Has your roof taken a beating from a hurricane? Let's dive into what you need to know about storm damage and getting your home back in shape.

Think of your roof as your home's protective helmet – when a hurricane strikes, it's usually the first line of defense to take the hit. You'll spot the telltale signs: shingles playing hide-and-seek (they're missing!), your roof looking more like a roller coaster (hello, warping), and uninvited water making its way into your attic.

Don't let these costs catch you off guard. A full roof replacement after hurricane damage typically runs between $3,000 to $15,000, depending on your home's size and material choices. Breaking it down, materials might set you back $1.00-$2.50 per square foot, while skilled labor adds another $2.00-$4.00 per square foot.

Here's the silver lining – your homeowner's insurance likely has your back! Most policies include hurricane coverage, though you'll want to brush up on those deductibles (usually 2-5% of your home's value). Want to maximize your claim? Document everything like a storm chaser – snap photos, keep receipts, and file that claim pronto.

Remember, your roof isn't just another home repair – it's your shelter's crown, and treating storm damage quickly helps prevent a royal headache down the road. Ready to tackle that hurricane damage? A professional assessment is your next smart move.

Key Takeaways

Is Your Roof Telling You It's Had Enough After the Hurricane?

Let's face it – your roof just went toe-to-toe with Mother Nature's worst, and it might be showing the battle scars. Think of those missing shingles as lost armor, while water stains on your ceiling are like nature's Morse code saying "Help needed!"

Walking Through Hurricane Aftermath: Your Roof Inspection Guide

- Think your roof's doing the sag dance? That's a red flag you can't ignore

- Spot those impact marks? They're like nature's autograph – and not the kind you want

- Water drips in your living room? Your roof's crying for help

The Money Talk: What's This Going to Cost You?

Getting your roof back in fighting shape isn't cheap, but it's cheaper than letting the problem snowball. Typical hurricane damage repairs can hit your wallet anywhere from $3,000 to $15,000. Shopping for shingles? Basic 3-tab options start around $3.50 per square foot, while their high-performance cousins begin at $7.00.

Insurance: Your Financial Safety Net

Here's the silver lining in those storm clouds – your homeowner's insurance likely has your back. Most policies cover hurricane damage, though you'll need to handle a deductible (usually 2-5% of your home's insured value). Think of it as your share of the recovery effort.

Pro Tip: Become a Documentation Ninja

- Snap photos like you're shooting for National Geographic

- Get a pro assessment (yes, it's worth it!)

- Keep every receipt like it's a winning lottery ticket

Remember, your roof is your home's first line of defense – treat it like the MVP it is. Don't wait until that small leak turns into an indoor waterfall!

Common Types Of Hurricane Damage To Roofs

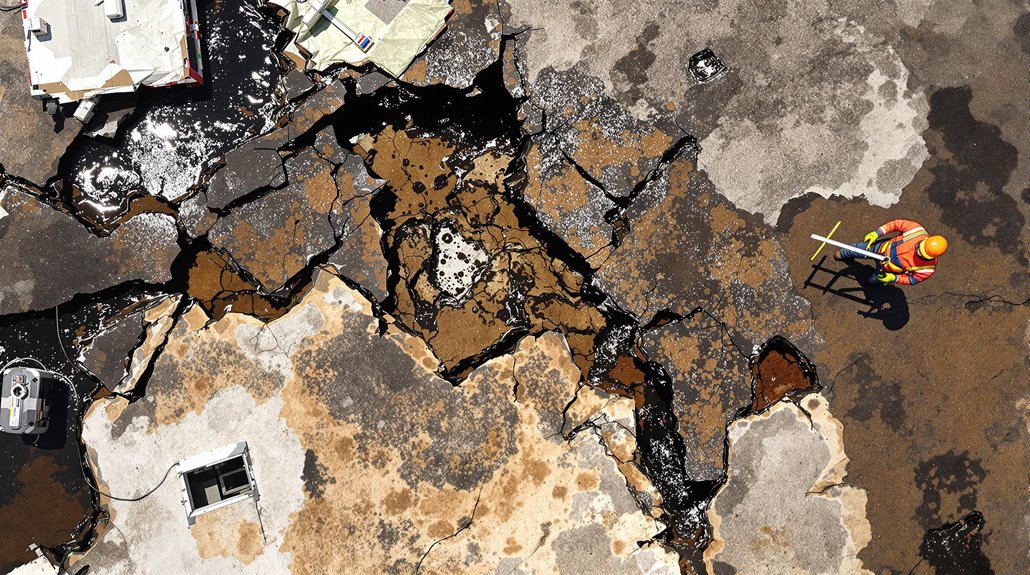

When hurricanes strike, they can inflict several distinct types of damage to residential and commercial roofs. High winds often result in missing shingles and compromised roofing materials, while airborne debris can create punctures that require immediate roof inspection. Water intrusion through damaged areas leads to interior deterioration, potentially necessitating complete roof replacement. Professional safety inspections can help identify both visible and hidden hurricane damage before it worsens.

| Damage Type | Impact |

|---|---|

| Missing Shingles | Wind uplift and material separation |

| Water Intrusion | Interior leaks and structural decay |

| Debris Impact | Punctures and surface penetration |

| Flashing Damage | Separation around vents and chimneys |

| Structural Issues | Sagging roofline and support failure |

Proper documentation of hurricane damage is essential for insurance claims, particularly when structural damage affects the roof's integrity. Professional assessment can determine whether repairs or complete replacement is necessary to restore the roof's protective function. Working with a public adjuster fees typically range between 5-15% of the settlement amount but can increase roofing claim settlements by up to 350%.

What Does Hurricane Damage Look Like On A Roof?

Following the assessment of common hurricane damage types, identifying specific visual indicators enables property owners to recognize roof damage requiring professional attention. Hurricane damage manifests through multiple visible signs that warrant documentation for insurance claims and potential roof replacement. Public adjusters assist in documenting hurricane damage and typically achieve significantly higher settlement amounts for homeowners.

| Damage Type | Visual Indicators |

|---|---|

| Shingle Damage | Missing, torn, or curled shingles |

| Water Damage | Interior leaks, attic moisture |

| Structural Issues | Sagging areas, visible deformities |

| Surface Impact | Dents, punctures from debris |

| Material Deterioration | Cracked surfaces, granule loss |

Professional inspection becomes vital when these signs appear, as some forms of hurricane damage may not be immediately visible from ground level. Proper documentation of all signs of damage, including photographs and detailed descriptions, supports effective insurance claims and guarantees appropriate remediation measures. Homeowners should contact their insurer within 24-72 hours of discovering any hurricane-related roof damage to initiate the claims process.

Does Homeowners Insurance Cover Hurricane Damage Roof Replacement Claims?

Most homeowner insurance policies cover hurricane-related roof damage, though specific terms depend on deductibles, coverage limits, and named peril exclusions. It’s important for homeowners to familiarize themselves with their policy details to ensure they understand what is covered. After a hurricane, they should inspect their roofs for any roof hurricane damage signs, such as missing shingles or leaks, which could indicate more severe issues. Prompt reporting of these damages to the insurance company can expedite the claims process and facilitate timely repairs.

Coverage typically extends to damage from high winds, wind-driven rain, and falling debris, with policies offering either Actual Cash Value (ACV) or Replacement Cost Value (RCV) reimbursement. Under an HO-3 policy, open perils coverage automatically includes protection for hurricane damage to the dwelling structure.

Understanding policy specifics, including hurricane deductibles and coverage exclusions, is essential for maximizing insurance claim benefits and ensuring proper roof replacement compensation.

- Standard hurricane deductibles range from 2% to 5% of the home's insured value, with coastal areas often requiring higher percentages.

- Replacement Cost Value policies provide fuller coverage by paying for new materials without depreciation, while ACV policies subtract depreciation from the settlement.

- Named peril policies specifically list covered events, while all-risk policies cover everything except explicitly excluded perils.

Working with public adjusters services can increase claim payouts by 20-50% and improve claims processing efficiency.

Insurance Deductibles, Coverage Limits, & Exclusions For Hurricane Damage Roof Replacement Claims

Understanding hurricane damage coverage for roof replacement requires careful examination of insurance policies, as coverage terms can markedly impact out-of-pocket expenses. Insurance deductibles for hurricane damage typically range from 2-5% of the home’s insured value, while coverage limits within homeowners insurance policies may restrict the total amount available for repairs. Regular maintenance records documentation can significantly improve claim outcomes. Additionally, homeowners should be vigilant in identifying hurricane roof damage signs early on, as prompt reporting can expedite the claims process. Engaging with a knowledgeable insurance adjuster may also help in navigating the complexities of your policy and ensuring all relevant damage is accurately documented. By staying proactive and informed, policyholders can better protect their investments and minimize unforeseen costs associated with roof repairs after a hurricane. Furthermore, keeping an eye on your roof for any potential vulnerabilities, such as missing shingles or leaks, can aid in early detection of issues linked to hurricane roof damage signs. If a storm is approaching, it is wise to take preventative measures, such as securing loose materials and clearing gutters, to reduce the likelihood of extensive damage. Being prepared not only helps in safeguarding your home but also reinforces your position when filing claims, ensuring that you’re fully equipped to address any fallout from hurricane-related incidents.

| Policy Component | Key Considerations |

|---|---|

| Deductibles | Higher for hurricanes; percentage-based |

| Coverage Limits | Must align with dwelling coverage needs |

| Exclusions | Wind/storm damage may require separate coverage |

| Claims Process | Timely submission vital for approval |

Timely reporting of damage is necessary, as delayed claims may result in denial or reduced compensation. Property owners should review their policy terms carefully to guarantee adequate protection against hurricane-related roof damage. Working with public adjusters can increase insurance claim settlements by 30-50% through expert policy navigation and objective damage assessment.

Actual Cash Value Vs. Replacement Cost In Relation To Hurricane Damaged Roofing

A critical distinction in homeowners insurance policies lies between Actual Cash Value (ACV) and Replacement Cost Value (RCV) coverage for hurricane-damaged roofs. When filing insurance claims, homeowners with ACV policies receive compensation based on the depreciated value of their roof at the time damage occurred, potentially leaving them with significant out-of-pocket expenses. Conversely, RCV policies cover the complete cost of roof replacement regardless of depreciation. Extended replacement cost options can provide an additional 10-50% coverage beyond standard policy limits for unexpected rebuild expenses. Working with public adjusters can increase insurance settlements by 30-50% compared to filing independently.

| Coverage Type | Claim Payment | Financial Impact |

|---|---|---|

| ACV | Depreciated Value | Higher Out-of-Pocket |

| RCV | Full Replacement | Minimal Extra Costs |

| Age Impact | 15-20 Year Limit | Possible Denial |

Understanding whether a policy covers ACV or RCV is vital when initiating the claims process, as it directly affects the financial outcome of hurricane damage roof replacement claims.

Named Vs. Hidden Perils Related To Hurricane Damage Roofing Replacement Claims

When homeowners face hurricane damage to their roofs, the distinction between named and hidden perils becomes essential for insurance coverage determination. Homeowners insurance typically covers named perils, including hurricane-related damage, while excluding hidden perils like gradual deterioration or lack of maintenance. Emergency roof tarping must be implemented immediately after hurricane damage to prevent further issues.

| Coverage Type | Named Perils | Hidden Perils |

|---|---|---|

| Wind Damage | Covered | Not Covered |

| Storm Debris | Covered | Not Covered |

| Water Damage | Variable Coverage | Generally Excluded |

| Structural Issues | Storm-Related Covered | Wear-Related Excluded |

Successful insurance claims require thorough documentation of hurricane damage, including detailed photos and professional assessments. Policy holders must file claims promptly to avoid denial based on reporting deadlines. Understanding policy specifics regarding named perils helps homeowners navigate the claim process effectively while ensuring proper roof maintenance to prevent coverage disputes related to hidden perils. Working with public insurance adjusters can increase claim settlements by 20-50% through professional systematic evaluation and detailed inspections.

Solar Panel Hurricane Damage: Types Of Damage, Replacement Costs, & Home Insurance Coverage

Solar panels installed on roofs face significant risks during hurricanes, including physical damage from flying debris, water infiltration, and structural compromises that can affect their functionality. The replacement costs for hurricane-damaged solar panels typically range from $200 to $1,000 per panel, with variables such as panel type, installation requirements, and extent of damage influencing the final expense. Most home insurance policies provide coverage for hurricane-damaged solar panels when they are permanently installed and considered part of the dwelling structure, though specific coverage terms and deductibles vary by policy. Working with public insurance adjusters can increase settlement amounts by 20-50% for hurricane-damaged solar panel claims. Detailed documentation of all visible damage is essential for maximizing insurance claim success.

| Damage Type | Common Causes | Typical Impact |

|---|---|---|

| Physical Damage | Flying Debris, Hail | Cracked Panels, Broken Glass |

| Structural Damage | High Winds, Mounting Failures | Loose/Dislodged Panels |

| Electrical Damage | Water Infiltration | System Malfunction |

| Internal Component Damage | Moisture Exposure | Reduced Efficiency |

Types Of Solar Panel Damages Caused By Hurricanes

Hurricanes release devastating forces that can inflict multiple types of damage on residential solar panel systems. The primary forms of hurricane damage include physical impact from wind-driven debris, structural compromise from extreme winds, and water infiltration affecting electrical components. When evaluating solar panel damage, homeowners should document all issues for insurance claims and potential roof replacement. Working with public insurance adjusters can lead to settlements up to 6 times larger compared to filing claims independently. Named perils policies typically offer lower premiums but require homeowners to prove damage causation.

| Damage Type | Common Signs | Impact Level |

|---|---|---|

| Physical | Cracked glass, bent frames | Severe |

| Structural | Dislodged panels, loose mounts | Critical |

| Water | Moisture in components, corrosion | Moderate |

| Electrical | System malfunction, wiring damage | High |

Most homeowners insurance policies cover hurricane-related solar panel damage, though coverage specifics vary. Repair costs typically range from $1,000 to $3,000 per panel, depending on damage severity and panel type.

How Much Does It Cost To Replacement Hurricane Damaged Solar Panels?

Understanding the financial implications of replacing hurricane-damaged solar panels helps homeowners prepare for potential recovery costs. The replacement expenses typically range from $2,000 to $10,000, varying based on damage severity and panel quantity. Homeowners must verify coverage with their insurance provider and promptly report damage to initiate claims processes. Working with public insurance adjusters can increase claim settlements by 20-50% for hurricane-damaged solar panels. Certified inspectors must evaluate damage within 72 hours to ensure proper documentation for insurance claims.

| Cost Factor | Range | Additional Considerations |

|---|---|---|

| Panel Units | $500-2,000/panel | Quantity affected |

| Labor | $500-1,500 | Installation complexity |

| Mounting System | $300-1,000 | Upgraded hurricane resistance |

| Disposal Fees | $200-500 | Environmental regulations |

| Additional Materials | $500-1,000 | Wiring, connectors, fasteners |

Timely documentation and reporting of hurricane damage are essential for successful insurance claims. Delays may result in reduced coverage or claim denials, impacting the homeowner's out-of-pocket expenses for solar panel replacement.

Does Home Insurance Cover Hurricane Damage Replacements To Solar Panels?

When evaluating hurricane damage to solar panel installations, homeowners must carefully review their insurance policies to determine coverage eligibility. Most standard homeowners insurance covers sudden and accidental storm damage to solar panels, provided they are properly documented and reported. The insurance claim process requires thorough documentation of property damage claims through photographs and detailed reports. Working with professional claims specialists can increase insurance settlements by up to 800% compared to self-managed claims. Federal assistance programs through HUD and USDA may provide additional funding options for qualifying homeowners.

| Aspect | Coverage Details |

|---|---|

| Storm Damage | Typically covered if sudden/accidental |

| Filing Requirements | Prompt reporting with documentation |

| Replacement Costs | $10,000-$30,000 depending on system |

| Coverage Limitations | Policy-specific exclusions may apply |

Insurance policies cover varying degrees of solar panel damage, making it essential for homeowners to understand their specific coverage terms and maintain accurate records of installation values and maintenance history when filing an insurance claim.

Can Solar Panels Withstand Hurricanes?

Modern solar panel systems demonstrate remarkable resilience against extreme weather conditions, including hurricane-force winds. Most installations can withstand wind speeds up to 140 mph, though proper installation by qualified professionals remains vital for ideal performance and durability.

While solar panels offer robust protection, they can sustain damage during severe hurricanes, particularly from flying debris and water infiltration.

- Replacement costs typically range from $200 to $1,000 per panel, with variations based on damage extent and system type.

- Home insurance coverage often includes hurricane-related solar panel damage, though specific policy terms vary.

- Professional installation and secure mounting greatly reduce hurricane damage risk, potentially minimizing future insurance claims.

These factors underscore the importance of both proper installation and thorough insurance coverage to protect solar panel investments during extreme weather events.

Are There Hurricane Resistant Solar Panels?

Hurricane-resistant solar panels represent a significant advancement in photovoltaic technology, incorporating specialized design features to withstand extreme weather conditions.

These systems offer enhanced protection against physical impacts, water infiltration, and electrical failures common during severe storms. Home insurance policies may cover damage to solar panels, though coverage specifics vary by provider and region.

When damage occurs, homeowners should thoroughly document and photograph affected panels to support insurance claims and expedite the repair or replacement process.

- Reinforced frames and impact-resistant glass protect against flying debris and high winds

- Enhanced mounting systems prevent structural failures during extreme weather events

- Waterproof sealing systems minimize the risk of moisture-related electrical malfunctions

Replacement Vs. Replacement For Hurricane Damaged Roofing

Determining when to replace a hurricane-damaged roof requires careful evaluation of multiple structural and safety factors.

Professional assessors examine the severity of damage, considering factors like missing shingles, water infiltration, and compromised decking to determine if partial repairs will suffice or if complete replacement is necessary.

The decision often hinges on the age of the existing roof, the extent of hurricane damage, and the potential cost differences between repair and replacement options.

- Extensive damage affecting more than 30% of the roof typically indicates replacement is more cost-effective than repairs.

- Multiple layers of existing roofing materials may necessitate complete replacement to guarantee proper installation.

- Visible sagging, buckling, or interior water damage suggests structural compromise requiring full replacement.

When To Choose Roof Replacement For A Hurricane Damaged Roof

Deciding between roof repair and complete replacement after hurricane damage requires careful examination of multiple factors that affect both short-term functionality and long-term structural integrity. Professional inspection becomes essential when determining whether roof replacement is necessary, particularly when evaluating insurance coverage and compliance with local building codes.

| Decision Factors | Replacement Indicators |

|---|---|

| Age of Roof | Exceeds 15-20 years |

| Damage Extent | 50%+ of roof value |

| Building Codes | Mandatory replacement requirements |

A complete roof replacement is typically warranted when significant damage compromises roof integrity, including extensive shingle loss or major structural issues. Insurance claims should be filed promptly, with thorough documentation of hurricane damage. Homeowners must consider both the immediate repair costs and long-term implications when choosing between repair or replacement options.

Hurricane Damaged Shingle Roof: Damage Signs & Replacement Costs

Hurricane damage to shingle roofs presents distinct characteristics that differ from typical wear patterns like blistering, with damaged shingles showing immediate signs of displacement or granule loss. The replacement costs for hurricane-damaged shingles vary considerably based on the specific type of shingle material, with architectural shingles generally commanding higher prices than traditional 3-tab varieties. Insurance claims for hurricane damage require thorough documentation of both visible and underlying damage patterns to guarantee proper coverage and appropriate replacement solutions.

| Shingle Type | Average Cost per Square (100 sq ft) | Common Hurricane Damage Signs |

|---|---|---|

| 3-Tab | $70-$100 | Missing tabs, torn edges, granule loss |

| Architectural | $100-$150 | Creasing, uplift damage, complete section loss |

| Performance | $150-$200 | Wind seal failure, impact damage, delamination |

| Impact-Resistant | $200-$400 | Punctures, stress fractures, edge lifting |

Hurricane Damage VS. Shingle Blistering

Roof damage assessment requires careful distinction between hurricane-related destruction and shingle blistering, as these issues present distinct characteristics and repair implications. Hurricane damage typically manifests through missing, creased, or cracked shingles, often requiring full roof replacement due to compromised structural integrity. Conversely, shingle blistering appears as raised bubbles caused by trapped heat and moisture, usually warranting only localized repairs.

| Characteristic | Hurricane Damage | Shingle Blistering |

|---|---|---|

| Appearance | Missing/torn shingles | Bubble-like formations |

| Visibility | Requires close inspection | Visible from ground |

| Insurance Coverage | Generally covered with documentation | May be excluded as wear and tear |

Insurance claims for hurricane damage demand prompt documentation with detailed photos, while shingle blistering might be classified as normal wear and tear by homeowners insurance, affecting repair costs and coverage eligibility.

Costs For Hurricane Damaged Asphalt Shingles

Understanding the costs associated with hurricane-damaged asphalt shingles requires careful consideration of multiple factors, including material expenses, labor charges, and disposal fees. The cost of a roof replacement typically ranges from $3,000 to $15,000, with homeowners insurance often covering hurricane-damaged roof claims. When filing a claim for roof damage, documentation and prompt reporting to the insurance company are essential for expediting the insurance process.

| Cost Component | Range per Sq Ft | Factors Affecting Cost |

|---|---|---|

| Materials | $1.00-$2.50 | Shingle quality, type |

| Labor | $2.00-$4.00 | Roof complexity, location |

| Disposal | $1.00-$5.00 | Local rates, volume |

Claims adjusters evaluate hurricane-damaged roofs to determine coverage extent, considering factors such as age, maintenance history, and documented storm damage when processing damage claims.

Costs For Hurricane Damaged Architectural Shingles

Replacing architectural shingles damaged by hurricane forces requires a detailed assessment of both visible and hidden deterioration. The cost value for hurricane damage repairs typically ranges from $3.50 to $5.50 per square foot, with additional expenses for underlayment and ventilation systems potentially increasing total repair costs by 15-25%.

| Factor | Impact | Consideration |

|---|---|---|

| Age | Older roofs | Less coverage |

| Damage Type | Roof integrity | Higher costs |

| Documentation | Insurance claims | Better outcomes |

Insurance companies generally provide more favorable coverage for roofs under 15 years old. To maximize claim potential, property owners should promptly document damage through detailed photos and descriptions. The extensive replacement of architectural shingles must address both surface damage and underlying structural issues to guarantee long-term durability and protection against future storms.

Costs For Hurricane Damaged 3-Tab Shingles

When hurricane-force winds impact 3-tab shingle roofs, the resulting damage typically necessitates replacement costs between $3.50 and $5.50 per square foot. For standard-sized homes, complete roof replacement costs range from $7,500 to $15,000, varying by labor and material availability.

| Cost Factor | Impact on Total Expense |

|---|---|

| Signs of Damage | Missing/curled shingles, granule loss |

| Labor Rates | $2.00-$3.00 per square foot |

| Materials | $1.50-$2.50 per square foot |

| Insurance Coverage | Based on age of shingles |

| Documentation | Photos and detailed damage lists |

Homeowners insurance typically covers hurricane damage to 3-tab shingles, though coverage may be limited for roofs exceeding 15-20 years. Proper documentation through photographs and detailed descriptions is essential for expediting insurance claims and ensuring appropriate compensation for repair costs.

Costs For Hurricane Damaged Performance Shingles

Performance shingle costs differ considerably from standard 3-tab options when hurricane damage occurs, with material expenses ranging from $4.50 to $7.00 per square foot. Insurance claims for performance shingles require thorough documentation of damage and professional assessment to guarantee proper coverage. Consultation with a qualified roofing contractor is essential for accurate estimate for damage repair.

| Damage Type | Cost Range (per sq ft) | Insurance Coverage | Required Documentation |

|---|---|---|---|

| Minor Damage | $4.50-$5.50 | Typically Covered | Photos, Inspection Report |

| Moderate Damage | $5.50-$6.25 | Full Assessment | Detailed Damage List |

| Severe Damage | $6.25-$7.00 | Structural Review | Engineering Report |

| Complete Replacement | $7.00+ | Coverage Varies | Thorough Evaluation |

When structural issues are present, repair costs can increase considerably, potentially requiring additional insurance coverage for complete roof replacement. It’s essential for homeowners to be aware of the various roof repair types and costs involved, as these can vary significantly depending on the extent of the damage and the materials used. In some cases, opting for preventative maintenance can mitigate larger expenses down the line, making it crucial to assess the roof’s condition regularly. By understanding these factors, property owners can better prepare for potential financial implications and ensure their homes remain protected against further deterioration.

Costs For Hurricane Damaged Impact Resistant Shingles

Impact-resistant shingle replacements after hurricane damage typically range from $3.50 to $5.50 per square foot, with installation costs adding 10-20% to the total project expense. When evaluating roof replacement costs, homeowners should consider potential insurance coverage and long-term savings through reduced repair needs and lower insurance premiums.

| Cost Factor | Standard Range | Premium Range |

|---|---|---|

| Materials | $3.50/sq ft | $5.50/sq ft |

| Installation | +10% | +20% |

| Insurance Coverage | Varies by Policy | Full if Covered Peril |

| Premium Discount | 5-15% | 15-25% |

While the initial investment in impact-resistant shingles is higher, these materials often qualify for insurance claim coverage when damaged by hurricanes. Homeowners insurance typically covers replacement costs when damage results from a covered peril, making the investment more financially viable despite higher upfront costs.

Costs For Hurricane Damaged Luxury Designer Shingles

Luxury designer shingles present unique cost considerations when damaged by hurricanes, with replacement expenses ranging from $3 to $8 per square foot for materials alone. Installation costs add $2 to $4 per square foot, bringing total roof replacement costs to $15,000-$30,000 for most homes. Homeowners must carefully document hurricane damage for insurance claims, including photographs and professional assessments.

| Cost Factor | Range | Notes |

|---|---|---|

| Materials | $3-8/sq ft | Brand dependent |

| Installation | $2-4/sq ft | Labor costs |

| Total Project | $15k-30k | Size variable |

| Insurance Coverage | Varies | Policy specific |

Insurance policies may have specific limitations regarding luxury materials, making it essential for homeowners to review their coverage details before filing claims for hurricane-damaged designer shingles.

Costs For Hurricane Damaged Metal Shingles/Shakes

Metal shingle replacement costs after hurricane damage typically range from $5 to $15 per square foot, with total project expenses varying based on roof size and material quality. When filing insurance claims, thorough documentation of hurricane damage, including professional assessments of compromised roof integrity, is essential. Additional costs include underlayment, flashing, and labor, which can increase the total by 20-30%.

| Cost Component | Price Range |

|---|---|

| Metal Shingles | $5-15/sq ft |

| Labor | $2-4/sq ft |

| Underlayment | $1-2/sq ft |

| Flashing/Trim | $1.50-3/sq ft |

Insurance policies typically cover metal shingle roof replacement costs, subject to deductibles and specific limitations. Homeowners should document all damage with detailed photographs and professional reports to support their claims and expedite the replacement process.

Costs For Hurricane Damaged Wood Shake Shingles

While metal shingles offer durability against hurricane forces, wood shake shingles present their own set of replacement considerations following storm damage. Homeowners must carefully document signs of damage, including cracked, missing, or splintered shakes, to support insurance claims. The cost of replacement typically ranges from $5 to $15 per square foot, with labor potentially doubling the total expense.

| Cost Factor | Details |

|---|---|

| Materials | $5-15/sq ft |

| Labor | 50-100% of material cost |

| Insurance Coverage | Wind/hail damage covered |

| Documentation Needed | Photos and descriptions |

Before filing a claim, property owners should review their insurance policy specifics, as coverage may exclude normal wear and tear while including hurricane-related damage. Thorough documentation of all visible damage supports a more efficient claims process.

Costs For Hurricane Damaged Solar Tile Shingles

Solar tile shingles, a premium roofing option combining aesthetic appeal with energy generation, require specialized assessment and potentially substantial investment when damaged by hurricanes. Replacement cost value (RCV) typically ranges from $15,000 to $30,000, with insurance coverage varying based on policy specifics and documented damage extent.

| Aspect | Requirements | Cost Factors |

|---|---|---|

| Damage Assessment | Professional inspection | Labor rates |

| Documentation | Photo evidence | Material costs |

| Insurance Claims | Detailed inventory | Installation complexity |

| Replacement Process | Specialized contractors | Solar integration |

Homeowners insurance claims for hurricane-damaged solar tile shingles demand thorough damage documentation, including photographs and detailed descriptions. Roofing contractors must carefully assess the extent of damage, considering both structural integrity and solar functionality. The replacement process requires specialized expertise to guarantee proper installation and restoration of energy-generating capabilities.

Costs For Hurricane Damaged Clay & Concrete Tile Shingles

Clay and concrete tile roofs present unique challenges when damaged by hurricanes, requiring specific assessment protocols and replacement considerations. The costs for hurricane damage roof replacement vary based on material type and extent of structural damage.

| Material Type | Cost per Sq Ft | Common Damage |

|---|---|---|

| Clay Tiles | $15-$25 | Cracking, Displacement |

| Concrete Tiles | $10-$20 | Chipping, Breaking |

| Both Types | Varies | Water Intrusion |

Insurance claims for clay and concrete tile roofs typically cover replacement costs when properly documented. Homeowners should thoroughly photograph and report damage to insurance companies immediately following a hurricane. Coverage terms may include full replacement if structural damage is evident. Additional expenses often arise when underlying issues are discovered during the replacement process, making proper documentation essential for thorough coverage.

Costs For Hurricane Damaged Slate & Synthetic Slate Shingles

Slate and synthetic slate shingles represent significant investments in roofing materials that can sustain substantial damage during hurricanes. The replacement costs vary considerably based on material choice and damage extent, with natural slate commanding premium prices. Insurance claims for hurricane damage typically cover sudden and accidental roof damage, though coverage details vary by policy.

| Material Type | Cost Per Square | Labor Rate/Hour | Common Damage |

|---|---|---|---|

| Natural Slate | $1,000-$2,500 | $50-$100 | Cracks, Chips |

| Synthetic Slate | $800-$1,500 | $50-$100 | Displacement |

| Underlayment | $200-$400 | Included | Water Damage |

| Flashing | $300-$600 | Included | Separation |

Homeowners should document all hurricane damage thoroughly with photos and detailed descriptions to facilitate efficient insurance claims processing and expedite necessary roof replacement procedures.

Hurricane Damaged Flat Roof Replacement: Damage Signs & Replacement Costs

When hurricanes strike residential areas, flat roofs are particularly vulnerable to severe damage that can manifest through multiple warning signs. Professional roofing contractors identify key indicators including water pooling, membrane tears, and wind uplift damage. Homeowners insurance claims require thorough documentation of these issues.

| Damage Type | Signs | Action Required |

|---|---|---|

| Surface Damage | Water pooling, blisters | Immediate inspection |

| Structural Issues | Wind uplift, membrane tears | Professional assessment |

| Interior Problems | Leaks, ceiling stains | Document and report |

| Safety Concerns | Sagging, compromised supports | Emergency repairs |

Replacement costs for hurricane-damaged flat roofs typically range from $5 to $12 per square foot, varying by material quality and damage extent. Insurance coverage may have specific exclusions for flat roofs, making it essential to review policy details before filing claims.

Hurricane Damaged Wood Roof Replacement: Damage Signs & Replacement Costs

Homeowners with wood roofs face unique challenges in the aftermath of hurricane damage, requiring careful assessment of multiple deterioration indicators. Professional assessments reveal common damage signs, including missing or curled shingles, water stains, and structural compromise from high winds. Documenting these issues thoroughly supports insurance claims for roof replacement.

| Damage Category | Signs | Action Required |

|---|---|---|

| Surface Damage | Missing/Curled Shingles | Photo Documentation |

| Water Damage | Attic Stains/Leaks | Moisture Assessment |

| Structural Issues | Framework Weakness | Engineering Report |

Replacement costs typically range from $5,000 to $15,000, varying based on damage extent and wood type selected. Insurance companies require detailed documentation, including photographs and professional evaluations, to process claims efficiently. Additional expenses may arise if structural reinforcement becomes necessary due to compromised framework.

Hurricane Damaged Built-Up Roof (BUR) Replacement: Damage Signs & Replacement Costs

Built-up roofs (BUR) require thorough assessment following hurricane exposure, as these multi-layered systems can sustain various forms of damage that compromise their protective capabilities. Common signs of hurricane damage include blistering, cracking, and punctures, often accompanied by water pooling or leaks. Replacement costs typically range from $5-$10 per square foot, with final expenses determined by damage extent and local labor rates.

| Aspect | Assessment | Action Required |

|---|---|---|

| Visible Damage | Blisters, Cracks | Document with Photos |

| Water Issues | Pooling, Leaks | Immediate Inspection |

| Insurance | Policy Review | File Prompt Claim |

| Contractor | Expertise Check | Obtain Multiple Bids |

For insurance claims, property owners should thoroughly document all visible damage and contact their provider immediately, ensuring proper coverage evaluation and potential reimbursement for BUR replacement costs.

Hurricane Damaged Wood Roof Replacement: Damage Signs & Replacement Costs

Wood roofs exposed to hurricane-force winds require immediate assessment to identify critical damage indicators and determine replacement needs. Key signs include missing shingles, warped boards, and water intrusion evidence. When damage exceeds 30% of the roof's surface, complete replacement becomes necessary.

| Aspect | Details | Action Required |

|---|---|---|

| Signs | Missing shingles | Document with photos |

| Damage Extent | >30% compromised | Full replacement |

| Cost Range | $5,000-$20,000 | Get multiple quotes |

| Insurance | File within 24h | Contact provider |

| Documentation | Photos & notes | Submit with claim |

Homeowners must promptly file insurance claims and thoroughly document damage to guarantee coverage eligibility. Thorough documentation, including detailed photographs and written descriptions, remarkably improves the likelihood of successful claims processing and expedited roof replacement approval. Additionally, homeowners should familiarize themselves with their insurance policy to understand the specific requirements and conditions for roof replacement coverage. Seeking assistance from a public adjuster can provide valuable guidance on how to claim roof replacement costs effectively, ensuring that all necessary documentation is presented in a compelling manner. By being proactive and organized in their approach, homeowners can navigate the claims process with greater ease and confidence.

Hurricane Damaged Green Roof Replacement: Damage Signs & Replacement Costs

Similar to traditional roofing systems, green roofs face distinct challenges when subjected to hurricane-force winds and heavy rainfall. The most notable damage signs include compromised waterproof membranes, exposed soil layers, and disrupted vegetation patterns. Professional assessments often reveal extensive damage to drainage systems, necessitating detailed documentation for insurance claims.

| Damage Component | Assessment Criteria | Cost Impact |

|---|---|---|

| Vegetation Layer | Missing plants, bare spots | $3-7/sq ft |

| Drainage System | Water pooling, blockages | $4-8/sq ft |

| Waterproof Membrane | Tears, penetrations | $5-10/sq ft |

Regular maintenance helps minimize hurricane damage through early identification of vulnerabilities. Replacement costs typically range from $10 to $25 per square foot, varying based on damage severity and material selection. Insurance providers require thorough documentation, including photographs and detailed professional assessments, to process claims effectively.

Hurricane Damaged Membrane Roof Replacement: Damage Signs & Replacement Costs

When exposed to hurricane-force winds and driving rain, membrane roofs exhibit distinct patterns of damage that property owners must promptly identify and address. Key damage signs include tears, punctures, and compromised waterproofing capabilities through seam separation. Property owners should conduct thorough inspections to detect hidden damage before further deterioration occurs.

| Membrane Roof Aspects | Critical Considerations |

|---|---|

| Primary Damage Signs | Tears, punctures, blisters |

| Secondary Issues | Seam separation, water pooling |

| Replacement Costs | $5-$15 per square foot |

| Insurance Claims | Immediate documentation required |

| Assessment Needs | Professional inspection for hidden damage |

Initiating the claim process requires thorough documentation of all visible hurricane damage. Prompt reporting damage to the insurance company greatly impacts claim outcomes, particularly when addressing extensive membrane roof replacement costs.

Hurricane Damaged Rolled Roof Replacement: Damage Signs & Replacement Costs

Rolled roofing systems exposed to hurricane conditions face unique vulnerabilities that property owners must identify and address promptly. Common damage signs include tears, punctures, and lifted edges caused by high winds and debris impact. Water intrusion manifesting as ceiling leaks or wall dampness indicates immediate replacement needs.

| Aspect | Details | Action Required |

|---|---|---|

| Damage Signs | Tears, Punctures, Lifted Edges | Document with Photos |

| Water Issues | Ceiling Leaks, Wall Dampness | Immediate Inspection |

| Costs | $3-$5 per Square Foot | Get Multiple Quotes |

| Insurance | Standard Coverage | File Claim Promptly |

Professional roofing contractors should assess the damage while homeowners initiate insurance claims. Thorough documentation and swift communication with insurance adjusters facilitate faster claim processing and roof replacement authorization. Replacement costs vary based on damage extent and local market conditions.

Hurricane Damaged Metal Roof Replacement: Damage Signs & Replacement Costs

Metal roofs subjected to hurricane-force winds exhibit distinctive patterns of damage that property owners must identify promptly to prevent secondary structural issues. Key indicators include dented panels, compromised fasteners, and water leaks in the attic. Professional inspections can reveal subtle damage from high winds that may not be immediately visible.

| Damage Signs | Action Required |

|---|---|

| Dented Panels | Document with photos |

| Loose Fasteners | Immediate inspection |

| Water Leaks | Check attic/ceiling |

| Rust/Corrosion | Assess severity |

| Warped Panels | Contact insurance |

Metal roof replacement costs typically range from $7 to $12 per square foot. When filing insurance claims, property owners must thoroughly document damage and adhere to reporting guidelines. Success in claim approval often depends on thorough documentation and prompt communication with the insurance company.

Homeonwers Insurance Claim Process For Hurricane Damaged Roofing Replacements

Insurance adjusters work for the insurance company, not the homeowner, and their primary objective is to minimize the company's financial liability. Homeowners must approach interactions with adjusters strategically, maintaining detailed documentation and potentially seeking representation from a public adjuster or attorney. Understanding this dynamic is vital for achieving fair compensation for hurricane roof damage, as adjusters may overlook or undervalue legitimate claims.

| Adjuster Interaction Tips | Homeowner Actions |

|---|---|

| Document all communication | Keep written records of calls, emails, and meetings |

| Avoid recorded statements | Request written questions and respond in writing |

| Never accept first offer | Get independent contractor estimates |

| Request detailed explanations | Question unclear decisions or denials |

| Know policy rights | Consider professional representation |

Dealing With Insurance Company Adjusters: No, They Are NOT Your Friend

Managing the complex process of hurricane damage claims requires homeowners to understand an essential reality: insurance company adjusters primarily serve their employers' interests, not the property owner's needs.

When dealing with roof damage claims, homeowners must actively advocate for their interests by thoroughly documenting damage before the adjuster's inspection and maintaining a presence during the assessment to guarantee accurate documentation.

- Prepare extensive documentation with detailed photos and descriptions of all roof damage before the adjuster arrives

- Review policy terms thoroughly, understanding coverage limits and potential exclusions that could affect claim approval

- Be prepared to challenge underpayment or denials by supplementing claims with additional evidence and professional assessments

This proactive approach helps protect homeowners' interests while maneuvering the claims process effectively.

Getting Help From A Public Adjuster: Your Advocate & Ally

When managing the complexities of hurricane-damaged roof replacement claims, public adjusters serve as dedicated advocates who work exclusively for the policyholder's interests, unlike insurance company adjusters who represent the insurer. Research demonstrates that policyholders who engage public adjusters often secure remarkably higher settlements, with the Landmak OPPAGA Study reporting increases of up to 800% compared to unrepresented claims. Public adjusters typically charge 10-20% of the final settlement amount, making their services accessible while ensuring their motivation aligns with maximizing the policyholder's recovery.

| Service Aspect | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Represents | Policyholder | Insurance Company |

| Primary Goal | Maximize Claim Settlement | Control Claim Costs |

| Fee Structure | 10-20% of Settlement | Employed by Insurer |

| Claim Expertise | Independent Assessment | Company Guidelines |

The Role Of Public Claims Adjusters In Hurricane Damaged Roof Replacement Claims

Maneuvering the complexities of hurricane-damaged roof insurance claims can overwhelm homeowners who are already dealing with property devastation. Public claims adjusters serve as essential advocates, offering expertise in managing the claims process while ensuring fair compensation for roofing damage. These professionals navigate the intricate details of policies, mitigating the stress that often accompanies such situations. By providing clear guidance, they help homeowners understand the intricacies involved, with roof damage insurance claims explained in a way that demystifies the process. As advocates, public claims adjusters empower homeowners to secure the financial support they need to restore their homes and regain a sense of normalcy.

| Key Services | Benefits | Outcomes |

|---|---|---|

| Damage Assessment | Expert Documentation | Higher Settlements |

| Policy Analysis | Coverage Optimization | Reduced Stress |

| Claims Management | Professional Negotiation | Faster Resolution |

These professionals thoroughly document evidence, analyze insurance policies for coverage options, and negotiate with insurance companies on behalf of homeowners. Their thorough understanding of claims procedures and policy nuances enables them to identify opportunities that property owners might miss, greatly increasing the likelihood of a successful claim while streamlining the entire process.

Benefits Of Using A Public Adjuster For Hurricane Damaged Roof Replacement Claims

The decision to engage a public adjuster for hurricane-damaged roof claims can considerably impact the outcome of an insurance settlement. When filing a roof claim, public adjusters serve as specialized advocates who thoroughly document damages and negotiate with the insurance company on behalf of homeowners.

| Benefits | Impact |

|---|---|

| Expertise | Identifies hidden damages and storm damages beyond visible issues |

| Documentation | Professional assessment and detailed evidence collection |

| Negotiation | Maximizes settlement through experienced policy interpretation |

| Time Management | Expedites claim resolution while reducing homeowner stress |

Public adjusters work on contingency, ensuring their interests align with maximizing the homeowners insurance settlement. Their expertise in documenting and presenting claims often results in higher compensation than homeowners might secure independently, particularly when dealing with complex hurricane damage scenarios that require thorough investigation to properly cover all damages.

How Are Public Insurance Adjusters Paid & What Are Their Fees?

Understanding public adjuster compensation structures helps property owners make informed decisions about representation during insurance claims. Most public adjuster fees range from 10% to 20% of the final settlement amount, with payment contingent upon successful claim resolution. Studies indicate that despite these fees, policyholders often receive considerably higher settlements when utilizing licensed professionals for complex claims.

| Service Component | Value Added | Fee Impact |

|---|---|---|

| Damage Evaluation | Detailed Documentation | Included |

| Claim Preparation | Expert Analysis | Standard % |

| Negotiation | Higher Settlements | Success-Based |

This fee structure aligns the adjuster's interests with maximizing claim settlements while providing thorough services, from initial property damage assessment through final resolution. For disputed claims or extensive hurricane damage, this investment often yields markedly higher compensation compared to self-managed claims.

Public Adjusters Vs. The Insurance Company Adjuster

After considering fee structures, homeowners must recognize the fundamental differences between public adjusters and insurance company adjusters during hurricane damage claims. Public adjusters work exclusively for policyholders, focusing on maximizing claim settlements and identifying all coverage opportunities. In contrast, insurance company adjusters represent the insurer's interests throughout the claims process.

| Aspect | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Represents | Policyholder | Insurance Company |

| Focus | Maximize Settlement | Control Costs |

| Payment | Contingency Fee | Company Salary |

Understanding these distinctions is essential as public adjusters provide thorough documentation, negotiate on behalf of homeowners, and help prevent claim denials through their extensive knowledge of insurance policies. Their expertise often results in higher settlements and smoother claims processes for hurricane damage roof replacements.

When to Contact Your Insurance Provider For Roof Hurricane Damage Replacements

Property owners managing hurricane roof damage claims have two primary paths: working with a public adjuster or filing directly with their insurance provider.

Those utilizing a public adjuster should coordinate communication between their adjuster and insurance company, ensuring proper documentation and claim presentation.

Homeowners choosing to file independently must contact their insurance provider immediately after discovering damage, thoroughly document all issues with photos and detailed notes, and maintain consistent communication throughout the claims process.

If Using A Public Adjuster

When homeowners decide to engage a public adjuster for hurricane-related roof damage, they should contact their insurance provider immediately to initiate the claims process. A public adjuster can help maximize the roof insurance claim by thoroughly documenting storm damage and providing detailed repair estimates.

Working alongside a public adjuster requires maintaining clear communication channels between all parties involved. The adjuster will assist in gathering extensive evidence of hurricane damage, guaranteeing that homeowners insurance claims include all necessary documentation.

They can also help interpret policy coverage and exclusions, potentially leading to more favorable settlement outcomes. Throughout the claim process, the public adjuster serves as an advocate, working to guarantee the insurance company fully addresses all aspects of the roof damage and provides appropriate compensation for necessary repairs.

If Filing On Your Own

Filing a hurricane-related roof damage claim independently requires immediate action to protect both the property and the validity of the insurance claim. Property owners must document all visible damage through photographs and detailed notes before initiating roof repairs.

When filing a roof claim, homeowners should review their policy to understand whether coverage is based on actual cash value (ACV) or replacement cost value (RCV).

Timely reporting of damage is essential, as insurance companies may deny claims submitted outside specified timeframes. Maintaining thorough records of all communications with the insurance company will help track the claim's progress and prevent potential disputes.

Documentation should include dates of correspondence, names of representatives, and copies of submitted materials. This systematic approach increases the likelihood of successful claim resolution.

Filing Process For Hurricane Damaged Roof Replacement Claims Using A Public Adjuster

A public adjuster streamlines the hurricane damage claims process by conducting detailed roof inspections and documenting all visible and hidden damage through photographs, measurements, and professional assessments.

Through thorough policy analysis, they identify applicable coverage benefits and gather supporting evidence to build a robust case for maximum compensation. The adjuster then manages all communications with the insurance company, negotiating directly with their adjusters while advocating for the policyholder's interests throughout the settlement process.

- Professional documentation includes high-resolution photographs, drone imagery, and detailed measurements of all damaged roof areas.

- Policy analysis reveals coverage for often-overlooked items such as secondary water damage, debris removal, and temporary repairs.

- Direct negotiations with insurance adjusters typically result in 20-40% higher settlement amounts compared to self-filed claims.

Public Adjuster Thoroughly Inspects & Documents Hurricane Damage To Roof

Professional public adjusters play a pivotal role in documenting hurricane-related roof damage during insurance claim proceedings. They conduct thorough inspections to identify visible and concealed damage, meticulously documenting findings through detailed photographs and written reports. This thorough documentation serves as critical evidence during the claims process.

| Inspection Phase | Documentation Required | Impact on Claim |

|---|---|---|

| Initial Assessment | Visual Evidence | Establishes Baseline |

| Detailed Analysis | Written Reports | Supports Valuation |

| Final Evaluation | Detailed Photos | Facilitates Settlement |

Public adjusters leverage their expertise in homeowners insurance to ascertain all covered damages are properly reported. They negotiate with insurance companies on behalf of property owners, utilizing their documented evidence to secure fair settlements for roof replacement costs, ultimately streamlining the entire claims process.

Public Adjuster Reviews Policy For Hidden Roofing Coverage & Helps Maximize Policy Benefits

Beyond documenting physical damage, successful hurricane-related roof claims require a thorough understanding of insurance policy provisions. A public adjuster analyzes policies to identify hidden coverage for roof repair that homeowners might overlook. Through systematic review and expert interpretation, they maximize policy benefits by confirming all eligible damages are documented and presented effectively to the insurance company.

| Claim Process Steps | Public Adjuster's Role |

|---|---|

| Policy Review | Identifies hidden coverage options |

| Damage Assessment | Documents all eligible damages |

| Cost Estimation | Calculates detailed repair costs |

| Claim Filing | Confirms timely submissions |

| Settlement Negotiation | Advocates for maximum benefits |

This complex process requires expertise in both technical assessment and policy interpretation, helping confirm the claim is approved and adequately compensated through proper documentation and strategic presentation of damages.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

When partnering with policyholders, public adjusters serve as intermediaries who manage all communications with insurance companies throughout the hurricane damage claims process.

They streamline negotiations by presenting thorough documentation of roof replacement needs and ensuring proper interpretation of coverage terms. Their expertise facilitates efficient claim settlements while protecting policyholder interests.

- Public adjusters compile and submit detailed damage assessments, including photographic evidence and expert evaluations, to substantiate hurricane damage claims.

- They handle all correspondence, meetings, and negotiations with insurance company adjusters, eliminating direct confrontations between policyholders and insurers.

- These professionals monitor claim progression, address potential disputes, and advocate for fair settlements based on policy terms and documented hurricane damage evidence.

Public Adjuster Gets Professional Assessments

Public adjusters initiate the hurricane damage claim process by obtaining extensive professional assessments of affected roofs. These experts conduct detailed evaluations to document both visible and hidden damages, ensuring complete coverage in homeowners insurance claims.

Their systematic approach maximizes potential settlement amounts by identifying all damage-related issues that might affect the property's structural integrity.

- Professional assessments include detailed photography, measurements, and written documentation of all hurricane-related roof damage.

- Experts evaluate hidden damages that may not be immediately apparent, such as underlying structural compromises or water infiltration.

- Technical reports are prepared to substantiate claims with insurance companies, incorporating building code requirements and policy specifications.

The thorough documentation assembled through these professional assessments strengthens the claims process and supports the adjuster's negotiations for ideal settlement outcomes.

Public Adjuster Gathers Supporting Evidence

Thorough evidence collection forms the cornerstone of successful hurricane damage roof replacement claims. Public adjusters systematically gather extensive documentation to substantiate insurance claims and maximize settlement outcomes. Their meticulous approach guarantees claim validity while expediting the claims process for homeowners insurance.

| Evidence Type | Purpose |

|---|---|

| Photographs | Visual documentation of hurricane damage |

| Video Documentation | Dynamic capture of structural issues |

| Written Reports | Detailed assessment of roof damage |

| Policy Analysis | Verification of coverage parameters |

| Cost Estimates | Accurate replacement valuations |

The adjuster's documented evidence strengthens negotiation positions with insurance companies, particularly when demonstrating the necessity for roof replacement. This systematic approach to documenting damage helps prevent claim denials and supports fair compensation for hurricane-related repairs, ultimately protecting the homeowner's interests throughout the settlement process.

Public Adjuster Submits Complete Claims Package

Building upon the collected evidence, the submission of a complete claims package represents a critical phase in the hurricane damage roof replacement process. The public adjuster meticulously compiles documentation, including detailed damage assessments and extensive estimates, to present a thorough case to the insurance company.

| Claims Package Components | Purpose | Impact |

|---|---|---|

| Damage Documentation | Evidence Collection | Validates Claim |

| Extensive Estimate | Cost Assessment | Guarantees Fair Value |

| Policy Analysis | Coverage Verification | Maximizes Benefits |

Acting as an advocate, the public adjuster navigates complex insurance policies while submitting the claims package. Their expertise in documenting damage and negotiating with insurance companies greatly enhances the likelihood of a successful claim for roof replacement, streamlining the entire process and working to secure appropriate compensation for the homeowner.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Once a claims package has been submitted, the public adjuster assumes responsibility for managing all subsequent communications and deadlines with the insurance company.

Their expertise guarantees timely processing of roof replacement claims while adhering to strict filing requirements and documentation standards.

Public adjusters maintain consistent follow-up with insurance carriers, track claim progress, and negotiate claim amounts for ideal settlements.

- Manages all correspondence and documentation requirements throughout the claims process for hurricane damage insurance

- Monitors critical deadlines and submission timelines to prevent claim denials for homeowners insurance

- Handles negotiations directly with insurance adjusters to maximize settlement for filing a roof replacement claim

This professional oversight allows property owners to focus on recovery while guaranteeing their interests are protected throughout the document damage and claims settlement process.

Public Adjuster Enforces Policyholder's Rights, & Negotiates Higher & More Fair Settlement

Professional public adjusters serve as powerful advocates for policyholders during hurricane damage roof replacement claims, leveraging their expertise to secure fair settlements.

Through meticulous review of insurance policies and detailed documenting of damage, they guarantee accurate assessment of hurricane-damaged roofs. Their specialized knowledge of the claims process enables them to negotiate higher settlements with insurance companies, protecting policyholder's rights throughout claims negotiation.

- Conduct thorough damage assessments and create detailed documentation to support claims

- Review insurance policies thoroughly to identify all covered damages and applicable benefits

- Utilize industry expertise to expedite quicker claim resolutions while maximizing settlement values

These professionals streamline the claims process, handling complex negotiations and documentation requirements to achieve ideal outcomes for property owners affected by hurricane damage.

Public Adjuster Speeds Up Claim Settlement Time

When homeowners engage public adjusters for hurricane-damaged roof claims, the filing process typically accelerates due to their systematic approach and industry expertise.

These professionals streamline insurance claims by efficiently documenting damages and preparing detailed reports that satisfy insurers' requirements. Their experience in handling claims for hurricane-damaged roofs enables faster processing and settlement time.

- Public adjusters expedite the claims process by immediately conducting thorough assessments and documenting all damages covered by homeowners insurance.

- They facilitate direct communication with insurance companies, reducing delays and ensuring all necessary documentation is submitted correctly.

- Their expertise in maximizing compensation helps avoid common pitfalls that often slow down claim settlements, such as incomplete documentation or missed damage identification.

Common Reasons For Hurricane Damage Roof Replacement Claim Denials

Insurance companies frequently deny hurricane damage roof replacement claims due to pre-existing damage, inadequate maintenance records, or normal wear and tear that exceeds the roof's expected lifespan.

Critical filing deadlines must be met to prevent automatic claim denials, as insurers strictly enforce timeline requirements for damage reporting and documentation submission.

Claims may also face rejection if the documented weather event falls outside the policy's specific covered perils, requiring careful examination of policy terms and conditions.

Pre-Existing Roof Damage

Pre-existing roof damage poses a significant obstacle for homeowners seeking coverage after hurricane-related incidents, as insurance companies frequently cite these prior conditions as grounds for claim denials. Insurance providers scrutinize the roof's condition, particularly focusing on maintenance issues and aging materials that may have compromised structural integrity before weather conditions deteriorated it further.

| Condition | Impact on Claims |

|---|---|

| Aging Materials | Reduced coverage for roofs >15 years |

| Previous Leaks | Potential denial if unrepaired |

| Poor Installation | Coverage exclusion possible |

| Deferred Maintenance | May void hurricane damage claims |

Timely reporting and thorough documentation of pre-existing conditions through regular inspections are essential for protecting homeowners' interests. Insurance companies typically require evidence that prior damage was properly addressed to validate new hurricane-related claims for roof replacement.

Poor Maintenance Records

Maintaining thorough roof maintenance records plays a pivotal role in securing insurance coverage for hurricane-related damage. Insurance companies frequently scrutinize documentation of regular upkeep when evaluating claims for roof replacement due to hurricane damage. Claims may be denied if there is evidence of poor maintenance, such as unchecked moss growth or previously missing shingles.

The condition of your roof prior to storm damage greatly influences claim outcomes. Insurance providers assess maintenance records to determine if damage resulted from the hurricane or gradual deterioration due to neglect.

Regular inspection reports, repair receipts, and photographic evidence of consistent upkeep strengthen claims and demonstrate responsible ownership. Conversely, inadequate maintenance records can lead to denied claims, particularly when the roof shows signs of long-term neglect or has exceeded its expected lifespan.

Normal Wear & Tear

Beyond inadequate maintenance records, normal wear and tear represents a significant factor in hurricane damage roof replacement claim denials. Insurance companies carefully evaluate a roof's condition to distinguish between storm-related damage and pre-existing deterioration. Visible signs of neglect and natural depreciation often lead to claim denials, particularly when the damage appears gradual rather than sudden.

| Age Factor | Insurance Impact | Required Action |

|---|---|---|

| 0-5 years | Full coverage likely | Regular inspection |

| 5-10 years | Partial depreciation | Document maintenance |

| 10-15 years | Higher scrutiny | Professional assessment |

| 15-20 years | Limited coverage | Increased documentation |

| 20+ years | Likely denial | Consider replacement |

Timely reporting and thorough documentation are essential for homeowners insurance claims, as insurers typically exclude coverage for deterioration that occurs through normal aging processes rather than specific weather events.

Missed Filing Deadlines

How quickly homeowners respond to hurricane damage can determine the success of their insurance claims. Insurance companies typically require timely action following storm events, making missed filing deadlines a significant reason for claim denials.

Homeowners must notify the insurer promptly about hurricane damage to their roof, as policies often specify strict timeframes for reporting losses.

Proper documentation and timely roof inspections are essential elements of the claims process. Delays in reporting damage, whether due to unawareness or procrastination, can lead to automatic claim rejection.

To avoid getting denied, homeowners insurance policyholders should familiarize themselves with filing requirements and act swiftly after a hurricane. Documentation should include detailed photographs and descriptions of damage, submitted within the specified timeframe to guarantee claim validity.

Non-Covered Weather Events

Insurance policies often specify certain weather-related events that fall outside the scope of hurricane damage coverage, leading to potential claim denials for roof replacement. Understanding non-covered weather events is vital for homeowners reviewing their insurance claims. Regular wear and tear from prolonged exposure to elements typically falls outside coverage parameters, as insurance companies focus on sudden, unexpected events.

| Weather Event | Coverage Status |

|---|---|

| Hurricane Damage | Generally Covered |

| Gradual Deterioration | Not Covered |

| Maintenance Issues | Not Covered |

| Pre-existing Damage | Not Covered |

| Normal Aging | Not Covered |

Insurance companies carefully evaluate whether roof needs stem from the hurricane itself or from excluded conditions. Claims may be denied if damage results from poor maintenance, age-related wear, or events specifically excluded in the policy. Prompt reporting within the designated period remains essential for claim consideration.

Insurance Claim Appeals Process

Public adjusters serve as valuable advocates for homeowners facing denied hurricane roof damage claims by leveraging their expertise in insurance policies and claims procedures. These professionals thoroughly examine denial reasons, gather additional supporting evidence, and develop thorough appeal strategies tailored to each case's specific circumstances. Their industry knowledge and experience can greatly improve the likelihood of successful appeals while relieving homeowners of the complex documentation and negotiation processes.

| Public Adjuster Services | Benefits | Impact on Claims |

|---|---|---|

| Policy Analysis | Identifies coverage gaps | Strengthens appeal basis |

| Damage Documentation | Creates detailed evidence files | Supports claim validity |

| Claim Valuation | Guarantees accurate cost assessment | Maximizes settlement |

| Negotiation Support | Represents homeowner interests | Improves success rates |

How Public Adjusters Help With Denied Hurricane Damaged Roof Replacement Claims

When homeowners face denied insurance claims for hurricane-damaged roofs, professional public adjusters serve as essential advocates throughout the appeals process. These specialists help navigate complex policy details and identify coverage nuances that may have contributed to the initial denial. They meticulously document wind damage and provide detailed assessments to support the claim.

| Service | Benefit |

|---|---|

| Damage Assessment | Thorough documentation of all roof damage |

| Policy Analysis | Identification of covered perils and exclusions |

| Negotiation | Direct interaction with insurance company |

Public adjusters streamline the process of filing appeals by gathering extensive evidence, preparing detailed reports, and negotiating directly with insurance companies. Their expertise often results in successful claim resolutions, helping homeowners secure the necessary funds for professional roof replacement while ensuring fair compensation for all documented hurricane damage.

Choosing & Working With Trusted Hurricane Damage Contractors

Professional public adjusters maintain extensive networks of trusted roofing contractors who specialize in hurricane damage repairs and replacements. These networks enable homeowners to access vetted professionals who can provide detailed, accurate estimates for necessary roof repairs or replacements following storm damage. Public adjusters review contractor estimates to identify potential discrepancies, guarantee fair pricing, and verify that all storm-related damage is properly documented for insurance claims.

| Contractor Evaluation Criteria | Required Documentation | Red Flags to Watch |

|---|---|---|

| License & Insurance Status | State Contractor License | No Physical Business Address |

| Hurricane Repair Experience | Liability Insurance Policy | Demands Full Payment Upfront |

| Past Client References | Worker's Compensation | Pressure Sales Tactics |

| BBB Rating & Reviews | Written Contract | No Written Estimates |

| Insurance Claims Experience | Detailed Cost Breakdown | Unsolicited Door-to-Door Sales |

Utilize Your Public Adjusters Extensive Professional Network

Following a hurricane's devastating impact, homeowners can greatly benefit from leveraging their public adjuster's extensive network of trusted contractors for roof replacement projects.

These established connections facilitate efficient coordination between all parties involved in the insurance claims process, ensuring thorough documentation and proper execution of repair work.

Public adjusters' contractor networks consist of pre-vetted professionals who specialize in hurricane damage repairs and understand insurance claim requirements.

This expertise helps homeowners avoid potential scams while ensuring quality workmanship.

Additionally, public adjusters can assist in obtaining competitive estimates from reliable contractors, providing valuable insights into fair market pricing and realistic project timelines.

This all-encompassing support system enables homeowners to navigate the complex roof replacement process more effectively, from initial damage assessment through project completion.

Getting Professional Roof Replacement Estimates

Securing accurate and thorough roof replacement estimates requires homeowners to carefully evaluate potential contractors who specialize in hurricane damage repairs. When pursuing insurance claims for high-quality roofing, understanding both actual cash value (ACV) and replacement cost value (RCV) helps determine how homeowners insurance will cover the cost of repairs.

| Evaluation Criteria | What to Verify | Why It Matters |

|---|---|---|

| Licensing | Current state credentials | Guarantees legal compliance |

| Insurance | Liability coverage | Protects homeowner interests |

| Experience | Hurricane damage expertise | Assures proper repairs |

| References | Past storm repair projects | Confirms reliability |

Working with a public adjuster can help identify qualified contractors whose damage assessments align with insurance requirements. Thorough documentation and professional estimates prevent claim delays and guarantee appropriate compensation for necessary repairs. Contact us for guidance through this critical process.

Let Your Public Adjuster Review Replacement Estimates To Ensure Contractor Honesty

Enlisting a public adjuster to review contractor estimates serves as an essential safeguard against potential overcharging or inadequate repair assessments following hurricane damage.

These professionals provide unbiased evaluations of replacement estimates, helping homeowners navigate complex insurance language and guarantee fair compensation for roof replacement claims.

Public adjusters excel at identifying overlooked costs and missing items that could lead to insurance claim underpayment. Their expertise enables them to negotiate effectively with contractors while verifying that proposed repairs align with actual hurricane damage.

This independent review brings transparency to the estimation process, protecting homeowners from inflated costs while guaranteeing all necessary repairs are included.

Additionally, public adjusters help verify that repair proposals comply with homeowners insurance policy terms, maximizing the likelihood of successful claims processing.

Tips For Preventing Future Roof Hurricane Damage

While hurricanes pose significant threats to residential roofs, homeowners can implement several preventive measures to minimize potential storm damage. Regular inspections of the roof's condition help identify vulnerabilities before severe storms strike, allowing homeowners insurance to cover necessary permanent repairs. Understanding both actual cash value (ACV) and replacement cost value (RCV) guarantees proper coverage against wind and hail damage.