Homeowners insurance provides coverage for structural damage caused by specific covered perils such as fires, windstorms, and falling objects. Standard policies typically include dwelling coverage ranging from $100,000 to $500,000 based on replacement costs. However, notable exclusions apply for damage from earthquakes, floods, gradual settling, poor maintenance, and pest infestations. Understanding the full scope of coverage and limitations enables homeowners to identify potential gaps requiring supplemental protection.

Key Takeaways

- Standard homeowners insurance covers structural damage caused by specific perils like fires, windstorms, and fallen trees.

- Coverage typically ranges from $100,000 to $500,000, protecting foundations, walls, roofs, and floors from covered events.

- Damage from earthquakes, floods, gradual settling, poor maintenance, and pest infestations are usually excluded from standard policies.

- Claims require thorough documentation, including photos, professional evaluations, and contractor estimates to support validity.

- Supplemental coverage options are available for excluded perils, requiring careful evaluation of specific risks in your area.

Understanding Common Types of Structural Damage in Homes

Structural damage in residential properties encompasses a range of vital issues that can compromise a home's stability and safety.

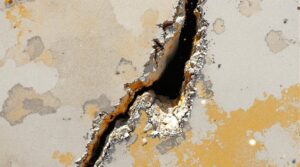

Foundation problems frequently manifest through visible cracks, uneven settling, and shifting, which can affect the entire building's structural integrity.

Roof damage, often resulting from severe weather events or falling debris, creates vulnerabilities that lead to water infiltration and subsequent deterioration of interior components.

Load-bearing walls face particular risks from both external forces and internal issues. Water infiltration from plumbing failures or environmental sources can weaken these significant structural elements, while termite infestations pose a considerable threat to wooden support members throughout the home.

These insects can silently compromise structural integrity long before visible signs appear.

Most homeowners insurance policies address specific types of structural damage, making it essential for property owners to understand their coverage. Additionally, it’s important for homeowners to be aware of the limitations and exclusions that may apply to their policies, such as specific natural disasters or maintenance issues. Familiarizing themselves with these aspects can help prevent surprises during the claims process. Homeowners should also seek tips for filing structural damage claims to ensure they provide all necessary documentation and follow the correct procedures for a smoother experience.

Regular maintenance and professional inspections remain vital for identifying potential issues before they develop into major structural problems.

Comprehensive coverage and costs for structural repairs typically depend on policy provisions, damage type, and the age of affected components.

What Your Standard Homeowners Policy Actually Covers

Standard homeowners insurance policies provide extensive coverage for structural damage caused by specified perils, with typical coverage limits ranging from $100,000 to $500,000 based on replacement cost valuations.

Notable exclusions include damage from earthquakes, floods, and gradual foundation settling, which require separate insurance products or policy endorsements for protection.

Coverage limitations are defined by specific terms within each policy, making it essential for homeowners to understand both their basic coverage elements and any potential gaps requiring supplementary coverage.

Dwelling coverage encompasses repairs to the main structure of your home when damaged by covered hazards like fire or severe weather.

Basic Coverage Elements Explained

A thorough homeowners insurance policy provides fundamental protection for the physical structure of a residence through dwelling coverage, which encompasses damages to essential components such as the foundation, walls, roof, and floors.

Standard policy provisions typically include coverage for structural damage caused by specific perils like fire, windstorms, and vandalism, with coverage limits ranging from $100,000 to $500,000 based on replacement costs.

While home insurance policy terms address unexpected structural damages, they exclude issues arising from home maintenance neglect, substandard workmanship, or gradual deterioration.

Importantly, certain types of structural damage, particularly those resulting from earthquakes and floods, require separate policies or additional riders.

Insurance professionals recommend regular policy reviews to identify potential coverage gaps and guarantee adequate protection levels for homeowners.

Working with public adjusters during property damage claims can help ensure maximum compensation for covered structural repairs.

Exclusions You Should Know

Understanding the limits of homeowners insurance coverage requires close examination of common policy exclusions. Standard homeowners insurance policies typically exclude structural damage resulting from poor maintenance, natural settling, and normal wear and tear. These exclusions emphasize the homeowner's responsibility to maintain their property properly.

Additional significant exclusions include damage from faulty construction, substandard materials, and pest infestations like termites. Most policies also exclude repairs needed due to floods and earthquakes, which require separate specialized coverage.

Only 27% of flood zone homeowners maintain flood insurance coverage, leaving many properties vulnerable to catastrophic water damage. Insurance providers consider these events distinctly different from covered perils such as fire, windstorms, and vandalism.

Homeowners should carefully review their insurance policies to understand specific limitations and exclusions that may affect potential claims for structural damages. This knowledge helps prevent coverage gaps and guarantees appropriate protection for their property.

Key Coverage Limitations Defined

The scope of structural coverage in homeowners insurance policies centers on specific, identifiable perils while maintaining clear boundaries regarding exclusions.

Standard policies typically cover structural damage resulting from incidents like fires, windstorms, and vandalism, with coverage limitations ranging from $100,000 to $500,000 based on replacement costs.

Foundation issues are covered perils only when caused by sudden, specific events such as falling trees or severe storms.

Notable elements excluded from standard policies include mold damage, natural settling, and gradual deterioration.

The homeowner bears responsibility to prevent further damage through proper maintenance, as neglect-related issues remain outside policy parameters.

Additional endorsements may be necessary for specialized coverage against risks like earthquakes and floods, which typically fall beyond standard policy protection.

Medical payments coverage helps protect homeowners if guests sustain minor injuries on their property.

Key Exclusions and Limitations in Structural Damage Coverage

Standard homeowners insurance policies contain significant coverage gaps related to structural damage caused by negligence, inadequate maintenance, and substandard workmanship.

Policy restrictions typically exclude damages resulting from natural foundation settling, mold growth, pest infestations, and general wear and tear, as these issues stem from preventable circumstances.

Coverage limitations extend to specific perils such as floods and earthquakes, which require separate insurance policies, while structural protection typically ranges between $100,000 and $500,000 in dwelling coverage.

Understanding depreciation clauses helps homeowners anticipate potential reductions in claim payouts for aging structural components like roofs and siding.

Common Coverage Gaps

When homeowners examine their insurance policies, they often discover significant coverage gaps related to structural damage that could leave them financially exposed.

Insurance policies typically exclude damages resulting from poor workmanship, construction defects, and neglect, leading to potential claim denials. Natural settling of foundations represents another notable exclusion in standard homeowners insurance coverage.

Critical gaps also exist in protection against mold, fungus, and pest-related structural damage, requiring additional coverage through specialized policies or riders.

Gradual deterioration stemming from inadequate maintenance falls outside standard coverage parameters, as insurers consider this the homeowner's responsibility to prevent.

In addition, specific perils like earthquakes and floods necessitate separate insurance products, as these risks are not included in conventional policies.

Understanding the difference between Actual Cash Value and Replacement Cost Value coverage is essential when evaluating structural damage protection options.

Policy Restriction Scenarios

Despite extensive coverage offered by many homeowners insurance policies, significant structural damage exclusions and limitations create notable financial risks for property owners.

Policy restrictions commonly exclude damage resulting from poor workmanship, construction defects, and repairs performed by unqualified contractors.

Standard homeowners insurance explicitly denies claims related to foundation damage caused by natural soil settling or ground movement.

The claims process typically rejects structural damage that occurs gradually through deterioration, neglect, or inadequate maintenance. While policies cover sudden and accidental occurrences, they exclude long-term issues like rotting wood or mold growth.

Additionally, structural damage from natural disasters such as earthquakes and floods requires separate coverage options.

Understanding these limitations is essential, as insurance coverage gaps can lead to substantial out-of-pocket expenses for repairs.

HO-5 policies provide the most comprehensive structural coverage for single-family homes, though exclusions still apply.

When Insurance Will Pay for Foundation Repairs

Insurance coverage for foundation repairs depends primarily on the specific cause of the damage and the terms outlined in the homeowners policy. Standard policies typically cover structural damage resulting from specified perils such as fires, windstorms, and fallen trees. Coverage limits generally range from $100,000 to $500,000, based on the dwelling portion of the insurance policy.

To successfully file a claim for foundation repairs, homeowners must document damage thoroughly with photographs and promptly report issues to their insurance provider. Independent contractor assessments may strengthen the claim by providing professional repair estimates.

However, natural disasters like earthquakes and floods often require supplemental coverage, as these events are typically excluded from standard policies.

It's important to note that insurance providers do not cover foundation issues arising from natural settling or normal wear and tear. Understanding these distinctions helps homeowners properly maintain their properties and secure appropriate coverage for potential structural damages. Working with public insurance adjusters can help maximize settlement amounts when filing complex structural damage claims.

Documentation and Assessment Requirements for Claims

Submitting a successful structural damage claim requires three essential documentation components: detailed photographic evidence, thorough written descriptions, and professional assessments. Insurance adjusters rely on extensive documentation to assess the extent of structural damage and determine appropriate coverage in the event of a claim.

Homeowners must promptly report damages to their insurance provider while maintaining organized records of all repair work and previous maintenance.

Key requirements for structural damage claims include:

- Clear photographs capturing all affected areas, with detailed close-ups of specific damage points

- Written documentation detailing the nature, location, and timeline of the damage

- Professional evaluation reports from certified insurance adjusters

- Multiple contractor estimates for necessary repairs

When submitting claims, policy coverage verification depends heavily on proper documentation.

Maintaining inspection reports, maintenance records, and repair histories strengthens the claim's validity and expedites the assessment process.

Working with public insurance adjusters can be especially beneficial for maximizing settlements in complex structural damage cases.

Additional Coverage Options for Better Protection

While standard homeowners insurance policies provide basic structural protection, savvy property owners often seek supplemental coverage options to address specific risks and vulnerabilities.

Specialized endorsements can be added to existing policies to cover structural damage from specific perils that standard coverage excludes.

Earthquake insurance represents a vital additional coverage option in seismically active regions, while flood insurance becomes indispensable for properties in flood-prone areas.

Both types specifically address structural damage and repairs that basic homeowners insurance typically excludes.

Insurance providers also offer home warranty options that may cover structural issues beyond standard policy limitations.

Property owners should regularly evaluate their coverage needs and consider adding specialized riders for risks such as mold damage or sewer backup.

This proactive approach to insurance coverage helps guarantee extensive protection against various forms of structural damage while minimizing potential financial exposure from uncovered events.

Preventive Measures to Protect Your Home's Structure

Proactive maintenance and regular inspections form the foundation of effective structural protection for residential properties. Insurance policies may cover structural damage, but preventing issues through consistent maintenance proves more cost-effective than filing claims.

Proper home maintenance includes monitoring drainage systems, reinforcing vulnerable areas, and implementing preventive measures against severe weather events.

Key preventive measures to protect structural integrity:

- Schedule quarterly property inspections to detect early signs of structural damage and address issues before they escalate.

- Maintain gutters and drainage systems to prevent water accumulation that can compromise foundation stability.

- Install storm shutters and reinforce windows to protect against severe weather events that could impact structural components.

- Implement thorough pest control measures, including sealing entry points and regular inspections, to prevent infestations that deteriorate structural elements.

Understanding local environmental risks enables homeowners to adopt targeted preventive strategies, potentially reducing insurance claims and maintaining property value.

Steps to File a Structural Damage Insurance Claim

Filing a structural damage insurance claim requires a systematic approach to confirm proper documentation and timely processing of the request. When homeowners insurance needs to cover structural damage, the policyholder must initiate contact with their insurance company immediately upon discovering the issue.

The process involves several critical steps to confirm proper claim handling. First, detailed documentation through photographs and videos provides essential evidence of the structural damage.

Next, policyholders must accurately complete all required claims forms provided by their insurance company. An insurance adjuster will then conduct an on-site evaluation to assess the extent of the damage and validate the claim.

To strengthen the negotiation position regarding repair costs, obtaining estimates from licensed contractors is recommended. This professional assessment helps establish the anticipated expenses and supports discussions with the insurance company about compensation for necessary structural repairs.

Frequently Asked Questions

Is Structural Damage Covered by Home Insurance?

Home insurance typically covers structural repairs resulting from covered perils, subject to policy exclusions and coverage limits. Construction defects, normal wear, and maintenance issues require damage assessment before insurance claims approval.

What Happens if Your House Has Structural Damage?

Structural damage requires immediate attention due to compromised home safety. Foundation issues, water damage, and pest infestation demand professional assessment. Homeowners must address repairs promptly to prevent escalating costs and maintain insurance claims validity.

What Is Considered Structural Damage?

Like a crumbling castle's foundation, structural damage encompasses defects compromising a building's core integrity, including foundation issues, load-bearing wall failures, severe roof damage, and compromised support systems requiring professional assessment.

Are Structural Cracks Covered by Insurance?

Insurance policies cover structural cracks caused by sudden, covered perils but exclude normal settling. Coverage limits vary by crack types, requiring thorough home inspections and expert opinions during claim processes.

Final Thoughts

Homeowners must understand their policy coverage, maintain thorough documentation, and implement preventive measures to protect their property's structural integrity. While standard policies cover sudden, accidental structural damage, they exclude gradual deterioration and certain natural events. Regular inspections, proper maintenance, and supplemental coverage options provide extensive protection against structural issues, ensuring both financial security and structural stability for residential properties.

When dealing with structural damage or any property-related insurance claims, insurance industry professionals and legal experts strongly advise homeowners to consult a qualified state-licensed public adjuster. These professionals work exclusively for policyholders, not insurance companies, serving as dedicated advocates throughout the claims process. Public adjusters are specially trained to identify hidden damages that homeowners might not know are covered under their policies, thoroughly document losses, and negotiate effectively with insurance companies to secure fair settlements.

By engaging a public adjuster, homeowners can maximize their claim payouts, expedite the claims process, and reduce the stress of dealing with insurance companies. Public adjusters' expertise in policy interpretation and claims management allows homeowners to focus on recovery while ensuring their legal rights are protected. For those seeking guidance with property damage or loss claims, Public Claims Adjusters Network (PCAN) members offer free, no-obligation consultations to discuss your specific situation and potential claim options.