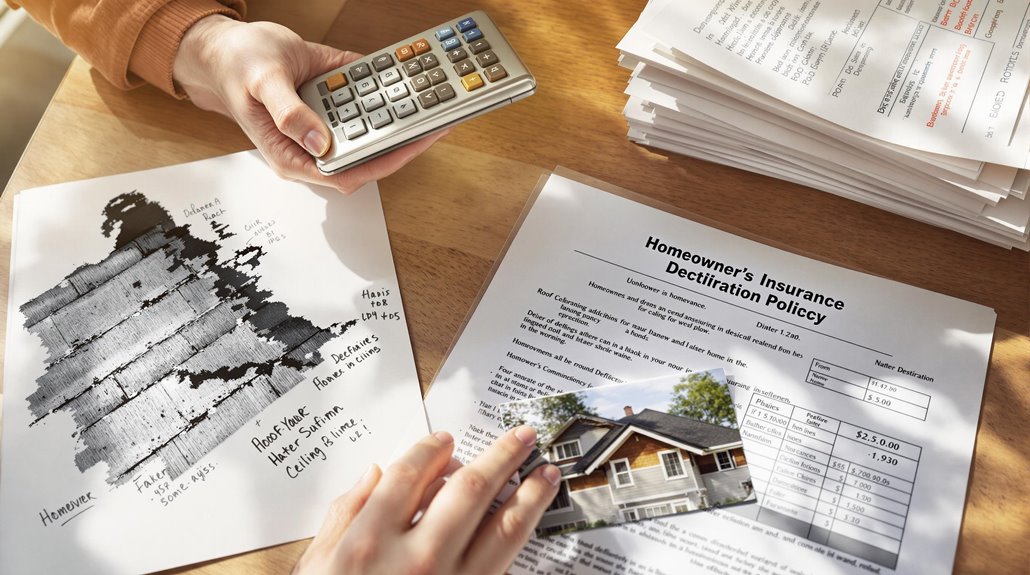

A home insurance deductible is the amount a homeowner must pay before insurance coverage begins on a claim. This out-of-pocket expense can be either a fixed dollar amount or a percentage of the home's insured value, typically ranging from $500 to $2,500. Higher deductibles generally result in lower premium payments, with potential annual savings of hundreds of dollars. Understanding deductible options and their impact on coverage helps homeowners make informed financial decisions.

Key Takeaways

- A home insurance deductible is the amount you pay out-of-pocket before your insurance coverage begins paying for a claim.

- Deductibles can be either fixed dollar amounts or percentages of your home's insured value, affecting how much you'll pay.

- You pay the deductible directly to repair providers, not to the insurance company, when making a claim.

- Higher deductibles generally result in lower monthly premium payments, offering potential long-term savings.

- Special deductibles may apply for natural disasters like hurricanes or earthquakes, often with different percentage-based calculations.

What Is a Home Insurance Deductible?

A home insurance deductible represents the out-of-pocket amount a homeowner must pay before their insurance coverage takes effect for a covered loss. This amount is subtracted from the total insurance payment during the claim process and is typically paid directly to the repair service provider, not the insurance company.

The deductible impact varies depending on its structure, which can be either a fixed dollar amount or a percentage of the home's insured value. For most claims involving dwelling coverage, personal property, or other structures, the deductible applies on a per-claim basis.

However, certain coverages, such as personal liability and medical payments to others, generally do not require a deductible.

Understanding how deductibles work is essential for homeowners, as they must ascertain they can afford their chosen amount when filing a claim. The deductible remains constant regardless of the claim size for fixed-dollar amounts, while percentage-based deductibles fluctuate with the home's insured value.

Understanding Different Types of Deductibles

Home insurance policies feature several distinct types of deductibles that homeowners must understand when selecting their coverage. The most common types include dollar-amount deductibles, which remain fixed regardless of claim size, and percentage-based deductibles, which fluctuate based on the home's insured value. Understanding these deductible strategies is vital for effective coverage planning.

| Type | Characteristics | Implications |

|---|---|---|

| Dollar-Amount | Fixed amount regardless of damage | Predictable out-of-pocket costs |

| Percentage-Based | Varies with home's insured value | Higher risk in costly claims |

| Disaster-Specific | Separate from standard coverage | Additional financial planning needed |

Specialty deductibles apply to specific perils like floods and earthquakes, often requiring separate policies. The deductible implications vary greatly based on location and risk factors. High-risk areas may mandate minimum percentage requirements for certain coverages, while some policy endorsements may not require deductibles at all. This complexity emphasizes the importance of carefully evaluating deductible options when structuring home insurance coverage.

Calculating Your Home Insurance Deductible

Understanding how to calculate home insurance deductibles requires careful consideration of both fixed-rate and percentage-based options.

Fixed-rate deductibles involve straightforward deductible calculation methods where a set amount, such as $1,000, is subtracted from each claim. For example, a $15,000 claim with a $1,000 deductible results in a $14,000 insurance payout.

Percentage-based deductibles operate differently, calculated as a percentage of the home's insured value. When comparing deductible strategies, consider that a 2% deductible on a $300,000 home equals $6,000 in out-of-pocket expenses per claim. This calculation becomes particularly significant in areas prone to natural disasters or frequent claims.

Homeowners should evaluate their financial situation, risk tolerance, and location when selecting a deductible type. Higher deductibles typically reduce premium costs but require greater out-of-pocket expenses during claims.

Some policies may also include separate deductibles for specific types of coverage, such as hurricane or earthquake protection.

Standard vs. Percentage-Based Deductibles

Two distinct types of deductibles shape how homeowners manage their insurance costs: standard fixed-rate deductibles and percentage-based deductibles.

Standard deductibles maintain consistent amounts, typically ranging from $500 to $5,000, providing predictable out-of-pocket expenses when filing claims.

Percentage-based deductibles, calculated as 1% to 10% of the home's insured value, fluctuate with dwelling coverage limits and inflation.

Deductible comparison analysis reveals key differences in their application and financial impact. Standard deductibles apply universally to covered claims, while percentage-based options often relate to specific perils like wind or hurricane damage.

Deductible selection strategies should account for factors such as risk tolerance, premium costs, and ability to pay. Homeowners anticipating frequent claims might prefer lower standard deductibles, while those seeking reduced premiums could opt for percentage-based options, understanding that inflation may increase their out-of-pocket responsibilities over time.

Making the Right Choice for Your Deductible Amount

Choosing the ideal deductible amount requires careful analysis of both immediate financial capabilities and long-term savings potential through premium reductions.

Homeowners must evaluate their emergency funds, monthly budget flexibility, and risk exposure factors such as location and property value when determining their perfect deductible level.

The decision should balance the potential premium savings from higher deductibles against the policyholder's ability to cover out-of-pocket expenses during a claim event.

Financial Impact Analysis

The delicate balance between monthly premiums and out-of-pocket expenses lies at the heart of selecting an appropriate home insurance deductible. Financial preparedness plays an essential role in this decision, as 56% of Americans cannot afford a $1,000 emergency expense from savings.

When evaluating deductible options, homeowners must carefully assess their ability to manage potential costs during the claim process.

Risk vs. Savings Balance

Successful home insurance planning requires careful consideration of both risk tolerance and potential savings when selecting a deductible amount. A balanced deductible strategy must account for both immediate financial capabilities and long-term cost implications.

Research indicates that 59% of Americans lack adequate emergency savings to cover typical deductibles, making financial preparedness a vital factor in this decision. While higher deductibles can reduce premium costs, homeowners must make certain they can manage the out-of-pocket expenses if a claim becomes necessary.

The age and condition of the property also influence ideal deductible levels, as older homes may face increased risk of damage. Regular assessment of deductible choices helps maintain alignment with changing financial circumstances and property conditions, guaranteeing the selected amount remains appropriate for both risk management and savings objectives.

The Impact of Deductibles on Insurance Premiums

Understanding the relationship between home insurance deductibles and premiums reveals a fundamental inverse correlation: as deductibles increase, premium costs decrease.

Insurance providers offer significant deductible savings when policyholders opt for higher out-of-pocket responsibilities, with potential premium adjustments ranging from hundreds to thousands of dollars annually.

Raising a deductible from $500 to $2,500 can result in average savings of $512 on yearly premiums.

This financial dynamic reflects the shared risk between insurers and homeowners:

- Higher deductibles reduce the likelihood of small claims being filed, lowering administrative costs

- A $2,500 deductible typically yields substantially lower premiums compared to a $500 deductible

- Premium reductions become more pronounced as deductible levels increase

- The average deductible of $1,000 represents a balanced approach between premium costs and claim expenses

This trade-off system allows homeowners to strategically manage their insurance expenses while maintaining necessary coverage protection.

When and How to Pay Your Deductible

Maneuvering home insurance deductible payments requires careful attention to timing and process. The deductible payment occurs during the claims process, not as a direct payment to the insurance company. Instead, the deductible amount is subtracted from the final settlement, requiring homeowners to combine their out-of-pocket deductible with the insurance payout to cover repair costs.

| Deductible Type | Payment Timing | Typical Range |

|---|---|---|

| Standard Fixed | Per Claim | $500-$2,000 |

| Percentage Based | Per Event | 1-5% of Home Value |

| Special Perils | Per Occurrence | Varies by Risk |

Understanding when to pay is essential for financial planning. Homeowners must pay the deductible for each claim filed, except for personal liability, medical payments, or loss of use claims. If damage costs fall below the deductible amount, filing a claim becomes unnecessary, and the homeowner assumes full responsibility for repairs.

Special Considerations for Natural Disaster Deductibles

Natural disaster deductibles often involve complex rules that vary based on specific weather events, geographic regions, and insurance regulations.

Hurricane deductibles typically apply during officially designated hurricane seasons and range from 1% to 10% of a home's insured value.

Earthquake coverage requires separate policies with distinct deductible structures.

Wind and hail deductibles can differ substantially by state and may be percentage-based or fixed amounts, making it essential for homeowners to understand their policy's specific terms.

Hurricane Season Special Rules

When severe weather threatens coastal regions, homeowners face unique insurance considerations during hurricane season. Hurricane deductibles differ from standard home insurance deductibles, typically ranging from 1% to 5% of the dwelling coverage limit. These specialized deductibles activate when specific trigger events occur, such as official hurricane warnings from the National Hurricane Center.

- Deductibles apply once per hurricane season, regardless of multiple storms

- Coverage excludes flood damage, requiring separate flood insurance

- States may mandate different percentage thresholds (up to 10% in Florida)

- Flat-dollar deductible options exist in some policies

For ideal seasonal disaster preparedness, homeowners should review their policies' trigger events, maintain sufficient savings for deductibles, and understand their coverage limitations.

This knowledge becomes critical when filing claims and managing post-hurricane recovery expenses.

Earthquake Coverage Differences

Understanding earthquake insurance deductibles requires special attention, as they differ markedly from standard homeowners' insurance policies.

Unlike typical home insurance deductibles that use fixed dollar amounts, earthquake coverage applies percentage-based deductibles ranging from 5% to 25% of the insured property value.

These deductible percentages greatly impact out-of-pocket expenses during claims, with higher percentages resulting in lower premiums but greater financial responsibility for homeowners. Location plays a vital role, as areas with increased seismic activity often require higher deductibles.

Additionally, earthquake policies maintain separate deductibles from other perils and specifically exclude certain items like detached structures, landscaping, and pools.

Coverage typically extends to the main dwelling, personal belongings, and temporary living expenses if the home becomes uninhabitable following an earthquake.

Wind-Hail Deductible Variations

Similar to earthquake coverage, wind and hail deductibles represent another specialized aspect of home insurance that varies considerably by region and risk level.

These deductibles specifically activate when damage occurs from wind-related events, including tornadoes and wind-driven rain.

Insurance providers typically structure these deductibles as either flat dollar amounts or percentages of the total dwelling coverage, with premium adjustments reflecting the chosen deductible format.

- Areas prone to severe storms often have mandatory wind damage deductibles set by insurers

- Percentage-based deductibles commonly range from 1% to 5% of the home's insured value

- Deductible triggers must meet specific criteria defined in the policy terms

- Homeowners in high-risk regions may have limited options for modifying their wind-hail coverage

Tips for Managing Your Home Insurance Deductible

Managing a home insurance deductible effectively requires careful consideration of both short-term and long-term financial implications. Homeowners should evaluate their financial capacity to handle different deductible levels while weighing the impact on premium costs. Implementing deductible strategies, such as maintaining an emergency fund equal to the highest possible deductible amount, helps guarantee preparedness for potential claims.

When engaging in deductible negotiation with insurers, homeowners should analyze the trade-offs between flat-dollar and percentage-based deductibles. Understanding how each type applies to different claim scenarios enables better decision-making.

For instance, while a higher standard deductible might lower monthly premiums, homeowners must ascertain they can cover this amount if needed. Similarly, percentage-based deductibles for specific perils like wind or hail require careful consideration, as these can result in significant out-of-pocket expenses during catastrophic events.

Regular review of deductible choices helps maintain alignment with changing financial circumstances and risk tolerance levels.

Frequently Asked Questions

Can I Change My Deductible Mid-Policy Without Waiting for Renewal?

Most insurance providers allow changing deductibles mid-policy through policy adjustments, though fees may apply. Homeowners should review terms and coordinate with their insurer for proper documentation and timing.

What Happens if I Can't Afford to Pay My Deductible?

When financial storms strike, homeowners unable to pay deductibles can explore multiple solutions: payment plans with contractors, credit options, selling assets, or seeking deductible assistance through non-profit organizations.

Do Home Warranty Deductibles Work Differently Than Insurance Deductibles?

Home warranty coverage requires flat-rate service fees paid per repair visit, while insurance deductibles are subtracted from claim amounts. These policy differences reflect distinct business models in warranty versus insurance protection.

Are Deductibles Tax-Deductible for Rental Properties?

Why do landlords often misunderstand deductible implications? Insurance deductibles for rental properties are not tax-deductible, though insurance premiums themselves qualify as legitimate rental property expenses for tax purposes.

Can Insurance Companies Waive Deductibles During Widespread Natural Disasters?

Insurance companies can implement deductible waivers during natural disasters, though it's not standard practice. Most maintain strict natural disaster policies requiring standard or percentage-based deductibles for catastrophic events.

Final Thoughts

According to the Insurance Information Institute, 98% of homeowners insurance claims occur with losses exceeding standard deductible amounts. Understanding home insurance deductibles remains essential for financial planning and protection. By carefully weighing deductible options against premium costs and considering specific regional risks, homeowners can optimize their coverage while maintaining manageable out-of-pocket expenses for potential claims.

When dealing with property damage claims related to homeowners insurance policies, insurance industry professionals and legal experts strongly recommend consulting a qualified state-licensed public adjuster. These professionals work exclusively for policyholders, not insurance companies, serving as dedicated advocates throughout the claims process. Public adjusters are state-licensed experts who help policyholders navigate complex insurance policies, identify hidden damages often unknown to policyholders, thoroughly document losses, and negotiate with insurance companies to ensure fair settlements while protecting policyholder rights.

Engaging a public adjuster can provide significant advantages, including maximized claim settlements, expedited processing, and reduced stress during the claims process. This allows homeowners to focus on recovery while ensuring their interests are properly represented. For those seeking expert assistance with property damage or loss claims, no-obligation free consultations are available through Public Claims Adjusters Network (PCAN) member public adjusters.