Is your flat roof showing battle scars from a recent hailstorm? You're not alone! Think of your roof's membrane like your smartphone's screen protector – it's tough, but hail can leave its mark. Those telltale dark circles and dents aren't just cosmetic wounds; they're warning signs your roof's protective layer might be compromised.

Let's talk numbers (and your wallet will want to pay attention): fixing hail damage won't break the bank if you catch it early. For a typical 1,500-square-foot flat roof, you're looking at $300-$1,250 for repairs. But wait until you need a full replacement? That's when costs can soar beyond $15,000 – ouch!

The good news? Your homeowner's insurance likely has your back. Whether you've got an Actual Cash Value policy (think depreciation included) or Replacement Cost Value coverage (the whole enchilada), you're probably covered. Want to maximize your claim? A public adjuster is like having a personal advocate who knows all the insurance industry's ins and outs.

Remember, spotting hail damage is like being a roof detective – you need to know what clues to look for. From punctures that look like meteor impacts to subtle membrane wrinkles, catching these signs early can mean the difference between a quick fix and a major overhaul. Ready to become a flat roof guardian? Time to grab those binoculars and start inspecting!

Key Takeaways

Is Your Flat Roof Under Attack? Spotting Hail Damage Like a Pro

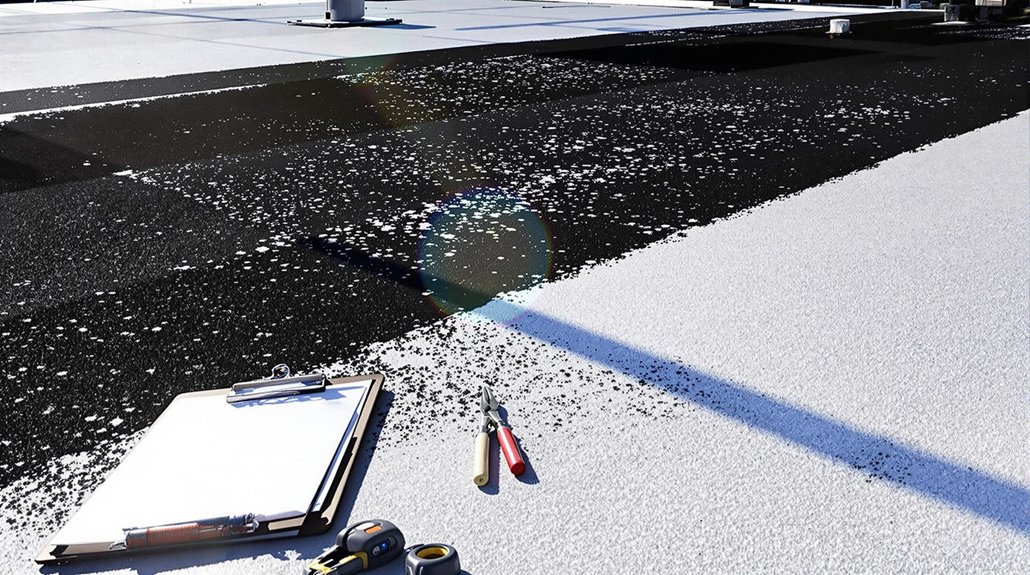

Think of your flat roof as a protective shield – when hail strikes, it leaves behind telltale battlescars. You'll spot dark circular bruises, nasty punctures, and suspicious cracks that weren't there before. If you notice water pooling like tiny lakes where it shouldn't, that's another red flag waving at you.

Here's the scary part: those innocent-looking frozen projectiles pack quite a punch. Once they reach 1-inch in diameter, they mean business, but when they grow beyond 1¾ inches? That's when your roof really needs to watch out!

Got a 1,500-square-foot flat roof that's taken a beating? You're looking at repair costs that could dance anywhere between $300 and $1,250. The final number depends on how badly Mother Nature decided to play drums on your rooftop.

Don't let insurance claims give you a headache! Think of yourself as a detective – gather evidence like photos and videos before those marks fade away. Time isn't your friend here; each insurance company has its own countdown clock for filing claims.

Want to level up your insurance game? Consider bringing in a public adjuster – they're like professional negotiators who speak fluent 'insurance.' They'll assess every dent and dimple, potentially turning that settlement from meh to magnificent. Remember, what looks like a minor ding to you might be a major damage point to these experts!

Does Hail Damage Flat Roofs?

Flat roofs are particularly vulnerable to hail damage, with hailstones larger than 1¾ inches posing significant risks to common roofing materials like TPO and single-ply membranes.

Modern hail-resistant flat roofing systems incorporate enhanced materials and reinforced membranes that can withstand impacts from smaller hailstones up to 2 inches in diameter.

The effectiveness of hail resistance depends on factors including membrane thickness, substrate composition, and proper installation techniques, with multi-layer systems generally offering superior protection against hail damage. Dark impact circles on the membrane surface often indicate compromised roofing integrity that requires immediate attention.

Regular inspections by public claims adjusters can help identify and document hail damage to flat roofs, leading to more successful insurance claims and fair settlements.

What Size Hail Will Damage A Flat Roof?

Significant roof damage can occur when hailstones reach approximately 1 inch in diameter, though the specific threshold varies based on the roofing material and existing conditions. TPO membranes typically resist hailstones up to 1¾ inches, while other materials may show vulnerability at smaller sizes.

| Hailstone Size | Impact on Flat Roofs |

|---|---|

| Under 1 inch | Minimal damage to most materials |

| 1-1.5 inches | Potential punctures and cracks |

| 1.5-2 inches | Significant membrane damage |

| Over 2 inches | Severe structural damage |

The severity of damage also depends on factors such as wind speed, roof age, and membrane thickness. Older roofs or those with pre-existing wear may sustain damage from smaller hailstones, while newer, well-maintained roofs typically offer greater resistance to hail impacts. With powerful updraft speeds reaching 110 mph during severe storms, hailstones can strike roofs with devastating force. Annual hail damage costs in the United States range between $8-14 billion, highlighting the importance of proper roof maintenance and protection. Additionally, homeowners should be vigilant in identifying metal roof hail damage signs, which can include dents, scratches, and discoloration. These indicators can help determine whether repairs are necessary to prevent further deterioration and leaks. Regular inspections, especially after severe weather events, can mitigate long-term damage and preserve the integrity of the roof, ultimately saving homeowners from costly repairs down the line.

Are There Hail Resistant Flat Roofs?

While understanding hail size thresholds is important, property owners should know that hail-resistant flat roofing options exist to mitigate potential damage.

Alternative roofing materials like reinforced EPDM rubber and modified bitumen provide enhanced protection against hail impacts.

Rubberized asphalt systems offer increased elasticity and durability during severe weather conditions.

Impact-resistant membranes and thicker PVC installations represent modern solutions that can greatly reduce maintenance costs over time.

Selecting appropriate materials can help avoid repair costs ranging from $200 to $25,000 for hail damage.

The benefits of roof coatings include additional protection layers that help prevent cosmetic degradation and structural compromise.

While these hail-resistant options may require higher initial investments, they often prove cost-effective by minimizing repair needs and potentially lowering insurance premiums.

Proper material selection should consider local weather patterns, building requirements, and long-term durability goals.

Property owners in Hail Alley regions should especially consider these impact-resistant materials due to the increased frequency of severe hail events.

Common Types Of Hail Damage To Flat Roofing

Several distinct types of damage can occur when hail impacts flat roofing systems. The severity and type of damage depend on factors such as hailstone size, roof material composition, and existing roof conditions. Understanding these damage patterns is essential for effective types of damage prevention and roof material comparison. Standard homeowners insurance typically covers structural damage from hailstorms to roofing systems.

| Damage Type | Impact on Roof |

|---|---|

| Surface Dents | Depressions in membrane without penetration |

| Punctures | Complete penetration through roofing material |

| Granule Loss | Erosion of protective top layer |

| Membrane Stress | Weakening of material flexibility |

| Structural Cracks | Formation of splits in roofing surface |

Large hailstones typically cause immediate visible damage, while smaller impacts may create subtle wear patterns that develop into serious issues over time. Different membrane types exhibit varying resistance levels, with PVC and TPO generally showing superior impact resistance compared to traditional materials. Public insurance adjusters can help optimize claim settlements by providing objective damage assessments within 15-45 days.

Warning Signs Your Flat Roof Needs Repairs From Hail Damage

Recognizing hail damage on flat roofs requires careful observation of specific warning signs. A thorough inspection checklist should include both exterior and interior indicators, while understanding potential repair techniques depends on correctly identifying these signals. Working with public insurance adjusters can increase hail damage claim settlements by up to 400% through detailed documentation and expert assessment. Open-perils protection typically covers hail damage unless specific exclusions are noted in the policy.

| Warning Sign | Location | Significance |

|---|---|---|

| Punctures & Cracks | Roof Surface | Direct Impact Damage |

| Water Pooling | Flat Areas | Drainage Issues |

| Dents & Damage | Metal Components | Storm Severity |

Building owners should monitor for visible surface damage, including membrane punctures and cracks in roofing materials. Interior signs like water stains, mold growth, or active leaks often indicate compromised roofing integrity. Ground-level indicators, such as damaged siding or exterior fixtures, can corroborate the extent of hail damage and help determine appropriate repair approaches.

Does Homeowners Insurance Cover Flat Roof Hail Damage Claims?

While homeowners insurance typically covers hail damage to flat roofs, policies often include specific deductibles, coverage limits, and potential exclusions that property owners must carefully review. The type of coverage – whether Actual Cash Value (ACV) or Replacement Cost Value (RCV) – markedly impacts the compensation amount for flat roof hail damage claims. Insurance policies may also vary between named perils, which explicitly list covered events like hail damage, and hidden perils that require careful policy examination to understand coverage scope. Consulting with public insurance adjusters can help maximize settlement amounts and expedite the claims process for roof damage. Thorough damage documentation through photos and videos immediately after a hail event is essential for supporting insurance claims.

| Coverage Aspect | Impact on Claims | Considerations |

|---|---|---|

| Deductibles | Determines out-of-pocket costs | May have separate hail damage deductibles |

| Coverage Type | Affects reimbursement amount | ACV includes depreciation, RCV covers full replacement |

| Peril Classification | Defines claim eligibility | Named perils offer clearer coverage terms |

Insurance Deductibles, Coverage Limits, & Exclusions For Flat Roof Hail Damage Claims

Understanding flat roof hail damage coverage requires careful examination of insurance policies, as homeowners insurance typically covers this type of damage when listed as a covered peril. Deductible differences can notably impact out-of-pocket expenses, with some policies requiring percentage-based deductibles rather than flat fees. Policy negotiations may help secure better coverage terms, especially in areas prone to hailstorms. Public insurance adjusters can help maximize settlement amounts and ensure accurate damage assessment documentation.

| Coverage Aspect | Standard Policy | Enhanced Policy | High-Risk Areas |

|---|---|---|---|

| Deductible Type | Flat Fee | Percentage-Based | Wind/Hail Specific |

| Coverage Limits | Basic Replacement | Full Replacement | Limited Coverage |

| Exclusions | Standard Wear | Weather Events | Maintenance Issues |

Insurance providers often require professional assessments to validate claims, and coverage limits determine the maximum reimbursement for repairs or replacement. Understanding policy exclusions is vital, as some may specifically exclude wind and hail damage in certain regions. Regular certified installer inspections are crucial for maintaining valid insurance coverage and identifying potential damage early before it worsens.

Actual Cash Value Vs. Replacement Cost In Relation To Flat Roof Hail Damage

When homeowners face flat roof hail damage claims, the distinction between Actual Cash Value (ACV) and Replacement Cost Value (RCV) coverage greatly impacts their financial outcomes. Understanding these coverage types is essential for making informed insurance decisions.

| Coverage Aspect | ACV vs RCV Comparison |

|---|---|

| Payout Basis | Depreciated Value vs Full Replacement |

| Premium Cost | Lower vs Higher |

| Out-of-Pocket | Higher vs Lower |

| Claim Process | Immediate vs May Require Completion |

| Material Quality | Limited vs Original Standard |

ACV coverage factors in depreciation, resulting in lower payouts but reduced premiums. Hailstorm claims have increased significantly, with insurance companies processing over $3.5 billion in damages during 2022. Conversely, RCV provides extensive coverage for full replacement costs without depreciation consideration. While RCV typically demands higher premiums, it offers superior protection for flat roof repairs, ensuring restoration to pre-damage condition. Property owners must weigh these options carefully, considering their roof's age and financial capabilities. Homeowners who utilize public adjusters for their claims typically receive settlements averaging $22,266 compared to $18,659 when handling claims independently.

Named Vs. Hidden Perils

Despite variations in policy coverage, most standard homeowners insurance policies include hail damage as a named peril for flat roofs. Understanding the distinction between named peril coverage and hidden peril risks is essential for property owners to effectively manage their insurance protection. Time limit restrictions can significantly impact claim approvals, with deadlines varying from 30 days to three years depending on state regulations.

| Coverage Type | Typically Covered | Usually Excluded |

|---|---|---|

| Named Perils | Hail Damage | Wear and Tear |

| Wind Damage | Animal Damage | |

| Fire Damage | Maintenance Issues | |

| Lightning Strikes | Flood/Earthquake |

While named perils provide clear coverage parameters, hidden perils often present unexpected challenges. Property owners should carefully review their policies to identify potential coverage gaps, particularly regarding age-related restrictions, maintenance requirements, and regional exclusions that could affect their flat roof protection. Working with a public insurance adjuster can increase settlement amounts by up to 800% compared to filing claims independently.

Flat Roof Hail Damage Repair Vs. Replacement

When facing hail damage on a flat roof, property owners must carefully evaluate whether repair or replacement is the most appropriate solution based on the extent of damage and other key factors.

A thorough professional assessment helps determine the most cost-effective approach while ensuring long-term roof integrity and performance. Professional documentation through thermal imaging assessments can reveal hidden damage that may influence the repair versus replacement decision.

The decision between repair and replacement typically depends on:

- Age of Roof: Repairs are suitable for newer roofs (less than 15 years old), while older roofs near end-of-life often warrant replacement.

- Damage Scope: Localized damage affecting less than 30% of the roof surface suggests repair, while widespread damage indicates replacement.

- Cost Analysis: Compare repair costs ($200-$1,000) versus replacement ($5,000-$15,000), factoring in long-term maintenance requirements.

- Material Condition: Sound underlying structure supports repair options, while deteriorated materials necessitate complete replacement.

Property owners should consider working with public adjusters to maximize insurance claim settlements, as they typically secure higher payouts compared to self-filed claims.

When To Choose Roof Repair For A Hail Damaged Flat Roof

Making the decision between roof repair and complete replacement after hail damage requires careful analysis of multiple factors, including the extent of damage, cost considerations, and the roof's current age.

| Repair Indicators | Replacement Indicators |

|---|---|

| Localized damage | Widespread damage |

| Minor punctures | Structural compromise |

| Recent roof installation | Near end of lifespan |

| Sound membrane integrity | Multiple layer failure |

| Cost under $1,000 | Repeated repair history |

When evaluating repairability, professionals assess the scope of damage and structural integrity. Repair is typically suitable for isolated issues such as small leaks, punctures, or localized damage that doesn't compromise the overall roofing system. Professional inspection can determine if repair vs. maintenance is the appropriate solution, considering factors like material compatibility and long-term cost-effectiveness. Temporary fixes may serve as immediate solutions while awaiting thorough repairs.

When To Choose Roof Replacement For A Hail Damaged Flat Roof

The decision to replace a hail-damaged flat roof depends on critical factors such as structural integrity, extent of damage, and long-term economic implications. When hailstones exceed one inch in diameter, they often compromise roof safety and necessitate complete replacement rather than repairs. Professional inspections can determine if structural damage warrants replacement, particularly when the roof deck is impacted.

| Replacement Indicators | Safety Impact | Hail Prevention Measures |

|---|---|---|

| Widespread Punctures | High Risk | Impact-Resistant Materials |

| Deck Damage | Structural Compromise | Protective Membranes |

| Multiple Leaks | Water Damage Risk | Regular Inspections |

| Age Over 15 Years | Deterioration Risk | Maintenance Programs |

Insurance adjusters evaluate test areas to determine replacement eligibility, considering factors like material type, age, and extent of damage. Documentation and thorough assessment support successful claims processing.

Hail Damage Flat Roof Repair Cost Breakdown

Understanding the cost breakdown of flat roof hail damage repair requires careful consideration of multiple factors that influence the final price. Professional damage assessment reveals the extent of repairs needed, from minor patching to complete resurfacing, with cost estimation varying accordingly. Additional factors that can impact the overall cost include the type of materials used, labor rates in the area, and any necessary permits. Homeowners should consult a roof hail damage repairs guide to better understand the common expenses associated with different repair options. By being informed about these aspects, they can make more educated decisions and potentially save on unnecessary costs.

| Repair Type | Cost Range | Common Applications |

|---|---|---|

| Patching | $150-$1,500 | Small holes, cracks |

| Resurfacing | $250-$1,500 | Blistering, surface wear |

| Full Repair | $750-$4,000 | Extensive damage |

The national average for flat roof repairs ranges from $300 to $1,250 for a 1,500-square-foot roof. Location, material quality, and climate conditions impact final costs. Emergency repairs typically command higher prices due to immediate service requirements, while insurance coverage can help offset expenses depending on policy terms and deductibles. Homeowners should also be vigilant for storm damage roof signs, such as missing shingles, leaks, or sagging areas, which can indicate the need for urgent repairs. Regular inspections can help identify these issues early, potentially saving money in the long run. Additionally, understanding the scope of necessary repairs and consulting with professional contractors can provide clarity on pricing and help ensure quality work. It’s essential for homeowners to conduct a thorough roof repair cost analysis before committing to any service, as this can provide insights into the most economical options available. Additionally, comparing quotes from multiple contractors ensures that homeowners receive competitive pricing while helping them understand the scope of required repairs. Regular maintenance can also help prevent costly repairs in the future, making it crucial to address minor issues before they escalate. Additionally, homeowners should consider the potential benefits of filing homeowners insurance roof replacement claims, as they may significantly alleviate out-of-pocket expenses. It’s crucial to review policy terms carefully, as some plans may cover a substantial portion of repair costs, especially in cases of storm damage or other unforeseen events. Ultimately, being informed about coverage options can lead to more affordable solutions for necessary roof repairs.

Hail Damage Flat Roof Replacement Cost Breakdown

When extensive hail damage necessitates complete flat roof replacement, costs can escalate greatly beyond basic repairs. Professional inspection techniques reveal the full extent of damage, helping determine ideal repair materials and replacement strategies. Total replacement costs vary markedly based on roofing material selection and labor requirements.

| Material Type | Cost Range per Sq Ft |

|---|---|

| EPDM | $5 – $15 |

| PVC | $6 – $18 |

| TPO | $6 – $14 |

| Labor | $35 – $200/hr |

The thorough replacement process includes debris removal, substrate preparation, and new material installation. Factors influencing final costs include roof accessibility, local building codes, and material availability. Property owners should consider long-term durability when selecting replacement materials, as higher-quality options may offer superior hail resistance and extended service life.

Insurance Company Adjusters: They Work For The Insurance Company's Benefit … NOT YOURS

Insurance adjusters fulfill a critical role in evaluating hail damage claims, yet their primary obligation remains to their employer rather than the policyholder.

Understanding common insurance adjuster tactics can help property owners navigate the claims process more effectively and avoid policyholder misconceptions about the adjuster's role.

- Adjusters often attribute damage to normal wear rather than hail impact, potentially limiting claim payouts.

- They interpret complex policy language according to the insurance company's interests.

- Their assessments may underestimate repair costs or dispute damage extent.

- They review claims to minimize the company's financial liability.

To protect their interests, property owners should consider engaging independent professionals, such as public adjusters or roofing experts, before filing claims.

These third-party evaluations can provide unbiased documentation and help guarantee fair treatment during the claims process.

Getting Help From A Public Adjuster: Your Advocate & Ally

Public adjusters serve as dedicated advocates who represent policyholders' interests in flat roof hail damage claims, offering expertise in damage assessment, policy interpretation, and settlement negotiations.

These professionals work on a contingency fee basis, typically charging a percentage of the final settlement amount, while providing specialized knowledge of flat roof systems and insurance claim procedures.

Unlike insurance company adjusters who represent the insurer's interests, public adjusters focus solely on maximizing claim settlements for property owners, making them valuable allies during the complex claims process for flat roof hail damage repairs or replacements.

The Role Of Public Adjusters In Hail Damaged Flat Roof Claims

A skilled advocate can make a significant difference when maneuvering hail damage claims for flat roofs. Public adjusters provide essential expertise in managing complex insurance policies and securing fair settlements for property owners. Their independent status guarantees unbiased representation throughout the claim settlement process.

| Public Adjuster Benefits | Claim Actions | Outcomes |

|---|---|---|

| Expert Documentation | Detailed Assessment | Maximum Coverage |

| Policy Interpretation | Evidence Collection | Fair Settlement |

| Negotiation Power | Dispute Resolution | Expedited Process |

These professionals conduct thorough damage assessments, document evidence, and handle negotiations with insurance companies. Their expertise particularly benefits flat roof claims, where damage assessment requires specialized knowledge. Public adjusters streamline the claims process while guaranteeing all covered damages are properly addressed, from material replacement considerations to depreciation disputes.

Benefits Of Using A Public Claims Adjuster For Hail Damaged Flat Roof Repair Or Replacement Claims

Partnering with a public claims adjuster provides property owners significant advantages when managing hail-damaged flat roof claims. These professionals maximize settlements through expert documentation and negotiation while protecting the policyholder's long-term insurability.

| Factors Influencing Claims | Advantages of Expertise |

|---|---|

| Policy Interpretation | Expert analysis of coverage terms and conditions |

| Damage Assessment | Thorough documentation of all hail-related impacts |

| Settlement Negotiation | Strategic advocacy for fair compensation |

Public adjusters expedite the claims process by properly evaluating damage extent, challenging unfair wear-and-tear designations, and ensuring appropriate materials are specified for repairs. Their expertise helps prevent claim denials and settlement disputes while maintaining detailed records that support future coverage. For property owners facing complex hail damage claims, professional representation often proves invaluable in securing favorable claim outcomes.

How Are Public Insurance Adjusters Paid & What Are Their Fees?

Understanding the cost structure for public insurance adjuster services is essential for property owners considering professional claims assistance. The most common adjuster commission structure involves contingency fee agreements, where payment is based on a percentage of the final settlement amount, typically ranging from 5-15%.

| Payment Type | Description | Typical Range | When Paid |

|---|---|---|---|

| Contingency Fee | % of settlement | 5-15% | After settlement |

| Flat Rate | Fixed amount | Varies by case | As agreed |

| Hourly Rate | Time-based | $100-300/hr | Monthly/completion |

| Mixed Structure | Combined methods | Case dependent | Per agreement |

State regulations govern maximum allowable fees and payment timing. Most public adjusters only receive compensation after successfully settling the claim, creating alignment with the property owner's interests.

Public Adjusters Vs. The Insurance Company Adjuster

While knowing public adjuster fees helps inform hiring decisions, the fundamental difference between public and insurance company adjusters lies in their core objectives and allegiances. Public adjuster advantages include unbiased damage assessment, detailed documentation, and maximized settlement values. Insurance adjuster limitations stem from their obligation to minimize payouts for their employers.

| Factor | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Represents | Policyholder | Insurance Company |

| Objective | Maximum Fair Settlement | Minimize Payout |

| Assessment | Detailed Documentation | Basic Evaluation |

| Negotiation | Advocates for Full Coverage | Focuses on Cost Control |

This contrast becomes particularly critical in flat roof hail damage claims, where damage assessment requires specialized expertise and thorough documentation to secure appropriate compensation for repairs or replacement.

When To Contact A Public Adjuster For Flat Roof Hail Damage

Determining the ideal time to contact a public adjuster for flat roof hail damage can greatly impact claim outcomes and settlement values. To maximize public adjuster benefits, property owners should engage these professionals early in the claim process, particularly when facing complex damage assessments or insurance disputes.

| Timing | Scenario | Action Required |

|---|---|---|

| Immediate | After Storm Damage | Document damage, contact public adjuster before insurer inspection |

| Early Process | Complex Damage Pattern | Secure expert assessment and detailed documentation |

| During Dispute | Claim Denial/Underpayment | Obtain professional re-evaluation and negotiation support |

| Re-Opening | New Evidence Found | Request thorough reinspection and policy review |

Early involvement guarantees proper documentation, accurate damage assessment, and ideal claim strategy development, ultimately leading to fair settlements that reflect the true extent of hail damage to flat roofs.

When to Contact Your Insurance Provider For Flat Roof Hail Damage

Property owners have two primary paths when filing an insurance claim for flat roof hail damage: working with a public adjuster or managing the process independently.

Those pursuing claims through a public adjuster should contact their insurance provider after the adjuster has completed a thorough damage assessment and documentation process.

Property owners filing independently should contact their insurance company immediately after discovering potential hail damage, ensuring they meet policy deadlines while gathering necessary documentation and professional evaluations.

If Using A Public Adjuster

When faced with significant hail damage to a flat roof, property owners should carefully evaluate whether to engage a public adjuster before contacting their insurance provider.

Public adjuster benefits include expert advocacy during claim process navigation, thorough damage assessments, and maximized settlement potential.

These professionals conduct extensive property inspections, document all damage meticulously, and leverage their expertise in policy interpretation to secure ideal payouts. Their involvement can be particularly valuable when claims are complex or when disputes with insurance companies arise.

Public adjusters manage all documentation, handle negotiations with insurers, and provide detailed cost estimates for necessary repairs. Their compensation structure typically aligns with achieving the best possible settlement outcomes, making them motivated advocates for property owners throughout the claims process.

If Filing On Your Own

Filing a flat roof hail damage claim independently requires careful timing and thorough preparation before contacting the insurance provider.

A successful claim strategy begins with an extensive evaluation of the damage, including detailed photo documentation and professional repair estimates. Property owners must review their insurance policy to understand coverage limitations and exclusions.

Before initiating the insurance timeline, owners should assess whether repairs or full replacement is necessary, considering the potential impact on future premiums.

Documentation of maintenance history and collateral damage strengthens the claim. Once prepared, property owners should contact their insurer promptly, being mindful of statute of limitations.

The process involves completing claim forms, scheduling adjuster visits, and monitoring the settlement process. If disputes arise, owners should be prepared to appeal with additional supporting evidence.

Filing Process For Hail Damaged Flat Roof Claims Using A Public Adjuster

A public adjuster plays a crucial role in managing flat roof hail damage claims through a systematic process that protects policyholder interests.

The process includes essential steps that maximize claim potential while reducing stress for property owners.

The following key actions outline how public adjusters handle flat roof hail damage claims:

- Conduct thorough roof inspections and document all hail-related damage through detailed photos, measurements, and written assessments.

- Review insurance policies to identify applicable coverage and benefits while developing effective claim strategies.

- Handle all communications with insurance carriers and their adjusters, presenting professional evidence and advocating for fair settlements.

- Obtain independent expert evaluations and compile supporting documentation to strengthen the claim position.

Public Adjuster Thoroughly Inspects & Documents Hail Damage To Your Flat Roof

Professional roof inspections conducted by public adjusters form the cornerstone of successful hail damage claims for flat roofs. Their adjusting service benefits include detailed documentation through photographs, videos, and thorough reports that capture both obvious and subtle signs of impact damage. Insurance claim strategies employed by public adjusters involve systematic assessment of granule loss, dents, and potential structural compromise.

| Inspection Component | Documentation Method |

|---|---|

| Impact Points | High-resolution photos |

| Granule Loss | Test square analysis |

| Structural Integrity | Video documentation |

| Surface Damage | Detailed measurements |

| Hidden Issues | Technical assessment |

Public adjusters utilize test squares and specialized evaluation techniques to quantify damage extent, ensuring all issues are properly recorded for insurance claims. Their meticulous documentation helps prevent disputes over repair versus replacement decisions and supports maximum claim settlements.

Public Adjuster Reviews Policy For Hidden Roofing Coverage & Helps Maximize Policy Benefits

Leveraging their expertise in insurance policies, public adjusters conduct thorough reviews to uncover hidden coverage options and maximize benefits for flat roof hail damage claims. Through extensive policy analysis, they identify potential coverage gaps and guarantee all damages are properly documented for peak compensation. Their coverage enhancement process includes collaborating with roofing contractors and meticulously reviewing policy exclusions. By staying updated on industry trends and practices, public adjusters provide valuable insights, including roof repair and replacement tips that can further aid property owners in navigating the claims process. This comprehensive approach ensures that clients not only receive fair compensation but also gain knowledge on how to address future damage effectively. Ultimately, their goal is to empower homeowners with the information necessary to make informed decisions about their property and its upkeep.

| Process Step | Key Actions | Outcome |

|---|---|---|

| Initial Review | Policy analysis, exclusion assessment | Identify coverage scope |

| Documentation | Damage evidence collection, contractor consultation | Support claim validity |

| Claim Filing | Submit extensive documentation, meet deadlines | Initiate process |

| Follow-up | Monitor claim progress, appeal if necessary | Maximize payout |

The adjuster's expertise helps navigate complex insurance terminology while ensuring claims aren't undervalued, typically charging 10-30% of the settlement amount based on state regulations.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Skilled public adjusters streamline the insurance claims process by serving as intermediaries between policyholders and insurance companies for flat roof hail damage claims. Among the key public adjuster benefits is their expertise in managing all aspects of communication and documentation with insurers, guaranteeing thorough field assessments and accurate damage identification.

- Initiates contact with insurance companies and handles all claim-related communications

- Coordinates and attends field assessments with insurance company adjusters

- Documents and submits extensive evidence of hail damage

- Conducts insurance negotiations to secure fair settlements

Public adjusters maintain professional relationships with insurance company representatives while advocating for policyholders' interests. Their involvement helps guarantee accurate damage classification, proper scope of work documentation, and appropriate settlement values for flat roof repairs or replacements.

Public Adjuster Gets Professional Assessments

After establishing communication channels with insurers, public adjusters initiate thorough professional assessments to fortify hail damage claims for flat roofs.

Their role involves coordinating with multiple experts to document and validate damage extensively, ensuring no aspect of the damage goes unnoticed or undocumented.

Professional assessments secured by public adjusters typically include:

- Core sampling analysis to evaluate subsurface damage and material integrity

- Thermal imaging scans to detect moisture infiltration and hidden structural issues

- Manufacturer inspections to verify damage impact on warranty compliance

- Expert reports with detailed photographic evidence and comparative analyses

These assessments provide essential documentation for claim negotiations, helping public adjusters establish the full scope of damage and necessary repairs while meeting insurance company requirements for claim validation.

Public Adjuster Gathers Supporting Evidence

Public adjusters meticulously compile thorough evidence portfolios to substantiate hail damage claims for flat roofs. Their expertise guarantees extensive documentation through high-quality photographs, videos, and precise measurements of hail impacts. Professional assessment reports and detailed damage quantification strengthen the claim's validity.

| Evidence Type | Documentation Method | Purpose |

|---|---|---|

| Physical Damage | Photos/Videos | Visual Proof |

| Storm Data | Weather Reports | Event Verification |

| Cost Analysis | Repair Estimates | Settlement Support |

The public adjuster's systematic approach includes gathering maintenance records, conducting witness interviews, and organizing repair estimates from qualified contractors. Their expertise in evidence collection proves invaluable when negotiating with insurance companies, as properly documented claims typically result in more favorable settlements. This methodical documentation process helps distinguish hail damage from other types of roof deterioration.

Public Adjuster Submits Complete Claims Package

When submitting a complete claims package for hail-damaged flat roofs, a thorough and methodical approach guarantees ideal results. Public adjuster tools encompass extensive documentation, expert analysis, and strategic presentation of evidence. The claims package essentials include detailed photographs, contractor estimates, and policy documentation to support the claim's validity.

| Component | Purpose | Impact |

|---|---|---|

| Photo Evidence | Documents Damage | Validates Claim |

| Cost Analysis | Details Expenses | Justifies Settlement |

| Policy Review | Confirms Coverage | Ensures Compliance |

The public adjuster coordinates with insurance companies, tracks claim progress, and facilitates negotiations to secure fair compensation. This systematic approach streamlines the claims process while maximizing the potential for successful outcomes and appropriate settlements for flat roof hail damage repairs.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Effectively managing follow-up procedures and time requirements stands at the core of a public adjuster's responsibilities during flat roof hail damage claims. Their systematic approach to the claim process guarantees all documentation, inspections, and communications proceed efficiently while meeting insurance company deadlines.

- Coordinates timely inspections with insurance adjusters and roofing professionals to document hail damage thoroughly.

- Manages all claim-related documentation, including damage evidence, repair estimates, and correspondence.

- Monitors claim status continuously through the insurance company's system to prevent delays.

- Provides policy guidance to guarantee policyholders understand their rights and coverage throughout the process.

This structured oversight by public adjusters streamlines the claims process while maintaining compliance with insurance company requirements, ultimately facilitating more efficient claim resolutions for flat roof hail damage.

Public Adjuster Enforces Policyholder's Rights, & Negotiates Higher & More Fair Settlement

Leveraging their expertise in insurance policies and claim negotiations, professional public adjusters vigorously advocate for policyholder rights while pursuing maximum settlements for flat roof hail damage claims. Their commitment to public adjuster ethics guarantees unbiased representation focused solely on policyholder empowerment throughout the claims process.

- Thoroughly documents all hail damage evidence, including hidden impacts and structural compromises.

- Interprets complex policy language to identify maximum coverage entitlements.

- Challenges unfair claim denials or inadequate settlement offers through strategic negotiation.

- Facilitates the appraisal process when disputes arise over damage valuation.

Public adjusters employ their technical expertise and legal knowledge to counterbalance insurance company interests, guaranteeing fair compensation for both obvious and subtle hail damage to flat roofs.

This professional representation often results in markedly higher settlement amounts compared to self-filed claims.

Public Adjuster Speeds Up Claim Settlement Time

Professional public adjusters dramatically accelerate the settlement process for flat roof hail damage claims through systematic documentation and strategic communication protocols.

Their expertise in expediting claims delivers significant public adjuster benefits through established procedures that minimize delays and maximize claim settlement efficiency.

Key steps in accelerating claim settlements include:

- Immediate damage assessment and documentation with extensive photographic evidence

- Strategic coordination of inspections between all involved parties

- Proactive management of communication channels with insurance providers

- Expert preparation and submission of detailed claim documentation

This systematic approach eliminates common bottlenecks in the claims process, reduces administrative delays, and guarantees all necessary documentation is properly submitted.

Public adjusters' thorough understanding of insurance policies and industry standards further streamlines the settlement timeline while maintaining claim accuracy.

Choosing & Working With Trusted Flat Roof Contractors

Having a public adjuster review contractor estimates provides an additional layer of protection against potential overcharging or unnecessary work. The adjuster's expertise helps verify that proposed repairs align with documented hail damage and industry-standard pricing. Their involvement can prevent contractors from inflating costs or including unrelated repairs in their estimates.

| Estimate Component | What Adjusters Review | Red Flags to Watch |

|---|---|---|

| Material Costs | Market-rate pricing | Inflated prices above market |

| Labor Hours | Industry standards | Excessive time estimates |

| Scope of Work | Damage correlation | Unrelated repairs included |

Let Your Public Adjuster Review Estimates To Ensure Contractor Honesty

While selecting a contractor for flat roof repairs is crucial, having estimates reviewed by a public adjuster adds an essential layer of protection against potential overcharging or unnecessary work.

Public adjuster benefits include thorough evaluation of contractor estimates for accuracy, completeness, and alignment with insurance coverage requirements.

A qualified public adjuster examines itemized costs, ensuring all necessary components are included while identifying any inflated prices or superfluous repairs.

This professional review helps validate contractor honesty and promotes transparency throughout the repair process.

Preventing Future Flat Roof Damage From Hail

To protect flat roofs from future hail damage, property owners can implement several preventive measures that greatly reduce the risk of costly repairs. Key strategies include applying protective coating applications and maintaining proper maintenance frequency through regular inspections.

| Prevention Strategy | Primary Benefit | Implementation |

|---|---|---|

| Elastomeric Coatings | Impact Resistance | Bi-annual Application |

| Regular Inspections | Early Issue Detection | Semi-annual Schedule |

| Impact-Resistant Materials | Enhanced Durability | During Replacement |

| Pre-storm Preparation | Damage Prevention | Seasonal Assessment |

Professional installation of impact-resistant materials combined with protective coatings provides ideal defense against hail damage. Regular maintenance inspections, particularly before storm seasons, help identify potential vulnerabilities. Property owners should also guarantee proper drainage systems and trim overhanging branches to minimize additional risks during severe weather events. These preventive measures, when implemented systematically, greatly extend roof longevity and reduce repair costs.

About The Public Claims Adjusters Network (PCAN)

Professional insurance advocates seeking information about the Public Claims Adjusters Network (PCAN) should note that verifiable details about this specific organization are limited.

However, public adjusters generally operate within established networks that provide extensive claims handling solutions for policyholders.

A benefits overview of working with licensed public adjusters includes expert policy interpretation, dedicated policyholder representation, and skilled settlement negotiation.

Adjuster qualifications typically include state licensing, demonstrated expertise in claims preparation, and adherence to ethical guidelines.

These professionals work exclusively for the insured party, receiving compensation as a percentage of the final settlement.

While specific PCAN information is unavailable, public adjusters must meet strict regulatory requirements and maintain professional standards while advocating for policyholders' interests in insurance claim settlements.

References

- https://hornbrothersroofing.com/why-flat-roofing-systems-are-more-vulnerable-to-hail-damage/

- https://embrysroofing.com/blog/flat-roof-hail-damage/

- https://roofreplacementcontractor.net/blogs/flat-roof-hail-damage-repair/

- https://730southexteriors.com/flat-roof-hail-damage/

- https://www.alpharoofingtexas.com/faq/flat-roofing-hail-hazards/

- https://www.kirberg.com/recognize-flat-roof-hail-damage/

- https://www.billraganroofing.com/blog/what-size-hail-damage-roof

- https://www.travelers.com/resources/weather/hail/identifying-hail-damage-to-your-roof

- https://www.angi.com/articles/what-size-hail-will-damage-roof.htm

- https://www.roofingservicesofnewengland.com/2020/07/29/flat-roofing-that-holds-up-in-hailstorms/