To secure homeowners insurance coverage for a new roof replacement, a claim must be submitted with supporting documentation, including proof of damage from a covered peril and a detailed estimate of replacement costs.

An insurance adjuster will then assess the damage to determine validity and provide a cost estimate. Homeowners should understand their policy limits and deductibles, as these factors can impact coverage.

Effective communication and collaboration between insurance adjusters, roofing contractors, and homeowners are essential for a successful claim. By understanding the intricacies of the insurance claim process, homeowners can increase their chances of a favorable outcome.

Key Takeaways

• Document roof damage thoroughly with photos and receipts to support your insurance claim.

• Understand your policy limits and deductibles to determine if filing a claim is beneficial.

• Hire a reputable roofing contractor to inspect damage and provide estimates for the insurance company.

• Ensure effective communication and collaboration between the insurance adjuster and roofing contractor.

• Consider hiring a public adjuster for unbiased evaluations and negotiation expertise to secure a better settlement.

How To Get Homeowners Insurance To Pay For A New Roof

When seeking to obtain homeowners insurance coverage for a new roof, it is essential to understand the intricacies of roof insurance claims, including the process, payouts, and prerequisites for filing.

A thorough comprehension of how much insurance pays for roof replacements, as well as the factors influencing claim outcomes, can help homeowners make informed decisions.

This understanding also involves knowing when to file a claim, whether to contact a roofer or insurance provider first, and how to effectively claim roof repairs on insurance.

How Do Roof Insurance Claims Work?

Typically, a roof insurance claim is initiated by the homeowner notifying their insurance provider of damage to their roof, which triggers an inspection by an adjuster to assess the extent of the damage.

The claim process involves the homeowner providing documentation, such as photos and receipts, to support their claim.

The adjuster’s role is to verify the damage and determine the cause, which is vital in determining coverage.

Insurance terms, such as policy limits and deductibles, play a significant role in the claim process. Homeowners must understand their policy’s coverage limits to determine if their roof damage is fully covered.The adjuster will assess the damage and provide a report outlining the extent of the damage and the associated costs.

If the damage is deemed covered, the insurance provider will issue a settlement based on the policy’s terms. It is important for homeowners to carefully review their policy and understand the claim process to guarantee a smooth and efficient experience. By understanding the claim process, homeowners can navigate the complexities of roof insurance claims with confidence.

How Much Does Insurance Pay For Roof Replacements?

Determining the extent of insurance coverage for roof replacements involves evaluating the policy’s provisions, including the age and condition of the roof, as well as the type and cause of damage. It’s crucial to assess how the specific terms of the insurance policy apply to your situation. Age considerations for roofing insurance can significantly impact coverage options, as older roofs may have different eligibility criteria for replacement compared to newer ones. Additionally, understanding the deductible amounts and any exclusions related to specific types of damage, such as wear and tear versus storm damage, will help ensure that homeowners make informed decisions regarding their claims.

Roof replacement costs vary widely depending on factors such as roofing material types, size, and complexity of the job. Additionally, labor costs and regional pricing trends can also impact the total expense of a roof replacement. Homeowners should consider the long-term benefits and durability of different roof installation material types when making a decision. Investing in high-quality materials may lead to reduced maintenance costs and extended lifespan, ultimately providing better value over time.

Homeowners should review their insurance policy limits to understand the maximum amount of coverage available for roof replacement.

The insurance company will typically assess the damage and provide an estimate of the costs to replace or repair the roof. After the assessment, the insurance company may also determine the coverage applicable to the specific type of damage incurred. For instance, if there is significant wind damage on green roofs, additional considerations may be needed due to the unique materials and structures involved. Homeowners should ensure all relevant documentation and photographs of the damage are submitted to facilitate the claims process.

The claim process timeline may vary depending on the insurance company and the complexity of the claim. Homeowners should also consider deductible considerations, as they will need to pay the deductible amount before the insurance coverage kicks in.

It is crucial to carefully review the insurance policy and understand the coverage provisions to guarantee that homeowners receive fair compensation for their roof replacement costs.

Should I File An Insurance Claim For My Roof?

To maximize insurance coverage for a roof replacement, homeowners must first determine whether filing an insurance claim is the most advantageous course of action, taking into account factors such as policy limitations, deductible costs, and the likelihood of claim approval.

When evaluating roof damage, consider the extent of the damage and whether it exceeds the deductible amounts specified in the policy.

Homeowners should also review their policy limits to determine the maximum amount of insurance coverage available for roof replacement.

The claim process typically involves submitting documentation of the damage, including photographs and repair estimates, to the insurance provider. Insurers will evaluate the damage and determine the amount of coverage applicable. Homeowners should be aware that filing a claim may result in increased premiums or policy cancellations.

As a result, it is essential to weigh the benefits of filing a claim against the potential drawbacks. By carefully considering these factors, homeowners can make an informed decision about whether to file an insurance claim for their roof replacement.

Should I Call A Roofer Or Insurance First?

When dealing with roof damage, homeowners often face a dilemma regarding the order in which to contact a roofer and their insurance provider, as this decision can greatly impact the insurance claims process and coverage eligibility.

It is generally recommended to contact your insurance provider first to report the damage and initiate the claims process. This allows the insurance company to assess the damage and provide guidance on the necessary steps to take.

Contacting a roofer first may lead to unauthorized repairs or recommendations that may not be covered under your insurance policy. However, your insurance provider may request roofer recommendations or damage assessments to support your claim. Be sure to review your policy details to understand what is covered and what is not.

Be aware of claim timelines to guarantee you submit all necessary documentation within the required timeframe to avoid delays or denial of insurance coverage.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

Claiming Roof Repairs On Insurance

Homeowners’ insurance policies typically cover roof repairs or replacement if the damage is caused by a qualifying event, such as a storm, hail, or another catastrophic occurrence. It is essential for homeowners to understand the specific terms of their policy, as certain exclusions may apply. For example, wear and tear from age is generally not covered, and homeowners may need to request a wind damage inspection for metal roofs to ensure that any potential issues are documented and addressed promptly. Regular maintenance and timely inspections can also help prevent costly repairs in the long run, ultimately protecting both the roof and the homeowner’s investment. In order to determine if the damage is eligible for coverage, homeowners should carefully document any hurricane roof damage signs, such as missing shingles, leaks, or significant wear. It’s also advisable to conduct regular inspections, especially after severe weather events, to catch any potential issues early. By being proactive, homeowners can ensure they’re prepared to take the necessary steps to file claims and secure the repairs they need. However, policyholders should be aware that coverage can vary significantly between different insurance providers and individual policies. In some cases, please note that certain exclusions may apply, particularly regarding wear and tear or routine maintenance issues. When assessing claims, insurers often categorize incidents, including various hurricane roof damage types, to determine eligibility for repairs or replacement coverage following severe weather events. However, many policies may exclude wear and tear or damage caused by lack of maintenance. It’s essential for homeowners to understand the specifics of their coverage, especially when it comes to events like severe weather. For those seeking clarity on their coverage options, ‘roof hail damage repairs explained‘ can provide valuable insights into what is typically included and the steps necessary to file a claim successfully. It is important for homeowners to regularly inspect their roofs for any potential issues to ensure they remain covered in the event of a claim. Flat roof hail damage signs can include cracked or punctured areas, granule loss, and water pooling that may lead to leaks. By being proactive and addressing these signs early, homeowners can prevent more extensive damage and ensure their insurance coverage is more effective when they need it most. It is important for homeowners to understand their policy details, including any exclusions or limits that may apply. Additionally, in the case of severe weather, they should be on the lookout for roof lightning damage signs and symptoms, such as scorch marks or melted shingles, which might indicate a need for immediate inspection and potential claims. Regular maintenance and prompt reporting of any damage are key to ensuring adequate coverage and protection. To ensure that you are adequately protected, it’s essential to understand what your policy includes and any exclusions that may apply. After a severe storm, homeowners should inspect their roofs for any visible signs of damage, including metal roof hail damage signs, such as dents or punctures. Documenting these signs promptly can help streamline the claims process and ensure that necessary repairs are made efficiently. In order to ensure coverage, homeowners should review their policy details to understand the specific conditions and limits that apply. Additionally, it is important to document any damage and notify the insurance company promptly. For those assessing the impact of severe weather, a shingle roof hail damage overview can help clarify what types of repairs are typically covered and how to navigate the claims process effectively.

Understanding the specifics of your policy is vital for a successful claim. Knowing what to expect and how to proceed is important for navigating the claim process effectively.

Here are key factors to take into account when claiming roof repairs on insurance:

- Assess roof damage: Carefully document the extent of the damage to support your claim.

- Review insurance coverage: Verify that your policy covers the type of damage your roof sustained.

- Understand deductible impact: Be aware that your deductible will be subtracted from the claim payout, affecting the amount you receive.

- Check policy limits: Confirm that your policy’s coverage limits can accommodate the cost of repairs or replacement.

How Long Does A Roof Claim Take?

Following a thorough assessment of the damage and verification of coverage, the next logical step is determining the timeframe for resolving the claim, which raises a common question: how long does a roof claim typically take to process and finalize?

The roof claim timeline can vary depending on several factors, including the complexity of the roof damage assessment, the speed of communication between the homeowner and the insurance provider, and the presence of insurance processing delays.

Typically, a roof claim can take anywhere from a few days to several weeks or even months to resolve. Claim approval factors, such as the extent of the damage and the policy’s coverage limits, can influence the processing time. Additionally, weather impact assessments, which may be required to determine the cause and scope of the damage, can also affect the timeline.

To minimize delays, homeowners should guarantee timely and thorough documentation of the damage and maintain open communication with their insurance provider. By understanding the factors that influence the roof claim timeline, homeowners can better navigate the process and manage their expectations.

How Do Roofing Companies Work With Insurance Companies?

The collaboration between roofing companies and insurance companies is essential in facilitating the roof replacement process for homeowners.

Effective communication and transparency are key in ensuring a seamless experience, particularly when it comes to sharing insurance estimates and determining repair costs.

Understanding the dynamic between these two entities can help homeowners navigate the often-complex process of filing a claim and securing adequate compensation for roof repairs or replacement.

Should I Show My Contractor My Insurance Estimate?

Typically, when a homeowner files an insurance claim for roof damage, the insurance company will provide a detailed estimate outlining the scope of work and associated costs, which may be requested by the roofing contractor to facilitate the repair or replacement process.

This prompts the question: Should I show my contractor my insurance estimate?

The answer lies in the importance of insurance transparency and contractor communication.

To guarantee a smooth claim process, consider the following:

- Verify estimate accuracy: Share your insurance estimate with your contractor to ensure their understanding of the scope and costs.

- Facilitate estimate comparison: Provide your contractor with the insurance estimate to compare with their own assessment, ensuring alignment and minimizing potential disputes.

- Streamline claim negotiation: Transparency with your contractor can aid in claim negotiation, as they can address any discrepancies or concerns with the insurance company.

- Maintain roofing documentation: Keep a record of all correspondence, including the insurance estimate, to ensure a clear audit trail and support any future claims or disputes.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

How Much Should A Roof Repair Cost?

Roof repair costs vary widely depending on factors such as the extent of damage, roofing material type, and geographic location, making it vital for homeowners to understand the intersecting roles of roofing companies and insurance providers in the claims process.

The average roofing expenses for repairs can range from $300 to $1,500 or more, depending on the scope of work. Factors influencing pricing include the type and quality of roofing materials, labor costs, and the complexity of the repair.

Roofing material prices also play a significant role in determining the overall cost. For instance, asphalt shingles are generally less expensive than metal or slate roofing. Homeowners should review their insurance policies to understand their coverage limits and any applicable deductibles. Insurance companies typically cover roof repairs resulting from sudden events like storms or accidents, but may not cover wear and tear or maintenance-related issues. Homeowners planning a roofing project should also factor in potential shingle roof repair costs explained in detail by professionals. Understanding these costs can help budget effectively and avoid unexpected expenses. It’s advisable to obtain multiple quotes from contractors to ensure that the repair and replacement work is both comprehensive and reasonably priced.

Understanding the factors that influence roof repair costs and their insurance coverage, homeowners can better navigate the claims process and work effectively with roofing companies to guarantee a successful repair or replacement.

Roof Inspection For Insurance Claim

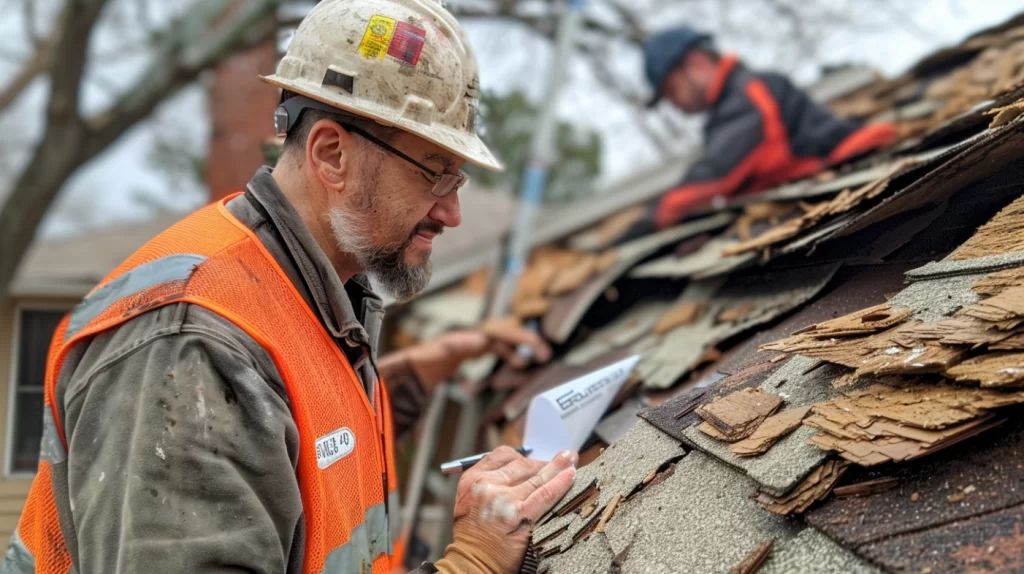

When evaluating a roof insurance claim, insurance adjusters conduct a thorough examination of the roof to determine the extent of damage and validity of the claim.

This inspection focuses on identifying damage caused by covered perils, such as hail, wind, or lightning, and evaluating the overall condition of the roof. A clear understanding of what insurance adjusters look for during a roof inspection is essential for homeowners to navigate the claims process effectively.

What Do Insurance Adjusters Look For On Roofs?

During a roof inspection for an insurance claim, adjusters scrutinize the roof’s condition, searching for evidence of damage, wear, and tear that may be covered under the homeowner’s policy.

To guarantee a thorough assessment, adjusters follow a detailed roof inspection checklist, which includes evaluating the condition of various roofing material types, such as asphalt shingles, metal, or tile.

Adjusters must meet specific training requirements to identify common roof damages, including:

- Hail damage: indentations, cracks, or broken shingles

- Wind damage: missing, loose, or torn shingles

- Water damage: signs of leaks, stains, or warping

- Age-related wear: curling, buckling, or granule loss

Insurance Estimate Lower Than Contractor

When a homeowner receives an insurance estimate that is lower than the contractor’s quote for roof replacement, it can create a discrepancy that requires resolution. In such cases, it is essential to understand the options available to reconcile the difference in costs.

This situation raises important questions, particularly regarding what to do if the roof repair cost is less than the insurance estimate, which will be explored in this section.

What To Do If The Roof Repair Cost Less Than The Insurance Estimate?

The homeowner’s receipt of an insurance estimate that exceeds the contractor’s bid for roof repairs presents a unique situation requiring careful consideration of the next steps to guarantee fair compensation and compliance with policy terms.

In such cases, roof repair negotiations may be necessary to reconcile insurance estimate discrepancies and contractor pricing strategies.

To navigate this situation effectively, consider the following steps:

- Review policy terms: Understand the claim adjustment processes and ascertain that the insurance estimate aligns with policy provisions.

- Compare estimates: Carefully examine the insurance estimate and contractor’s bid to identify areas of discrepancy.

- Negotiate with the contractor: Discuss the insurance estimate with the contractor to determine if they can adjust their pricing to align with the insurance estimate.

- Seek homeowner rights awareness: Familiarize yourself with your rights as a homeowner and ascertain that you are receiving fair compensation for the roof repairs.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.

How To Dispute An Insurance Claim Denial

Homeowners who receive a denial of their roof replacement claim have the right to dispute the decision and can initiate the process by reviewing their policy and understanding the reasons for the denial.

To navigate the dispute effectively, it is vital to familiarize oneself with the claim processes and appeal strategies outlined in the policy. Reviewing the policy coverage and documentation requirements will help identify potential gaps or errors in the initial claim submission.

Homeowners should gather all relevant documentation, including photos, inspection reports, and repair estimates, to support their dispute. It is also important to understand the negotiation tactics employed by insurance companies to be better prepared for potential outcomes. By being informed and prepared, homeowners can increase their chances of a successful appeal. A clear and concise written appeal should be submitted, addressing the specific reasons for the denial and providing evidence to support the claim.

Will My Insurance Go Up If I Get A New Roof?

Installing a new roof may impact insurance premiums, and several factors determine whether rates increase, decrease, or remain unaffected.

The impact on premiums depends on various considerations, including the roof’s lifespan, coverage limits, deductible impact, and policy renewal.

Here are four factors to evaluate:

- Improved Roof Lifespan: A new roof can increase the lifespan of your home’s roofing system, potentially reducing the likelihood of future claims and, in turn, lowering insurance premiums.

- Increased Coverage Limits: If your new roof is more valuable than the previous one, you may need to increase your coverage limits, which can raise your premiums.

- Deductible Impact: If you file a claim for a new roof, you may need to pay a deductible, which can impact your premiums.

- Policy Renewal: When your policy is up for renewal, your insurer may reevaluate your premiums based on the new roof, potentially leading to changes in your rates.

It’s essential to review your policy and consult with your insurer to understand how a new roof may affect your insurance premiums.

Your Insurance Company Has An Adjuster ... Shouldn’t You?

Our Expert Public Adjusters Work Exclusively For You To Ensure You Get The Highest Settlement Possible From Your Property Insurance Claim After A Disaster.