Wondering why fire damage claims can be such a maze to navigate? That’s where public adjusters become your secret weapon in the insurance battlefield. Think of them as your personal claim champions – they’re licensed pros who fight exclusively in your corner, not the insurance company’s. They understand the nuances of the claims process and can help you maximize your payout by ensuring every detail of your loss is accounted for. Additionally, if you’re dealing with lightning damage insurance claims explained, they can expertly guide you through the specific criteria and coverage options related to that type of incident. With their expertise, you can rest assured that your interests are prioritized while minimizing the stress of dealing with the insurance company.

Here's the game-changer: professional adjusters have been known to boost settlements by several times what you might get on your own. They're like property damage detectives, uncovering hidden issues that your untrained eye might miss – from smoke damage lurking in your HVAC system to structural weaknesses that aren't immediately visible.

When you're facing fire restoration costs that can climb as high as $75,000, you'll want someone who speaks the complex language of insurance policies and building codes. These experts work on contingency, typically taking a percentage of your final settlement, which means they're motivated to maximize your claim.

Just like you'd want a skilled mechanic for your luxury car, your substantial fire claim (especially those over $10,000) deserves a professional who can decode policy fine print, document every detail, and negotiate like a pro. They're particularly valuable when dealing with tricky situations like smoke residue, water damage from firefighting efforts, or disputed coverage areas.

Remember, you're not just paying for their service – you're investing in peace of mind and expertise that often pays for itself multiple times over.

Key Takeaways

- Public adjusters help secure settlements up to 800% higher than self-negotiated claims while working on a contingency fee basis.

- Professional adjusters possess technical construction knowledge and insurance policy expertise to identify hidden fire-related damages.

- Adjusters handle complex paperwork, documentation requirements, and negotiations with insurance companies, reducing stress for homeowners.

- Qualified adjusters evaluate total damages including smoke particles, structural issues, and water damage to ensure comprehensive claim coverage.

- Best results occur when public adjusters are contacted immediately after fire damage, especially for claims exceeding $10,000.

Chapter 1: Understanding Fire Damage

Ever wondered how a tiny spark can turn your cozy home into a disaster zone? Fire damage isn't just about those scary flames you see – it's like an unwelcome guest that leaves behind multiple calling cards.

Think of your home as a domino set. When fire strikes (usually from that forgotten pot on the stove, a rebellious electrical wire, or that old space heater that's seen better days), it triggers a chain reaction.

First comes the obvious culprit – flames dancing across your walls and furniture. But that's just the opening act.

The real drama unfolds behind the scenes. Smoke, like an invasive detective, sneaks into every nook and cranny, leaving its sooty fingerprints everywhere.

Your HVAC system? It becomes a superhighway for smoke particles, spreading them throughout your home faster than gossip at a family reunion.

But wait – there's a plot twist! The water used to fight the fire joins the party, creating its own chaos.

Picture this: while flames attack from above, water damage ambushes from below, and sneaky chemical residues play the long game, slowly munching away at your home's bones (aka structural integrity).

Want to know the scariest part? Some of these uninvited guests stick around long after the fire trucks leave, continuing their destructive house party when you least expect it. It's like dealing with a mystery that keeps unfolding, layer by layer, requiring expert eyes to spot and solve.

That's why experts recommend using trisodium phosphate cleaner to effectively tackle stubborn smoke damage on your walls and surfaces.

Common Causes Of Fire Damage

Did you know that your home's biggest fire threats might be hiding in plain sight? Let's dive into the real culprits behind residential fires and how you can outsmart them.

Picture your kitchen as a potential hotspot – it's where 50% of home fires begin. Just like a detective solving a case, understanding these patterns helps us prevent disasters.

Think of your stovetop as mission control: one moment of distraction while cooking could spark a grease fire faster than you can say "dinner's ready!"

The silent troublemaker? Your electrical system. Contributing to 35% of fire incidents, those innocent-looking outlets and hidden wires can pack quite a punch. Just as you wouldn't overload your plate at a buffet, avoid overwhelming your circuits with too many devices.

Heating equipment rounds out our fire-starting trio at 15%. Those cozy space heaters and hardworking furnaces need proper care – think of them as temperamental pets that require constant attention to stay safe.

🔥 Fire Risk Quick Guide:

- Kitchen mishaps: Watch those pots like a hawk!

- Electrical gremlins: Keep your wiring in check

- Heating heroes-turned-hazards: Give them space and maintenance

Weather wildcards like lightning strikes and carelessly discarded cigarettes might seem like minor players, but they're especially sneaky during those quiet night hours.

Remember, fires are like uninvited guests – the longer they go unnoticed, the more damage they cause.

Want to stay fire-smart? Regular maintenance isn't just a chore; it's your home's best defense against these flame-friendly foes. Think of it as giving your house a regular health check-up – prevention beats cure every time!

Creating a designated meeting spot outside your home ensures all family members can be quickly accounted for during an emergency.

The Impact Of Fire Damage On Your Home

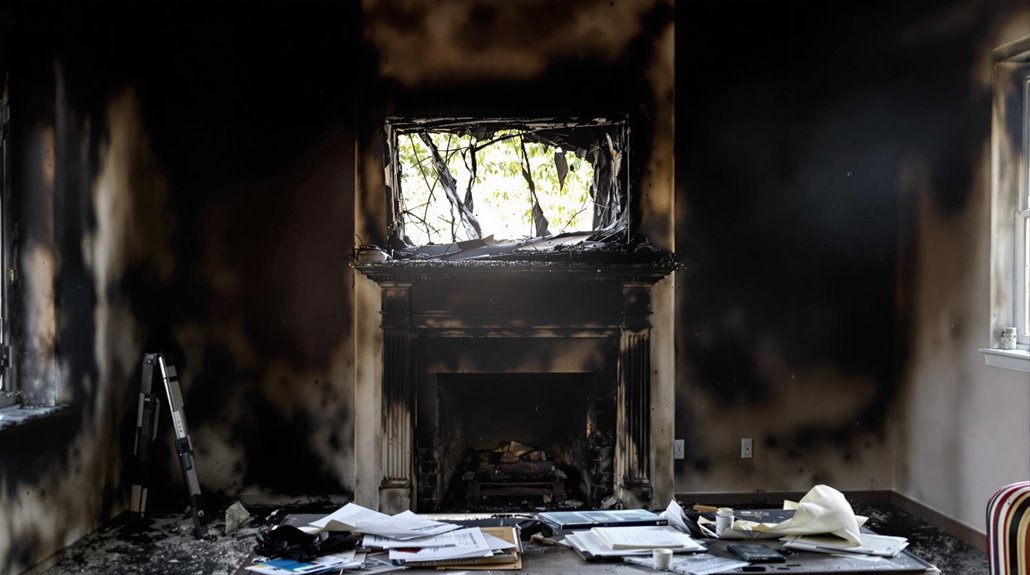

The Hidden Battle: Understanding Fire's Full Impact on Your Home

Ever wondered what happens to your home after the last fire truck leaves? It's not just about what you can see – fire launches a stealth attack that goes way beyond those scary flames. Think of your house like a complex puzzle where each piece faces its own unique challenge.

When temperatures skyrocket to a mind-boggling 1,500°F, your home experiences something similar to what happens when you drop a hot glass in cold water. This thermal shock creates a network of tiny cracks you might not even notice at first – like invisible spider webs spreading through your walls.

Let's break down the domino effect:

| Impact Zone | What You See | What's Lurking Beneath |

|---|---|---|

| Heat's Fury | Twisted materials | Foundation stress |

| Smoke's Revenge | Black residue | Air system invasion |

| Water's Aftermath | Soaked interiors | Sneaky mold invasion |

| Hidden Damage | Surface cracks | Internal structure stress |

Those microscopic smoke particles (smaller than a human hair at 0.1 microns) are particularly sneaky – they're like uninvited guests that make themselves at home in your walls and ventilation system. And here's the kicker: while you're dealing with the fire's aftermath, water from firefighting efforts starts its own timer. You've got just 48 hours before potential mold decides to join the party.

Want to protect your investment? Quick action and professional help aren't just recommendations – they're your best defense against this cascade of challenges.

Released toxic chemicals and carcinogens can linger long after the flames are extinguished, making professional remediation essential for your safety.

Chapter 2: How Much Will Professional Fire Damage Restoration Cost?

Want to know what fire damage restoration really costs? Let's break down these numbers together – because nobody likes surprise bills after dealing with fire damage!

Think of fire restoration like fixing a car after an accident – the costs depend on how bad the damage is. While a typical home restoration averages $12,500, you're looking at anything from $3,000 for a small kitchen fire to a whopping $40,000+ when structural repairs enter the picture.

Working with certified IICRC technicians ensures professional restoration that meets industry standards for fire and smoke damage repair.

Here's what influences your final bill:

- Property size (bigger space = bigger investment)

- Damage severity (surface smoke vs. deep structural damage)

- Required services (from basic cleanup to complete rebuilding)

- Hidden complications (like water damage from firefighting)

Let's peek at the cost breakdown (spoiler: it might make your eyes water):

| Service Component | Average Cost Range |

|---|---|

| Basic Fire Restoration | $4-$6.50/sq ft |

| Severe Structural Damage | $25-$35/sq ft |

| Smoke Removal | $2,000-$6,000 |

| Water Damage Remediation | $3.75-$7/sq ft |

Did you know? The trickiest part isn't always the visible fire damage – it's often the hidden smoke damage lurking in your ventilation system or the water damage from those life-saving fire hoses. Think of it as an onion – there are many layers to peel back during restoration.

Remember: These numbers are ballpark figures. Your actual costs might vary based on your location, the restoration company you choose, and those unexpected surprises that love to pop up during repairs.

Typical Fire Damage Restoration Costs

Ever wondered what it really takes to bounce back after a fire? Let's break down the restoration journey that many homeowners face – it's more complex than you might think!

Think of fire damage restoration like rebuilding a puzzle, where each piece comes with its own price tag. Most homeowners find themselves investing between $3,000 and $40,000 for complete recovery, though severe cases can climb up to $75,000. Why such a wide range? It's all about the domino effect of damage.

Your restoration roadmap typically includes:

- Initial cleanup: Picture this as the first aid phase, costing $4-$6.50 per square foot

- Structural healing: The heavy lifting part at $25-$30 per square foot

- Smoke's sneaky aftermath: Typically runs $2,000-$6,000

- Water damage (yes, from firefighting!): Ranges from $2.50-$7 per square foot

Did you know that the water used to save your home often accounts for about a quarter of your total restoration bill? It's like dealing with two disasters in one – fire and flood.

The entire restoration process is like orchestrating a symphony, with multiple specialists working in harmony for 2-6 weeks to bring your home back to life. Working with public adjusters can help ensure you receive the maximum settlement possible for these extensive restoration costs.

Emergency Service Price Factors

Ever wondered what goes into those emergency fire damage restoration bills? Let's break down the pricing puzzle together!

Think of fire damage restoration like a complex recipe – every ingredient affects the final cost.

First up, we're talking about the damage footprint. Just like a tiny scratch versus a major dent on your car, the size and severity of fire damage dramatically shape your restoration budget.

Time is literally money in this game! The faster pros can jump into action, the better chance you've got at preventing those sneaky secondary problems. You know, like when smoke decides to play hide-and-seek in your walls or water from firefighting efforts throws an unwanted house party.

Your restoration team's expertise level plays a huge role too. Some jobs need specialized pros with high-tech equipment – imagine trying to restore a vintage guitar collection versus cleaning a concrete floor. Each material tells its own story and demands different treatment approaches.

Location and timing? They're the wild cards! If you're living off the beaten path or facing an emergency at 3 AM, expect to pay premium rates. It's like calling for pizza delivery during a snowstorm – convenience comes at a cost.

From delicate antiques requiring surgical precision to hazardous materials needing special handling, each unique challenge adds another layer to the pricing equation. Understanding these factors helps you grasp why no two fire restoration projects ever cost exactly the same.

Professional restorers can maximize recovery by evaluating hidden damage, including structural integrity and lingering odors that might not be immediately apparent.

Labor & Material Expenses

Ever wondered what goes into those fire restoration bills? Let's dive into the nitty-gritty of bringing your property back to life after a fire. Think of it as piecing together a complex puzzle – you've got the labor pieces and the material pieces, each playing a crucial role in the restoration story.

Working with public insurance adjusters can significantly improve your chances of receiving fair compensation for both labor and material costs in complex fire damage claims.

The Labor Chronicles

Skilled restoration experts don't come cheap, and for good reason. These fire damage warriors charge between $50-150 per hour, wielding their expertise to breathe new life into damaged spaces.

Materials, on the other hand, typically eat up 40-60% of your total restoration budget – think specialized cleaning agents, replacement materials, and state-of-the-art equipment.

Your Restoration Roadmap: Service Breakdown

🔥 Basic Restoration: $50-150/hr (time varies by damage extent)

🧹 Smoke Removal: $200-600 per room (1-3 days to clear the air)

🛡️ Emergency Board-up: $500-1000 (immediate protection)

💧 Water Mitigation: $70-90/hr (3-5 days to dry out)

🧪 Decontamination: $200-600 per room (2-4 days for safety)

Why Document Everything?

Just as a detective needs evidence to solve a case, you'll need solid documentation to maximize your insurance settlement. Each receipt, every labor hour, and all material costs tell the story of your property's journey from damaged to restored.

Think of it as building your case for fair compensation – the more detailed your records, the stronger your position when negotiating with insurance providers.

Hidden Damage Cost Variables

Ever wonder what's really hiding in your walls after a fire? Let's dive into the sneaky costs that most property owners don't see coming – think of it as solving a costly puzzle where every hidden piece matters!

Picture this: you're looking at fire damage that seems manageable, but just like an iceberg, the real challenges lie beneath the surface.

I've seen countless property owners breathe a sigh of relief too soon, only to discover a web of interconnected issues that can send restoration budgets through the roof.

The silent troublemakers? They're craftier than you'd think:

- Smoke particles playing hide-and-seek in your insulation (+20-40% to costs)

- Weakened support beams playing a dangerous game of Jenga (+30-50% to costs)

- Your HVAC system turning into an unwanted damage delivery system (+25-35% to costs)

But here's the kicker – water from firefighting efforts doesn't just dry up and disappear. It's like giving mold a VIP pass to your property's after-party.

And that soot? It's not just sitting pretty – it's actively corroding surfaces while you're planning repairs.

Think of damage assessment as a medical check-up for your property. Just like how doctors don't just treat visible symptoms, professional restoration experts need to dig deeper.

Your building's health depends on catching these hidden issues before they transform into major headaches.

Want to stay ahead of the game? Document everything meticulously – it's your insurance claim's best friend. Remember, what you can't see CAN hurt your wallet!

Installing a home sprinkler system can reduce your risk of extensive fire damage by up to 80% in future incidents.

Chapter 3: Insurance Basics For Homeowners

Let's Decode Your Home Insurance: A Fire Safety Guide

Ever wondered what's really hiding in those pages of your homeowners insurance policy? When it comes to fire protection, think of your policy as a safety net – but one you need to understand before you're hanging from it!

Your fire coverage is like a three-layer cake:

- The foundation: Dwelling coverage (protects your home's structure)

- The filling: Personal property protection (safeguards your belongings)

- The topping: Additional living expenses (helps you stay afloat if you're displaced)

But here's where it gets interesting – your policy speaks its own language.

Like choosing between actual cash value (what your stuff's worth today) and replacement cost (what it costs to buy new). It's kind of like picking between getting the current value of your old smartphone versus the price of the latest model.

Watch out for those sneaky exclusions and deductibles! They're the fine print that could make or break your claim. Think of your deductible as your skin in the game – you'll need to pitch in this amount before your insurance kicks in.

Consider getting extended replacement cost coverage which provides an extra 10% to 50% protection above your dwelling coverage limit for unexpected rebuild expenses.

Understanding Your Homeowners Insurance Policy

Think of your homeowners insurance policy as your home's financial safety net – it's not just a document, it's your protection plan when life throws curveballs your way.

Let's break down what you really need to know about keeping your biggest investment safe.

Your declarations page can be easily accessed through your insurance provider's online portal or by contacting your agent directly.

What's Actually in Your Policy?

Your home insurance is like a Swiss Army knife of protection, with different tools for different challenges:

- Home Sweet Home Protection: Covers your actual house structure and anything permanently attached (think built-in appliances and that fancy deck you just added)

- Your Stuff Matters: Safeguards everything inside, from your grandmother's antique mirror to your latest tech gadgets (pro tip: replacement cost value gives you more bang for your buck than actual cash value)

- Plan B Living: Helps foot the bill when you need temporary digs during repairs (because hotel life isn't cheap!)

- The "Oops" Shield: Protects you when someone gets hurt on your property or you accidentally damage someone else's stuff

Getting Smart About Coverage

You wouldn't buy a car without checking under the hood, right? Same goes for your insurance policy.

Dig into that declarations page – it's your roadmap to understanding:

- What you'll pay out-of-pocket (your deductible)

- Maximum coverage limits (how much insurance will actually pay)

- Special add-ons for specific situations (like that home office you just set up)

Understanding these elements isn't just insurance-speak – it's your ticket to smoother sailing when you need to file a claim.

Key Terms & Definitions Related To Fire Damage Claims

Navigating Fire Damage Insurance Claims: Your Essential Guide

Ever wondered why some homeowners breeze through fire damage claims while others struggle? It all comes down to understanding five game-changing insurance terms that can make or break your claim's success.

Let's crack the code of insurance lingo together:

ACV vs. RCV: The Value Battle

Think of Actual Cash Value (ACV) as what you'd get for your items at a yard sale – depreciated value. Replacement Cost Value (RCV), however, is like having a "new-for-old" guarantee. The difference can be thousands of dollars in your pocket!

The Deductible Dance

Your deductible is like the cover charge at a club – you've got to pay to play. Before insurance kicks in, you'll need to contribute this amount from your pocket.

Smart tip: Choose a deductible that balances affordable premiums with manageable out-of-pocket costs.

Loss of Use: Your Safety Net

When fire forces you out of your home, Loss of Use coverage becomes your financial lifeline. It's like having a backup plan that covers hotel stays, restaurant meals, and other temporary living expenses while your home gets back on its feet.

Property Coverage: The Dynamic Duo

Think of this as two separate shields: one protecting your house's structure (dwelling coverage) and another safeguarding your belongings (personal property coverage). Each has its own limits and rules – knowing the difference is crucial!

Working with public adjusters can boost your insurance claim settlement by 30-50% compared to handling it alone.

Remember: Your Proof of Loss document is like your insurance claim's resume – it needs to showcase these components clearly and accurately to land you the best possible settlement. Wouldn't you rather be prepared than caught off guard when disaster strikes?

Chapter 4: Types Of Fire Damage Covered By Homeowners Insurance

Ever wondered what keeps insurance adjusters up at night? Fire damage claims top their list, and for good reason.

Let's dive into the real-world scenarios that could turn your cozy home into an insurance claim statistic.

Think of your home as a complex ecosystem where three fiery culprits love to cause chaos:

1. Kitchen Chaos: The Heart of Home Hazards

Your kitchen might be a culinary paradise, but it's also prime territory for fire incidents. Whether it's that forgotten pan of sizzling bacon or a grease fire that spiraled out of control, kitchen-related claims typically set homeowners back $30,000-50,000.

2. Electrical Gremlins: The Hidden Threat

Like silent troublemakers hiding in your walls, faulty wiring and overloaded circuits can spark serious problems. These sneaky electrical fires often lead to the most expensive claims, ranging from $45,000-75,000.

When your smart home isn't so smart after all, the price tag can make your wallet weep.

3. Heating Headaches: When Warmth Goes Wrong

Your trusty heating system works overtime to keep you cozy, but skip maintenance, and it might decide to throw a dangerous tantrum. System malfunctions and poor upkeep can trigger fires costing $40,000-65,000 to fix.

Pro Tip: While these numbers might make you break into a cold sweat, remember that prevention is your best friend. Regular maintenance checks, smart cooking habits, and up-to-date wiring aren't just safety measures – they're your insurance policy's best friends too!

Having loss of use coverage can provide essential financial support for temporary housing if your home becomes uninhabitable due to fire damage.

What Are The Most Common Fire Damage Insurance Claims?

Ever wondered what keeps insurance adjusters busiest when it comes to fire claims? Let's dive into the world of fire damage insurance – it's more fascinating than you might think!

Think of your home as a complex puzzle, where fire can impact each piece differently. When disaster strikes, knowing what's typically covered can be your financial lifeline.

With 358,000 home fires occurring annually in the US, having the right coverage is crucial for protecting your property and belongings.

Top Fire Insurance Claims That'll Make You Check Your Policy:

- The Big One: Structural Damage

- Your home's backbone – from crispy roof trusses to weakened foundations

- Interior walls that look like they've been through a barbecue gone wrong

- Melted siding and warped window frames

- Your Precious Belongings

- Everything from that comfy couch to your grandma's antique clock

- Electronics that didn't survive the heat

- Clothing and personal items that smell like a forgotten campfire

- The Silent Troublemakers

- Smoke damage that sneaks into every nook and cranny

- Water damage (plot twist: sometimes firefighters cause more water damage than fire damage!)

- Hidden damages like compromised electrical systems

Pro tip: Did you know smoke damage can affect rooms the fire never touched? It's like having an unwanted house guest that leaves its mark everywhere!

Don't wait for disaster to strike – document your belongings now (yes, that means taking photos of your stuff before anything happens). Trust me, future you will be incredibly grateful for this basic prep work.

Remember: Insurance companies appreciate detailed evidence like a food critic appreciates a well-plated meal. The more documentation you have, the smoother your claim process will be.

🔥 Quick Action Steps:

- Inventory your valuables

- Store important documents digitally

- Keep receipts for major purchases

- Update your policy annually

Stay prepared, stay protected, and let's hope you never need to use this knowledge!

Chapter 5: Coverage Exclusions & Limitations For Fire Damage

Fire Insurance Exclusions: What Your Policy Won't Cover (And Why You Need to Know)

Think your fire insurance covers everything? Let's dive into the surprising gaps that might leave you feeling the heat. Just like a safety net with intentional holes, your policy comes with specific exclusions that could make or break your claim.

Did you know your property could lose coverage just by sitting empty? Most insurers hit the pause button on protection after 30-60 days of vacancy – it's like having an expiration date on your safety net. And when it comes to those family heirlooms or that vintage guitar collection, standard policies often pump the brakes with strict dollar limits.

Only flood insurance policies provide protection against flood-related fire damage, which standard homeowners insurance excludes.

Key Coverage Gaps to Watch For:

- War damage and nuclear incidents (because some risks are just too big)

- Intentionally set fires (sorry, no insurance for arson)

- Building code upgrades (unless you've specifically added this protection)

- External smoke damage (yes, your neighbor's bonfire mishap might not be covered)

| What's Limited | Why It Matters |

|---|---|

| Vacant Homes | Coverage drops after 30-60 days |

| Valuables | Dollar caps restrict protection |

| Building Codes | Updates often need extra coverage |

| Smoke Issues | External sources may not qualify |

| Special Items | Specific limits apply |

Ready to outsmart these limitations? Start by treating your policy like a treasure map – every exclusion is a potential pitfall you'll want to navigate around. Consider adding endorsements for extra protection, especially for those building code requirements that pop up during repairs. And remember, documenting everything isn't just good practice – it's your best friend when claim time rolls around.

Want to avoid surprises? Schedule a policy review with your agent and ask the tough questions. After all, understanding what's not covered is just as crucial as knowing what is.

Chapter 6: Should You File A Fire Damage Claim?

Filing a Fire Damage Claim: What You Need to Know

Ever wonder if filing a fire damage claim is the right move? Let's dive into this hot topic (pun intended!) and help you make a smart decision that won't leave you burned financially.

Is Your Claim Worth Filing?

Think of your insurance claim like a game of financial chess – every move matters. Before you make that call to your insurance company, let's break down the crucial factors:

Money Matters:

- Add up your total damage costs

- Subtract your deductible

- Factor in potential premium hikes

- Consider your emergency savings cushion

Beyond the Obvious Damage:

- Hidden smoke damage in walls and fabrics

- Lingering soot in air ducts and surfaces

- Water damage from firefighting efforts

- Structural integrity concerns

Smart Documentation Strategies:

- Take detailed photos and videos

- Keep all receipts and estimates

- Create a room-by-room inventory

- Record conversations with contractors

Pro Tips for Success:

- Get multiple repair estimates

- Consider hiring a public adjuster

- Document everything before cleanup begins

- Research your policy's specific coverage limits

The Long Game:

Remember, filing a claim is like using a lifeline on Who Wants to Be a Millionaire – you want to save it for when you really need it.

Small claims might cost you more in the long run through increased premiums, while major damages absolutely warrant insurance intervention.

Bottom Line:

Your decision should balance immediate financial relief against long-term insurance costs. When in doubt, consult with a trusted public adjuster who can help you navigate these choppy waters.

Chapter 7: Introduction To Public Adjusters

The Ultimate Guide to Public Adjusters: Your Insurance Claim Secret Weapon

Ever wondered why some people get way more from their fire insurance claims than others? Enter public adjusters – your personal insurance claim champions who work exclusively for you, not the insurance company. Think of them as your skilled negotiators in the complex world of insurance settlements.

Why Should You Care About Public Adjusters?

Let's cut to the chase: when disaster strikes, having a public adjuster in your corner can be a game-changer.

Studies reveal that policyholders who team up with these pros often secure settlements up to 800% higher than those who go it alone. It's like having a seasoned poker player represent you at a high-stakes table!

What Makes Public Adjusters Different?

Unlike insurance company adjusters (who work for the insurer), public adjusters are your dedicated advocates.

They work on contingency, typically taking 10-20% of your settlement – meaning they only win when you win. Pretty fair deal, right?

Here's What They Bring to the Table:

- Deep-dive damage assessments that catch everything insurers might "overlook"

- Expert policy interpretation (because let's face it, insurance-speak is like a foreign language)

- Strategic negotiation skills that level the playing field

- Professional documentation that turns your claim into an airtight case

Want to maximize your claim? Time is crucial.

The sooner you bring in a public adjuster, the better they can document evidence, assess damage, and build your case. It's like having a detective gather evidence while it's still fresh!

All public adjusters must maintain state insurance licenses and undergo continuous education to legally represent policyholders.

The Role Of A Public Adjuster In Fire Damage Insurance Claims

Has a fire turned your world upside down? Let's talk about your secret weapon in the insurance claims battlefield – the public adjuster.

Think of a public adjuster as your personal claims champion, fighting in your corner when fire damage leaves you feeling lost in a maze of paperwork and procedures. They're like insurance detectives, uncovering every bit of damage that might slip through the cracks of an ordinary inspection.

What makes these pros worth their salt? For starters, they speak "insurance language" fluently and know exactly how to document your losses.

Imagine trying to solve a complex puzzle – while you might see the obvious pieces, they'll spot the subtle patterns that complete the bigger picture.

Did you know property owners who team up with public adjusters often walk away with significantly higher settlements? The numbers tell quite a story – settlements can jump anywhere from 35% to 200% compared to going it alone.

Why? Because these experts know the ins and outs of building codes, policy fine print, and negotiation strategies that most of us wouldn't even think about.

The best part? You won't need to shell out money upfront. Public adjusters work on contingency, meaning they only get paid when you get paid.

While you focus on getting your life back on track, they're busy ensuring every scorched corner and smoke-damaged item is accounted for in your claim.

Remember – when fire strikes, you don't have to navigate the claims labyrinth alone. A public adjuster can be your compass, guide, and advocate all rolled into one.

Their construction backgrounds and expertise allow them to provide more accurate damage evaluations than the average inspector could achieve.

Benefits Of Using A Public Adjuster For Fire Damage Claims

Is Your Fire Damage Claim Getting the Attention It Deserves?

Think of a public adjuster as your personal insurance claim champion – someone who fights in your corner when fire turns your world upside down. They're like having a skilled detective and negotiator rolled into one, uncovering every bit of damage that deserves compensation.

Want to know what makes hiring a public adjuster a game-changer? Property owners who team up with these pros often secure settlements 35-200% higher than those who go it alone. It's like having an expert treasure hunter who knows exactly where to look!

| Smart Solutions | Real Results |

|---|---|

| Money Matters | Maximum settlements, detailed damage discovery |

| Knowledge Power | Insurance-speak translation, damage detection expertise |

| Peace of Mind | Stress-free process, paperwork handled, pro-level negotiations |

Ever wondered about that lingering smoke smell or hidden water damage? Public adjusters are masters at spotting these sneaky problems that insurance companies might miss. They work on contingency, which means they're invested in your success – they only win when you win.

You wouldn't represent yourself in court, right? Similarly, having a public adjuster means you've got an industry insider who speaks the complex language of insurance policies, building codes, and claims procedures. While you focus on getting your life back on track, they're busy ensuring every dollar you deserve finds its way to your settlement.

Let's face it – dealing with fire damage is tough enough. Why navigate the claims maze alone when you can have a professional guide leading the way?

Their technical construction knowledge helps identify both obvious and concealed damages that could impact your claim's value.

How Are Public Adjusters Paid & What Are Their Fees?

Wondering How Public Adjusters Get Paid? Let's Break It Down!

Think of public adjusters as your insurance claim champions who only win when you win. They work on what's called a contingency basis – meaning they don't get paid unless you get paid. Pretty fair, right?

| Fee Component | Let's Talk Numbers |

|---|---|

| Success Fee | 10-20% of your win |

| When They Get Paid | Only after you're paid |

| Upfront Costs | Zero, nada, zilch |

| Payment Structure | No settlement = no fee |

Here's the real kicker – while giving up 10-20% might sound steep at first, most people who team up with public adjusters end up with way bigger settlements. We're talking potential increases of up to 800% compared to going solo! It's like having a seasoned pro negotiate your salary instead of walking into that meeting alone.

Ever tried navigating an insurance claim by yourself? It's like trying to solve a Rubik's cube blindfolded. Public adjusters know all the moves, speak the insurance lingo, and fight to maximize your payout. They'll document every detail, negotiate like pros, and ensure you don't leave money on the table.

Remember: Their success is literally tied to yours – the better they do for you, the better they do for themselves. It's a win-win partnership that typically pays for itself many times over in the final settlement amount.

In Texas, public adjuster fees are capped at 10% of the total insurance claim settlement to ensure fair practices within the industry.

Public Adjusters Vs. The Insurance Company Adjuster

Ever wondered why some fire damage claims hit the jackpot while others fall flat? Let's dive into the fascinating world of insurance adjusters – the tale of two professionals who couldn't be more different!

Think of public adjusters as your personal claims champions, fighting exclusively in your corner when disaster strikes. Meanwhile, insurance company adjusters are like company quarterbacks, trained to protect their team's endzone (and bottom line).

Breaking it down:

| Game-Changing Factors | Your Claims Champion (Public) | Company's Player (Insurance) |

|---|---|---|

| Loyalty Lies With | You, the policyholder | Their employer |

| Paycheck Source | Success-based commission | Regular company salary |

| Juggling Act | Focused attention on fewer cases | Drowning in paperwork |

Here's the kicker – public adjusters typically help homeowners score 35-200% higher settlements. Why? They're like building code ninjas with a Ph.D. in policy fine print! They meticulously document every scratch, scorch, and structural issue, leaving no stone unturned.

The best part? They only get paid when you win. Working on contingency (usually 10-30% of the settlement), they're motivated to unleash their full expertise in maximizing your claim. It's like having a seasoned detective on your case who only collects if they crack it!

Think of it this way: Would you represent yourself in court, or hire an expert lawyer? Your insurance claim deserves the same level of professional advocacy – especially when flames have turned your world upside down.

For complex claims involving multiple parties or coverage disputes, bad faith practices by insurers often require both public adjusters and attorneys working together for the best outcome.

Public Adjusters Vs. Bad Faith & Property Damage Lawyers – Which To Hire & When

Stuck in an insurance claim nightmare? Let's clear up the confusion between public adjusters and property damage lawyers – your potential allies in the claims battlefield.

Think of public adjusters as your claim's first responders. They jump into action right after disaster strikes, documenting every crack, leak, and broken piece with the precision of a CSI investigator. But when your insurance company plays hardball or flat-out denies your claim? That's when property damage lawyers step in as your legal warriors.

Public adjusters have proven their value with settlements increased 747% compared to unrepresented claims.

Here's the real deal on who does what:

| Factor | Public Adjuster | Property Damage Lawyer |

|---|---|---|

| Timing | Day one heroes | Last-resort champions |

| Expertise | Claim wizards & negotiators | Legal eagles & courtroom pros |

| Cost | 10-30% slice of the pie | 33-40% if they win |

| Battlefield | Insurance company tables | Courtroom trenches |

| Sweet spot | Fresh claims needing muscle | When insurers play dirty |

Ever watched a skilled negotiator at work? That's your public adjuster, armed with documentation and industry know-how, fighting for every dollar you deserve. But when negotiations hit a wall, property damage lawyers bring out the legal big guns, potentially unlocking additional damages for bad faith behavior.

Remember: While public adjusters are your claims quarterbacks, leading the initial charge, lawyers are your nuclear option – best deployed when insurance companies cross the line from difficult to downright unfair. The key? Knowing when to pass the baton from one to the other.

Want the best results? Don't wait until you're drowning in claim paperwork or buried under denial letters. The right professional at the right time can mean the difference between a fair settlement and years of frustration.

When To Contact A Public Adjuster For A Fire Damage Claim

Has Fire Damage Turned Your World Upside Down? Know When to Call a Public Adjuster

Think of a public adjuster as your personal fire damage detective – someone who's got your back when smoke clears and reality hits. But timing? It's everything. Let's break down when you should pick up that phone.

Critical Moments That Scream "Call a Public Adjuster!"

| When It Happens | What You Need | Why It's Crucial |

|---|---|---|

| Right After the Fire | Immediate Support | Preserves vital evidence |

| Major Damage ($10K+) | Expert Eyes | Prevents costly mistakes |

| Insurance Lowballing | Professional Backup | Fights for fair value |

| Hidden Smoke Issues | Technical Know-how | Uncovers masked damage |

| Need to Relocate | Expense Tracking | Ensures full reimbursement |

Ever tried solving a puzzle with missing pieces? That's what handling a fire claim alone feels like. You'll want a public adjuster on speed dial especially if:

- Your kitchen looks more like a charcoal sketch than a cooking space

- Smoke decided to redecorate your entire home (it's not as artistic as it sounds)

- The insurance company's offer wouldn't cover your dog's house, let alone yours

- You're playing musical houses while repairs happen

Remember: Like a first responder to your wallet's emergency, a public adjuster works best when called early. They'll translate that insurance-speak into plain English and make sure every scorched socket and smoky curtain gets its fair value in your claim.

Don't let the ashes settle before making that call – your claim's success might just depend on it.

Chapter 8: When To Contact Your Insurance Provider For Fire Damage Claims

Don't Let Fire Damage Burn Through Your Insurance Rights: A Smart Guide to Claims

Has your property suffered fire damage? Time is of the essence when it comes to protecting your investment. Let's walk through when and how to contact your insurance provider – because timing can make or break your claim success.

The Golden 24-Hour Window

Think of insurance claims like emergency medical care – the sooner you act, the better your chances of recovery.

Contact your insurance provider within 24 hours of the fire incident, even if you're still processing what happened. This quick action shows you're proactive and helps establish a solid claim foundation.

Public Adjuster or DIY? Choose Your Path Early

Whether you're teaming up with a public adjuster (your personal claims champion) or tackling the process solo, make that decision fast.

If you're leaning toward hiring an adjuster, bring them on board before filing – they're like GPS for your claims journey, helping you navigate tricky policy terrain.

Essential Steps for Claim Success:

- Document everything like a crime scene investigator – photos, videos, damaged item lists

- Create a paper trail of every conversation with your insurance company

- Stay on top of deadlines like they're urgent work meetings

- Keep pushing your claim forward with regular follow-ups

Pro Tip: Your smartphone is your best friend here – use it to timestamp photos and record conversations (with permission) during insurance inspections. Remember, you're building a bulletproof case for your claim, not just filing paperwork.

If Using A Public Adjuster

Navigating Insurance Claims with Your Public Adjuster: A Smart Strategy

Got a public adjuster on your team? Smart move! Think of them as your personal insurance claim quarterback, calling the plays to maximize your settlement.

First things first: you'll need to notify your insurance company about the damage within that crucial 24-48 hour window.

But here's where it gets interesting – make sure your public adjuster is looped into every single conversation from day one. Why? Because they're your expert eyes and ears, catching details you might miss.

Your public adjuster becomes your claims guardian, wearing multiple hats throughout the process:

- They'll fine-tune your insurance paperwork before it hits the insurer's desk

- They'll coordinate and oversee property inspections (think of them as your quality control)

- They'll decode your policy's fine print (goodbye, insurance jargon headaches!)

- They'll time your settlement negotiations just right (like a chess master planning their moves)

Remember, documentation is king in the insurance world, and your public adjuster knows exactly what evidence to collect and present. They're essentially translating your fire damage into the language insurance companies understand best – detailed proof and precise valuations.

Let them be your advocate while you focus on getting your life back to normal. After all, that's what they're there for – turning a complex claims process into a manageable journey with a better outcome.

If Filing On Your Own

Thinking of Filing Your Fire Damage Claim Solo? Here's Your Roadmap

Let's face it – handling a fire damage claim by yourself is like being your own captain through stormy waters. While it's totally doable, you'll need to stay sharp and organized to secure the compensation you deserve.

First things first: time is of the essence! Ring up your insurance company within 24-48 hours after the fire. It's crucial – just like calling 911 in an emergency.

Before you even think about touching anything or starting cleanup, grab your phone and become a documentation ninja. Snap detailed photos and record videos of every scorched corner and smoke-damaged item.

Remember the golden rule: don't lift a finger for repairs until your insurance company gives you the green light. Think of it as a crime scene – you wouldn't want to tamper with the evidence, right?

Want to make your claim bulletproof? Create a paper trail that would make a detective proud:

- Keep a detailed diary of all insurance conversations

- Save every receipt (yes, even that $5 tarp)

- Create a digital folder for all claim-related documents

- Document new damage discoveries immediately

If you spot additional damage after filing your initial claim, don't sit on it! Contact your insurer right away – think of it as adding a PS to an important letter. Your thoroughness now can save you headaches later.

Pro tip: Consider starting a digital claim journal on your phone – it's like having a personal assistant keeping track of everything while you focus on recovery.

Chapter 9: Filing Process For Fire Damage Insurance Claims (Without Public Adjuster)

The Fire Insurance Claim DIY Guide: Navigate Your Claim Like a Pro

Ever wondered how to tackle a fire damage claim without bringing in a public adjuster? Let's walk through this together – it's like building your case for a courtroom, except you're your own advocate.

First things first: Your smartphone is your new best friend. Before touching anything, snap those photos like you're documenting a crime scene. Why? Because every scorch mark, every piece of damaged furniture tells your story to the insurance company.

Time-stamp these photos – they're your proof of what happened and when.

Got your photos? Now let's sprint into action. You've got a 48-hour window to notify your insurer – think of it as your golden ticket to starting the claims process. Don't worry about perfect documentation yet; just get the ball rolling with basic incident details.

Here's where your inner detective comes in handy. Create a damage inventory that would make Sherlock proud:

- What got damaged?

- When did you buy it?

- How much did it cost?

- What's it worth now?

Pro tip: Don't rely solely on the insurance company's adjuster. They're looking at your claim through their company's lens. Bring in independent contractors and restoration experts – they're like your expert witnesses, providing unbiased assessments of damage and repair costs.

Remember: You're not just filing a claim; you're building a bulletproof case for fair compensation. Each document, photo, and expert opinion is another brick in your wall of evidence. Keep everything organized, dated, and readily accessible – your future self will thank you!

Document Fire Damage Thoroughly

Got Fire Damage? Here's Your Ultimate Documentation Survival Guide

Think of documenting fire damage like building your case as a detective – every piece of evidence counts! Let's walk through how you can create an airtight record that'll make your insurance claim rock-solid.

🔥 Your Documentation Arsenal:

| Must-Have Evidence | Smart Tips |

|---|---|

| Photos & Videos | Snap like a pro: panoramas, close-ups, and even drone shots if possible |

| Damage Inventory | Create your "fire diary" – from charred furniture to smoke-stained walls |

| Material Samples | Grab those telling pieces (safely!) that show the fire's signature |

| Money Trail | Track every penny spent on recovery – yes, even those small purchases count |

| Conversation Records | Keep a play-by-play of who said what and when |

Why such detective work? Because your insurance adjuster needs to see the whole story! Think of your documentation as painting a picture – the more detailed your strokes, the clearer the image becomes.

Pro Tips:

- Use your smartphone's timestamp feature

- Create a digital backup of everything

- Film a walking tour of the damage

- Include before-and-after comparisons

- Note down even seemingly minor details

Remember: When it comes to fire damage documentation, you're not just collecting evidence – you're building your path to recovery. The more thorough your documentation game is, the smoother your claim journey will be.

Need a success strategy? Start documenting before you even think about cleaning up. Your future self will thank you for being this organized!

Contact Insurance

Has Fire Damaged Your Property? Here's How to Contact Your Insurance Company

Don't let the aftermath of a fire leave you feeling lost – reaching out to your insurance company is your first step toward recovery.

Think of your insurance provider as your financial first responder, ready to help you navigate through this challenging time.

Why Timing Matters

Quick action is crucial when reporting fire damage to your insurer. Just like treating a burn, the sooner you address it, the better the outcome.

Your policy likely has specific timeframes for reporting incidents, and missing these deadlines could jeopardize your claim.

Smart Steps to Take When Calling Your Insurer:

- Grab your policy number before dialing

- Take notes during the conversation

- Ask for your claim number immediately

- Get your claims adjuster's direct contact info

- Request a detailed breakdown of next steps

Pro tip: Create a dedicated folder (digital or physical) for all your claim-related documents and correspondence right from this first call. You'll thank yourself later!

Remember, you're not just filing a claim – you're starting a conversation that could impact your property's restoration.

Keep your communication clear, documented, and consistent. Your insurance company speaks in policy terms, but don't be afraid to ask for plain-English explanations of any insurance jargon that leaves you scratching your head.

Need to clarify something about your coverage? Ask away! Your insurance team should be your partners in recovery, not puzzle-makers adding to your stress.

Deal With Insurance Company Adjuster & Low Ball Assessments

Dealing with Insurance Adjusters? Don't Let Low-Ball Offers Leave You High and Dry!

Picture this: your property's damaged, and the insurance adjuster rolls in with an offer that feels like pocket change. You're not imagining things – these initial assessments often come in at a whopping 30-50% below what you deserve.

But don't worry, I'll show you how to turn the tables!

Think of insurance negotiations like a chess game – every move counts. Your secret weapon? Documentation, documentation, documentation!

Keep a detailed play-by-play of every conversation, just like you're building your case for Judge Judy.

Here's how to fight back against those lowball offers:

- Build your arsenal of evidence:

- Fresh contractor estimates

- Crystal-clear damage photos

- Detailed repair lists

- Professional inspection reports

- Challenge the lowball like a pro:

- Demand written explanations for denied items

- Counter with specific, fact-based proposals

- Break down repair costs item by item

When the going gets tough, bring in the cavalry – independent adjusters can be your secret weapon, especially with tricky structural damage claims. They're like having a translator who speaks fluent "insurance-ese"!

Remember, you're not just accepting a number – you're fighting for what's rightfully yours. Stay confident, stay persistent, and don't settle for less than you deserve. Your property's worth it!

Want to level up your claim game? Keep reading our expert tips on maximizing your insurance settlement! 👇

Get Professional Assessment

Need a Professional Fire Damage Assessment? Here's What You Should Know

Ever wondered what happens behind the scenes when fire damage experts evaluate your property? Think of them as modern-day detectives, armed with high-tech tools and years of expertise to uncover every trace of damage – even the sneaky ones hiding in your walls.

A professional assessment isn't just about snapping photos of charred surfaces. It's your insurance claim's secret weapon!

Certified experts dive deep into your property's story, documenting everything from obvious burns to invisible smoke damage that could haunt you later.

Picture this: while you see a slightly smoky wall, these pros use specialized equipment to measure air quality, detect hidden moisture (yes, from those firefighting efforts), and check if your home's bones are still strong.

They're like medical doctors for your house, running comprehensive tests to ensure nothing slips through the cracks.

Want to know what makes these assessments truly valuable? They often involve carefully controlled "surgical procedures" on your property – strategic openings in walls and floors to reveal concealed damage.

This thorough investigation creates an ironclad record before any cleanup begins, giving you the upper hand when negotiating with your insurance company.

Remember: what you can't see can hurt your claim. That's why having these professionals in your corner isn't just helpful – it's essential for getting the coverage you deserve.

They speak the insurance language and know exactly what documentation will make your case bulletproof.

Gather Supporting Evidence

Building Your Fire Insurance Claim: A Rock-Solid Evidence Guide

Want to nail your fire damage insurance claim? Think of yourself as a detective gathering clues for the perfect case. You'll need to become a documentation pro, capturing every smoke-stained detail and charred remnant that tells your property's story.

Let's break down your evidence-gathering mission:

Picture Perfect Documentation

✓ Snap detailed photos from multiple angles

✓ Record walk-through videos of affected areas

✓ Create time-stamped digital archives

The Paper Trail That Matters

✓ Fire department incident reports

✓ Original purchase receipts

✓ Repair estimates and invoices

✓ Temporary relocation expenses

Smart Inventory Management

Think of your inventory list as a GPS for your claim – it guides adjusters straight to the value of your losses. Include:

- Item descriptions with serial numbers

- Purchase dates and original costs

- Current market values

- Condition before the fire

| Must-Have Evidence | Why It Matters | Best Format |

|---|---|---|

| Scene Photos | Shows actual damage | Digital images |

| Emergency Response | Validates incident | Official paperwork |

| Expense Records | Proves financial impact | Digital/physical copies |

| Eyewitness Accounts | Strengthens claim | Written statements |

Remember to grab often-forgotten proof like security camera footage, maintenance records, and building inspection certificates. These pieces complete your evidence puzzle, helping ensure you get fair compensation for every loss you've suffered.

Pro tip: Store your evidence digitally with multiple backups – you can't be too careful when protecting your claim's foundation!

Submit Complete Claims Package

Want to Win Your Fire Damage Insurance Claim? Here's Your Power-Packed Submission Guide!

Think of your insurance claim package as your golden ticket to recovery – it needs to tell your story clearly and convincingly.

Just like building a rock-solid case, you'll want to stack your evidence perfectly.

Let's break down your winning claim package:

- The Show-and-Tell Evidence

- Crystal-clear photos capturing every scorched corner

- Before-and-after shots when possible

- Video documentation walking through the damage

- Drone footage for extensive roof or exterior damage

- Your Claim Letter Arsenal

- Policy number front and center

- Your contact details

- Timeline of the fire incident

- Summary of losses

- Action steps you've taken

- The Money Trail

- Fresh contractor estimates

- Original purchase receipts

- Bank statements showing purchases

- Digital records of transactions

- Professional appraisals

- Your Loss Inventory Bible

- Item-by-item breakdown

- Age and condition notes

- Original price tags

- Current replacement costs

- Brand names and model numbers

Remember, your claim package isn't just paperwork – it's your recovery roadmap.

The more organized and detailed you are, the smoother your journey to reimbursement will be.

Got everything labeled, dated, and cross-referenced? You're not just filing a claim; you're presenting an airtight case for your recovery!

Try To Negotiate Claim Settlement Offer

Ready to Fight for Your Fair Share? Insurance Claim Negotiation 101

Don't let that initial settlement offer make your jaw drop – it's just the opening move in this chess game!

When insurance companies present their first number, they're testing the waters. Your job? Be the savvy property owner who knows their worth.

Think of claim negotiation like building a rock-solid case. You'll need your "evidence vault" packed with:

- Crystal-clear photos showing every scratch and dent

- Professional repair estimates (the more detailed, the better)

- Expert assessments backing your position

- A well-organized damage inventory

Pro tip: When crafting your counter-offer, speak their language.

Insurance adjusters love data, so give them numbers they can't ignore. Break down costs, highlight overlooked damages, and always keep communication professional yet assertive.

Feeling overwhelmed by the back-and-forth? You're not alone.

Many property owners bring in a public adjuster – think of them as your personal claim champion. They know the industry inside out and can often spot settlement opportunities you might miss.

Remember: Insurance companies expect negotiation – it's part of the process.

Stand your ground, document everything, and don't settle until you're satisfied. After all, this is about getting what you truly deserve to restore your property to its former glory.

Want to strengthen your position? Always ask for written explanations of disputed amounts and keep your evidence arsenal updated. You've got this!

Chapter 10: Filing Process For Fire Damage Insurance Claims (With A Public Adjuster)

The Fire Claims Game-Changer: How Public Adjusters Fight for Your Rights

Ever wondered who's really in your corner when fire turns your world upside down?

Enter public adjusters – your personal claims champions who transform the overwhelming insurance maze into a manageable journey.

Think of them as your insurance detectives, armed with expertise to uncover every dollar you deserve. They're like having a seasoned poker player at your side, knowing exactly when to hold 'em and when to push for more in the settlement game.

What sets them apart? Let's break it down:

🔍 CSI-Level Documentation

- Capture crystal-clear photos that tell your story

- Create detailed damage inventories that leave no ash unturned

- Map out the fire's impact, from visible burns to hidden smoke damage

📋 Policy Power-Play

- Decode insurance jargon into plain English

- Spot coverage gems others might miss

- Identify additional benefits lurking in policy fine print

🏗️ Expert Alliance Building

- Team up with trusted contractors who know their stuff

- Bring in specialists who can validate damage claims

- Calculate repair costs down to the last nail

💪 Negotiation Ninjas

- Handle insurance company back-and-forth like pros

- Shield you from stressful claim disputes

- Push for settlements that truly reflect your losses

Remember: While you focus on getting your life back on track, these pros handle the heavy lifting of your claim. They're not just filing paperwork – they're maximizing your recovery and turning insurance headaches into healing solutions.

Public Adjuster Documents Fire Damage Thoroughly

Fire Damage Documentation: Your Public Adjuster's Secret Weapon

Ever wondered how public adjusters turn chaos into clarity after a fire? Let's dive into their documentation magic that makes insurance claims rock-solid.

Think of your public adjuster as a CSI investigator for fire damage – they leave no stone unturned.

Using state-of-the-art tools and battle-tested methods, they build your case like a master storyteller piecing together crucial evidence.

What's in Their Documentation Arsenal?

🔥 Crystal-Clear Photos: Before-and-after snapshots that speak louder than words

📱 Live Video Footage: Real-time walkthroughs capturing damage from every angle

📋 Smart Inventory Tracking: Digital catalogs of affected items, from treasured heirlooms to everyday essentials

🏗️ Expert Structural Analysis: Deep-dive reports on your building's battle scars

💰 Precision Cost Breakdown: Reality-based estimates that insurance companies can't ignore

Why does this matter to you? Because proper documentation is like having an ace up your sleeve during settlement talks.

Your public adjuster transforms complex damage evidence into a compelling narrative that insurance companies must take seriously.

Ready to level up your fire damage claim? Your public adjuster combines old-school attention to detail with modern tech-savvy solutions.

They're not just documenting damage – they're building your path to fair compensation.

Remember: Quality documentation isn't just about taking pictures; it's about telling your property's story in a way that demands attention and fair treatment.

Public Adjuster Reviews Policy For Hidden Fire Damage Coverage & To Maximize Policy Benefits

Wondering why insurance policies read like ancient scrolls? Let's crack the code on fire damage coverage together! As your trusted guide, I'll show you how public adjusters become policyholder detectives, uncovering those sneaky benefits hiding in plain sight.

Think of your insurance policy as an onion – there are layers upon layers of coverage waiting to be peeled back. Public adjusters don't just skim the surface; they dig deep into every endorsement, rider, and provision to ensure you're not leaving money on the table.

Check out these often-overlooked coverage gems:

| Coverage Type | Documentation Required | Potential Benefits |

|---|---|---|

| Smoke Damage | Photo evidence, air quality tests | Interior restoration costs |

| Water Damage | Moisture readings, structural assessment | Mold prevention, repairs |

| Code Upgrades | Building permits, local ordinances | Mandatory improvements |

| Living Expenses | Temporary housing receipts | Relocation costs |

Did you know that fire damage isn't just about the obvious burn marks? It's like a domino effect – one incident can trigger multiple coverage opportunities. Your public adjuster acts as your personal advocate, connecting the dots between visible damage and those tricky hidden impacts that could affect your property's long-term value.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjusters On Policyholders Behalf

Let's Talk Insurance: How Public Adjusters Handle Your Claim Communications

Ever wonder what happens after you hand over your claim to a public adjuster? They become your insurance claim superhero, taking the reins of all those headache-inducing conversations with insurance carriers.

Think of your public adjuster as your personal claims ambassador. They'll send an official "hey, we're in charge now" notice to your insurance company, making sure every email, call, and letter about your claim comes straight to their desk.

Here's how they've got your back:

🤝 They're your meeting master

- Running point on all insurer conversations

- Setting up property inspections

- Handling paperwork like a pro

- Keeping everything organized and on track

📋 They're your damage detective

- Creating detailed damage reports

- Crunching numbers for accurate repair costs

- Using industry-leading tools and expertise

- Documenting everything (and we mean everything!)

💪 They're your claim champion

- Fighting undervalued settlement offers

- Backing up every dollar with solid evidence

- Using their technical know-how to your advantage

🤔 They're your negotiation ninja

- Leveraging years of claims experience

- Understanding insurance company tactics

- Fighting for what you deserve

While they're battling the insurance bureaucracy, you can focus on getting your life back to normal. Isn't that what you really need after a loss?

Public Adjuster Gets Professional Assessments

Fire Damage Claims: How Public Adjusters Use Expert Assessments to Win

Ever wondered how public adjusters build rock-solid fire damage claims? Think of them as damage detectives, orchestrating a dream team of specialists who leave no scorched corner unexplored.

Let's dive into their systematic approach that turns complex fire losses into winning claims.

Smart Tech Meets Expert Eyes

When your property faces fire damage, we're not just talking about what you can see. Modern public adjusters leverage cutting-edge technology like:

- Thermal imaging cameras that spot hidden hot spots

- Moisture detection tools that reveal water damage from firefighting

- Digital mapping systems for precise damage documentation

Building Your Expert Arsenal

Your public adjuster brings together key professionals:

✓ Structural engineers who assess building integrity

✓ Environmental experts testing for toxic residues

✓ Licensed contractors creating detailed repair estimates

✓ Indoor air quality specialists measuring smoke contamination

Why This Matters For Your Claim

Think of these assessments as pieces of a puzzle. Each expert evaluation adds weight to your claim, creating an airtight case that insurance companies can't ignore.

It's like having a team of CSI investigators working to maximize your settlement.

The best part? This comprehensive approach doesn't just document obvious damage – it uncovers hidden issues that could become costly problems down the road. Whether it's smoke damage lurking in your HVAC system or structural weaknesses that aren't visible to the naked eye, these professional assessments ensure nothing slips through the cracks.

Public Adjuster Gathers Supporting Evidence

The Art of Evidence Collection: A Public Adjuster's Secret Weapon

Ever wondered how public adjusters build rock-solid insurance claims? Let's dive into their evidence-gathering playbook!

Think of a public adjuster as a detective piecing together a puzzle. They don't just snap a few photos and call it a day – they're creating an airtight case that insurance companies can't ignore.

It's like building a fortress of facts, one brick of evidence at a time.

Key Evidence Arsenal:

✓ High-res photos and videos that tell the whole damage story

✓ Smart inspection tools that reveal hidden problems (like moisture meters and thermal cameras)

✓ Property inventories that leave no item uncounted

✓ Purchase receipts and replacement cost research

✓ Expert reports from engineers and specialists

✓ Environmental testing results

✓ Building code compliance documentation

But here's where it gets interesting – public adjusters go beyond just documenting the obvious fire or water damage.

They're tracking every single conversation with insurance companies, keeping tabs on your temporary housing costs, and calculating exactly how much business income you're losing while your property's out of commission.

Essential Documentation Categories:

- Visual Proof

- Before and after comparison shots

- Damage progression documentation

- Inspection findings with expert annotations

- Property Documentation

- Digital inventory databases

- Value authentication records

- Market-based replacement estimates

- Technical Verification

- Structural assessment reports

- Air quality measurements

- Code violation implications

Public Adjuster Submits Complete Claims Package

Ready to See How a Pro Public Adjuster Nails Your Fire Claim? Let's Dive In!

Think of your claims package as a winning presentation – it's your ticket to getting what you deserve from your insurance company after a fire. When we public adjusters put together your case, we're not just throwing papers in a folder.

We're crafting your story with bulletproof evidence.

What's in Your Power-Packed Claims Arsenal?

🔥 The Deep-Dive Damage Report

- Maps out every crack, burn, and smoke trail

- Puts real dollars to your losses

- Speaks the insurance company's language

📸 Your Visual Proof Portfolio

- Before and after shots that tell the whole story

- Time-stamped evidence that backs your claim

- Detailed documentation that leaves no room for doubt

📋 The Policy Match-Up

- Connects your damages to your coverage

- Highlights every benefit you're entitled to

- Prevents insurance companies from shortchanging you

We've seen how this strategic approach can transform a claim from "under review" to "approved" faster than you might think. It's like having a skilled chess player plan every move – we know exactly how to position your claim for maximum impact.

Remember, a well-prepared claims package isn't just paperwork – it's your roadmap to recovery. By following insurance protocols while advocating for your interests, we're not just filing a claim; we're building your case for the settlement you deserve.

Pro Tip: The magic isn't just in what we submit – it's how we submit it. Every document, photo, and estimate works together to tell your story and fast-track your path to recovery.

Public Adjuster Handles All Follow Up & Time Requirements With Insurance Company

Think of a public adjuster as your claims process quarterback, calling the plays and managing the game clock with the insurance company.

After submitting your claim, they become your dedicated timeline champion, making sure nothing slips through the cracks.

Ever wonder what happens behind the scenes? Your public adjuster is busy:

- Dancing the paperwork tango with insurance carriers, responding to their questions faster than you can say "claim number"

- Building a bulletproof communication trail that would make a detective jealous

- Orchestrating a symphony of contractors, inspectors, and experts to keep your claim moving

- Playing deadline defense like a pro sports team, protecting your rights and policy requirements

What makes this follow-up process so crucial? Just like a well-oiled machine, every part needs to move at the right time. Your adjuster keeps track of:

✓ Time-sensitive documentation requirements

✓ Response windows for insurance inquiries

✓ Appeal deadlines that could impact your claim

✓ Inspection schedules and assessment timelines

The best part? You don't have to stress about missing important deadlines or forgetting crucial paperwork.

Your public adjuster handles these moving parts while you focus on getting back to normal. Think of them as your personal claims GPS, navigating the complex insurance landscape and keeping you on the fastest route to settlement.

Remember: Insurance companies have their own timelines – but your public adjuster ensures you're always one step ahead in this complex dance of documentation and deadlines.

Public Adjuster Enforces Policyholder's Rights, & Negotiates Higher & More Fair Claim Settlement Offer

Ever felt like David facing Goliath when dealing with your insurance company after a fire? That's where public adjusters step in as your secret weapon, turning the tables in your favor!

Think of public adjusters as your personal insurance detectives and negotiation ninjas rolled into one. They're the pros who know exactly where to look, what to document, and how to speak the complex insurance language that gets results.

Let's break down how they transform your claim from "meh" to "wow":

🔍 They leave no stone unturned in documenting your losses – from that cherished family sofa to hidden smoke damage in your walls

💪 They're like insurance policy whisperers, uncovering coverage benefits you didn't even know you had

🤝 When insurance companies play hardball with lowball offers, public adjusters counter with rock-solid evidence and negotiation strategies that work

Here's the game-changer: Property owners working with public adjusters typically see settlement increases of 35-200% compared to going it alone. That's like turning a $50,000 offer into potentially $150,000 – now we're talking!

Want to know the best part? While you focus on getting your life back together, these claims champions handle the heavy lifting – documenting, negotiating, and fighting for every dollar you deserve under your policy.

It's like having a skilled translator who speaks fluent "insurance-ese" working exclusively for you!

Remember: Insurance companies have their experts – shouldn't you have yours?

Public Adjuster Speeds Up Claim Settlement Time

Want to Fast-Track Your Fire Insurance Claim? Here's Why Public Adjusters Are Your Secret Weapon

Did you know that navigating a fire damage claim can feel like solving a complex puzzle? That's where public adjusters come in – they're essentially your personal GPS through the insurance maze.

Think of public adjusters as your claim's pit crew – they don't just get you better results; they turbocharge the entire process.

Their deep understanding of insurance lingo and procedures helps dodge common roadblocks that typically slow things down.

Why You'll Get Your Settlement Faster:

- Public adjusters slash processing time by up to 45% through expert documentation

- Their insurance company connections create express lanes for communication

- Quick response after fire damage can save you precious weeks of waiting

- Comprehensive initial paperwork prevents those frustrating back-and-forth exchanges

What makes them so effective? Just as a seasoned chef knows exactly which ingredients to use, public adjusters understand precisely what insurance companies need.

They've mastered the art of presenting claims in a way that speeds up approval without cutting corners.

Remember, time is literally money when it comes to fire damage. While you're focused on getting your life back to normal, your public adjuster is working behind the scenes, turning what could be a marathon into a sprint.

They'll handle the paperwork jungle while you handle what matters most – getting back on your feet.

Chapter 11: Legal Rights When Fire Damage Claims Are Denied

Fighting a Denied Fire Damage Claim? Here's Your Comeback Strategy!

Ever felt like David facing Goliath when your insurance company denies your fire damage claim? Don't worry – public adjusters are your secret weapon in turning that "no" into a "yes."

Think of them as your personal insurance detectives, armed with policy-cracking skills and evidence-gathering expertise.

Why You Need a Public Adjuster When Your Claim Gets Denied:

- They speak "insurance-ese" fluently and can decode those cryptic denial letters

- They're like CSI investigators for your property damage, documenting every detail

- They know exactly where to look for policy loopholes that work in your favor

Breaking Down Your Comeback Plan:

1. Policy Deep Dive

✓ Expert analysis of your coverage

✓ Identification of hidden benefits

✓ Translation of complex terms into plain English

2. Evidence Arsenal

✓ High-tech documentation methods

✓ Strategic damage assessment

✓ Loss valuation that insurance companies can't ignore

3. Appeal Power Moves

✓ Custom-built reinstatement strategies

✓ Negotiation tactics that level the playing field

✓ Step-by-step claim resurrection plans

When things get heated (pun intended), your public adjuster can connect you with specialized insurance attorneys who'll take your fight to the next level.

Remember, a denied claim isn't the end of the road – it's just the beginning of your comeback story.

Think of your public adjuster as your claim's personal trainer, strengthening your case until it's too robust to deny. Ready to turn that denial into an approval? Let's get your claim back in fighting shape!

How Public Adjusters Can Help With Denied Fire Damage Home Insurance Claims