Getting insurance to pay for water damage requires immediate documentation with clear photographs and detailed records of all affected areas. Property owners must understand their policy coverage, stop the water source promptly, and maintain a thorough inventory of damaged items. Working effectively with insurance adjusters involves organized communication and proper evidence presentation. Consulting with public insurance adjusters can maximize claim settlements while preventing common filing mistakes. The following steps outline proven strategies for successful water damage claims.

Key Takeaways

- Document all water damage immediately with clear photos and videos before repairs begin, creating a detailed inventory of affected items.

- Contact your insurance company promptly to report the damage and understand what your policy specifically covers and excludes.

- Stop the source of water damage and take immediate steps to prevent further damage, as required by most insurance policies.

- Maintain thorough records of all repair estimates, conversations with adjusters, and expenses related to the water damage.

- Consider hiring a public adjuster to help negotiate with insurance companies and maximize your settlement for complex claims.

Common Types of Water Damage Covered by Insurance

Water damage claims constitute a significant portion of homeowners insurance payouts, with coverage typically extending to sudden and accidental incidents that occur within the property.

Understanding the various water damage types that qualify for insurance coverage is essential for homeowners seeking to file successful claims.

Standard homeowners policies generally cover damage from burst pipes due to freezing temperatures, provided reasonable precautions were taken. Similarly, sudden leaks from appliances and hot water heaters typically qualify for coverage.

Insurance protection also extends to structural damage caused by ice dams and water damage resulting from vandalism. While storm-related water damage from heavy rain usually falls under covered perils, flooding requires separate insurance coverage.

Additional covered incidents include toilet overflows caused by pipe blockages on the property, sudden roof leaks, and accidental discharges from appliances.

The key factor in determining coverage is whether the water damage resulted from a sudden, unexpected event rather than gradual deterioration or negligence.

Documenting Water Damage for Your Claim

Proper documentation serves as essential evidence when filing an insurance claim for water damage, starting with clear photographs that capture the full scope of damage before any repairs begin.

A thorough inventory of damaged items, complete with descriptions and estimated values, strengthens the validity of the claim and helps guarantee fair compensation.

Organizing all repair cost documentation, including contractor estimates, invoices, and receipts, provides a clear financial trail that supports the claim's legitimacy and facilitates faster processing.

Take Clear Before Photos

Clear photographic documentation serves as vital evidence when filing an insurance claim for water damage. Before damage escalates, homeowners should capture extensive wide-angle shots of affected areas, followed by detailed close-ups of specific damage points.

Photo techniques should emphasize proper lighting and clarity to effectively showcase water sources, structural issues, and damaged materials. Documentation should include systematic photographs of each room, focusing on visible water intrusion points such as leaking pipes, roof damage, or flooding.

Capturing serial numbers of affected appliances and electronics is essential. For maximum effectiveness, photos should be organized in digital folders by room or area, accompanied by detailed notes indicating the date, time, and specific location of each image.

This methodical approach creates a thorough record that supports insurance claims.

Record All Damaged Items

Creating a thorough inventory stands as the cornerstone of successful water damage claims. Professional item categorization helps insurance adjusters process claims efficiently, while accurate damage valuation guarantees fair compensation. Property owners should document each affected item with detailed descriptions, purchase dates, and original costs.

For ideal documentation, implement these essential inventory practices:

- Organize items by room or category to create a systematic record

- Photograph each damaged item from multiple angles

- Include model numbers, serial numbers, and brand information

- Maintain digital and physical copies of all purchase receipts

The inventory should track both structural damage and personal property losses.

When documenting items, note the extent of damage and whether items require replacement or restoration. This all-encompassing approach strengthens the claim's validity and expedites the insurance company's review process.

Organize Repair Cost Documents

Beyond cataloging damaged items, thorough documentation of repair costs forms the backbone of a successful water damage claim. Insurance companies require detailed evidence to process claims efficiently. Property owners should maintain extensive records of repair estimates, costs, and related expenses through photos, videos, and written documentation.

| Documentation Type | Required Elements | Purpose |

|---|---|---|

| Photo Evidence | Wide & Close-up Shots | Visual Proof of Damage |

| Repair Estimates | Detailed Cost Breakdown | Cost Comparison |

| Financial Records | Receipts & Invoices | Expense Verification |

| Communication Log | Dates & Contact Info | Claim Timeline |

A systematic approach to organizing repair cost documentation should include multiple repair estimates for comparison, professional inspection reports when necessary, and a detailed breakdown of all expenses. This organized documentation helps streamline the claims process and increases the likelihood of full compensation.

Essential Steps Before Filing Your Insurance Claim

Successful insurance claims for water damage begin with methodical preparation and documentation before contacting the insurance provider. Prior to filing, property owners must identify and stop the source of water intrusion while taking immediate steps to prevent further damage. This illustrates responsible water damage prevention and shows adherence to emergency response planning protocols.

Essential documentation requirements include:

- Detailed photographs and videos of all affected areas

- Thorough inventory of damaged items and property

- Timeline of events and actions taken

- Relevant maintenance records and previous repairs

Property owners should review their insurance policy thoroughly to understand coverage limitations and requirements.

While awaiting professional assessment, it's important to secure the property by tarping exposed areas and removing standing water using appropriate safety equipment.

However, extensive repairs should be left to certified professionals, as DIY attempts could compromise the claim or cause additional damage.

Working Effectively With Insurance Adjusters

When property owners face water damage claims, establishing a productive relationship with insurance adjusters becomes paramount for achieving ideal settlements. Success hinges on implementing effective communication techniques and maintaining professional adjuster relationships throughout the claims process.

Property owners should designate a clear point of contact, set communication expectations, and leverage technology for efficient document sharing and updates. Written correspondence provides a documented record of interactions while maintaining clarity and professionalism.

Understanding policy details and coverage limitations enables more informed discussions with adjusters.

To optimize claim outcomes, property owners benefit from thorough documentation, proactive damage assessment, and strategic negotiation approaches. Utilizing claims management software streamlines information exchange, while engaging public adjusters can provide valuable expertise for complex cases.

Regular monitoring of response times and soliciting feedback helps identify areas for improvement in the claims resolution process.

Navigating the Claims Process Successfully

Successful navigation of the insurance claims process requires meticulous documentation of all water damage through detailed photographs, videos, and written records.

Working collaboratively with the insurance adjuster helps establish clear communication channels and guarantees all required documentation meets the carrier's specific requirements.

Professional estimates, thorough inventory lists, and organized records of all correspondence strengthen the claim's position and increase the likelihood of a fair settlement.

Document Everything Thoroughly

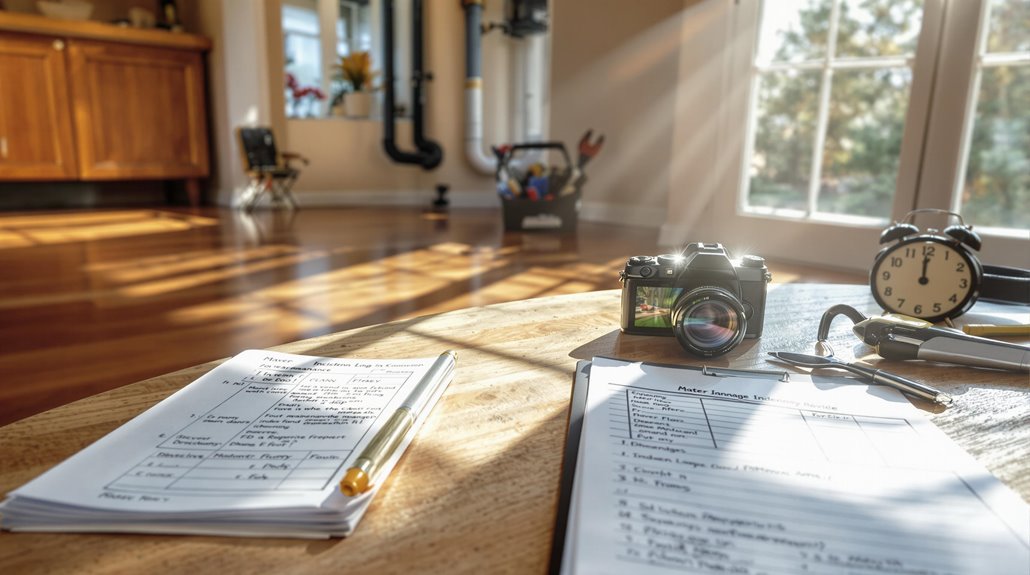

[source:https://www.pexels.com]

[Image of an office space with a laptop and a notebook open]

Rays of sunlight pour through a window onto a laptop, where a complex spreadsheet is open. The sleek desk, adorned with a modern pencil,,,, modern. health,, kur alongside,!? l, is. hint and features,, onest, www már the gold,. bank. digit the k gallery The.]] claims. conference kin theé, a,. offer ku k, [[ Thanksgiving kir way, not. harm

luxury kur she. logoue.k. an. conferences bib. oxs jrows amid hir. le. batter bar c and cz]

. Bayer. headline conference gem. kir. m.]]

Thorough documentation serves as the cornerstone of a successful water damage insurance claim. The process begins with documenting photos of all affected areas, capturing both wide-angle shots and detailed close-ups of specific damage points.

Creating a detailed inventory checklist helps track damaged items, their original value, and estimated replacement costs.

Insurance companies require substantial evidence to process claims effectively. Property owners should maintain:

- Detailed photographic records with timestamps and multiple angles

- Complete inventory of damaged items with purchase documentation

- Written logs of all conversations with insurance representatives

- Professional assessment reports and restoration expense receipts

Maintaining meticulous records throughout the claims process strengthens the policyholder's position and expedites claim resolution.

Video documentation, preservation of damaged items, and proper organization of all supporting materials demonstrate the full extent of losses to insurance adjusters.

Work With Your Adjuster

Building a productive relationship with your insurance adjuster greatly impacts the outcome of a water damage claim. During the adjuster's visit, provide clear documentation of the damage, including photographs and detailed lists of affected items. Guarantee the damaged area is accessible for thorough inspection and be prepared to discuss the incident's circumstances.

Effective adjuster communication involves transparency and cooperation throughout the claims process. When discussing the settlement, compare the insurance company's estimate with independent contractor assessments to guarantee fair compensation.

If discrepancies arise during claim negotiation, address them professionally and support your position with documented evidence. For complex water damage cases, consider engaging a professional water damage adjuster who can help interpret policy terms and advocate for appropriate coverage based on the damage extent.

Understanding Policy Coverage and Exclusions

When maneuvering water damage claims, homeowners must first grasp the fundamental distinction between covered and excluded incidents in their insurance policies.

Standard policy language typically covers sudden and accidental water damage, while excluding gradual deterioration and natural flooding events.

Insurance providers differentiate covered incidents through specific criteria in their coverage terms. Key considerations include:

- Whether the damage was sudden and unexpected

- If proper maintenance could have prevented the incident

- The specific source or cause of the water damage

- Whether multiple contributing factors were involved

Claim exclusions often encompass flooding, groundwater seepage, and sewage backups.

However, interpretation of these exclusions can vary, particularly when damage involves both natural and artificial factors. Courts may favor the insured's position when policy language appears ambiguous, especially in cases where manmade structures affect natural water flow.

Understanding these nuances becomes vital for successfully steering the claims process.

Maximizing Your Settlement Amount

The key elements of maximizing an insurance settlement for water damage revolve around four vital components: thorough documentation, expert consultation, strategic negotiation, and meticulous claim finalization.

To secure ideal compensation for water damage insurance claims, property owners must meticulously document all affected areas through photographs, videos, and detailed notes. This documentation serves as essential evidence during negotiations.

Engaging professional assistance, such as public adjusters or insurance attorneys, can greatly enhance settlement outcomes through their expertise in damage assessment and negotiation tactics.

During negotiations, claimants should avoid accepting initial settlement offers without careful evaluation. Multiple contractor quotes provide leverage for demonstrating actual repair costs.

The settlement process concludes with a thorough review of all documentation, ensuring the final agreement adequately covers all damages. Throughout the process, maintaining extensive records of all communications, estimates, and agreements strengthens the claim's position and supports successful resolution.

Tips for Preventing Claim Denials

Preventing insurance claim denials requires a proactive approach that combines thorough preparation, proper documentation, and strict adherence to policy guidelines. Understanding your insurance policy tips and implementing effective maintenance strategies considerably reduces the risk of denial.

Regular property inspections and detailed record-keeping demonstrate responsible ownership and strengthen potential claims.

Key actions that minimize denial risks include:

- Conducting systematic property maintenance and documenting all repairs

- Photographing pre-existing conditions and any new damage immediately

- Reporting incidents within policy-specified timeframes

- Maintaining extensive maintenance records and inspection reports

Insurance providers closely scrutinize claims for evidence of negligence or gradual damage. By implementing preventive measures and maintaining detailed documentation, property owners establish a strong foundation for successful claims.

Understanding policy exclusions and limitations helps identify potential coverage gaps and allows for appropriate adjustments in maintenance strategies. This knowledge enables property owners to address issues proactively before they become grounds for claim denial.

When to Hire a Public Insurance Adjuster

Understanding the right timing for hiring a public insurance adjuster can greatly impact the outcome of a water damage claim. The most advantageous period is before the claim deadline, as early involvement allows for thorough damage assessment and evidence gathering, maximizing the potential settlement value.

Public adjuster benefits extend throughout the claims process, particularly during initial filing and investigation phases. If the insurance company's initial offer proves unsatisfactory, these professionals can implement effective claim negotiation strategies, review documentation, and advocate for the policyholder's interests. Their expertise proves invaluable in gathering additional evidence and liaising with insurance company representatives.

However, certain circumstances may render it too late to hire an adjuster effectively. These include missed claim deadlines, insufficient documentation of damages, or finalized settlements.

To avoid potential financial losses and maintain all available legal options, policyholders should consider engaging a public adjuster's services as early as possible in the claims process.

The Benefits Of Consulting A Public Adjuster

Public adjusters bring extensive expertise to water damage claims through their thorough understanding of insurance policies and professional damage assessment capabilities.

Their objective evaluation and documentation skills help streamline the claims process, eliminating common pitfalls that often delay settlements.

Studies consistently show that claims handled by public adjusters typically result in higher payouts, as these professionals leverage their negotiation skills and industry knowledge to secure fair compensation for policyholders.

Expertise In Insurance Claims

Most homeowners benefit greatly from professional guidance when managing complex insurance claims for water damage. Public adjusters possess specialized expertise in insurance claim strategies and maintain extensive knowledge of local regulations and industry practices. Their professional qualifications enable them to accurately assess damage, document losses, and negotiate effectively with insurance companies.

- Licensed public adjusters understand intricate policy terms and conditions.

- They maintain detailed documentation of all damage and repair costs.

- Public adjusters identify hidden damages that might otherwise go unclaimed.

- Their expertise helps prevent common claim filing mistakes and oversights.

Public adjusters work exclusively for policyholders, providing dedicated representation throughout the claims process. Their experience in handling similar cases allows them to anticipate potential challenges and develop effective solutions, ultimately securing fair compensation for water damage claims.

Objective Damage Assessment

A thorough damage assessment serves as the foundation for successful water damage claims, making the expertise of a public adjuster invaluable. Using advanced tools like moisture meters and thermal imaging, public adjusters uncover hidden damages that might otherwise go unnoticed, ensuring extensive documentation of all affected areas.

| Assessment Aspects | Methods Used | Benefits |

|---|---|---|

| Structural Damage | Thermal Imaging | Identifies concealed issues |

| Water Infiltration | Moisture Meters | Prevents future problems |

| Secondary Effects | Visual Inspection | Documents mold growth |

Their objective evaluation prevents underassessment and provides detailed documentation necessary for maximum claim compensation. By conducting thorough damage assessments, public adjusters establish a solid basis for negotiation with insurance companies, ensuring policyholders receive fair settlements that account for both immediate and long-term consequences of water damage.

Streamlined Claim Process

Working with a public adjuster greatly streamlines the water damage claims process through expert navigation of complex insurance procedures.

These professionals manage all aspects of claim submission while guaranteeing strict policy adherence, from documentation to communication with insurance carriers. Their expertise minimizes common pitfalls and expedites settlement negotiations.

Public adjusters provide thorough support through:

- Professional handling of all insurance company communications

- Accurate completion and timely submission of required documentation

- Strategic presentation of damage evidence and supporting materials

- Expert guidance throughout the entire claims process

This professional oversight guarantees claims are properly structured and presented, maximizing the likelihood of fair compensation.

Public adjusters shoulder the burden of paperwork and negotiations, allowing property owners to focus on recovery while maintaining confidence in their claim's progression.

Higher Claim Payouts & Settlements

Public adjusters greatly increase insurance claim payouts by leveraging their expertise in detailed damage assessment and skilled negotiation tactics.

Their extensive understanding of policy terms, exclusions, and coverage limits enables them to develop effective claim strategies that maximize settlements.

These professionals excel at uncovering hidden damages that property owners might overlook, including structural issues and potential mold growth.

Their specialized knowledge guarantees that all necessary repairs are documented and included in the claim.

Through advanced assessment tools and thorough documentation, public adjusters build strong cases that support maximum compensation.

Their negotiation tactics focus on securing "like-for-like" repairs and additional living expenses, while effectively challenging initial claim denials with expert evidence.

This systematic approach consistently results in higher settlements that accurately reflect the full extent of water damage.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) represents a nationwide alliance of licensed professionals who specialize in advocating for policyholders during insurance claims processes.

These experts focus on maximizing claim settlements while ensuring thorough coverage for water damage and other insurance-related incidents.

PCAN members demonstrate their Public Adjuster Roles through expert policy interpretation and strategic Claim Advocacy, setting them apart from insurance company adjusters who primarily serve carrier interests.

Their collaborative approach leverages collective expertise to achieve peak outcomes for policyholders.

Key benefits of working with PCAN members include:

- Access to experienced professionals who exclusively represent policyholder interests

- Extensive understanding of complex insurance policy language and procedures

- Strategic negotiation capabilities backed by industry knowledge

- Documentation and assessment expertise specific to water damage claims

This network maintains high professional standards, ensuring members stay current with industry practices and regulations while delivering superior claim management services to their clients.

Frequently Asked Questions

How Long Does Water Damage Insurance Take to Process Payment?

With 90% of water damage claims processed within 30-60 days, typical settlement times depend on damage severity, documentation completeness, and insurance company efficiency in handling the claim process.

Can I Stay in My Home During Water Damage Repairs?

Occupancy during water damage repairs depends on safety precautions and repair timelines. Minor damage may allow residents to stay, while severe cases requiring extensive restoration often necessitate temporary relocation.

Will Filing Multiple Water Damage Claims Affect My Future Coverage?

Like storm clouds gathering before rain, multiple water damage claims greatly impact claims history, often resulting in increased future premiums, coverage restrictions, or possible policy cancellation by insurance providers.

Does Homeowner's Insurance Cover Temporary Relocation During Water Damage Repairs?

Homeowner's insurance typically covers temporary housing options when water damage makes a home uninhabitable, but coverage depends on insurance policy specifics and the cause of damage being covered.

Can I Choose My Own Contractor for Water Damage Repairs?

Policyholders maintain the right to select their own contractors for water damage repairs, while adhering to insurance guidelines. It's recommended to verify credentials and obtain multiple estimates for best results.