Standard homeowners insurance policies cover mold remediation and removal only when the mold damage directly results from a covered peril, such as burst pipes or appliance malfunctions. Coverage typically ranges from $1,000 to $10,000, with additional mold riders available for $10,000 to $25,000 in protection. Exclusions apply for pre-existing conditions, poor maintenance, and gradual damage. Understanding policy specifics and documentation requirements can substantially impact claim success rates and payout amounts.

Key Takeaways

- Home insurance covers mold damage only when directly caused by a covered peril like burst pipes or sudden water events.

- Standard policies include mold coverage between $1,000-$10,000, with additional mold riders available for $10,000-$25,000 coverage.

- Insurance excludes mold from poor maintenance, chronic leaks, pre-existing conditions, or gradual wear and tear.

- Claims require thorough documentation including photos, professional inspection reports, and evidence of the sudden incident causing mold.

- Hidden water damage coverage limits range from $1,000-$5,000, while water backup protection offers $5,000-$10,000 in coverage.

Understanding Home Insurance Coverage for Mold Damage

Home insurance coverage for mold damage operates under specific conditions and limitations that property owners must understand. Coverage typically applies when mold results from sudden and accidental incidents, such as burst pipes or appliance malfunctions, that are listed as covered perils in the policy. However, insurers generally exclude mold caused by neglect, maintenance issues, or gradual water damage.

Policy requirements stipulate that homeowners must demonstrate the mold damage directly resulted from a covered peril. Coverage limits for mold remediation vary among insurance carriers, typically ranging from $1,000 to $10,000 per occurrence.

Standard policies often contain specific exclusions, though additional coverage may be available through specialized endorsements or riders. While black mold and other variants are included when resulting from covered incidents, damage stemming from poor ventilation, humidity issues, or gradual leaks typically falls outside the scope of coverage. Prompt action is essential since mold can develop within 24 to 48 hours after water exposure.

When Your Insurance Policy Will Cover Mold Problems

Insurance coverage for mold damage hinges on specific circumstances that determine whether remediation costs will be approved under a standard homeowner’s policy. Policy verification reveals that coverage primarily applies when mold results from sudden, accidental events that are already covered perils within the policy terms.

| Incident Type | Insurance Eligibility | Required Documentation |

|---|---|---|

| Burst Pipes | Typically Covered | Photos, Professional Assessment |

| Storm Damage | Generally Approved | Weather Reports, Damage Evidence |

| Fire Suppression | Covered if from firefighting | Fire Report, Water Damage Records |

| Hidden Mold | Case-by-case Basis | Inspection Reports, Timeline Evidence |

The source of mold growth substantially impacts coverage determination. For instance, mold resulting from a ruptured water heater or water used in fire suppression typically qualifies for coverage, while damage from long-term maintenance issues or neglect does not meet eligibility requirements. Coverage limits typically range from $1,000 to $10,000, with specific sub-limits applying to mold remediation services. Engaging public insurance adjusters can significantly increase the likelihood of maximizing compensation through their expertise in identifying overlooked policy benefits and negotiating fair settlements.

Common Scenarios of Covered Mold Claims

Understanding specific scenarios where mold claims receive coverage helps property owners identify qualifying incidents.

Several common remediation scenarios typically fall within standard policy coverage parameters.

Sudden and accidental water damage from burst pipes, malfunctioning appliances, or water heater failures often qualify for mold remediation coverage.

Coverage examples extend to fire-related incidents, where mold growth resulting from firefighting efforts or post-fire water damage typically receives coverage.

Storm-related mold damage presents another category of covered claims, including windstorm damage, hail-induced roof leaks, and lightning-related water intrusion. However, flood-related mold may require separate flood insurance.

Hidden mold situations also frequently qualify for coverage when resulting from covered perils.

This includes mold growth within walls, under flooring, or in crawl spaces due to sudden water events.

The key factor in these scenarios remains the connection to sudden, accidental events rather than long-term maintenance issues.

Working with public adjusters can significantly increase claim settlements for mold-related damages.

Key Exclusions in Mold Coverage

Property owners seeking mold coverage must recognize significant policy exclusions that limit their protection. Standard homeowners insurance policies contain notable policy gaps regarding mold damage, particularly when it results from maintenance neglect or natural disasters.

Coverage denials frequently occur when mold develops from poor maintenance, including unaddressed leaks, inadequate ventilation, or improperly sealed windows and doors.

Natural disasters present another major exclusion category, with flooding-related mold damage requiring separate coverage. Additionally, water damage from sewer backups or broken sump pumps typically needs specific endorsements.

Insurance policies often implement strict limitations on mold remediation, with sub-limits typically ranging from $1,000 to $10,000.

Pre-existing conditions, gradual wear and tear, and mold resulting from uncovered perils like termite infestations are consistently excluded.

Homeowners must also understand that damage from condensation and ongoing humidity issues unrelated to covered events falls outside standard policy protection.

Similar to how only 27% of homeowners in designated flood zones carry flood insurance, many property owners lack adequate mold coverage.

Steps to File a Successful Mold Damage Claim

When homeowners discover mold damage in their residence, filing a thorough insurance claim requires a systematic approach to maximize the likelihood of approval. Successful claims depend on exhaustive documentation, adherence to claim deadlines, and coverage verification within the policy terms. Since mold develops rapidly after water exposure, immediate action is critical for preventing further damage.

| Action Step | Required Documentation |

|---|---|

| Initial Discovery | Detailed photos of mold damage |

| Cause Assessment | Professional inspection reports |

| Policy Review | Coverage limits verification |

| Damage Documentation | Itemized repair estimates |

| Claim Submission | Complete claim forms with evidence |

The process begins with extensive photographic documentation of the affected areas, followed by professional assessment to determine the cause. Homeowners must review their policy to understand coverage limitations and exclusions specifically related to mold damage. Maintaining detailed records of all communications with insurers, including timestamps and reference numbers, strengthens the claim. Professional remediation services should be engaged only after confirming coverage to guarantee alignment with policy requirements.

The Process of Professional Mold Remediation

Professional mold remediation follows a systematic process that begins with thorough assessment and containment of affected areas using specialized testing equipment and containment barriers.

Licensed remediation specialists then implement exhaustive cleaning protocols using EPA-approved antimicrobial agents, HEPA filtration systems, and advanced extraction methods to eliminate mold colonies and sanitize contaminated surfaces.

The final phase involves structural restoration and repairs, which may include replacing damaged building materials, addressing moisture sources, and implementing preventative measures to guard against future mold growth.

Maintaining proper indoor humidity levels between 30-50% is crucial for preventing mold recurrence after remediation is complete.

Assessment and Area Containment

Successful mold remediation begins with a thorough assessment of the affected area and proper containment protocols to prevent cross-contamination. The process starts with moisture mapping to identify water sources and determine if the damage falls under covered perils in the insurance policy. For areas up to 30 square feet, remediation follows Level 1 or 2 guidelines.

Containment procedures involve sealing the affected space using 6 mil polyethylene sheeting over windows, doorways, and openings, with seams secured by duct tape. Area sealing includes misting contaminated zones to suppress dust and spore dispersal.

The protocol requires double-bagging contaminated materials in 6 mil plastic bags and proper disposal after surface cleaning with detergent solution. Maintaining indoor humidity below 50% and addressing moisture sources promptly prevents future contamination. Professional thermal imaging equipment is essential for detecting hidden moisture that could lead to recurring mold problems.

Cleaning and Sanitization Methods

The process of professional mold remediation employs multiple specialized cleaning and sanitization techniques to guarantee thorough contamination removal.

Surface preparation begins with dry ice blasting or wire brushing to remove visible growth, followed by HEPA vacuuming to capture loose spores. Antimicrobial applications then target remaining microscopic organisms on nonporous surfaces.

- Deep cleaning with borax-based solutions penetrates porous materials, destroying hidden colonies

- HEPA-filtered equipment captures 99.97% of airborne spores during sanitization

- Chemical-free dry ice blasting protects structural integrity while eliminating contamination

- Professional-grade antimicrobial treatments prevent future growth through residual protection

Each step requires precise execution using appropriate protective equipment and containment measures. Technicians systematically clean and treat affected areas, ensuring complete sanitization before proceeding to subsequent remediation phases.

For natural alternatives, undiluted vinegar can eliminate up to 82% of mold species when applied with proper contact time of 15-60 minutes.

Restoration and Damage Repair

Complete restoration and damage repair processes constitute the final phase of mold remediation, encompassing four critical components: containment setup, source identification, material replacement, and preventive measures.

The process begins with establishing mold barriers through isolation techniques, including sealing windows and openings with plastic sheeting. Professional moisture detection and repair of water sources follow to prevent future infestations. Areas exceeding 30 square feet typically require specialized containment protocols and HEPA filtration.

Damaged porous materials are carefully removed and disposed of in sealed bags, while non-porous surfaces undergo biocide treatment. The final steps involve thorough drying using dehumidifiers and fans, followed by material replacement once moisture levels stabilize. Maintaining indoor humidity below 50% and implementing regular inspections serve as ongoing preventive measures against future mold growth.

Technicians must wear protective TYVEK suits and respiratory equipment during the removal process to ensure safety as mold particle counts can increase up to 1,000 times during remediation work.

Cost Factors in Mold Removal and Insurance Coverage

Understanding mold remediation costs requires analysis of multiple interconnected factors, from labor and sampling expenses to regional variations and insurance coverage limitations.

Regional pricing substantially impacts overall expenses, with remediation costs ranging from $2,500 to $100,000 depending on location.

Remediation timelines vary based on infestation size, with small areas under 10 square feet costing $150-$300 and larger spaces requiring $1,000-$5,000 or more.

- Black mold removal commands premium pricing ($800-$7,000) due to its hazardous nature

- Labor costs fluctuate dramatically by region, affecting total project expenses

- Insurance coverage limits often cap at $10,000, leaving homeowners exposed to significant out-of-pocket costs

- Cross-contamination can multiply expenses exponentially, particularly in connected living spaces

Insurance typically covers mold remediation when resulting from sudden, accidental water damage like burst pipes or appliance malfunctions.

However, coverage depends on prompt reporting and proper documentation of the moisture source, with claims evaluated individually based on specific policy terms.

Professional environmental assessments and moisture testing must be completed before any remediation work can begin.

Additional Insurance Options for Better Mold Protection

Given standard homeowners insurance limitations regarding mold coverage, property owners can strengthen their protection through various supplemental insurance options and policy endorsements. Several coverage enhancements are available, including specialty riders for hidden water damage, water backup protection, and thorough mold remediation. Major insurers like Allstate, Progressive, and Chubb offer these additional protections.

| Coverage Type | Purpose | Typical Limits |

|---|---|---|

| Hidden Water | Gradual damage detection | $1,000-$5,000 |

| Water Backup | Sewer/sump pump issues | $5,000-$10,000 |

| Flood Insurance | Flood-related mold | Based on policy |

| Mold Riders | Enhanced remediation | $10,000-$25,000 |

| Special Endorsements | Specific mold types | Varies by insurer |

Insurance companies like Heritage Property & Casualty and People’s Trust Insurance provide specialized endorsements targeting specific mold scenarios. Coverage limits typically range from $1,000 to $10,000 per occurrence, with variations based on policy terms and the cause of mold growth.

Preventing Mold Growth to Maintain Insurance Coverage

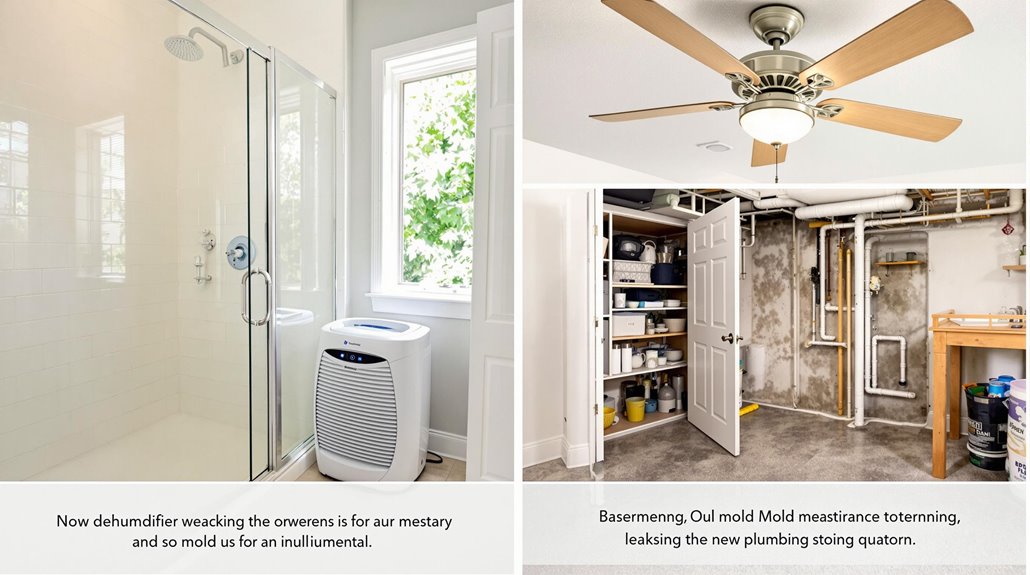

Regular inspections of high-risk areas like bathrooms, basements, and plumbing systems enable homeowners to identify potential mold triggers before they become insurance claims.

Swift remediation of water leaks, whether from pipes, roofs, or appliances, prevents the moisture accumulation that leads to mold growth and subsequent coverage disputes.

Maintaining indoor humidity levels below 60% through proper ventilation, dehumidification, and air circulation creates an environment inhospitable to mold, thereby preserving insurance coverage eligibility.

Regular Inspection Prevents Problems

Through proactive home inspections and consistent moisture monitoring, homeowners can substantially reduce their risk of mold-related insurance claims.

Regular visual inspections and structural evaluation of vulnerable areas, including attics, basements, and wall cavities, enable early detection of moisture issues before they escalate into significant problems.

- Schedule quarterly inspections of hidden spaces where moisture tends to accumulate

- Monitor humidity levels consistently using calibrated hygrometers

- Document all inspection findings and maintenance activities

- Implement immediate corrective actions when issues are identified

A thorough inspection protocol should include moisture control strategies such as proper ventilation, dehumidification, and maintaining ideal humidity levels between 30-50%.

Special attention must be directed to potential water intrusion points, including gutters, downspouts, and foundation areas, while ensuring adequate insulation to prevent condensation on cold surfaces.

Fix Leaks Immediately

Since insurance coverage for mold damage hinges on prompt response to water issues, homeowners must address leaks immediately upon discovery to maintain their policy protection. Insurance companies specifically evaluate whether mold resulted from sudden, accidental incidents versus neglected maintenance issues when determining coverage eligibility.

Effective plumbing maintenance and leak detection practices are essential, as most policies exclude damage from slow, unaddressed leaks. Documentation through photographs and repair records supports potential claims by demonstrating that water damage was promptly addressed.

Coverage typically ranges from $1,000 to $10,000 for mold remediation when resulting from covered perils like burst pipes. However, damage from chronic leaks or delayed repairs often leads to claim denials, making immediate response to water issues essential for preserving insurance protection and minimizing remediation costs.

Control Indoor Humidity Levels

Maintaining precise indoor humidity control plays a vital role in preserving home insurance coverage for mold-related claims.

Effective moisture control requires maintaining relative humidity levels between 30% and 50%, particularly in high-risk areas like bathrooms, basements, and kitchens. Regular humidity monitoring through hygrometers enables early detection of conditions conducive to mold growth.

- Install exhaust fans in moisture-prone areas to prevent devastating structural damage

- Implement dehumidification systems to protect valuable possessions from mold contamination

- Guarantee proper insulation and ventilation to safeguard family health and property value

- Maintain HVAC systems regularly to defend against costly insurance claim denials

Strategic placement of dehumidifiers, coupled with enhanced air circulation through ventilation systems, creates an environment where mold cannot thrive, thereby reducing insurance liability risks.

The Benefits Of Consulting A Public Adjuster

Public adjusters offer specialized expertise in insurance claims handling, providing objective assessments of mold-related damages and exhaustive documentation that strengthens the validity of claims.

Their professional involvement streamlines the claims process through efficient communication with insurance companies and careful analysis of policy coverage limits and exclusions.

Statistical evidence indicates that claims handled by public adjusters typically result in higher settlement amounts compared to those filed directly by policyholders, primarily due to their thorough understanding of insurance policies and negotiation strategies.

Expertise In Insurance Claims

Insurance claims involving mold damage can present complex challenges that require specialized expertise to maneuver successfully.

Public adjusters possess thorough insurance expertise and extensive experience in handling claims processes, ensuring ideal outcomes for policyholders. Their technical knowledge of policy interpretations, documentation requirements, and negotiation strategies proves invaluable throughout the claims process.

- Meticulous analysis of policy coverage and limitations to identify maximum eligible benefits

- Strategic documentation compilation that strengthens claim validity and expedites processing

- Expert negotiation tactics that counter insurance company minimization strategies

- Professional guidance through complex procedural requirements and regulatory compliance

These specialized skills enable public adjusters to streamline the claims process while maximizing settlement potential, ultimately protecting policyholder interests through their thorough understanding of insurance industry protocols and requirements.

Objective Damage Assessment

When analyzing mold-related property damage, objective evaluation stands as a cornerstone of successful claims processing. Public adjusters employ systematic approaches to assess structural vulnerabilities and conduct thorough moisture detection, ensuring complete documentation of all damages.

These professionals utilize their specialized expertise to identify both visible and concealed mold damage that might elude untrained observers. Their methodical assessment process includes detailed documentation of affected areas, precise evaluation of repair requirements, and accurate cost estimation for remediation services.

Streamlined Claim Process

Traversing the complexities of mold-related insurance claims becomes substantially more efficient through professional adjuster consultation.

Public adjusters streamline the process through expedited processing and paperwork optimization, ensuring thorough documentation while minimizing administrative burden. Their expertise in policy interpretation and negotiation tactics substantially reduces processing time and maximizes settlement potential.

- Thorough documentation and damage assessment protocols enhance claim validity

- Strategic negotiations counter insurance company minimization tactics

- Systematic paperwork management eliminates costly submission errors

- Expert policy interpretation identifies all applicable coverage benefits

Public adjusters operate on a contingency basis, aligning their objectives with policyholder interests.

Their professional management of claim procedures allows property owners to focus on remediation while ensuring ideal settlement outcomes through methodical documentation and strategic representation.

Higher Claim Payouts & Settlements

Public adjuster expertise substantially elevates claim settlement outcomes, as evidenced by FAPIA research indicating a 19.3% higher average payout for homeowners who engage professional representation. Their specialized knowledge in policy interpretation and claim valuation guarantees thorough damage assessment, identifying covered losses that might otherwise go unnoticed.

Working exclusively for policyholders, public adjusters apply methodical documentation practices and strategic negotiation techniques for settlement optimization.

Their contingency-based compensation model aligns with maximizing claim recovery, encompassing both direct damage costs and auxiliary expenses such as temporary relocation. Through objective evaluation and thorough understanding of insurance procedures, these professionals systematically build stronger cases for higher settlements, while maintaining accuracy in documentation to prevent delays or disputes in the claims process.

About The Public Claims Adjusters Network (PCAN)

Insurance professionals seeking assistance with claims management can benefit from established networks of adjusters, though specific information about the Public Claims Adjusters Network (PCAN) remains limited in public records.

Alternative adjuster networks demonstrate thorough service coverage through nationwide programs, specialized expertise, and dedicated support systems.

Key advantages of established adjuster networks include:

- Seamless claims handling from initial notice of loss to final settlement

- Access to seasoned adjusters for both routine and catastrophic events

- Customized solutions tailored to specific operational challenges

- Enhanced efficiency through integrated call centers and status tracking

These networks maintain rigorous industry standards while providing thorough claims management solutions.

Their expertise spans various sectors, offering tailored approaches to complex claims scenarios.

Professional adjusters within these networks leverage decades of experience to navigate intricate claims processes, ensuring ideal outcomes for both insurers and policyholders.

Frequently Asked Questions

Can I Stay in My Home During Professional Mold Remediation?

For ideal occupant safety, temporary relocation is strongly recommended during professional mold remediation, as the process releases countless airborne spores and involves potentially harmful chemical treatments.

How Long Does a Typical Mold Remediation Process Take to Complete?

A typical mold remediation timeline spans 5-7 days, encompassing assessment, containment, removal, sanitization, and drying duration. Extensive infestations exceeding 100 square feet may require 1-2 weeks for completion.

Will My Insurance Rates Increase After Filing a Mold Damage Claim?

Insurance rates typically adjust based on premium calculation factors and coverage history, with mold claims potentially triggering increases, especially if preventable maintenance issues are identified as root causes.

Are DIY Mold Removal Attempts Covered if They Cause Additional Damage?

Insurance policies typically exclude repair costs from DIY mold removal attempts causing additional damage. Structural assessment and remediation expenses resulting from improper handling are generally considered homeowner negligence and remain uncovered.

Can I Choose My Own Mold Remediation Company or Must Use Insurer’s Preferred?

Policyholders maintain full contractor selection rights and are not required to use insurer-recommended companies. While preferred vendors may streamline payment options, homeowners can choose any qualified remediation service provider.

References

- https://www.servicemasterrestore.com/servicemaster-by-ta-russell/why-us/blog/2021/july/does-homeowner-s-insurance-typically-cover-mold-remediation-in-california-/

- https://krapflegal.com/recources/mold-insurance-claims/what-insurance-companies-cover-mold-damage/

- https://www.plymouthrock.com/resources/does-home-insurance-cover-mold

- https://www.valuepenguin.com/does-homeowners-insurance-cover-mold

- https://www.hippo.com/learn-center/does-homeowners-insurance-cover-mold

- https://www.avnergat.com/home-insurance-mold-coverage-guide/

- https://www.puroclean.com/southlake-tx-puroclean-southlake/blog/mold-remediation-costs-what-to-expect/

- https://www.insurance.com/home-and-renters-insurance/home-insurance-basics/mold-coverage.html

- https://www.si-restoration.com/resources/mold-remediation/does-homeowners-insurance-cover-mold

- https://www.progressive.com/answers/does-homeowners-insurance-cover-mold/