Homeowners insurance covers crawl space mold only when directly caused by sudden, accidental, and covered perils like burst pipes or flooding from appliance failures. Coverage typically ranges from $1,000-$10,000 per occurrence, with remediation costs averaging $10-$25 per square foot. Documentation through photos, moisture readings, and professional inspection reports must clearly demonstrate the covered peril's link to mold growth. Public adjusters can increase settlement amounts by 30-50% through detailed technical assessments and expert claim management.

Key Takeaways

- Homeowners insurance typically covers mold damage only if caused by a covered sudden/accidental event like burst pipes.

- Coverage is denied for mold resulting from poor maintenance, gradual leaks, or inadequate ventilation in crawl spaces.

- Insurance claims require thorough documentation, including photos and professional testing reports linking mold to a covered peril.

- Crawl space mold remediation costs range from $500-$2,000, with insurance coverage limits typically between $1,000-$10,000.

- Regular maintenance and prevention measures like vapor barriers and humidity control affect coverage eligibility for crawl space mold.

Understanding Mold Coverage in Home Insurance Policies

When it comes to mold coverage in homeowners insurance policies, the protection typically hinges on the specific cause of the mold damage and the terms outlined in the policy. Insurance providers generally cover mold damage resulting from sudden and accidental events, such as burst pipes or water heater failures, that are listed as covered perils. However, mold damage resulting from long-term issues, such as chronic leaks or insufficient maintenance, is often excluded from coverage. It’s important for policyholders to carefully review their insurance contracts to understand the limitations and exclusions that may apply. Additionally, renters should be aware that mold damage coverage in renters insurance may vary significantly, so it’s advisable to check the specific terms of their policy as well.

Understanding coverage specifics is essential, as most policies impose strict insurance limitations on mold remediation, typically ranging from $1,000 to $10,000 per occurrence. These limitations vary substantially among carriers and policy terms.

While standard coverage may address certain mold situations, homeowners should be aware that damages stemming from negligence, long-term water seepage, or maintenance issues are typically excluded. Additional protection may be available through special endorsements or separate policies, particularly for specific scenarios like flood-related mold damage.

Professional assessment and thorough documentation are often required to substantiate claims and determine coverage eligibility. Rapid response is critical since mold can develop within 24-48 hours after water exposure.

Common Causes of Crawl Space Mold

The two primary causes of crawl space mold are plumbing failures and excessive humidity levels.

Leaking pipes, burst water lines, and faulty plumbing connections can introduce water directly into the crawl space environment, creating ideal conditions for mold growth.

High humidity levels, often exacerbated by poor ventilation, can lead to condensation on surfaces and sustained moisture conditions that promote mold development.

Without proper remediation using EPA-registered antimicrobial solutions, crawl space mold can spread rapidly and create serious health hazards.

Plumbing Leaks and Failures

Plumbing leaks and failures rank among the primary culprits behind crawl space mold infestations in residential properties. When pipe corrosion or flood overflow occurs, water can infiltrate crawl spaces, creating ideal conditions for mold proliferation. Even minor leaks, if left unaddressed, can saturate wooden structures and lead to extensive fungal growth.

Regular inspection of plumbing components is essential for early detection and prevention of water intrusion. This includes examining pipes, foundation cracks, and drainage systems to guarantee proper water management.

Downspouts must direct water away from the foundation to prevent seepage into crawl spaces. Insurance coverage for resulting mold damage typically depends on the cause, with sudden events like burst pipes often covered, while gradual water infiltration usually falls outside standard policy parameters. Since most standard policies exclude maintenance and wear-related issues, homeowners should consider consulting public adjusters to help maximize potential mold damage claims.

Humidity and Poor Ventilation

Stagnant air and excessive moisture levels create perfect conditions for mold growth in residential crawl spaces. When humidity levels exceed 50%, the environment becomes particularly conducive to mold and mildew proliferation. This situation often occurs due to inadequate ventilation systems that fail to properly circulate air, allowing moisture to accumulate.

Poor ventilation in crawl spaces typically relies on passive airflow through wind or pressure changes, which proves ineffective in controlling moisture. The problem compounds when groundwater enters through capillary action, or when vapor barriers are damaged or missing.

The trapped moisture can lead to condensation on pipes and walls, while temperature differentials between the crawl space and soil further exacerbate the problem. These conditions not only promote mold growth but can also compromise structural integrity through wood rot and metal corrosion. Most mold species thrive in temperatures between 77-86 degrees Fahrenheit and will rapidly colonize damp crawl spaces within 48 hours.

When Insurance Will Cover Crawl Space Mold

Understanding when homeowners insurance covers crawl space mold requires examining specific covered perils and their associated conditions. Insurance providers typically cover mold damage in crawl spaces when it results from sudden and accidental covered incidents, such as burst pipes, malfunctioning appliances, or roof leaks from severe weather events. Coverage also extends to mold resulting from firefighting efforts or ice dam formation.

To meet insurance requirements for crawl space mold claims, homeowners must demonstrate a direct link between the mold growth and a covered peril. The damage must occur quickly following the incident, rather than developing gradually over time.

Claims require thorough documentation, including professional assessments and photographic evidence. Coverage limits for mold remediation generally range from $1,000 to $10,000, though limits may vary in high-humidity regions. Prompt reporting and adherence to insurer guidelines are essential for successful claims processing. Working with public adjusters can significantly increase claim success rates through their expertise in documenting damages and negotiating fair settlements.

Key Exclusions for Mold Coverage

Insurance policies generally exclude mold damage that develops gradually over time due to ongoing moisture issues or poor ventilation in crawl spaces.

Problems stemming from homeowner neglect, such as failing to address small leaks or maintain proper drainage systems, typically fall outside the scope of coverage.

Insurance carriers also deny claims where mold results from inadequate home maintenance, including failure to repair known plumbing issues or address recurring moisture problems in crawl space environments.

However, homeowners can obtain mold coverage options through special policy endorsements to protect against fungal damage.

Gradual Damage Issues

Gradual deterioration poses significant challenges when seeking coverage for crawl space mold under homeowners insurance policies. Insurance providers typically exclude damage resulting from long-term leaks, continuous water exposure, and extended seepage that could have been prevented through regular maintenance.

Key exclusions often apply to situations where homeowners fail to address visible water damage or leaks promptly. Hidden but preventable leaks that develop over time are frequently denied coverage, particularly when regular inspections could have identified the issue earlier.

Additionally, insurance companies may reject claims if there is evidence that the mold growth resulted from delayed action in addressing water intrusion. These exclusions emphasize the importance of regular crawl space inspections and immediate response to any signs of moisture problems.

Similar to how termite infestations are excluded from standard coverage, most policies consider mold damage a maintenance issue rather than a sudden, accidental event.

Neglect and Maintenance Problems

Regular maintenance stands as a primary factor in determining whether homeowners insurance will cover mold damage in crawl spaces. Insurance providers typically exclude coverage for mold resulting from neglect, creating significant property liability concerns for homeowners with deferred repairs.

| Maintenance Issue | Coverage Impact |

|---|---|

| Unattended Leaks | Not Covered |

| Poor Ventilation | Excluded |

| Unsealed Openings | No Coverage |

| Drainage Problems | Coverage Denied |

Insurers specifically exclude mold damage stemming from prolonged moisture exposure due to inadequate maintenance. This includes unaddressed plumbing leaks, insufficient ventilation in humid areas, and failure to maintain proper drainage systems. Coverage may also be denied when homeowners neglect to use dehumidifiers or fail to address visible water intrusion promptly, particularly in crawl space environments. Working with public adjusters can significantly increase insurance settlements by 30-50% when mold damage claims are initially denied.

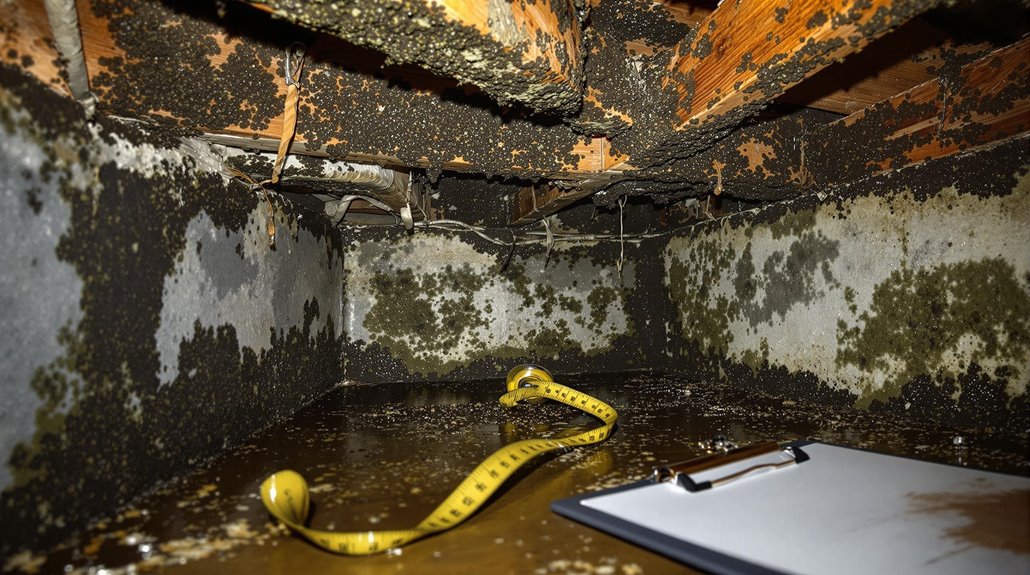

Documentation Requirements for Mold Claims

Filing a successful mold claim requires complete documentation that establishes the presence, cause, and extent of the damage in the crawl space. Proper claim preparation involves gathering detailed photographs, videos, and written descriptions of affected areas, along with professional mold testing reports that confirm the presence and type of mold growth.

Essential paperwork organization must include evidence demonstrating that the mold resulted from a covered peril, such as water damage from burst pipes or roof leaks.

Documentation should clearly identify the source of mold growth and verify that it wasn't caused by neglect. Records must show all mitigation efforts, including immediate actions taken to prevent further damage and professional remediation work performed.

Insurance companies require proof of compliance with policy provisions, including timely reporting and following prescribed remediation guidelines. Maintaining detailed records of all communications with the insurer and relevant policy sections that cover mold damage strengthens the claim's validity.

Working with insurance adjusters during the inspection process helps ensure accurate assessment of mold-related damages and appropriate compensation determination.

Steps to File a Crawl Space Mold Claim

When homeowners discover mold in their crawl space, initiating a systematic claim process becomes essential for securing insurance coverage. The process begins with a thorough inspection of the affected area, documenting all visible mold and water damage through extensive photo evidence and video documentation. This visual record should capture multiple angles of the damage to provide a complete assessment.

The next phase involves promptly notifying the insurance provider while maintaining detailed claim timelines. Homeowners must review their policy coverage, submit initial documentation, and coordinate with claims adjusters for property inspection.

Throughout the process, maintaining clear communication and providing requested documentation helps facilitate claim processing. Essential elements include repair estimates, maintenance records, and a chronological account of the damage discovery. Insurance adjusters will evaluate the cause of mold growth to determine coverage eligibility, making it vital for homeowners to preserve all evidence and follow prescribed claim procedures meticulously. Working with public adjusters can increase settlement amounts by 30-50% for property damage claims.

Preventing Mold Growth in Crawl Spaces

Effective mold prevention in crawl spaces requires a complete moisture management strategy encompassing multiple control measures. A thorough approach includes proper barrier installation, ventilation enhancement, and active dehumidification systems.

Homeowners should implement both preventive and maintenance measures to guarantee long-term protection against mold growth.

Key elements of crawl space moisture control include:

- Installing vapor barriers covering 100% of soil surfaces

- Maintaining humidity levels below 50% using specialized dehumidifiers

- Sealing all foundation gaps and vents to prevent external moisture infiltration

- Implementing proper drainage systems, including functioning gutters and downspouts

- Insulating pipes and walls to prevent condensation formation

Regular inspections and maintenance are vital for early detection of potential moisture issues.

Proper crawl space encapsulation, combined with adequate ventilation and dehumidification, creates an environment inhospitable to mold growth. This systematic approach to moisture management helps protect the structural integrity of the home while maintaining healthy indoor air quality.

The Role of Professional Mold Inspections

Professional mold inspections serve as a critical diagnostic tool for identifying and evaluating fungal contamination in crawl spaces.

These assessments, typically lasting 2-6 hours, require specific inspection timing and preparation protocols, including deactivating HVAC systems and maintaining a controlled environment for 48 hours prior to testing.

Certified inspectors, holding credentials from organizations like ACAC or IICRC, utilize specialized equipment and follow established sampling protocols.

The process encompasses visual examination, outdoor baseline assessment, and multiple sampling methods including air, surface, and bulk collection. Samples undergo laboratory analysis to determine mold species and concentration levels.

For ideal results, property owners must adhere to pre-inspection guidelines, such as turning off air purification devices and avoiding cleaning activities that could affect baseline measurements.

Independent inspectors, unaffiliated with remediation companies, provide unbiased assessments following industry standards like IICRC-S520, delivering thorough reports with actionable recommendations for addressing identified issues.

Cost Considerations for Mold Remediation

Following a professional mold inspection, property owners must consider the substantial financial implications of mold remediation services. Professional estimates typically range from $1,125 to $3,439, with a national average of $2,254.

The damage extent dramatically influences costs, as remediation charges vary from $10 to $25 per square foot. Labor expenses constitute approximately 60% of total costs, with specialized equipment and materials comprising the remainder.

- Crawl space remediation costs range from $500 to $2,000, depending on accessibility and contamination level

- HVAC system treatment requires $3,000 to $10,000 due to complex decontamination procedures

- Black mold removal commands higher prices ($800 to $7,000) due to its hazardous nature

- Geographic location affects pricing through varying labor rates and regulatory requirements

- Specialized equipment needs, including HEPA filtration and negative air pressure systems, impact final costs

The complexity of mold remediation necessitates careful financial planning, as factors such as material types and infestation severity can significantly alter the final expense.

The Benefits Of Consulting A Public Adjuster

Public adjusters provide specialized expertise in maneuvering complex insurance claims for crawl space mold, offering objective damage assessments that insurance companies find credible.

Their professional involvement streamlines the entire claims process by handling documentation, negotiations, and policy interpretation with technical precision.

Statistical evidence indicates that claims handled by public adjusters typically result in substantially higher settlements compared to those processed without professional representation.

Expertise In Insurance Claims

When dealing with complex mold-related insurance claims, consulting a public adjuster offers significant advantages due to their specialized expertise in policy interpretation and claims management.

These licensed professionals possess extensive knowledge of insurance policies, enabling them to develop effective filing strategies and navigate intricate claims procedures.

Their expertise guarantees thorough documentation, accurate damage assessments, and proper presentation of evidence to support claims.

- Deep understanding of insurance policy language, exclusions, and endorsements

- Strategic approach to claims documentation and submission procedures

- Experience in identifying coverage limits and applicable policy provisions

- Proficiency in managing complex mold-related damage assessments

- Knowledge of industry standards and regulatory requirements for claims processing

Public adjusters leverage their technical expertise to advocate for policyholders, guarantees proper evaluation of mold damage and maximizing potential settlements within policy parameters.

Objective Damage Assessment

Obtaining an objective damage assessment through a licensed public adjuster represents an essential step in properly evaluating mold-related claims in crawl spaces. Public adjusters utilize systematic assessment methods and inspection details to document all damages thoroughly, including hidden areas behind walls and beneath surfaces.

| Assessment Component | Documentation Method | Outcome |

|---|---|---|

| Visual Inspection | Photographic Evidence | Identifies visible mold growth |

| Moisture Testing | Digital Measurements | Determines affected zones |

| Structural Analysis | Technical Reports | Evaluates damage severity |

The evaluation process includes thorough documentation of damages, professional estimates for repairs, and detailed analysis of policy coverage. This systematic approach guarantees that insurance claims accurately reflect the full scope of mold damage, leading to appropriate compensation for necessary remediation and repairs.

Streamlined Claim Process

Engaging a public adjuster transforms the insurance claim process into a streamlined, efficient operation that maximizes the potential for successful mold-related claims in crawl spaces.

Through process optimization and claim simplification, these professionals manage all aspects of the insurance claim while maintaining emotional objectivity. Their contingency-based payment structure guarantees alignment with policyholder interests, while their expertise in policy interpretation and damage assessment accelerates settlement timelines.

- Systematic documentation and submission protocols enhance claim accuracy

- Professional negotiation tactics leverage industry knowledge for maximum settlements

- Contingency-based fees eliminate upfront costs for homeowners

- Expert testimony capabilities strengthen disputed claims

- Objective damage assessment methods secure thorough coverage analysis

The streamlined approach implemented by public adjusters allows homeowners to focus on property restoration while experts navigate complex claim procedures.

Higher Claim Payouts & Settlements

The decision to consult a public adjuster for mold-related claims substantially enhances the probability of securing higher settlement amounts. These professionals employ expert damage assessment techniques to identify all mold-related issues within crawl spaces, including those that might go unnoticed by untrained observers.

Public adjusters leverage their thorough understanding of insurance policies and negotiation expertise to counteract common tactics used by insurance companies to minimize payouts. Their thorough documentation and professional advocacy guarantee that all legitimate damages are included in the claim, leading to increased compensation.

Operating on a contingency basis, public adjusters are inherently motivated to maximize settlements while simultaneously relieving homeowners of the stress associated with complex claim negotiations, ultimately resulting in higher settlements that accurately reflect the full extent of mold-related damages.

About The Public Claims Adjusters Network (PCAN)

Professional adjusters within the Public Claims Adjusters Network (PCAN) form a complete alliance of licensed claims specialists who assist policyholders in managing complex insurance matters.

Through organizations like the Network of Independent Claims Adjusters (NICA), these professionals deliver thorough solutions encompassing daily adjusting, catastrophic claims management, and specialized support services. The network benefits extend beyond basic claims handling, incorporating expertise in customized approaches for unique challenges.

- Initial notice of loss processing and documentation

- Ongoing claims management with professional oversight

- Coverage expertise in complex policy interpretation

- Detailed estimation and scope preparation services

- Settlement negotiation and dispute resolution support

PCAN's structure facilitates maximum outcomes by eliminating conflicts of interest between policyholders and insurance companies.

The network's industry-leading experience guarantees professional handling of claims while maintaining high standards of service delivery. Through NICA's integrated approach, adjusters provide responsive solutions that enhance efficiency throughout the claims process.

Frequently Asked Questions

Can Switching Insurance Providers Affect Existing Mold Coverage in My Crawl Space?

Switching providers can substantially impact mold coverage, as coverage transfers are not automatic. Policy timing between providers must align to prevent gaps, and pre-existing conditions may face new limitations.

Does Having Previous Mold Claims Impact Future Insurance Rates or Coverage Eligibility?

Previous mold claims substantially influence insurance outcomes, typically resulting in premium increases and potential coverage limitations. Claims history affects risk assessment, leading to stricter underwriting criteria for future policies.

How Long Does Mold Remediation Coverage Last After a Successful Claim?

Like a ticking clock, standard coverage duration spans 14 days post-claim approval, encompassing the complete treatment lifecycle while addressing immediate damage from covered perils during active remediation procedures.

Are DIY Mold Treatments Covered if They Fail to Solve the Problem?

Insurance policies typically do not cover failed DIY mold treatment costs. Such attempts may increase liability risks and void coverage, particularly when professional remediation becomes subsequently necessary.

Do Insurance Companies Require Specific Types of Vapor Barriers for Coverage?

Insurance companies generally do not specify vapor barrier requirements or installation standards for coverage. Building codes and climate zones, rather than insurers, determine appropriate vapor barrier specifications for structures.

References

- https://clovered.com/does-homeowners-insurance-cover-mold/

- https://www.eduyush.com/en-us/blogs/how-to/does-homeowners-insurance-cover-mold

- https://falconecrawlspace.com/homeowners-insurance-crawl-space-encapsulation/

- https://www.hippo.com/learn-center/does-homeowners-insurance-cover-mold

- https://www.sawyerlabar.com/blog/does-california-homeowners-insurance-cover-mold-damage/

- https://www.plymouthrock.com/resources/does-home-insurance-cover-mold

- https://www.tdi.texas.gov/tips/when-are-water-damage-and-mold-covered-by-insurance.html

- https://www.progressive.com/answers/does-homeowners-insurance-cover-mold/

- https://www.investopedia.com/does-homeowners-insurance-cover-mold-4782771

- https://www.greenattic.com/blogs/what-causes-mold-in-crawlspace