Dealing with foundation damage? Think of public adjusters as your insurance claim superheros – they're the experts who can turn a frustrating situation into a financial win. Just like having a skilled attorney in court, these independent pros fight for your rights with insurance companies, often securing settlements that make homeowners' jaws drop.

Let's get real about what they bring to the table. These specialists work on contingency, meaning they only get paid when you do (typically 10-20% of your settlement). But here's the game-changer: their deep understanding of insurance policies and structural engineering can transform your claim from basic to comprehensive.

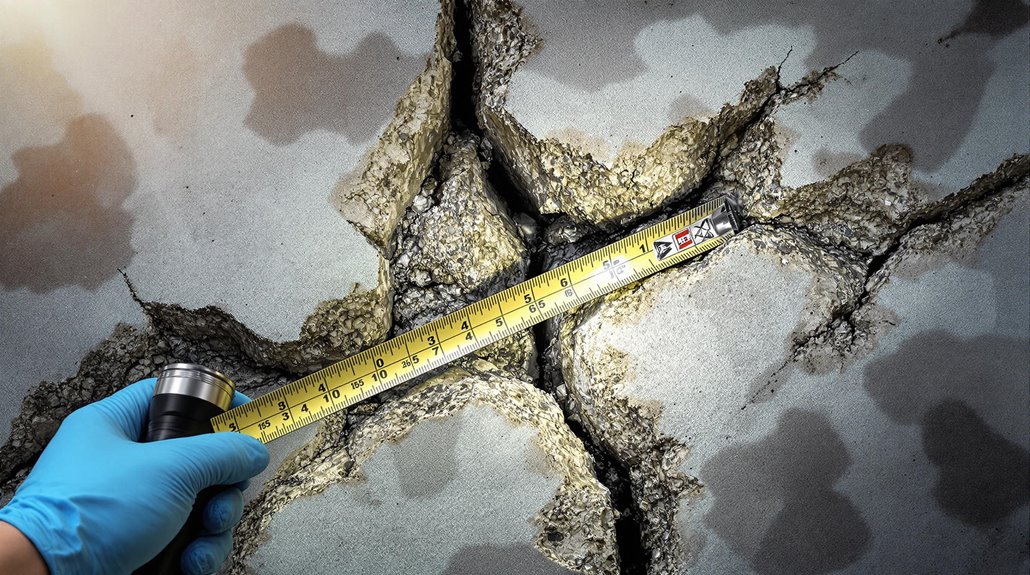

Ever tried explaining complex foundation issues to your insurance company? It's like speaking two different languages. Public adjusters act as your translators, converting crack patterns, settling issues, and structural concerns into insurance-speak that demands attention. They'll document every detail – from microscopic fissures to major displacement – using state-of-the-art forensic methods and structural assessments.

Want to know what makes them so effective? They understand the hidden domino effect of foundation damage. That small crack you see might signal bigger problems lurking beneath the surface. By uncovering these connected issues, they build rock-solid cases that insurance companies can't easily dismiss.

Remember: foundation problems rarely travel alone. Your public adjuster will investigate related damage to walls, floors, plumbing, and even your roof – aspects you might have missed but deserve compensation for. It's like having a detective who specializes in both construction and insurance on your side.

Key Takeaways

Cracking the Foundation Insurance Code: Your Guide to Maximum Claims

Think of your home's foundation as its backbone – when it's damaged, you need more than just a quick fix. That's where public adjusters become your secret weapon in the insurance claims battle.

Did you know savvy homeowners who partner with public adjusters often secure settlements up to 8 times higher than handling claims solo? Working on a success-fee basis (typically 10-20%), these pros only win when you win.

Let's break it down:

📋 Documentation Wizardry

- Capture crystal-clear evidence through strategic photo angles

- Record precise measurements that tell the whole story

- Create bulletproof timelines that connect the dots

🔍 Technical Translation Service

"Settlement" doesn't just mean your foundation's sinking – it's insurance-speak for money in your pocket. Public adjusters translate complex structural jargon into terms that make insurance companies pay attention.

⚡ Engineering Excellence

- Professional structural assessments that leave no stone unturned

- Forensic documentation that challenges claim denials

- Expert analysis that spots hidden damage patterns

🛡️ Coverage Navigation

Insurance policies love their fine print, but public adjusters know every loophole and exclusion. They're like GPS systems guiding you through the maze of claim requirements, steering clear of common denial pitfalls.

Remember: Foundation damage isn't just about cracks and shifts – it's about protecting your biggest investment. A public adjuster transforms your claim from a possible denial into a compelling case for maximum compensation.

Think of them as your personal claim architects, building your case from the ground up!

Chapter 1: Understanding Foundation Damage

Think of your home's foundation as your body's skeleton – when something's not quite right, you'll notice the effects from head to toe. Let's dive into what really makes your foundation cry for help.

Ever wondered why your walls suddenly look like a spider's web of cracks? Foundation damage isn't just about bad luck – it's usually Mother Nature and everyday issues teaming up against your home. Four main troublemakers typically show up to the party:

- Soil playing musical chairs beneath your home

- Water sneaking in where it shouldn't

- Sneaky plumbing leaks doing their dirty work

- Natural disasters throwing a wrench in the works

When your foundation starts waving the white flag, your entire home feels the impact.

Picture this: doors that suddenly decide they're too cool to close properly, floors that ripple like gentle waves, and walls that look like they've been solving complex math equations with all their cracks.

Why should you care about documenting all this drama? Well, if you're planning to knock on your insurance company's door, you'll need more than just a sad story.

Insurance claims are like detective cases – the more evidence you gather about what caused the damage and how bad it really is, the stronger your case becomes.

Remember: catching these issues early isn't just about protecting your wallet – it's about preserving your home's structural story for years to come. Think of it as preventive medicine for your house's foundation.

Experts recommend scheduling structural assessments every 2-3 years to catch potential problems before they become major issues.

Common Causes Of Foundation Damage

Is Your Home's Foundation Sending You Warning Signals?

Think of your home's foundation as your body's skeleton – when something's not quite right, you'll start noticing the signs.

Let's dive into what's really causing those worrying cracks and shifts that keep homeowners up at night.

The Silent Foundation Killers:

Mother Nature's Impact:

- Sneaky soil erosion that slowly undermines stability

- Natural ground settling (yes, homes actually sink!)

- Weather mood swings causing expansion and contraction

- Earth's occasional temper tantrums (seismic activity)

Human-Related Headaches:

- Building blunders during construction

- Hidden plumbing leaks playing havoc underground

- Poor drainage turning your foundation into a swimming pool

- Tree roots playing hide and seek with your foundation walls

Want to know the real troublemaker? Water is your foundation's worst enemy.

Like a persistent detective, it finds every weakness – creating pressure, seeping through tiny cracks, and gradually wearing down your home's structural integrity.

Studies show that poor water management accounts for 60% of all foundation problems.

Imagine your foundation playing a constant game of tug-of-war with the elements!

Pro Tip: Keep an eye on these warning signs:

- Uneven floors (those rolling marbles aren't lying!)

- Sticky doors and windows

- Suspicious cracks appearing like unwanted guests

- Water pooling around your home's perimeter

Remember, your foundation isn't just concrete and steel – it's your home's lifeline.

Regular checks and maintenance can save you from those heart-stopping repair bills later.

Wouldn't you rather catch these issues while they're still minor hiccups rather than full-blown structural emergencies?

The Impact Of Foundation Damage On Your Home

Think of your home's foundation as its backbone – when it starts acting up, everything else feels the impact. Just like a domino effect, foundation problems cascade through your entire house, creating a symphony of unwanted changes you can't ignore.

Research shows that poor water drainage accounts for 90% of all foundation-related problems.

Your Home's Warning Signs at a Glance:

| Red Flag Zone | What You'll Notice | The Snowball Effect |

|---|---|---|

| Structure | Sneaky wall cracks appearing | Your home's stability becomes compromised |

| Living Spaces | Doors playing hard-to-open and floors doing the wave | Progressive wear speeds up across rooms |

| Home Systems | Your pipes and wiring throw a fit | Uninvited moisture leads to mold parties |

Ever noticed how one small crack can turn into your wallet's worst enemy? Foundation issues are like uninvited house guests – the longer they stick around, the more chaos they create. When these problems take root, your property value could take a nosedive of up to 15%, making real estate agents cringe.

But here's the real kicker – the longer you wait to address foundation problems, the more complicated (and expensive) they become. It's like ignoring a toothache until you need a root canal. Your home literally depends on its foundation staying strong and stable.

Want to protect your biggest investment? Keep your eyes peeled for these warning signs and don't hesitate to call in the pros when something seems off. After all, wouldn't you rather catch a small problem before it turns into a structural soap opera?

Chapter 2: How Much Will Professional Foundation Damage Restoration Cost?

Looking to Fix Your Foundation? Let's Talk Real Costs 💰

Foundation repairs aren't exactly pocket change – think of them as a home's medical bill, ranging from a quick check-up to major surgery.

While minor cracks might set you back $2,000, serious structural issues can skyrocket beyond $100,000. Most homeowners typically land somewhere in the $15,000-$30,000 range.

Ever wonder why emergency repairs cost more? Just like calling a plumber at 3 AM, urgent foundation work comes with a premium price tag.

You're looking at an extra 25-50% on top of standard rates – because structural emergencies won't wait for regular business hours!

Breaking Down Your Foundation Repair Bill:

✓ Core Repairs (Labor & Materials): $2,000 – $30,000+

✓ Emergency Response Premium: Quarter to half more than standard rates

✓ Professional Diagnosis: $300 – $3,000

✓ Essential Support Services: About 15-30% of your total bill

Think of foundation repair like building a pyramid – it's not just about the blocks.

You're paying for expertise, specialized equipment, and careful planning. Those supporting services? They're your safety net, including everything from structural assessments to protecting your home's utilities during repairs.

Want to avoid sticker shock? The key is catching problems early.

Just like how a small cavity costs less than a root canal, minor foundation issues are significantly cheaper to fix than major structural failures.

Pier and beam adjustments can cost between $1,000 to $2,000 per pier when repairs are needed.

Remember: The cheapest repair today might become the most expensive problem tomorrow. Ready to tackle your foundation concerns head-on?

Typical Foundation Damage Restoration Costs

Ever wondered what it takes to fix a crumbling foundation? Let's dive into the nitty-gritty of foundation restoration costs – it's like giving your home's backbone a much-needed tune-up!

Think of foundation repair costs as a sliding scale, ranging from a manageable $4,000 to a jaw-dropping $100,000.

Just like how a minor scratch needs different treatment than a broken bone, your foundation's repair needs vary dramatically based on the damage severity.

The Real Cost Breakdown:

- Pier & Beam Installation: $300-$1,500 per pier (think of these as your home's support pillars)

- Hydraulic Lifting: $1,000-$3,000 per point (imagine giving your house a controlled mini-lift)

- Crack Injection: $250-$800 per linear foot (similar to filling a cavity in a tooth)

Want to know what moves the price needle? Several factors come into play:

- Soil composition (sandy, clay, or rocky terrain)

- Weather conditions during repairs

- Required waterproofing measures ($2,000-$6,000 extra)

- Structural engineering assessments

- Equipment and material requirements

The sweet spot? Most homeowners typically invest between $5,000 and $25,000 for professional foundation restoration. Remember, it's not just about fixing what's broken – it's about preventing future issues and protecting your home's value.

Pro tip: Don't wait until small problems become major headaches! Regular foundation inspections can catch issues early, potentially saving you thousands in extensive repairs down the road.

Early detection of foundation problems through regular inspections can save homeowners an average of $4,500 in repair costs.

Emergency Service Price Factors

Emergency Foundation Repair Costs: What You Need to Know

Ever wondered why emergency foundation repairs make your wallet sweat? Let's dive into the real deal behind those urgent fix-it situations that just can't wait.

Think of emergency foundation repairs like calling a plumber at 3 AM with a flooded basement – you're paying premium rates for that immediate rescue mission.

Off-hours, weekends, and holidays? That's when prices really kick into high gear.

What's driving those sky-high emergency costs?

- Location logistics (because distance isn't just a number)

- Site accessibility (sometimes getting there is half the battle)

- Equipment mobilization (those heavy-duty tools won't move themselves)

- Weather challenges (Mother Nature loves throwing curveballs)

- Water damage complications (when it rains, it pours – literally)

You're not just paying for the repair itself – you're investing in rapid response and risk prevention.

Picture your foundation as a house of cards; emergency crews need to stabilize everything before they can even start the actual repair work. This often means bringing in temporary support systems faster than you can say "structural integrity."

Depending on soil conditions and foundation type, repairs typically include helical piers which provide exceptional stability in emergency situations.

Pro tip: While you can't always prevent foundation emergencies, having a regular inspection schedule might help you catch issues before they become midnight emergencies. Your future self (and bank account) will thank you!

Remember: Emergency foundation work isn't just about fixing what's broken – it's about preventing a minor crisis from becoming a major catastrophe. Sometimes, paying more now means saving a fortune later.

Labor & Material Expenses

Want to Know Where Your Foundation Repair Budget Really Goes?

Let's crack open the mystery of foundation repair costs – it's simpler than you might think! Think of it as building a three-layer cake, where each layer represents a crucial cost component.

The biggest slice of your repair pie? That's labor costs. Just like a master chef commanding the kitchen, skilled foundation specialists typically charge between $75-150 per hour. Your location, the complexity of repairs, and their expertise level all stir into this rate.

The second layer involves materials – about one-third of your total investment. From high-grade concrete to reinforcement steel, these aren't your average hardware store supplies. What's interesting? Material quality can make the difference between a repair lasting 10 years versus 50!

Don't forget the heavy-duty equipment – the third crucial ingredient. Picture massive hydraulic jacks and stabilization systems working like superhero tools to lift and secure your home. These specialized machines typically account for about one-fifth of your project costs.

| Cost Component | Percentage | Rate Range |

|---|---|---|

| Labor | 35-45% | $75-150/hr |

| Materials | 30-40% | Varies |

| Equipment | 15-25% | By Project |

Remember how a good insurance claim needs solid paperwork? Smart homeowners keep detailed records of every expense, from initial assessments to final stabilization measures. This documentation isn't just paperwork – it's your financial safety net!

While DIY repairs might seem tempting, they often lack professional warranties and could lead to more extensive damage down the road.

Hidden Damage Cost Variables

The Hidden Price Tag of Foundation Problems: What Lurks Beneath

Think of your home's foundation like an iceberg – what you see is just the tip of a complex structural puzzle.

When cracks appear or floors start tilting, you're actually glimpsing signals from an intricate underground world that could hit your wallet harder than expected.

Why Foundation Repair Costs Love to Play Hide and Seek

Just like a doctor can't diagnose everything from a quick check-up, foundation issues often mask their true complexity behind surface-level symptoms. Let's dive into what's really going on underground:

Secret Cost Drivers:

🌎 Soil Stories: Different soil types tell different tales

- Clay soils expand and contract like a sponge

- Sandy soils might wash away under pressure

- Mixed soils create unpredictable support patterns

💧 Water's Silent Influence

- Groundwater levels shift seasonally

- Hidden drainage patterns affect stability

- Moisture distribution impacts repair approaches

🪨 Bedrock Basics

- Distance to bedrock determines repair methods

- Rock quality influences foundation support

- Excavation challenges affect labor costs

Smart Tip: Before signing any repair contracts, insist on comprehensive geological testing and engineering assessments. These might seem like extra expenses upfront, but they're your best defense against costly surprises mid-project.

Real-World Impact: Your foundation repair journey might start with a visible crack but could unveil a network of interconnected issues requiring specialized solutions.

Think of it as solving a 3D puzzle where each piece affects the others – from soil composition to water management systems.

Documentation becomes your best friend here, especially for insurance purposes.

Keep detailed records of all assessments, as they're crucial for building your case and ensuring proper coverage.

Working with a public adjuster's expertise can lead to settlements up to 800% higher than handling the claim alone.

Chapter 3: Insurance Basics For Homeowners

Let's Decode Your Homeowners Insurance Like a Pro! 🏠

Think of your homeowners insurance policy as a safety net – but one with specific rules about when it catches you. Just like reading the fine print on your smartphone warranty, understanding your policy's foundation coverage is crucial.

Ever wondered why insurance companies use language that feels like a foreign dialect? Those tricky terms like "settling" versus "sudden collapse" aren't just fancy words – they're your claim's make-or-break points.

What might seem like obvious foundation damage to you could be classified differently in your policy's universe.

Want to be foundation-claim savvy? Here's what you need to focus on:

- Covered perils (what's definitely protected)

- Exclusions (the "sorry, not sorry" list)

- Specific conditions (the "if-then" scenarios)

Pro tip: Don't wait until your foundation cracks to learn what's covered. Think of it as studying for an exam – you wouldn't wait until test day to crack open the books, right?

Remember that the 80% rule requires you to insure your property at its full replacement cost value to receive complete coverage.

Grab your policy document, a highlighter, and start mapping out your coverage landscape now.

Understanding Your Homeowners Insurance Policy

Think of your homeowners insurance policy as your home's financial bodyguard – it's there when things go sideways, but do you really know what it's protecting? Let's break it down in plain English.

Your Insurance Policy's Building Blocks:

The Declaration Page – Your Policy's Front Door

✓ What's your home worth on paper?

✓ How much coverage are you actually getting?

✓ What's the damage to your wallet (premium-wise)?

Covered Perils – The "We've Got Your Back" List

Ever wondered what disasters your policy actually covers?

From windstorms to fires, knowing your covered perils is like having a risk roadmap for your home. But watch out for those sneaky exclusions!

Deductibles – The "Your Share" Equation

Before your insurance kicks in, you'll need to chip in. Think of your deductible as your policy's cover charge – understanding it helps avoid surprise expenses when claiming.

Endorsements – Your Policy's Power-Ups

Want extra protection? Endorsements are like bonus features you can add to your basic coverage. They're particularly crucial for foundation issues, which standard policies might give the cold shoulder.

With public adjusters helping maximize claim settlements up to 700% higher for hurricane damage, having professional guidance can make a significant difference in your payout.

Pro Tip: Don't wait for disaster to strike before getting cozy with your policy details. Regular policy check-ups are like home maintenance – a little effort now saves major headaches later.

Remember: Every claim you file tells a story, and knowing your policy inside-out helps ensure it has a happy ending. Ready to become your policy's best interpreter?

Key Terms & Definitions Related To Foundation Damage Claims

Cracking the Code: Your Guide to Foundation Damage Claim Language

Ever felt like insurance adjusters speak a different language? Let's decode the essential foundation damage terminology you'll need to become fluent in the world of home insurance claims.

Think of insurance terms as puzzle pieces – when you understand how they fit together, you're better equipped to protect your investment.

Ready to dive in?

Core Insurance Terms You Need to Know:

- ACV (Actual Cash Value)

- Think "depreciated value" – like selling a used car

- What your property's worth today, not what you paid

- Factors in age and wear-and-tear

- RCV (Replacement Cost Value)

- The "good as new" price tag

- Full cost to replace damaged items

- No depreciation deductions applied

- ALE (Additional Living Expenses)

- Your "Plan B" coverage

- Covers temporary housing during repairs

- Includes extra costs above normal living expenses

Pro Tip: Understanding foundation-specific terms like "soil subsidence," "structural settling," and "hydrostatic pressure" can make the difference between a denied claim and a successful payout.

Extended replacement coverage provides up to 50% additional dwelling coverage for unexpected rebuild costs.

Why does this matter? When you're speaking the same language as your insurance adjuster, you're better positioned to:

- Navigate claim discussions confidently

- Spot potential coverage gaps

- Challenge unfair claim decisions

- Maximize your settlement potential

Remember: Insurance language doesn't have to be intimidating. Think of it as learning the rules of a new game – once you know how to play, you're much more likely to win!

Chapter 4: Types Of Foundation Damage Covered By Homeowners Insurance

Understanding Foundation Damage Coverage: What Your Home Insurance Actually Protects

Ever wondered what keeps your home's foundation protected when disaster strikes? Let's dive into the nitty-gritty of foundation coverage that your homeowners insurance typically has your back on.

Think of your home's foundation as its backbone – when it's compromised, everything else becomes shaky. Insurance companies recognize certain foundation-threatening events as covered perils, but knowing which ones make the cut is crucial for your peace of mind.

Working with public insurance adjusters can increase your settlement payouts by up to 25% through expert claim handling and negotiations.

🚰 Sudden Water Events

Those unexpected plumbing disasters? You're usually covered! When pipes burst or your water heater decides to flood your basement, insurance typically steps in to handle foundation repairs caused by these sudden water casualties.

🌪️ Nature's Fury

Mother Nature can be tough on foundations, but here's the catch – standard policies don't cover everything. While fire damage is typically included, you'll need extra protection for:

- Earthquake damage (separate policy required)

- Flood damage (federal flood insurance recommended)

- Hurricane impacts (may need additional riders)

Coverage Quick-Reference Table:

| Damage Source | Coverage Status | Notes |

|---|---|---|

| Sudden Plumbing Issues | ✅ Covered | Must be accidental/sudden |

| Natural Disasters | 🤔 Varies | Additional coverage often needed |

| Fire/Explosions | ✅ Covered | Standard in most policies |

| Normal Wear | ❌ Not Covered | Regular maintenance is on you |

Pro Tip: Document your foundation's condition regularly – it's like taking vital signs for your home's health. When issues arise, you'll have a clear before-and-after picture for your insurance claim.

What Are The Most Common Foundation Damage Insurance Claims?

Foundation Insurance Claims: What's Really Cracking Your Home's Bottom Line?

Ever wondered what keeps insurance adjusters up at night when it comes to foundation damage? Let's dive into the most frequent claims that shake up homeowners' peace of mind.

Picture your home's foundation as its bedrock of stability – when it's compromised, everything else can come tumbling down.

From sneaky water damage to unexpected impacts, these foundation challenges often send homeowners rushing to their insurance providers.

The Big Five Foundation Headaches:

- Burst Pipes: The Silent Destroyer

- Like arteries in your body, when these pipes burst, they can wreak havoc

- Usually covered by insurance (good news!)

- Watch for telltale signs: sudden cracks or settling

- Soil Shifts: The Ground Beneath Your Feet

- Mother Nature's way of keeping us on our toes

- Coverage can be tricky – check your policy

- Think of it as Earth's version of a mood swing

- Water Infiltration

- Your basement's worst nightmare

- Insurance response: "It depends" (classic, right?)

- Each case gets unique scrutiny

- Tree Troubles

- When nature decides to redecorate your foundation

- Generally covered under most policies

- Pro tip: Keep those trees properly maintained

- Construction Quirks

- The skeleton in your home's closet

- Usually excluded from coverage

- Prevention beats cure every time

In colder regions, frost heave plays its own game of "lift and shift" with your foundation. Think of it as nature's jack-in-the-box – unpredictable and potentially problematic.

Want to stay ahead of the game? Understanding these common claims helps you spot early warning signs and take action before minor issues become major headaches.

While many homeowners face foundation challenges, only 27% of residents in designated flood zones maintain proper flood insurance coverage for their properties.

Chapter 5: Coverage Exclusions & Limitations For Foundation Damage

Foundation Insurance: What Your Policy Won't Cover (And Why You Need to Know)

Think of your home's foundation as your body's skeleton – it needs proper protection, but not all insurance policies have your back!

Let's crack open the often-confusing world of foundation coverage exclusions that might leave you exposed.

🏠 Key Coverage Gaps You Can't Ignore:

The Big Three Foundation Coverage Exclusions:

- Natural settlement (those pesky gravity-related shifts)

- Earth movement (when Mother Nature decides to dance)

- Gradual water seepage (the silent foundation killer)

Breaking Down Coverage Limitations:

Water Damage Coverage:

- Only covers sudden, unexpected events (think burst pipes)

- Says "no thanks" to slow-developing moisture issues

- Won't help with that persistent basement dampness

Structural Protection:

- Skips normal settling and shifting

- Sets strict dollar limits on repairs

- May require additional riders for full protection

Construction-Related Issues:

- Waves goodbye to DIY mishaps

- Won't touch pre-existing problems

- Ages out older homes from certain coverages

Pro Tip: That sneaky "anti-concurrent causation" clause? It's like a referee calling "game over" when both covered and excluded problems tag-team your foundation.

Installing native plant landscaping around your foundation can significantly reduce water-related damage risks and improve your chances of claim approval.

Want solid foundation protection? Consider these action steps:

- Review your policy's fine print

- Document existing foundation conditions

- Ask about supplemental coverage options

- Schedule regular professional inspections

Remember: Just like you wouldn't skip health insurance, don't leave your home's foundation vulnerable to coverage gaps. Smart homeowners stay ahead of the game!

Chapter 6: Should You File A Foundation Damage Claim?

Filing a Foundation Damage Claim? Here's What You Need to Know

Got foundation problems? Let's talk about whether filing an insurance claim is your best move.

Think of your foundation like your home's backbone – when it's compromised, you need to make smart decisions about treatment.

With 25% of homes experiencing structural damage in their lifetime, knowing when to file is crucial.

Before you dial up your insurance company, consider these game-changing factors:

🏠 Safety First

- Is your home showing urgent warning signs like widening cracks or sticking doors?

- Could waiting make the problem (and repair costs) snowball?

- Are your family's safety and structural integrity at immediate risk?

💰 Money Matters

- How does your deductible stack up against estimated repair costs?

- Have you double-checked what your policy actually covers?

- Will filing a claim impact your future premiums?

🏘️ Property Value Impact

- Could foundation issues affect your home's market value?

- How do similar homes in your neighborhood handle foundation repairs?

- Will documented repairs boost your property's appeal to future buyers?

Pro Tip: Bring in the experts before making your move. A qualified structural engineer or foundation specialist can give you the solid evidence you need to build a strong claim.

Think of them as your foundation damage detectives – they'll uncover the real story behind those cracks and shifts.

Want to maximize your claim's success? Document everything like a CSI investigator – photos, videos, timeline of events, and professional assessments.

Consider partnering with a public adjuster who knows the ins and outs of foundation claims. They're like your personal claim coaches, working to get you the best possible outcome.

Remember: Timing isn't just everything – it's the only thing. The right moment to file can make or break your claim's success rate.

Chapter 7: Introduction To Public Adjusters

Navigating Foundation Damage Claims? Meet Your Secret Weapon: Public Adjusters

Think of public adjusters as your personal insurance claim champions – they're the pros who stand in your corner when foundation issues shake up your world.

Unlike insurance company adjusters, these certified experts work exclusively for you, the homeowner.

Why should you care? Picture this: You wouldn't represent yourself in court, right?

The same logic applies here. Foundation damage claims are complex beasts, and public adjusters know exactly how to tame them.

What sets them apart:

🏠 They speak "insurance-ese" fluently and translate it into plain English

🏠 They're master detectives at spotting hidden foundation damage

🏠 They're skilled negotiators who know every policy loophole

🏠 They're your advocates from day one until the check clears

Did you know? Studies show homeowners working with public adjusters typically secure significantly higher settlements – sometimes up to 800% more than those going it alone.

That's like turning a $10,000 claim into $80,000!

Think of them as your foundation damage GPS:

- They map out the entire claims journey

- Navigate around common claim pitfalls

- Chart the fastest route to maximum compensation

- Keep you heading in the right direction

Remember: While insurance companies have their adjusters protecting their interests, public adjusters protect yours. It's like having an expert translator who ensures your foundation damage story doesn't get lost in translation.

Most public adjusters work on a contingency fee basis, earning between 10-20% of your final settlement amount.

The Role Of A Public Adjuster In Foundation Damage Insurance Claims

Dealing with foundation damage? Think of a public adjuster as your personal insurance detective and advocate rolled into one! These skilled professionals are your secret weapon when navigating the maze of complex foundation claims.

Ever wondered what makes public adjusters so valuable? They're like construction whisperers who speak fluent insurance-ese. With their deep understanding of structural engineering and policy fine print, they know exactly where to look and what documentation will make your case rock-solid.

Picture them as master chess players in the insurance game. They're constantly thinking several moves ahead, using tried-and-true strategies to counter insurance company tactics.

From microscopic crack analysis to full-scale structural assessments, they leave no stone unturned in building your case.

What sets great public adjusters apart? They're methodical investigators who:

- Document every detail with forensic precision

- Translate complex structural issues into clear insurance terms

- Navigate tricky policy exclusions and coverage gaps

- Fight for fair compensation like it's their own home

Don't risk going it alone when foundation problems strike. Would you represent yourself in court? Probably not! The same logic applies here.

Public adjusters bring professional muscle to your corner, ensuring insurance companies don't shortchange you on repairs that could affect your home's very foundation.

Remember: Foundation claims are notorious for denial and underpayment. Having a skilled public adjuster by your side dramatically improves your chances of securing the settlement you deserve. They're not just claim handlers – they're your foundation damage champions!

Studies show that claims handled by public adjusters achieve up to 800% higher settlements compared to those filed without professional representation.

Benefits Of Using A Public Adjuster For Foundation Damage Claims

Dealing with Foundation Damage? Here's Why a Public Adjuster Is Your Secret Weapon

Think of your home's foundation as its backbone – when it's damaged, everything else feels the impact. But did you know that having a public adjuster in your corner can be a game-changer for your insurance claim?

Let's dive into why these professionals are worth their weight in gold:

Sharp-Eyed Detection Specialists

✓ They spot those sneaky foundation issues your insurance company might miss

✓ Think of them as structural detectives who leave no crack uninvestigated

✓ They understand how foundation problems ripple through your entire home

Power-Packed Documentation

| Expertise Area | What They Deliver | Why It Matters |

|---|---|---|

| Technical Analysis | Professional engineering assessments | Makes your claim bulletproof |

| Policy Knowledge | Expert coverage interpretation | Unlocks hidden benefits |

| Damage Evaluation | Comprehensive inspections | Nothing falls through the cracks |

Ever wondered why insurance companies often lowball foundation claims? That's where your public adjuster becomes your MVP (Most Valuable Professional). They speak the complex language of insurance, translate policy jargon into plain English, and fight for every dollar you deserve.

Smart tip: The sooner you bring a public adjuster on board, the better your chances of maximizing your settlement. They're like your personal insurance claim coach, guiding you through the process while keeping the insurance company honest.

Remember: Foundation damage isn't just about what you can see – it's about what could happen if it's not properly addressed. A public adjuster ensures your claim covers both immediate and potential long-term impacts.

Studies show that property owners receive 800% higher settlements when working with public adjusters compared to handling claims alone.

How Are Public Adjusters Paid & What Are Their Fees?

Wondering How Public Adjusters Get Paid? Let's Break It Down!

Think of public adjusters as your insurance claim champions who only win when you win. Unlike upfront fees that leave you wondering about results, these professionals work on a success-based model that keeps everyone's goals perfectly aligned.

Studies show that public adjuster settlements typically range 20-50% higher than initial insurance estimates.

The Money Talk: What to Know

Picture this: Your public adjuster becomes your partner in the claims process, investing their time and expertise while only getting paid when you receive your settlement. Pretty fair, right?

| Fee Element | What to Expect | The Inside Scoop |

|---|---|---|

| Success Share | 10-20% | Larger claims often mean lower percentages |

| When They Get Paid | After You Do | No settlement = no payment |

| What's Included | Everything | From paperwork to negotiations |

| Time Frame | Until It's Done | Stays with you through the finish line |

| Fee Flexibility | Let's Talk | Complex cases might vary |

Did you know? State insurance departments actually keep an eye on these fees, setting maximum rates to ensure everything stays fair and square. It's like having a referee in the game!

Smart Tip: Before signing anything, have a heart-to-heart about the payment structure. Every detail should be crystal clear – from percentages to payment timing. After all, transparency is your best friend when navigating insurance claims!

Public Adjusters Vs. The Insurance Company Adjuster

Navigating Insurance Claims: Public vs. Company Adjusters – What You Need to Know

Ever wondered who's really on your side when disaster strikes your home? Let's dive into the world of insurance adjusters – think of them as detectives investigating your claim, but with very different badges!

Public Adjusters: Your Personal Insurance Advocates

🏠 Work exclusively for you, the policyholder

💰 Earn through a percentage of your settlement

🔍 Act like forensic investigators, leaving no stone unturned

📱 Keep you in the loop every step of the way

Insurance Company Adjusters: The Corporate Representatives

🏢 Represent the insurance company's interests

💼 Receive a regular salary from the insurer

📋 Follow standardized company procedures

📞 Communicate within strict corporate guidelines

Think of it this way: A public adjuster is like your personal attorney in the claims process, fighting to maximize your settlement. Meanwhile, the insurance company adjuster is more like a corporate accountant, carefully watching the bottom line.

Why does this matter to you? When facing foundation damage or any property claim, understanding these key players can make or break your settlement.

Public adjusters typically dig deeper, asking questions you might not think to ask, while company adjusters follow a more structured, company-oriented approach.

Most states require public adjusters to complete strict licensing requirements and background checks before they can represent policyholders.

Pro Tip: The most successful claims often involve understanding each adjuster's role and motivation. Remember, while both are professionals, their goals differ significantly – one aims to maximize your recovery, the other to minimize company costs.

Want to make an informed choice? Consider what matters most: personalized advocacy or standard corporate handling of your claim.

Public Adjusters Vs. Bad Faith & Property Damage Lawyers – Which To Hire & When

Dealing with Foundation Damage? Choose Your Claims Champion Wisely!

Think of insurance claims like a complex chess game – you need the right player in your corner.

While insurance company adjusters prioritize minimizing payouts for their employers, public adjusters focus solely on maximizing your settlement.

Let's dive into the world of public adjusters and property damage attorneys to help you make the smart choice for your foundation issues.

Who's Who in the Claims Game?

Public Adjusters: Your Claims Quarterbacks

- Think of them as your personal damage detectives

- Calculate losses and negotiate with insurance companies

- Work for a slice of your settlement (typically 5-15%)

- Perfect for straightforward claims needing quick resolution

Property Damage Attorneys: Your Legal Warriors

- Step in when insurance companies play hardball

- Fight for you in court when negotiations fail

- Usually charge contingency fees (pay only if you win)

- Essential for bad faith claims or complex legal battles

Key Differences That Matter:

Strategy & Approach:

✓ Public Adjusters: Focus on number-crunching and direct negotiations

✓ Attorneys: Bring legal muscle and courtroom expertise

Timeline & Process:

✓ Public Adjusters: Often faster resolution for standard claims

✓ Attorneys: Longer process, but necessary for legal battles

When to Pick Which Pro?

Choose a Public Adjuster if:

- Your claim is relatively straightforward

- You're comfortable with negotiation-based solutions

- Time is of the essence

- You want hands-on claim management

Go with an Attorney if:

- Your insurer acts in bad faith

- Legal action seems inevitable

- Your claim involves complex liability issues

- You're facing significant foundation damage disputes

Remember: Sometimes you might need both! Think of it as having both a general contractor and an architect for a major home renovation – different experts for different aspects of your claim.

When To Contact A Public Adjuster For A Foundation Damage Claim

Is Your Home's Foundation Crumbling? Here's When to Call a Public Adjuster

Think of your home's foundation as its backbone – when it starts showing signs of weakness, you need a skilled advocate in your corner. That's where public adjusters come in, your secret weapon for navigating complex foundation damage claims.

Don't wait until your walls are doing the cha-cha! Contact a public adjuster when you spot these red flags:

- Uneven floors that make your furniture wobble

- Cracks that keep playing peek-a-boo in your walls

- Doors and windows that suddenly develop attitude problems

- Water seeping where it shouldn't be

Smart Claim Management Timeline:

| Stage | What You Need to Do | Why It Matters |

|---|---|---|

| First Signs | Document everything like a CSI investigator | Creates your damage storyline |

| Assessment | Get expert eyes on the problem | Builds your claim's foundation (pun intended!) |

| Strategy | Gather evidence like you're building a case | Maximizes your settlement potential |

A public adjuster becomes your personal claim quarterback, coordinating every play to ensure you don't leave money on the table. They'll speak insurance-ese so you don't have to, translating complex policy language into plain English.

Remember: Insurance companies have their experts – shouldn't you have yours? Public adjusters bring professional muscle to your claim, ensuring every crack, shift, and settlement gets the attention (and compensation) it deserves.

Pro Tip: Save yourself headaches by documenting changes in your foundation regularly. Your smartphone camera is your best friend here – use it to track any suspicious changes in your home's structure.

Working on a contingency basis of 10-20% of settlement, public adjusters only get paid when you receive your insurance payout.

Chapter 8: When To Contact Your Insurance Provider For Foundation Damage Claims

Dealing with Foundation Damage? Here's When to Ring Your Insurance Company

Found cracks in your foundation? Don't panic – but don't wait around either!

Think of foundation damage like a small leak in a boat; the longer you wait, the bigger the problem gets. Working with a licensed public adjuster can significantly improve your chances of a successful claim.

Smart Steps for Insurance Claims:

🏠 Act Fast (The 48-Hour Golden Window)

Your first priority? Grab that phone! Insurance providers love proactive homeowners who report foundation issues within 48 hours of discovery.

It's like calling the doctor when you first notice symptoms – early action often leads to better outcomes.

📸 Document Everything (Be a Home Detective)

- Snap clear photos from multiple angles

- Jot down when and where you spotted the damage

- Measure those cracks (yes, size matters!)

- Track any changes in doors or windows sticking

💡 Pro Tip: Create a digital folder on your phone labeled “Foundation Claim [Date]” to keep everything organized.

⚡ Emergency Repairs and Records

Started some urgent fixes? Smart move! Just remember to:

- Keep every receipt (even for temporary fixes)

- Take before-and-after photos

- Log all conversations with contractors

- Note dates and times of all insurance communications

Think of your claim like building a court case – the more evidence you have, the stronger your position.

Remember, you're not just filing a claim; you're telling the story of your home's foundation issues, and every detail helps paint that picture for your insurance provider.

Questions about whether something's claim-worthy? When in doubt, report it. Better to have your insurance company say "no" than miss out on legitimate coverage!

If Using A Public Adjuster

Thinking About Hiring a Public Adjuster? Here's Your Foundation Claim Game Plan

Let's face it – dealing with foundation damage is stressful enough without navigating the complex world of insurance claims.

That's where public adjusters come in, acting like your personal insurance claim champions.

First things first: don't wait to contact your insurance company. Even if you're bringing a public adjuster on board, you'll need to report that foundation damage pronto. Think of it as calling both your doctor and getting a second opinion simultaneously – you're covering all your bases.

Why do homeowners love working with public adjusters? They're like foundation claim detectives, armed with:

- Market-savvy pricing knowledge

- Sharp negotiation skills (imagine having a professional poker player at your table)

- Detailed documentation expertise

The payment structure is refreshingly straightforward – they typically earn a percentage of your settled claim. It's like having a partner who only wins when you win.

Want to know what really sets them apart? These pros create a bulletproof case for your claim by:

- Capturing crystal-clear photo and video evidence

- Recording every conversation with insurance reps

- Building comprehensive damage timelines

Remember, foundation issues can be tricky beasts to handle alone. A public adjuster brings years of industry wisdom to your corner, helping you navigate the claims maze while maximizing your settlement potential.

They're essentially your insurance-speaking translator, turning complex jargon into plain English you can understand.

Think of them as your foundation claim's project manager – they handle the heavy lifting while you focus on what matters most: getting your home back to rock-solid condition.

With catastrophic claims settlements showing up to 700% higher payouts when using a public adjuster, the decision to hire one could significantly impact your foundation repair compensation.

If Filing On Your Own

Filing Your Own Foundation Damage Claim: A DIY Guide

Think of filing a foundation damage claim like building a house – you need a solid plan and the right tools.

Ready to tackle this on your own? Let's break it down into manageable steps.

First Things First: Quick Action Matters

Don't wait around when you spot foundation issues – reach out to your insurance company within 24-48 hours. It's like treating a wound – the sooner you address it, the better your chances of a positive outcome.

Document Everything (And We Mean Everything)

- Snap clear, well-lit photos from multiple angles

- Measure cracks and shifts with a ruler for scale

- Create a timeline of when you first noticed issues

- Keep a digital folder of all maintenance records

- Record any weather events that might have contributed

Know Your Policy Inside Out

Ever tried following a recipe without reading it first? That's what filing a claim without understanding your coverage is like.

Before diving in:

- Review your policy's foundation coverage limits

- Check for exclusions and special conditions

- Understand your deductible requirements

- Identify covered perils versus excluded events

Smart Filing Strategies

Want to strengthen your claim? Focus on:

- Linking cause and effect clearly in your documentation

- Recording all communication with your insurer

- Getting independent expert assessments

- Maintaining a detailed expense log

Watch Out For Common Pitfalls

- Overlooking gradual damage documentation

- Missing filing deadlines

- Providing inconsistent information

- Accepting the first offer without proper evaluation

Remember: your thoroughness today can make or break your claim tomorrow. Feeling overwhelmed? That's perfectly normal – and might be a sign to consider professional help.

Statistics show that working with public insurance adjusters can result in settlements up to 800% higher than handling claims independently.

Chapter 9: Filing Process For Foundation Damage Insurance Claims (Without Public Adjuster)

Navigating a Foundation Damage Insurance Claim? Let's Make It Less Rocky!

Think of filing a foundation damage claim as building a rock-solid case for your home's health.

Without a public adjuster in your corner, you'll need to become your property's best advocate – but don't worry, I'll walk you through this!

Key Steps That'll Make Your Claim Stand Out:

Become a Documentation Detective

- Snap crystal-clear photos of every crack, shift, and settle

- Record video evidence, capturing the full scope of damage

- Write detailed descriptions as if you're telling the story of your foundation's issues

Time is Your Foundation Friend

- Contact your insurance carrier immediately (yes, even if it's 3 AM!)

- Keep communication records like they're gold

- Create a digital paper trail of every conversation and email

Build Your Expert Army

- Get a structural engineer's professional assessment

- Collect multiple contractor estimates (aim for at least three)

- Dig up maintenance records showing you've been a responsible homeowner

Pro Tips for Success:

💡 Insurance adjusters might initially lowball your claim – stand firm with your evidence

💡 Use specific foundation damage terminology in your documentation

💡 Consider creating a timeline of when you first noticed issues

Remember: You're not just filing paperwork – you're building a compelling narrative about your home's structural integrity. Stay organized, persistent, and thorough, and you'll maximize your chances of a fair settlement.

Question: Have you noticed any recent changes in your foundation that need immediate attention?

Document Foundation Damage Thoroughly

Cracking the Foundation Damage Documentation Code: A Homeowner's Guide

Want to make your foundation damage claim rock-solid? Let's dive into how you can document every crack, shift, and settling issue like a pro. Think of your documentation process as building a bulletproof case – you wouldn't go to court without evidence, right?

🏠 Smart Documentation Essentials:

- Visual Story-Telling

- Snap crystal-clear photos from multiple angles

- Record video walkthroughs of problem areas

- Create detailed crack maps (think treasure maps, but for damage!)

- Number-Crunching That Matters

- Measure crack widths (even tiny ones count!)

- Track foundation shifting patterns

- Monitor moisture levels around your foundation

- Time-Travel Documentation

- Keep a damage diary with dates

- Document weather events affecting the foundation

- Save repair estimates and expert assessments

Pro Tip: Your foundation's story needs to be as clear as a blueprint. Remember, insurance companies love data the way engineers love calculators!

| Smart Documentation | Why It Matters | Power Tips |

|---|---|---|

| Before & After Shots | Shows progression | Use consistent lighting |

| Measurement Records | Proves movement | Digital tools preferred |

| Expert Reports | Adds credibility | Get certified opinions |

Think of your documentation as your foundation's medical records – the more detailed they are, the better your diagnosis and treatment plan will be. Ready to strengthen your claim? Start documenting today!

#FoundationRepair #HomeInsurance #PropertyClaims #HomeownerTips

Contact Insurance

Dealing with Foundation Damage? Here's Your Insurance Contact Game Plan

Got foundation troubles? Don't let panic set in – your first power move is reaching out to your insurance provider.

Think of it like calling a doctor when you're sick – the sooner you make that call, the better your chances for a smooth recovery.

Smart Insurance Contact Checklist:

✓ Document everything (yes, every single crack and shift)

✓ Grab your policy number

✓ Set up that crucial first contact

Pro tip: Most insurance policies come with strict timeframes for reporting damage – it's like having a ticking clock on your claim eligibility.

Miss that window, and you might be left holding the repair bill.

Before You Dial:

- Gather those foundation damage photos

- Note down when you first spotted the issue

- Have your policy details at your fingertips

During your conversation with the insurance rep, treat it like building your case. Ask about:

- Coverage specifics for foundation issues

- Next steps in the claims process

- Timeline expectations

Remember to snag that all-important claim number and jot down every interaction detail – who you talked to, when, and what was discussed.

Think of it as creating your paper trail breadcrumbs – they might come in handy later.

Quick Action = Better Results: The insurance world moves fast, and being proactive puts you in the driver's seat of your claim journey. Ready to make that call?

Deal With Insurance Company Adjuster & Low Ball Assessments

Battling Insurance Adjusters: Your Game Plan for Fair Foundation Claims

Ever feel like you're playing chess with insurance adjusters who seem to have all the pieces?

Let's flip the script on those low-ball estimates for your foundation damage!

Think of your claim like building a rock-solid case – you wouldn't go to court without evidence, right? Here's how to become a claim-winning pro:

Document Like a Detective

- Snap before-and-after photos (think crime scene investigation, but for your foundation)

- Record every conversation (date, time, who said what)

- Create your own claim timeline (it's your story to tell)

Beat the Low-Ball Game

✓ Grab multiple independent contractor estimates

✓ Research local construction costs (knowledge is power!)

✓ Get professional engineering reports (your secret weapon)

Smart Negotiation Moves:

- Challenge questionable assessments with facts, not emotions

- Set response deadlines (keep them on their toes)

- Build your evidence portfolio like you're preparing for a blockbuster case

Pro Tips for Success:

- Keep a digital paper trail (your smartphone is your best friend)

- Store photos in cloud backup (because technology happens)

- Follow up in writing after every phone call (leave nothing to chance)

Remember: You're not just protecting your home – you're protecting your investment.

Think of yourself as the CEO of "My House, Inc." and negotiate accordingly.

Insurance adjusters respect preparedness, so show up ready to play ball!

Want better results? Treat every interaction like you're building your case for the ultimate foundation damage championship.

Your home's foundation deserves a fair assessment, and you've got the tools to make it happen!

Get Professional Assessment

Professional Foundation Assessment: Your Insurance Claim's Secret Weapon

Want to nail your foundation damage insurance claim? Let's talk about why professional assessments are your best friend in this process!

Think of it as building your case with ironclad evidence – you wouldn't go to court without a lawyer, right?

Licensed structural engineers (your foundation's detectives) dive deep into your home's story through:

- Structural integrity checks (like giving your house a full-body scan)

- Advanced stability testing

- Mathematical load calculations that reveal hidden stresses

But wait, there's more to this foundation mystery! Your assessment dream team typically includes:

✓ Geotechnical experts who study your soil's secrets

✓ Subsurface investigators who peek beneath the surface

✓ Material specialists who decode your foundation's composition

Think of forensic studies as CSI for your house – they connect the dots between cause and effect.

Environmental factors? They're on it! From water movement patterns to landscape analysis, nothing escapes their expert eyes.

And if you're in earthquake country, they'll throw in seismic evaluations too.

Why does all this matter? Insurance companies love solid evidence – it's like having a winning poker hand when you file your claim.

When you've got a detailed professional report backing you up, you're not just another claim number – you're a homeowner with proof that demands attention.

Ready to transform your foundation concerns into a rock-solid insurance claim? Professional assessment is your first step toward success!

Gather Supporting Evidence

Building Your Foundation Damage Insurance Claim: The Evidence Playbook

Think of gathering evidence for your foundation damage claim like building a rock-solid case – you wouldn't go to court without your ace cards, would you? Let's dive into what makes your claim bulletproof.

Smart Documentation Strategy:

✓ Snap crystal-clear photos from multiple angles

✓ Record precise measurements of cracks and shifts

✓ Track the timeline of damage progression

✓ Collect third-party expert evaluations

Key Evidence Pillars:

| Must-Have Documentation | Why It Matters |

|---|---|

| High-res Photo Gallery | Shows the real story of your damage journey |

| Professional Assessments | Adds credibility with technical expertise |

| Environmental Data | Links damage to covered perils |

Want to supercharge your claim? Think like an investigator! Did you know foundation experts recommend capturing seasonal changes in your documentation? Those hairline cracks might tell a bigger story over time.

Pro Tips for Maximum Impact:

- Create a digital evidence vault with dated entries

- Get multiple contractor quotes (aim for 3-4)

- Keep a detailed repair timeline

- Document pre-existing conditions

Remember, insurance adjusters love thorough documentation like bees love honey. The more comprehensive your evidence package, the stronger your position when negotiating your claim. Wondering what makes adjusters take notice? It's all about connecting those dots between cause and effect with solid, irrefutable proof.

Your evidence arsenal should paint a clear picture that even a five-year-old could understand – that's when you know you've nailed it!

Submit Complete Claims Package

Ready to Master Your Foundation Damage Claims? Let's Make It Rock-Solid!

Think of your claims package as building the perfect sandwich – every layer matters! Your insurance carrier needs a well-organized feast of documentation, and we'll help you serve it up right.

Start with your documentation checklist (think of it as your recipe card). You'll want to include:

- Detailed receipts (arranged by date)

- Professional engineering assessments

- High-quality photos showing every crack and concern

- Expert evaluations and estimates

Pro tip: Create a digital index (like chapters in your favorite book) to help your claims adjuster navigate through your documentation. They'll thank you for making their job easier!

Want to stand out? Organize your evidence like a museum curator – each piece telling part of your foundation's story.

Label everything clearly, cross-reference related documents, and maintain a crystal-clear timeline of events.

Before hitting 'send' on your claim:

✓ Double-check all certification requirements

✓ Verify every supporting document is present

✓ Create backup copies (because life happens!)

✓ Document your submission date and method

Remember, this isn't just paperwork – it's your ticket to getting your home back on solid ground. By following these steps, you're not just filing a claim; you're building a compelling case for your foundation repair.

Keep track of your claim's journey through the insurance maze. Set calendar reminders for follow-ups and maintain a communication log. After all, wouldn't you rather be the homeowner who's on top of things?

Try To Negotiate Claim Settlement Offer

Want to Turn the Tables on Your Foundation Damage Settlement? Let's Talk Strategy!

Think of negotiating a claim settlement like playing chess – every move counts, and you need to be three steps ahead.

Ready to maximize your settlement? Let's dive in!

Smart Documentation: Your Secret Weapon 🏠

- Snap detailed photos from multiple angles

- Record video walkthroughs of damage areas

- Secure professional inspection reports

- Create a digital damage diary

Your Negotiation Toolkit:

- Build an ironclad case with independent expert assessments

- Craft a compelling counteroffer backed by real contractor quotes

- Leverage professional opinions from structural engineers

- Keep a paper trail like it's your job (because it kind of is!)

Pro Tips That Make Insurance Adjusters Listen:

- Compare repair estimates from multiple contractors

- Highlight safety concerns and long-term implications

- Document every conversation (yes, even those "quick chats")

- Use precise technical terms when describing damage

Remember, you're not just accepting what's offered – you're advocating for your home's future.

Think of yourself as your house's personal attorney, armed with facts and ready to negotiate.

Power Moves in Your Settlement Game:

✓ Present before-and-after evidence

✓ Calculate long-term maintenance costs

✓ Show impact on property value

✓ Demonstrate urgency without desperation

Getting pushback? That's normal! Like any good negotiation, expect some back-and-forth.

Stay firm, stay focused, and keep your end goal in sight – fair compensation for your foundation repairs.

Remember: Your home's foundation isn't just concrete and steel – it's your investment's backbone. Fight for what it's worth!

Chapter 10: Filing Process For Foundation Damage Insurance Claims (With A Public Adjuster)

Filing Foundation Damage Claims: Why a Public Adjuster Is Your Secret Weapon

Think of a public adjuster as your personal insurance detective – they're experts at cracking the code of complex foundation damage claims.

Ready to turn the overwhelming claims process into a manageable journey? Let's dive in!

What Makes Public Adjusters Foundation Claim Champions?

They're like having a GPS for your insurance maze, steering you clear of common pitfalls while maximizing your claim's potential.

Your adjuster becomes your foundation damage quarterback, calling the plays that matter most.

Key Advantages You'll Experience:

✓ Documentation Masters: They capture every crack, shift, and settlement issue with professional-grade precision

✓ Policy Whisperers: Ever wondered if your policy covers more than meets the eye? They'll uncover those hidden gems

✓ Technical Dream Team: They bring in structural engineers and contractors who speak the language insurance companies respect

✓ Negotiation Ninjas: While you focus on your daily life, they're battling insurance carriers to maximize your settlement

Pro Tip: The earlier you bring in a public adjuster, the stronger your foundation claim becomes. They'll ensure no stone is left unturned – literally and figuratively!

Remember: Foundation issues can be like icebergs – what you see on the surface might just be the tip.

A public adjuster helps reveal and document the full scope of damage, ensuring you don't settle for less than you deserve.

Want the best possible outcome? Let a public adjuster transform your foundation claim from a stressful ordeal into a strategic victory.

Public Adjuster Documents Foundation Damage Thoroughly

Foundation Damage Documentation: Your Public Adjuster's Secret Weapon

Ever wondered how public adjusters turn complex foundation damage into winning insurance claims? Let's crack open their documentation playbook!

Think of your public adjuster as a CSI investigator for your home's foundation – they're gathering evidence that tells the complete story of your property's structural challenges.

Modern documentation isn't just about snapping a few photos anymore; it's a high-tech operation that leaves no stone unturned.

Smart Documentation Arsenal:

✓ Crystal-clear HD imagery (because a picture speaks a thousand words to insurance carriers)

✓ Cutting-edge thermal imaging (spots hidden moisture like a detective's x-ray vision)

✓ Drone surveillance (gets those hard-to-reach angles insurance companies love to see)

✓ Real-time monitoring systems (tracks foundation movement like a fitness tracker for your house)

Key Documentation Strategies:

- Visual Storytelling: HD cameras + strategic location markers paint the full damage picture

- Scientific Analysis: Moisture meters and thermal tools reveal invisible threats

- Environmental Investigation: Soil testing uncovers the root causes

- Dynamic Monitoring: Regular video updates show how damage evolves

What makes this approach so powerful? It's like building an airtight legal case – every piece of evidence strengthens your position at the negotiating table.

Your adjuster transforms technical data into compelling proof that insurance carriers can't ignore.

Remember: The difference between a denied claim and a full settlement often lies in the details your public adjuster captures. Ready to document your foundation damage like a pro?

Public Adjuster Reviews Policy For Hidden Foundation Damage Coverage & To Maximize Policy Benefits

Wondering if Your Home's Foundation Issues Are Actually Covered? Let's Dig Deeper!

Think of your insurance policy as a treasure map, with public adjusters being your expert navigators through the complex maze of coverage terms. They're like foundation damage detectives, uncovering hidden gems of coverage you might never know existed!

Why Trust a Public Adjuster with Your Foundation Claim?

- Policy Detective Work:

- Decodes insurance jargon into plain English

- Spots sneaky exclusions that could affect your claim

- Maps out every possible coverage angle

- Coverage Maximization Strategy:

| Smart Review Steps | What It Means For You |

|---|---|

| Deep Policy Dive | Finding every dollar you deserve |

| Hidden Benefit Hunt | Discovering overlooked coverages |

| Strategic Planning | Building stronger claims |

Did you know most homeowners miss out on 30-40% of their eligible coverage simply because they don't know where to look? That's where public adjusters shine – they're like your personal claim advocates, fighting to squeeze every legitimate penny from your policy.

Pro Tips for Maximum Foundation Coverage:

- Get a thorough documentation before repairs start

- Understand how different perils affect coverage

- Know your rights and policy timelines

Remember: Insurance companies have their experts protecting their interests – shouldn't you have someone in your corner too? A public adjuster turns complex policy language into real-world results, ensuring you don't leave money on the table when foundation problems strike.

Want to know if you're getting everything you deserve from your policy? Let's chat about your foundation concerns!

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Let's Talk Insurance: Your Public Adjuster Takes the Communication Wheel

Ever feel like you're speaking a different language when dealing with insurance companies? That's where your public adjuster becomes your ultimate translator and spokesperson for foundation damage claims!

Think of your public adjuster as your claim's diplomatic ambassador – they're fluent in "insurance-speak" and know exactly how to navigate those tricky conversations with insurance company representatives.

Once you bring them on board, you can breathe easier knowing a pro is handling all the back-and-forth.

What's Your Public Adjuster Actually Doing Behind the Scenes?

🏠 Playing Detective During Inspections

They're right there alongside insurance company adjusters, documenting every crack, shift, and settling issue in your foundation. No detail escapes their trained eye!

📋 Mastering the Paper Trail

From engineering evaluations to structural reports, they're organizing and submitting documentation that speaks volumes about your claim's validity.

💪 Negotiating Like a Pro

When insurance companies try to lowball with unfair depreciation or inadequate offers, your public adjuster steps in with data-backed counterarguments.

⚖️ Fighting in Your Corner

If your claim hits a roadblock, they know exactly which doors to knock on and which decision-makers to approach for resolution.

Remember: You wouldn't go to court without a lawyer, so why face insurance companies without a public adjuster? They're your professional shield, ensuring you're never at a disadvantage while maintaining those crucial insurance relationships.

Want to make your foundation claim rock-solid? Let your public adjuster do the heavy lifting in the communication department – that's what they do best!

Public Adjuster Gets Professional Assessments

Building Your Foundation Claim: How Public Adjusters Secure Expert Proof

Ever wondered how public adjusters transform your foundation damage from a headache into a rock-solid claim? It's like assembling a dream team of specialists who'll dig deep into every crack and crevice of your property.

Professional assessments serve as your claim's backbone, and here's how your public adjuster orchestrates this crucial phase:

Must-Have Professional Evaluations:

✓ Structural Engineers: These foundation detectives investigate load-bearing walls, settlement patterns, and structural integrity with laser precision

✓ Independent Inspectors: Their unbiased eyes document every detail, from hairline cracks to major shifts

✓ Soil and Environmental Experts: Think of them as property CSIs, analyzing ground conditions and water patterns

✓ Certified Appraisers: They translate damage into dollars, calculating repair costs and property value impacts

Why does this matter? Think of these assessments as your claim's armor – each expert report strengthens your position with insurance companies.

Your public adjuster weaves these professional findings into a compelling narrative that's hard to dispute.

Pro Tip: Quality assessments often reveal hidden damage patterns that might've gone unnoticed, potentially increasing your claim's value. They're not just reports; they're your ticket to fair compensation.

Public Adjuster Gathers Supporting Evidence

Building Your Foundation Damage Claim: A Public Adjuster's Evidence Playbook

Ever wonder how public adjusters turn complex foundation damage into winning insurance claims? Let's dive into the art of evidence gathering – it's like building a rock-solid case that insurance companies can't ignore.

Think of your public adjuster as a detective, piecing together a compelling story of your property's damage. They'll create an evidence portfolio that packs a serious punch:

Capturing the Visual Story

- Before-and-after photography that speaks volumes

- Time-lapse videos showing progressive damage

- Drone footage for those hard-to-reach angles

- 360-degree interior and exterior documentation

Getting Technical (The Nitty-Gritty)

- Professional soil composition analysis

- Structural engineering evaluations

- Historical weather pattern data

- Moisture level readings and maps

Following the Money Trail

- Competitive contractor estimates

- Historical maintenance records

- Property value impact assessments

- Utility consumption patterns showing structural issues

Expert Backup

- Structural engineer testimonials

- Geotechnical specialist reports

- Neighboring property impact statements

- Local building code compliance verification

Why does all this matter? Just like a master chef needs quality ingredients for a perfect dish, your adjuster needs comprehensive evidence to cook up a successful claim.

They'll weave these elements into a narrative that clearly shows what happened, why it happened, and what it'll take to make it right.

Remember: The stronger your evidence package, the harder it becomes for insurance companies to dispute your claim. Your public adjuster isn't just collecting data – they're building your case for maximum compensation.

Public Adjuster Submits Complete Claims Package

Got Your Back: How Public Adjusters Make Your Insurance Claim Rock-Solid

Think of a public adjuster as your claim's personal bodyguard, armed with a bulletproof documentation strategy. When foundation damage strikes your home, they're the pros who turn chaos into clarity.

Let's dive into how they build your winning claims package:

The Documentation Dream Team:

- Structural engineering reports that tell your home's whole story

- Crystal-clear photo evidence that speaks louder than words

- Real-world cost estimates that leave no penny uncounted

- Time-stamped damage progression that connects all the dots

Ever wondered what makes their approach different? They're like master chess players, strategically positioning each piece of evidence:

| Power Move | Why It Matters |

|---|---|

| Expert Reports | Backs your claim with scientific muscle |

| Damage Timeline | Shows how things went south |

| Pro Testimony | Brings heavyweight credibility |

| Smart Formatting | Plays by insurance rules – and wins |

They're not just collecting papers – they're building your case like a seasoned detective. Every maintenance record, expert opinion, and technical detail gets woven into a compelling narrative that insurance companies can't ignore.

Want to know the secret sauce? It's all about speaking the insurer's language while fighting in your corner. Your adjuster transforms complex building codes and technical specs into ammunition for your claim's success.

Pro Tip: Quality documentation isn't just about quantity – it's about telling your property's story in a way that demands attention and fair compensation.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Never Miss a Beat: How Public Adjusters Keep Your Foundation Claim on Track

Think of your public adjuster as your claim's personal timekeeper – they're like that super-organized friend who never forgets important dates!

When it comes to foundation claims, timing isn't just everything – it's the difference between success and frustration.

Why let deadlines and paperwork keep you up at night? Your public adjuster handles:

✓ Timeline Management

- Tracks those pesky engineering report deadlines

- Keeps damage assessments flowing smoothly

- Ensures supplemental docs hit the mark every time

✓ Communication Command Center

- Maintains a crystal-clear paper trail

- Responds to insurance company queries at lightning speed

- Creates detailed logs of every conversation and interaction

✓ Strategic Follow-Up System

- Prevents your claim from gathering dust

- Implements smart reminder protocols

- Stays one step ahead of insurance company requirements

Ever wondered how the pros keep complex claims moving forward? It's all about having a systematic approach.

Your adjuster acts as your claim's GPS, navigating through insurance company red tape while keeping everything documented and organized.

Pro Tip: Documentation isn't just about collecting papers – it's about telling your claim's story effectively. Public adjusters know exactly what evidence to gather, when to submit it, and how to present it for maximum impact.

Remember: While you focus on your daily life, your public adjuster keeps your foundation claim's pulse strong and steady, ensuring nothing falls through the cracks. It's like having a claim concierge who never takes a day off!