Homeowners insurance may cover water leaks under the foundation, but coverage depends on the origin of the leak. Sudden leaks from burst pipes or natural disasters are typically covered, while gradual issues due to wear and tear are often excluded. Policyholders must demonstrate the leak resulted from a covered peril to establish a successful claim. Determining the cause of a water leak and understanding insurance policy terms are essential for managing coverage and potential repair costs.

Key Takeaways

- Homeowners insurance typically covers water damage from plumbing issues under the foundation caused by sudden events or covered perils.

- Gradual leaks from wear and tear or maintenance issues, such as tree root intrusion, are generally excluded from coverage.

- Coverage for slab leaks depends on the origin of the leak and may be subject to dwelling coverage limits and deductible amounts.

- Successful claims require establishing the leak was caused by a covered peril and providing thorough documentation of the damage.

- Policyholders should weigh repair costs against deductibles before filing a claim, as claims can lead to increased insurance rates in the future.

What Is a Slab Leak and How Does It Happen?

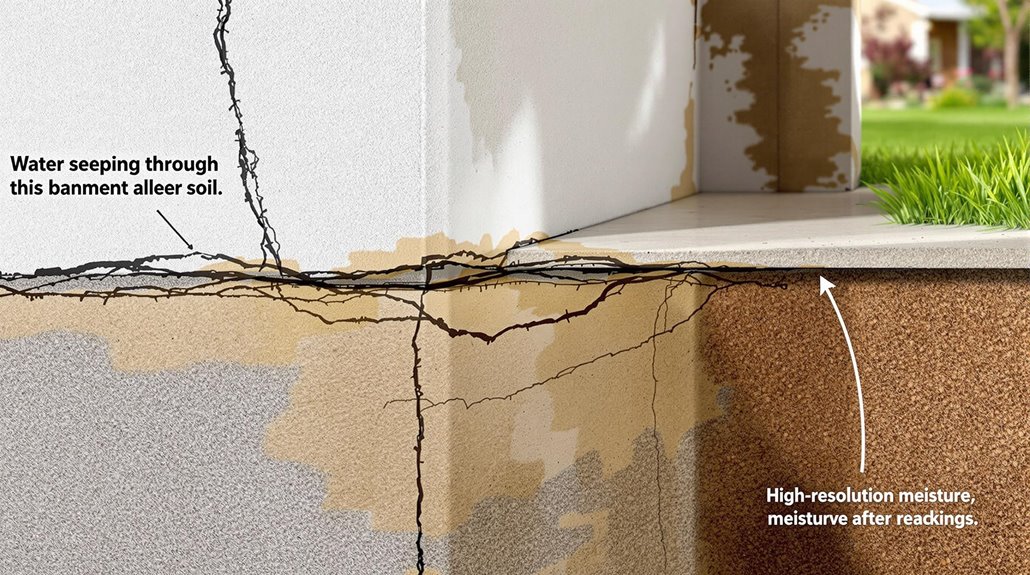

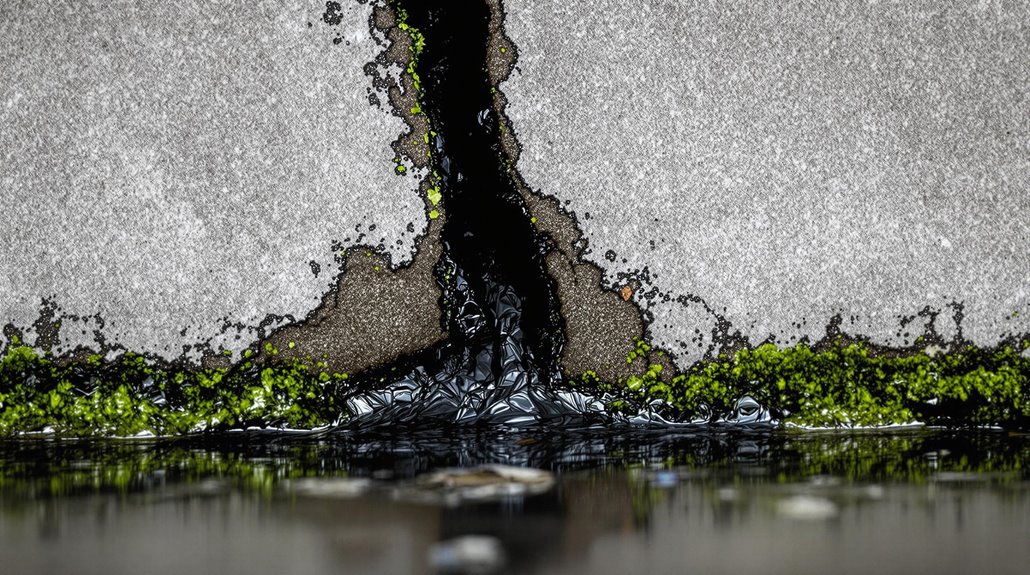

How exactly does a slab leak occur, and what are its underlying causes? A slab leak refers to a plumbing leak that occurs beneath the concrete foundation of a home, often leading to significant water damage if not addressed promptly.

Common indicators of a slab leak include unusually high water bills, damp spots on floors, and the presence of mold or mildew odors.

The causes of slab leaks can be varied, including burst pipes, natural disasters, and gradual issues like tree root pressure or soil movement. These gradual issues can lead to the deterioration of pipes over time, increasing the likelihood of a leak.

In some cases, a slab leak may be covered by homeowners insurance if it results from a covered peril, such as a burst pipe.

Having actual cash value coverage may result in lower claim payouts for slab leak damage due to depreciation of affected materials and components.

Repair costs for slab leaks can be substantial, averaging around $2,300 as of 2024. Detection and prompt repair are essential to mitigate damage.

Does Homeowners Insurance Cover Water Leaks Under the Foundation?

Homeowners insurance provides coverage for slab leaks in certain instances, primarily where the leak is sudden and accidental, such as a burst pipe.

Conversely, gradual leaks resulting from wear and tear or natural settling of the foundation typically do not qualify for coverage.

In general, the cause of the leak determines the extent of coverage, with repairs to the slab potentially being included if the damage was caused by a covered peril.

Understanding your dwelling coverage limits is crucial when assessing potential foundation leak repairs and associated costs.

Causes of Slab Leaks

Beneath the concrete foundation of a house lies a complex network of plumbing pipes that can be prone to damage and leaks. Slab leaks, which occur when these pipes burst, rupture, or are damaged, can be caused by various events, including natural disasters, explosions, or sudden impacts. The following table outlines common causes of slab leaks and their potential impact on homeowners insurance claims:

| Cause | Insurance Coverage |

|---|---|

| Burst pipe due to sudden impact | May be covered if caused by a covered peril |

| Gradual plumbing leak | Typically not covered, as considered normal wear and tear |

| Natural disaster (e.g., earthquake) | May be covered, depending on policy specifics |

Insurance Coverage for Leaks

Determining whether homeowners insurance covers water leaks under the foundation depends on the leak's origin. A homeowners insurance policy may cover slab replacement due to water leaks if the leak is caused by a covered peril, such as a burst pipe or explosion.

Coverage options for foundation damage typically exclude gradual causes like settling or tree root pressure. Slab leak repair costs can average $2,300, which may be paid out of pocket if the deductible is higher.

Before filing an insurance claim, homeowners should weigh repair costs against potential premium hikes. It is essential to review the policy to understand what foundation damage is covered.

Preventive measures can also help mitigate common causes of foundation damage, and consulting an insurance adjuster can provide further guidance on coverage.

Filing a Leak Claim

In many cases, filing a successful claim for water leaks under the foundation requires establishing that the leak was caused by a covered peril. Homeowners insurance may cover damage resulting from sudden events such as burst pipes or explosions, but not gradual plumbing issues or wear and tear.

- Concerns about higher insurance rates due to claims for water leaks under the foundation

- Potential repair costs averaging around $2,300 for slab leaks

- The significance of weighing repair costs against the deductible to determine the best course of action

Documentation, including photos and records of the damage, is essential in facilitating the claims process.

Homeowners must carefully review their policy to understand what is covered and what is excluded, such as natural settling or tree root pressure, to guarantee a smooth claims process.

Causes of Slab Leaks That Are Typically Covered by Insurance

While homeowners insurance policies can be complex and vary in their coverage, there are certain causes of slab leaks that are typically covered. Homeowners insurance generally covers slab leaks resulting from sudden and accidental events classified as covered perils, such as burst pipes or explosions.

Additionally, damage from natural disasters like tornadoes or fires that lead to slab leaks is also usually covered.

In contrast, damage from gradual causes, such as natural settling or tree root pressure, is typically excluded from coverage as it is not considered sudden or accidental.

If a covered slab leak occurs, homeowners insurance may provide repair coverage for the resulting damage to the slab, but it will not cover the broken pipes causing the leak.

Similar to how only 27% of flood zone homeowners carry flood insurance, many property owners lack adequate coverage for water-related foundation damage.

To support a claim, homeowners should document signs of slab leaks, such as high water bills or foundation cracks. This documentation can be essential in securing repair coverage.

Signs You Have a Slab Leak Under Your Foundation

How do homeowners identify when a potentially catastrophic slab leak is occurring beneath their foundation? Recognizing early warning signs can help mitigate water intrusion and associated signs of foundation damage.

Common indicators of a slab leak include visible *cracks in the slab*, suggesting underlying plumbing issues. Homeowners should be vigilant for:

- Damp spots on floors or carpets resulting from water pooling due to a hidden leak

- Unusually high water bills indicating excess water usage

- Warm areas on the floor, signaling potential hot water line leaks beneath the foundation

Additionally, the presence of mold or mildew odors may indicate moisture accumulation from a slab leak, requiring immediate attention.

Effective communication between homeowners and insurance providers is essential for initiating prompt investigation of potential slab leaks.

Investigating these signs can help homeowners detect a slab leak early and take corrective action to minimize damage to their property. Regular monitoring of these signs can also aid in identifying potential plumbing issues before they escalate.

The Cost of Repairing a Slab Leak and Filing an Insurance Claim

The average cost to repair a slab leak is approximately $2,300; however, detection costs, which can range from $150 to $600, also factor into the overall expense.

Homeowners may be able to offset some or all of these costs by filing a claim with their insurance provider, but coverage is contingent on the cause of the leak.

Successful claims often require a specific covered peril, such as a burst pipe, to be identified as the source of the leak.

Public insurance adjusters can help maximize settlements and navigate complex policy terms when filing foundation leak claims.

Repair Cost Estimates Breakdown

Detection and repair costs are essential factors for homeowners to take into account when dealing with slab leaks. According to 2024 data, the average cost to detect a slab leak is approximately $280, while repairing a slab leak typically costs around $2,300. The cost of detection ranges from $150 to $600.

Homeowners must consider the following factors:

- Home insurance may cover damage caused by a slab leak, but coverage depends on whether the leak was caused by a covered peril, such as burst pipes or explosions.

- Homeowners will typically be required to pay their deductible when filing a claim for slab leak repairs.

- Claims related to water damage and slab issues may result in higher insurance premiums over time.

Filing an Insurance Claim

When dealing with costly slab leak repairs, a crucial consideration for homeowners is whether filing an insurance claim is the most practical course of action.

Homeowners insurance typically covers slab leaks caused by covered perils, such as burst pipes or explosions, but not for gradual issues like settling or wear and tear.

If a homeowner decides to file an insurance claim, they will generally be responsible for paying their deductible. However, claims related to water damage and foundation issues may lead to increased insurance rates.

Consequently, homeowners must weigh the repair costs against their deductible to determine the most cost-effective approach.

The average repair cost for a slab leak is approximately $2,300, and detection costs range from $150 to $600.

Types of Foundation Damage That Are Usually Covered by Homeowners Insurance

While standard homeowners insurance policies do not cover all types of foundation damage, certain types of damage are typically included under dwelling coverage. Homeowners insurance policies usually cover foundation damage caused by sudden and accidental incidents, such as burst pipes or explosions. However, homeowners should be aware that homeowners insurance and foundation damage caused by gradual wear and tear, poor maintenance, or natural events like earthquakes may not be covered. Additionally, some policies may offer endorsements or additional coverage options specifically for foundation issues, which could be beneficial for those in high-risk areas. It is essential for homeowners to review their policies carefully and consider supplemental coverage if necessary to protect their investment.

The following types of foundation damage are typically covered:

- Water damage resulting from plumbing issues, including leaks beneath the foundation, if the leak is due to a covered peril.

- Foundation damage caused by a covered event, such as fire or vandalism.

- Slab replacement resulting from a covered event, such as a burst pipe.

It is important to review specific insurance policies for detailed coverage terms and potential exclusions regarding foundation damage.

Exclusions may include damage from natural settling, wear and tear, or groundwater intrusion. Understanding coverage terms can help homeowners navigate the complexities of foundation repair and guarantee they are adequately protected in the event of damage.

Foundation Issues That Are Not Typically Covered by Insurance

Although standard homeowners insurance policies offer protection against a wide range of potential risks and hazards, there are specific types of foundation issues that typically fall outside the scope of coverage.

Homeowners insurance generally excludes foundation damage resulting from normal wear and tear, gradual plumbing leaks, and maintenance issues, such as tree root intrusion. Damage from natural settling of the soil or frost heave is also typically excluded from coverage.

Additionally, foundation damage caused by poor construction practices, including inadequate preparation or compaction, is not covered under standard homeowners insurance policies.

Earthquake and flood damage, which can cause foundation issues, are usually not covered by standard homeowners insurance, requiring separate earthquake insurance and flood insurance policies for protection.

Understanding these coverage exclusions is essential for homeowners to identify potential gaps in their insurance coverage and take steps to mitigate these risks.

Foundation damage from excluded causes can be costly.

Filing an Insurance Claim for Water Leaks Under Your Foundation

Determining the cause of a water leak under the foundation is a critical step in filing a successful insurance claim. Homeowners insurance typically covers water damage resulting from a covered peril, such as a burst pipe or explosion.

To initiate the claims process, notify the insurance company promptly and document the damage thoroughly with photographs and records of repairs or evaluations.

The following are key considerations when filing a claim:

- The insurance company will send an adjuster to evaluate the damage and determine coverage eligibility, requiring all necessary documentation and information regarding the cause of the leak.

- If the claim is approved, the policyholder may still be responsible for paying the deductible.

- Filing a claim for water damage can lead to higher insurance rates in the future.

After evaluating coverage eligibility, the insurance adjuster will guide the policyholder through the claims process.

Preventing Foundation Damage and Slab Leaks in Your Home

Foundation damage and slab leaks can have severe consequences for a home's structural integrity and the homeowner's finances. To prevent issues, regular home maintenance is essential. This includes inspecting and maintaining the plumbing system to detect leaks early, which can contribute to slab damage and foundation issues.

Installing gutters and downspouts can direct rainwater away from the foundation, reducing the risk of water intrusion that can lead to slab leaks. Grading the soil around the home to slope away from the foundation can prevent water accumulation and potential foundation damage.

Consider installing a foundation drainage system, such as French drains, in areas prone to heavy rainfall. Routine foundation inspections can identify and address potential problems before they escalate into significant damage or costly repairs.

Effective measures to drain away water and prevent soil erosion can help prevent foundation damage and slab leaks, ensuring the home's structural integrity and value.

Frequently Asked Questions

What Type of Water Damage Is Not Covered by Insurance?

A ticking time bomb, hidden beneath the surface. Water damage from foundation issues, poor home maintenance, and undetected leaks are not covered by insurance policies, emphasizing homeowner responsibilities in leak detection and prevention to avoid costly repair claims.

Does Homeowners Insurance Pay for Foundation Repair?

Homeowners insurance typically pays for foundation repair if the damage is caused by a covered peril, such as sudden and accidental water damage, subject to policy exclusions, deductible, and claim process requirements and potential rate increases.

How Do I Make a Successful Water Leak Insurance Claim?

To make a successful water leak insurance claim, homeowners must promptly document damage, review insurance policy details, and hire experts to assess repairs, while understanding deductibles, avoiding common claim mistakes, and interacting effectively with insurance adjusters.

What Is the 80% Rule in Homeowners Insurance?

Ironically, many homeowners misinterpret the 80% rule, which stipulates that home insurance coverage limits must be at least 80% of the replacement cost, not the actual cash value, to avoid reduced claim payouts and increased premium costs.