Home warranty coverage for slab leaks varies by provider and policy terms. Standard plans often include basic leak detection services but may impose strict dollar limits and repair method requirements. Enhanced coverage options typically provide higher limits and fewer exclusions for slab leak repairs, which can cost up to $2000. Homeowners should examine their policy details carefully, considering factors like home age and local geological conditions. Understanding the full scope of available coverage options helps protect against unexpected repair costs. Additionally, homeowners are encouraged to consult with their home warranty provider to clarify any ambiguities regarding slab leak repair and insurance coverage. Knowing the specific terms of the policy can aid in making informed decisions when facing potential plumbing issues. By proactively addressing these concerns, homeowners can ensure they are adequately protected against the financial implications of unforeseen slab leaks.

Key Takeaways

- Standard home warranty plans often include slab leak coverage but with specific dollar limits and repair method restrictions.

- Basic coverage typically includes leak detection services but may have limitations on the actual repair costs.

- Enhanced coverage options provide higher coverage limits and fewer exclusions for slab leak repairs.

- Most home warranties require using approved contractors and following specific claim filing procedures for slab leak coverage.

- Coverage levels vary by provider, so homeowners should carefully review policy details regarding slab leak limits and exclusions.

Understanding Slab Leaks and Their Impact on Your Home

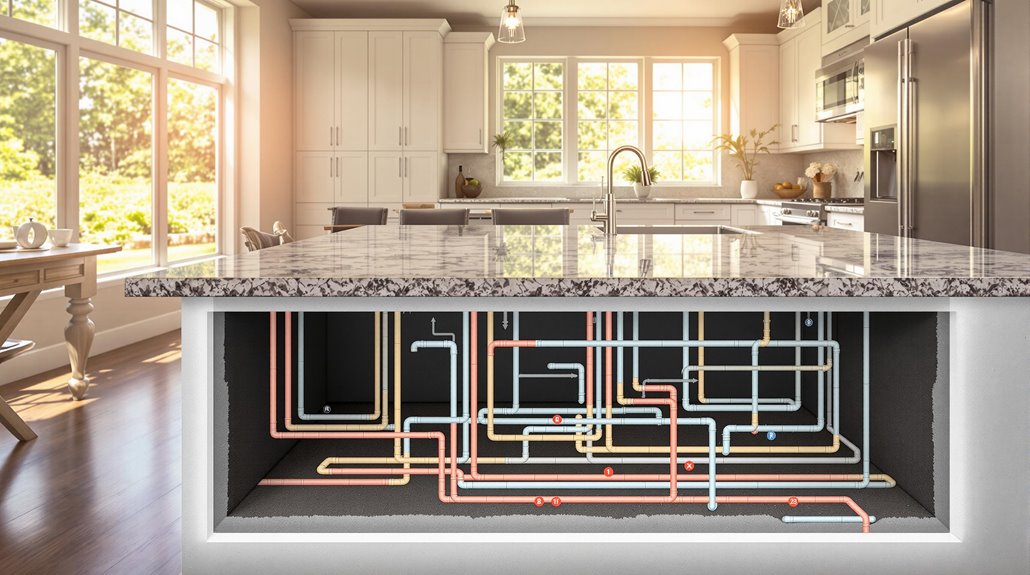

Slab leaks, which occur in the copper pipes beneath concrete foundations, represent one of the most serious plumbing issues that can affect residential properties. These leaks typically result from various factors, including ground shifting, improper construction, water corrosion, or the natural aging of pipes. Repair costs can reach up to $2000 on average for professional slab leak fixes.

Early slab leak detection is essential, as unaddressed leaks can lead to substantial water bills, structural damage, and extensive foundation problems.

Homeowners should remain vigilant for common indicators that may necessitate slab leak repair, including unexplained water pooling, damp carpeting, reduced water pressure, or the sound of running water when fixtures are inactive.

Professional detection methods utilize advanced technology such as acoustic listening devices, infrared cameras, and pressure testing to precisely locate leaks.

The severity of slab leaks often requires immediate attention from qualified plumbers who can implement appropriate repair solutions, potentially including pipe replacement or rerouting to prevent future occurrences.

Home Warranty Coverage Options for Slab Leaks

When considering protection against costly slab leak repairs, homeowners must carefully evaluate their home warranty coverage options, as standard plans often exclude or limit coverage for these underground plumbing issues.

Basic warranty plans typically restrict coverage for slab leaks, setting specific dollar limits and repair method requirements. Most providers include leak detection services as part of their standard coverage.

For thorough slab leak prevention, enhanced coverage options present a more robust solution. These specialized add-ons often feature higher coverage limits, more flexible repair methods, and fewer exclusions.

Enhanced plans may cover additional aspects such as re-routing pipes and repairing foundation cracks. When making warranty comparisons, homeowners should examine factors including policy details, home age, and local geological conditions.

Coverage availability and terms vary greatly based on the plumbing system's age and location-specific risks.

Understanding claim procedures and following proper protocols remains essential for successful coverage implementation, regardless of the chosen warranty level.

How to File a Claim for Slab Leak Coverage

Successfully filing a claim for slab leak coverage requires homeowners to follow specific procedures and documentation requirements established by their warranty provider. The claim submission process typically begins with immediate notification upon discovering the leak, followed by thorough documentation of the damage through photographs and detailed descriptions.

Essential steps for a successful claim include:

- Contacting the warranty provider immediately to initiate the claims process and obtain a claim number.

- Documenting all damage with photographs, videos, and written descriptions of affected areas.

- Working with approved contractors to assess damage and obtain repair estimates.

Homeowners must maintain detailed records of all communications with the warranty company and contractors throughout the process.

Regular follow-up guarantees the claim progresses efficiently while adhering to documentation requirements.

Professional assistance from qualified plumbers can strengthen the claim by providing expert assessment of the leak's cause and extent of damage.

Most homeowners should be aware that home warranties typically exclude slab leak coverage from their standard policies.

Alternative Coverage Solutions Beyond Home Warranties

Beyond traditional home warranties, homeowners have multiple coverage options for protecting against costly slab leak repairs.

Standard homeowners insurance policies typically include dwelling coverage, which addresses structural damage from slab leaks but not the plumbing repairs themselves. Personal property coverage helps with water damage to belongings, while service line coverage can be added to protect underground pipes.

Alternative insurance solutions include specialized policies specifically designed for water damage and slab leaks. During home purchases, coverage negotiation can secure protection through the purchase contract. A typical inspection to identify slab issues costs between $150 to $600.

Enhanced warranty plans with specific add-ons may offer expanded slab leak coverage, though careful contract review is essential to understand limitations and exclusions.

Regular maintenance and professional inspections remain vital, as most policies exclude damage from wear and tear, gradual deterioration, or lack of maintenance.

Homeowners should note that natural disasters, faulty construction, and settling-related damages typically require separate coverage options.

Prevention and Detection of Future Slab Leaks

Proactive measures in preventing slab leaks begin with establishing thorough detection and maintenance protocols. Foundation stability serves as the cornerstone of leak prevention, requiring quality materials and proper construction techniques during initial installation. Quality cement or concrete is essential for creating a solid foundation that minimizes the risk of shifting and cracking.

Advanced leak detection methods, including acoustic devices and thermal imaging, enable early identification of potential issues before they escalate into costly repairs.

To maintain plumbing system integrity, property owners should focus on:

- Annual professional inspections utilizing inline cameras and pressure testing

- Regular monitoring of water pressure levels and installation of pressure-reducing valves

- Management of soil conditions and drainage systems to prevent foundation shifts

Environmental factors play an essential role in preventing slab leaks. Proper soil moisture maintenance, combined with adequate drainage systems, helps preserve foundation stability.

Regular assessments of water pressure and soil conditions, coupled with professional inspections, create a thorough approach to preventing future slab leaks and maintaining plumbing system health.

The Benefits Of Consulting A Public Adjuster

Consulting a public adjuster for slab leak claims provides critical expertise in maneuvering through complex insurance policies and maximizing settlement outcomes.

Their objective assessment methodology guarantees thorough documentation of all damages, while their specialized knowledge helps identify coverage areas that homeowners might otherwise overlook.

The streamlined claims process handled by public adjusters typically results in higher payouts compared to self-managed claims, as these professionals understand how to properly value damages and negotiate effectively with insurance carriers.

Expertise In Insurance Claims

Many homeowners facing slab leak claims can benefit considerably from engaging a public adjuster, whose expertise in insurance matters provides essential advantages during the claims process.

Public adjusters excel in insurance policy interpretation and employ proven claims negotiation strategies to maximize settlements while maneuvering complex coverage disputes.

These professionals deliver vital expertise in three key areas:

- Policy analysis and identification of covered damages

- Thorough documentation and evidence compilation

- Strategic negotiations with insurance carriers to secure best settlements

Their technical knowledge of policy exclusions, limits, and procedural requirements helps prevent claim denials due to technicalities.

Additionally, public adjusters manage the entire claims process efficiently, allowing homeowners to focus on property restoration while ensuring their interests are professionally represented throughout negotiations.

Objective Damage Assessment

Professional damage assessment by public adjusters provides homeowners with extensive and unbiased evaluations of slab leak damages.

These experts utilize advanced diagnostic tools, including moisture meters and thermal imaging cameras, to identify both visible and concealed water damage throughout the property. Their detailed inspections detect potential structural issues and mold growth that might otherwise remain undiscovered.

Public adjusters document all findings meticulously, creating detailed records essential for insurance claims.

Their specialized knowledge of restoration processes guarantees accurate assessment of repair requirements to restore properties to pre-loss condition.

Through objective expertise and technical proficiency, they establish precise damage extent while avoiding assumptions or oversights.

This systematic approach to damage assessment strengthens the homeowner's position when dealing with insurance carriers and helps secure appropriate compensation for necessary repairs.

Streamlined Claim Process

When homeowners face the complexities of slab leak claims, public adjusters greatly streamline the insurance process through expert claim management and documentation services.

These professionals leverage their specialized knowledge of insurance policies and procedures to guarantee thorough coverage assessment and maximum compensation for damages.

Public adjusters facilitate efficient insurance negotiations by:

- Managing all communication with insurance companies while maintaining detailed documentation

- Analyzing policies to identify applicable coverage and potential exclusions

- Presenting professionally prepared claims supported by thorough evidence

Their contingency-based service model aligns with the policyholder's interests, guaranteeing diligent representation throughout the claims process.

Higher Claim Payouts & Settlements

Studies consistently demonstrate the financial advantages of engaging public adjusters for slab leak insurance claims. Data shows that claims handled by public adjusters result in settlements averaging $22,266, compared to $18,659 without professional representation. Their expertise in settlement strategies and thorough damage assessment leads to higher claim values.

| Factor | Impact on Settlement |

|---|---|

| Professional Assessment | Thorough damage identification |

| Policy Expertise | Maximum benefit utilization |

| Negotiation Skills | Enhanced compensation outcomes |

| Documentation | Complete claim substantiation |

| Objective Evaluation | Ideal settlement amounts |

Public adjusters leverage their industry knowledge and experience to identify overlooked damages, interpret complex policy terms, and effectively counter insurance company tactics designed to minimize payouts. Their professional representation guarantees policyholders receive fair compensation while removing the burden of direct negotiations with insurers.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) serves as a national organization connecting licensed public adjusters who advocate for policyholders during insurance claim processes.

When dealing with slab leak claims, PCAN members assist homeowners in steering through both home warranty and insurance coverage issues, ensuring proper documentation and maximum claim settlements.

Professional public adjusters within the network specifically help homeowners by:

- Evaluating coverage limitations between home warranty and insurance policies for slab leak claims

- Documenting the full scope of damage, including structural impacts and personal property losses

- Negotiating with insurance carriers and warranty companies for thorough settlements

The Adjusters Network maintains stringent professional standards, requiring members to possess state licensing and demonstrate expertise in various claim types, including complex slab leak scenarios.

This expertise becomes particularly valuable when claims involve multiple coverage sources or when disputes arise regarding covered versus excluded damages.

Frequently Asked Questions

Can I Transfer My Home Warranty Slab Leak Coverage to a New Owner?

Home warranty policies with slab leak coverage may be transferable to new owners, subject to provider-specific conditions. Transfer terms must be verified directly with the warranty company before property sale completion.

How Long Does It Typically Take to Complete Slab Leak Repairs?

Slab leak repair duration typically ranges from 1-3 days, including leak detection. Simple spot repairs take 4-8 hours, while complex repiping or rerouting methods require 2-3 days for completion.

Will Multiple Slab Leak Claims Affect My Future Home Warranty Premiums?

Like ripples in a pond, multiple slab leak claims create expanding financial effects. Future warranty premiums typically increase markedly, with providers implementing stricter coverage terms and elevated rates to offset risks.

Are Earthquake-Related Slab Leaks Treated Differently by Home Warranty Companies?

Earthquake impact on slab leaks typically falls under standard warranty exclusions. Home warranty companies generally do not cover damage resulting from natural disasters, requiring separate earthquake coverage or specialized insurance policies.

Can I Choose My Own Contractor for Slab Leak Repairs Under Warranty?

Home warranty companies typically restrict contractor selection to their pre-approved network. While some policies may permit outside contractors, this requires pre-authorization and could affect coverage during repair processes.

References

- https://www.allstate.com/resources/home-insurance/slab-leaks

- https://www.plumbingkingsllc.com/blog/2019/06/what-is-a-slab-leak-and-how-bad-is-it/

- https://www.libertyhomeguard.com/questions/does-home-warranty-cover-slab-leaks/

- https://www.simplyinsurance.com/slab-leak-insurance-coverage/

- https://www.jimsplumbingnow.com/blog/what-is-a-slab-leak-causes-signs-and-repair/

- https://www.plumbingbyjake.com/faqs/common-causes-of-slab-leaks/

- https://www.fryplumbing.com/how-does-a-plumber-find-a-slab-leak

- https://delta1plumbing.com/is-a-slab-leak-covered-by-home-warranty/

- https://www.ahs.com/our-coverage/home-systems/plumbing/

- https://hacklerplumbingmckinney.com/is-slab-leak-covered-by-insurance/