Filing a personal property insurance claim requires systematic documentation and clear communication with insurers. Key steps include photographing all damage, creating detailed inventories of affected items, and maintaining records of all interactions with insurance representatives. Policyholders must understand coverage types, meet filing deadlines, and navigate adjuster requirements. While self-filing is possible, consulting professionals like public adjusters can greatly increase settlement amounts and streamline the complex claims process.

Key Takeaways

- Document all property damage immediately with detailed photographs, videos, and a comprehensive inventory list of affected items.

- Contact your insurance company promptly to report the incident and maintain records of all communications with representatives.

- Create a detailed inventory of damaged items including descriptions, purchase dates, and estimated values with supporting receipts.

- Review your policy thoroughly to understand coverage limits, deductibles, and specific requirements for filing claims.

- Keep damaged property until the insurance adjuster inspects it and follow up regularly on claim status.

Essential Documentation Before Starting Your Claim

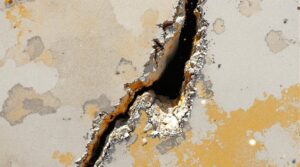

Documentation plays an essential role in the success of personal property insurance claims. Before initiating the claims process, policyholders must gather thorough photographic and video evidence that clearly shows all damage to affected property. These visual records should capture both overall views and detailed close-ups of the impacted areas.

A complete inventory listing of damaged items forms another significant component of essential documentation. This inventory should include specific descriptions, quantities, and estimated values for each item. Original receipts serve as critical proof of ownership and value, strengthening the claim's validity.

Insurance policies should be carefully reviewed to understand coverage parameters, deductibles, and filing requirements.

Additionally, maintaining detailed records of all interactions with insurance representatives is fundamental. This communication log should document names, dates, and conversation summaries throughout the claims process. Such meticulous record-keeping helps guarantee a smooth progression of the claim and provides necessary reference points for follow-up discussions.

Initial Steps to Report Property Damage

When property damage occurs, policyholders must take immediate action to protect their insurance claim rights. The first important step in filing a claim involves contacting the insurance agent promptly to report the incident. During this initial conversation, individuals should document the name and position of the representative they speak with.

Following the verbal report, policyholders should send a written confirmation letter to the insurance company detailing the claim specifics. This creates an official paper trail of the reported damage.

Simultaneously, thorough documentation through photographs and videos of all damaged items is necessary, accompanied by a detailed inventory list. It is essential to preserve damaged property until the insurer has conducted their inspection.

Throughout the claims process, maintaining detailed records of all interactions with the insurance company is critical. This includes logging dates, times, and names of representatives involved in handling the claim.

Navigating the Insurance Company's Requirements

Successfully steering through an insurance company's requirements demands a thorough understanding of the policy terms and claim procedures. Policyholders must first review their coverage details, including limits and exclusions, to guarantee they meet all necessary criteria when filing insurance claims.

Documentation plays an essential role in meeting the insurer's requirements. This includes maintaining detailed records of damaged property through photographs, creating thorough inventories of lost items, and collecting relevant receipts. The insurance company typically requires this evidence to validate the claim and determine appropriate compensation.

Communication management is equally important throughout the claims process. Claimants should document every interaction with insurance representatives, noting dates, times, and names of contacts.

Regular follow-up guarantees the claim stays active and allows for prompt responses to requests for additional information. This systematic approach helps navigate the requirements efficiently while maintaining a clear record of the claim's progression.

Creating a Detailed Property Inventory

A detailed property inventory forms the foundation of a successful insurance claim. The inventory process should commence immediately following a loss, with claimants documenting each item's description, purchase date, and estimated value.

Insurance adjusters typically provide specific forms or templates that should be utilized to guarantee all required information is properly captured. As recollections of lost items surface over time, the inventory should be continuously updated to maintain accuracy.

Visual documentation through photographs or videos serves as vital supplementary evidence, providing clear proof of ownership and the condition of belongings. For substantial claims involving high-value items or extensive collections, professional assistance may be warranted to guarantee thorough documentation.

The systematic approach to creating a detailed inventory not only expedites the claims process but also helps guarantee proper compensation for lost or damaged items. This methodical documentation becomes particularly valuable when discussing settlement terms with insurance providers.

Working With Insurance Adjusters Effectively

A thorough documentation process forms the foundation for effective interactions with insurance adjusters during property claims.

Maintaining detailed records, including photographs, receipts, and written accounts of all damage, provides concrete evidence to support claim discussions.

While maintaining a professional demeanor throughout the process, policyholders should advocate firmly for their interests by presenting organized documentation and following up consistently on claim status.

Document Everything Thoroughly

Properly documenting damage and interactions throughout the insurance claims process plays a crucial role in achieving a fair settlement.

To document everything thoroughly, claimants should photograph and videotape all damaged property from multiple angles, recording the date and time of the damage. A detailed inventory of affected items, including descriptions, purchase dates, and receipts, provides essential documentation for the adjuster's review.

Maintaining clear records extends to all communications with the insurance company. Keep detailed logs of conversations, noting representatives' names, titles, and key discussion points. Important conversations should be confirmed in writing to prevent misunderstandings.

Additionally, damaged items must be preserved until the adjuster completes their inspection, ensuring proper claim validation and assessment.

Stay Professional Yet Firm

Successfully maneuvering the insurance claims process requires maintaining a delicate balance between professionalism and assertiveness when working with adjusters.

When interacting with insurance adjusters, policyholders should establish a professional rapport while maintaining clear boundaries. This approach involves keeping detailed records of all communications, including dates and names of representatives involved in the claims process.

Claimants must articulate their concerns clearly and support their positions with thorough documentation. A thorough understanding of policy terms strengthens negotiating positions and enables informed discussions about coverage decisions.

While persistence is essential for moving claims forward, maintaining respectful communication helps prevent unnecessary friction. Regular follow-up communications should be conducted diplomatically, demonstrating both commitment to resolution and professional courtesy throughout the process.

Understanding Coverage Limits and Deductibles

Understanding personal property insurance coverage requires familiarity with policy limit tiers, which typically range from 50% to 70% of the dwelling coverage amount.

The calculation of deductibles follows either a fixed dollar amount or a percentage-based method, determining how much the policyholder must pay before insurance benefits activate.

Coverage types are distinguished primarily between Actual Cash Value (ACV), which factors in depreciation, and Replacement Cost Value (RCV), which covers the full cost of replacing damaged items at current market prices.

Coverage Types Explained

Insurance policies contain distinct coverage types and limits that determine how much compensation a policyholder can receive for personal property losses. Understanding these variations is essential for filing successful claims and guaranteeing adequate protection for belongings.

| Coverage Type | Key Features |

|---|---|

| Actual Cash Value | Includes depreciation; lower premiums |

| Replacement Cost | Full replacement without depreciation |

| Standard Coverage | Percentage of dwelling coverage |

| Enhanced Coverage | Additional protection for valuables |

Personal property coverage typically ranges from 50% to 70% of the dwelling coverage amount. When filing claims, policyholders must consider their specific coverage type and corresponding deductibles. High-value items often require separate endorsements or riders to guarantee full protection, as standard policies may have category-specific limitations or exclusions. It’s essential for policyholders to review their insurance policy thoroughly to understand the nuances of what is included under personal property coverage. For those with significant collections or valuable items, seeking ‘special personal property coverage explained‘ can provide clarity on securing appropriate protection beyond standard limits. Additionally, regular inventory updates and appraisals can help ensure that coverage levels accurately reflect the current value of possessions, minimizing potential out-of-pocket expenses during a claim.

Deductible Calculation Methods

When filing a personal property claim, policyholders must first determine their applicable deductible, which directly influences the final settlement amount.

Insurance providers typically calculate deductibles using one of two primary methods: fixed dollar amounts or percentage-based calculations.

Fixed dollar deductibles specify a set amount, commonly $500 or $1,000, which the policyholder must pay before insurance coverage begins.

Percentage-based deductibles, usually ranging from 1% to 5% of the total insured value, fluctuate based on the property's worth.

Insurance policies may incorporate different deductible structures for various coverage types within the same policy.

Selecting higher deductibles reduces premium costs but increases out-of-pocket expenses during claims.

Understanding these calculation methods helps policyholders accurately estimate their financial responsibility and potential reimbursement amounts when filing claims.

Policy Limit Tiers

Personal property insurance policies incorporate distinct coverage tiers that establish maximum payout limits for different types of claims. These tiers typically include dwelling coverage as the base, with personal property coverage often calculated as a percentage, usually 50-70% of the dwelling amount.

Liability coverage represents a separate tier with its own specified limits.

Before any coverage applies, policyholders must satisfy their policy deductible, which varies based on the type of claim filed. Standard policies may have limitations for high-value items, necessitating additional endorsements to guarantee adequate coverage.

Regular evaluation of coverage tiers is essential, particularly following major purchases or home improvements, to maintain appropriate protection levels. This systematic approach helps guarantee that coverage aligns with current property values and personal asset requirements.

Securing Fair Compensation for Your Losses

Obtaining fair compensation for property losses requires a strategic and well-documented approach to the claims process. The initial step involves promptly reporting the insurance claim while maintaining detailed records of all communications with insurance representatives, including their names and positions.

A detailed inventory of affected items serves as essential evidence, supported by photographs and original receipts. Understanding policy terminology, particularly the distinctions between Replacement Cost Value (RCV) and Actual Cash Value (ACV), enables claimants to better navigate compensation negotiations.

When addressing depreciation calculations, policyholders should present evidence of their items' condition and maintenance history, which can positively impact the final settlement amount.

Consistent follow-up with the insurance provider throughout the claims process helps guarantee timely resolution and appropriate compensation. This systematic approach, coupled with thorough documentation and persistent communication, greatly improves the likelihood of securing fair compensation for property losses.

Common Challenges and How to Address Them

When filing personal property insurance claims, policyholders often encounter three primary obstacles: incomplete documentation, slow insurer responses, and disagreements over settlement amounts.

Missing documentation can greatly delay claim processing, making it essential to maintain detailed records of damaged items, repair estimates, and communications with the insurance company.

Disputed settlements frequently arise from differences in valuation methods or misunderstandings about coverage terms, requiring policyholders to carefully review their policies and prepare supporting evidence for negotiations.

Missing Documentation Hurdles

Insurance claims can be considerably delayed or derailed by missing documentation, creating hurdles that policyholders must carefully navigate. When essential paperwork is unavailable, claimants should explore alternative forms of proof, such as bank statements or credit card records, to substantiate ownership of damaged items.

Maintaining a thorough communication log with the insurance provider helps track information gaps and resolve documentation disputes effectively.

When obstacles arise in obtaining required documents like police reports or repair estimates, prompt communication with the insurer can lead to workable solutions or timeline adjustments.

Additionally, proactive documentation of property condition and value before any loss occurs serves as a valuable safeguard, potentially eliminating future challenges related to missing documentation during the claims process.

Delayed Response Times

Patience and persistence prove essential when facing delayed response times from insurance providers during the personal property claims process. High claim volumes, particularly after widespread disasters, often create processing backlogs. Understanding these delays and implementing strategic responses can help expedite claim resolution.

| Challenge | Solution |

|---|---|

| Extended Processing Times | Maintain detailed communication logs |

| Limited Updates | Schedule regular follow-up calls |

| Documentation Requests | Keep organized records readily available |

| Response Deadlines | Know policy timelines and requirements |

| Communication Gaps | Document all interactions with dates |

To minimize delayed response times, policyholders should maintain thorough records of all insurer communications while understanding their policy's specified timelines. Regular, documented follow-ups can place appropriate pressure on insurers to process claims more efficiently, especially when combined with complete, organized documentation that prevents additional processing delays.

Disputed Settlement Amounts

Beyond processing delays, settlement amount disputes represent a frequent hurdle in personal property insurance claims.

These disputes often stem from differing interpretations of property value, particularly when insurers apply Actual Cash Value rather than Replacement Cost calculations.

To address disputed settlement amounts effectively, policyholders should request detailed breakdowns of the insurer's calculations, including depreciation schedules and valuation methods used.

Maintaining thorough documentation of item conditions and all communications with the insurance company strengthens the policyholder's negotiating position.

When significant discrepancies exist, engaging an independent appraiser can provide professional validation of claimed values.

This third-party assessment often helps bridge valuation gaps and can serve as valuable leverage during settlement negotiations with insurance providers.

Time Frames and Deadlines to Remember

Several critical deadlines govern the personal property claims process, making timely action essential for successful outcomes. Most insurance carriers establish specific time frames for claim reporting, typically requiring notification within 30 to 60 days of the loss event.

Policy holders must carefully review their coverage documents to identify these deadlines and avoid claim denials due to late submission.

Insurance companies often implement additional deadlines for supplementary documentation, commonly requiring inventories and receipts within 90 days after the initial claim filing.

When circumstances prevent meeting these deadlines, policyholders should submit written extension requests before the original due date expires.

Additionally, if disputes arise leading to potential legal action, state-specific statutes of limitations apply, generally allowing one to three years from the loss date to initiate litigation against insurers.

Understanding and adhering to these time-sensitive requirements helps maintain claims as valid throughout the settlement process.

Professional Resources and Support Options

A policyholder's successful navigation of personal property insurance claims often requires professional guidance and support resources.

Before signing any release of claim, consulting with an attorney or claims expert is essential to protect one's rights and understand the agreement's implications.

Military personnel can access specialized resources through the Office of the OJAG Personnel Claims Unit Norfolk, which provides specific claims packets and forms.

The Claims Help Line at (888) 897-8217 serves active duty members, reservists, and civilian employees seeking assistance with claims-related questions.

Professional assistance extends to creating detailed inventories of damaged items, a vital step in substantiating claims and documenting losses.

For an objective evaluation of damages, policyholders may benefit from hiring an independent adjuster who can provide a second opinion on the insurer's assessment.

This additional expertise can strengthen negotiating positions during the settlement process.

The Benefits Of Consulting A Public Adjuster

Consulting a public adjuster offers significant advantages for policyholders maneuvering complex insurance claims.

These licensed professionals provide objective damage assessments and expertly manage the documentation process, resulting in more thorough and accurate claim submissions.

Research indicates that claims handled by public adjusters typically yield substantially higher settlements, with studies showing increases of up to 800% compared to claims filed without professional assistance.

Expertise In Insurance Claims

Professional public adjusters bring invaluable expertise to the personal property insurance claims process, offering policyholders significant advantages in settlement negotiations and claim management.

Their specialized knowledge of policy nuances and local regulations guarantees claims are filed correctly, minimizing the risk of denial due to technical errors.

Studies demonstrate that public adjusters' expertise in insurance claims typically results in settlements 20% to 50% higher than those handled by policyholders alone.

Their professional understanding of documentation requirements and negotiation strategies expedites the claims process while maximizing potential settlements.

Public adjusters leverage their industry knowledge to navigate complex claim procedures, allowing property owners to focus on recovery.

Their percentage-based fee structure aligns with successful outcomes, making their services a worthwhile investment for policyholders seeking ideal claim resolutions.

Objective Damage Assessment

Independent public adjusters provide objective damage assessments that serve as an essential counterbalance to insurance company evaluations. Their specialized training enables them to conduct detailed property inspections, identifying both obvious and hidden damages that might otherwise go unnoticed.

The objective damage assessment process benefits from public adjusters' extensive knowledge of local building codes and insurance policies. This expertise typically results in settlements 20-30% higher than those achieved by policyholders acting alone.

Working on a contingency fee basis, public adjusters have a vested interest in maximizing claim values while maintaining professional objectivity. Their involvement streamlines the claims process by managing all communications with insurance companies, allowing property owners to focus on recovery efforts while ensuring accurate damage documentation and fair compensation.

Streamlined Claim Process

Engaging a public adjuster transforms the insurance claims process into a more efficient and effective experience for policyholders. These professionals offer expert guidance while managing all aspects of the claim, from documentation to final settlement negotiations.

| Public Adjuster Benefits | Impact on Claims |

|---|---|

| Expert Knowledge | Enhanced Policy Understanding |

| Direct Negotiation | Higher Settlement Potential |

| Time Management | Reduced Policyholder Stress |

| Thorough Documentation | Accurate Damage Valuation |

| Contingency-Based Fees | Aligned Financial Interests |

The contingency fee structure guarantees public adjusters are motivated to secure maximum settlements, as their compensation directly correlates with the claim outcome. Their industry expertise helps navigate complex policy terms and avoid common processing delays, while their professional assessment methods guarantee all damages are properly documented and valued. This systematic approach typically results in more favorable settlements compared to policyholder-managed claims.

Higher Claim Payouts & Settlements

When pursuing an insurance claim, policyholders who consult public adjusters typically secure substantially higher settlements compared to those who manage claims independently.

Research demonstrates that settlements negotiated through public adjusters average 20-30% higher claim payouts than self-managed claims.

These licensed professionals leverage their expertise in damage assessment and policy interpretation to identify all eligible losses, ensuring extensive documentation for maximum compensation.

Their thorough understanding of coverage terms enables them to advocate effectively on behalf of policyholders during negotiations with insurance companies.

Working on a contingency fee basis, public adjusters make their services financially accessible while maintaining motivation to secure ideal settlements.

They also handle essential paperwork and meet filing deadlines, preventing claim denials or reduced settlements due to administrative errors.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) operates as a nationwide organization of thoroughly vetted, state-licensed public adjusters who handle residential and commercial property insurance claims.

With coverage in over 40 states, PCAN members specialize in managing more than 30 different types of property damage claims, serving as expert advocates for policyholders.

Admission to PCAN requires public adjusters to complete a rigorous application and interview process, ensuring only the most qualified professionals join the network.

Members must maintain the highest standards of ethics and professionalism, with their licenses and complaint records subject to mandatory annual audits.

This strict vetting process helps maintain PCAN's reputation for excellence in the industry.

PCAN functions as a valuable resource, connecting property owners with top-tier public adjusters who possess the expertise necessary to navigate complex insurance claims effectively.

The network's commitment to quality assurance provides policyholders access to trusted professionals who can properly represent their interests.

Frequently Asked Questions

How Do I Maximize My Personal Property Claim?

Effective claim strategies include thorough documentation of damaged items, maintaining detailed records, understanding policy terms, challenging low assessments, and providing extensive evidence through photos, receipts, and communication logs.

What Not to Say When Filing a Home Insurance Claim?

Major claim missteps include admitting fault, exaggerating losses, providing incomplete information, sharing irrelevant personal details, and missing deadlines. These statements can compromise insurance claims and lead to denials.

What Is the 80% Rule in Homeowners Insurance?

Studies show 60% of homes are underinsured. The 80% rule requires homeowners to insure their property for at least 80% of replacement cost to avoid penalties during claims under Coverage Requirements.

How to Estimate the Value of Personal Belongings?

Personal belongings valuation methods include creating detailed inventories, researching market prices online, estimating depreciation, obtaining professional appraisals, and maintaining purchase documentation for accurate assessment of current worth.