So, you’ve received that insurance check for your roof – exciting times, right? Let’s walk through what happens next, because this isn’t as simple as cashing the check and calling it a day. It’s crucial to understand the steps you need to take before starting any repairs. For instance, you should thoroughly research and vet any contractors you consider hiring to ensure they are reputable. Additionally, it’s wise to educate yourself on how to spot roof insurance scams, as fraudsters may take advantage of homeowners eager to get their roofs repaired quickly. Taking the time to follow these steps can help you avoid costly mistakes and ensure your repairs are done correctly.

First things first: give that check a good look. Think of it as your golden ticket to a solid roof over your head, but one that comes with some important fine print. You'll need to double-check your coverage details, just like reading the recipe before starting to cook.

Got a mortgage? Here's where things get interesting. Your lender is like that protective parent who wants to make sure the job's done right. They'll typically set up an escrow account – think of it as a safety deposit box – holding about one and a half times the repair cost. Why? It's their way of ensuring your home (their investment) stays protected.

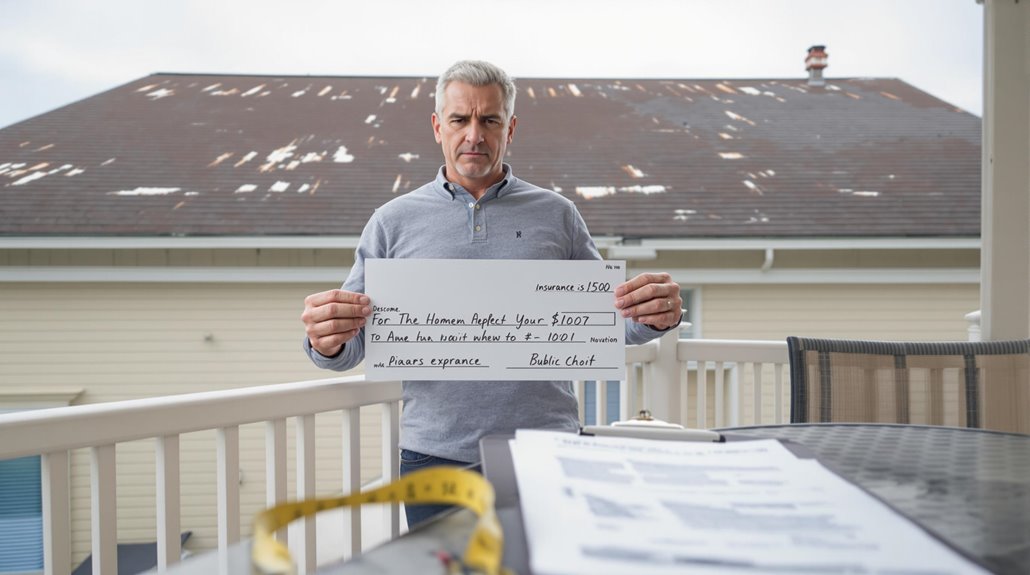

Smart tip: Consider bringing a public adjuster into the mix. These pros are like skilled negotiators who know the insurance game inside and out. They often help homeowners secure significantly better settlements – sometimes even doubling what was initially offered.

Ready to get those repairs rolling? You'll need:

- Contractor estimates (get multiple!)

- Proper endorsement on that check

- Clear communication with your lender

- Documentation of everything (yes, everything!)

Remember, this isn't a race to the finish line. Taking your time to handle each step properly ensures you'll get the quality roof repairs you deserve without any headaches down the road.

Key Takeaways

Got an Insurance Check for Your Roof? Let's Make Sure You're Covered!

First things first – is your check playing nice with everyone? Before you rush to deposit that insurance check, double-check if it needs both your signature and your mortgage lender's John Hancock. It's like having two keys to unlock a treasure chest!

Numbers matter, so let's crunch them. Pull out your policy details and match them against the check amount. Did they factor in your deductible? What about your roof's age – because just like humans, older roofs might not get full coverage. Smart homeowners keep score!

Think of yourself as a document detective. Snap photos of that check, save those emails, and keep a paper trail of every conversation with your insurance company. Trust me, future-you will thank present-you for this organized approach.

Ready to hire roofers? Hold that thought! Make sure their estimates dance to the same tune as your insurance settlement. You don't want to be caught in the rain with a funding gap – literally!

Finally, have a heart-to-heart with your mortgage company. They might be holding your insurance funds in escrow like a protective parent. Understanding their release requirements now saves headaches later.

Remember: this isn't just about getting your roof fixed – it's about making smart moves with your insurance windfall!

Understanding Your Insurance Check Details

Insurance checks for roof damage typically follow a structured payment schedule that varies based on multiple factors, including the roof's age and condition. The payment structure operates on a sliding scale, with specific percentages applied to the replacement cost depending on the roof's age bracket.

Coverage details are determined through a systematic calculation process where insurance providers apply predetermined percentages to the total replacement value, minus the deductible. For example, newer roofs may qualify for 100% coverage in the first five years, while coverage decreases incrementally for older roofs.

Some policies implement a roof surfacing endorsement, which modifies the claims settlement basis specifically for wind or hail damage. This endorsement considers various components, including shingles, tiles, underlayment, and other roofing materials when determining payout amounts. Working with public insurance adjusters can increase settlement amounts by 30-50% compared to filing independently.

Steps to Verify and Endorse the Payment

Proper verification and endorsement of a roof insurance payment involves multiple sequential steps to guarantee secure fund disbursement and quality work completion.

The payment verification process begins with a thorough document review of the insurance policy, contractor credentials, and submitted estimates. This includes validating insurance coverage details, checking contractor licenses, and confirming estimate compliance with manufacturer specifications.

The endorsement phase requires establishing formal contracts with contractors, implementing milestone-based payment schedules, and potentially utilizing escrow accounts for fund management.

Insurance companies should be consulted regarding payment procedures, and checks should only be endorsed after satisfactory work completion. When mortgage companies are involved as endorsers, their specific procedures for check processing and fund release must be followed to guarantee compliance with all requirements.

Public adjusters can help optimize insurance settlements by 30-50% through specialized claims knowledge and strategic negotiations.

Working With Your Mortgage Lender

Insurance settlement checks for roof repairs typically require endorsement from both the homeowner and mortgage lender before funds can be accessed.

The lender's involvement stems from their financial interest in protecting the property, necessitating their control over repair funds through an escrow account.

Homeowners must submit the check along with an assignment of claim to their lender, who will establish specific requirements for releasing funds based on repair progress and contractor documentation.

Working with a public adjuster service can increase settlement amounts by 30-50% when navigating the claims process with both insurers and mortgage lenders.

Endorsing The Settlement Check

When homeowners receive a settlement check for roof damage, they must navigate a specific endorsement process that involves their mortgage lender. Most insurance companies issue checks payable to both the homeowner and mortgage company, requiring dual endorsement before funds can be accessed.

While some lenders offer electronic endorsement or direct deposit options, most follow traditional procedures.

Key steps in the endorsement process include:

- Homeowner endorses the check first

- Check is sent to mortgage company's Loss Drafts Department

- Lender reviews and endorses according to their policies

The mortgage company typically places larger settlement amounts in an escrow account, releasing funds incrementally as roof repairs progress.

This oversight guarantees proper use of insurance proceeds and protects the lender's financial interest in the property. Understanding the lender's specific requirements helps expedite the endorsement process.

Damage assessment inspections by insurance adjusters determine the final settlement check amount.

Escrow Release Requirements

Working with a mortgage lender during the insurance settlement process involves understanding specific escrow release requirements and protocols. The release timeline typically begins after repairs are completed and verified through proper documentation.

Borrowers must submit detailed contractor bids, completion certificates, and inspection reports to initiate the release process.

The documentation process requires several key components: written confirmation from the borrower that repairs meet satisfaction, compliance inspection reports when applicable, and contractor invoices with itemized costs.

Lenders typically hold 150% of estimated repair costs in escrow and require regular updates on repair progress. Funds are released only after the lender verifies all requirements have been met through their established protocols, which may include submission through online portals or direct communication with representatives. Working with public adjusters during the claims process can increase settlement amounts by 30-50% and help ensure proper documentation for escrow release.

Managing the Escrow Process

Managing insurance claim funds through an escrow account represents a critical step in the roof repair process.

The escrow system requires careful fund monitoring and adherence to escrow deadlines while ensuring proper documentation throughout the repair timeline.

Homeowners must coordinate with their mortgage lender and insurance company to facilitate smooth fund disbursement.

Key steps in managing the escrow process include:

- Endorsing the insurance check with both homeowner and lender signatures

- Submitting required documentation, including contractor estimates, licenses, and W-9 forms

- Following lender-specific procedures for installment releases as repairs progress

The successful management of escrow funds depends on maintaining detailed records, understanding policy requirements, and ensuring effective communication between all parties.

Homeowners should familiarize themselves with their lender's specific guidelines to avoid delays in fund disbursement.

Working with public adjusters can increase settlement amounts by 30-50% for property damage claims.

Coordinating With Your Roofing Contractor

Successful coordination between homeowners and roofing contractors forms the foundation of an efficient insurance claim process. Effective contractor scheduling and timeline planning guarantee proper documentation, inspection coordination, and claim processing. The contractor should participate in the initial damage assessment and be present during the insurance adjuster's inspection to provide technical expertise. Working with public insurance adjusters can increase settlement amounts by up to 800% compared to direct insurance settlements.

| Phase | Contractor Role | Homeowner Role |

|---|---|---|

| Initial Assessment | Conduct inspection | Schedule appointment |

| Insurance Inspection | Present findings to adjuster | Facilitate meeting |

| Estimate Development | Prepare detailed quote | Review documentation |

| Contract Formation | Outline scope and timeline | Review terms |

| Project Execution | Complete repairs | Monitor progress |

Professional contractors maintain clear communication throughout the process, documenting all interactions and ensuring thorough completion of repairs before requesting final payment. This systematic approach helps streamline the insurance claim process while protecting both parties' interests.

Tracking Additional Payments and Supplements

The process of tracking supplemental payments requires meticulous attention to detail and systematic documentation throughout the insurance claim lifecycle.

Homeowners and contractors must maintain accurate records of all correspondence, estimates, and payment statuses to guarantee proper reimbursement for roofing repairs.

Key components of effective supplement status and payment tracking include:

- Implementing a structured spreadsheet system to monitor supplement submissions and approvals

- Recording all communication with insurance adjusters, including dates and outcomes

- Documenting any changes in scope or additional repair requirements discovered during the project

This systematic approach helps prevent delays, ensures all legitimate expenses are captured, and facilitates smoother negotiations with insurance providers.

Regular monitoring of payment tracking data enables stakeholders to identify potential issues early and take corrective action when necessary.

Working with public adjuster services can increase settlement amounts by 20-50% while handling all claim-related documentation and tracking.

Navigating Payment Disputes and Resolutions

When payment disputes arise during insurance claims for roof damage, policyholders must follow established protocols to reach fair resolutions.

The initial step in any payment resolution strategy involves reviewing denial letters and documenting all interactions with the insurance provider, including dates and conversation details.

If the insurance company's assessment differs from the expected compensation, policyholders can initiate a formal dispute by submitting additional documentation and evidence.

The appraisal process offers an alternative dispute strategy, involving independent assessors to determine repair costs. This binding process requires careful consideration and professional representation.

Should these methods prove unsuccessful, policyholders may need to pursue legal action. Insurance attorneys can navigate state insurance codes and advocate for fair compensation, particularly in cases where insurers demonstrate bad faith practices.

Working with public adjusters can increase settlement amounts by up to 800% compared to handling claims independently.

The Benefits Of Consulting A Public Adjuster

Public adjusters provide expert assessment and documentation of roof damage while offering specialized knowledge of insurance policies and claim procedures.

Their objective evaluation and established relationships with insurance companies facilitate a more streamlined claims process, reducing the complexity and time investment required from property owners.

Studies indicate that claims handled by public adjusters frequently result in higher settlements due to their thorough documentation methods and professional negotiation skills.

Public adjusters typically charge 5-15% commission fees based on the final insurance settlement amount, but the increased payouts often more than offset their costs.

Expertise In Insurance Claims

Insurance professionals known as public adjusters bring specialized expertise to the complex world of insurance claims, offering policyholders a significant advantage during the settlement process.

Their claims experience and professional guidance guarantee thorough policy interpretation and maximum settlement potential.

Public adjusters leverage their expertise through:

- Complete policy analysis to identify all applicable coverages and benefits hidden in complex documentation

- Systematic documentation of damages, including detailed evidence collection and proper damage validation procedures

- Strategic negotiation techniques that effectively counter insurance company tactics while advocating for policyholder interests

Their methodical approach combines thorough documentation, skilled negotiation, and detailed policy knowledge. This expertise enables them to navigate intricate claims processes efficiently, validate damages exhaustively, and secure appropriate settlements based on policy terms and actual losses.

Objective Damage Assessment

Accurate damage assessment serves as the cornerstone of successful insurance claims, requiring a systematic evaluation process conducted by qualified professionals. Through thorough damage verification and advanced assessment techniques, public adjusters document structural issues, evaluate repair costs, and guarantee maximum claim compensation.

| Assessment Component | Primary Function | Documentation Required |

|---|---|---|

| Physical Inspection | Damage Verification | Photos/Videos |

| Cost Analysis | Repair Estimation | Contractor Quotes |

| Policy Review | Coverage Verification | Policy Documents |

This methodical approach includes detailed photographic evidence, written reports, and expert evaluations to establish claim validity. Public adjusters utilize their expertise to identify both visible and hidden damage, ensuring no aspects are overlooked during the assessment process. Their objective evaluation helps address potential discrepancies between policyholder and insurer assessments, facilitating fair settlements based on documented evidence.

Streamlined Claim Process

A thorough consultation with a public adjuster transforms the often complex insurance claim process into a streamlined operation that maximizes efficiency and claim outcomes.

Public adjusters systematically manage documentation requirements while implementing proven methodologies for efficient processing of claims.

Key advantages of working with a public adjuster include:

- Complete organization and preparation of all necessary documentation, including damage assessments and proof of loss

- Expert negotiation with insurance carriers, leveraging in-depth policy knowledge

- Expedited claim resolution through professional communication channels and systematic processing

Their expertise in managing paperwork, understanding policy intricacies, and maintaining organized documentation substantially reduces processing delays.

Higher Claim Payouts & Settlements

Statistical data consistently demonstrates that engaging a public adjuster leads to substantially higher claim settlements, with average increases of up to 574% compared to policyholder-negotiated outcomes. Public adjusters implement thorough claim optimization strategies by meticulously documenting damages, securing multiple repair estimates, and identifying often-overlooked losses that warrant compensation.

Their settlement strategy encompasses thorough policy analysis, detailed damage assessments, and skilled negotiations with insurance carriers.

As independent advocates working solely for policyholders, public adjusters leverage their expertise to challenge inadequate estimates and guarantee all covered losses are properly valued. Their in-depth understanding of insurance procedures and company tactics enables them to navigate complex claims effectively, ultimately securing settlements that more accurately reflect the true extent of property damage.

About The Public Claims Adjusters Network (PCAN)

Professional claims adjusters rely on the Public Claims Adjusters Network (PCAN) to establish industry standards and facilitate collaboration among licensed practitioners.

The network provides adjuster memberships that enable access to shared resources, expertise, and support across jurisdictions.

Through PCAN, public adjusters maintain high professional standards while maximizing benefits for policyholders.

Key network benefits include:

- Standardized contract templates and documentation approved by Insurance Departments

- Access to specialized training for complex claim assessments and policy interpretation

- Collaborative resources for calculating business interruption costs and property value losses

PCAN members must adhere to strict regulations, including timely communication requirements with insurers and policyholders.

This structured approach guarantees consistent service delivery while maintaining compliance with state-specific insurance regulations and disclosure requirements.

Frequently Asked Questions

Can I Use Leftover Insurance Money for Other Home Repairs?

"A penny saved is a penny earned," but leftover insurance money must first fulfill the original repair budget before considering additional home upgrades, subject to policy terms and documentation requirements.

What Happens if My Contractor Finds Additional Damage During Repairs?

When contractors discover hidden problems or structural deficiencies during repairs, immediate documentation and insurance notification are required. The additional damage may be covered under the original claim with proper verification.

Will Filing a Roof Claim Increase My Insurance Premiums?

Premium calculations typically result in 9-15% increases after roof claims, though rate assessments vary by insurer, claim frequency, severity, and regional factors affecting overall risk evaluation.

Can I Choose a Different Roofing Material Than What Was Originally Installed?

Property owners can select different material upgrades and design options, though supplemental costs beyond insurance coverage must be paid out-of-pocket when choosing materials different from original specifications.

How Long Do I Have to Wait Before Filing Another Roof Claim?

While policies require a one-year filing limit from damage discovery, claim frequency should be carefully managed. Multiple claims within short periods risk rate increases or potential coverage termination under standard policy terms.

References

- https://www.lanelaw.com/insurance-claim-denied/blog/your-guide-to-understanding-the-roof-insurance-claim-process

- https://birdseyeroofing.com/blog/roof-insurance-claim-guide/

- https://www.datopian.com/playbook/dojo/writing-a-data-oriented-blog-post

- https://totalroofingandconstruction.com/insurance/8-steps-of-the-roofing-insurance-process/

- https://www.tdi.texas.gov/tips/replacing-your-roof.html

- https://www.blanchardinsurance.com/what-is-a-roof-replacement-schedule/

- https://www.dolanroofing.com/insurance-sent-me-a-check-for-roof-now-what/

- https://www.ameriguardinsurance.com/understanding-your-roof-insurance-settlement-payment-schedule-a-guide-for-homeowners/

- https://masterblogging.com/blog-post-research/

- https://www.kin.com/blog/roof-surface-payment-schedule/