Filing a kitchen water damage insurance claim requires immediate action and thorough documentation. Property owners must first shut off water sources and disconnect electrical appliances for safety. Documentation through photographs, videos, and written records establishes proof for adjusters to evaluate. The claim process involves submitting detailed evidence of damage, obtaining contractor estimates, and negotiating settlements based on policy coverage. Understanding the specific procedures and requirements can greatly impact claim outcomes. Additionally, property owners should familiarize themselves with how to file an insurance claim to streamline the process effectively. It’s also essential to maintain open communication with the insurance adjuster throughout the evaluation, as this can help clarify any questions and ensure no crucial details are overlooked. Promptly addressing any requests for additional information will facilitate quicker resolutions and improve the chances of receiving a fair settlement.

Key Takeaways

- Document all damage immediately with detailed photos and videos, focusing on the water source and affected areas in your kitchen.

- Contact your insurance provider immediately to report the incident and begin the claims process within required timeframes.

- Shut off water supply and disconnect electrical appliances before taking emergency measures to prevent further kitchen damage.

- Gather repair estimates from licensed contractors and maintain all receipts for emergency services or temporary repairs.

- Submit a comprehensive claim package including photos, repair estimates, receipts, and proof of ownership for damaged items.

Recognizing Types of Kitchen Water Damage

Water damage in kitchens falls into three distinct categories based on contamination levels and source types. While Category 1 clean water damage rarely applies to kitchen scenarios due to the presence of organic contaminants, Categories 2 and 3 are more relevant when evaluating kitchen water damage types.

Category 2 grey water damage commonly occurs from kitchen appliance leaks, including dishwasher malfunctions and sink drainage issues. This type contains moderate contamination from food particles, grease, and organic matter.

Category 3 black water damage, the most severe classification, involves hazardous contaminants requiring professional biohazard remediation.

Common sources of kitchen water damage include malfunctioning dishwashers with clogged filters, refrigerators with defrost drain issues, leaking sinks, and faulty garbage disposals.

High humidity conditions and drainage problems beneath sinks can exacerbate water damage situations. Understanding these classifications is essential for proper documentation when filing insurance claims and determining appropriate restoration procedures.

Immediate Steps After Discovering Water Damage

Discovering kitchen water damage requires immediate action through a systematic emergency response protocol. For effective water damage prevention, residents must first shut off the main water supply and disconnect all electrical appliances in the affected area. Following these critical safety measures, the focus shifts to damage containment and documentation for insurance claim tips.

| Action | Purpose |

|---|---|

| Document Damage | Photograph all affected areas for insurance claims |

| Remove Water | Use wet/dry vacuum to prevent structural damage |

| Ventilate Space | Open windows to minimize mold growth potential |

Professional assessment preparation includes securing the affected area and identifying the water source. While initial cleanup begins, residents should contact their insurance provider and a certified water damage restoration specialist. The combination of proper documentation, swift response, and professional evaluation guarantees a thorough approach to both immediate mitigation and long-term restoration, maximizing the potential for a successful insurance claim resolution.

Gathering Essential Documentation

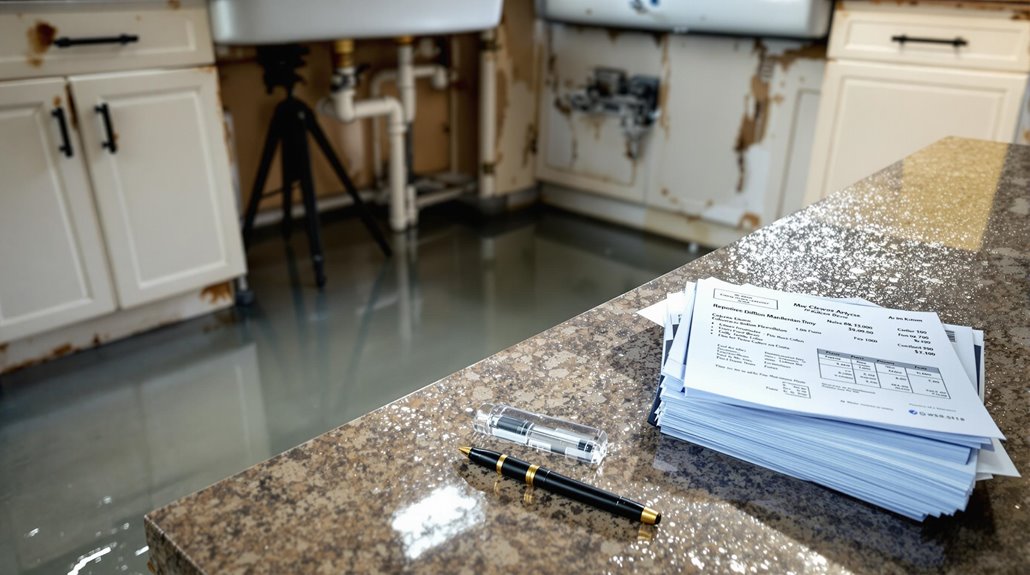

Successful insurance claims require thorough documentation of kitchen water damage through a systematic collection process. Claim documentation should include extensive photographic evidence, capturing both overview shots and detailed close-ups of affected areas. A video walkthrough provides additional context for adjusters to assess the full scope of damage.

Evidence collection must encompass detailed written records of all observations, including dates, times, and specific descriptions of damage. Property owners should maintain organized files containing repair estimates, receipts for emergency services, and proof of ownership for damaged items. Documentation of the water source, whether from appliance malfunction or plumbing failure, is essential for claim processing.

Insurance companies require systematic organization of all gathered materials. This includes maintaining chronological records of all communications with insurers, restoration professionals, and contractors.

Written logs should detail every interaction, expense, and observation throughout the claim process, establishing a clear chain of documentation for assessment purposes.

Understanding Your Insurance Policy Coverage

Insurance policies for kitchen water damage typically cover sudden and accidental events while excluding damage from maintenance issues or gradual leaks under standard coverage types.

Policy limits establish maximum payout amounts for covered losses, while deductibles represent the policyholder's financial responsibility before insurance benefits activate.

Excluded water events commonly include flood damage, sewer backup without specific riders, and long-term seepage that results from neglected maintenance or repairs.

Common Coverage Types

Kitchen water damage policies typically encompass several distinct coverage types that homeowners should understand before filing a claim.

Insurance claims commonly cover sudden and accidental incidents, including burst pipes, appliance malfunctions, and unforeseen plumbing issues. Water damage from faulty water heaters and frozen pipes due to cold weather generally falls within standard coverage parameters.

Structural and property damage resulting from covered events receives protection under most policies. This includes damage to kitchen cabinets, furniture, carpets, and personal belongings when caused by sudden, unforeseen water-related incidents.

Additionally, policies may provide coverage for temporary living arrangements if water damage renders the home uninhabitable during repairs.

However, damages stemming from gradual leaks, lack of maintenance, or neglect typically remain excluded from coverage.

Policy Limits and Deductibles

When filing a water damage claim, homeowners must carefully examine their policy limits and deductibles to understand their financial obligations and coverage boundaries. Limited Water provisions typically cap claims at $10,000, while Full Water coverage offers no maximum limitations. Policy limitations vary greatly between carriers, affecting claim settlements and repair compensation.

Key aspects of policy limits and deductible impacts include:

- Maximum payout restrictions for specific water damage sources

- Deductible requirements before insurance coverage activation

- Impact on total claim settlements and repair costs

- Coverage variations for different types of water damage

Understanding these elements helps homeowners anticipate their financial responsibilities during claims processing.

While Limited Water provisions may suffice for minor incidents, extensive kitchen damage often requires thorough coverage due to high repair costs and potential multi-story impacts.

Excluded Water Events

Understanding excluded water events forms a vital foundation for successful insurance claims processing.

Standard homeowner's policies typically exclude damage from natural floods, surface water, groundwater seepage, and sewage backups. While flood prevention measures may reduce risk, insurers maintain strict distinctions between natural and manmade water damage events.

Policy language specifically defines surface water and flood conditions, with courts generally interpreting exclusions to apply primarily to natural water phenomena.

Coverage determinations hinge on identifying the precise source of water damage, whether from natural events or manmade incidents like burst pipes.

Professional assessment becomes essential in documenting the cause and extent of damage. Insureds should note that even when water damage results from multiple causes, exclusions may still apply regardless of contributing factors.

Working With Insurance Adjusters

Insurance adjusters serve as the primary evaluators who determine claim validity and settlement amounts based on policy coverage and documented damage.

Property owners must maintain detailed records of all kitchen water damage through photographs, contractor estimates, and professional assessments for the adjuster's inspection.

The settlement negotiation process requires property owners to understand their coverage limits while presenting clear evidence that supports their claimed losses.

Know Your Adjuster's Role

A property insurance adjuster serves as the primary evaluator and decision-maker during the kitchen water damage claims process. Their role encompasses thorough claim evaluation through investigation, documentation review, and settlement negotiations.

Through adjuster communication, property owners can expect a detailed evaluation of their situation.

The adjuster performs several critical functions:

- Investigates the source and extent of water damage to kitchen structures and appliances

- Reviews policy coverage specifics and identifies any applicable exclusions

- Calculates repair costs based on documented evidence and contractor estimates

- Determines final settlement amounts based on policy terms and coverage limits

Understanding the adjuster's role helps property owners prepare appropriate documentation and participate effectively in the claims process.

Professional certifications, such as Water Damage Restoration Technician (WRT), validate the adjuster's expertise in accurately evaluating water-related damages.

Document Everything For Inspection

When filing a kitchen water damage claim, thorough documentation serves as the foundation for a successful inspection process. Evidence preservation requires extensive photographic and video documentation, coupled with detailed written records of all affected areas. Proper damage categorization helps insurance adjusters assess the extent of destruction accurately.

| Documentation Type | Required Elements | Purpose |

|---|---|---|

| Visual Evidence | Photos, Videos | Capture damage extent |

| Written Records | Dates, Times, Details | Track incident timeline |

| Professional Reports | Service costs, Contact info | Verify restoration work |

Insurance adjusters rely on meticulous documentation to evaluate claims effectively. Homeowners should maintain time-stamped records, create detailed inventories of damaged items, and preserve all evidence systematically. This documentation becomes essential during the inspection process, enabling adjusters to make accurate assessments and facilitate prompt claim resolution.

Negotiate Settlement Terms

Maneuvering settlement terms with insurance adjusters requires strategic preparation and extensive understanding of policy coverage. When negotiating kitchen water damage claims, policyholders must implement effective settlement strategies while remaining cognizant of common negotiation tactics used by adjusters to minimize payouts.

Key elements for successful negotiations include:

- Presenting extensive documentation of all water-related damages

- Maintaining detailed records of communication with insurance representatives

- Calculating accurate repair and replacement costs with supporting evidence

- Demonstrating knowledge of policy provisions and coverage limits

Consider engaging a public adjuster to strengthen negotiating position and guarantee fair settlement terms.

These professionals possess expertise in policy interpretation and can effectively counter potential claim reduction attempts. Their involvement often leads to more favorable outcomes through strategic claim presentation and thorough damage assessment validation.

Submitting Your Water Damage Claim

The proper submission of a water damage insurance claim requires strict adherence to established protocols and detailed documentation. When initiating the claim process, homeowners must immediately contact their insurance provider to report the incident, providing specific details about the date, time, and nature of the water damage.

Documentation should include thorough photographs of affected areas and an itemized inventory of damaged possessions. A vital component of damage assessment involves gathering supporting documentation, including proof of ownership, repair estimates, and correspondence records with restoration companies.

Homeowners may benefit from engaging a public adjuster to facilitate negotiations and guarantee proper claim handling. All repair-related receipts, contractor estimates, and communication records must be systematically maintained and submitted according to the insurance company's requirements.

Meeting specific deadlines and following prescribed procedures is key for claim approval. The submission package should contain all required forms, supporting evidence, and detailed descriptions of the water damage incident.

Preventing Additional Kitchen Damage

Once water damage occurs in a kitchen environment, implementing immediate preventive measures becomes critical to minimize secondary complications and protect insurance claim validity.

The first response should focus on stopping water flow by locating and shutting off the main valve, followed by immediate removal of affected items to prevent mold growth.

Effective preventive maintenance includes regular inspection of appliances and water supply components. Property owners should implement a systematic approach to identifying leaks through:

- Visual examination of flexible water supply tubing and gaskets

- Inspection behind major appliances for condensation or water pooling

- Assessment of sink fixtures and countertop seals for deterioration

- Monitoring of dishwasher and refrigerator water connections

Professional assistance may be necessary for thorough damage assessment and remediation.

Documentation through photographs and detailed records remains essential for insurance purposes.

Installing moisture detection systems and maintaining proper ventilation can help prevent future incidents while protecting the property's structural integrity.

Negotiating Your Settlement

Successfully negotiating a kitchen water damage insurance settlement requires systematic preparation and strategic communication with the insurance carrier. Property owners should begin by thoroughly documenting all damage through photographs, videos, and detailed contractor estimates, establishing an extensive evidence portfolio to support their claim.

Effective settlement strategies include determining a minimum acceptable settlement amount before negotiations commence and understanding the specific terms of the insurance policy regarding water damage coverage.

During discussions with insurance adjusters, claimants should present organized documentation and be prepared to challenge any lowball offers with supporting evidence. Professional assistance, such as public adjusters or legal representatives, can provide valuable negotiation tactics and expertise in policy interpretation.

If initial negotiations prove unsuccessful, consider pursuing mediation with a neutral third party.

Throughout the process, maintain detailed records of all communications and continue documenting any additional damage or repairs that occur during the settlement period.

Managing Kitchen Repairs and Restoration

Effective management of kitchen repairs requires careful selection of qualified restoration contractors who can demonstrate expertise in water damage remediation and kitchen reconstruction.

The coordination of multiple specialized contractors, including plumbers, electricians, and cabinet installers, necessitates establishing clear timelines and communication protocols to guarantee work progresses efficiently.

Homeowners must evaluate cabinet replacement options based on insurance coverage limits, considering both stock and custom alternatives that align with the original specifications while potentially incorporating water-resistant materials for future protection.

Choosing Quality Repair Services

Quality restoration specialists play a critical role in mitigating kitchen water damage and ensuring proper repairs. When selecting a service provider, prioritize companies that demonstrate professional certification and offer extensive water extraction techniques.

The chosen contractor should maintain an arsenal of restoration equipment options and provide 24/7 emergency response capabilities.

Key criteria for selecting a qualified restoration service include:

- Certified technicians with documented water damage restoration experience

- Advanced moisture detection and structural drying equipment

- Full-spectrum restoration capabilities, from water removal to mold prevention

- Detailed documentation practices for insurance claim support

The restoration company should provide thorough estimates, maintain clear communication throughout the project, and implement proper safety protocols to protect both occupants and workers during the restoration process.

Coordinating Multiple Contractors

The coordination of multiple contractors during kitchen water damage restoration requires systematic oversight and clear procedural guidelines. Establishing detailed documentation protocols and maintaining thorough communication logs guarantees accountability throughout the restoration process.

Effective contractor management involves implementing structured project timelines with defined milestones for each phase of restoration. A designated project manager should oversee the verification of contractor licenses, insurance documentation, and necessary permits before work commences.

Regular progress meetings facilitate contractor communication and help identify potential scheduling conflicts or technical issues. The project manager must maintain detailed records of all estimates, material costs, and completed work phases while guaranteeing compliance with insurance claim requirements.

This systematic approach streamlines the restoration process and maintains quality control standards across all contracted services.

Cabinet Replacement Options

Professional assessment of water-damaged kitchen cabinets requires systematic evaluation to determine appropriate replacement options and restoration strategies.

When existing cabinets cannot be salvaged, homeowners must consider various replacement materials and cabinet styles that offer enhanced water resistance and durability.

- Semi-custom hardwood cabinets with moisture-resistant finishes and marine-grade plywood construction

- Water-resistant manufactured wood products featuring thermally fused laminate surfaces

- Stainless steel or aluminum cabinet options for maximum moisture protection

- Solid wood cabinets treated with specialized sealants and water-repelling compounds

The selection process should account for cost considerations, ranging from $3.75 to $7 per square foot, while ensuring compliance with insurance coverage parameters.

Installation of new cabinets must incorporate proper moisture barriers and protective sealants to prevent future water damage incidents.

Getting Professional Assistance for Your Claim

Seeking expert guidance marks an vital step in filing a successful kitchen water damage insurance claim. Insurance companies often deploy their own specialists, including plumbers and claims adjusters, to assess damage and initiate repairs. However, engaging independent contractors can provide valuable comparative estimates and guarantee fair compensation. The contractor selection process impacts the claims timeline considerably.

| Professional Type | Primary Role | Documentation Required | Claim Impact |

|---|---|---|---|

| Insurance Adjuster | Damage Assessment | Inspection Reports | Settlement Amount |

| Water Damage Expert | Source Investigation | Technical Analysis | Claim Eligibility |

| Independent Contractor | Repair Estimation | Cost Breakdowns | Compensation Validation |

| Restoration Specialist | Remediation Planning | Service Records | Scope of Work |

Water damage professionals provide vital documentation through detailed reports and assessments, strengthening claim submissions. Their expertise helps identify leak sources and determine if damage qualifies as "accidental and sudden," a key factor in claim approval. Maintaining organized records of all professional interactions, including correspondence and technical reports, guarantees thorough claim processing.

The Benefits Of Consulting A Public Adjuster

A public adjuster's expertise in insurance claims provides policyholders with professional guidance through complex coverage terms and documentation requirements.

Their objective damage assessment methodology guarantees accurate identification and valuation of all kitchen water damage, including hidden or secondary issues that might otherwise go undocumented.

The involvement of a public adjuster typically results in higher claim settlements through their systematic approach to claims processing, professional negotiation skills, and thorough understanding of insurance policy provisions.

Expertise In Insurance Claims

Consulting a public adjuster for kitchen water damage claims provides homeowners with specialized expertise in managing complex insurance processes.

Their extensive understanding of Insurance Policy Interpretation and Claims Process Strategies guarantees accurate assessment of coverage entitlements and compliance with procedural requirements.

Public adjusters deliver professional expertise through:

- Thorough analysis of policy language to identify all applicable coverage benefits

- Strategic documentation of water damage, including photographic evidence and detailed inventory lists

- Implementation of proven negotiation techniques with insurance carriers

- Systematic management of claim documentation and regulatory compliance requirements

Their professional knowledge extends to counteracting common insurance company tactics that might minimize claim settlements, while guaranteeing all documentation meets required standards for proper claim processing and maximum policy benefits.

Objective Damage Assessment

When homeowners experience kitchen water damage, objective assessment through a public adjuster provides extensive documentation and evaluation essential for successful insurance claims.

These professionals employ specialized expertise to identify hidden damage that may not be immediately apparent, including potential structural issues and mold growth risks.

Public adjusters conduct unbiased evaluations independently from insurance companies, ensuring that assessments serve the homeowner's interests rather than the insurer's agenda.

Their systematic approach includes utilizing advanced diagnostic tools and techniques to document all affected areas comprehensively.

This extensive documentation helps prevent claim denials due to incomplete information and supports fair settlement negotiations with insurance providers.

Streamlined Claim Process

Public adjusters greatly enhance the efficiency and effectiveness of kitchen water damage insurance claims through their systematic approach to claims processing. Their thorough policy understanding enables accurate interpretation of coverage terms while guaranteeing all documentation meets insurance company requirements.

The streamlined process managed by public adjusters markedly reduces claim processing time and potential complications.

Key elements of claim efficiency include:

- Precise documentation of water damage extent and affected kitchen components

- Strategic compilation of supporting evidence and cost estimates

- Professional communication with insurance carriers to expedite decisions

- Systematic tracking of claim progress and deadlines

This methodical approach, combined with their expertise in policy interpretation and regulatory compliance, guarantees ideal outcomes while minimizing delays and disputes.

Their professional oversight provides a structured pathway to claim resolution, maximizing the probability of fair settlement.

Higher Claim Payouts & Settlements

A significant advantage of engaging professional claim assistance lies in the demonstrably higher settlement amounts achieved through public adjuster representation.

These licensed professionals implement a thorough claim strategy that identifies all compensable damages, ensuring no aspect of the kitchen water damage goes undocumented or unaddressed.

Public adjusters excel in settlement maximization through their expert interpretation of policy provisions and detailed documentation practices.

Operating on a contingency basis, they are incentivized to secure ideal compensation by countering insurance companies' minimization tactics.

Their professional expertise enables them to recognize and include costs that might otherwise be overlooked, from structural damage to secondary effects.

Through skilled negotiation and detailed documentation, public adjusters consistently demonstrate their ability to achieve more favorable settlement outcomes compared to policyholder-managed claims.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) represents a nationwide coalition of licensed professionals specializing in property damage claim management and policyholder advocacy.

Operating across all 50 states and internationally, PCAN members maintain rigorous certifications, including the Senior Professional Public Adjuster (SPPA) designation, while adhering to strict ethical standards.

The network delivers thorough claims process support through:

- Advanced damage assessment technologies and industry-leading software

- Strategic negotiations with insurance carriers to maximize settlements

- Expertise in both residential and commercial property claims

- Specialized knowledge in business interruption and disaster recovery

PCAN members work exclusively for policyholders, not insurance companies, ensuring unbiased representation throughout the claims process.

All affiliated adjusters maintain proper licensing, bonding, and certifications while participating in continuous professional development.

The public adjuster benefits include contingency-based fee structures, eliminating upfront costs for policyholders seeking expert claim management services.

Frequently Asked Questions

Will My Insurance Rates Increase After Filing a Kitchen Water Damage Claim?

Insurance rates typically undergo premium adjustments following water damage claims, with increases ranging from 30-60%. Claim frequency and policyholder history considerably influence the magnitude and duration of rate modifications.

How Long Do I Need to Keep Receipts and Documentation After Claim Settlement?

Standard document retention practices require maintaining claim documentation for 5-7 years post-settlement, though jurisdictional requirements may extend this period. Digital storage offers indefinite preservation capabilities for extensive record-keeping.

Can I Choose My Own Contractor for Repairs After Insurance Approves?

Policyholders maintain the legal right to select their own contractor regardless of insurance company preferences. Repair costs remain covered under approved claims when using independently chosen, properly licensed contractors.

Are Appliance Warranties Voided if Damaged by Water Covered by Insurance?

Appliance warranties generally remain valid when water damage is covered by insurance, provided proper maintenance was performed. The warranty continues to cover mechanical failures while insurance addresses external water damage.

Will Insurance Cover Upgrading to Current Building Codes During Repairs?

Standard insurance policies typically exclude building code upgrades unless specific endorsements exist. Coverage limitations require careful claim negotiation to secure compensation for code-mandated improvements during repairs.