Homeowners insurance typically covers foundation cracks and damage caused by sudden and accidental events, such as fires, lightning strikes, and windstorms. Coverage varies based on policy terms and exclusions. Damage from natural disasters like tornadoes is often covered, while earthquakes and floods usually require separate policies. Negligence-related damage and normal wear and tear are generally excluded. Understanding policy exclusions is essential for determining coverage. Exploring specific policy terms and conditions can provide further clarity on foundation damage coverage.

Key Takeaways

- Homeowners insurance typically covers foundation damage from sudden and accidental events like fire, lightning, wind, and plumbing failures.

- Natural disasters like tornadoes are usually covered, but earthquakes and floods require separate policies.

- Coverage depends on the policy's outlined perils, and negligence-related damage is typically excluded from coverage.

- Foundation damage from poor construction practices, normal wear and tear, and pest damage is usually not covered by homeowners insurance.

- Understanding policy exclusions and purchasing additional insurance coverage, like flood or earthquake insurance, can provide extra protection for foundation damage risks.

Understanding Homeowners Insurance Coverage for Foundation Damage

While homeowners insurance provides financial protection against various risks, understanding the extent of coverage for foundation damage is essential for homeowners to confirm they are adequately protected.

Homeowners insurance typically covers foundation damage resulting from sudden and accidental events, such as fire, lightning, wind, and vandalism. However, not all foundation damage is covered. Natural disasters like tornadoes are usually covered, while earthquakes and floods generally require separate insurance policies. Homeowners must review their insurance policy to identify the specific covered perils.

Coverage for foundation damage largely depends on the policy's outlined perils. Negligence-related damage, such as poor construction or tree root pressure, is usually excluded from standard homeowners insurance.

Homeowners insurance covers only explicitly stated perils, emphasizing the importance of understanding policy exclusions to determine whether a specific foundation damage incident is covered. Awareness of policy details confirms that homeowners can respond appropriately to foundation damage.

Filing a foundation damage claim requires submitting detailed documentation and paying the applicable deductible before receiving compensation.

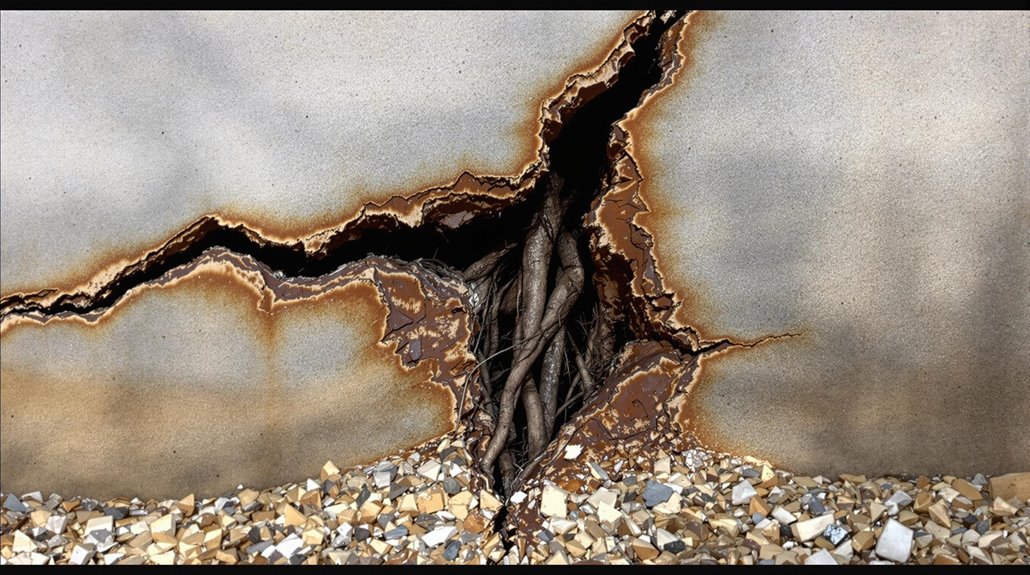

Common Causes of Foundation Cracks and Damage

Foundation cracks and damage can be attributed to various factors, often involving a combination of natural and external forces.

Soil saturation from improper drainage or leaks is a common cause, as it increases pressure on the foundation, leading to cracks and structural issues. Natural wear and tear, including settling and shifting, can also cause foundation damage over time.

External forces, such as tree roots or expansive soils, can exert significant pressure on foundations, necessitating proper management to prevent damage. Sudden water damage from burst pipes can result in immediate foundation issues, while vehicle impacts, such as collisions with the home, can directly damage the foundation.

Homeowners insurance often covers foundation damage resulting from sudden, accidental events, but it is crucial to understand the common causes of foundation cracks and damage to take preventative measures and guarantee adequate coverage.

Common causes of foundation damage can be mitigated with proper maintenance and inspections.

Working with public adjusters on complex foundation damage claims can increase settlement amounts by up to 50%.

Types of Foundation Damage Covered by Homeowners Insurance

Homeowners insurance policies typically cover various types of foundation damage resulting from sudden and accidental events.

Coverage options may include damage caused by fire, lightning, windstorms, falling trees or branches, vandalism, explosions, and water damage from plumbing failures.

The specific coverage and exclusions applicable to foundation damage vary by policy, emphasizing the importance of reviewing policy details.

Understanding your liability coverage limits helps determine if additional protection is needed for potential foundation-related incidents.

Foundation Damage Coverage Options

How does homeowners insurance respond to various types of foundation damage?

Home insurance typically covers foundation damage caused by sudden events such as fire, lightning, windstorms, and vandalism, as long as the damage is not due to neglect or gradual wear and tear.

Coverage options may also include damage resulting from vehicle crashes or falling objects, as well as water damage from burst pipes or sudden plumbing failures.

However, the extent of coverage varies by insurer and policy type, with open peril policies offering broader coverage compared to named peril policies.

It is essential to review specific policy details to understand the coverage options available for foundation damage.

Homeowners should be aware of the coverage options provided by their home insurance policy.

Common Exclusions Apply

Although standard homeowners insurance policies provide coverage for various types of foundation damage, there are common exclusions that apply. Home insurance companies typically do not cover damage resulting from poor construction practices, negligence, or normal wear and tear. Additionally, damage caused by flooding and earthquake-related foundation damage are excluded unless separate policies are in place.

| Exclusion | Description |

|---|---|

| Poor Construction | Damage resulting from substandard building practices or materials |

| Flooding | Damage caused by flooding, unless separate flood insurance is purchased |

| Earthquake | Earthquake-related foundation damage, unless specific earthquake insurance is in place |

| Normal Wear | Gradual settling or small cracks not caused by a covered peril |

| Pest Damage | Damage caused by pests, such as termites, is typically not covered |

Exclusions From Homeowners Insurance Coverage for Foundation Damage

When it comes to foundation damage, standard homeowners insurance policies have significant exclusions that often leave homeowners without coverage for costly repairs. These exclusions typically include damage resulting from normal wear and tear, such as gradual settling or small cracks. Flooding is also excluded, requiring separate flood insurance for coverage. Moreover, many policies do not cover foundation damage caused by poor maintenance or neglect, putting the burden of costly repairs solely on the homeowner. It’s important to fully understand the limitations of homeowners insurance and water damage, as flood-related issues can be particularly devastating. Homeowners are encouraged to review their policies carefully and consider additional coverage options to protect themselves from unexpected foundation issues.

Additionally, foundation damage due to earthquakes is not covered unless the homeowner has purchased additional earthquake insurance. Issues stemming from faulty construction, poor maintenance practices, and groundwater intrusion through the foundation are also generally excluded from coverage.

These exclusions underscore the importance of reviewing and understanding homeowners insurance policies to avoid unexpected repair costs. Homeowners must be aware of the exclusions and consider additional coverage options to guarantee adequate protection for their homes.

Understanding these exclusions can help homeowners plan for potential foundation damage and budget accordingly for repairs or prevention measures. Only 27% of homeowners who live in flood zones maintain flood insurance, highlighting a concerning gap in protection against foundation damage.

How to File a Claim for Foundation Repair

To initiate the claim process for foundation repair, it is important to begin by evaluating the initial damage and gathering thorough evidence to support the claim.

Homeowners should take detailed photos and videos to document the damage, as these will serve as essential components of the claim.

Following this step, contacting the insurance company promptly is necessary to guarantee timely reporting and facilitate a smooth claim process.

Working with public insurance adjusters can help maximize potential settlements for complex foundation damage claims.

Assessing Initial Damage

How does a homeowner determine if foundation damage is covered under their insurance policy?

The first step is to assess the damage and determine if it was caused by a covered peril, such as fire, lightning, or sudden water damage from burst pipes.

If the damage is a result of a covered peril, the homeowner should document the damage thoroughly with clear photos or videos. This documentation will be necessary when contacting the insurance company to start the claim process.

It is essential to determine the cause of the damage, as it will directly impact the coverage and the claim's outcome.

Accurate assessment and documentation will facilitate a smoother claim process.

Gathering Claim Evidence

Establishing a well-documented claim is essential for homeowners seeking insurance coverage for foundation damage. Homeowners should begin by taking clear photographs or videos of the damage from multiple angles, including close-ups of any cracks or issues.

Reports from contractors or foundation specialists can help establish the cause of the damage. If the damage is related to vandalism, filing a police report is often required for insurance claims.

Homeowners should also keep receipts and records of any immediate repairs made to prevent further damage. By gathering and providing these documents, homeowners can support their claim and increase the likelihood that their damage is covered by their insurance policy.

A thorough claim package is key to a successful claim.

Contacting Insurance Company

When is the right time to contact an insurance company about foundation damage? After documenting the damage with photos and videos, promptly contact the insurance company to initiate the claims process. This is particularly important if the damage was caused by severe weather or vandalism.

| Claims Process Steps | Important Details |

|---|---|

| Document the damage | Take photos and videos of the damage for evidence |

| Contact insurance company | Initiate claims process promptly after incident |

| File police report (if necessary) | Required for claims related to vandalism or other crimes |

| Obtain repair estimates | Get quotes from licensed contractors for insurance adjuster review |

The Role of Maintenance in Preventing Foundation Damage

While regular upkeep is often overlooked as a critical aspect of homeownership, proper maintenance plays an essential role in preserving the structural integrity of a home's foundation. Effective home maintenance can prevent foundation damage by addressing potential issues before they escalate.

Regular inspection and maintenance of drainage systems, such as gutters and downspouts, guarantees water is directed away from the foundation, reducing the risk of moisture-related issues. Additionally, periodic watering of the yard in drought-prone areas helps maintain consistent soil moisture levels, preventing extreme soil shrinkage and expansion that can stress the foundation.

Proper landscaping, including avoiding large trees or bushes near the foundation, also minimizes the risk of root damage and soil displacement. By prioritizing home maintenance, homeowners can greatly reduce the likelihood of foundation damage and the associated costly repairs.

Preventing foundation damage through proactive measures is essential for maintaining the overall integrity of the home.

Recognizing Signs of Foundation Cracks and Damage

Home foundations can exhibit a range of signs indicating potential cracks or damage, often subtle yet critical to recognize for timely intervention.

Visible cracks in walls, particularly around windows and doors, can be an obvious indicator of structural movement or settling. Additionally, uneven or sloping floors may suggest that the foundation is shifting or has settled improperly. Difficulty opening or closing doors and windows can signal misalignment caused by foundation problems, pointing to potential structural instability.

Other signs of foundation damage include water leaks around the foundation area, which can signify drainage issues or cracks. Standing water pooling near the foundation can exacerbate existing problems and increase the likelihood of damage over time.

Recognizing these signs allows homeowners to address issues promptly, ultimately helping to mitigate more extensive damage and costly repairs. Regular monitoring and maintenance can help prevent foundation damage and its associated costs.

Coverage for Detached Structures and Secondary Homes

Although the primary focus of homeowners insurance is often on the main dwelling, coverage can also extend to detached structures and secondary homes under certain circumstances.

Homeowners insurance typically extends coverage to detached structures, such as garages and sheds, if the damage is caused by a covered peril outlined in the policy. Secondary homes may also be covered, but specific terms and conditions can vary by insurer and policy type.

Coverage for detached structures is often included under the dwelling coverage section of the homeowners policy.

Foundation Damage Risks to Detached Structures

- Fire damage: Damage from fires, including those caused by wildfires, can be covered under the homeowners policy.

- Windstorms: Severe winds can cause damage to foundations of detached structures.

- Vandalism: Intentional damage to detached structures can be covered under the policy.

- Collapsed roof: Foundation damage resulting from a collapsed roof can be covered.

The Importance of Reviewing Your Insurance Policy for Foundation Coverage

To effectively protect a home's foundation, it is essential to understand the specific coverage details outlined in the homeowners insurance policy.

A thorough review of the policy will reveal what types of foundation damage are covered, excluded, and any applicable deductibles or limitations.

Knowing the intricacies of the policy coverage is vital, as it directly impacts the claims process steps and ultimate resolution of foundation-related claims.

Policy Coverage Details

While the specifics of homeowners insurance policies can be complex and varied, one aspect that warrants close attention is the extent of coverage for foundation damage. Reviewing your policy can provide vital insights into covered perils and exclusions related to foundation issues.

Some important coverage details to note include:

- Sudden event coverage: Many policies cover foundation damage resulting from fire, wind, or vandalism, but exclude damage from gradual wear or poor maintenance.

- Exclusions and endorsements: Separate policies or endorsements may be necessary to cover foundation damage caused by flooding or earthquakes.

- Definition and limits of coverage: Confirm your policy contract specifies the type of foundation damage covered and applicable coverage limits.

- Consult with your insurance agent: Reviewing policy terms with an agent can help guarantee adequate coverage and clarify foundation-related policy terms.

Claims Process Steps

Maneuvering through the claims process for foundation damage requires a thorough understanding of the specific terms outlined in a homeowner's insurance policy.

To initiate the process, homeowners should review their policy to determine if the damage is covered by their policy. If covered, the next step is to document the damage thoroughly and seek professional assessments to strengthen their case.

Homeowners should then contact their insurer to report the damage and initiate an insurance claim. A claims adjuster will be assigned to evaluate the damage and determine the extent of coverage.

Familiarizing oneself with the insurer's claims process can help streamline the filing process, ensuring all necessary requirements are met for a successful claim. This preparation is essential for a smooth and efficient claims process.

Alternative Options for Foundation Repair Not Covered by Homeowners Insurance

Numerous homeowners facing foundation damage not covered by their insurance policies are left with few options but to explore alternative methods for financing the necessary repairs.

Foundation repairs can be costly, and without homeowners insurance coverage, paying out-of-pocket may not be feasible. In this scenario, hiring a foundation specialist can help determine the extent of the damage and provide a detailed report that may support future claims or help secure financing options.

Alternative options for financing foundation repairs include:

- Taking out a personal loan, which allows homeowners to borrow the necessary funds to cover the cost of foundation repairs.

- Home equity line of credit (HELOC), enabling homeowners to withdraw funds as needed to finance repairs.

- Local government programs or grants, providing financial assistance for foundation repairs, especially in areas affected by natural disasters.

- Separate flood or earthquake insurance policies, offering additional coverage options for foundation damage in high-risk areas.

Frequently Asked Questions

Is a Cracked Foundation Covered by Homeowners Insurance?

Amidst the labyrinth of insurance coverage, a cracked foundation's fate hangs in the balance. Homeowners insurance may cover foundation repair options, unless insurance policy exclusions apply; diligent home maintenance tips can mitigate the risk of damage.

What Is the Most Common Damage to Your Home That Insurance Does Not Cover?

Common damages not covered by homeowners insurance include water damage from gradual leaks, pest infestations such as termite damage, and maintenance neglect, such as failure to address cracks in walls and foundations, all considered preventable with regular upkeep.

What Is the 80% Rule in Homeowners Insurance?

The 80% rule in homeowners insurance stipulates that a property must be insured for at least 80% of its replacement value to receive full coverage, emphasizing the importance of adequate insurance coverage, foundation maintenance tips, and damage prevention strategies.

How Much Does a Cracked Foundation Affect Home Value?

A cracked foundation's impact on home value depreciation is substantial, with real estate appraisal decreases ranging from 10% to 30%. This loss often surpasses foundation repair costs, further diminishing the property's worth over time.