during repairs, and homeowners should file a claim promptly after the loss occurs to expedite the settlement process.

Working with public insurance adjusters can increase claim settlements by 30-50% for loss of use coverage.

Key considerations when filing a claim:

- Notify the insurance company immediately: Inform the claims representative as soon as possible to initiate the claims process.

- Document all expenses: Keep detailed receipts of additional living expenses to substantiate claims.

- Understand coverage limits: Review the home insurance policy to determine the maximum amount available for claims, typically a percentage of the dwelling coverage.

- Review policy exclusions: Familiarize yourself with specific terms and exclusions, such as non-coverage of flood damage or ongoing mortgage payments.

What Expenses Are Covered Under Loss of Use?

Under Loss of Use coverage, various expenses are reimbursable, including costs for temporary housing, food, storage, and transportation, as well as additional living expenses such as pet boarding and laundry services.

To qualify for reimbursement, these expenses must be incurred as a direct result of the home being uninhabitable due to a covered event.

An examination of the specific types of covered expenses and those excluded from coverage is necessary to understand the scope of Loss of Use protection.

Types of Covered Expenses

When a home is rendered uninhabitable due to a covered loss, Loss of Use Coverage plays an essential role in mitigating the financial burden of temporary relocation.

Home insurance policies include various expenses under Loss of Use Coverage. Key types of covered expenses include:

- Temporary Housing: Hotel stays, rental apartments, and other temporary accommodations.

- Additional Living Expenses: Increased food costs, restaurant meals, and grocery expenses incurred while displaced from the home.

- Pet Care and Transportation: Costs associated with pet boarding and transportation during temporary relocation.

- Miscellaneous Expenses: Laundry services, moving costs to store belongings, public transportation, and parking fees incurred while living away from home during the repair process.

These expenses are typically reimbursed under Loss of Use Coverage.

Expenses Excluded Coverage

A thorough understanding of Loss of Use Coverage requires knowledge of not only what expenses are covered, but also those that are specifically excluded from this type of provision.

Expenses excluded from coverage under Loss of Use provisions in home policies include ongoing mortgage or rent payments, home improvements, and elective renovations. Additionally, flood damage is typically excluded unless the homeowner holds a separate flood insurance policy.

Normal wear and tear or preventable damage, such as pest infestations, are also not covered. Reviewing policy documents for detailed terms and conditions is essential, as insurance policies may have specific exclusions limiting coverage to particular events.

Clarifying these exclusions is vital to provide accurate insurance information regarding what is covered under Loss of Use.

Understanding the Limits of Loss of Use Coverage

Because the specifics of Loss of Use coverage can vary between policies, it is essential for homeowners to carefully review their individual policy details to determine the applicable coverage limits.

Loss of Use coverage limits are typically a percentage of the dwelling coverage amount, and may also be influenced by the type of policy.

The following key points outline the typical limits and variations of Loss of Use coverage:

- Standard Policies: 10% to 20% of the dwelling coverage amount, such as $30,000 to $60,000 on a $300,000 dwelling coverage.

- Condominium Policies: Often 20% of combined dwelling and personal property coverage.

- Renters Insurance: May offer a flat amount or a percentage of personal property coverage.

- Variations by Insurer: Specific limits and percentages can differ between insurers, emphasizing the importance of policy review for policyholders to understand their home insurance cover.

What Is Not Covered by Loss of Use Insurance?

Understanding the coverage limits of Loss of Use insurance is only half the equation; equally important is recognizing what expenses are excluded from reimbursement.

Expenses related to ongoing bills, such as mortgage or car payments, are not covered by Loss of Use insurance while the home is uninhabitable. Additionally, costs incurred from home improvements or elective renovations are excluded from coverage.

Policyholders should also be aware that flood damage is typically not covered unless separate flood insurance is purchased. Moreover, normal wear and tear or damage due to pest infestations are not included in Loss of Use claims.

Non-essential or luxury purchases are also not reimbursed under Loss of Use coverage. It is essential for policyholders to review their policy specifics to understand what expenses are not covered by Loss of Use insurance to avoid unexpected financial burdens.

Excluded expenses can considerably impact the policyholder's financial situation.

How to File a Loss of Use Claim

When faced with the inability to inhabit their home, how do policyholders initiate the claims process to secure reimbursement for additional living expenses? To file a Loss of Use claim, policyholders must promptly contact their insurance company to report the loss and initiate the claims process.

The following steps outline the necessary actions to take:

- Gather necessary documentation: Collect photographs of the damage, repair estimates, and all relevant invoices for additional living expenses.

- Keep detailed records: Maintain receipts for all incurred expenses, as insurers may require this documentation for claims processing.

- Understand policy coverage limits: Review the policy to confirm that the expenses claimed are eligible for reimbursement and fall within coverage limits.

- Collaborate with the claims representative: Work closely with the assigned claims representative to navigate the claims process and provide requested information or documentation efficiently.

Determining the Right Amount of Loss of Use Coverage

Policyholders who have successfully filed a Loss of Use claim and secured reimbursement for additional living expenses must also consider the adequacy of their coverage limits.

The amount of Loss of Use coverage typically defaults to around 20% of the dwelling coverage in homeowners insurance policies. However, this may not be sufficient to cover additional living costs, which can exceed standard expenses, especially if policyholders are displaced from their home for an extended period.

To determine the right amount of Loss of Use coverage, homeowners should assess their potential living expenses during a displacement. They should also review their policy details to understand the exact percentage or flat amount provided for Loss of Use, as coverage limits can vary by insurer.

Additionally, policyholders should consider any unique circumstances that could increase living costs during repairs and maintain an emergency fund to cover any expenses that exceed the Loss of Use policy limits.

The Benefits Of Consulting A Public Adjuster

In the context of loss of use coverage, consulting a public adjuster can provide policyholders with objective expertise in insurance claims.

Public adjusters offer a streamlined claim process through their ability to assess damage accurately and prepare thorough claims documentation, ultimately leading to more efficient negotiations with insurers.

Studies have shown that claims handled by public adjusters typically result in settlements that are 500-800% higher compared to those without professional representation.

Expertise In Insurance Claims

Because managing loss of use claims can be a complex and time-consuming process, seeking the expertise of a public adjuster is often beneficial for homeowners. A public adjuster can provide valuable guidance on steering through the claims process and help you recoup losses.

Some key benefits of engaging a public adjuster include:

- Comprehensive Claim Assessment: They provide a thorough evaluation of damages and associated loss of use coverage.

- Expert Negotiation: Public adjusters are skilled at negotiating with insurance companies on behalf of policyholders.

- Documentation and Expense Management: They help guarantee all eligible loss of use expenses are documented and included in the claim.

- Contingency Fee Basis: Public adjusters typically only get paid if you receive a settlement, aligning their interests with yours for a successful claim.

With fees ranging from 5 to 20 percent of the final claim amount, public adjusters often provide more cost-effective representation compared to attorneys.

Objective Damage Assessment

A homeowner's ability to accurately assess property damage is essential when filing a Loss of Use claim under their homeowners insurance.

This is where consulting a public adjuster can provide significant benefits. They offer an objective damage assessment, which is critical in maximizing the claim amount for Loss of Use coverage.

A public adjuster's expertise allows them to evaluate damages thoroughly and provide detailed documentation to support claims. This helps to identify and quantify all eligible additional living expenses, guaranteeing policyholders receive full compensation for temporary housing, meals, and other incurred costs.

Streamlined Claim Process

Numerous benefits can be derived from consulting a public adjuster when managing the complexities of a Loss of Use claim.

A public adjuster can considerably streamline the claims process by providing expert guidance on policy interpretation and ensuring all eligible expenses under Loss of Use Coverage are accurately documented and submitted.

The benefits of consulting a public adjuster include:

- Expert Policy Interpretation: Providing help in understanding use coverage offers and policy terms.

- Accurate Documentation: Ensuring all eligible expenses incurred are accurately documented and submitted.

- Streamlined Claims Process: Facilitating a quicker claims process, allowing homeowners to focus on finding temporary housing.

- Effective Negotiation: Negotiating with insurance companies to potentially secure higher compensation for additional living expenses.

Higher Claim Payouts & Settlements

When maneuvering the complexities of a Loss of Use claim, consulting a public adjuster can have a significant impact on the claim payout. Public adjusters guarantee all eligible expenses are accurately documented and presented, leading to higher claim payouts.

| Benefits | Public Adjuster Expertise | Homeowner Gain |

|---|---|---|

| Accurate documentation | Policy expertise | Maximized settlements |

| Detailed expense tracking | Complex claim navigation | 20-50% higher payouts |

| Expedited claim process | Insurance company negotiation | Faster funds for expenses |

| Thorough understanding | Coverage limits and exclusions | Informed decision-making |

| Strategic claim presentation | Adjuster's industry knowledge | Higher settlement offers |

About The Public Claims Adjusters Network (PCAN)

Behind the process of maneuvering complex insurance claims, a trusted ally often proves invaluable. The Public Claims Adjusters Network (PCAN) serves as a resource for policyholders to connect with expert public adjusters who are pre-vetted, licensed, and experts in their field.

PCAN member adjusters specialize in residential and commercial property damage insurance claims, covering over 30 different claim types and located in 40+ states.

Key aspects of PCAN include:

- Pre-vetted and licensed members: Only top public adjusters are admitted after an intensive application and interview process.

- Expertise in property damage claims: Member adjusters are specialists in residential and commercial property damage insurance claims.

- Nationwide coverage: Member adjusters are located in 40+ states.

- Stringent standards of ethics: Member adjusters are held to the highest standards of ethics, morals, and professionalism with mandatory yearly audits of licenses and complaints.

Frequently Asked Questions

What Is Considered Loss of Use on Homeowners Insurance?

In homeowners insurance, Loss of Use refers to the insurance coverage that reimburses policyholders for additional living expenses, such as temporary housing, within policy limits, during the claim process, when the home is uninhabitable due to a covered event. This coverage is crucial for homeowners who find themselves displaced due to events like fires, storms, or other disasters that render their home unlivable. It’s important to note that while Loss of Use provides essential financial support during this challenging time, it does not cover the depreciation in homeowners insurance, which affects the cash value of the home in case of a total loss. Understanding both aspects of your policy can help ensure that you are adequately prepared for unexpected situations and can navigate the claims process more effectively.

What Is the Meaning of Loss of Use?

Loss of use refers to the temporary relocation of a homeowner due to unforeseen circumstances, with insurance claims providing financial assistance up to coverage limits, while also considering policy exclusions that may affect claim eligibility.

What Is the Difference Between Loss of Use and Fair Rental Value?

Approximately 95% of homeowners have insurance, yet many are unclear about policy specifics. Loss of use and fair rental value differ in that loss coverage reimburses living expenses, while fair rental value covers lost rental income, subject to policy exclusions and coverage limits.

What Is Loss of Use of Property Damages?

Loss of use of property damages refers to the inability to occupy a dwelling due to damages, triggering insurance benefits for temporary housing and loss of income, subject to policy coverage and the claim process.