Want a new roof without breaking the bank? Let's explore some legit ways to dodge that hefty deductible! Think of your roof as an investment puzzle – there are more pieces to solving it than you might realize.

First up, Uncle Sam's got your back! Federal programs through HUD and USDA Rural Repair can be your golden ticket, especially if you're a senior homeowner. It's like finding a secret passage to home improvement heaven – you just need to know where to look.

State housing programs are another hidden gem in your roofing toolkit. Each state offers its unique flavor of assistance, kind of like a menu of financial help options waiting to be discovered. Your local housing department might be sitting on resources you never knew existed!

But here's the deal – steer clear of those too-good-to-be-true contractor schemes. They're like wolves in sheep's clothing, promising the moon while potentially landing you in hot water with your insurance company. Remember, if it sounds sketchy, it probably is.

Non-profit organizations can be your knight in shining armor, offering qualified homeowners a pathway to that much-needed roof replacement. Think of them as your community superheroes, ready to help when traditional options fall short.

Ready to crack the code on getting that new roof? Start by connecting with these resources – your dream of a leak-free home might be more achievable than you thought!

Key Takeaways

Want a New Roof Without Touching Your Deductible? Let's Make It Happen!

Getting Uncle Sam to Help You Out

Did you know there's free money waiting for your new roof? The HUD Community Development Block Grants and USDA Rural Repair programs are like hidden treasure chests for homeowners. Think of them as your roof-saving superheroes – they're just waiting for your call!

Weather the Storm with WAP

The Weatherization Assistance Program isn't just a fancy name – it's your ticket to a solid roof over your head if you're watching your pennies. It's like having a financial umbrella during a downpour, especially for families stretching every dollar.

Your Local Heroes

Right in your backyard, non-profits and city housing departments are quietly working magic for homeowners. They're like your neighborhood roof fairy godparents, turning "I can't afford it" into "When can we start?"

Emergency Support When You Need It Most

Don't let a leaky roof keep you up at night! Emergency assistance programs are standing by, ready to jump in like first responders for your home. These initiatives ensure your roof meets safety standards without breaking the bank.

Double Your Chances of Success

Why put all your eggs in one basket? Mix modern crowdfunding power with traditional housing programs – it's like fishing with multiple lines in the water. Cast your net wide across state and local assistance options to maximize your chances of scoring that free roof replacement.

Understanding Insurance Coverage and Legal Requirements for Roof Deductibles

While homeowners may seek ways to avoid paying insurance deductibles for roof replacements, both legal requirements and insurance policies mandate these payments as part of the claims process.

Insurance coverage for roofs operates under either Actual Cash Value (ACV) or Replacement Cost Value (RCV) policies, each with specific settlement structures.

Under Florida law, deductible payment remains a non-negotiable component of insurance claims. The state's regulations have evolved, particularly with the elimination of the 25% rule for full roof replacements.

Now, only damaged portions require repair if the existing roof meets 2007 Florida Building Code standards. Additionally, the 15-year roof rule protects homeowners from coverage denial based solely on roof age, provided the structure meets specific criteria and passes professional inspection.

Thorough damage documentation requirements include detailed photos of any hail indentations, wind-torn materials, or water damage signs to support insurance claims.

Government Assistance Programs and Grants for Roof Replacements

Although obtaining a new roof can be financially challenging, numerous government assistance programs and grants offer viable solutions for eligible homeowners. Federal grants through HUD's Community Development Block Grants and the Weatherization Assistance Program provide substantial support for qualified applicants.

Local assistance programs, administered by state and municipal authorities, further expand opportunities for homeowners seeking roof replacements.

Key government programs available include:

- USDA Rural Repair grants targeting seniors 62+ in rural communities

- State-specific housing rehabilitation programs focusing on low-income households

- Community-based initiatives supporting urgent roof repairs for safety compliance

Eligibility typically depends on income level, age, location, and property ownership status. Applicants must demonstrate genuine need and meet specific program requirements.

Documentation of income, property ownership, and urgent repair necessity strengthens application success rates.

Many homeowners can also utilize Additional Living Expense coverage during roof repairs if their home becomes temporarily uninhabitable due to covered damages.

Navigating Local Community Resources and Support Options

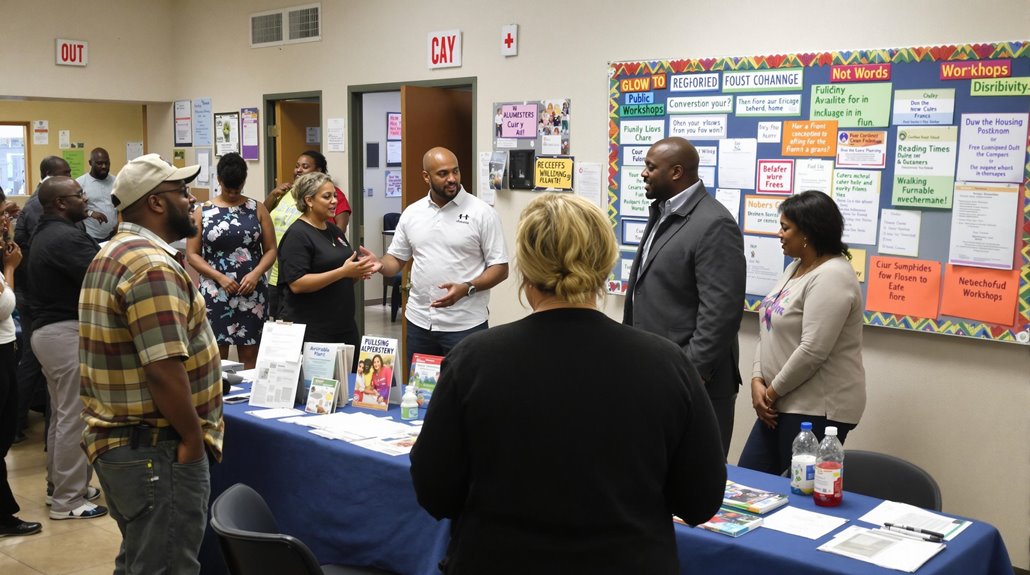

Local communities offer extensive resources and support options that homeowners can strategically access for roof replacements. By leveraging multiple community resources simultaneously, property owners can minimize out-of-pocket expenses through coordinated assistance programs.

Key support networks include city housing departments, non-profit organizations, and faith-based groups that provide financial aid and services. Community development agencies often manage block grants specifically designed for housing rehabilitation.

Local contractors may participate in assistance programs, offering reduced rates or payment plans. Emergency assistance programs and disaster relief funds can address immediate roofing needs, while specialized programs target vulnerable populations such as seniors and individuals with disabilities.

Homeowners should investigate workshops, neighborhood initiatives, and crowdfunding platforms to maximize available community-based funding opportunities. Working with public adjusters can increase settlement amounts by 30-50% when filing insurance claims for roof damage.

Legitimate Ways to Finance Your Roof Replacement Project

Beyond community assistance programs, homeowners can explore multiple legitimate financing pathways to fund their roof replacement projects. Various loan types cater to different financial situations, including direct financing through roofing companies, personal loans, and home equity options. Each financing option carries distinct advantages and risks that require careful evaluation.

- Service Finance partnerships offering loans up to $45,000 with flexible repayment terms

- Home equity loans leveraging property value for lower interest rates and extended payment periods

- Non-profit organization financing programs providing reduced-interest solutions for qualified applicants

Homeowners should analyze their creditworthiness, available equity, and monthly budget capacity when selecting financing options.

Understanding the terms, interest rates, and repayment obligations of each loan type guarantees informed decision-making and sustainable financial management throughout the roof replacement process.

With insurance claim settlements averaging $12,000, homeowners should carefully evaluate coverage options before pursuing alternative financing.

Warning Signs of Roofing Scams and Deceptive Practices

Protecting oneself against roofing scams requires vigilant awareness of common deceptive practices that can leave homeowners financially vulnerable. Effective scam identification involves recognizing suspicious behaviors and implementing thorough contractor vetting procedures. Texas law explicitly states that waiving insurance deductibles is illegal and should be reported to authorities. Homeowners should also be cautious of door-to-door solicitors who pressure them into making hasty decisions about roofing repairs. Furthermore, it is essential to discuss roofer insurance check concerns before hiring any contractor, ensuring that they have the necessary coverage to protect against potential liabilities. By educating themselves about these issues and seeking recommendations from trusted sources, homeowners can significantly reduce the risk of falling victim to roofing scams.

| Warning Sign | Risk Level | Recommended Action |

|---|---|---|

| Unsolicited Door-to-Door | High | Decline immediate engagement |

| Large Down Payment | High | Refuse payment over 20% |

| No Local Office | High | Verify physical location |

| Insurance Promises | Medium | Contact insurer directly |

| Pressure Tactics | Medium | Take time to research |

Red flags include contractors appearing uninvited after storms, demanding immediate decisions, or offering to manipulate insurance claims. Legitimate contractors maintain proper documentation, provide detailed written estimates, and demonstrate established local presence. Homeowners should verify licenses, obtain multiple bids, and resist high-pressure sales tactics that create artificial urgency.

The Benefits Of Consulting A Public Adjuster

Public adjusters offer specialized expertise in maneuvering complex insurance claims, conducting objective damage assessments, and managing the intricacies of policy coverage to maximize settlements.

Their professional oversight helps streamline the claims process by ensuring accurate documentation, thorough evidence collection, and proper procedural compliance.

Studies indicate that policyholders who engage public adjusters typically receive higher claim payouts due to detailed damage identification and skilled negotiation with insurance carriers.

Research shows settlement amounts increase up to 800% higher when utilizing a public adjuster compared to independently filed insurance claims.

Expertise In Insurance Claims

Leveraging the expertise of a public adjuster can considerably enhance the outcome of roof-related insurance claims. Their extensive understanding of insurance policy interpretation and claims process navigation guarantees policyholders receive maximum compensation for roof damage.

Public adjusters possess the technical knowledge to challenge insurance decisions and identify all potential coverage areas within existing policies.

Key aspects of public adjuster expertise include:

- Detailed analysis of policy documents to uncover hidden coverage benefits

- Strategic documentation of roof damage through professional assessment methods

- Implementation of proven negotiation tactics to counter insurance company minimization strategies

Their professional oversight streamlines the entire claims process while maintaining thorough documentation standards.

This expertise proves particularly valuable when dealing with complex roof damage claims, guaranteeing proper valuation and implementation of all available coverage options.

Claims handled by public adjusters typically result in 800% higher settlements compared to independently filed claims.

Objective Damage Assessment

A professional damage assessment conducted by a public adjuster establishes an unbiased evaluation of roof deterioration and structural impact.

Through systematic inspection protocols, adjusters perform thorough damage evaluations that examine both visible and hidden issues affecting the property's integrity.

The claim documentation process involves detailed photographic evidence, precise measurements, and expert analysis of damage patterns.

Public adjusters coordinate joint inspections with roofing contractors to validate findings and establish consensus on repair requirements.

This collaborative approach guarantees accurate cause determination while identifying all factors that may affect claim approval.

Studies show that property owners receive 800% higher settlements when working with licensed public adjusters for their damage claims.

Streamlined Claim Process

When homeowners engage professional public adjusters, they gain access to streamlined claim processes that greatly enhance their chances of successful outcomes. Through efficient claims handling and expertise in insurance policies, public adjusters navigate complex paperwork while managing thorough documentation of damage and necessary repairs.

- Adjusters meticulously photograph and document evidence, preparing detailed reports that prevent underestimation of damages.

- They handle direct communication with insurance companies, translating complex policy language and negotiating settlements.

- The streamlined documentation process eliminates common mistakes, such as incomplete information or missed deadlines.

This professional approach considerably reduces stress for homeowners while ensuring claims are processed accurately and expeditiously.

Their expertise in managing the entire process, from initial assessment to final settlement, proves invaluable in securing appropriate compensation.

Statistics show that public adjuster involvement typically results in settlements 10-15% higher than claims filed without professional assistance.

Higher Claim Payouts & Settlements

Public adjusters considerably enhance insurance claim settlements through their specialized expertise and negotiation skills. Their claim strategies focus on maximizing payouts by identifying all relevant damages, including those that might be overlooked by homeowners.

Through thorough documentation and professional assessment, they guarantee no legitimate damage goes unclaimed.

Their negotiation tactics stem from daily interactions with insurance companies, enabling them to anticipate and counter arguments effectively. Unlike insurance company adjusters who protect their employer's interests, public adjusters work exclusively for homeowners, eliminating conflicts of interest.

Their continuous education in local insurance laws and policy interpretation helps avoid costly mistakes that could reduce settlements. Operating on a contingency basis, public adjusters are motivated to secure the highest possible payout while minimizing homeowners' out-of-pocket expenses.

Members of PCAN's vetted network must maintain strict professional standards including 24-hour communication response times and regular client updates every 10 days.

About The Public Claims Adjusters Network (PCAN)

Licensed professionals within the Public Claims Adjusters Network (PCAN) form an extensive system of independent adjusters operating across domestic and international territories.

These specialists manage thorough claim processes, ensuring maximum benefits for policyholders without requiring upfront fees.

PCAN members deliver critical services through:

- Thorough analysis of insurance policies to identify all available coverage options

- Detailed documentation and assessment of property damage using advanced evaluation methods

- Strategic negotiation with insurance carriers to secure ideal settlement values

Public adjusters within the network maintain strict compliance with state-specific regulations while providing expert guidance throughout the entire claims process.

Their expertise spans residential and commercial properties, offering specialized services in areas such as business interruption claims and disaster recovery planning, consistently achieving settlement increases averaging 300-400% above initial offers.

Frequently Asked Questions

Can a Homeowner's Association Help Cover Roof Replacement Costs?

HOA funding for roof replacement depends on property classification. Common elements typically receive full HOA coverage, while limited common elements and single-family homes may have partial or no maintenance coverage.

What Happens if My Roof Fails Inspection During Installation?

Failed roof inspections during installation require immediate corrective actions. Contractors must address identified deficiencies, replace substandard materials, and rectify installation issues before proceeding. Re-inspection guarantees compliance with building codes.

Do Solar Panel Installations Affect Roof Replacement Warranty Coverage?

Solar panel installations can impact roof warranties if not properly executed. Warranty limitations may apply when modifications affect roofing materials, though correctly installed systems typically maintain coverage under manufacturer specifications.

How Long Does the Typical Roof Replacement Grant Approval Process Take?

The roof replacement grant application process typically spans two to six months, contingent upon documentation completeness, program requirements, verification procedures, and the reviewing agency's current application volume.

Are Veterans Eligible for Additional Roof Replacement Benefits Through VA Programs?

Like a safety net, VA loan benefits cover roof requirements through appraisal standards, but direct roof replacement grants aren't available. Veterans must utilize standard VA financing or HISA for structural modifications.

References

- https://www.myfinancialprograms.com/guides/roof/california-programs/

- https://www.youtube.com/watch?v=qAdxUkYEcRE

- https://weroof.com/blog/government-grants-for-roof-replacement/

- https://www.billraganroofing.com/blog/do-have-pay-deductible-roof-replacement

- https://www.rd.usda.gov/programs-services/single-family-housing-programs/single-family-housing-repair-loans-grants

- https://www.jimersonfirm.com/blog/2023/01/recent-changes-floridas-25-roof-replacement-rule/

- https://point.com/blog/how-to-get-insurance-to-pay-for-a-roof-replacement

- https://www.kin.com/blog/does-home-insurance-cover-roof-repair/

- https://www.kin.com/blog/15-year-roof-rule-florida/

- https://www.lacda.org/home-improvements/senior-grant-program