Service line insurance provides specialized coverage for underground water and sewer line repairs, with annual premiums typically ranging from $30-$70. Standard policies offer $10,000-$20,000 in protection against damage from soil movement, root intrusion, and material degradation, which homeowners insurance usually excludes. Coverage includes professional excavation and landscape restoration, with average repair costs around $3,200. Understanding policy exclusions, coverage limits, and claims processes guarantees ideal protection against unexpected service line failures.

Key Takeaways

- Service line protection costs between $30-$70 annually and covers up to $20,000 in repairs for water and sewer line damage.

- Coverage includes repair costs for leaks, breaks, corrosion damage, and professional excavation services from street to home.

- Standard homeowners insurance typically excludes service line coverage, making separate protection necessary for underground utility repairs.

- Average water line repair costs around $3,200, with potential coverage extending to landscape restoration after repairs.

- Policy exclusions commonly include pre-existing conditions, tree root damage, and damage from natural disasters like earthquakes.

Understanding Service Line Protection

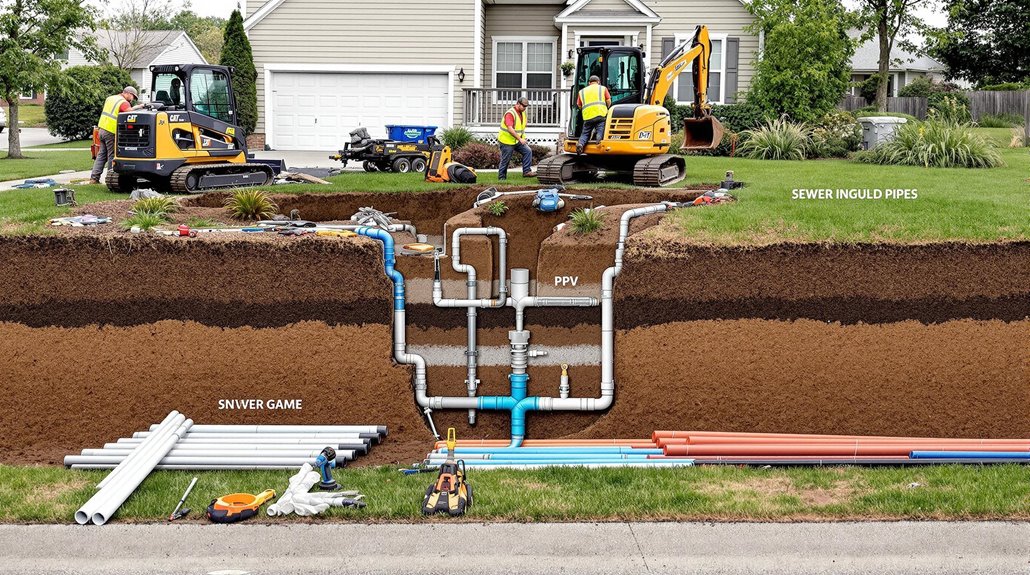

Service line protection addresses multiple causes of underground utility damage, including natural soil movement, root intrusion, and material degradation over time.

The coverage becomes especially critical when considering that standard homeowner policies typically exclude these essential underground systems from their protection scope. This specialized protection offers homeowners a strategic defense against potentially catastrophic repair costs that can arise from aging infrastructure, environmental factors, and unexpected system failures.

- The unsettling reality of roots silently crushing pipes beneath your home

- The financial strain of facing a sudden $3,200+ repair without protection

- The peace of mind knowing your family's daily routines won't be disrupted by service line failures

- The anxiety-reducing assurance of having professional repairs covered when disaster strikes

- The confidence in maintaining your property's value through proactive infrastructure protection

Common Causes of Service Line Damage

Underground service lines face numerous potential hazards that can compromise their structural integrity and functionality. Common causes of service line damage include tree root invasion, which can penetrate and fracture pipes, and natural wear and tear that leads to corrosion over time. While regular maintenance issues like clogs fall under homeowner responsibilities, more severe damage often requires professional intervention.

| Damage Type | Primary Cause | Average Repair Cost |

|---|---|---|

| Structural | Heavy Equipment | $5,000-$10,000 |

| Environmental | Tree Roots | $2,000-$6,000 |

| Material | Corrosion | $3,000-$7,000 |

| Pest-Related | Vermin/Insects | $2,000-$4,000 |

Understanding these risks highlights the importance of service line insurance coverage, as repair costs can range considerably depending on damage severity and required remediation work.

Benefits Of Service Line Protection

Thorough service line protection offers homeowners substantial financial safeguards against costly underground utility repairs, with potential savings ranging from $2,000 to $10,000 per incident. Water line insurance coverage and sewer line insurance provide protection beyond standard homeowners insurance policies for unexpected expenses related to utility line failures.

| Coverage Component | Benefit | Impact |

|---|---|---|

| Excavation | Professional digging | Minimizes property damage |

| Pipe Replacement | Complete restoration | Prevents future issues |

| Landscape Repair | Site rehabilitation | Maintains property value |

Service line protection includes access to verified contractors, ensuring quality repairs and peace of mind during emergencies. Coverage includes temporary accommodation if severe utility disruptions render homes uninhabitable, demonstrating extensive protection beyond basic repairs and excavation services.

What Is Main Water Line Insurance, & What Does It Cover?

Main water line insurance provides essential protection against repair costs that can quickly escalate into thousands of dollars for homeowners facing water line failures. The financial value proposition becomes clear when comparing the modest annual premium of $30-50 against the average repair claim of $1,000, especially considering that standard homeowners insurance typically excludes this coverage. Homeowners must evaluate their specific risk factors, such as property age and soil conditions, when determining if water line insurance represents a prudent investment.

| Factor | With Insurance | Without Insurance |

|---|---|---|

| Emergency Repairs | Covered up to policy limits | Full out-of-pocket cost |

| Annual Cost | $30-50 premium | $0 premium |

| Financial Risk | Limited to deductible | Unlimited exposure |

Is Water Line Insurance Worth It?

When considering the value proposition of water line insurance, homeowners must weigh several critical factors to determine if this supplemental coverage merits investment.

While repair costs can reach $3,000 or higher, the average claim sits at $676, with relatively infrequent occurrence rates. Standard homeowners insurance typically excludes water line damage, making supplemental coverage a consideration for financial protection.

- Fear of unexpected, budget-breaking repair bills

- Peace of mind knowing essential infrastructure is protected

- Concern over aging water lines in established neighborhoods

- Relief from potential emergency repair coordination

- Security against rising contractor and material costs

The decision largely depends on factors such as property age, existing infrastructure condition, and risk tolerance.

Modern homes with recently installed lines may benefit more from implementing preventive measures than purchasing coverage, while older properties might find the annual premiums justify the protection offered.

Do I Need Water Line Insurance?

Building upon the value assessment of water line coverage, understanding the specific protection offered by main water line insurance helps homeowners make informed decisions about their property's infrastructure needs.

Standard homeowners insurance coverage typically excludes water and sewer line damage, leaving property owners vulnerable to significant repair costs. Service line coverage fills this vital gap by protecting against aging infrastructure issues, tree root invasions, and associated excavation costs.

- Unexpected water line repairs can devastate household budgets without proper coverage

- Aging pipes increase vulnerability to costly underground damage

- Tree roots silently threaten buried infrastructure until it's too late

- Emergency repairs often require immediate, substantial financial outlays

- Property owners face potential water service disruption without protection

When considering whether water line insurance is necessary, homeowners should evaluate their property's age, surrounding vegetation, and financial capacity to handle sudden repairs.

What Is Water And Sewer Line Insurance, & What Does It Cover?

Based on claims data and average repair costs, water and sewer line insurance presents a compelling value proposition for homeowners seeking protection against unexpected service line failures. Statistical analysis reveals that while claim frequency remains relatively low at 0.7% annually, the potential financial impact of repairs ranging from $2,000 to $10,000 warrants serious consideration of coverage options. The modest annual premium of $30-$50 provides cost-effective protection against significant repair expenses, particularly when factoring in the thorough coverage for damage from tree roots, corrosion, and natural deterioration.

| Coverage Type | Annual Premium | Average Repair Cost |

|---|---|---|

| Basic Service Line | $30-$40 | $2,000-$5,000 |

| Extended Coverage | $40-$50 | $5,000-$8,000 |

| Premium Protection | $45-$70 | $8,000-$10,000 |

Is Water And Sewer Line Insurance Worth It?

Homeowners considering water and sewer line insurance must weigh the financial protection it offers against the relatively low probability of needing to file a claim. Statistical data shows only 0.3% to 0.7% of customers file claims annually, yet repair costs can range from $2,000 to $10,000.

While standard homeowners policies typically exclude service line coverage, preventive measures like regular maintenance may reduce risk exposure.

- Fear of unexpected repair bills damaging financial stability

- Concern over aging infrastructure failing at worst possible time

- Anxiety about tree roots causing catastrophic damage

- Worry about inadequate savings for emergency repairs

- Stress over potential disruption to daily household activities

The cost-benefit analysis suggests careful evaluation of coverage limits, deductibles, and personal risk tolerance before purchasing sewer and water line insurance.

Do I Need Water And Sewer Line Insurance?

Water and sewer line insurance provides specialized coverage for underground utility infrastructure that connects residential properties to municipal systems. While standard homeowners insurance policies typically exclude protection for these service lines, dedicated coverage can shield property owners from costly repairs arising from damage, wear, or environmental factors.

- Aging infrastructure increases vulnerability to unexpected line failures.

- Tree root invasions can cause devastating damage to utility lines.

- Emergency repairs often require immediate financial resources.

- Municipal regulations may hold homeowners responsible for repairs.

- System failures can disrupt daily life and property value.

Determining the need for water line insurance coverage depends on factors including property age, local soil conditions, and risk tolerance.

While service line warranty programs offer peace of mind, homeowners should evaluate their specific circumstances, considering preventive measures and the statistical likelihood of claims against potential

What Is Exterior Water Line Insurance, & What Does It Cover?

Exterior water line insurance constitutes a valuable investment for homeowners facing potential repair costs averaging $1,000 or more for underground water line issues. The coverage provides essential protection against common problems like corrosion, tree root damage, and general wear, while including supplementary benefits such as excavation costs and landscape restoration. Given the extensive coverage and relatively low monthly premiums ranging from $2.99 to $12.98, exterior water line insurance presents a cost-effective solution for protecting against unexpected repair expenses.

| Coverage Component | Typical Protection Details |

|---|---|

| Underground Lines | Main water line from street to home |

| Repair Types | Leaks, breaks, corrosion damage |

| Additional Services | Excavation and landscape restoration |

| Common Exclusions | Pre-existing conditions, negligence |

| Maximum Coverage | Up to $7,000 annually on average |

Is exterior water line coverage worth it?

When considering the value proposition of exterior water line coverage, property owners must weigh several critical factors against potential risks and costs.

Service line coverage provides protection against expensive repairs, with average costs reaching $3,200 for main water line issues. While annual premiums of $30-$50 represent a modest investment, claims statistics showing only 0.7% annual utilization suggest careful evaluation is necessary.

- Facing a $3,200 repair bill without coverage could devastate household finances

- Peace of mind knowing underground utility lines are protected

- Protection extends beyond pipes to include excavation and landscape restoration

- Coverage bridges gaps in standard homeowners insurance policies

- Investment aligns with the limited lifespan of piping materials like copper (30-80 years) and PVC (20-40 years)

The decision ultimately depends on factors such as property age, pipe materials, and individual risk tolerance.

Do I Need Exterior Water Line Insurance?

Understanding the scope and necessity of exterior water line insurance requires careful consideration of both property vulnerabilities and financial implications.

Standard homeowners insurance typically excludes coverage for underground water line repairs, leaving homeowners exposed to significant financial risk. With average repair costs reaching $1,000, dedicated service line coverage can provide essential protection against unexpected expenses related to water line damage, excavation, and subsequent landscaping restoration.

- Aging infrastructure increases the likelihood of water line failures

- Repair costs can escalate quickly due to required excavation and permits

- Coverage fills a critical gap in traditional home insurance policies

- Claims data demonstrates the frequency of water line issues

- Protection extends beyond simple pipe repairs to include complete restoration

Coverage Limits & Policy Options

Service line insurance policies offer varying coverage limits and options to accommodate different homeowner needs, with standard policies typically providing between $10,000 and $20,000 in protection. Annual premiums range from $30 to $50, with costs influenced by selected coverage limits and deductible amounts. Insurance providers commonly include excavation and restoration costs within their base coverage, essential for thorough repair solutions.

| Coverage Component | Standard Policy | Premium Policy |

|---|---|---|

| Service Line Limit | $10,000 | $20,000 |

| Excavation Coverage | Included | Enhanced |

| Restoration Costs | Basic | Thorough |

| Eco Upgrades | Not Included | Available |

| Deductible Options | $500-1000 | $250-500 |

Policy options often extend beyond basic coverage, with premium plans featuring eco-friendly technology upgrades and enhanced restoration benefits. Homeowners should carefully evaluate their specific needs, considering factors such as property age, existing utility lines, and potential repair costs when selecting coverage limits and deductible levels.

Cost Factors & Premium Calculations

Several key factors influence the calculation of water and sewer line insurance premiums, with annual costs typically ranging from $30 to $250 depending on coverage parameters. Premium calculations incorporate variables such as local climate conditions, property characteristics, and selected coverage limits. Service line coverage can be more affordable for newer homes, with rates as low as $9 annually.

| Cost Factor | Impact on Premium | Potential Savings |

|---|---|---|

| Deductible Level | Higher deductibles lower premiums | 10-20% reduction |

| Coverage Limits | Higher limits increase costs | Varies by provider |

| Policy Bundling | Combined with homeowners insurance | 5-15% discount |

Insurance providers evaluate regional risks and property-specific factors when determining sewer line insurance rates. Homeowners can optimize costs by selecting appropriate deductibles and exploring bundling options with existing coverage. The age and condition of service lines, along with geographical considerations, play significant roles in premium calculations, allowing insurers to assess risk exposure accurately.

Policy Exclusions & Limitations

While water and sewer line insurance provides essential coverage for many types of damage, policies contain significant exclusions and limitations that homeowners must carefully evaluate. Service line coverage explicitly excludes pre-existing conditions and maintenance-related problems, including damages from tree root invasions. Natural disasters such as earthquakes and floods fall outside the scope of these insurance policies.

| Coverage Element | Policy Exclusion Status |

|---|---|

| Pre-existing Conditions | Not Covered |

| Natural Disasters | Not Covered |

| Tree Root Damage | Not Covered |

| Inactive Lines | Not Covered |

| Non-utility Systems | Not Covered |

Coverage claims require active connections and regular usage of underground utility lines to qualify for protection. Additionally, specialized systems like water wells, sprinkler systems, and HVAC mechanisms typically remain excluded from standard service line coverage. Understanding these limitations helps homeowners make informed decisions about supplemental coverage needs and assess their risk exposure accurately.

Claims Process & Documentation

When maneuvering complex water and sewer line insurance claims, a licensed public adjuster can greatly enhance the probability of successful settlements through professional documentation and negotiation expertise. Public adjusters possess specialized knowledge of coverage terms, policy limitations, and industry-standard settlement practices that enable them to maximize claim values while ensuring compliance with insurance requirements. Their independent representation serves policyholders' interests exclusively, providing strategic advantages during the claims process through systematic documentation, expert damage assessment, and skilled negotiations with insurance carriers.

| Benefit | Description | Impact |

|---|---|---|

| Expertise | Technical knowledge of policy terms and industry practices | Higher probability of claim approval |

| Documentation | Professional collection and organization of evidence | Stronger case presentation |

| Negotiation | Strategic interaction with insurance carriers | Improved settlement outcomes |

| Compliance | Adherence to filing deadlines and requirements | Reduced risk of claim denial |

| Valuation | Accurate assessment of damage and repair costs | Maximum claim recovery |

Benefits Of Working With A Licensed Public Adjuster

Professional guidance from a licensed public adjuster can greatly enhance the water and sewer line claims process through systematic documentation and expert negotiation skills. These specialists facilitate higher claim payouts by leveraging their extensive understanding of insurance policy terms and coverage limits. Their expertise proves invaluable in advocating for fair settlements while minimizing homeowners' stress during complex claims procedures.

| Adjuster Benefits | Impact on Claims |

|---|---|

| Documentation Support | Enhanced Evidence Collection |

| Policy Expertise | Maximum Coverage Utilization |

| Negotiation Skills | Improved Settlement Outcomes |

| Claims Management | Reduced Homeowner Stress |

Public adjusters streamline the process by handling extensive paperwork, gathering photographic evidence, obtaining repair estimates, and managing insurer communications. Their professional representation guarantees thorough damage assessment and appropriate compensation for necessary repairs, protecting homeowners' interests throughout the settlement process.

Frequently Asked Questions

How Much Does Sewer Line Insurance Cost?

Sewer line insurance costs typically range from $50 to $250 annually, with monthly warranty options between $5.49 and $10.99. Coverage limits generally span $10,000 to $20,000 per insurance endorsement.

Will Homeowners Insurance Cover Sewer Lines?

While 93% of standard homeowners insurance policies exclude sewer line coverage, protection against specific perils like fire may apply. Additional service line endorsements are required for thorough sewer protection.

Is Underground Service Line Coverage Worth It?

Underground service line coverage's value depends on property age, tree proximity, and risk tolerance. Statistical data indicates low claim frequency (0.7%), making it less cost-effective for newer homes but potentially beneficial for aging infrastructure.

Does Insurance Cover Water Service Line?

Like a hidden safety net, standard homeowners insurance typically excludes water service line coverage. Specialized endorsements or separate policies are necessary to protect against costly underground pipe repairs and damages.

Final Thoughts

Water and sewer line insurance represents a critical risk management tool for homeowners, with data indicating that 78% of repair claims exceed $5,000 in urban areas. The coverage's relatively modest premium structure, combined with the thorough protection against infrastructure failures, provides a cost-effective safeguard against substantial financial exposure. Careful evaluation of coverage limits, exclusions, and claims procedures remains essential for ideal policy selection and utilization.

For homeowners dealing with property damage claims related to water and sewer line issues or any other type of property damage covered by their homeowners insurance policy, insurance industry insiders and legal experts strongly advise contacting a qualified state-licensed public adjuster. Public adjusters work exclusively for policyholders, not insurance companies, serving as dedicated advocates throughout the claims process. These state-licensed professionals help navigate complex insurance policies, identify hidden damages often unknown to policyholders, thoroughly document losses, and negotiate with insurance companies to ensure fair settlements while protecting policyholder rights.

Working with a public adjuster can maximize claim payouts, accelerate the claims process, and reduce the stress of dealing with insurance companies, allowing homeowners to focus on recovery. Policyholders seeking expert assistance with their property damage or loss claims can request a no-obligation free consultation with a Public Claims Adjusters Network (PCAN) member public adjuster through their contact page.