Think of homeowners insurance as your home's financial superhero cape – it's that crucial safety net that catches you when life throws unexpected curveballs at your biggest investment. But what exactly makes this protection tick?

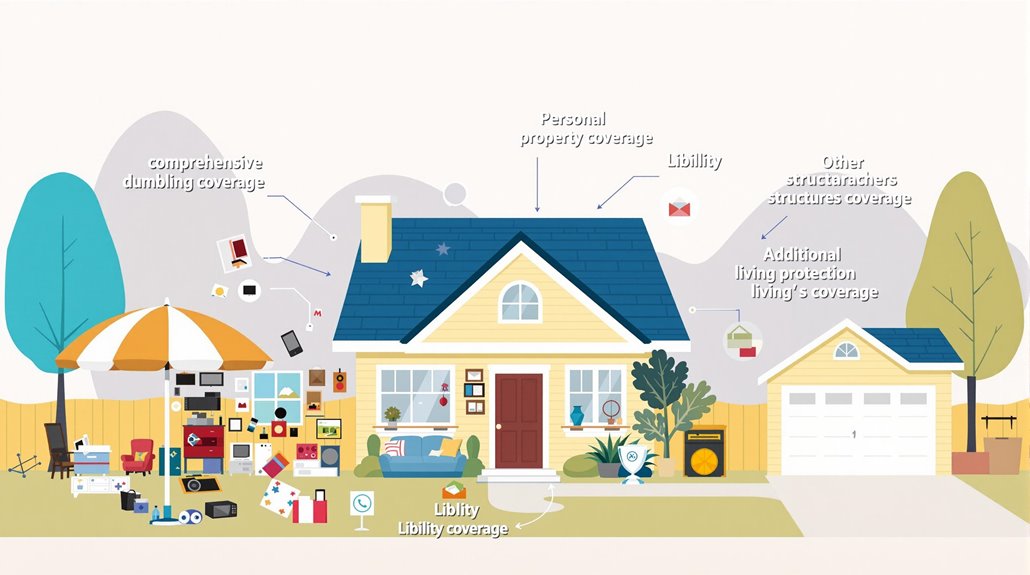

At its core, homeowners insurance wraps your property in multiple layers of coverage, much like a cozy security blanket. Your dwelling coverage protects the actual structure (imagine a protective shield around your walls and roof), while personal property coverage keeps your belongings safe (from your comfy couch to your prized coffee maker).

But wait, there's more! Liability protection acts as your personal bodyguard, stepping in if someone gets injured on your property. And if disaster strikes and you can't stay in your home? Additional living expenses coverage becomes your temporary lifeline, covering hotel stays and extra costs while your home gets back on its feet.

The beauty of this protection lies in its flexibility – you can customize coverage limits and deductibles to fit your needs like a perfectly tailored suit. Just remember, every policy is unique, with its own set of rules and boundaries, much like a fingerprint.

Want to maximize your protection? Dive into your policy's fine print, understand your coverage limits, and stay in touch with your insurance provider. After all, the best insurance is the one you fully understand and can count on when you need it most!

Key Takeaways

- Homeowners insurance provides financial protection against losses and damages to a home and its contents.

- Policies include dwelling coverage for the home structure and personal property coverage for belongings.

- Liability coverage protects homeowners from legal claims due to injuries sustained by others on their property.

- Coverage limits impact the annual premium, influenced by factors such as location and credit score.

- Specific provisions determine the extent of coverage, with exclusions for floods and earthquakes typically applying.

Understanding Homeowners Insurance Policies

While homeowners insurance is not mandated by law in most states, understanding homeowners insurance policies is essential for homeowners to protect their financial interests. A homeowners insurance policy provides financial protection against losses and damages to a home and its contents. It typically includes multiple types of insurance coverage, such as dwelling coverage for the home structure and personal property coverage for belongings.

To guarantee adequate protection, homeowners must carefully review their policies' terms, coverage limits, and exclusions. Coverage limits impact the annual premium, which averages $1,300, varying based on factors such as location and credit score.

The policy's specific provisions determine the extent of insurance coverage, with some exclusions applying, for example, for floods and earthquakes. Understanding the homeowners insurance policy is key to selecting suitable coverage limits to safeguard personal assets and liabilities in case of incidents like fire, theft, vandalism, and certain natural disasters. Working with public adjusters can help homeowners receive settlements up to 700% higher when filing insurance claims.

Types of Homeowners Insurance Coverage

Homeowners insurance policies comprise multiple types of insurance coverage, which collectively provide thorough protection to a home and its contents. One primary component is dwelling coverage, which safeguards the physical structure of the home against perils such as fire and vandalism.

Personal property coverage is another essential aspect, insuring belongings inside the home, including furniture and electronics, against loss or damage from covered events.

In addition to these core coverages, homeowners insurance policies often include liability coverage, which protects homeowners from legal claims due to injuries sustained by others on their property.

Other structures coverage extends protection to detached structures, such as garages or sheds.

Additional living expenses coverage is also typically available to assist with temporary housing costs if the home is uninhabitable due to a covered loss.

These various types of coverage work in tandem to provide thorough protection for homeowners and their assets.

Working with public insurance adjusters on claims can increase settlement amounts by 30-50% compared to handling claims independently.

What Homeowners Insurance Policies Typically Cover

Homeowners insurance policies typically provide coverage for various types of damage to the home and its contents, including interior and exterior damage, as well as loss or theft of personal assets.

In addition to property protection, these policies also include liability coverage, which safeguards homeowners against financial losses resulting from injuries or damages incurred on their property.

Additionally, homeowners insurance policies often cover detached structures, such as garages or fences, and may provide additional living expenses coverage in the event the insured home becomes uninhabitable.

While standard policies offer broad protection, they exclude certain perils like flood damage which requires separate specialized insurance coverage.

Types of Covered Damage

Insurance policies for residential properties typically encompass a wide range of incidents that can cause damage to the property or loss of personal assets. A homeowners policy provides financial protection against various types of covered loss.

- Damage caused by fire, lightning, or high winds

- Loss or damage resulting from vandalism or theft

- Liability for injuries occurring on the property, including medical payments for those injured

- Additional living expenses if the home is uninhabitable due to a covered loss, such as temporary housing costs

Property insurance policies outline specific details about the coverage, including limitations and exclusions, to help homeowners understand what is included in their policy.

Reviewing and understanding the terms of the homeowners policy is essential to guarantee adequate protection for the property and personal assets.

Working with public adjusters can help simplify the claims process and ensure proper interpretation of policy coverage.

Personal Property Protection

In addition to covering various types of damage to the property itself, a homeowners policy also provides protection for personal property, including belongings inside the home.

Personal property protection typically covers items such as furniture, electronics, clothing, and appliances against losses due to theft, fire, and other specified perils. Coverage limits for personal property are usually a percentage of the dwelling coverage, often around 50% to 70%.

Insurance protects personal belongings both on and off the premises, although coverage limits may be reduced for items stolen or damaged while traveling. Homeowners should review their policies to guarantee adequate coverage limits for their personal assets, as high-value items may require additional endorsements or floaters for full protection.

Public adjusters can help navigate complex personal property claims for maximum compensation.

Deductibles apply to personal property claims.

Liability Coverage Details

Typically, a substantial portion of a homeowners insurance policy is dedicated to liability coverage, which shields the policyholder from the financial repercussions of lawsuits stemming from accidents or injuries that occur on their property. This coverage not only protects against legal expenses but also provides compensation for damages awarded to injured parties. In addition to liability coverage, homeowners insurance often encompasses various scenarios, including those that might lead to a catastrophe claim in homeowners insurance, such as severe weather events or other unexpected disasters. Ensuring adequate liability coverage is essential for homeowners to safeguard their assets and financial stability against unforeseen incidents.

This protection includes coverage for medical payments for injuries to others regardless of fault and extends to incidents caused by household members or pets.

Liability coverage details in homeowners insurance policies usually include:

- A minimum liability coverage amount, typically $100,000, with optional increases for additional protection

- Coverage for legal fees and settlement costs up to policy limits

- Medical payments for injuries to others, usually ranging from $1,000 to $5,000

- Financial protection against claims made by guests injured on the insured property, which can impact insurance premiums if claims exceed liability coverage limits.

The Role of Deductibles in Homeowners Insurance

The deductible payment structure in homeowners insurance policies requires policyholders to pay a predetermined amount out-of-pocket before the insurance coverage takes effect for a claim.

When choosing a deductible amount, homeowners must balance the desire for lower premium rates against the potential financial burden of higher out-of-pocket costs during a claim.

The deductible amount selected will directly impact the overall cost of the insurance policy, making it a critical consideration in the policy selection process.

Deductible Payment Structures

Deductible payment structures play an essential role in homeowners insurance policies, as they determine the amount of financial responsibility borne by the policyholder in the event of a claim. A deductible is the amount a policyholder must pay out of pocket before their homeowners insurance coverage kicks in for a claim. The structure of deductibles can vary based on the policy terms.

- Deductibles can be a fixed dollar amount (e.g., $1,000) or a percentage of the home's insured value (e.g., 1% of a $300,000 home equals $3,000).

- Some policies may have separate deductibles for specific types of claims, such as wind or hail damage.

- The deductible amount affects the overall premium cost, with higher deductibles resulting in lower premiums.

- Deductibles require homeowners to carefully assess their financial situation to guarantee they can afford out-of-pocket costs if a claim arises.

Choosing a Deductible Amount

Homeowners must carefully consider their financial situation when evaluating deductible payment structures to guarantee adequate coverage in the event of a claim. A deductible is the amount a policyholder must pay out of pocket before their homeowners insurance coverage kicks in.

Choosing a higher deductible can lower the premium cost, as homeowners take on more risk. Standard deductibles typically range from $500 to $2,500, but some policies may have separate, higher deductibles for specific perils.

Homeowners should assess their financial situation and potential claim frequency when selecting a deductible. A balance between premium savings and out-of-pocket expenses is essential.

Insurers may offer a percentage-based deductible, particularly for natural disasters, calculated as a percentage of the home's insured value rather than a flat dollar amount.

Factors Affecting Homeowners Insurance Premiums

When determining the cost of homeowners insurance premiums, several factors are taken into consideration by insurers to assess potential risk. Homeowners insurance covers losses and damages to a property and its contents, and the cost of premiums is directly related to the level of risk associated with the property.

Some of the key factors that affect homeowners insurance premiums include:

- The location of the property, with areas prone to natural disasters resulting in higher rates

- The age and condition of the home, with older homes requiring more maintenance and being more susceptible to damage

- A homeowner's credit score, with higher scores generally resulting in lower rates

- The amount of coverage selected, including dwelling and personal property limits, which directly affects the premium

These factors are used by insurers to calculate the likelihood and potential cost of a claim, and to determine the appropriate premium for the level of risk.

The Importance of Reviewing and Updating Homeowners Insurance Policies

Numerous factors can impact the adequacy of homeowners insurance coverage over time, underscoring the need for regular policy reviews and updates. Property values can fluctuate, and major life events, such as renovations or changes in family size, can render existing coverage limits inadequate. To guarantee sufficient protection, homeowners should assess their home policies annually and update coverage limits as needed.

| Life Event | Impact on Coverage | Action Required |

|---|---|---|

| Renovation | Increased property value | Update coverage limits |

| New purchases | Additional personal belongings | Adjust personal property coverage |

| Change in family size | Potential increase in liability | Review liability coverage |

Engaging in annual discussions with an insurance agent can help identify gaps in coverage and guarantee that the policy aligns with the homeowner's current needs and risks. Regular reviews can also lead to better coverage options and potential premium discounts.

The Benefits Of Consulting A Public Adjuster

Consulting a public adjuster can provide homeowners with expertise in insurance claims, ensuring a thorough understanding of policy terms and conditions.

A public adjuster's objective damage assessment helps to accurately determine the extent of losses, which is essential for a streamlined claim process.

Expertise In Insurance Claims

Policyholders traversing the complexities of homeowners insurance claims can markedly benefit from the expertise of a public adjuster.

These professionals possess in-depth knowledge of homeowners insurance cover, enabling them to accurately assess damages and negotiate with insurance companies on behalf of the policyholder.

Key benefits of consulting a public adjuster include:

- Skilled assessment of damages to guarantee maximum settlement

- Expert navigation of homeowners insurance policies to utilize all applicable coverages and benefits

- Independent advocacy for the policyholder, eliminating potential conflicts of interest with insurance companies

- Time-saving management of the claims process from start to finish, handling all communication with the insurance company.

Objective Damage Assessment

When dealing with complex insurance claims, the presence of a public adjuster can prove invaluable in guaranteeing that damages are assessed objectively and accurately.

Consulting a public adjuster enables homeowners to receive a thorough and accurate damage assessment, potentially leading to higher claim payouts compared to the insurance company's initial evaluation.

Public adjusters work solely for the policyholder, advocating for their interests and negotiating with the insurance company to secure the best possible settlement.

By thoroughly reviewing policies, they identify covered damages and guarantee that all eligible losses are accounted for in the claim submission, providing an objective assessment of losses resulting from a covered peril.

This expertise helps homeowners navigate complex insurance negotiations.

Streamlined Claim Process

Although maneuvering the complexities of a homeowners insurance claim can be an intimidating task for many individuals, hiring a public adjuster can provide a more streamlined process. A public adjuster's expertise in managing homeowners insurance policies enables them to guarantee that all relevant damages are accurately documented and claimed, resulting in a more efficient claims process.

- A public adjuster works on behalf of the policyholder, advocating for their best interests throughout the claims process.

- They manage all communications and negotiations with the insurance company, saving homeowners time and stress.

- A thorough evaluation of the property damage is provided, ensuring that no potential claims are overlooked.

- By hiring a public adjuster, homeowners can benefit from a streamlined claims process, maximizing the benefits from their homeowners insurance policy.

Higher Claim Payouts & Settlements

Numerous studies have demonstrated that consulting a public adjuster can result in markedly higher claim payouts for homeowners.

Public adjusters are skilled in negotiating settlements and understanding policy language, ensuring all eligible damages are accounted for. This expertise can lead to increased settlements, with statistics showing that homeowners who hire public adjusters receive, on average, 20% to 50% higher payouts than those who handle claims independently.

Public adjusters charge a fee of 10% to 20% of the claim amount, but their services can greatly increase the settlement, often recovering more than the cost of their services. This can provide homeowners with the financial support needed to cover liability coverage and other expenses associated with damages.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) is a national network comprised of pre-vetted, verified, and state-licensed public adjusters who specialize in handling residential and commercial property damage insurance claims.

PCAN serves as a resource for policyholders to connect with expert public adjusters who are licensed and experts in their field.

Some key aspects of PCAN include:

- Member adjusters cover over 30 different claim types, including those involving liability coverage.

- Adjusters are located in 40+ states, offering nationwide support.

- All member adjusters are held to the utmost standards of ethics, morals, and professionalism.

- Mandatory yearly audits of licenses and any complaints guarantee accountability.

As a trusted resource for policyholders, PCAN provides access to exceptional public adjusters.

Frequently Asked Questions

What Does Coverage a Insurance Mean in a Homeowners Policy?

Coverage A insurance, paralleling mortgage requirements, protects the home structure against specified perils, with policy limits typically based on the home's replacement cost, underscoring the importance of adequate coverage to guarantee complete reconstruction.

How to Define Insurance?

Insurance is defined as a contractual agreement transferring risk from an individual to an insurer, who assesses and manages risk through policy types and insurance basics, providing financial protection against specified losses or liabilities.

How Much Is Homeowners Insurance on a $500,000 House?

Importantly, roughly 1 in 20 insured homes file a claim annually. Homeowners insurance on a $500,000 house averages $1,000 to $2,500 yearly, largely dependent on home value estimation, premium comparison, and applicable coverage factors.

What Are the Three Main Types of Homeowners Insurance?

The three main types of homeowners insurance policies are HO-1, HO-2, and HO-3, which vary in dwelling coverage, personal property protection, and liability protection, offering distinct levels of financial safeguard against losses.