Homeowners insurance provides limited coverage for mold damage, but only when it results from a covered peril like sudden water damage from burst pipes or appliance malfunctions. Standard policies typically exclude mold from maintenance issues, chronic leaks, or poor ventilation. Coverage limits generally range from $1,000 to $10,000, with specific caps and deductibles applying. Understanding policy details and maintaining proper documentation of sudden incidents helps guarantee successful claims and reveals important coverage nuances.

Key Takeaways

- Home insurance covers mold damage only when caused by sudden, covered perils like burst pipes or appliance malfunctions.

- Standard policies typically provide mold coverage between $1,000 to $10,000, with specific limits varying by insurer.

- Mold from maintenance neglect, chronic leaks, or poor ventilation is generally excluded from standard homeowners insurance coverage.

- Additional mold coverage endorsements may be available for purchase to extend protection beyond standard policy limits.

- Geographic location, humidity levels, and property maintenance history can affect both coverage availability and insurance premiums.

How Do You Know When There's Mold In Your Home?

While mold can sometimes remain hidden within walls or under surfaces, several telltale signs can alert homeowners to its presence. Common indicators include visible mold growth in damp areas, particularly bathrooms, basements, and spaces with poor ventilation. The detection of a musty odor often signals hidden mold, especially in areas prone to high humidity or water exposure. Since standard homeowners insurance typically excludes maintenance-related issues, preventing mold through proper upkeep is essential.

| Warning Sign | What to Look For |

|---|---|

| Visual Clues | Visible mold growth, water stains, warped walls |

| Odor Signs | Persistent musty smell, damp earthy scents |

| Physical Symptoms | Nasal congestion, coughing, allergic reactions |

| Environmental Factors | High humidity, water damage, poor ventilation |

Regular monitoring through routine inspections is essential for early mold detection, particularly following water-related incidents. Health symptoms can also indicate mold presence, making it vital for homeowners to remain vigilant about potential growth areas and address water damage promptly to prevent mold development.

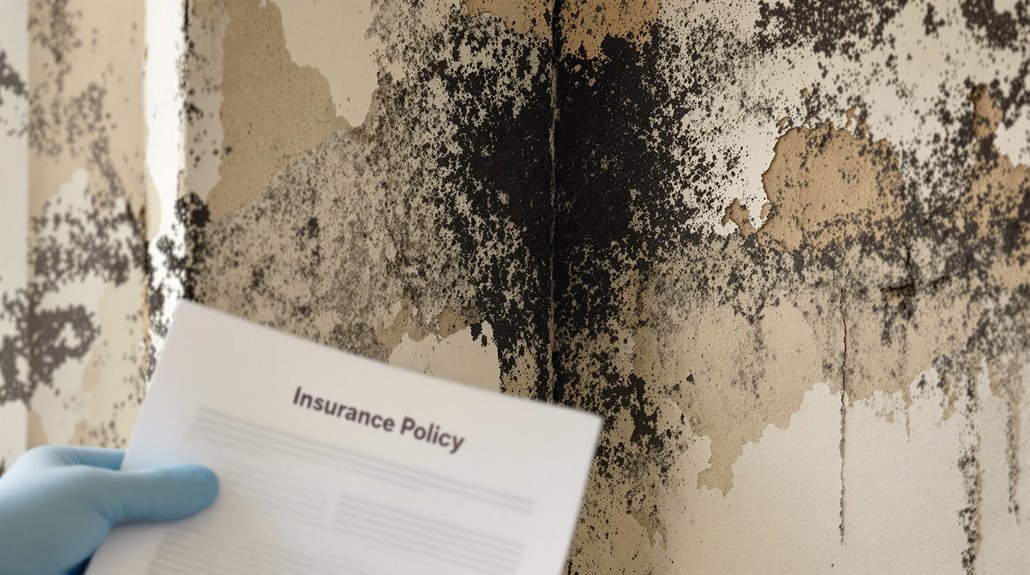

Understanding Mold Coverage Within Homeowners Insurance Policies

Insurance coverage for mold damage hinges on whether the growth stems from a covered peril or preventable neglect.

Most homeowners insurance policies offer protection when sudden incidents, like burst pipes or appliance malfunctions, trigger mold growth, but deny claims related to long-term maintenance issues or gradual water damage.

Standard policies typically specify mold coverage limits between $1,000 and $10,000 per occurrence, making it essential for homeowners to understand their specific policy terms.

- Covered perils include sudden water damage from burst pipes, HVAC system failures, and appliance malfunctions

- Excluded scenarios often involve preventable issues like poor ventilation, delayed repairs, or chronic moisture problems

- Coverage limits vary by insurer and policy type, with standard amounts ranging from $1,000 to $10,000

- Additional mold coverage endorsements may be available for extensive protection beyond standard limits

Reviewing your insurance premium factors annually can help ensure you maintain adequate mold coverage as rates and circumstances change.

When Homeowners Insurance Does Cover Mold

Although mold damage can be a complex issue for homeowners, standard insurance policies do provide coverage under specific circumstances. When mold growth results from a covered peril, such as sudden water damage from burst pipes, homeowners insurance typically covers mold removal and remediation. Coverage limits generally range from $1,000 to $10,000 per occurrence, with options for additional protection through special endorsements. Understanding your actual cash value coverage can affect how much you receive for mold-related claims after depreciation is factored in.

| Covered Situations | Non-Covered Situations |

|---|---|

| Burst pipes | Ongoing leaks |

| Fire suppression | Poor ventilation |

| Appliance malfunction | Maintenance neglect |

| Storm damage | Humidity issues |

Insurance claims for mold remediation are evaluated individually, considering factors like the source of moisture, timing of discovery, and preventive measures taken. Homeowners must document the cause and extent of damage while promptly addressing any water-related issues to maintain coverage eligibility.

When Homeowners Insurance Does Not Cover Mold

Homeowners insurance policies typically exclude mold damage resulting from neglected maintenance issues, such as long-standing leaks or poor repairs that create moisture-prone conditions. Construction-related mold problems, including those stemming from improper materials or techniques that allow water infiltration, generally fall outside standard coverage parameters. Normal wear and tear that leads to mold growth is consistently excluded from policies, highlighting the importance of regular home maintenance and prompt repairs. For complex mold damage claims, consulting a public adjuster can help evaluate coverage and negotiate settlements with insurance companies.

| Source of Mold | Insurance Coverage | Required Action |

|---|---|---|

| Unrepaired Leaks | Not Covered | Immediate leak repair and documentation |

| Construction Issues | Not Covered | Professional inspection and contractor liability |

| Wear and Tear | Not Covered | Regular maintenance and updates |

| Poor Repairs | Not Covered | Professional repairs with proper materials |

| Inadequate Ventilation | Not Covered | Improve airflow and moisture control |

Mold From Long-Standing Leaks That Went Unrepaired

Long-standing water leaks that remain unaddressed create a significant coverage gap in standard homeowners insurance policies when it comes to mold damage.

Insurance companies typically deny claims for mold growth resulting from ongoing leaks, considering it a lack of maintenance rather than a sudden and accidental event.

Policies specifically exclude coverage for water damage and subsequent mold issues stemming from unrepaired, persistent leaks.

Understanding your policy limitations and exclusions is crucial for maintaining proper coverage against potential mold damage.

Mold From Water/Moisture Introduced During Construction

Another common exclusion in homeowners insurance policies relates to mold damage stemming from construction-related moisture issues.

Policies usually won't cover mold growth caused by improper sealing, poor ventilation, or water damage introduced during building processes.

Insurance providers typically deny mold remediation claims when moisture infiltration results from construction defects or negligent workmanship, considering these preventable through proper building practices.

Regular policy reviews are critical to understand coverage exclusions and identify potential gaps in mold protection.

Mold From Wear And Tear

When mold growth stems from wear and tear or gradual deterioration, insurance policies typically exclude coverage for remediation costs.

Homeowners insurance does not cover mold damage resulting from neglected conditions, such as ongoing water leaks or poor maintenance issues.

Coverage exclusions often apply to situations where mold claims arise from preventable circumstances rather than sudden and accidental events.

Working with a public adjuster can help homeowners better understand their policy exclusions and coverage limitations regarding mold damage.

Mold From Poor Repairs

Poor repair work that leads to mold growth typically falls outside the scope of homeowners insurance coverage.

When mold develops due to improper repairs, such as incorrectly fixed leaky faucets or poor maintenance, insurance companies often deny claims.

Most homeowners policy exclusions specifically address damage resulting from negligence.

Understanding these limitations is essential, as mold insurance coverage generally requires sudden, accidental events rather than ongoing repair issues.

How Much Will Insurance Cover For Mold?

Understanding the financial scope of mold coverage in homeowners insurance policies can help property owners prepare for potential remediation costs. Insurance coverage for mold damage typically ranges from $1,000 to $10,000 per occurrence when resulting from sudden and accidental events. Property owners should review their policy to understand specific limitations and explore additional coverage for mold through endorsements. Regular policy coverage reviews can prevent gaps in protection against mold-related damages.

| Coverage Aspect | Details |

|---|---|

| Standard Limit | $1,000-$10,000 |

| Covered Perils | Burst pipes, firefighting water damage |

| Not Covered | Long-term leaks, maintenance neglect |

| Additional Options | Endorsements for higher limits |

Homeowners must verify that their mold damage claims stem from covered perils, as insurance companies typically exclude damage resulting from poor maintenance or chronic moisture issues. Removal services must be properly documented and promptly addressed to guarantee claim approval.

How Is Mold Covered?

Mold coverage in homeowners insurance policies typically activates when damage stems from specific covered perils such as burst pipes, sudden appliance failures, or other accidental water incidents.

Insurance providers often limit or exclude mold coverage from standard policies due to the high costs associated with remediation and the preventable nature of most mold issues.

Understanding these coverage limitations is essential, as policyholders may need additional endorsements for thorough mold protection.

- Water damage from sudden, accidental events (covered)

- Gradual water leaks leading to mold (typically excluded)

- Natural flooding and resulting mold (requires separate flood insurance)

- Mold from poor ventilation or maintenance (excluded)

Actual cash value calculations by insurance adjusters will determine compensation for mold-damaged property based on replacement cost minus depreciation.

Mold Caused By Covered Perils

When homeowners face mold issues, their insurance coverage typically depends on the specific cause of the damage. Insurance policies generally provide coverage when mold results from sudden and accidental events classified as covered perils. Understanding these scenarios is essential for successful mold claims.

| Covered Peril | Typical Coverage Status |

|---|---|

| Burst Pipes | Covered |

| Appliance Malfunction | Covered |

| Firefighting Water Damage | Covered |

| Gradual Water Leaks | Not Covered |

| Poor Maintenance | Not Covered |

The policy language specifically outlines coverage limits for mold removal, which can range from $1,000 to $10,000 per occurrence. When filing a claim, homeowners must demonstrate that the mold damage directly resulted from a covered loss. Insurance providers evaluate these claims individually, considering factors such as the source of moisture and timing of the incident. For complex mold damage situations, consulting with public insurance adjusters can help maximize your settlement potential.

Why Isn't Mold Coverage Part Of A Standard Home Policy?

Insurance companies typically exclude extensive mold coverage from standard home policies due to the high risks and costs associated with mold remediation.

Home insurance covers mold damage only when caused by something specifically listed as a covered peril, while policies usually won't cover damage resulting from neglect or maintenance issues.

Insurers limit standard mold coverage for several key reasons:

- Mold remediation costs can reach tens of thousands of dollars

- Homeowners can prevent mold from growing through proper maintenance

- Long-term moisture problems indicate negligence rather than sudden accidents

- Multiple claims could arise from ongoing issues

While optional mold coverage exists as a policy add-on, homeowners should carefully review details of their coverage limits and requirements before filing claims.

Understanding these limitations helps policyholders make informed decisions about additional protection needs.

Common Types Of Covered Mold Damage Claims

When homeowners face mold issues, understanding which scenarios qualify for insurance coverage is essential for proper claims processing. Insurance providers evaluate mold claims based on specific circumstances and policy terms, with coverage typically extending to sudden and accidental water damage from sources like burst pipes or malfunctioning appliances. While some types of mold damage receive coverage under standard policies, others may require additional endorsements or separate coverage options.

| Source of Mold | Typically Covered | Key Requirements |

|---|---|---|

| Burst Pipes | Yes | Prompt reporting and repair |

| Appliance Failure | Yes | Regular maintenance records |

| Storm Damage | Limited | Direct water damage link |

| Construction Defects | Varies | Clear causation evidence |

Mold Caused By Flooding

Although many homeowners assume their standard insurance policies protect against all water-related mold issues, damage resulting from flooding requires separate flood insurance coverage.

Standard homeowners insurance specifically excludes mold damage caused by rising waters from rivers, lakes, or other natural water sources.

To be protected against mold growth from flood-related damage, property owners must secure a dedicated flood insurance policy.

When flooding occurs, quick water removal is vital to prevent mold from developing, as spores can begin growing within 24 to 48 hours of water exposure.

Even with proper mold cleanup efforts, damages will only be covered if the homeowner has an active flood insurance policy in place.

This distinction makes it essential for homeowners in flood-prone areas to maintain appropriate coverage beyond their standard insurance.

Mold Caused By Construction Or Repair

Construction and repair activities can introduce various pathways for water intrusion that lead to mold growth in homes, creating complex scenarios for insurance coverage.

Home insurance policies typically cover mold claim examples that stem from sudden, construction-related water leaks, such as a burst pipe during renovations, when classified as a covered peril. However, mold resulting from poor workmanship or maintenance issues may be denied coverage.

Successful claims require thoroughly documented claims demonstrating that water damage occurred unexpectedly during construction, rather than from ongoing neglect.

Coverage limits for mold remediation vary considerably between policies, commonly ranging from $1,000 to $10,000. Homeowners should carefully review their policies to understand specific coverage parameters and available endorsements before undertaking construction projects that could potentially lead to water-related complications.

Mold Caused By Sewer Backup

Since standard homeowners insurance policies typically exclude mold damage caused by sewer backups, property owners must purchase additional sewer backup endorsements for complete protection.

Water backup incidents can lead to extensive mold growth, with remediation costs averaging $2,235 nationwide.

Coverage for sewer backup-related mold damage depends on several factors. Insurance providers generally deny claims resulting from negligence, such as failing to address known sewage leaks promptly.

Additionally, damage from public system overflows typically requires separate flood insurance coverage. To strengthen potential claims, homeowners should thoroughly document the source of water backup and subsequent mold development.

Given the significant expenses associated with mold remediation, securing adequate coverage through appropriate endorsements is imperative for all-encompassing property protection.

Mold Caused By Negligence

Standard homeowners insurance policies draw a clear line when it comes to mold damage caused by negligence. Insurance providers consistently deny claims when mold growth results from a homeowner's failure to address maintenance issues or properly manage moisture levels within the property.

Coverage is typically refused for mold damage stemming from prolonged leaks, poorly maintained plumbing fixtures, or inadequate ventilation. Insurance companies specifically exclude situations where homeowners have neglected to correct known issues, such as improperly sealed windows or roofs that allow moisture infiltration.

This stance reflects the fundamental principle that homeowners insurance is designed to protect against sudden, accidental events rather than damage arising from long-term neglect. Maintaining regular property upkeep is essential, as insurers closely examine whether proper maintenance could have prevented the mold damage when evaluating claims.

Mold Caused By Leaking Pipes & Hoses Attached To Sinks & Water Heaters

Water damage from plumbing failures represents one of the most common scenarios where homeowners insurance covers subsequent mold growth. When leaking pipes or hoses attached to sinks and water heaters cause sudden and accidental water damage, resulting mold remediation expenses typically fall under covered perils.

Insurance providers generally extend coverage when the damage stems from unexpected plumbing malfunctions rather than long-term leaks due to neglect.

Coverage limits for mold damage claims usually range from $1,000 to $10,000 per occurrence, though specific amounts vary by policy. To guarantee coverage eligibility, homeowners must practice immediate reporting of water damage incidents, as mold can develop within 24 hours of moisture exposure.

Insurance companies emphasize the distinction between sudden plumbing failures and gradual deterioration when evaluating mold-related claims.

Mold Caused By Appliance Malfunctions

When appliances malfunction and cause water damage, homeowners insurance policies generally cover the resulting mold damage as part of their standard coverage. Common scenarios include water leaking from washing machines, dishwashers, or water heaters that lead to sudden or accidental damage.

Insurance covers mold remediation in these cases because appliance malfunction is considered a covered peril.

However, homeowners should note that coverage limits for mold-related claims typically range from $1,000 to $10,000, depending on their specific policy. It is crucial to document and address the water damage promptly, as insurers may deny claims if the mold resulted from neglect or lack of maintenance.

Some policies offer additional protection through equipment breakdown coverage, which can provide enhanced coverage for appliance-related mold issues.

Mold Caused By Toilet Overflows

Among the most common covered mold damage claims, toilet overflows represent a significant source of water-related issues that homeowners insurance typically covers. When mold growth results from an accidental toilet overflow, insurance policies generally include coverage for both the initial water damage and subsequent mold remediation efforts.

To successfully process these claims, homeowners must thoroughly document damage with photographs and detailed descriptions of the affected areas. Insurance providers evaluate each situation individually, considering factors such as the sudden nature of the overflow and resulting mold development.

Coverage typically extends to mold removal services and necessary repairs to damaged flooring or surrounding structures. However, policyholders should carefully review their specific insurance policy terms to understand the full scope of covered expenses and any limitations regarding mold-related claims from toilet overflows.

Mold Caused By Roof Damage From A Storm That Lets Water In

Storm-related roof damage represents one of the most frequently covered causes of mold growth in residential insurance claims.

When storms compromise a roof's integrity, allowing water to infiltrate the home, resulting mold damage is typically covered under homeowners insurance as a covered peril.

Insurance providers generally view this scenario as a direct consequence of the storm damage rather than negligence.

Policyholders can often file claims for both initial water damage and subsequent mold remediation, though coverage limits for mold-specific claims typically range from $1,000 to $10,000.

To guarantee successful claims processing, homeowners must promptly report the damage and provide thorough documentation, including photographic evidence.

It is crucial to review specific policy terms, as coverage for storm-related mold can vary greatly between insurance providers and geographical locations.

Mold Caused By Water From Firefighters Extinguishing A Fire

Fire-related mold damage caused by firefighting efforts represents a commonly covered claim under standard homeowners insurance policies.

Since fire is considered a covered peril, any subsequent water damage and mold growth resulting from fire suppression activities typically falls within policy coverage limits.

When filing claims for mold damage following a fire incident, homeowners should act swiftly, as mold can develop within 24 to 48 hours of water exposure.

Thorough documentation, including photographs and videos of affected areas, is essential for supporting claims and securing coverage for remediation costs.

Policyholders should review their homeowners insurance terms carefully, as coverage limits and specific requirements for mold-related claims may vary.

Insurance providers typically reimburse costs associated with professional mold remediation services when the damage stems directly from firefighting water damage.

Exclusions & Limitations For Mold Coverage

Standard homeowners insurance policies contain significant exclusions and limitations regarding mold damage coverage, particularly for maintenance-related issues and pre-existing conditions. Insurance companies often set strict maximum payout limits for mold claims, typically ranging from $5,000 to $10,000, and may exclude coverage entirely in high-risk geographic areas. Prevention-related exclusions are common, with insurers denying claims for mold resulting from homeowner negligence or failure to address preventable water damage promptly.

| Coverage Limitation | Typical Exclusion | Impact on Claims |

|---|---|---|

| Maintenance Issues | Gradual leaks, poor ventilation | Claims denied for neglect |

| Geographic Factors | Flood-prone zones, humid regions | Limited or no coverage |

| Prevention Failures | Delayed repairs, ignored warnings | Reduced claim amounts |

Maintenance-Related Mold Growth

When homeowners discover mold growth resulting from maintenance-related issues, they often find themselves facing significant coverage limitations under their insurance policies. Standard home insurance typically excludes mold damage caused by neglect or ongoing maintenance problems. Insurance providers consider proper home maintenance a homeowner's responsibility.

| Maintenance Issue | Coverage Status |

|---|---|

| Chronic water leaks | Not covered |

| Poor ventilation | Not covered |

| Unsealed windows/doors | Not covered |

| Long-term seepage | Not covered |

Regular home maintenance plays an essential role in preventing mold growth. Insurance companies expect homeowners to address moisture issues promptly, maintain proper ventilation in bathrooms and basements, and repair leaks immediately. Failure to perform these vital maintenance tasks can result in denied claims, as insurers view such mold damage as preventable through routine upkeep rather than sudden, unforeseen events.

Pre-Existing Mold Conditions

Insurance providers consistently exclude pre-existing mold conditions from coverage under standard homeowners policies, citing these situations as uninsurable risks. Coverage exclusions typically encompass mold damage resulting from chronic leaks, gradual development, and sustained moisture accumulation. Additionally, flood-related mold remains outside standard policy limits, requiring separate flood insurance coverage.

| Exclusion Type | Common Causes | Coverage Status |

|---|---|---|

| Maintenance | Poor ventilation | Not covered |

| Gradual Damage | Chronic leaks | Not covered |

| Moisture Issues | Unsealed windows | Not covered |

| Flood-Related | Water intrusion | Separate policy |

| Pre-existing | Prior damage | Not covered |

Insurance policies specifically deny claims for mold damage stemming from negligence or long-term exposure to moisture. Understanding these limitations helps homeowners recognize their responsibility in preventing mold through proper maintenance and prompt repairs.

Maximum Payout Limits In Mold Claims

Most homeowners policies establish strict monetary caps for mold-related claims, with typical coverage limits ranging from $1,000 to $10,000 per occurrence. These maximum payout limits vary considerably based on the specific policy terms and any additional endorsements purchased. Standard policies often restrict coverage for mold remediation costs, particularly for claims arising from gradual water damage or maintenance issues.

| Coverage Type | Typical Limit | Additional Notes |

|---|---|---|

| Basic Policy | $1,000-$10,000 | Standard coverage |

| Water Backup | Varies | Requires endorsement |

| Flood Damage | Not covered | Separate policy needed |

Insurance providers may deny claims exceeding the specified limits, making it imperative for homeowners to understand their policy restrictions. Coverage for mold resulting from sump pump failures typically requires additional endorsements, while flood insurance remains essential for mold damage caused by rising water events.

High-Risk Areas Excluded From Mold Claims

Standard homeowners policies exclude mold damage in several high-risk areas and scenarios where preventable conditions lead to fungal growth. Insurance won't cover damage caused by gradual water seepage, insufficient ventilation, or poor humidity control. While sudden leaks may be covered perils, homeowners must address any leak as soon as possible to maintain coverage eligibility.

| Area | Common Issue | Insurance Status |

|---|---|---|

| Bathrooms | High humidity | Not covered |

| Basements | Water seepage | Excluded |

| Crawl spaces | Poor ventilation | Excluded |

| Window frames | Ongoing leaks | Not covered |

| Attics | Moisture buildup | Excluded |

Home policies specifically exclude mold resulting from maintenance-related issues or long-term exposure to moisture. These exclusions emphasize the importance of proper home maintenance and prompt attention to water-related problems.

Preventable Water Damage & Mold Claims

When homeowners file claims for mold damage, preventable water issues often lead to denied coverage due to specific policy exclusions and limitations. Insurance carriers expect property owners to maintain their homes and fix leaks promptly, as mold can cause extensive damage when moisture control is neglected.

| Prevention Factor | Coverage Impact | Professional Remediation |

|---|---|---|

| Accidental damage | Limited coverage | Usually covered |

| Gradual seepage | Typically denied | Owner's expense |

| Maintenance issues | Not covered | Owner's expense |

While policies may cover mold damage resulting from sudden, unforeseen events, they generally exclude issues arising from negligence. Understanding policy limits regarding water and mold damage is essential, as many insurers restrict coverage for preventable situations that could have been addressed through routine maintenance and timely repairs.

Cost Factors In Mold Damage Insurance Claims

Understanding the cost factors in mold damage insurance claims requires careful consideration of coverage limits, deductibles, and regional variations that impact overall expenses. Insurance providers typically establish specific caps on mold-related claims, with standard policies offering coverage between $1,000 and $10,000, while additional endorsements may increase these limits for an extra premium. The financial implications of filing a mold claim depend heavily on the policy's deductible structure, pre-existing condition exclusions, and location-based premium adjustments that reflect regional risk factors.

| Cost Factor | Impact Range | Considerations |

|---|---|---|

| Coverage Limits | $1,000-$10,000 | Standard policy caps versus enhanced coverage options |

| Deductibles | $500-$2,500 | Higher deductibles may offset premium costs |

| Location Risk | Varies by Region | Climate, humidity, and historical claim data influence rates |

Mold Claim Coverage Limits & Caps

Insurance coverage for mold damage often comes with specific monetary limits and caps that homeowners must carefully consider when filing claims. Typical homeowners insurance policies set payout limits between $1,000 and $10,000 per occurrence for mold removal, with the average mold remediation cost in the U.S. reaching approximately $2,235.

These coverage limits can greatly impact claim outcomes, particularly when factoring in policy deductibles.

Insurance providers typically establish distinct caps for mold-related expenses within their policies, making it essential for homeowners to understand their specific coverage parameters. Claims resulting from neglect or maintenance issues are generally excluded from coverage, emphasizing the importance of regular property upkeep.

Policyholders should review their insurance policy details with their agents to fully comprehend their mold damage protection limits.

Additional Endorsement Price Options

Expanding mold coverage through additional endorsements presents homeowners with various price options that depend on several key factors. The cost of these coverage enhancements typically varies based on the desired coverage limits, which can range from $1,000 to $10,000 per occurrence.

Insurance agents can help policyholders appraise their specific needs and explain the pricing structure for different levels of protection.

Key considerations affecting endorsement costs include the type of remediation coverage needed and optional add-ons, such as sump pump failure protection.

When reviewing additional mold coverage options, homeowners insurance providers consider the property's risk factors and potential claim scenarios.

Policyholders should carefully weigh the cost of enhanced coverage against their property's exposure to mold-related risks to make informed decisions about their coverage selections.

Deductible Impact On Mold Claims

When evaluating mold damage claims, homeowners must carefully weigh their policy deductible against potential insurance payouts. With average mold remediation costs around $2,235, filing a claim may not be financially advantageous if the deductible is close to this amount.

Homeowners insurance policies often include specific coverage limits and sublimits for mold damage, which can greatly impact the final payout. Even when insurers cover mold-related issues, these limitations may result in substantial out-of-pocket expenses for the homeowner.

To make informed decisions about filing claims, property owners should thoroughly document all mold damage and communicate with their insurer to understand how their deductible affects potential reimbursement.

Understanding these financial implications helps homeowners determine whether pursuing an insurance claim is the most cost-effective solution for addressing mold problems.

Pre-Existing Condition Costs

Despite homeowners' expectations, mold damage stemming from pre-existing conditions presents significant financial challenges, as standard insurance policies typically exclude coverage for these situations.

Insurance providers routinely deny claims when mold growth results from maintenance issues like ongoing water damage or improperly sealed windows.

With average mold remediation costs reaching $2,235, homeowners bear full financial responsibility when insurers determine the damage originated from pre-existing conditions rather than a sudden event.

To maintain valid coverage options, property owners must document and address moisture issues promptly, as evidence of neglect can void future claims.

Regular maintenance plays a vital role in preserving insurance protection, as policies specifically exclude damages resulting from long-term exposure or unresolved problems.

Understanding these limitations helps homeowners prepare for potential out-of-pocket expenses.

Location-Based Premium Variations

Geographic location greatly influences homeowners insurance premiums for mold coverage, with notable variations across different regions of the country. Areas prone to flooding or high humidity face elevated insurance premiums due to increased risks of mold developing in homes.

Conversely, regions with strict building codes that help prevent mold growth often benefit from lower rates.

Location-based factors, such as proximity to bodies of water and local weather patterns, directly impact how policies are priced. Areas frequently experiencing heavy rainfall or snowmelt face higher premiums due to increased potential for water and mold damage.

Insurance companies particularly scrutinize regions with historical patterns of mold-related claims, adjusting coverage costs accordingly. Understanding these geographic variables is essential for homeowners, as location-specific risks considerably affect how mold damage is covered by their policies.

Additional Coverage Options For Mold Protection

Insurance providers offer specialized mold endorsements and riders that expand coverage beyond standard policy limits. Homeowners can select from various additional protection plans, including enhanced coverage limits and extensive water damage plus mold packages. These supplementary options often include preventive coverage features that address both immediate mold concerns and long-term moisture management needs.

| Coverage Type | Protection Features |

|---|---|

| Basic Endorsement | Standard mold removal, testing services |

| Enhanced Rider | Increased coverage limits, preventive treatments |

| Extensive Package | Full moisture management, restoration services |

Mold Endorsement Policies Available

Many homeowners seeking enhanced protection against mold-related issues can opt for specialized mold endorsements to supplement their standard insurance policies.

These endorsements typically provide additional mold coverage ranging from $1,000 to $10,000, depending on the insurance provider and specific plan selected.

Insurance companies offer various types of mold remediation coverage, including optional coverage for damage resulting from sump pump failures.

Policyholders should carefully review the terms and conditions of available endorsements, as coverage limits and exclusions vary considerably between insurers.

To make informed decisions about mold protection, homeowners should consult with their insurance agent to evaluate risk factors and select appropriate coverage options that align with their property's specific needs and circumstances.

Enhanced Coverage Limit Options

While standard homeowners insurance provides basic mold coverage, enhanced protection options allow policyholders to markedly increase their coverage limits beyond typical policy restrictions. Additional provisions can extend coverage limits from $1,000 to $10,000 per occurrence, offering extensive protection for mold damage cleanup costs and removal services.

Enhanced coverage modifications typically include protection for incidents related to water heater failures and other covered perils, along with backup coverage for necessary remediation work.

Homeowners can customize their policies by consulting with an insurance agent to select appropriate coverage levels based on their property's specific risks. These expanded provisions often encompass both immediate cleanup expenses and preventive measures, ensuring thorough protection against future mold-related issues while maintaining the home's structural integrity.

Rider Protection Plans

For extensive mold protection beyond standard policy limits, homeowners can secure additional coverage through specialized rider protection plans.

These added riders typically increase mold coverage limits from $1,000 to $10,000 per occurrence, providing enhanced financial protection for mold remediation and cleanup costs.

When a covered peril triggers mold growth, these supplemental coverage options can help offset expenses associated with professional removal services and restoration work.

Homeowners should consult with an insurance representative to understand the specific terms and limitations of available rider protection plans.

This is particularly important for properties susceptible to water-related incidents.

Regular policy reviews help determine whether additional protection for mold-related expenses is necessary, ensuring adequate coverage when unexpected situations arise.

Water Damage Plus Mold

The intersection of water damage and mold presents unique challenges for homeowners seeking all-inclusive insurance protection. When water damage occurs from a covered peril, such as a burst pipe, standard policies typically include mold remediation as part of the claim.

However, coverage limits for mold cleanup often range from $1,000 to $10,000 per occurrence, which may not fully address extensive contamination.

Policyholders can strengthen their protection by securing additional coverage options specifically designed for mold-related issues. Insurance agents can help evaluate whether existing coverage adequately addresses potential risks and recommend appropriate endorsements.

While basic policies may offer limited protection, enhanced coverage guarantees extensive support for both immediate water damage restoration and subsequent mold remediation, providing peace of mind for homeowners facing these dual threats.

Preventive Coverage Add-Ons

Proactive homeowners can greatly enhance their mold protection through specialized insurance endorsements and policy add-ons.

By discussing options with their insurance agents, property owners can add coverage beyond standard limits to better protect against mold damage and its costly remediation.

Insurance providers often offer modified provisions that help you understand and expand coverage for mold cleanup. These endorsements can increase protection limits from typical $1,000 thresholds to as much as $10,000 for accidental incidents.

Additional riders may also cover damaged items resulting from sump pump failures when combined with water backup protection.

For homes in moisture-prone regions, these enhanced coverage options prove particularly valuable, ensuring extensive protection against mold-related expenses that exceed basic policy limitations.

Insurance agents can explain available endorsements tailored to specific needs.

Sump Pump Failure & Water Backup Coverage

Securing additional coverage for sump pump failures represents a vital safeguard against mold damage in residential properties.

Standard homeowners insurance policies typically exclude water damage resulting from these failures, making a water backup endorsement necessary for thorough protection.

This specialized coverage helps address the costs associated with mold cleanup and remediation when sump pump failures lead to water damage in basements.

Insurance agents recommend consulting them to understand specific coverage limits and conditions related to mold damage claims.

Maintaining regular sump pump inspections remains essential for claim eligibility and preventing water-related issues.

Homeowners should review their policies carefully to guarantee adequate protection against both immediate water damage and subsequent mold growth, as remediation costs can be substantial without proper coverage.

Hidden Water Damage Coverage

Hidden leaks within walls, floors, and ceilings pose significant risks for homeowners seeking extensive mold protection through their insurance coverage. Unlike car insurance or separate flood policies, standard homeowners insurance may cover sudden water damage that results in mold, but only when it's the result of a covered peril.

When water damage occurs from concealed leaks, insurers typically require temporary repairs to protect the home's foundation and prevent mold from starting to grow.

To address potential gaps in coverage for damage caused by hidden water issues, homeowners can explore specialized endorsements for mold removal.

These additional coverage options often provide broader protection than standard policies, particularly when mold develops gradually due to undetected leaks behind walls or under flooring.

Should You File A Mold Claim?

Insurance providers evaluate mold claims differently based on specific scenarios and causes of damage.

A burst pipe leading to sudden water damage and subsequent mold growth typically qualifies for coverage, while long-term moisture issues from poor ventilation usually do not.

Understanding common claim examples helps homeowners determine whether their situation warrants filing an insurance claim for mold damage.

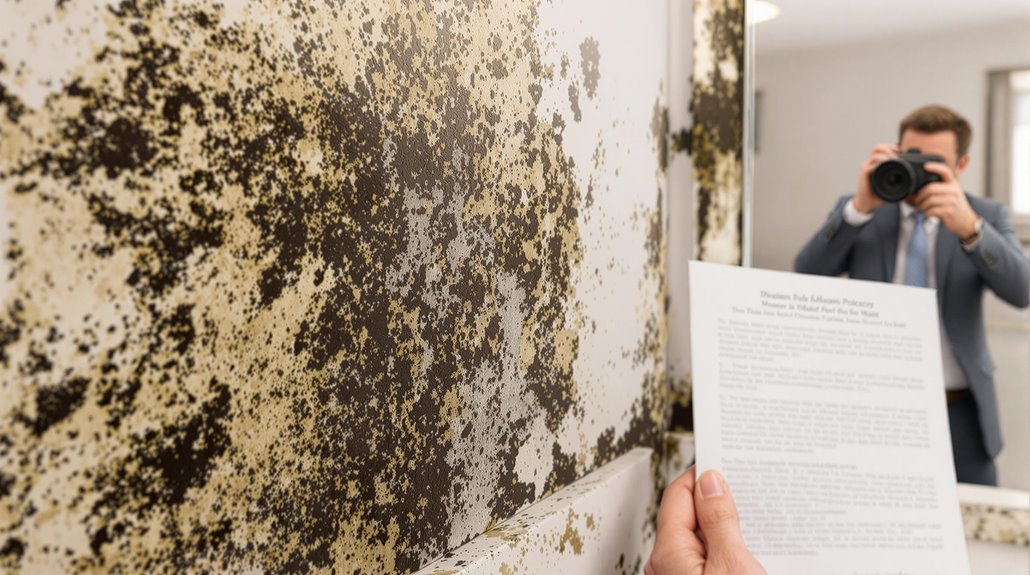

Mold Claim Examples

Determining whether to file a mold claim requires careful evaluation of several factors, including the cause of damage, policy coverage limits, and potential costs.

When causing mold stems from a sudden incident, such as a burst pipe, home insurance typically provides coverage. However, the average remediation cost of $2,235 should be weighed against policy deductibles and potential premium increases.

Successful mold claims depend on thorough documentation of the damage and prompt action to remove the mold. For example, if a malfunctioning water heater leads to mold growth, insurers generally cover the damage when properly documented with photos and detailed lists of affected items.

Understanding specific exclusions in your policy is essential, as coverage limits vary considerably between insurers and may affect the decision to file a claim.

The Role & Benefits Of Public Adjusters In Mold Damage Home Insurance Claims

Public adjusters serve as dedicated advocates who represent homeowners rather than insurance companies during mold damage claims, providing expertise in policy interpretation and damage documentation.

These licensed professionals can greatly improve claim outcomes by accurately evaluating mold damage, negotiating with insurers, and ensuring all covered damages are properly identified and valued.

While public adjusters typically charge a percentage of the final settlement, their involvement often results in higher payouts that can offset their fees while expediting the claims process.

What Are Public Adjusters

When homeowners face complex mold damage claims, professional public adjusters serve as invaluable advocates throughout the insurance settlement process.

These licensed professionals specialize in interpreting insurance policies and understanding the intricacies of mold damage coverage. Public adjusters work directly for policyholders, ensuring their interests are protected while seeking fair compensation from insurance companies.

Their expertise extends to thoroughly documenting mold damage through detailed reports and photographic evidence, which strengthens claim submissions.

Operating on a contingency fee basis, public adjusters only receive payment as a percentage of the final settlement, aligning their goals with the policyholder's success. This arrangement allows homeowners to focus on remediation while the adjuster manages all aspects of the insurance claim, from initial filing to final settlement negotiations.

Benefits Of Using A Public Adjuster For Mold Claims

Steering through the complexities of mold damage insurance claims can overwhelm even the most diligent homeowners. Public adjusters serve as invaluable allies in maneuvering casualty insurance claims, particularly when dealing with mold in your home. These professionals help you find the cause of the mold, whether from faulty exhaust fans or failure to properly cover water sources, and guarantee proper documentation.

| Benefits | Impact |

|---|---|

| Claim Assessment | 20-50% higher settlements |

| Documentation | Keep receipts and evidence |

| Expert Guidance | Available in all states |

Professional adjusters meticulously evaluate how to treat mold situations, interpret policy language, and negotiate with insurance companies. Their expertise often results in considerably higher claim settlements while relieving homeowners of the burden of complex negotiations and technical documentation requirements.

How Are Public Adjusters Paid & What Are Their Fees?

The cost structure for professional claims assistance follows a straightforward model in mold damage cases. Public adjusters typically charge a fee percentage ranging from 5% to 15% of the final insurance claim settlement amount.

These professionals operate on a contingency fee basis, meaning they only receive payment when the claim is successfully settled.

For homeowners dealing with mold damage, this payment structure offers significant advantages. Public adjusters handle all aspects of negotiation with insurance companies, provide documentation expertise, and work to maximize coverage benefits without requiring upfront costs.

Their fee structure aligns their interests with the policyholder's goals, often resulting in higher settlement amounts that can offset their service costs. This arrangement also provides stress relief for homeowners, allowing them to focus on property restoration while experts manage the claims process.

Public Adjusters Vs. The Insurance Company Adjuster

Understanding the distinction between public adjusters and insurance company adjusters proves essential for homeowners facing mold damage claims. While insurance company adjusters represent the insurer's interests, public adjusters work independently to maximize policyholder settlements.

| Key Aspect | Public Adjuster | Insurance Company Adjuster |

|---|---|---|

| Represents | Policyholder | Insurance Company |

| Settlement Focus | Maximum Recovery | Cost Containment |

| Documentation | Thorough | Basic Requirements |

| Expertise Level | Specialized in Claims | General Claims Processing |

Public adjusters offer distinct advantages in mold damage claims, including thorough documentation practices, expertise in policy language interpretation, and detailed understanding of remediation costs. Their involvement often results in higher settlement amounts due to their extensive knowledge of the insurance claims process and ability to accurately assess all damage-related expenses.

When To Contact A Public Adjuster For A Mold Damage Claim

When homeowners discover mold damage in their property, consulting a public adjuster can greatly improve their chances of receiving fair compensation through their insurance claim. These professionals specialize in evaluating coverage, documenting damage, and negotiating with insurance companies on behalf of policyholders.

| Timing Factor | Benefits of Public Adjuster |

|---|---|

| Initial Claim | Professional documentation and policy interpretation |

| Claim Denial | Expert appeal preparation and negotiation |

| Complex Cases | Thorough damage assessment and coverage analysis |

Public adjusters work on a contingency fee basis, making their services accessible to homeowners facing mold-related issues. Their expertise becomes particularly valuable when claims are denied or when the extent of damage requires detailed documentation. By leveraging their knowledge of insurance policies and claims processes, public adjusters help guarantee that homeowners receive appropriate compensation for covered mold damage.

When To Contact Your Insurance Provider For Mold Damage

When addressing mold damage in a home, property owners must decide whether to handle insurance claims independently or engage a public adjuster.

Insurance companies require prompt notification of water-related incidents that could lead to mold growth, making timing essential for claim approval.

Understanding the distinct responsibilities and procedures for each approach helps homeowners navigate the claims process effectively.

- Contact your insurance provider within 24-48 hours of discovering water damage or visible mold

- Submit detailed documentation including photos, repair estimates, and maintenance records

- Request a professional mold inspection through your insurance company or independent contractor

- Follow up with written correspondence to establish a clear record of all communication

If Using A Public Adjuster

Once homeowners identify potential mold damage in their property, engaging a public adjuster can greatly strengthen their insurance claim process.

These professionals specialize in evaluating damages and negotiating with insurance providers to guarantee fair compensation under the home insurance policy.

Before involving a public adjuster, homeowners must first file claims with their insurance provider and thoroughly document damages through photographs and detailed lists of affected items.

Public adjusters become particularly valuable when facing claim denials or inadequate settlement offers, as they can advocate for better coverage options based on their expertise. Their knowledge of insurance policies and claims procedures helps homeowners navigate complex situations, potentially leading to more favorable outcomes.

However, it is essential to recognize that public adjusters can only assist with claims that have already been filed with the insurance company.

If Filing On Your Own

Identifying the right moment to contact an insurance provider about mold damage requires careful evaluation of several key factors.

When mold appears due to a covered peril, such as water damage from burst pipes affecting wet items, homeowners should notify their insurer promptly. Before filing, thoroughly document all mold damage with photos and detailed descriptions of affected areas.

Homeowners should review their policy limits regarding mold remediation coverage and consider whether estimated costs exceed their deductible to determine if filing makes financial sense.

To strengthen a claim, obtain professional inspections and maintain records of all correspondence. Acting quickly is significant, as delays may complicate the claims process or lead to denial.

Understanding out-of-pocket expenses and coverage limitations helps make informed decisions about proceeding with insurance claims versus handling remediation independently.

Filing Process For Mold Damage Homeowners Insurance Claims (Without Public Adjuster)

The process of filing a mold damage claim requires careful attention to documentation and procedural requirements. Homeowners must maintain thorough records, from initial damage discovery through remediation completion, to support their insurance claim.

Successful claims typically follow this structured approach:

- Document all visible mold damage with detailed photos, videos, and written descriptions

- Contact your insurance provider immediately to report the incident and receive claim filing instructions

- Obtain professional mold assessment reports and remediation estimates from licensed contractors

- Submit a complete claims package including all evidence, reports, and supporting documentation

Document Damage Thoroughly

Proper documentation stands as a critical cornerstone when filing a mold damage claim with homeowners insurance. When identifying mold damage, homeowners should photograph pools of water, ceiling tiles, and any areas showing signs of growth. The average cost of mold remediation makes thorough documentation vital for maximum coverage potential.

| Documentation Element | Purpose |

|---|---|

| Photos/Videos | Capture visual evidence of damage |

| Detailed Lists | Record affected items and surfaces |

| Professional Reports | Verify extent of contamination |

| Communication Records | Track interactions with insurers |

| Receipts/Invoices | Document remediation expenses |

Homeowners should document hard surfaces, air conditioners, and areas near gutters and downspouts direct. This all-encompassing approach guarantees that when insurance pays for mold damage, all affected areas are properly accounted for in the claim process.

Contact Insurance

Once homeowners have gathered thorough documentation of mold damage, filing an insurance claim requires immediate action and careful attention to procedure. Claims should be initiated as soon as possible through the insurer's preferred method, whether online, via mobile app, or by phone.

When reporting mold anywhere in your home, homeowners must make sure to explain how the damage occurred, as insurers usually cover mold only when it's not the result of a lack of maintenance.

Documentation should include photos of affected items, sealed doors, and any related issues like a damaged sewer line.

While awaiting the adjuster's inspection, homeowners can implement temporary protective measures but should avoid permanent modifications. The protection agency-approved remediation process can begin once the insurance company approves the claim.

Get Professional Assessment

Securing a professional mold assessment strengthens the foundation of any homeowners insurance claim. Coverage limits vary by state, making it essential to engage certified mold remediation specialists who can provide detailed documentation of the damage.

These experts evaluate the extent of contamination, which often includes mold behind walls, under carpet in areas of moisture, and around improperly maintained gutters free of debris.

Professional assessors document their findings through extensive reports, photographs, and testing results, establishing vital evidence for insurance claims. They also provide removal certificates upon completion of remediation work, which insurance companies typically require.

Their assessment helps determine whether the mold resulted from a covered peril and can identify the source of moisture, supporting the validity of claims while ensuring proper remediation protocols are followed.

Gather Supporting Evidence

Thorough documentation of mold damage serves as the cornerstone of a successful insurance claim. Homeowners must systematically collect evidence that demonstrates the extent and cause of the damage to support their case.

| Evidence Type | Purpose |

|---|---|

| Photographs | Visual documentation of affected areas and spread |

| Videos | Dynamic capture of damage scope and conditions |

| Inventory List | Detailed record of damaged items and materials |

| Professional Reports | Expert assessment and verification of damage |

Key documentation should include clear, well-lit photos and videos of all affected areas, accompanied by an extensive inventory of damaged items. Maintaining organized records of all communications with the insurance company, including emails, letters, and phone call logs, strengthens the claim's validity. Professional assessment reports and repair estimates from qualified contractors provide additional credibility to the documentation package.

Submit Complete Claims Package

After gathering all necessary documentation, homeowners should submit a thorough claims package that includes detailed evidence of mold damage, repair estimates, and relevant correspondence with contractors.

Insurance companies typically offer multiple submission methods, including online portals, mobile apps, or phone claims services, allowing homeowners to choose the most convenient option.

Timely submission is essential for expediting the claims process. The package should contain photographs, videos, and an extensive inventory of affected items.

Additionally, homeowners must document any temporary repairs made to prevent further damage, while awaiting the insurance adjuster's inspection before initiating permanent repairs.

Understanding policy-specific coverage limits for mold removal is vital, as insurers often cap payouts at predetermined amounts per occurrence.

If a claim faces denial, homeowners retain the right to appeal with additional supporting evidence.

Try To Negotiate Claim Settlement Offer

Successful negotiation of a mold damage claim settlement begins with a thorough evaluation of the insurance company's initial offer. Homeowners should carefully compare the proposed settlement against their documented evidence, including photographs, videos, and detailed lists of affected items.

If the initial offer appears insufficient, policyholders should prepare a counter-proposal supported by professional repair estimates and mold remediation costs. Communication with the insurer should be clear and factual, referencing specific policy language that supports the claim.

When appealing a low settlement or denied claim, homeowners must present additional evidence promptly, as timing is critical due to mold's rapid development within 24 hours of water damage. Having extensive documentation and understanding policy coverage limits strengthens the policyholder's position during negotiations and increases the likelihood of securing a fair settlement.

Filing Process For Mold Damage Homeowners Insurance Claim (With A Public Adjuster)

When homeowners engage a public adjuster for mold damage claims, they gain an expert advocate who manages the entire claims process on their behalf.

Public adjusters enhance the likelihood of claim approval through meticulous documentation, policy analysis, and direct negotiations with insurance companies. Their professional approach includes:

- Thorough documentation of all mold damage through photos, moisture readings, and detailed inventories

- In-depth policy review to identify maximum coverage opportunities and applicable benefits

- Direct communication with insurance company representatives while protecting the homeowner's interests

- Coordination of professional assessments and gathering of supporting evidence to strengthen the claim

Public Adjuster Documents Damage Thoroughly

Public adjusters meticulously document mold damage through thorough visual evidence and detailed reports to build a strong insurance claim. Their expertise in capturing extensive documentation helps guarantee that all aspects of mold damage are properly represented to insurance companies. This systematic approach includes collecting photographs, videos, and maintaining detailed records of affected areas and items.

| Documentation Type | Purpose | Impact on Claim |

|---|---|---|

| Photographs | Visual Evidence | Establishes Damage Extent |

| Videos | Dynamic Documentation | Shows Spread Patterns |

| Inspection Reports | Technical Assessment | Validates Damage Source |

| Communication Logs | Record Keeping | Tracks Claim Progress |

| Item Inventories | Loss Documentation | Quantifies Damages |

The adjuster's thorough documentation process creates a clear timeline of events, helping connect the mold damage to covered perils and strengthening the homeowner's position during the claims process.

Public Adjuster Reviews Your Policy For Hidden Coverage & To Maximize Policy Benefits

Beyond documenting visible damage, a thorough review of the insurance policy represents a key step in maximizing coverage for mold-related claims. A public adjuster's expertise helps identify potential hidden coverage options that homeowners might overlook. Their systematic analysis guarantees all applicable benefits are discovered and properly utilized.

| Policy Review Elements | Benefits to Homeowner |

|---|---|

| Coverage Conditions | Identifies qualifying perils |

| Exclusion Analysis | Prevents misapplication of limitations |

| Hidden Provisions | Uncovers additional coverage options |

| Claim Requirements | Guarantees proper documentation |

| Benefit Maximization | Optimizes settlement potential |

This detailed examination of policy terms and conditions enables the public adjuster to develop a thorough claim strategy. By understanding the full scope of available coverage, they can effectively advocate for fair compensation while maneuvering complex policy language and exclusions.

Public Adjuster Contacts Insurance & Deals With Insurance Company Adjuster On Your Behalf

Expertise in insurance claim navigation becomes essential when a public adjuster steps in to manage communications with the insurance company.

These professionals serve as intermediaries, handling all aspects of the mold damage claim process while representing the homeowner's interests.

A public adjuster streamlines the claims process through:

- Direct communication with insurance company adjusters, eliminating the need for homeowners to navigate complex negotiations

- Timely submission of complete documentation and detailed damage assessments

- Expert evaluation of mold damage extent and necessary remediation costs

- Strategic negotiation of settlement terms to guarantee fair compensation based on policy coverage

This professional representation allows homeowners to focus on addressing their mold issues while making sure their claim receives proper attention and thorough processing from the insurance company.

Public Adjuster Gets Professional Assessments

When handling mold damage claims, professional assessments form the backbone of a thorough insurance claim strategy. A public adjuster coordinates with qualified professionals to conduct extensive evaluations, ensuring all damage is properly documented and assessed.

These expert consultations strengthen the claim's validity and help establish the full scope of necessary remediation.

- Environmental specialists test air quality and identify mold types present

- Structural engineers evaluate the extent of damage to building materials

- Water damage experts assess moisture levels and potential hidden damage

- Licensed contractors provide detailed cost estimates for remediation

These professional assessments provide essential documentation that supports the insurance claim, helping to justify the requested compensation.

The public adjuster uses these expert findings to build a compelling case, demonstrating both the extent of damage and the necessity of proposed repairs.

Public Adjuster Gathers Supporting Evidence

A thorough evidence-gathering process forms the cornerstone of successful mold damage claims. Public adjusters systematically collect and organize documentation to substantiate claims with insurance companies, ensuring all damage is properly recorded and evaluated.

| Evidence Type | Purpose |

|---|---|

| Photographs | Visual documentation of affected areas and spread |

| Video Documentation | Dynamic capture of damage extent and conditions |

| Detailed Inventories | Extensive lists of damaged items and materials |

The adjuster's expertise in documenting mold damage helps establish the connection between covered perils and resulting damage. Their systematic approach includes capturing pre-existing conditions, identifying the source of moisture, and tracking the progression of mold growth. This detailed documentation strengthens the claim's validity and can markedly improve the likelihood of approval from insurance providers.

Public Adjuster Submits Complete Claims Package

Professional public adjusters compile and submit thorough claims packages that detail all aspects of mold damage for insurance review. These packages contain essential documentation proving the damage resulted from a covered peril, ensuring maximum claim potential. The adjuster's expertise in policy interpretation and documentation requirements greatly increases the likelihood of claim approval.

| Claims Package Component | Purpose |

|---|---|

| Detailed Damage List | Itemizes affected areas and materials |

| Photo Documentation | Visual evidence of mold damage extent |

| Cause Documentation | Proves damage stems from covered peril |

| Cost Estimates | Details remediation and repair expenses |

| Timeline Records | Shows prompt claim reporting compliance |

The adjuster's systematic approach to package preparation helps overcome potential coverage limitations while providing extensive evidence needed for successful claim processing. Their advocacy throughout the submission process proves particularly valuable when managing complex policy terms or addressing claim disputes.

Public Adjuster Negotiates Claim Settlement Offer

Skilled public adjusters leverage their expertise to negotiate fair settlement offers with insurance companies for mold damage claims. Their experience in policy interpretation and valuation helps maximize compensation for homeowners dealing with mold remediation expenses.

During settlement negotiations, public adjusters:

- Present thorough documentation of mold damage, including detailed photographs and expert assessments.

- Challenge initial settlement offers that may undervalue the full scope of remediation costs.

- Apply their knowledge of policy language to counter potential claim denials or coverage limitations.

- Calculate fair compensation based on current market rates for mold removal and property restoration.

The adjuster's fee structure, typically based on a percentage of the final settlement, aligns their interests with achieving the highest possible payout while ensuring a timely resolution for the homeowner's claim.

Public Adjuster Speeds Up Claim Settlement Time

Working with a public adjuster greatly accelerates the mold damage claim settlement process, transforming what could be months of complex paperwork and negotiations into a more streamlined timeline.

These professionals leverage their expertise to expedite settlements, often achieving resolution within weeks rather than months.

Public adjusters contribute to faster settlements through:

- Immediate and thorough documentation of mold damage evidence

- Expert interpretation of insurance policy language and coverage terms

- Direct negotiation channels with insurance companies

- Strategic presentation of claim documentation and supporting materials

Their involvement, while requiring a fee of 5-15% of the settlement, typically results in more efficient claim processing.

The adjuster's understanding of insurance terminology and requirements helps avoid common delays that often occur when homeowners handle claims independently, making their services particularly valuable for complex mold-related claims.

Legal Rights When Mold Claims Are Denied

When homeowners face denied mold claims, public adjusters serve as expert advocates who understand the complex landscape of insurance policies and coverage rights. These licensed professionals examine denial letters, policy documents, and claim evidence to identify potential grounds for appeal while developing strategic responses to insurance company decisions. Public adjusters strengthen the homeowner's position by documenting damage properly, presenting technical evidence effectively, and negotiating directly with insurance representatives to challenge claim denials.

| Public Adjuster Services | Benefits to Homeowner |

|---|---|

| Policy Analysis | Identifies coverage gaps and potential grounds for appeal |

| Damage Documentation | Creates detailed evidence files with photos and expert reports |

| Technical Assessment | Provides professional evaluation of mold damage and causes |

| Claims Negotiation | Represents homeowner interests in discussions with insurers |

| Appeals Management | Handles formal dispute resolution processes and documentation |

How Public Adjusters Can Help With Denied Mold Home Insurance Claims

In cases where insurance companies deny mold-related claims, public adjusters serve as valuable advocates for homeowners seeking fair compensation. These professionals possess specialized knowledge of insurance policies and can effectively challenge claim denials by establishing connections between mold damage and covered perils.

- Public adjusters meticulously document mold damage through thorough photo and video evidence, strengthening the appeal process.

- They negotiate directly with insurance companies, leveraging their expertise to demonstrate how the damage falls within policy coverage.

- These experts can identify additional mold cleanup coverage options that homeowners might otherwise overlook.

- Their involvement often results in higher claim settlements due to their understanding of industry standards and ability to present compelling evidence.

Public adjusters' expertise proves particularly valuable when maneuvering complex policy exclusions and establishing legitimate grounds for coverage based on covered perils.

How Much Will Professional Mold Remediation & Removal Cost?

Professional mold remediation costs vary considerably based on several key factors, including the location and extent of damage, type of mold present, and affected materials. The assessment process requires thorough inspection of both visible and hidden areas to determine the full scope of contamination and necessary remediation steps. Cost calculations typically factor in square footage rates, specialized equipment requirements, and the complexity of accessing affected areas.

| Factor | Impact on Cost | Typical Range |

|---|---|---|

| Location | Attic/crawl space adds complexity | $1,000-3,000 extra |

| Square Footage | Basic remediation rate | $10-25 per sq ft |

| Mold Type | Toxic varieties require special handling | $500-1,000 premium |

| Materials | Porous vs non-porous surfaces | $200-2,000 variation |

| Testing | Pre/post remediation verification | $300-600 total |

Assessing The Problem

Understanding the cost of mold remediation is crucial for homeowners facing potential insurance claims. Homeowners should familiarize themselves with the various factors that influence remediation costs, including the extent of damage, the type of mold present, and the location of the affected area. To provide insight into this complex issue, a black mold remediation process overview can help homeowners grasp what to expect during the remediation process and the associated expenses, enabling them to make informed decisions about their insurance claims and next steps.

Professional remediation expenses typically average $2,235 nationwide, though costs can fluctuate considerably based on the severity and location of the infestation.

When evaluating mold remediation expenses, homeowners should consider these key factors:

- Basic remediation costs range from $500 for minor cases to $6,000+ for extensive damage.

- Additional fees may apply for professional inspections and air quality testing.

- Insurance coverage limits typically range from $1,000 to $10,000 per occurrence.

- Deductible amounts should be compared to remediation costs before filing claims.

For accurate cost assessment, homeowners should obtain multiple quotes from certified remediation specialists and review their insurance policy's specific coverage limits and exclusions.

Location Of Mold Damage

The location of mold damage greatly influences remediation costs, with certain areas of the home requiring more extensive and expensive treatment than others.

Professional remediation services typically assess the accessibility and extent of contamination before determining final costs, which can range from $500 to $6,000.

Common areas that affect remediation pricing include:

- Crawl spaces and attics: Limited access requires specialized equipment and expertise.

- Behind walls or under flooring: May require extensive demolition and reconstruction.

- Bathroom and kitchen areas: Plumbing complications can increase scope of work.

- HVAC systems: Complex removal processes due to potential spread through ductwork.

These location-specific challenges can considerably impact the overall cost, potentially pushing expenses beyond the average $2,235 remediation cost, especially when structural repairs are necessary.

Mold Damage Per Square Foot

When calculating mold remediation expenses, square footage serves as the primary metric for cost assessment, with typical rates ranging from $10 to $25 per square foot depending on severity and location. Professional remediation costs vary greatly based on multiple factors, with projects ranging from $500 to $30,000.

| Project Size | Cost Range |

|---|---|

| Small Areas | $500-$1,500 |

| Medium Areas | $2,000-$6,000 |

| Large Areas | $6,000-$15,000 |

| Severe Cases | $15,000-$30,000 |

The national average for mold remediation sits at approximately $2,235, though final costs depend heavily on factors such as material type affected, extent of infestation, and accessibility of contaminated spaces. Insurance coverage may offset these expenses if the mold results from covered perils, but homeowners should verify their specific policy terms.

Type Of Mold

Professional mold remediation costs vary considerably based on the type and severity of mold infestation present in a home. The total expense typically ranges from $500 for minor cases to over $6,000 for extensive contamination, with the national average being $2,235. Insurance coverage depends on whether the mold resulted from a covered peril, such as a burst pipe or appliance malfunction.

| Type of Service | Cost Range | Notes |

|---|---|---|

| Basic Removal | $500-$1,500 | Small localized areas |

| Standard Remediation | $2,000-$3,000 | Average-sized projects |

| Extensive Treatment | $3,000-$6,000+ | Severe contamination |

| Testing Services | $200-$400 | Laboratory analysis |

| Post-Remediation Inspection | $400-$600 | Verification testing |

Additional costs may include containment measures, air filtration systems, and the removal of affected building materials, making it essential to obtain detailed estimates from qualified professionals.

Materials

Material costs for mold remediation vary considerably based on the scope of work and required supplies, with extensive treatment packages ranging from $500 to $6,000 or more. Professional remediation services typically include specialized equipment, protective gear, and antimicrobial treatments, with costs averaging $2,235 nationwide.

| Material Component | Small Project | Large Project |

|---|---|---|

| Safety Equipment | $50-100 | $200-400 |

| Treatment Agents | $100-250 | $500-1,000 |

| Equipment Rental | $150-300 | $800-1,500 |

When considering material expenses, homeowners should evaluate their insurance coverage limits, which typically range from $1,000 to $10,000 per occurrence. Policy deductibles may influence the decision to file a claim, particularly for smaller remediation projects where out-of-pocket costs might be comparable to the deductible amount.

Tips For Stopping Mold Growth In Your House (Before It Starts) To Maintain Insurance Coverage

Preventing mold growth requires a systematic approach focused on moisture control and regular maintenance to maintain insurance coverage eligibility.

Homeowners must address potential water issues promptly while maintaining proper ventilation and humidity levels throughout their residence. Understanding and implementing key preventive measures can greatly reduce the risk of mold development and subsequent insurance claims.

- Monitor and fix all plumbing leaks within 24-48 hours of discovery

- Install and regularly use bathroom and kitchen exhaust fans during moisture-producing activities

- Position dehumidifiers in basements and crawl spaces to maintain humidity below 60%

- Clean and maintain gutters seasonally to prevent water from seeping into the foundation

Stay On Top Of Maintenance

Maintaining a mold-free home requires consistent vigilance and proactive measures to protect both the property and insurance coverage. Regular inspections of plumbing systems, roofing, and gutters can identify potential issues before they escalate into serious problems that could compromise insurance eligibility.

Homeowners should address moisture control through strategic maintenance practices. Installing proper ventilation systems, such as exhaust fans in bathrooms and kitchens, helps manage humidity levels effectively.

Additionally, ensuring gutters and downspouts direct water away from the foundation prevents water accumulation that could lead to mold growth. In moisture-prone areas, avoiding carpet installation and opting for water-resistant materials can greatly reduce mold risks.

These preventive maintenance steps not only protect the property but also help maintain valid insurance coverage by demonstrating responsible homeownership.

Manage Humidity