Homeowners insurance typically covers water heater damage from sudden, accidental events but excludes normal wear and tear or gradual leaks. Coverage applies to unexpected ruptures, fire damage, and structural damage resulting from catastrophic failures. Water heaters over 10 years old may face limitations, with claims potentially denied due to age. Regular maintenance documentation strengthens claim eligibility and supports coverage. Understanding specific policy terms and consulting professionals reveals essential details about thorough protection options.

Key Takeaways

- Homeowners insurance typically covers sudden and accidental water heater damage but excludes normal wear and tear or gradual leaks.

- Coverage applies to unexpected ruptures, fire damage, and structural damage caused by water heater failures.

- Water heaters over 10 years old may face coverage limitations or claim denials due to age-related risks.

- Regular maintenance documentation and prompt reporting of damage strengthen insurance claims and maintain coverage eligibility.

- Additional coverage options like equipment breakdown endorsements can supplement standard homeowners insurance for water heater protection.

Understanding Water Heater Coverage Basics

When homeowners evaluate their insurance coverage for water heaters, they must understand several key factors that determine eligibility for claims. Insurance policies typically cover sudden and accidental damage while excluding issues arising from neglect or normal wear and tear.

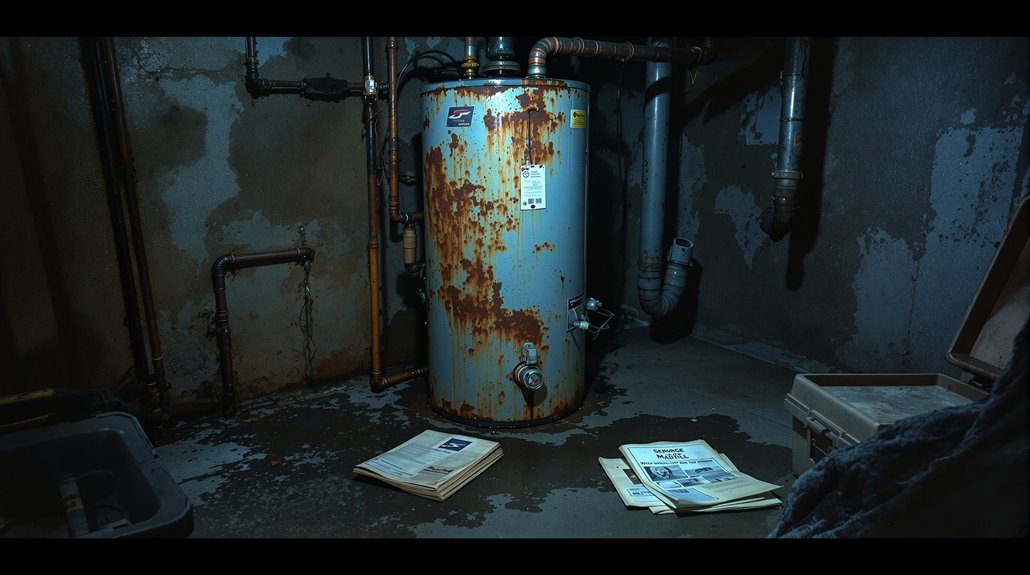

The age of the unit plays an essential role, as water heaters over 10 years old may face coverage limitations or exclusions.

Coverage considerations vary based on different water heater types and the nature of the incident. Policies generally protect against unexpected ruptures, fire damage from malfunctions, and resulting structural damage to the home.

However, specific policy limits and deductibles apply to appliance-related claims. Insurance providers require homeowners to demonstrate proper maintenance and timely replacement of aging units to maintain valid coverage.

Understanding these fundamental aspects helps homeowners navigate their policy terms effectively and guarantee appropriate protection for their water heater systems.

Types of Water Heater Damage Covered by Insurance

Standard homeowners insurance policies typically cover water heater damage resulting from sudden bursts, unexpected leaks, and catastrophic failures.

Fire damage caused by malfunctioning water heaters falls under covered perils, as does damage from storms and other weather-related incidents that directly impact the unit.

When water heater failures lead to structural damage of walls, floors, or ceilings, insurance policies generally cover both the repair costs and associated water damage restoration.

Sudden Bursts and Leaks

Water heater failures can release devastating damage to homes, making it essential for homeowners to understand their insurance coverage for sudden bursts and leaks. Standard policies typically cover unexpected malfunctions and resulting structural damage when water heaters rupture suddenly and accidentally.

| Coverage Type | Included | Requirements |

|---|---|---|

| Water Damage | Yes | Sudden/accidental |

| Structural Damage | Yes | Documentation |

| Personal Property | Yes | Prompt claims |

| Unit Replacement | No | Separate coverage |

For water heater safety and damage prevention, homeowners must maintain detailed maintenance records and promptly report incidents. Insurance providers exclude damage from neglect or lack of maintenance, particularly in units over ten years old. While policies cover water-related structural damage, they typically exclude the cost of replacing the water heater itself unless damaged by a covered peril. Additional coverage options may be available through home warranties or specialized appliance policies. Homeowners should regularly inspect their water heaters and address any signs of wear or malfunction to mitigate risks effectively. In the event of an incident, understanding the relationship between home insurance and water damage is crucial; policies may vary significantly in their coverage terms. To ensure adequate protection, it’s wise to consult with insurance agents about specific exclusions and consider supplementary options that cater to appliances, providing peace of mind against unexpected repairs or replacements.

Fire and Storm Damage

Beyond sudden bursts and leaks, homeowners face significant risks from fire and storm-related incidents affecting their water heaters.

Standard home insurance policies typically cover damage from external fires, electrical malfunctions, and gas-related incidents, including fire safety measures implemented by emergency responders. Coverage extends to extraction of debris and repair of secondary damage.

Storm damage protection encompasses a range of scenarios, including tornadoes, hurricanes, and lightning strikes.

Storm preparedness is essential, as policies may require specific endorsements for certain natural disasters like floods. Insurance coverage applies to sudden and accidental damage but excludes wear and tear.

When filing claims for either fire or storm damage, homeowners must document the damage thoroughly, prevent further deterioration by shutting off utilities, and schedule professional assessments to determine repair or replacement needs.

Structural Water Damage

When a water heater fails catastrophically, homeowners insurance typically covers the resulting structural damage to the property. This includes sudden leaks or bursts that affect walls, floors, foundations, and furnishings.

Insurance policies generally cover cleanup costs and debris removal associated with these incidents.

Coverage limitations vary greatly between insurance policies, particularly regarding water heater lifespan and maintenance history. Insurance policy comparison reveals that most carriers exclude damage resulting from wear and tear or neglected maintenance.

Claims may be denied if the water heater exceeded its expected service life or lacked proper servicing documentation. While structural damage from sudden failures is typically covered, the replacement of the water heater itself usually falls outside standard coverage unless damaged by a covered peril.

Understanding specific policy terms and maintaining detailed service records remains essential for claim approval.

Common Coverage Exclusions and Limitations

Insurance companies frequently deny claims for water heater damage once units exceed typical age thresholds of 10 years, regardless of their operational condition.

Failure to conduct regular maintenance, inspections, and repairs as specified by manufacturer guidelines constitutes policyholder negligence that voids coverage.

These age and maintenance-related exclusions underscore the homeowner's responsibility to proactively replace aging units and maintain proper documentation of service records.

Age-Related Claim Denials

As homeowners age, their likelihood of experiencing insurance claim denials increases greatly, with data showing denial rates climbing from 17.4% for those aged 50-54 to 28.7% for individuals between 60-64 years old. This pattern of age discrimination greatly impacts insurance accessibility, particularly regarding water heater claims.

| Age Group | Impact Factors |

|---|---|

| 50-54 | 17.4% denial rate |

| 55-59 | 22.3% denial rate |

| 60-64 | 28.7% denial rate |

| All Ages | Pre-existing conditions |

| Senior-Specific | Elimination riders |

Insurance providers often implement elimination riders and coverage exclusions for older policyholders, especially in states permitting such practices. These restrictions frequently affect water heater-related claims, with insurers scrutinizing factors such as maintenance history, installation date, and compliance with building codes when evaluating coverage eligibility.

Lack of Maintenance Issues

Maintaining proper care of water heaters directly impacts insurance coverage eligibility, with most policies explicitly excluding damage resulting from negligent maintenance practices.

Insurance providers typically deny claims when damage stems from neglected equipment or inadequate upkeep, as these issues fall under the homeowner's responsibility.

Common exclusions include gradual leaks developing over time, wear and tear from poor maintenance, and damage arising from failure to service equipment regularly.

Insurance companies may request maintenance records to verify proper care before approving claims. The absence of documented maintenance can result in claim denials, reduced coverage levels, or increased premiums.

Regular inspections and preventative maintenance help identify potential issues early, prolonging equipment life and preserving insurance coverage.

Annual professional servicing is essential for addressing common problems like corrosion and electrical malfunctions before they escalate.

Filing a Successful Water Heater Claim

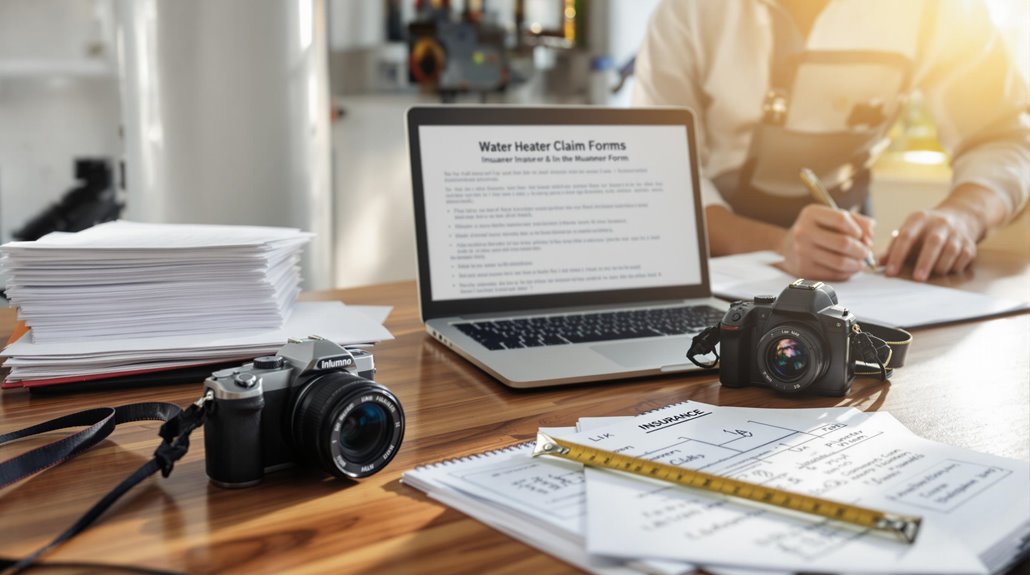

Submitting a water heater damage claim requires careful preparation and extensive documentation to maximize the likelihood of approval. When filing a claim, policyholders must promptly notify their insurance provider and supply their policy number, detailed descriptions of the damage, and thorough documentation including photos, videos, and professional assessments.

The claim process begins with initial contact through the insurer's designated channels, followed by submission of supporting evidence. Professional reports from licensed plumbers or water damage specialists can substantiate the claim's validity.

While standard policies typically exclude maintenance-related issues, water heater warranties may provide additional coverage options. Throughout the claim negotiation process, maintaining clear communication and using factual language is essential.

Regular follow-up on claim status helps guarantee timely processing, and if denial occurs, policyholders can appeal through their state's insurance department. Documentation of damaged property, including estimated values and purchase dates, strengthens the case for appropriate compensation.

The Role of Maintenance in Insurance Coverage

Regular maintenance plays a pivotal role in home insurance coverage by directly influencing claim eligibility, premium rates, and policy terms. Proper maintenance documentation and routine inspections demonstrate a commitment to property upkeep, potentially leading to favorable insurance conditions. Conversely, maintenance neglect can result in denied claims and increased premiums.

| Maintenance Aspect | Insurance Implications |

|---|---|

| Regular Inspections | Reduced risk assessment, possible premium discounts |

| Documentation | Improved claim eligibility, proof of responsible ownership |

| System Updates | Enhanced coverage terms, decreased liability exposure |

Insurance providers require homeowners to maintain essential systems, including water heaters, to mitigate potential risks. This includes conducting periodic inspections for wear, corrosion, or leaks. Strategic improvements and updates to these systems not only prevent hazards but also signal to insurers that the property presents a lower risk profile, potentially resulting in more favorable coverage terms and reduced premiums.

Protecting Your Investment: Preventive Measures

Strategic implementation of preventive measures safeguards both the water heater investment and homeowner insurance coverage. Regular maintenance extends water heater lifespan while ensuring compliance with insurance policy requirements. A thorough protection strategy incorporates systematic inspections, safety protocols, and documented maintenance activities.

Essential preventive measures that maximize protection include:

- Monthly leak detection checks and quarterly valve inspections with proper maintenance frequency documentation

- Annual professional evaluations of anode rods, temperature settings, and ventilation systems

- Installation of safety devices including leak detectors and anti-scald mechanisms

Protective maintenance requires adherence to manufacturer guidelines while implementing vital safety protocols. This includes maintaining water temperature at 120°F, ensuring proper ventilation, and conducting regular pressure relief valve tests.

Homeowners must also utilize appropriate safety equipment during maintenance procedures and maintain detailed records of all inspections and repairs to support potential insurance claims.

Additional Coverage Options Worth Considering

Beyond standard homeowners insurance protection, several additional coverage options enhance water heater protection and risk management. Equipment breakdown endorsements provide coverage for sudden malfunctions due to electrical surges and motor burnouts, extending beyond typical wear and tear limitations.

Home warranty plans offer extensive coverage benefits through annual premiums, covering repairs and replacements for water heaters and associated components like circulating pumps. These plans typically require service call fees but provide predictable maintenance costs.

Policy customization allows homeowners to select specialized coverage add-ons for specific risks, including protection against natural disasters that standard policies typically exclude.

Extended warranties present another layer of protection, specifically designed for water heaters and other appliances. These warranties supplement manufacturer coverage periods and can include maintenance guidance.

When combined, these coverage options create a robust protection strategy for water heater investments, ensuring financial security against various types of mechanical failures and damage.

What to Look for in Your Insurance Policy

Careful examination of insurance policy documentation reveals vital elements homeowners should identify regarding water heater coverage.

When conducting policy comparisons, understanding the specific distinctions between covered perils and maintenance-related issues becomes essential. Coverage limits and exclusions particularly affect water heater claims, as standard policies typically distinguish between damage caused by the appliance versus damage to the appliance itself.

Key elements to verify in policy documentation:

- Dwelling coverage specifications for attached fixtures and whether water heaters are explicitly included or excluded

- Personal property coverage limits and whether additional endorsements are necessary for appliance protection

- Specific covered perils that would qualify water heater damage for compensation

Insurance policies vary notably in their treatment of water heater incidents, making thorough documentation review vital.

Understanding the distinction between sudden, accidental damage versus wear and tear helps homeowners anticipate potential coverage gaps and make informed decisions about supplemental protection options.

Steps to Take When Water Heater Damage Occurs

When water heater damage occurs, homeowners must execute a precise sequence of actions to minimize property loss and secure safety. The initial emergency response requires shutting off both the water supply and power source to prevent further damage.

For electric heaters, this means switching off the circuit breaker, while gas units require closing the gas line.

Once immediate safety measures are secured, attention shifts to water damage mitigation. This includes removing furniture from affected areas, documenting the damage through photographs and videos for insurance purposes, and implementing proper ventilation procedures.

Professional water damage restoration services may be necessary for extensive flooding.

The final phase involves insurance documentation and assessment. Homeowners should promptly contact their insurance provider, preserve the damaged water heater for inspection, and maintain detailed records of affected items.

Understanding policy coverage limits and requirements guarantees proper claim processing and ideal compensation for damages sustained.

The Benefits Of Consulting A Public Adjuster

When water heater damage occurs, consulting a public adjuster provides several advantages due to their specialized expertise in insurance claims and objective damage assessment protocols.

Public adjusters streamline the claims process by managing documentation, meeting deadlines, and handling all communications with insurance companies.

Their professional negotiation skills and thorough understanding of policy coverage often result in higher claim settlements for property owners compared to self-filed claims.

Expertise In Insurance Claims

While managing complex insurance claims for water heater damage, consulting a public adjuster can provide invaluable expertise and professional guidance throughout the claims process. Their specialized knowledge in claims management and policyholder advocacy guarantees thorough documentation and proper handling of insurance claims.

Public adjusters deliver expertise through:

- Extensive understanding of insurance policies, including coverage limitations, exclusions, and specialized endorsements.

- Professional assessment and documentation of water heater damage, gathering necessary evidence for claim substantiation.

- Strategic negotiation with insurance carriers, leveraging industry knowledge to secure appropriate settlements.

These professionals meticulously organize documentation, evaluate damage assessments, and navigate complex policy terms.

Their expertise helps maximize claim settlements while guaranteeing compliance with insurance requirements and procedures, ultimately protecting the policyholder's interests throughout the claims process.

Objective Damage Assessment

Public adjusters provide a systematic and impartial approach to evaluating water heater damage through thorough assessment protocols.

Their expertise incorporates advanced damage detection methods, including moisture meters and thermal imaging technology, to identify both visible and concealed water damage. These inspection techniques are essential for discovering potential structural issues and hidden moisture sources.

Working independently from insurance companies, public adjusters meticulously document their findings using specialized tools and detailed floor plans.

Their extensive evaluation process includes analyzing the plumbing system's history, conducting visual inspections, and employing diagnostic equipment. This systematic approach guarantees accurate identification of damage extent and proper documentation for claims processing.

Their specialized knowledge of restoration costs and repair timelines enables them to construct thorough, well-supported claims that maximize policyholder benefits.

Streamlined Claim Process

Engaging a public adjuster considerably streamlines the insurance claims process for water heater damage through systematic procedures and professional expertise.

These professionals navigate complex insurance nuances while managing all aspects of documentation and communication with insurers, allowing homeowners to focus on property restoration.

Their specialized knowledge of the claim process guarantees thorough compliance with policy requirements and local regulations, leading to more efficient settlements.

Public adjusters typically operate on a contingency basis, aligning their interests with the policyholder's success.

Key benefits of their streamlined approach include:

- Detailed policy review and documentation preparation

- Direct management of insurer communications and negotiations

- Expert handling of procedural requirements and deadlines

This systematic approach often results in faster claim resolution and reduced stress for homeowners during the settlement process.

Higher Claim Payouts & Settlements

Studies consistently demonstrate that professional public adjusters secure significantly higher insurance claim settlements for water heater damage compared to homeowners managing claims independently. Through thorough policy evaluation and expert claim negotiation, public adjusters maximize compensation by identifying all covered damages and associated costs.

| Factor | Impact on Settlement |

|---|---|

| Expert Assessment | Thorough documentation of all damages |

| Technical Knowledge | Accurate interpretation of policy terms |

| Negotiation Skills | Strategic discussions with insurers |

| Documentation | Complete evidence compilation |

| Industry Experience | Understanding of fair market values |

Working on a contingency basis, public adjusters are incentivized to obtain ideal settlements. Their expertise in evaluating complex water heater damage claims, combined with their understanding of insurance policies and industry practices, results in settlements that more accurately reflect the true extent of losses and necessary repairs.

About The Public Claims Adjusters Network (PCAN)

Professional advocacy in insurance claims handling reaches new heights through The Public Claims Adjusters Network (PCAN), a global organization of licensed adjusters serving both residential and commercial clients.

This network of insurance advocacy specialists operates independently to guarantee policyholders receive fair compensation through extensive claim management services.

PCAN's core operational framework delivers three essential services:

- Policy analysis and interpretation, validating claim legitimacy

- Detailed damage assessment and accurate payout calculations

- Complete management of communications with insurers, contractors, and relevant parties

The network's licensed professionals possess extensive expertise in construction, property valuation, and business interruption cost analysis.

Their thorough understanding of repair requirements and long-term property value implications enables effective claim navigation.

PCAN public claims experts handle all aspects of the process, from initial filing through final settlement, providing policyholders with professional representation throughout their insurance claim journey.

Frequently Asked Questions

Can I Switch Insurance Providers if My Water Heater Is Currently Leaking?

A homeowner's undisclosed leaking water heater led to policy cancellation. Switching insurance providers requires full disclosure of existing damage and proper water heater maintenance records to avoid coverage complications.

How Does Tankless Water Heater Coverage Differ From Traditional Tank Coverage?

Tankless water heaters offer reduced leak risks and lower insurance claims potential despite higher installation costs. Traditional tanks have greater coverage needs due to increased water damage probability and storage-related issues.

Will Insurance Cover Damage Caused by Mineral Buildup in Pipes?

With a mountain of evidence against coverage, insurance typically excludes mineral buildup-related pipe damage, as it's considered gradual deterioration and lack of maintenance rather than sudden, accidental damage.

Does Homeowner's Insurance Cover Water Heaters in Rental Properties?

Rental property insurance typically excludes water heater repairs due to normal wear and maintenance issues. Coverage applies only when damage results from sudden, covered perils rather than routine water heater maintenance needs.

Are Solar Water Heater Systems Covered Differently Than Conventional Units?

Solar system coverage and conventional unit differences are minimal under standard homeowners insurance, with both types receiving similar protection against covered perils while excluding normal wear, tear, and mechanical breakdown.