Thorough auto insurance coverage includes protection against hail damage and other non-collision events. When hail strikes a vehicle, this insurance covers repairs for dents, cracked windshields, and total loss scenarios. Policyholders must meet their deductible before coverage applies, and claims may impact future premiums despite being no-fault incidents. Geographic location influences base rates, particularly in hail-prone regions like "Hail Alley." Understanding additional coverage details helps vehicle owners maximize their protection.

Key Takeaways

- Comprehensive insurance coverage explicitly includes hail damage along with other non-collision events like natural disasters and vandalism.

- Filing a claim requires paying a deductible first, which will be subtracted from the total repair cost.

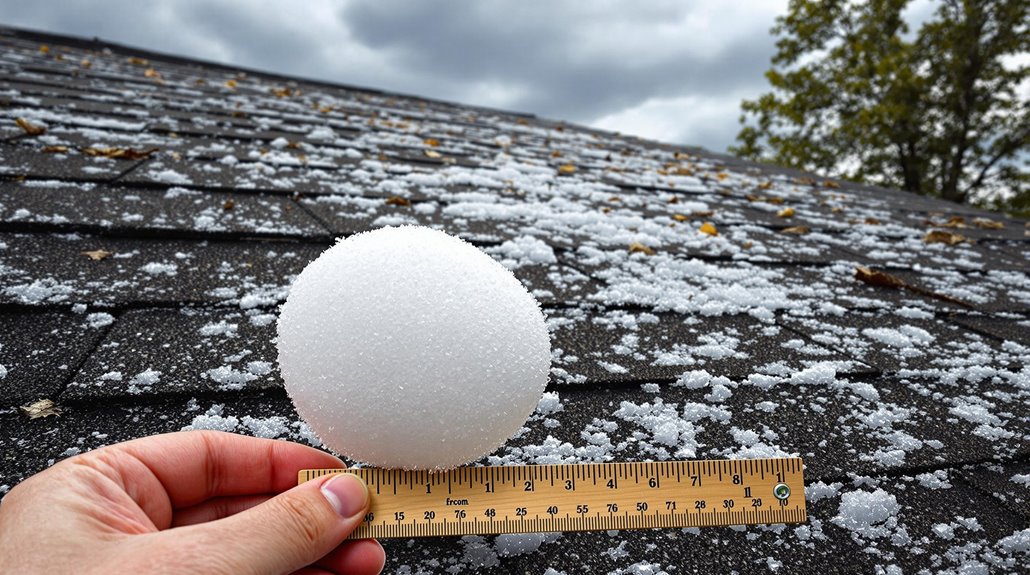

- Policyholders must document hail damage with photographs and measurements before contacting their insurance provider to initiate claims.

- Insurance adjusters will professionally evaluate the damage, and obtaining multiple repair estimates from licensed contractors is recommended.

- Claims for hail damage may impact future premiums despite being no-fault incidents, especially for repairs exceeding $5,000.

Understanding Comprehensive Coverage and Hail Damage

When severe weather strikes, thorough auto insurance provides essential protection against hail damage and other non-collision events. All-encompassing coverage benefits include protection for various weather-related incidents, making it particularly valuable in regions prone to severe storms, such as Texas and Colorado.

This coverage encompasses repairs for dents, cracked windshields, and even total loss scenarios resulting from hail damage. While all-encompassing coverage typically requires policyholders to pay a deductible, some policies offer deductible waivers specifically for glass repairs rather than replacements.

This optional coverage becomes vital for hail damage prevention and financial protection. For vehicles declared total losses due to hail damage, insurers will provide compensation based on the vehicle's actual cash value.

Without all-encompassing coverage, vehicle owners must bear the full cost of repairs independently. Understanding these coverage aspects helps policyholders make informed decisions about their insurance needs, especially in areas with frequent hailstorms.

Types of Vehicle Damage Covered by Comprehensive Insurance

All-encompassing auto insurance extends beyond hail protection to cover a wide spectrum of non-collision incidents. This all-inclusive coverage addresses damages from natural disasters, including floods, hurricanes, tornadoes, and volcanic eruptions. The claim process typically involves documenting damage from these events before repairs begin.

The policy also safeguards against human-caused incidents such as theft and vandalism. Coverage limits apply when addressing stolen vehicle parts, intentional damage, or destruction resulting from civil disturbances.

Additionally, comprehensive insurance protects against damages from falling objects, whether they are tree limbs, rocks, or debris dropped from other vehicles.

Animal-related incidents form another significant category of coverage. When vehicles sustain damage from collisions with wildlife or bird strikes, comprehensive insurance provides the necessary financial protection.

This coverage extends to both direct impact damage and subsequent effects, ensuring vehicle owners receive appropriate compensation within their policy parameters.

The Role of Deductibles in Hail Damage Claims

Every extensive insurance claim for hail damage requires policyholders to meet their deductible obligation before coverage takes effect. Deductible calculations involve subtracting the predetermined amount from the total repair cost, with insurance covering the remainder. For instance, a $1,000 repair with a $500 deductible results in $500 insurance coverage.

Claim strategies should consider whether filing is financially beneficial, as repair costs near the deductible amount might warrant out-of-pocket payment instead. Some policies in hail-prone regions implement separate hail deductibles, affecting overall cost considerations.

Additionally, while hail damage claims are classified as no-fault incidents, they can still impact future premiums. Understanding policy terms is essential for ideal claim outcomes. For homeowners, it is crucial to differentiate between liability insurance and hail damage coverage, as these policies serve different purposes. Taking proactive steps, such as regular roof inspections and maintenance, can help mitigate the impact of potential hail damage on future premium rates.

Documentation through photos and videos substantiates damage claims, while multiple repair estimates guarantee fair compensation. Insurance companies may directly pay repair facilities or reimburse policyholders after deductible requirements are satisfied. Effective communication between homeowners and insurance providers can significantly reduce claim processing delays.

Steps to File a Hail Damage Insurance Claim

Filing a successful hail damage insurance claim requires a systematic approach and extensive documentation. The claim process begins with thorough documentation of all damage through photographs, measurements of hailstones, and detailed lists of affected areas. Property owners must immediately contact their insurance provider and initiate the claim through available channels, including online platforms or mobile applications. Consulting with public insurance adjusters can help maximize potential settlements, especially in complex hail damage situations.

| Phase | Action Required | Documentation Needed |

|---|---|---|

| Initial | Document damage | Photos, measurements |

| Contact | File claim | Policy information |

| Assessment | Meet adjuster | Damage inventory |

| Estimates | Get quotes | Contractor reports |

| Settlement | Review offer | Repair estimates |

The damage assessment phase involves professional evaluation by insurance adjusters and obtaining multiple repair estimates from licensed contractors. Property owners should maintain records of all temporary repairs and associated expenses. The final settlement requires careful review to guarantee adequate compensation for all documented damage, with the option to dispute if the offered amount falls short of covering necessary repairs.

High-Risk Areas and Geographic Considerations

Geographic data from NOAA reveals distinct patterns of hail frequency across the United States, with regions like Kansas City and parts of the Dakotas experiencing markedly higher rates of hailstorms.

These high-risk zones, commonly known as "hail alleys," typically face increased insurance premiums due to the elevated probability of property damage.

Insurance carriers analyze historical storm data and regional weather patterns to assess risk levels and determine coverage costs for specific geographic locations.

Homeowners in these areas should regularly review their dwelling coverage limits to ensure adequate protection against severe weather events.

Regional Hail Risk Patterns

While severe weather patterns occur across the United States, distinct regional patterns emerge in the distribution and frequency of hail damage risks. The area known as "Hail Alley," stretching from Wyoming to Texas, experiences the highest hailstorm frequency due to the interaction between Gulf moisture and Rocky Mountain cold air masses.

Nebraska and Kansas exhibit particularly high vulnerability, with 52 and 14 counties respectively showing moderate to severe risk levels.

The Front Range of the Rocky Mountains creates unique atmospheric conditions that generate frequent and intense hailstorms, particularly affecting Colorado's metropolitan areas.

Regional weather patterns in the central and southern High Plains produce the strongest winds, intensifying property damage potential.

In contrast, the southeastern and southwestern United States experience considerably lower hail occurrence rates, demonstrating clear geographic variations in risk distribution.

Insurance Cost By Location

Insurance costs fluctuate considerably based on geographic location, with notable variations driven by regional risk factors and natural disaster exposure. Current insurance trends indicate that high-risk areas, particularly coastal regions and states prone to specific natural disasters, face substantially higher premiums. Climate impact has intensified these cost variations, with areas experiencing frequent hurricanes, wildfires, or tornadoes bearing the heaviest financial burden.

| Region | Primary Risk Factors |

|---|---|

| Florida/Gulf Coast | Hurricanes, Tropical Storms |

| California | Wildfires, Earthquakes |

| Oklahoma/Tornado Alley | Tornadoes, Severe Storms |

| East Coast | Hurricanes, Flooding |

| Western States | Wildfires, Drought |

The relationship between disaster risk and insurance premiums continues to strengthen, with rising reinsurance rates particularly affecting high-risk locations. States like Florida, California, and Texas consistently demonstrate higher insurance costs due to their increased vulnerability to natural disasters. Public adjusters can help property owners navigate complex claims processes and maximize compensation in these high-risk regions.

Recognizing and Documenting Hail Damage

Proper identification and documentation of hail damage requires a systematic approach to assess both obvious and subtle forms of impact. During hail damage assessment, inspectors examine visible markers including discolored indentations, bruised shingles, and circular patterns of granule loss.

Metal surfaces, such as gutters and utility boxes, provide essential evidence of hail size and directionality through dents and burnish marks.

Documentation techniques involve thorough photographic evidence and detailed reports of all affected areas. Inspectors analyze test squares to quantify damage, paying particular attention to vulnerable areas like ridges and valleys.

The evaluation extends beyond roofing to include aluminum siding, vinyl components, fences, and decks. This all-encompassing inspection identifies both immediate structural concerns and latent damage that may compromise roof integrity over time.

Through methodical documentation of impact patterns, size measurements, and surface distress, adjusters can accurately determine the extent of hail-related property damage.

Sudden and accidental damage from hailstorms is typically covered under comprehensive insurance policies, while normal wear and tear is excluded.

Choosing the Right Repair Contractor

Selecting a qualified contractor for hail damage repairs requires careful evaluation of multiple critical factors. Homeowners should prioritize local contractors who demonstrate thorough knowledge of regional weather patterns and building codes, while maintaining established relationships with insurance adjusters.

When evaluating contractor qualifications, verify proper licensing, insurance coverage, and industry certifications from organizations like NRCA. Essential verification steps include examining past project portfolios, reviewing customer testimonials across multiple platforms, and confirming manufacturer partnerships that enable enhanced warranty coverage.

Quality contractors provide detailed project timelines and maintain clear communication throughout the repair process. They should also demonstrate expertise in insurance claim procedures and documentation requirements.

The most reliable contractors typically hold strong community reputations, offer extensive warranties, and maintain transparency regarding their evaluation methods and repair strategies. Their established local presence guarantees accountability and accessibility for any future maintenance needs.

Prevention and Protection Strategies

Effective vehicle protection against hail damage involves strategic storage solutions, including utilizing covered parking structures and implementing temporary protective measures such as specialized hail covers.

Insurance coverage assessment requires a thorough examination of detailed policies, deductible options, and specific hail damage provisions to guarantee adequate financial protection.

Essential hail protection equipment encompasses impact-resistant materials for buildings, protective coverings for vehicles, and monitoring tools to track approaching storms.

Proactive Vehicle Storage Tips

When severe weather threatens, implementing strategic vehicle storage measures can greatly reduce the risk of hail damage to automobiles.

Vehicle safety priorities include positioning cars under protective structures like bridges, parking decks, or gas station canopies. Dense foliage can serve as a natural shield, though drivers should exercise caution during high winds or lightning.

Storm preparedness involves utilizing temporary covering solutions such as moving blankets, corrugated cardboard, or specialized hail protection equipment. Inflatable car covers, hail blankets, and mobile car tents offer purpose-built protection.

Advanced planning requires monitoring weather forecasts and identifying nearby shelter options. Vehicle owners should maintain a supply of protective materials and consider installing semi-permanent solutions like hail canopies or nets.

Proper positioning relative to buildings can provide additional shielding from approaching hailstorms.

Insurance Coverage Assessment Guide

Beyond physical protective measures, extensive insurance coverage forms a critical defense against hail-related vehicle damage. Vehicle owners should verify their insurance policy includes complete coverage, as standard liability insurance excludes hail damage protection.

A thorough damage assessment following hailstorms enables proper documentation for claims processing.

Complete coverage encompasses multiple forms of loss, including damage from falling objects, natural disasters, theft, and fire. When filing claims, policyholders typically must pay a deductible, though frequent hail-related claims may not impact insurance rates.

For severe cases resulting in total vehicle loss, complete coverage provides necessary financial protection. Regular policy reviews guarantee adequate coverage levels are maintained, particularly in regions prone to severe weather events.

Hail Protection Equipment Recommendations

Protecting vehicles and property from hail damage requires implementing multiple layers of protective equipment and preventive measures.

Effective vehicle protection strategies include installing permanent carports, utilizing portable garages with metal framing, and deploying retractable hail nets designed to withstand significant hailstone impact.

For thorough hail damage prevention, property owners should:

- Install hail guards and steel wire mesh over HVAC equipment condenser fins

- Reinforce roofs with impact-resistant materials and proper underlayment

- Secure protective coverings for windows and skylights

Regular maintenance inspections guarantee protection systems remain effective, while preventive measures like trimming overhanging branches reduce additional damage risks.

Property managers should establish clear procedures for emergency response during hailstorms, including protocols for securing equipment and providing shelter for vehicles and personnel.

Cost Factors and Premium Impacts

Understanding the cost factors and premium impacts of hail damage claims requires careful consideration of multiple variables that affect both insurers and policyholders. The cost evaluation process examines repair expenses relative to vehicle value, while premium analysis focuses on claim frequency and severity thresholds.

| Factor | Cost Impact | Premium Effect |

|---|---|---|

| Repair Costs | Vehicle-dependent | May trigger total loss |

| Deductibles | Out-of-pocket expense | Higher reduces premiums |

| Claim Frequency | Affects insurability | Increases future rates |

| Regional Risk | Location-based pricing | Higher in hail-prone areas |

| Damage Severity | Determines repair approach | >$5,000 impacts rates |

Insurance companies assess whether repair costs exceed the vehicle's depreciated value when determining total loss status. Claims exceeding $5,000 typically result in premium increases, while regional hail frequency can affect base rates for all policyholders in an area. Deductible choices directly influence both immediate out-of-pocket expenses and long-term premium costs, making it essential to balance these factors when selecting coverage options.

The Benefits Of Consulting A Public Adjuster

Public adjusters provide expert guidance through complex insurance claims while delivering objective assessments of hail damage to properties.

Their specialized knowledge of insurance policies and procedures enables a more streamlined claims process, reducing administrative burdens for policyholders.

Statistical evidence indicates that claims handled by public adjusters typically result in higher settlements compared to those processed without professional representation.

Expertise In Insurance Claims

When dealing with hail damage insurance claims, consulting a public adjuster offers significant advantages due to their specialized expertise in policy interpretation and claims management.

Their professional knowledge enables accurate assessment of damage and extensive understanding of coverage limitations within insurance policies.

Public adjusters demonstrate proficiency in insurance policy interpretation and claims process strategies through:

- Detailed analysis of policy terms and conditions to identify all applicable coverage

- Strategic documentation of damage using industry-standard assessment methods

- Implementation of proven negotiation techniques with insurance carriers

These licensed professionals streamline the claims process by managing documentation requirements, conducting thorough damage evaluations, and advocating for fair settlements.

Their expertise helps policyholders navigate complex claim procedures while ensuring maximum benefits under their coverage terms.

Objective Damage Assessment

A cornerstone of successful hail damage claims lies in conducting objective damage assessments through qualified public adjusters. These professionals perform thorough inspections utilizing photographs, videos, and detailed written reports to guarantee meticulous damage verification of both visible and concealed impacts to the property.

Public adjusters implement systematic documentation protocols that capture structural damage and effects on personal property. Their objective evaluation process includes detailed inspections by licensed professionals who assess cosmetic and structural implications of hail damage.

This methodical approach helps prevent potential disputes while establishing accurate claim valuations. The documentation process serves as a foundation for fair settlements, as public adjusters identify and quantify damages that might otherwise go unnoticed.

This systematic assessment guarantees property owners receive appropriate compensation for necessary repairs and replacements.

Streamlined Claim Process

Engaging a public adjuster greatly streamlines the insurance claim process for hail damage victims.

These licensed professionals manage documentation, paperwork, and claim negotiation strategies while communicating directly with insurance carriers. Their expertise in handling complex claims notably reduces administrative burden and expedites insurance claim timelines.

Public adjusters deliver value through:

- Professional representation during negotiations, ensuring accurate interpretation of policy terms

- Thorough documentation management, preventing common filing errors that could delay settlement

- Direct communication with insurance carriers, eliminating the need for policyholder involvement in technical discussions

This streamlined approach allows property owners to focus on recovery while experts handle the intricate details of claim processing.

Ultimately, this process works to secure appropriate settlements through established protocols and industry knowledge.

Higher Claim Payouts & Settlements

Studies consistently demonstrate that property owners who retain public adjusters receive considerably higher claim settlements compared to those who handle claims independently.

These claim strategies leverage professional expertise in damage assessment, policy interpretation, and negotiation to maximize compensation.

Key adjuster benefits include thorough documentation of all damages, including those easily overlooked, and extensive understanding of insurance policies to guarantee full coverage utilization.

Public adjusters typically work on a contingency basis, charging up to 10% of the final settlement, eliminating upfront costs. Their licensed status and ethical obligations provide additional security for property owners.

Through skilled negotiation and detailed knowledge of legal requirements, public adjusters help resolve disputes while advocating for the best settlements, making their services particularly valuable for complex hail damage claims.

About The Public Claims Adjusters Network (PCAN)

The Public Claims Adjusters Network (PCAN) represents a nationwide coalition of licensed insurance claim specialists who advocate for policyholders during the claims process. Operating across all 50 states and internationally, PCAN members provide thorough claims advocacy services, specializing in both residential and commercial insurance claims, including those related to disaster damage.

Key public adjuster benefits include:

- Professional policy interpretation and detailed damage assessment documentation

- Strategic negotiation with insurance companies to maximize settlement values

- Streamlined claims management that reduces policyholder stress and processing time

PCAN adjusters follow a systematic approach, beginning with initial policy review and damage evaluation, followed by detailed documentation and evidence gathering.

Their expertise in claims procedures and insurance policies enables them to effectively navigate complex claims processes while serving as intermediaries between policyholders and insurance companies.

This professional representation helps guarantee fair and appropriate claim settlements for their clients.

Frequently Asked Questions

Will My Insurance Rates Increase After Filing a Hail Damage Claim?

Insurance rates typically increase by approximately 30% after filing a hail damage claim. The claim impact varies based on damage severity, claim frequency, and state-specific insurance regulations.

Can I Wait to Repair Hail Damage Until After Receiving the Claim Payment?

Like money in a savings account, claim payments can be held while deciding on repairs. The repair timeline remains flexible after settlement, though documenting the claim process thoroughly is essential.

Does Comprehensive Coverage Protect My Car if Parked in Another State?

Thorough insurance policies provide out of state coverage for hail damage regardless of vehicle location. The policy terms, deductibles, and coverage limits remain consistent when parked in different states.

How Long Do I Have to File a Hail Damage Claim?

Most insurers require hail damage claim timeframes within one year of the incident. Filing deadlines vary by policy and provider, making immediate documentation and notification essential for claim validity.

What Happens if Multiple Hailstorms Damage My Car in One Year?

With premium increases averaging 8% after two claims, multiple hailstorms require separate claim submissions. Each multi storm impact must be documented individually, though policy claim limits may affect total compensation received.

References

- https://www.allstate.com/resources/car-insurance/hail-damage

- https://www.nicb.org/news/blog/hail-claims-fluctuate-over-past-three-years

- https://www.amfam.com/resources/articles/on-the-road/does-insurance-cover-hail-damage-to-cars

- https://www.nicb.org/news/news-releases/top-5-states-hail-claims-2017-2019-data

- https://www.caranddriver.com/car-insurance/a32731090/does-car-insurance-cover-hail-damage/

- https://lainsurance.com/blog/does-car-insurance-cover-hail-damage

- https://www.plymouthrock.com/resources/does-car-insurance-cover-hail-damage

- https://www.libertymutual.com/vehicle/auto-insurance/coverage/comprehensive-insurance

- https://tgsinsurance.com/texas-auto-insurance/comprehensive-coverge/

- https://www.geico.com/information/aboutinsurance/auto/comp-coverage/