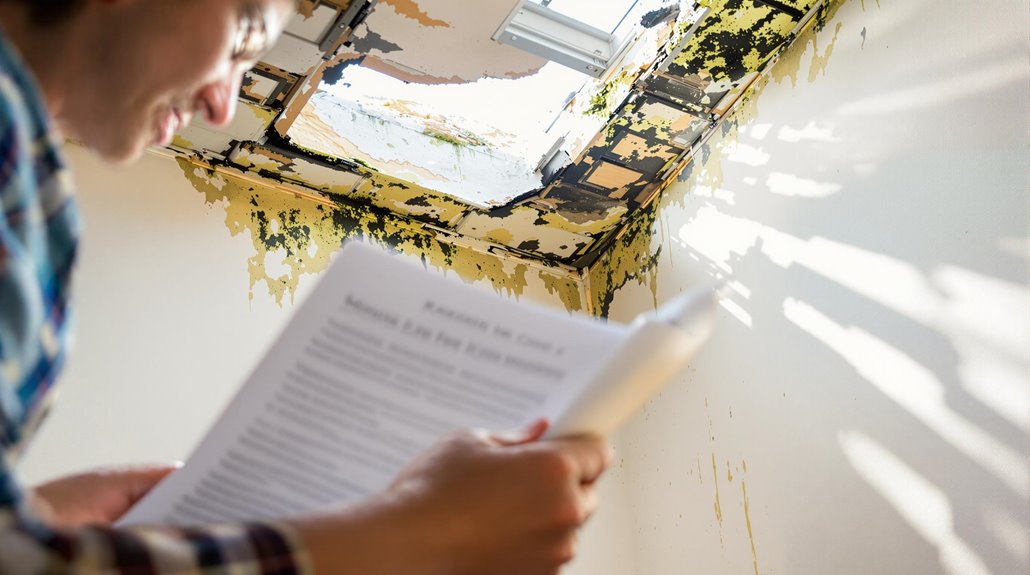

Homeowners insurance coverage for mold from roof leaks depends on the underlying cause. Policies typically cover mold damage when the roof leak results from a sudden, accidental event like storm damage or fallen trees. However, insurers deny claims stemming from poor maintenance, gradual water damage, or pre-existing conditions.

Coverage limits generally range from $1,000 to $10,000 per occurrence, with varying deductibles. Understanding the specifics of policy terms and proper documentation can substantially impact claim success.

Key Takeaways

- Mold damage is covered if caused by a sudden, accidental roof leak that qualifies as a covered peril.

- Coverage ranges from $1,000 to $10,000 per occurrence for roof leak mold remediation covered events.

- Standard policies do not cover long-term water exposure or poor maintenance leading to mold growth.

- Professional documentation through moisture mapping and mold certification helps determine coverage eligibility.

- Regular roof maintenance and prompt repairs are required, as neglect can lead to claim denials.

Understanding Coverage For Mold Remediation From Roof Leaks In Home Insurance Policies

When it comes to mold coverage in homeowners insurance policies, the basic rule is that mold damage is typically excluded unless it results from a covered peril. Policy interpretations vary among insurance providers, but coverage generally applies when mold develops from sudden, accidental events like burst pipes or fire suppression efforts.

Understanding coverage restrictions is essential, as standard policies often exclude mold resulting from neglect or lack of maintenance.

Insurance companies may offer additional coverage through endorsements, which can expand protection for mold-related claims. Professional remediation costs might be covered if the mold damage stems from a covered event, though specific limits and deductibles apply.

While sudden water damage incidents may qualify for coverage, gradual issues like slow leaks typically do not. Natural disasters, particularly flooding, require separate insurance policies to address resulting mold damage. Policy terms and covered perils ultimately determine the extent of mold coverage available to homeowners.

Most policies set mold coverage limits between $1,000 and $10,000 per occurrence.

Common Causes Of Roof Leaks That Insurance Will Cover

Roof leaks commonly occur from severe weather events, with storm damage and strong winds being primary causes that insurance typically covers. In addition to storm damage, age and wear can also contribute to the vulnerability of a roof, leading to potential leaks. Homeowners may find themselves facing small roof leak repair types, such as patching or sealing, to address minor issues before they escalate. Regular maintenance and timely inspections are crucial in preventing these leaks and protecting your home from further damage.

Hidden burst water lines within walls or ceilings can also lead to roof leaks and subsequent water damage that falls under most homeowners insurance policies.

These sudden and accidental events differ from gradual damage or wear and tear, which insurance companies generally exclude from coverage. Insurance adjusters must conduct thorough assessments to validate damage claims and determine appropriate coverage amounts.

Storm and Wind Damage

Since storms and high winds frequently cause roof damage, homeowners insurance typically covers resulting leaks and associated repairs. Wind patterns and storm surge can dislodge shingles, creating vulnerabilities that lead to water infiltration. Insurance policies generally cover these scenarios when properly documented and promptly reported. Public insurance adjusters can help maximize settlement amounts for complex storm damage claims.

| Damage Type | Insurance Coverage | Required Action |

|---|---|---|

| Wind Damage | Covered | Document displaced shingles |

| Hail Impact | Covered | Photograph impact marks |

| Storm Leaks | Covered | Report immediately |

Successful claims require thorough documentation of storm-related damage and swift action to prevent further deterioration. Insurance providers may deny claims if damage results from pre-existing maintenance issues or negligence. Understanding policy specifics, including deductibles and coverage limits, helps homeowners manage repair expectations and responsibilities effectively.

Hidden Burst Water Lines

Beyond storm damage, hidden burst water lines represent a significant source of roof-related water damage covered by homeowners insurance. When concealed plumbing fails, particularly in areas where pipes penetrate the roof through pipe boots, water can infiltrate the home’s structure undetected. Pipe boot failures are especially common in bathrooms and closets where plumbing vents extend through the roofing system.

Hidden drips from cracked neoprene pipe boots, which deteriorate due to UV exposure over time, can lead to extensive damage before discovery. While insurance typically covers sudden plumbing failures, gradual leaks from wear and tear may not qualify for coverage.

Regular inspection of pipe boots and prompt replacement of damaged components can prevent these issues, potentially saving homeowners from both costly repairs and insurance claim complications. Homeowners should note that public adjusters help maximize insurance claims for extensive water damage situations.

When Insurance Won’t Pay For Mold Damage

Insurance companies commonly deny mold damage claims that result from long-term water exposure or chronic roof leaks that went unaddressed.

A history of poor maintenance, including neglected repairs or inadequate upkeep of roofing materials, typically leads to claim rejection.

Pre-existing mold conditions or damage that developed gradually over time are also excluded from standard homeowners insurance coverage. This means that if homeowners discover mold growth due to longstanding water damage or inadequate maintenance, they may not receive financial assistance for remediation efforts. It is essential for policyholders to understand the limitations of their coverage regarding such issues. Homeowners insurance and black mold often present challenges for homeowners, as they may need to seek specialized policies or take preventive measures to avoid costly repairs.

Consider consulting public adjusters since they can help maximize settlement amounts and properly document water-related claims.

Long-Term Water Damage

When water damage occurs gradually over time, homeowners insurance typically denies claims for resulting mold issues. Continuous moisture penetration from unresolved leaks can lead to structural weakening and extensive damage that becomes the homeowner’s responsibility to repair.

Common sources of long-term water damage that insurers exclude from coverage include:

- Gradual leaks through poorly sealed windows and doors

- Ongoing seepage through the home’s foundation

- Prolonged roof leaks due to deferred maintenance

- Unaddressed water infiltration from failing sump pumps

Regular maintenance and prompt repairs are essential to prevent these issues, as insurance companies consider long-term water damage preventable through proper upkeep.

Detailed maintenance records and understanding policy exclusions can help homeowners manage their risk and avoid costly out-of-pocket expenses for uncovered water damage.

Maintaining indoor humidity below 50% through proper ventilation and dehumidification is crucial for preventing mold growth from moisture accumulation.

Poor Maintenance History

Poor maintenance history stands as a primary reason for denied mold damage claims from roof leaks. Insurance companies scrutinize maintenance records and inspection failures when evaluating claims, often denying coverage for damage resulting from neglect or inadequate upkeep.

Standard homeowners policies exclude mold damage caused by gradual water leaks, improper ventilation, or unaddressed maintenance issues.

Signs of poor maintenance, such as water stains, condensation on surfaces, and persistent mildew odors, can lead to claim denials. Common examples include unfixed leaky faucets, improperly sealed windows, and deteriorating roof conditions.

While policies may cover sudden events like burst pipes, insurers expect homeowners to perform routine maintenance. The cost of mold remediation from roof leaks typically falls on homeowners when damage stems from documented maintenance negligence.

Public adjusters can help evaluate maintenance records and identify any potential coverage under policy provisions that may not be immediately apparent.

Pre-existing Mold Conditions

A major exclusion in homeowners insurance policies involves pre-existing mold conditions, which typically result in claim denials. Insurance companies consider these conditions maintenance issues rather than sudden accidents, often requiring professional mold certification to determine the timeline of infestation.

Through moisture mapping and detailed inspection, insurers can identify long-standing mold problems that existed before policy activation.

Key reasons insurers deny pre-existing mold claims:

- The damage occurred before policy inception

- The mold resulted from chronic moisture issues left unaddressed

- The property owner failed to maintain proper ventilation and moisture control

- Previous water damage wasn’t adequately remediated

Homeowners must address existing mold issues before securing coverage, as insurance companies expect properties to be free of pre-existing conditions that could lead to future claims.

Professional inspectors use thermal imaging cameras and moisture meters to detect hidden infestations that could invalidate future claims.

Essential Steps For Filing Successful Mold Claims

Filing a successful mold claim requires careful planning and thorough documentation from the initial discovery through final resolution. The claim preparation process begins with reviewing the homeowners insurance policy to understand coverage limits and exclusions specific to mold damage.

Once mold is discovered, homeowners should immediately notify their insurance company and document the damage through photos, videos, and detailed notes.

Effective adjuster communication plays a critical role in claim success. Homeowners who have not exercised their legal right to hire a Public Adjuster must cooperate fully with assigned adjusters, providing detailed damage documentation, including professional assessments and repair estimates.

Maintaining records of all interactions, purchases, and expenses related to the mold remediation process is crucial.

If a claim is denied, homeowners can pursue an appeal through their insurance company or file a complaint with the state Department of Insurance. They can also hire a State-licensed public adjuster to strike the fear of God into the insurance company, ever-so-gently remind the insurance company of policyholder’s legal rights … and their legal responsibilities to adhere to the policy terms & the policyholder’s legal rights … and get their claim back on track. Working with public adjusters can increase settlement amounts by 30-50%, if not significantly more, for most property damage claims.

Understanding policy terms and maintaining organized documentation throughout the process increases the likelihood of a favorable outcome.

Maintaining Your Roof To Prevent Insurance Issues

Regular roof maintenance is essential in preserving property value and insurance coverage. Insurance providers require homeowners to meet specific maintenance standards, particularly concerning roof condition.

Conducting Seasonal Inspections and maintaining proper Warranty Documentation demonstrates responsible property management to insurers.

Key maintenance practices that prevent insurance issues include:

- Scheduling professional inspections twice yearly and after severe weather events

- Promptly addressing minor repairs, such as damaged shingles or flashing

- Maintaining clean gutters to prevent water damage and structural issues

- Documenting all maintenance activities and keeping inspection records

These preventive measures help homeowners maintain their insurance coverage and potentially secure better rates.

Insurance companies often restrict coverage for roofs over 20 years old, making regular maintenance vital for coverage retention. Well-maintained roofs may qualify for discounts and thorough coverage options, while neglected roofs risk policy cancellation or limited coverage.

Proper roof maintenance can result in 25% insurance savings through policy bundling and improved coverage terms.

Coverage Limits & Deductibles For Mold Claims

While proper roof maintenance helps prevent issues, homeowners must understand their policy’s specific coverage limits and deductibles when mold claims arise.

Standard policies typically cover mold damage resulting from covered perils like roof leaks, with coverage limits varying substantially between providers, often starting at $1,000.

In Florida, claim deductibles are subtracted from the dwelling coverage amount and range from $500 to $5,000 for standard claims.

Hurricane-related claims typically carry higher percentage-based deductibles calculated from the policy limit. Homeowners are responsible for covering the deductible amount before insurance benefits apply.

Optional endorsements can provide additional mold coverage, though these come with strict conditions and added costs.

Coverage depends heavily on the moisture source and whether it qualifies as a covered peril. Standard policies exclude damage from flooding, normal wear and tear, or neglected maintenance issues.

Best Practices For Documenting Roof Leak Damage

Proper documentation of roof leak damage plays a vital role in successful insurance claims. Creating a detailed Damage Timeline and maintaining thorough Insurance Documentation enhances the likelihood of claim approval.

Homeowners should immediately photograph and video record all visible damage, both external and internal, using high-resolution devices and multiple angles to capture the full extent of the problem.

Key documentation practices include:

- Capturing clear images immediately after discovering damage, ensuring proper lighting and detailed views of affected areas

- Maintaining written records of all conversations with insurance adjusters, contractors, and repair professionals

- Preserving receipts for temporary repairs and mitigation efforts

- Obtaining professional inspection reports and multiple repair estimates from licensed contractors

Store all documentation securely using both physical and digital methods, preferably with cloud backup.

Regular maintenance records and proof of preventative measures should also be included to demonstrate responsible homeownership.

The Benefits Of Consulting A Public Adjuster

When dealing with complex mold and roof leak claims, a public adjuster provides professional expertise in maneuvering through insurance policies and documenting damage objectively.

Public adjusters streamline the claims process by managing all aspects of documentation, negotiation, and settlement discussions with insurance companies.

Studies by FAPIA demonstrate that policyholders who work with public adjusters typically receive higher claim settlements, averaging $22,266 compared to $18,659 for unrepresented homeowners.

Expertise In Insurance Claims

Public adjusters bring specialized expertise to insurance claims, offering policyholders a significant advantage when dealing with mold damage from roof leaks.

Their policy expertise enables thorough understanding of coverage terms, exclusions, and benefits, while their professional claims navigation guarantees exhaustive documentation and proper presentation of damages.

- They interpret complex policy language to determine if mold resulting from roof leaks qualifies as a covered peril

- They gather and organize detailed documentation, including damage assessments and repair estimates

- They negotiate effectively with insurance companies, countering tactics used to minimize payouts

- They work on contingency basis, aligning their interests with maximizing the policyholder’s settlement

Their professional representation manages the complexities of the claims process while advocating for the policyholder’s best interests throughout the settlement negotiations.

Objective Damage Assessment

An objective damage assessment creates the foundation for successful mold damage claims, building upon the expertise public adjusters bring to the claims process. Their systematic evaluation employs proven inspection methods to identify damage patterns and document the full extent of mold issues stemming from roof leaks.

| Assessment Component | Public Adjuster’s Role |

|---|---|

| Initial Inspection | Thorough evaluation of visible and hidden damage |

| Documentation | Detailed photos, videos, and written reports |

| Cost Analysis | Accurate estimation of repair and restoration costs |

| Policy Review | Verification of coverage and exclusions |

| Claim Preparation | Professional presentation of findings to insurer |

Public adjusters conduct independent evaluations, ensuring complete documentation of all affected areas. Their expertise in assessment protocols and industry standards helps maximize claim value while maintaining objectivity throughout the process.

Streamlined Claim Process

Engaging a public adjuster streamlines the mold damage claims process by providing expert handling of documentation, negotiations, and communications with insurance companies.

Their professional expertise guarantees swift submission of required paperwork while managing all interactions with insurers, allowing homeowners to focus on property recovery.

Key benefits of public adjuster representation include:

- Expert coordination of claim documentation, including detailed inventories and thorough damage assessments

- Professional management of all insurance company communications, eliminating stress for the policyholder

- Thorough evaluation of policy coverage to identify all applicable benefits for mold damage

- Strategic negotiation with insurers to secure fair compensation for both visible and hidden damages

This systematic approach helps expedite claim resolution while guaranteeing proper documentation of all mold-related damages stemming from roof leaks.

Higher Claim Payouts & Settlements

Professional representation through a public adjuster substantially increases the likelihood of securing higher insurance claim settlements for mold damage from roof leaks. Their expertise in property damage assessment and policy interpretation leads to settlement maximization through exhaustive claim documentation and skilled negotiation.

| Benefit | Impact on Claim |

|---|---|

| Expert Assessment | Identifies overlooked damages and accurate valuation |

| Policy Knowledge | Guarantees all covered perils are properly claimed |

| Negotiation Skills | Achieves payout optimization through effective advocacy |

Public adjusters work on a contingency basis, aligning their interests with maximizing the policyholder’s settlement. Their thorough understanding of insurance procedures, combined with skilled advocacy, typically results in higher payouts compared to claims filed without professional representation.

This expertise particularly benefits complex cases involving mold damage from roof leaks, where damage assessment requires specialized knowledge.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) represents a collective of independent insurance professionals who advocate for policyholders during the claims process.

Through Network Benefits and Global Partners like WorldClaim, PCAN provides thorough support across all 50 states and international locations, guaranteeing expert guidance for property owners facing insurance claims.

These adjusters specialize in:

- Conducting thorough damage assessments and documenting all necessary repairs

- Analyzing insurance policies to identify covered perils and exclusions

- Managing communication between insurance companies and contractors

- Negotiating settlements to maximize claim payouts for policyholders

PCAN members possess extensive knowledge of insurance regulations and construction costs, enabling them to evaluate damages and necessary repairs accurately.

Their expertise spans various claim types, from residential to commercial properties, offering customized solutions for each policyholder’s unique situation.

This network guarantees that property owners receive fair treatment throughout the entire claims process, from initial assessment to final settlement.

Frequently Asked Questions

Can I Switch Insurance Providers if My Current Policy Doesn’t Cover Mold?

Homeowners can switch insurance providers at any time through policy transfer. It’s recommended to conduct a thorough coverage comparison to guarantee better mold protection from the new carrier.

How Long Does Mold Typically Take to Develop After a Roof Leak?

Research shows that 90% of mold colonies begin forming within 24-48 hours of moisture accumulation. Spore development accelerates substantially during this period when conditions remain damp and warm.

Will Insurance Cover Temporary Housing During Extensive Roof Leak Mold Remediation Work?

Insurance typically provides hotel coverage and relocation expenses during extensive mold remediation if the home becomes uninhabitable due to a covered peril, subject to Additional Living Expenses policy limits.

Does Insurance Cover Mold Testing and Air Quality Assessments?

Insurance typically covers mold testing coverage and laboratory analysis when mold results from covered perils. Testing must be performed by licensed professionals and properly documented for claim approval.

Can Previous Mold Damage Affect My Future Insurance Premiums?

Previous mold claims can trigger premium adjustments like a shadow following its owner. Insurance companies evaluate coverage history when determining rates, potentially leading to higher premiums or limited coverage options.

References

- https://www.bankrate.com/insurance/homeowners-insurance/does-homeowners-insurance-cover-roof-leaks/

- https://www.investopedia.com/does-homeowners-insurance-cover-mold-4782771

- https://www.progressive.com/answers/does-homeowners-insurance-cover-mold/

- https://krapflegal.com/recources/mold-insurance-claims/does-homeowners-insurance-cover-mold/

- https://www.nerdwallet.com/article/insurance/does-homeowners-insurance-cover-roof-leaks

- https://www.avnergat.com/home-insurance-mold-coverage-guide/

- https://www.libertymutual.com/insurance-resources/property/home-insurance-and-mold-faqs

- https://www.bankrate.com/insurance/homeowners-insurance/does-homeowners-insurance-cover-mold/

- https://roofclaim.com/does-homeowners-insurance-cover-roof-leaks/

- https://appleroof.com/does-insurance-cover-roof-leaks/